There’s a⚠️ campaign claiming⚠️ that you can legally stop paying tax to protest the war in Gaza, or even that it is illegal for you to pay tax. None of the claims have any legal basis – they originate in a racist US anti-tax cult. The man behind the campaign used the same arguments to try to avoid paying council tax in 2016 – he failed and spent Christmas in jail. The claim that you can legally stop paying tax is therefore either deluded or dishonest.

UPDATE 8 June: we reported today on another version of the same conspiracy theories, this time using them to profit from charging fees to vulnerable people in debt

UPDATE 6 May 2025: the “no tax for genocide” campaign now admits that it’s not lawful (or indeed required) to withhold tax. Instead they propose requesting refunds from HMRC. But Chris Coverdale continues to make false claims🔒 that it’s legal (indeed, required) to not pay tax, and to publish a nonsensical “trust deed🔒” that supposedly facilitates this.

The claims

The various websites🔒1 makes a series of legal claims:2

and:

Parliament has passed laws requiring us to pay tax, and Parliament is the supreme legal authority in the UK – complying with a law cannot be “illegal”. No human rights law or treaty3 can override a tax obligation. 4 Only in very clear cases does one statute override another, and it is then the most recent statute that takes precedence – and income tax is enacted every year. You are free to believe that the Government is immoral, or that paying tax is immoral, but paying tax is not just legal, but legally required.

