Our take on the Conservative manifesto

The Conservative manifesto is here, and an accompanying costings document is here. It proposes £6bn of tax cuts in 2024/25,

The Conservative manifesto is here, and an accompanying costings document is here. It proposes £6bn of tax cuts in 2024/25,

The Lib Dem manifesto is here, and a separate costings document is here. It claims to raise £27bn from tax

The Lib Dems are proposing a 4% tax on share buybacks that they say would raise £1.4bn/year. It’s based on

Stamp duty is a terrible tax. The Tories want to abolish it for most first time buyers. But the evidence

Iain Clifford Stamp and his business, “Matrix Freedom”, are selling a scheme which falsely claims to make their clients’ mortgages

The Green Party says it will raise £50bn in tax from the “richest”. But their proposal will probably end up

The Conservative Party has just proposed moving the point at which child benefit is phased out from income of £60k

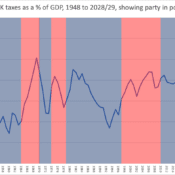

The general election tax debate has been irrelevant. The few £bn being discussed is dwarfed by the actual tax UK

Some people on social media are convinced that Jeremy Hunt avoided tax when he bought seven flats through a company

The Independent Schools Council received a survey on parents’ responses to VAT on private school fees. It was statistically meaningless,

All three political parties say they can raise £5bn or more from cracking down on tax avoidance and evasion. How

Robert Venables KC has a reputation for providing tax avoidance scheme promoters with convenient opinions that their schemes work. The

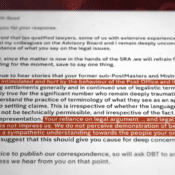

Nadhim Zahawi’s attempt to silence me has now resulted in disciplinary action for his lawyer. This is a short piece

We wrote in January about some of the ways private schools might try to avoid Labour’s proposed 20% VAT on

An unknown individual is trying to keep their tax avoidance scheme, and resultant dispute with HMRC, private. They attempted to

We are aware of a new form of VAT fraud which came close to stealing £m from HMRC last week,

New polling evidence from Tax Policy Associates and WeThink shows that half the public doesn’t understand a basic principle of

It’s very hard for normal people to understand tax legislation, and it’s often equally hard for tax lawyers, unless they

The Post Office’s incompetent compensation process left thousands of postmasters with large tax liabilities. When we revealed this, the Government

Aside from the labelling of nil offers which we accept was inappropriate, and without waiving

privilege in their advice,