There’s a campaign claiming that you can legally stop paying tax to protest the war in Gaza, or even that it is illegal for you to pay tax. None of the claims have any legal basis – they originate in a racist US anti-tax cult. The man behind the campaign used the same arguments to try to avoid paying council tax in 2016 – he failed and spent Christmas in jail. The claim that you can legally stop paying tax is therefore either deluded or dishonest.

UPDATE 8 June: we reported today on another version of the same conspiracy theories, this time using them to profit from charging fees to vulnerable people in debt

UPDATE 6 May 2025: the “no tax for genocide” campaign now admits that it’s not lawful (or indeed required) to withhold tax. Instead they propose requesting refunds from HMRC.

The claims

The various websites1 makes a series of legal claims:2

and:

Parliament has passed laws requiring us to pay tax, and Parliament is the supreme legal authority in the UK – complying with a law cannot be “illegal”. No human rights law or treaty3 can override a tax obligation. 4 Only in very clear cases does one statute override another, and it is then the most recent statute that takes precedence – and income tax is enacted every year. You are free to believe that the Government is immoral, or that paying tax is immoral, but paying tax is not just legal, but legally required.

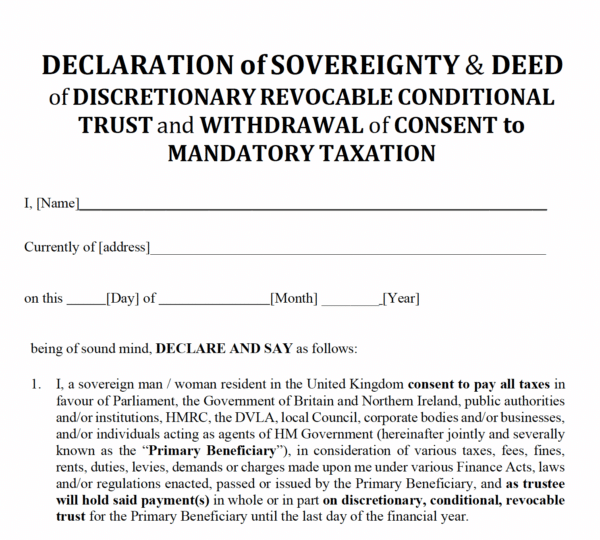

The campaigners have an unusual solution – a magic trust:

The claim is that, if you sign it, “you are protected against legal action for not paying tax“.

The trust document is posted here. The first paragraph of the trust refers to the signatory being a “sovereign man/woman”. This wording is legally meaningless and comes straight from the US sovereign citizen movement, which has its origins in a fringe racist group and the KKK. “Sovereign citizens” have used arguments of this kind to try to escape US tax, without any success. It’s also notable that the document says it’s a deed, but isn’t – whoever drafted it hasn’t even bothered to google the word “deed”.