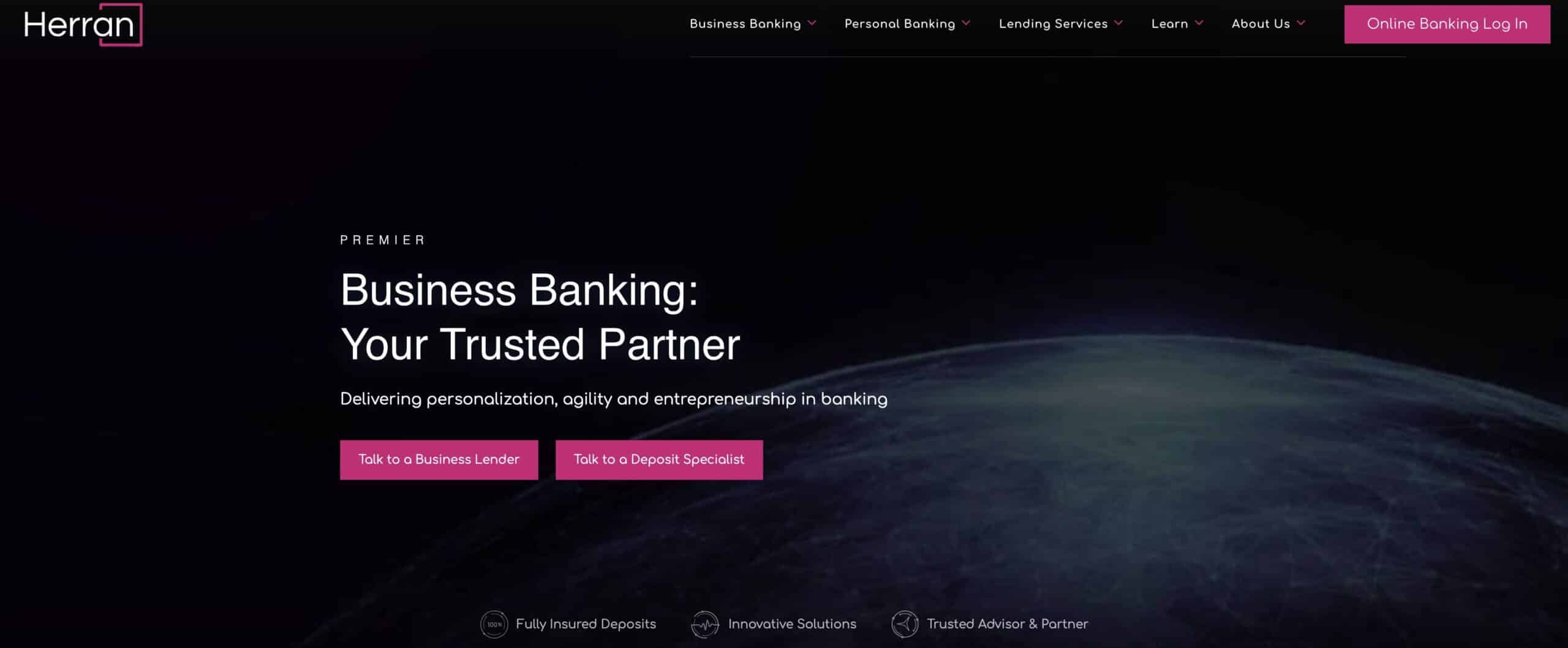

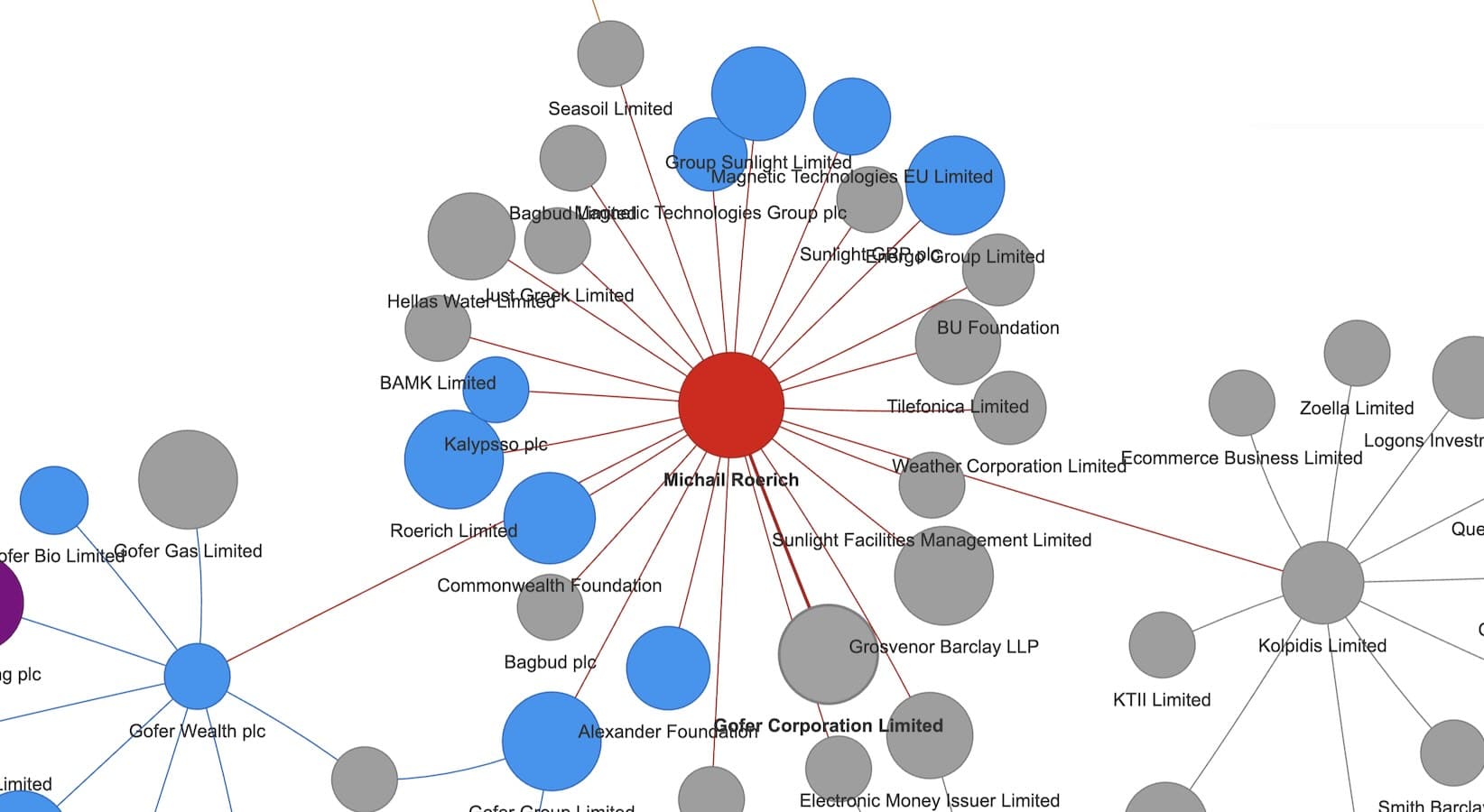

The campaigners have an unusual solution – a magic trust:

The claim is that, if you sign it, “you are protected against legal action for not paying tax“.

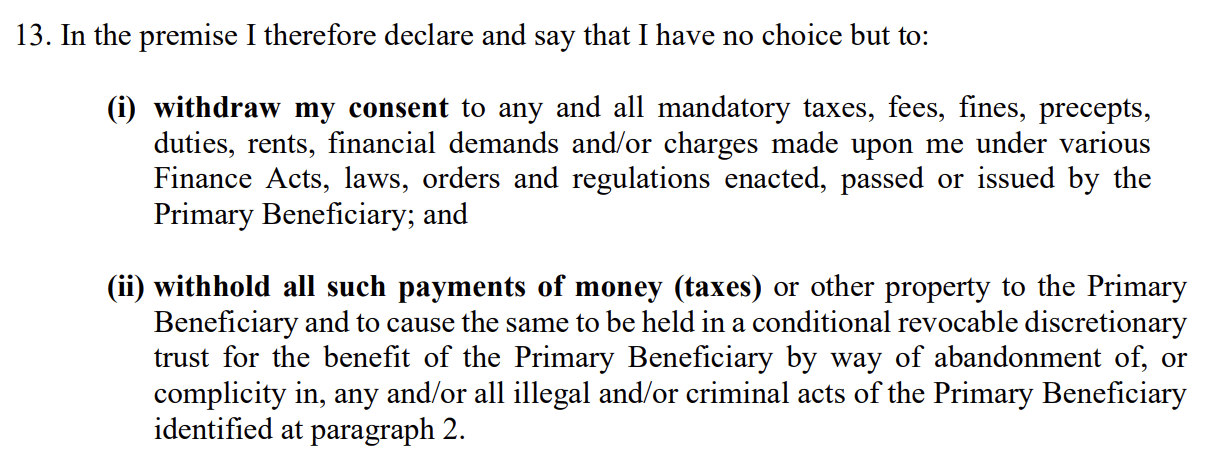

The trust document is posted here. The first paragraph of the trust refers to the signatory being a “sovereign man/woman”. This wording is legally meaningless and comes straight from the US sovereign citizen movement, which has its origins in a fringe racist group and the KKK. “Sovereign citizens” have used arguments of this kind to try to escape US tax, without any success. It’s also notable that the document says it’s a deed, but isn’t – whoever drafted it hasn’t even bothered to google the word “deed”.

