Iain Clifford Stamp and his business, “Matrix Freedom”, are selling a scheme which falsely claims to make their clients’ mortgages disappear. The scheme relies upon “freeman on the land” conspiracy theories about how the world and the legal system work. The High Court just threw out Stamp’s claims, and said those behind the schemes may have committed criminal offences. The police and the FCA should investigate before more consumers are defrauded, and more court time is wasted.

The High Court judgment 1 makes for alarming reading. We believe the increasing prevalence of pseudolaw scams like this represent a threat to vulnerable people in financial difficulties. The authorities should act.

UPDATE 24 June 2024: Iain Stamp brought a defamation claim against openDemocracy for their excellent article on Stamp and Matrix Freedom. That has just been dismissed as “totally without merit”, with the case being transferred to a High Court judge, which made a general civil restraint order against Stamp.

UPDATE January 2025: In response to this article, Stamp sent me a very long pseudo-legal document demanding that I respond to a number of nonsensical claims (including that “The UNITED KINGDOM is a UK limited company registered at 6 Sharon Court, London, N12 8NX”). I ignored it. Stamp sent a second similar document – I sent him a short response, asking him to stop sending me meaningless documents. Stamp didn’t reply, but sent me a third document on 6 January 2025, threatening to impose a $1.5m “lien” on me if I don’t agree to all manner of bizarre things. Finally on 20 January 2025 they served that fake “lien” on me. This is probably just playacting to impress his followers/victims, but if Stamp makes any attempt to collect on his fraudulent “lien” then he should expect serious consequences.

UPDATE JULY 2025: the FCA is pursuing a prosecution against Stamp for undertaking unauthorised related activity. It obtained an restraint order in 2023 preventing Stamp from hiding his assets, and a disclosure order in 2024 requiring Stamp to disclose all his assets. Stamp ignored the orders. As a result, he was found in contempt of court and sentenced to one year’s imprisonment. Here’s Stamp’s pseudo-legal defence (which the court described as “nonsense”).

UPDATE AUGUST 2025: Instead of complying with the contempt order, or indeed appealing Stamp, has raised complaints to the ECHR🔒 and the International Criminal Court (both of which complain about this report and name Dan Neidle).

UPDATE FEBRUARY 2026: Stamp is now threatening to sue Dan Neidle in Wyoming for “suppressing his ministry“. Here’s our response.

Iain Clifford Stamp and Matrix Freedom

Stamp runs a company2, a website3 and a “private members association”4, all called “Matrix Freedom”.5