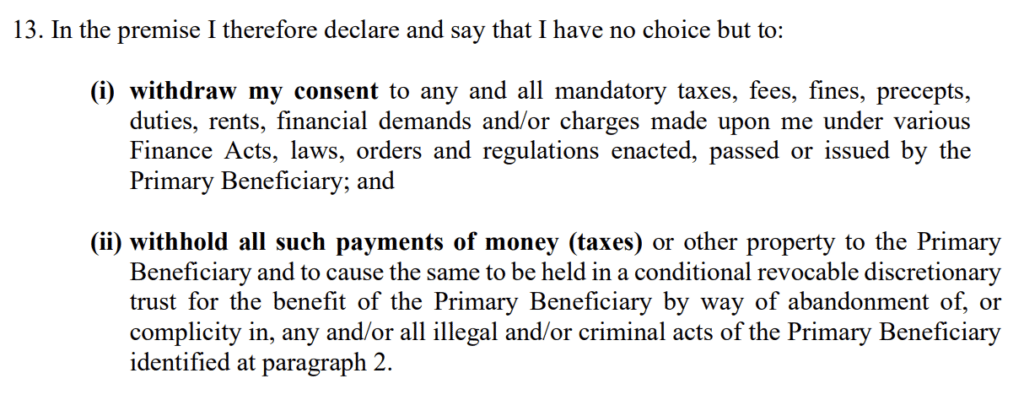

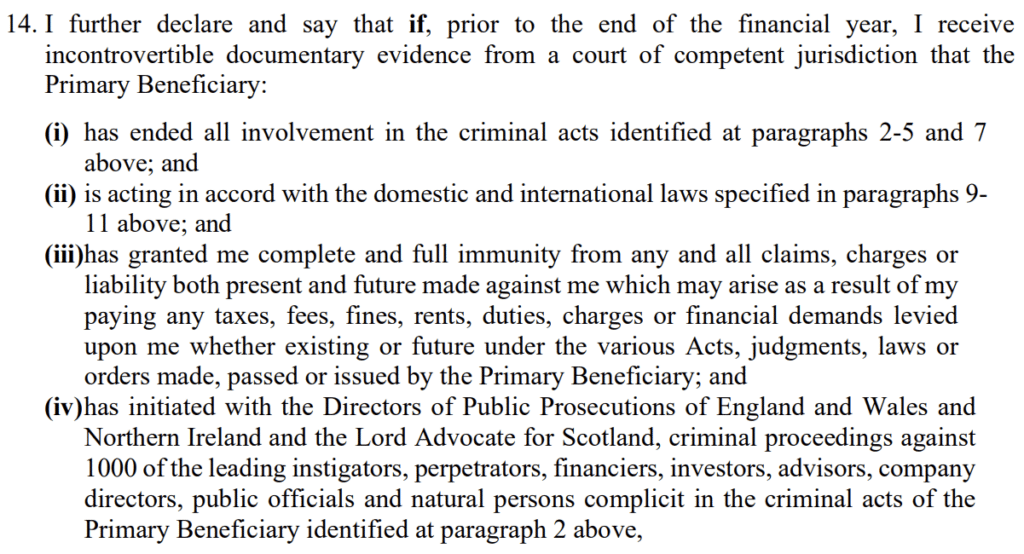

Here’s the key section of the document (the “Primary Beneficiary” is the Government):

The idea that we can individually “withdraw our consent” to tax or other laws is (obviously) false but, again, a common theme in sovereign citizen propaganda.5 If people could legally stop paying tax any time they disapproved of the government, the government would long since have run out of money.6

A further sign that the document originates in the US is that the trust is said to be “revocable” – revocable trusts are a US legal concept which have no equivalent in the UK.7 The consequences of signing such a document would be complex and uncertain – the trust may not be a substantive trust at all as drafted and, if it is, would give rise to a very messy tax position. One prominent trusts expert told us it would be a “disaster” for the person signing it, if it actually was recognised as a trust. Certainly nobody should do such a thing without detailed tax and trust advice.8

The “trust” then supposedly remains in place until a series of very specific and very unlikely things happen:

Which in practice means that you are stopping paying tax forever.

It’s unclear how much reality the trust has, even in the minds of the people running this scheme. At least one has confessed they just spend the money. Others have talked about putting a cheque in an envelope in a drawer.

So the “trust deed” appears to be neither a trust nor a deed.

What happens if you stop paying tax?

The promoters are comfortably reassuring:

and:

The problem here is that the campaigners are concealing what actually happened when Coverdale used these arguments in 2016 to try to get out of paying his council tax bill:

On a previous attempt in 2014, Coverdale was given a suspended sentence.

Coverdale describes himself as a “behavioural scientist, governance consultant, peace campaigner and memetic engineer.” Despite having been prosecuted for failing to pay tax, he said in January 2023 that you can’t be prosecuted for failing to pay tax:

In our view, Coverdale is either dishonest or delusional.

HMRC and councils pursue people for non-payment of tax all the time. They’re not going to behave any differently just because you wave a funny trust document at them.

The campaigners have the additional practical problem that most people pay don’t actually pay income tax – their employer deducts it under PAYE. The campaigners have an answer to this problem – ask HMRC to stop PAYE:

We expect most people will realise immediately that this doesn’t work – you can’t stop your employer deducting PAYE by notifying HMRC that you wish the money to go into trust (and tax evasion would be very easy if you could). The law requires employers to apply PAYE, and HMRC has no discretion to disapply the law.9

How fringe are these views?