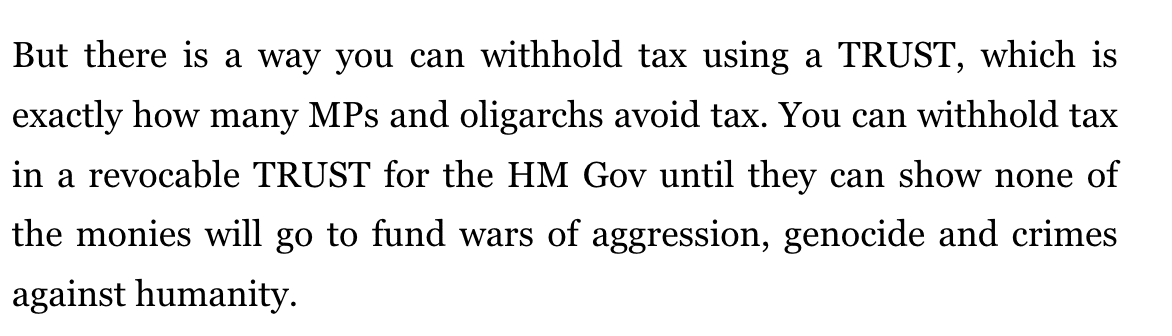

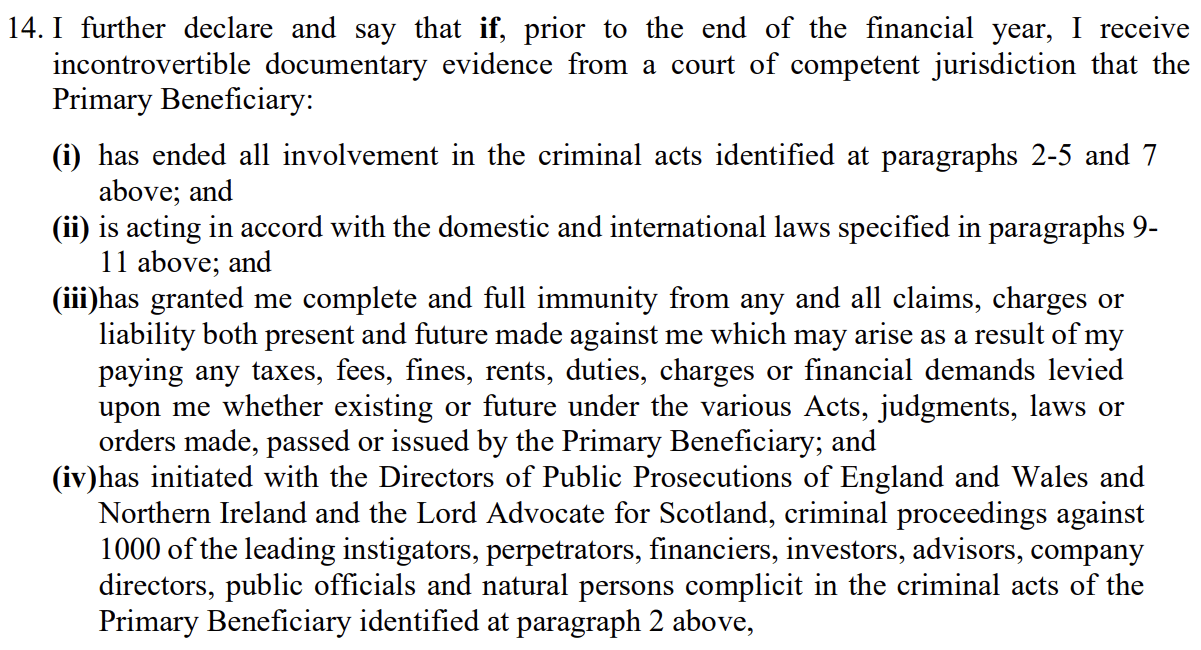

Here’s the key section of the document (the “Primary Beneficiary” is the Government):

The idea that we can individually “withdraw our consent” to tax or other laws is (obviously) false but, again, a common theme in sovereign citizen propaganda.5 If people could legally stop paying tax any time they disapproved of the government, the government would long since have run out of money.6

A further sign that the document originates in the US is that the trust is said to be “revocable” – revocable trusts are a US legal concept which have no equivalent in the UK.7 The consequences of signing such a document would be complex and uncertain – the trust may not be a substantive trust at all as drafted and, if it is, would give rise to a very messy tax position. One prominent trusts expert told us it would be a “disaster” for the person signing it, if it actually was recognised as a trust. Certainly nobody should do such a thing without detailed tax and trust advice.8

The “trust” then supposedly remains in place until a series of very specific and very unlikely things happen:

Which in practice means that you are stopping paying tax forever.

