We wrote in January about some of the ways private schools might try to avoid Labour’s proposed 20% VAT on school fees. One approach we mentioned – paying years’ of fees in advance – is now being widely used. We are concerned that schools and parents are not fully understanding the risks that these advance fee schemes create. Parents are being warned about the possibility of retrospective legislation – but a far worse prospect would be a challenge under existing law, and years of litigation.

This short report explains the risks, and suggests how the Labour Party, HMRC and schools could prevent a protracted period of uncertainty, and the potential for schools and parents to face significant unexpected costs. The Financial Times has more on this here.

We published a report in January concluding that most of the ways schools and parents could try to avoid VAT would not work. The one exception was paying fees in advance. We said that paying several years’ fees in advance would in principle avoid any later VAT change, because VAT would be charged at the point an early payment is made. We added that we doubted many people would want to do this – but it turns out we were wrong.

We have now received numerous reports of schools promoting the scheme.1

The advance payment schemes

Many schools (like Eton) have had advance fee schemes for years. They have in most cases been only occasionally used, but are now seeing much wider take-up. We’ve received reports that private schools across the country are now offering the schemes, and schools that have historically had only a couple of parents using the scheme each year, now have dozens.

This mostly isn’t visible to outsiders, but the sheer number of websites discussing the schemes gives an indication of how mainstream this is. For example:

- Haberdashers Boys – the website didn’t mention an advance fee scheme in January 2022; from June 2022 it now does.

- Perse School – the scheme wasn’t mentioned in 2022; is now.

- Warwick School – not mentioned in 2023; is now.

- New Hall School – not mentioned in March 2024; is now.

- Eltham College mentioned its advance scheme only in passing until 2023. Now its given much more prominence.

- Leeds Grammar didn’t mention its advance scheme in June 2023; it now does.

The older schemes usually don’t mention VAT⚠️; the schemes were a means of financial planning (and often limited to one year). By contrast, schemes now make clear that it’s all about the VAT – here’s one typical example:2

Interestingly, the wealthier/most sophisticated private schools appear not to be promoting fee schemes.

How do the schemes work?