The campaign website says:

We don’t know who the “team of experts” are, but we would be surprised if they include any tax advisers or lawyers.10 We don’t believe any qualified lawyer or tax adviser would agree with any of the claims made.11

The context

There is a long history of people protesting by withholding tax: the Peasants’ Revolt against the poll tax; the US colonists protesting against the Tea Act, the Women’s Tax Resistance League demanding equal voting rights, the 1989-91 anti-poll tax campaign. The protesters in these cases knew that their actions were illegal, but believed they were justified by wider moral considerations.

In recent times there has been a different type of tax protester. Not paying tax is central to their worldview, rather than just a tactic they adopt. They claim that they have found a “true” legal system which lets them walk away from tax and other inconvenient laws. It’s part of what adherents call the “sovereign citizen” or (particularly in the UK) the “freeman on the land” movement, which has its origins in the racist far-right in the US (although, oddly, UK followers seem to be found on the Left as much as the Right.)12

A better term for these movements is “pseudolaw” – the use of arguments that sound legal, but in fact are no more than gobbledegook, and the belief that correctly worded documents (like this trust) have almost magical power.13 There is a very complete analysis of the history of these arguments in the Canadian decision Meads v Meads (summarised in this post by barrister Adam Wagner). More recently, respected criminal barrister and blogger CrimeGirl has written an excellent summary of reported UK pseudolaw cases, and the “Secret Barrister” has written about pseudolaw arguments deployed to try to escape Covid regulations.

The most famous modern tax protester is Hollywood star Wesley Snipes – he used sovereign citizen arguments to avoid paying $15m of US tax, and was jailed for three years as a result. We don’t have any evidence for how widespread the modern UK tax protest movement is, but the prominence of the issue on council websites suggests it is more than a small fringe.

One thing all the various strains of sovereign citizen/freeman on the land have in common is that they behave like a cult, following charismatic leaders and believing to a fanatical level of religious certainty that their pseudo-legal beliefs are correct, regardless of the evidence.

What about the war in Gaza?

We are commenting on the law, and take no position on foreign policy, defence policy, or the war in Gaza. However, Gaza doesn’t seem the inspiration behind this campaign – the people behind it have been running the same tax arguments for years. The US sovereign citizen movement they’re inspired by, and from where they’ve taken both their arguments and their pseudo-legal documents, has its origins in a fringe racist group and the KKK. And these are arguments that have been rejected time and again by the courts in the US, UK, Canada and Australia.

Anyone who wishes to protest by not paying tax should be aware that this will break the law – that’s what civil disobedience by definition does. If someone believes that’s ethically justified, and is willing to take the legal and financial consequences, then we can respect their choice. But we can’t respect campaigners misleading people with false claims that you can legally stop paying tax.

Many thanks to criminal barrister Sarah McGill of Lincoln House Chambers for reviewing a draft of this article, and to C for the trusts tax expertise.

Footnotes

This and many of the other links in this article are tagged “nofollow”, which means that they should be ignored by search engines, and so won’t boost the internet profile of the websites. ↩︎

This is the kind of fringe thing we normally wouldn’t comment on, for fear we’re just giving it further publicity. But now it’s broken into the mainstream, including a disappointingly credulous piece in the Telegraph, we thought it would be helpful to comment. ↩︎

With the obvious exception of tax treaties, at least some of the time. ↩︎

When we were a member of the EU the position was in some cases different, as a UK law could be overriden by EU treaties or legislation. But this was only because Parliament permitted it to be different. ↩︎

This seems to be a variation on the normative fallacy. Sovereign citizens believe that individuals should be able to freely choose to opt out of the legal system that applies to everyone else – a valid political/philosophical view. However they then make an invalid leap of logic to the position that individuals in fact are able to opt out of the legal system. ↩︎

This line was stolen from Ian Rex-Hawes ↩︎

The reference to the trust being “discretionary” also makes no sense, because as drafted there is no discretion. Whoever drafted it appears to have been throwing words at a page. ↩︎

Trusts are nowadays not a good way of avoiding tax, because there’s an immediate 20% inheritance tax charge when you put property into trust. Things are different for non-doms, as they don’t generally face the 20% charge if they put foreign property into a foreign trust, and so trusts remain a very important way for non-doms to minimise their UK tax (or avoid UK tax, depending on your viewpoint). ↩︎