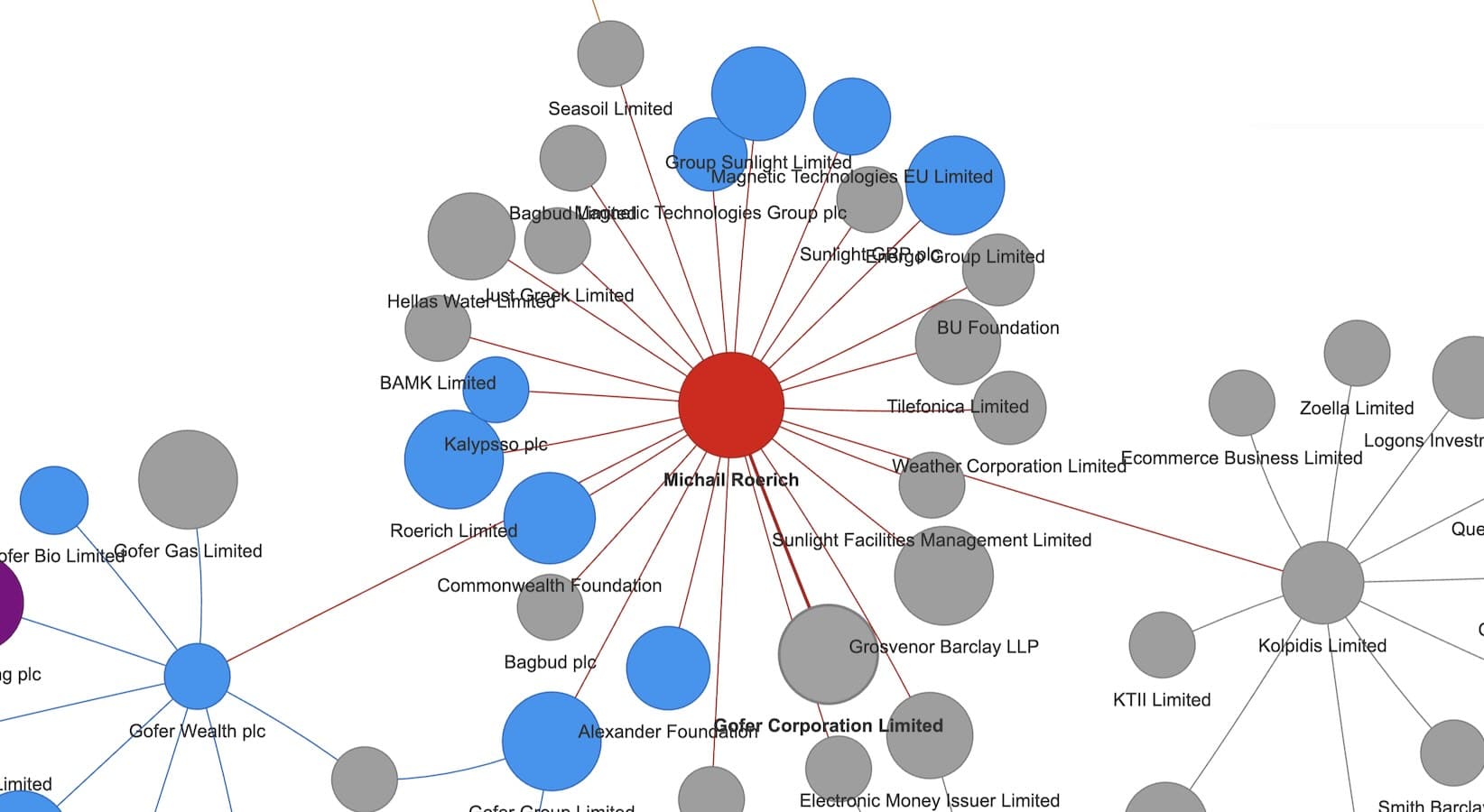

Stamp himself has a background of business failure and losing investors’ money in dubious circumstances.

Matrix Freedom uses their website, Facebook, TikTok, and traditional doorstep leaflets to make a series of spectacular “get rich quick” claims.

The website includes a calculator that lets you see how much you can “claim”, based on their theories. It says that someone earning £50,000 could claim £80,000 “recoupment and compensation”.

The internet is full of weird conspiracy theories about the nature of the financial and legal systems. This element of Matrix Freedom’s pitch is typical:

But Matrix Freedom are unusual in that they aggressively monetise their conspiracy theories. The first step is a “facilitation fee”:

And Matrix Freedom seems to operate like a normal business, complete with management meetings by Zoom (some of which were leaked here).

In February 2023, OpenDemocracy published a detailed analysis by Dimitris Dimitriadis into Stamp’s history and activities. It’s well worth a read.6

The mortgage scam

The materials on the website claim that you can “discharge your mortgage and get your payments back”. This is all set out in more detail in this webinar:

Here’s the key slide explaining how it works:

That list makes no legal sense at all, and neither do the “references” Stamp provides:

None of these are UK Acts of Parliament; most relate to US Federal and state law.7

There is more detail, but no more sense, in the ebook Stamp makes available on his website:

Most of this is taken directly from the “pseudolaw⚠️” Freeman on the Land and Sovereign Citizen conspiracy theories, which started in the US but are now increasingly common here. The footnote here8 has more background.

But everything starts to make sense once we see this:

In other words, Stamp and his associates charge people a £3k fee to give them template documents that (they claim) will make their mortgage magically disappear.

How much money does Matrix Freedom make?

A leaked Zoom management meeting shows that in its best month in 2022, Matrix Freedom made £500,000 from its clients:9

The High Court case

Prior to 2022, it seems that Matrix Freedom’s main strategy was persuading clients to reverse previous direct debits made on their mortgages. On a leaked management video,10 one of Stamp’s colleagues says (while laughing) that some people actually managed to recover ten years’ of mortgage payments in this way, but the banks got a “little bit more careful”.