It’s unclear how much reality the trust has, even in the minds of the people running this scheme. At least one has confessed they just spend the money. Others have talked about putting a cheque in an envelope in a drawer.

So the “trust deed” appears to be neither a trust nor a deed.

What happens if you stop paying tax?

The promoters are comfortably reassuring:

and:

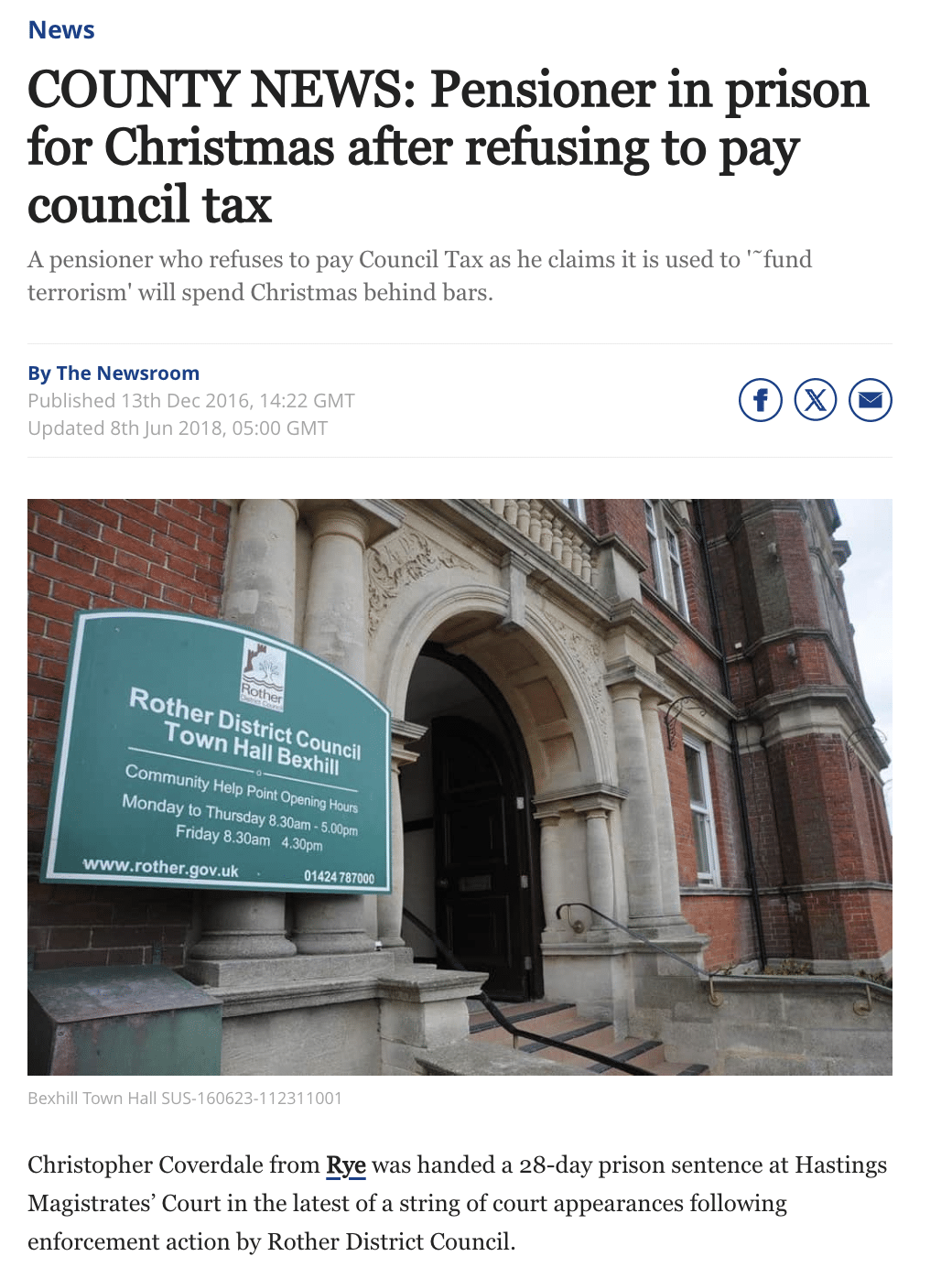

The problem here is that the campaigners are concealing what actually happened when Coverdale used these arguments in 2016 to try to get out of paying his council tax bill:

On a previous attempt in 2014, Coverdale was given a suspended sentence.