Except where they think they can better collect the tax from the employee directly. ↩︎

Aside from the legal non-sequiturs driving the campaign, their websites make numerous errors of fact and law, for example claiming that council tax receipts go into the (central) Government’s consolidated fund. They don’t – they go to an account held by the council. ↩︎

Although lawyers and advisers may have different views on whether those promoting this scheme have any liability under civil or criminal law. Our initial view was that the rules requiring disclosure of tax avoidance schemes won’t apply, because the promoters here are not acting in the course of a business; however it now seems they charge a monthly subscription, which suggests DOTAS could well apply. And if the promoters are aware that their scheme does not work (and Coverdale’s conviction suggests they might be) then they could be criminally liable for conspiracy to defraud the revenue. The IRS in the US has successfully pursued fraud charges against people organising sovereign citizen tax protest schemes. ↩︎

It was a “sovereign citizen” acting in a very bizarre way who recently caused chaos at Companies House. ↩︎

Obviously by analogy with pseudoscience, although it appears to us more akin to a “cargo cult” – it’s trying to summon legal effects by mimicking legal language. ↩︎

50 responses to ““No tax for genocide” – an anti-tax cult, and its false claim you can legally stop paying tax”

Why do you have to bring race into it? What’s the KKK got to do with people withholding tax that funds war? Derogatory labelling based around identity politics is so BORING. Parliament is not supreme, sorry. How can it be and where do you suppose it gets its authority from?

https://peacekeepers.org.uk/the-great-myth-of-parliamentary-supremacy-why-the-common-law-is-king-and-statement-of-case/

It is factual that the sovereign citizen movement originated in the KKK and similar far-right racist groups. I can see you’re upset by me mentioning this, but the real question is why it doesn’t set off the world’s largest alarm bells for you. Anyone who thinks the only valid law is ancient common law is welcome to re-enact feudalism any time they choose.

Also, I notice the link takes you to ProbityCo yet you refer to the NoTaxForGenocide site which seems full of holes – and lies. It’s a duplicitous position to take to conflate the two. And dishonest. BTW, Council Tax is a Statutory tax as it tells me on the website of my local council.

So when oligarchs keep their taxes in offshore trusts, that’s not tax evasion because…the FCA can’t get at them?

Is it a criminal offence in UK to pay tax if any of it is used to fund genocide, murder or any criminal activity as per the 1945 UN Charter, Terrorism Act 2000 & The Nuremberg Code?

Also can I withhold my tax money using a TRUST, with the HM Gov until they can show none of the monies will go to fund wars of aggression, genocide and crimes

against humanity?

Please read the article above. It is never a criminal offence to pay tax in the UK. You cannot lawfully stop paying tax. The “TRUST” is not a trust. This is being pushed by some people who are well-meaning but deluded, and others who simply don’t want to pay tax.

Does this scheme fall under the same bracket? They’re talking about requesting tax refunds instead of withholding them.

https://defundgenocide.co.uk/

Thanks – hadn’t seen that before. Still full of crazy sovereign citizen nonsense, but this version has the definite advantage that it’s not tax evasion and you won’t end up with large tax bills/penalties and even face potential jail time. We are all completely free to write to HMRC requesting a refund of your taxes because we disagree with government policy. No prizes for guessing what HMRC’s response will be.

You say that Parliament is supreme, but since the ICC Act 2001 that is no longer the case for the six crimes mentioned in the Act. This is a major omission. Is it intentional?

I don’t know why you think that, but it’s wrong. The Act gives effect to the ICC, just as other Acts and Regulations give effect to other laws and treaties. Parliament could amend/repeal the Act tomorrow.

Actually you can stop paying tax. As its unlawful anyway. In order to take tax you would ahve to enter in to a contract with the state and as you do not do this the state can not steel your money. It IS actual fact. Of course the government will always just go after you and steel it anyway by force as who will stop them. They own the biggest gang and they ahve all the power with no one to stop them. I personally know a group that have not paid income tax now for 3 years and are going round and round in the court tying them in knots. But as I said inevitably I think that the government will just go in and steel it.