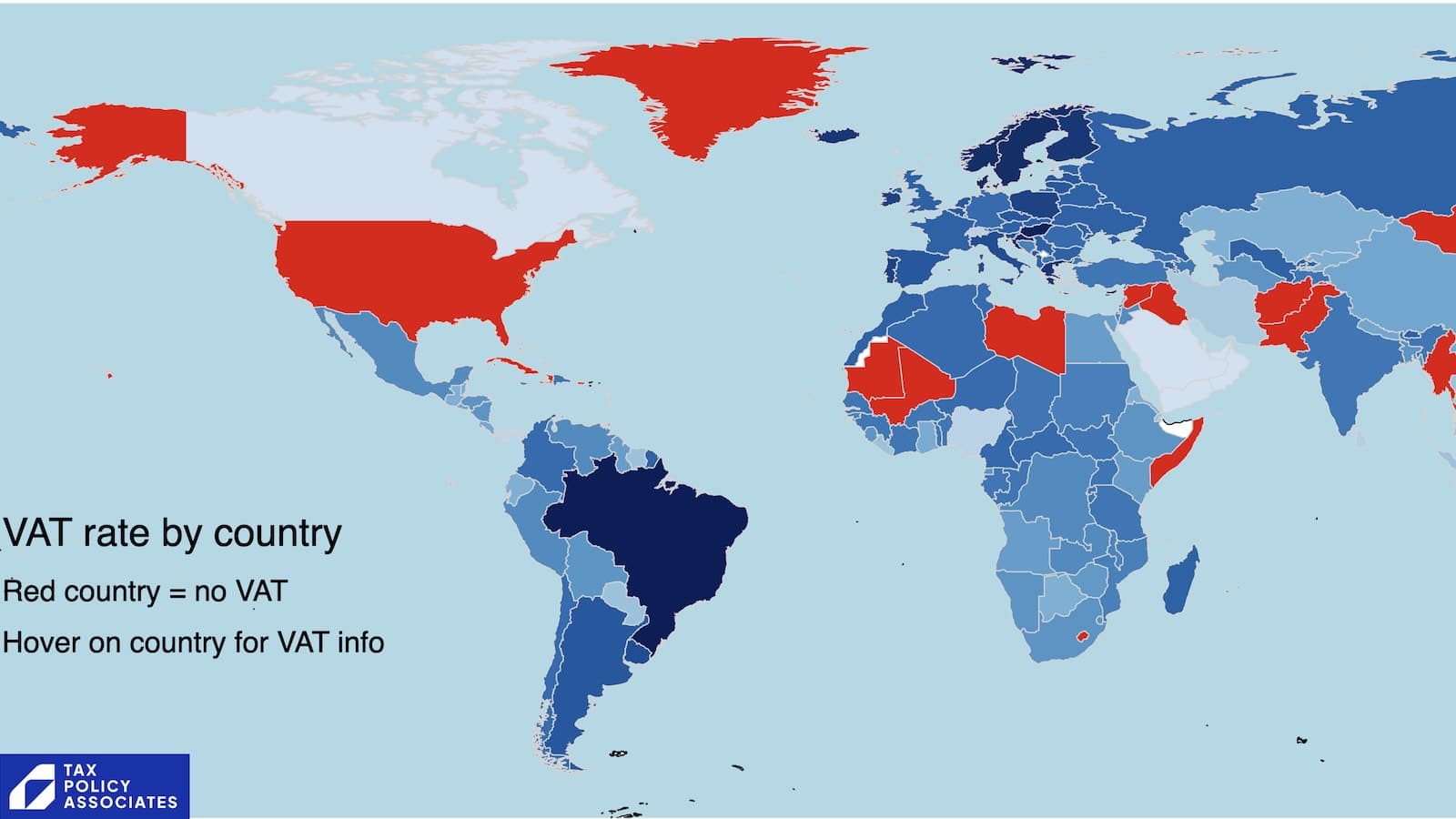

VAT is charged at the point an early payment is made. If I pay £5,000 for a car today, for delivery in a year’s time, then VAT is chargeable now, and the relevant rules are those in force today. This principle is part of what’s called the “time of supply” rules.

The basic idea of the advance fee schemes is that, by paying several years’ fees in advance, the time of supply is now, and parents can “lock in” today’s VAT rules and be entirely unaffected by any subsequent imposition of VAT on school fees. As a general proposition, this is correct.

However when we look at the way the school advance fee schemes work, things get more complicated. Unlike the car example, parents paying school fees in advance aren’t paying an agreed sum and buying a product. The amount they pay is in reality placed on deposit with the school, and then used by the school to satisfy each term’s fees. This means that if, for example, school fees increase, then the fees paid in advance will be used up more quickly than anticipated, and the parents will (eventually) have to pay more. If the parents decide to remove the child from the school, they get the money back (subject to notice periods). If the child gets a scholarship, the parents get a refund. And the schemes often let⚠️ parents pull out of the scheme, and get their money back, at any time (with notice).

Or, as one school⚠️ puts it: the scheme operates by “parents buying a credit against future invoices at a discounted amount.” And:

What does the School do with fees paid in advance?

Fees paid in advance form part of the general unrestricted reserves of the School, the School is therefore free to used fees paid in advance as it sees fit. However, as a general rule fees paid in advance are held in a separate bank account from the School’s general account and an amount is then released to general funds at the start of each term.

These schemes therefore don’t work at all like normal advance payments arrangements, and don’t have the usual benefit of locking in a price.