Coverdale describes himself as a “behavioural scientist, governance consultant, peace campaigner and memetic engineer.” Despite having been prosecuted for failing to pay tax, he said in January 2023 that you can’t be prosecuted for failing to pay tax:

In our view, Coverdale is either dishonest or delusional.

HMRC and councils pursue people for non-payment of tax all the time. They’re not going to behave any differently just because you wave a funny trust document at them.

The campaigners have the additional practical problem that most people pay don’t actually pay income tax – their employer deducts it under PAYE. The campaigners have an answer to this problem – ask HMRC to stop PAYE:

We expect most people will realise immediately that this doesn’t work – you can’t stop your employer deducting PAYE by notifying HMRC that you wish the money to go into trust (and tax evasion would be very easy if you could). The law requires employers to apply PAYE, and HMRC has no discretion to disapply the law.9

How fringe are these views?

The campaign website⚠️ says:

We don’t know who the “team of experts” are, but we would be surprised if they include any tax advisers or lawyers.10 We don’t believe any qualified lawyer or tax adviser would agree with any of the claims made.11

The context

There is a long history of people protesting by withholding tax: the Peasants’ Revolt against the poll tax; the US colonists protesting against the Tea Act, the Women’s Tax Resistance League demanding equal voting rights, the 1989-91 anti-poll tax campaign. The protesters in these cases knew that their actions were illegal, but believed they were justified by wider moral considerations.

In recent times there has been a different type of tax protester. Not paying tax is central to their worldview, rather than just a tactic they adopt. They claim that they have found a “true” legal system which lets them walk away from tax and other inconvenient laws. It’s part of what adherents call the “sovereign citizen” or (particularly in the UK) the “freeman on the land” movement, which has its origins in the racist far-right in the US (although, oddly, UK followers seem to be found on the Left as much as the Right🔒.)12

A better term for these movements is “pseudolaw” – the use of arguments that sound legal, but in fact are no more than gobbledegook, and the belief that correctly worded documents (like this trust) have almost magical power.13 There is a very complete analysis of the history of these arguments in the Canadian decision Meads v Meads (summarised in this post by barrister Adam Wagner). More recently, respected criminal barrister and blogger CrimeGirl has written an excellent summary of reported UK pseudolaw cases, and the “Secret Barrister” has written about pseudolaw arguments deployed to try to escape Covid regulations.

The most famous modern tax protester is Hollywood star Wesley Snipes – he used sovereign citizen arguments to avoid paying $15m of US tax, and was jailed for three years🔒 as a result. We don’t have any evidence for how widespread the modern UK tax protest movement is, but the prominence of the issue on council websites suggests it is more than a small fringe.

One thing all the various strains of sovereign citizen/freeman on the land have in common is that they behave like a cult, following charismatic leaders🔒 and believing to a fanatical level of religious certainty that their pseudo-legal beliefs are correct, regardless of the evidence.

What about the war in Gaza?

We are commenting on the law, and take no position on foreign policy, defence policy, or the war in Gaza. However, Gaza doesn’t seem to be the genuine inspiration behind this campaign – the people behind it have been running the same tax arguments🔒 for years🔒. The US sovereign citizen movement they’re inspired by, and from where they’ve taken both their arguments and their pseudo-legal documents, has its origins in a fringe racist group and the KKK. These are arguments that have been rejected time and again by the courts in the US, UK, Canada and Australia.

Anyone who wishes to protest by not paying tax should be aware that this will break the law – that’s what civil disobedience by definition is. If someone believes that’s ethically justified, and is willing to take the legal and financial consequences, then we can respect their choice. But we can’t respect campaigners misleading people with false claims that you can legally stop paying tax.