I don’t know about anyone else but I never said the government could take my money… also the money that they steel doesn’t even go towards what people generally argue about, ie infrastructure etc. As all that is privately owned. The water, power, transport, food, even the NHS is All private owned and only oublic in name… really next time your I a surgery look at the posters threading the nurses or doctors and look at the small print of who supplies them then go in to companies omhosue and you will see all Ltd companies who supply these staff. The roads are funded by road tax (please don’t start on its not road tax because the changed the bane to VED… you dint pay it I’d you dint drive in the road, yet you can drive all you want on any private land regardless… so it is a road tax!) Our council tax pays for a few local amenities but mostly for feckless and useless council jobs. Basically mine and all our income tax is stollen off us and given to the feckless and lazy scum with the eliets slushing it round and taking their share indirectly via golden handshakes (think PPE, extra jobs where the mp works 1 day a year yet gets £2million, the back hander that go on between the eu and the UK)

We are slaves we are just brainwashed in to thinking that we are free.

I’ve approved this comment so that readers can see the mindset of the people adopting this philosophy. “In order to take tax you would have to enter into a contract with the state”. The average 10 year old can see the logical problems with this.

The rest is just confusing “I don’t like this thing” with “this thing is illegal”.

Actually, it’s the other way around. Israel at this precise moment in time have been found to have committed acts of genocide, human rights breaches and crimes against humanity. The United Kingdom and the USA are at this moment selling arms, providing funding and military assistance to the Israel government. They are both guilty by association so all support must be withdrawn to comply with international law.

It is a criminal offence in the UK to pay tax if any of it is used to fund genocide, murder or any criminal activity, according to the 1945 UN Charter, Rome Statute of the International Criminal Court, Terrorism Act 2000, and the Nuremberg Code.

Whoever you got this information from lied to you. It is not possible for a breach of an international treaty to be a criminal offence in the UK; there has to be enabling legislation. Citing those charters/treaties is therefore incorrect. Obviously it cannot be a breach of the Terrorism Act 2000 to pay tax required by another Act of Parliament. This is basic law 101. Pull any constitutional law textbook off the shelf and check it out. nb TikTok videos are not constitutional law textbooks.

You can take whatever position you like on Israel/Palestine and politics in general, but the law is the law.

I’m The narrowest sense of “legally” Dan is correct.The “law is the law” says Dan. Also “we take no position on the debate about Gaza”. I.e. the law is the law unless the law is International Law and you represent the UK, Israeli or US Government. Also Dan’s position suggest taxes are a metaphysically distinct sphere from international standards of morality. Translate this = pay your taxes you serfs we need the money to bomb whoever we want. If there was a big collective movement to temporarily withhold taxes until the bombs stop falling I think I would join it – certainly I do not take a neutral position at all which is essentially condoning was crimes.

I’m going to leave aside your suggestion that the UK is paying for bombs in Gaza. I am not at all sure that is true, and no evidence is being provided. But let’s assume for argument’s sake it’s correct. If someone wants to withhold tax because they object to this, and accept the consequences of potentially going to prison, then I can respect that. Different people can have different views on whether such an action would be morally right or wrong

The claim here is different: that it is legal to not pay tax. That claim is wrong as a matter of law. Trivially so – I doubt a single lawyer would disagree with my statement.

When a campaign is set up to say it is *legal* not to pay the tax, and a lawyer agrees with them, they are lying… deceiving people and potentially getting them into serious legal and financial trouble. That is simply wrong and immoral.

The link to the site you provide does not claim it is legal to not pay tax. Merely that it is illegal to fund the crimes of government. As for the International laws cited, the site refers to those laws ratified by the UK. Both governments ignored the advice given to them by their legal advisors to suggest they were in breach of both international and domestic law by providing munitions and F-35 parts which could be used in the killing of civilians (see the CAAT case of 2019) which is why the current gov removed 30% of the munitions being provided to Israel. However, the UK Gov is still aiding and abetting ethnic cleansing and a genocide on the people of Gaza and the West Bank. This is a crime and the British Taxpayer should have the right not to fund such crimes.

yes it does: it says “you are acting within the law”. I quote their claims in detail above.