This means that, if we ignore VAT for a moment, the schemes don’t make much sense for most parents. There’s a discount for advance payment, but the discount rates we have seen are small – between 1% and 4%. That doesn’t make much sense given current bank base rates – you’d be better off putting the cash in a deposit account or other investments. And that would have the considerable advantage of being safe – by contrast, money paid in advance to a school may be lost if the school experiences financial difficulty.3

It’s therefore unsurprising that, historically, advance fee schemes were only rarely used – typically a handful of parents each year. Generally those parents had particular circumstances for which paying fees in advance made sense. One example would be where parents divorce, and pre-paying many years’ fees in advance formed part of the financial settlement

The recent widespread take-up of these schemes is, therefore, all about VAT.

So what tax risk are schools and parents running?

Retrospective legislation

The first risk is retrospective legislation.

It’s fairly common for new tax and VAT legislation to include “anti-forestalling” rules which prevent someone avoiding the tax between the date the legislation is announced, and the date it’s enacted. Labour have said that they’ll do this.

So, if we assume (for example) an election on 10 October 2024, we’d expect an announcement on school fee VAT a few days later, saying that legislation would be brought forward to apply VAT to school fees from April 2025. We’d also expect this to include a statement that anti-forestalling rules will apply VAT to any advance payment of more than one term made on or after the date of the announcement.

This won’t affect people who prepaid years of school fees before the election.

If Labour want to close that “loophole”, they’d need to enact proper retrospective legislation, going back before the post-election announcement. There are suggestions Labour has already discussed this.

The simplest way for retrospection to work would be to simply apply VAT to all payments in advance which relate to education services provided from April 2025 onwards. The time of supply could be (for example) the start of the term, or the time at which parents generally are required to pay for that term’s education.

What practical effect would retrospective legislation have?

If the suggested approach above were adopted, then the school would be required to account for VAT around the start of each term. Most of the scheme T&Cs we’ve seen should permit the schools to charge tax when necessary. So, in addition to applying part of the parents’ advance payment to school fees, they’d apply part of it to cover the VAT.

So where, for example, parents had paid in advance for five years, the additional VAT charges mean the funds would be used-up after four years, and the parents would then have to pay again. I expect in practice parents would cancel their participation in the scheme.

Things are messier if parents only paid for the Summer 2025 term in advance. Their advance payment would not be enough to cover the VAT, and the schools would have to ask them to pay more. This would present schools with the practical difficulty and risk of collecting additional money from unhappy parents.4

So, whilst retrospective legislation is unlikely to be welcomed by schools or parents, its implementation would be reasonably straightforward, and schools should in practice be able to cover the tax.

Most schools which are offering advance fee schemes are explicitly warning parents about the potential for retrospective legislation, and saying that if this happens then the parents would have to pay the VAT. That is unlikely to perturb parents too much, because it’s a one-way bet: best case, they save the VAT; worst case, they don’t. They’re not running any new risks (except the risk of the school going bust).

Could retrospective legislation be challenged?

It is often suggested that retrospective legislation is unlawful, either the ECHR/Human Rights Act or for some other reason. Our view is that any legal challenge is very unlikely to succeed, for two reasons. First, the courts have generally been relaxed about retrospective tax legislation in the context of anti-avoidance.5 Second, and more fundamentally, even if a taxpayer were successful, the way the Human Rights Act works means that primary tax legislation cannot be overriden – the court would issue a “declaration of incompatibility” and ask Parliament to think again.6

Retrospection will remain politically controversial – Geoffrey Howe made the argument against it very well back in 1978, and many people still share that view.7 But as a legal matter it’s our view that retrospective tax legislation to close what Government perceives (rightly or wrongly) as an avoidance scheme will generally be lawful, and when it’s implemented by primary legislation, there’s no realistic prospect of challenging it.

HMRC challenge

The messier outcome is that there is no retrospective legislation, but HMRC start to challenge some advance fee schemes on the the basis that they are not effective under the usual VAT principles. We haven’t seen any schools warning parents of this risk, probably because they aren’t aware of it themselves.8

Advance fee schemes have been around for decades, and never to our knowledge challenged – but of course there was never any reason to challenge them until now, as they created no tax advantage.