In that same video, Stamp says that using the “public” courts was not going to be effective. But, nevertheless, in 2023 and 2024, he appears to have coordinated over 200 people to bring court claims against various mortgage lenders.11 Stamp was the lead claimant. The High Court handed down judgment on 9 May 2024.12

The claims were completely incoherent; in Stamp’s case he had borrowed £312,500, repaid the mortgage in 2016, and now claimed £265,000. He said he had been mis-sold because the mortgage had been securitised13 – but was unable to explain why securitisation (which doesn’t affect a borrower’s rights) amounts to mis-selling, or why it caused him any loss. He claimed that the securitisation hadn’t been registered with the Land Registry (which it couldn’t have been, because securitisation doesn’t affect the legal title to security).

Stamp’s further legal justification for his claims was summarised by the court as follows:

The other claims all took the same form (almost identically), with some of the mortgages still being in existence, and some being in default. None of the 200 claimants was represented by a solicitor, but all the filings shared “a near miraculous uniformity of common purpose, style and prose”.

The defendant lenders applied for the claims to be struck out, and the court readily agreed:

Stamp didn’t turn up to the hearing – he said he was “beyond the seas”14 and would rely on the documents already delivered to the court.

There is a comprehensive summary of the judgment here, from Henderson Chambers.

The High Court’s view of the behaviour

The Court had previously ordered five of the claimants to explain why they had all filed identical claims with the courts, despite not identifying a legal representative. They did not comply.

The Court asked the same question of the claimants present at the hearing. One admitted to buying this scheme from Stamp. Given the near-identical documents the claimants submitted, however, it’s a reasonable inference that many or most of the 200 bought the scheme.

The conclusion was that whoever was behind these claims had likely committed a contempt of court, and it was “potentially criminal conduct”.

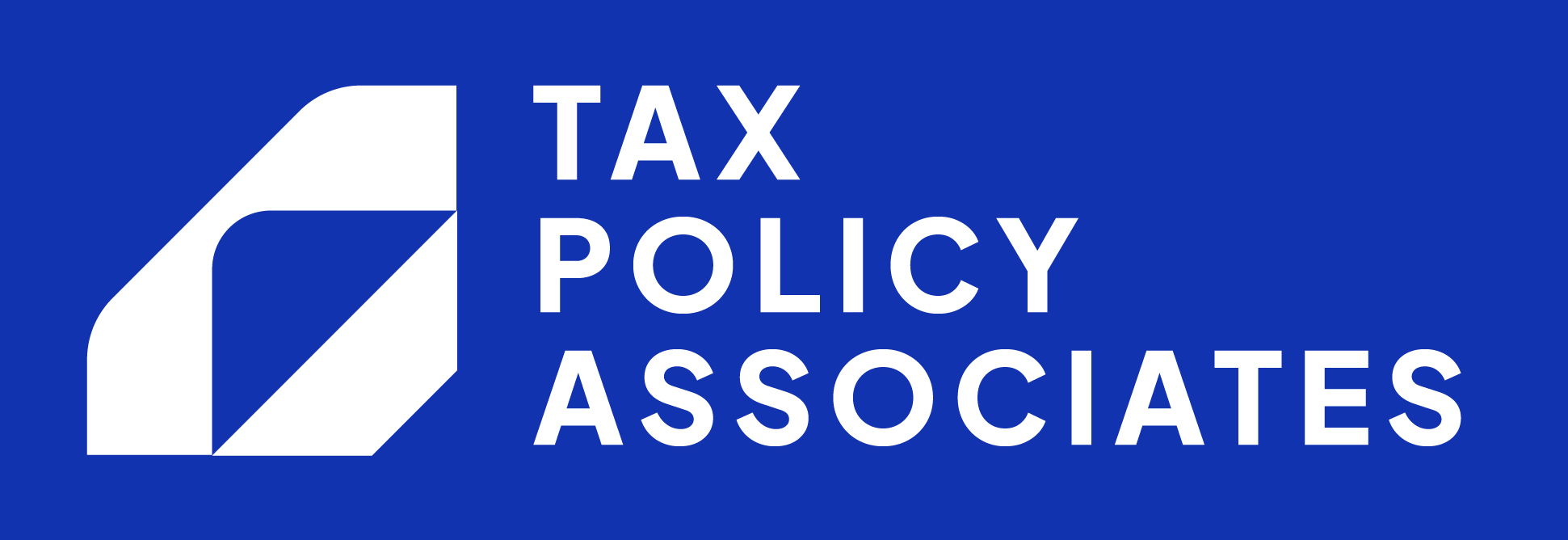

The court was deeply concerned at all this:

… and concludes by saying that:

We have never seen this before. There is a procedure for “civil restraint orders” to be obtained to prevent vexatious litigants filing repeated meritless claims, but here the court is saying that that the courts will ignore Stamp’s attempts to file claims, because they’re invalid on their face. Defendants won’t even need to file a defence.

Stamp appears to have a number of other active claims, referred to obliquely in the judgment. Most of these seem to relate to a feud or falling-out⚠️ with others⚠️ providing similar “services” to Stamp. It is unclear whether the Court’s pragmatic attitude to Stamp’s claims against lenders will extend to his claims against private individuals.

Stamp and tax

The Matrix Freedom website makes predictably far-fetched claims15 about tax:

“To learn how you can benefit from the fact that no Acts and Statutes have Royal Assent since 1973, meaning no tax Acts, including the council tax, applies, and all other Acts and Statutes from 1973 are void, attend the webinar.”

Stamp also appears to offers various tax services under companies called Creditor Tax Rebates Ltd, CQV Tax Rebates Ltd, Creditor Tax Filings Ltd and Creditor Tax Assessments Ltd. We haven’t been able to find out any further details, but anyone who has any information should get in touch.

He has another company probably called MTRXF Ltd16, which claims to offer an “IRS tax filing service⚠️“. It is doubtful they have the US IRS authorisation required to do this; their directors aren’t registered with the IRS as tax preparers. We asked them why this was and received no response.

Stamp also appears to have attempted to file some kind of claim of his own against HMRC. It wasn’t the usual tax appeal in a tribunal, but a high court claim for (we infer, given it’s under Part 7) over £100,000 which was dismissed.

It seems from Stamp’s failed defamation claim that the HMRC claim was struck out as “wholly without merit“.

Others appear to be actively using these kind of theories to attempt to defraud HMRC.

Who will protect the public?

These kinds of scams tend to be marketed to people who are vulnerable and in financial trouble. They’re precisely the kind of people who are supposed to be protected by the rules preventing non-lawyers from litigating. But, at the moment, nobody seems to be taking any action to stop Stamp and Matrix from ripping off their clients17, wasting valuable court time, and wasting the time and money of the people and organisations they bring claims against.

We don’t know whether Stamp and his colleagues genuinely believe the bizarre legal theories they are promoting, but we don’t think that matters. Here are some steps that could be taken:

- The police could investigate what the High Court has already described as “having every appearance of deceit, of abuse and contempt of court”, and “potentially criminal conduct”.18

- The police could also investigate whether Stamp and his associates defrauded their own clients, given the High Court’s suggestion that the long list of “elderly statutes” may have been intended to deceive them. OpenDemocracy published other evidence of potential fraud last year. There are also numerous claims on this website of fraud by Matrix Freedom – we do not know whether these reports are reliable or not. And, in their own management meetings,19 Stamp admitted that it was their fault that their “solutions” had caused problems to their own clients.

We are not aware of any active criminal proceedings.

Matrix Freedom has posted documents on the internet suggesting that the FCA is already taking action⚠️.20 Matrix Freedom haven’t stopped marketing their schemes. But they have demanded🔒 £100m in gold or silver from the FCA and the judge, failing which Stamp says he will “employ the US Secretary of the Treasury and the IRS” to collect it.

We’d like to see Stamp try to do that. But we’d prefer to see a criminal investigation into what looks like a conspiracy to defraud the public, mortgage lenders, and tax authorities.

Many thanks to K and I for their research and other contributions to this article, and thanks to B for technical review of the videos.

All videos/images (c) Iain Clifford Stamp/Matrix Freedom Limited, and reproduced in the public interest, and as fair dealing for the purposes of criticism.