The legal claims are lies. The “trust deed” is isn’t a deed and probably isn’t a trust. If it was a trust, it would create numerous tax liabilities for the poor mug signing it. International law has no force in the UK unless enacted into law by Parliament. A tax law cannot be “illegal”. This is all basic constitutional law, which anyone would know within 15 minutes of their first constitutional law lecture.

The people behind this website are luring well meaning people into serious legal jeopardy. They are either liars or incredibly reckless.

Many of these treaties are not only ratified but incorporated into UK law.

It doesn’t matter; a Finance Act passed this year overrides legislation passed two years ago. This is basic constitutional law, literally taught in the first lecture. The people behind these anti-tax cults are legally illiterate.

There is more about the “freeman on the land” nonsense here: https://taxpolicy.org.uk/2024/06/08/matrix_freedom_scamming_vulnerable_people/ with “Matrix Freedom” seeking to exploit the vulnerable. The focus of Iain Clifford Stamp there is on making debts “disappear”, though for good measure there is some idiocy about tax not being due either.

Hi Dan.

I assume that you have seen this;

https://caselaw.nationalarchives.gov.uk/ewhc/kb/2024/1092

Legal or illegal makes no difference. This is a protest against genocide designed to punish the uk government for flouting international law. The world is changing. Get used to it.

the whole campaign is based around the claim that not paying tax is legal. It’s a lie. Truth matters – get used to it.

This is loosely similar to the madness regarding “settling” ANY tax debt using a bill of exchange. There are some very unscrupulous individuals out there that are successfully brainwashing people into believing that tax debts and/or tax demands can be “settled” using spurious bills of exchange – together with protracted paper trails and processes. The sadness in this is that HMRC will flatly reject those claims (after maybe sitting on them for a number of months) whilst the promoters keep hold of the extortionately high fees that those poor individuals have handed over!!

The trust document purports to be a deed “…DEED of DISCRETIONARY REVOCABLE CONDITIONAL TRUST…”

But the word ‘signed as deed’ are absent nor is there anything about delivery, but I suppose those of the least of the documents problems.

Would be fun for someone to go through and work out what the actual legal/tax effect of the document is. Would take an unholy amount of patience.

Dan

So you know, the ProbityCo site has nothing to do with NoTaxForGenocide . You seem to be conflating the two. Also, Chris Coverdale went to jail BEFORE he started using the DEED. That’s the point. He hasn’t gone to jail SINCE using it.

I used the DEED for a fine and got a letter this morning from a County Court saying ‘It is ordered that the order for recovery of unpaid penalty charge be revoked’. Not saying that’s because of the DEED, might just be they couldn’t be bothered to argue after letter 3.

P

You and the others promoting this tax evasion scheme constantly lie about it. NoTaxForGenocide says at the bottom of their front page “The Campaign has been made possible because of Probity Associates Ltd”. They refer to “our own Chris Coverdale”. And the pseudolegal nonsense on both websites is the same.

Note that capitalising the word “deed” doesn’t make the document a deed. There are specific legal requirements for a document to be a deed, and the idiot who drafted this one didn’t know what they were. Your absolute best case is that the document has no effect. Worst case is that you are in a complex world of tax liability.

An absolutely typical response from tax evaders and tax evaders is “HMRC haven’t challenged us yet; therefore it’s fine”. Many of the schemes we’ve reported on have rapidly ceased to be “fine”.

As far as I’m concerned, you’re no different from any of the other tax evaders and tax avoiders we’ve reported on, just more ridiculous.

It appears no one is actually bothering to listen to the horses mouth. There will be no Tax “evasion” or Tax “avoiders”.

“We will take direct action WHEN we receive 100,000 pledges from members of the public”. It is the potential problem this could cause that will open debates.

Just look at the Poll Tax debacle .. “Six full years after the poll tax’s demise, an estimated 4,000,000 people who declined to pay as much as £5 billion..” The Tax was abolished, and the People’s voices were heard!

I think the Government will be forced to listen especially given the upcoming election.

I think this is called People Power!

no, it’s called lying. The claim that not paying tax is legal, or even required, is false, and taken straight from the deeply unsavoury sovereign citizen movement. Say what you like about the poll tax protests, but they weren’t inspired by the KKK.