Many thanks to criminal barrister Sarah McGill of Lincoln House Chambers for reviewing a draft of this article, and to C for the trusts tax expertise.

Footnotes

This and many of the other links in this article are tagged “nofollow”, which means that they should be ignored by search engines, and so won’t boost the internet profile of the websites. ↩︎

This is the kind of fringe thing we normally wouldn’t comment on, for fear we’re just giving it further publicity. But now it’s broken into the mainstream, including a disappointingly credulous piece in the Telegraph, we thought it would be helpful to comment. ↩︎

With the obvious exception of tax treaties, at least some of the time. ↩︎

When we were a member of the EU the position was in some cases different, as a UK law could be overriden by EU treaties or legislation. But this was only because Parliament permitted it to be different. ↩︎

This seems to be a variation on the normative fallacy. Sovereign citizens believe that individuals should be able to freely choose to opt out of the legal system that applies to everyone else – a valid political/philosophical view. However they then make an invalid leap of logic to the position that individuals in fact are able to opt out of the legal system. ↩︎

This line was stolen from Ian Rex-Hawes ↩︎

The reference to the trust being “discretionary” also makes no sense, because as drafted there is no discretion. Whoever drafted it appears to have been throwing words at a page. ↩︎

Trusts are nowadays not a good way of avoiding tax, because there’s an immediate 20% inheritance tax charge when you put property into trust. Things are different for non-doms, as they don’t generally face the 20% charge if they put foreign property into a foreign trust, and so trusts remain a very important way for non-doms to minimise their UK tax (or avoid UK tax, depending on your viewpoint). ↩︎

Except where they think they can better collect the tax from the employee directly. ↩︎

Aside from the legal non-sequiturs driving the campaign, their websites make numerous errors of fact and law, for example claiming that council tax receipts go into the (central) Government’s consolidated fund. They don’t – they go to an account held by the council. ↩︎

Although lawyers and advisers may have different views on whether those promoting this scheme have any liability under civil or criminal law. Our initial view was that the rules requiring disclosure of tax avoidance schemes won’t apply, because the promoters here are not acting in the course of a business; however it now seems they charge a monthly subscription, which suggests DOTAS could well apply. And if the promoters are aware that their scheme does not work (and Coverdale’s conviction suggests they might be) then they could be criminally liable for conspiracy to defraud the revenue. The IRS in the US has successfully pursued fraud charges🔒 against people organising sovereign citizen tax protest schemes. ↩︎

It was a “sovereign citizen” acting in a very bizarre way who recently caused chaos at Companies House. ↩︎

Obviously by analogy with pseudoscience, although it appears to us more akin to a “cargo cult” – it’s trying to summon legal effects by mimicking legal language. ↩︎

![DECLARATION of SOVEREIGNTY & DEED

of DISCRETIONARY REVOCABLE CONDITIONAL

TRUST and WITHDRAWAL of CONSENT to

MANDATORY TAXATION

I, [Name]

Currently of [address]

on this [Day] of [Month] [Year]

being of sound mind, DECLARE AND SAY as follows:

1. I, a sovereign man / woman resident in the United Kingdom consent to pay all taxes in

favour of Parliament, the Government of Britain and Northern Ireland, public authorities

and/or institutions, HMRC, the DVLA, local Council, corporate bodies and/or businesses,

and/or individuals acting as agents of HM Government (hereinafter jointly and severally

known as the “Primary Beneficiary”), in consideration of various taxes, fees, fines,

rents, duties, levies, demands or charges made upon me under various Finance Acts, laws

and/or regulations enacted, passed or issued by the Primary Beneficiary, and as trustee

will hold said payment(s) in whole or in part on discretionary, conditional, revocable

trust for the Primary Beneficiary until the last day of the financial year.](https://taxpolicy.org.uk/wp-content/uploads/2024/03/Screenshot-2024-03-15-at-17.50.27.png)

Leave a Reply