How might such a challenge be made? We can think of a few potential approaches:

- That, realistically, the invoice for the advance fees is not actually an invoice for the supply of school fees, but rather relates to an advance of credit. The parents are making a deposit with the school. The school then charges parents for each term’s school fees, and the deposit is used to satisfy this. It would follow that VAT is due separately on each term’s fees, at the time it is invoiced or applied to the deposit. Some of the scheme T&Cs we’ve seen look susceptible to this kind of challenge (particularly where termly invoices are issued⚠️); others less so.

- That the advance fee arrangement is artificial with the essential aim of avoiding a future VAT charge, and so can be countered using the Halifax VAT anti-abuse doctrine. If VAT had already been imposed on private school fees for a future date, and people were paying in advance before that date, then we believe it’s likely Halifax would apply, given the somewhat artificial nature of the schemes. However given that currently there is no VAT on private school fees, and the scheme is avoiding anticipated future change in law, the argument becomes much more difficult for HMRC. We are unaware of any authority permitting Halifax to be used in this manner, but it is not out of the question.

- A year before the Halifax judgment, in the BUPA Hospitals case⚠️, the CJEU ruled against a scheme operated by private health companies to make advance payments to pre-empt a change in UK VAT law. The time of supply rules are in large part anti-avoidance rules,9 and so the CJEU applied them purposively to defeat the scheme. There are a number of differences between the BUPA Hospitals advance payment scheme and the private schools’ scheme; but it would not take much imagination to apply a similar argument.

- Other technical VAT arguments, for example that the prepayment actually amounts to the purchase of a voucher so that the complex VAT rules on vouchers apply – HMRC may be able to argue that it is a “multi-purpose voucher”10 so that VAT is chargeable at the point that termly fees are satisfied with the prepayment arrangement.

Considerable analysis would be required to reach a view on these issues. We haven’t undertaken that analysis, and so have no view on whether ultimately HMRC or schools/parents would prevail. However these arguments are not fanciful, and the prospect of an HMRC challenge is in our view real.

What practical effect would an HMRC challenge have?

Any HMRC challenge would be a bad outcome for schools and parents.

HMRC VAT challenges are often made years after the event. HMRC usually has between one and four years to open an enquiry (depending on whether full disclosure was made to it). But HMRC can take broadly as long as it likes before issuing a “closure notice” saying that VAT is due. By this time, several years of VAT liability could have built up.

Unlike income tax/corporation tax, when HMRC issues that “closure notice”, the taxpayer has to pay the VAT up-front. Schools would then presumably seek to recover the VAT from parents.

- Given that years may have passed, this may not be straightforward (particularly where children have left the school).

- Whilst scheme T&Cs generally permit schools to recover the VAT from parents, parents argue that this was limited to the retrospective tax scenario that they were warned about. As far as we are aware, parents have not been warned about the possibility of challenge under current law, and that may both make them unhappy and provide potential legal grounds for resisting claims by schools.

It is therefore our view that schools may be running material risks which they don’t fully understand – years of litigation and uncertainty over whether they can recover the VAT from parents. Some schools could get into serious financial difficulty, particularly if several years of VAT have built up.

This is a much worse outcome for schools and parents than retrospective legislation.

What’s the impact on VAT revenues?

Let’s say Labour don’t legislation retrospectively, and HMRC either don’t challenge the schemes, or the challenges fail.

How much VAT revenue would be lost as a result of these schemes?

The IFS has estimated that imposing VAT on private school fees would raise about £1.6bn. We have written about the difficulty of making estimates in this area, and so that figure needs to be viewed cautiously, but it is in our view the only serious estimate that has been published.

So for every 1% of parents that use the schemes, there would broadly be a loss of VAT revenue of £16m.11 Plus the costs of challenging the scheme, if that is how HMRC proceeds.

What should happen?

We believe it’s in nobody’s interest to have years of litigation, and schools potentially finding themselves with large VAT bills they cannot afford to pay. To prevent this worst-case scenario, we would suggest that all parties try to provide as much clarity as possible.