Footnotes

Iain Clifford Stamp & Ors v Capital Home Loans Limited T/A CHL Mortgages & Ors [2024] EWHC 1092 (KB) ↩︎

It unlawfully uses a PO Box for its registered office, has never filed accounts, is late filing its confirmation statement, and is about to be struck off. ↩︎

Registration is required; it’s easy to do that with a disposable email address. This and all other links to Stamp’s business are marked “nofollow” so that our link does not increase their search engine prominence. ↩︎

Not an actual legal term, but one that appears to be used exclusively by “sovereign citizens” and similar pseudolaw practitioners ↩︎

There are also reports he used a company called SENJ Limited (Seychelles); however we can find no evidence that this company exists. Possibly it was dissolved at some point after the FCA started asking questions. ↩︎

This appears to have led to a libel claim by Stamp against OpenDemocracy. ↩︎

The second item on the list may be intended to refer to the Bills of Exchange Act 1882, which is mostly still in force, but of no relevance. ↩︎

There is a magisterial analysis of all these theories in the Canadian judgment Meads v Meads. Yisroel Greenberg has written about UK adherents to these theories, from the perspective of a local government lawyer. The criminal barrister who tweets as @CrimeGirl has compiled a useful summary of UK caselaw. The Ministry of Justice recently sent an impressively complete FOIA response to someone asking about these theories. We recently covered a tax-flavoured variant of this conspiracy theory, which used the war in Gaza as an excuse for tax evasion. ↩︎

The video was made available here. We would be cautious about believing many of the claims on this website, as the owner appears to have some kind of feud with Stamp. However, this video has every sign of being genuine (we showed it to an expert in “deep fake” video creation and he was confident that such techniques were not used). ↩︎

See the 31 May 2022 “full council meeting” video on this website, around the 31 minute mark ↩︎

Two of whom were wrongly identified; see the front page of the judgment ↩︎

The court had already struck out some of the claims on its own, without an application from the defendant lenders; the 9 May judgment includes an appeal against that decision by the affected claimants. ↩︎

A quick and simplified summary of securitisation: Banks can make only a limited amount of mortgage loans before running out of regulatory capital. So many banks will sell the beneficial interest in their loans to a “special purpose vehicle” which has raised funds issuing bonds on the capital markets. The risk of the loans not performing is now mostly borne by the bondholders, not the bank, meaning the bank has freed up regulatory capital and can make more loans. The bank remains the legal owner of the mortgage loans, and so has the relationship with the borrower. By definition, that means the arrangement doesn’t affect the borrower’s legal rights. ↩︎

A term very redolent of the “Freeman on the Land” movement ↩︎

As is typical of the genre, the claims are not even internally consistent – in the (impossible) event that all statutes since 1973 were void, we would have to pay tax under the pre-1973 statutes. This would not necessarily be a good outcome for their clients. There’s a not-entirely-serious comment below from Richard Thomas, the respected retired tax tribunal judge, on how this could play out. ↩︎

That is a little unclear, as the company number on its website is in fact the company number for Creditor Tax Rebates Ltd ↩︎

And despite the claims on the Matrix Freedom website that Matrix Freedom doesn’t have clients, Stamp freely uses that word in their own management meetings. ↩︎

Why a contempt of court? Because of the High Court’s statement that the activities “could well amount” to the conduct of litigation. That’s a “reserved legal activity” under the Legal Services Act, and it’s a criminal offence to carry on a reserved legal activity if you are not a qualified/regulated legal professional; and in addition to that specific offence, it’s also a contempt of court. ↩︎

See the 31 May 2022 “full council meeting” recording, at 37:00 ↩︎

This document🔒 claims that the FCA applied for, and obtained, some form of court order against Stamp at Southwark Crown Court 7th June 2023 (No 34 2023). This document🔒 attempts to appoint a judge and an FCA lawyer as “trustees” of Stamp’s “estate” (with both terms used in ways that have little in common with their actual meaning). It is unclear whether all of this relates to the mortgage scam, or other activities of Stamp/Matrix Freedom – we asked the FCA and they said they couldn’t comment on individual cases. ↩︎

Leave a Reply