Can’t really help what they put on their website Dan – And Probity Associates isn’t ProbityCo is it – should have checked that one. How many times did your last company get sued for negligence? But keep lying Dan – you’re winking lawyer & tax buddies will always be there for you. The system is rigged and you and your obedient flock help keep it that way. Coming in from the Dark Side won’t buy you a conscience. You kept the money remember.

“Probity Associates isn’t ProbityCo is it” … er, ProbityCo.com seems to think it is – it gives Probity Associates’ name and registered office on its boilerplate text.

Keep up the good work, Dan, lots of vulnerable people are at risk out there.

How about with holding payments to Thames Water for failing to deal with sewage properly?

Good idea Clive!

This is a question, not a comment. Assuming Dan’s claims about English, Welsh and Scots law to be true, and assuming their truth would be upheld by the Supreme Court and Privy Council, would you agree it would then be simply irrelevant that other jurisdictions might take a different view (e.g., if those bloody French thought UK internal financial arrangements affected them we could know their evidence should not be heard because our lawyers would have, with the ancient Omar, already have found the truth, or more pithily “What’s the hell has this question got to do with Dan’s point about UK spending on Israeli bombs?”)?

I’m not sure I understand the question. First, there’s zero doubt what I’m saying is correct, and I doubt you’ll find a single lawyer who disagrees. Second, it will be the same in every other country, because if tax was voluntary it wouldn’t be tax.

Dan – you are absolutely correct – save for the point that if tax were voluntary it wouldn’t be tax. Arguably, the older forms of stamp duty were voluntary, and less arguably (though a man more willing to argue a dumb point than I might give it a go) modern stamp duty on shares is voluntary.

Fair point, although I recall being carpeted as a trainee for saying stamp duty was voluntary!

“Arguably, the older forms of stamp duty were voluntary, and less arguably (though a man more willing to argue a dumb point than I might give it a go) modern stamp duty on shares is voluntary.”

“[…] I recall being carpeted as a trainee for saying stamp duty was voluntary!”

Perhaps I’m being dumb, but what do the above quotes refer to, please? I am a solicitor, but that didn’t help me! I asked ChatGPT and it suggested:

“Both quotes highlight a discussion around the concept of stamp duty being “voluntary.” This is likely referring to the idea that paying stamp duty can be avoided in certain situations, such as by not engaging in transactions that would incur it. However, the idea of taxes being “voluntary” in any traditional sense is unconventional since taxes are generally mandatory and enforced by law. The author seems to be playing with the concept to provoke thought or debate on how stamp duty is perceived and applied.“

Replying to “Expat” but the button seemed to be missing…

Looking at things last century:

1. Stamp duty was generally a tax on documents.

2. An unstamped document could not be be used for legal purposes (e.g. registering a transfer of ownership, production as evidence in Court – except in a criminal case) – Section 14(4) Stamp Act 1891

3. The Stamp Act 1891 did not say who had to pay to have a document stamped.

4. Traditionally, SD was paid by the purchaser because they would want to prove ownership.

5. There were penalties for getting the Stamp Office to adjudicate more than 30 days late (effectively pay the tax). But if the document was executed abroad then those penalties did not start until the document came back to the UK.

6. So you could delay paying the duty by executing the documents abroad and only bring them back to the UK (for stamping) if you had to prove ownership for some reason. So in that way it was said to be voluntary.

7. If SDRT or (this century) SDLT applied then most of the above goes out of the window.

Thank you! Yes, voluntary in that you don’t have to get it stamped. Involuntary in that if you want to rely on in court, you do. At least in theory.

Income tax law though has known of “revocable dispositions” since 1922 (s 20 of that year’s Finance Act) and later “revocable settlements” (eg s 446 ICTA 1970). “Disposition includes any trust” (s 20(5) FA 22) and “‘Settlement’ includes any disposition, trust …” (s 454(3) ICTA 70) – I realise the inclusive nature of the definitions means that you can, for the purposes of the legislation, have a revocable disposition or settlement that isn’t a trust, but I would be surprised if the term “revocable trust” wasn’t known in the UK, at least back then.

These arguments remind me Cheney v Conn [1968] 1 All ER 779 and Turton v Gen Commrs for Birdforth (Ch D 1970), both resounding defeats for the putative non-taxpayer.