- If Labour plans to enact retrospective legislation, it should say so now, at least in broad terms, and not just drop hints. That would probably end the schemes now, and prevent everyone involved wasting time and money.

- Schools should warn parents of the potential for legal challenge under current law, and that this could result in the schools pursuing parents for VAT potentially years later.

- It would also seem sensible for schools to warn parents that fees paid in advance could be lost if the school enters into financial difficulty. We’ve received many reports of communications from schools, and of those only Dulwich College mentions this scenario.

- Schools should be careful to plan for the worst-case scenario, and ensure that they will always have enough funds to cover a VAT assessment.

- If Labour wins the election, and announces it will introduce VAT on school fees without retrospection, then HMRC should either challenge the schemes early or say clearly that it will not be challenging them. HMRC often waits until the last week of the limitation period – that would be unfortunate here.

- In that same scenario, schools could minimise the risk of an HMRC challenge years after the event by providing full disclosure up-front, for example by sending HMRC a letter explaining precisely how their advance fee scheme works.

Thanks to L, R, O, W and C for drawing our attention to this, to E for the VAT technical input and K for a discussion on insolvency rules. And thanks to Anna Gross at the Financial Times.

Image by www.raisin.co.uk and licensed under Creative Commons Attribution Licensing.

Footnotes

We have also received a few reports of other schools considering the scheme but not doing so, because of the risks we discuss below. ↩︎

From Stamford School. ↩︎

In other words, the parents would just be unsecured creditors if the school became insolvent. ↩︎

It might therefore be wise for schools running these schemes to require advance payment for at least a year, so they don’t run into this problem. ↩︎

A few examples:

1. Legislation in 2008 retrospectively overrode a tax treaty to close down an income tax avoidance scheme that dated back to a 1987 Court of Appeal decision that the scheme was effective. There were numerous attempts by taxpayers to sidestep or override the legislation, all of which failed.

2. Legislation in 2012 retrospectively reversed a tax avoidance scheme implemented by Barclays. There was no attempt to challenge this in the courts.

3. Legislation in 2013 retrospectively closed down an SDLT avoidance scheme – the High Court refused permission for a judicial review to challenge the retrospection.

4. Whether the 2016 loan charge is retrospective is a complex question; attempts to challenge it in the courts have failed.

The House of Commons Library has written an excellent briefing on retrospective legislation which goes through these and other cases. ↩︎

By contrast, EU-law based challenges arguments enabled the courts to potentially override Acts of Parliament – but, post Brexit, such challenges can no longer be made. ↩︎

See, for example, the Protocol published by the Government in 2011 which says that retrospective legislation will only be enacted in “exceptional” cases. This is, however, in no sense legally binding. ↩︎

In the many briefings on advance fee schemes online, we’ve seen only one, from haysmacintyre, which mentions the point. ↩︎

An important point which we missed in the first draft of this report. Thanks to Professor Rita de la Feria for raising it. ↩︎

On the basis that the VAT due on the supply of education services is not known at the time the advance fee scheme is entered into or, in some implementations of the scheme which cover ancillary fees, because the services supplied are not known. This feels a rather artificial argument, but the voucher rules have always been rather artificial ↩︎

Presumably actually more, because parents at more expensive schools have a stronger incentive to pay in advance, and more ability to do so. There is also a technical reason it would be higher than the naive £16m figure, because in future years the schools will have reduced input VAT but their output VAT will be unchanged. So the parents who don’t use the scheme will obtain a small benefit from the fact others have used it. A quick example: imagine a school with £1,000 of fee income and £250 of VATable expenses. Without advance payment, it would have a VAT bill of 15% of its fees (i.e. 20% x (1000 – 250) = £150 out of £1,000). But say (unrealistically) 10% of the fees are paid in advance, its VAT bill would now be 14% of its fees (20% x (900 x 250) = £130 out of £900). ↩︎

Leave a Reply