Do you think that they could get done for breach of trust if they bought a flapjack (but not a Jaffa cake) and didn’t refuse to withhold the VAT?

As well as the normal avenues open to it, HMRC should probably get a work experience student to issue trust tax returns and then ask whether the chargeable lifetime transfer rules apply…

On a techy point, I’m not sure that “The law requires employers to apply PAYE, and HMRC has no discretion to disapply the law”. Section 684(7A)(b) ITEPA does give HMRC discretion to not require PAYE to be operated where an officer “is satisfied that it is unnecessary or not appropriate for the payer to do so” (see also Hoey at the Court of Appeal).

very fair point – the short version presumably should be “HMRC has no discretion to disapply the law, except where they think they can better collect the tax from the employee directly”.

It gives all the impression of a schoolboy approach to legal text. It looks like someone has written a core sentence or two then come up with more and more things that need to be added, and just bunged them in rather chaotically.

However, if it had any validity whatsoever, it also appears to me that by agreeing to all demands, fines, fees, etc., you could actually be forfeiting your rights to appeals or requests to correct wrongfully raised demands, fines, fees, etc.

It’s not a one-size-fits-all. For example, I once refused to pay a ‘parking ticket’ for parking on a piece of scrubland for 20 mins. They cited case law wherein by driving past a a sign, a driver has in fact contracted to pay. However, that case law was in regard to someone who has already paid his ticket and ran 40 mins over. In other words, he’d seen the sign as he’s paid for the first 2 hours. As I hadn’t paid (there was machine I could see)they was no way of proving I’d seen a sign. Dan is incorrect to suggest that Chris Coverdale went to jail after using his TRUST mechanism. He was jailed for willful refusal to pay. He could have paid at the last minute to avoid a jail sentence, but as he’s a peace campaigner, he decided to make a stand. Since using the TRUST, he’s managed to stay out of jail. If the majority of people don’t want wars, why should they pay for them – especially as taxpayer funds go to the shareholders of arms manufacturers.

Coverdale went to jail after running arguments that it was legal to not pay. He lost. He’s now invented a trust deed which isn’t a deed and probably isn’t a trust. If you think that changes anything, feel free to explain why.

You’re free to believe whatever political argument you like, but the legal position is entirely clear – you are required to pay tax, and the various sovereign citizen arguments otherwise are nonsense which were invented from thin air. If you think you’re politically on the Left then you might want to consider carefully why you are using these arguments, given that they were invented by far-right groups in the US, including the KKK. The arguments are also inconsistent with any kind of just, or indeed organised, modern society.

A deed or a trust only became so after the fact. They were nothing before someone invented the words and brought some form into existence…

The legal position is a belief, backed up by force. this is obvious – and it’s not ‘law’. hence why something can be legal one day and then illegal another, and the otherway around. It is all based in belief. The belief requires con-vincing others to follow and enforce your belief.

All legislation was invented from thin air for someones benefit.

“sovereign citizen” – you do realise there is no such thing right? it is a contradiction in terms to be sovereign and a citizen at the same time.

“If you think you’re politically on the Left then you might want to consider carefully why you are using these arguments, given that they were invented by far-right groups in the US, including the KKK”

do you not recognise this is a silly point to try and make? I’m sure the KKK recognise 1+1 =2. should we disregard this as well?

“The arguments are also inconsistent with any kind of just, or indeed organised, modern society”

This last bit is ridiculous. The ‘taxes’ forcing someone to pay a ‘tax’ they have not agreed to, from their labour.. that they must do to provide a roof over their heads and put food on their table is inconsistent with any kind of just society. It’s slavery. therefore goes against the idea of a ‘modern society’ and places us right back in feudal times under modern methods.

It just comes across as an attempt to slander the opposition to the position you hold… no doubt for your own benefit.

The KKK didn’t invent 1+1 = 2. They invented the legal “philosophy” that you seem drunk on.

This scam is dishonest. It fools people into thinking the “deed” has a legal effect that it doesn’t. No court will accept it. The people doing this are simple tax evaders. No better than Bernie Ecclestone.

And I think most ten year olds would see the problem with advocating a society where tax is optional.