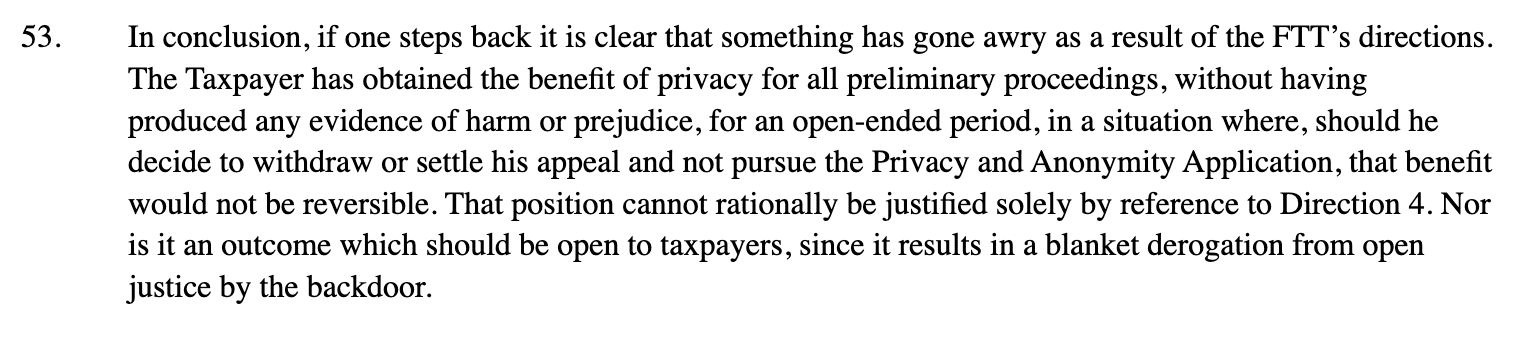

An unknown individual is trying to keep their tax avoidance scheme, and resultant dispute with HMRC, private. They attempted to apply to the courts for anonymity – and failed. But they’re so desperate to keep their name out of the papers that they then dropped their dispute with HMRC and applied for a lifetime anonymity order. HMRC are opposing this. So are Tax Policy Associates.

UPDATE 22 November 2024: the anonymous taxpayer lost their appeal and, unless they take the point to the Court of Appeal, their name will be revealed on 11 December.

UPDATE 9 December 2024: the anonymity has now been lost. It’s Frankie Dettori.

UPDATE 3 April 2025. We’ve published the bundle of legal arguments from the anonymity appeal here, and the authorities bundle (i.e. supporting caselaw/legislation) here.

There is an excellent Telegraph article on the Dettori affair here.

UPDATE 20 May 2025: HMRC has committed that, whenever a taxpayer makes an application for anonymity at a court/tribunal, it will (where appropriate) ask the court to serve notice of the application on the Press Association.

Open justice and tax appeals

Here’s the deal: your tax affairs are confidential. HMRC is bound by a strict statutory confidentiality obligation. Nobody can see your tax return. Nobody can find out if HMRC investigates you. If you buy a tax avoidance scheme, HMRC challenges you, and you give up and pay the tax, nobody will ever know.1 But if you appeal against HMRC’s decision, and it hits a tax tribunal, everybody will find out.

There is a longstanding common law principle of open justice – trials are public, even when private matters are litigated, and there is no special treatment for public figures or celebrities. This is reflected in the tax tribunal rules. A litigant can apply for an anonymity order, but only in special circumstances, and there is a very high bar. Peter Andre thought his celebrity status meant his tax appeal could remain confidential – the courts were unimpressed. Anonymity must be “strictly necessary”.

So normally tax appeals are open: anyone can attend,2 decisions are often published, and you don’t get to hide anything.

This is important in its own right, but it also shapes taxpayer incentives. If I was a billionaire faced with an HMRC demand for say £100m, I have an incentive to contest it even if my prospects of winning are low. The costs of an appeal are unlikely to top £1m, so an appeal is economically sensible even if I have only a 5% chance of winning. 3 The prospect of public opprobrium changes the calculation. If taxpayers could appeal anonymously then we would see more appeals on technically marginal points by wealthy individual and corporate taxpayers.

The first anonymity order

So it was very surprising that, in September 2021, an unknown taxpayer was granted anonymity by the First Tier Tribunal. More surprising still was that this was despite the taxpayer providing no evidence whatsoever of any harm or prejudice he would suffer if his name became public.4 This was in stark contrast with the Peter Andre case. The judgment wasn’t published, and nobody (other than HMRC) knew this had happened.

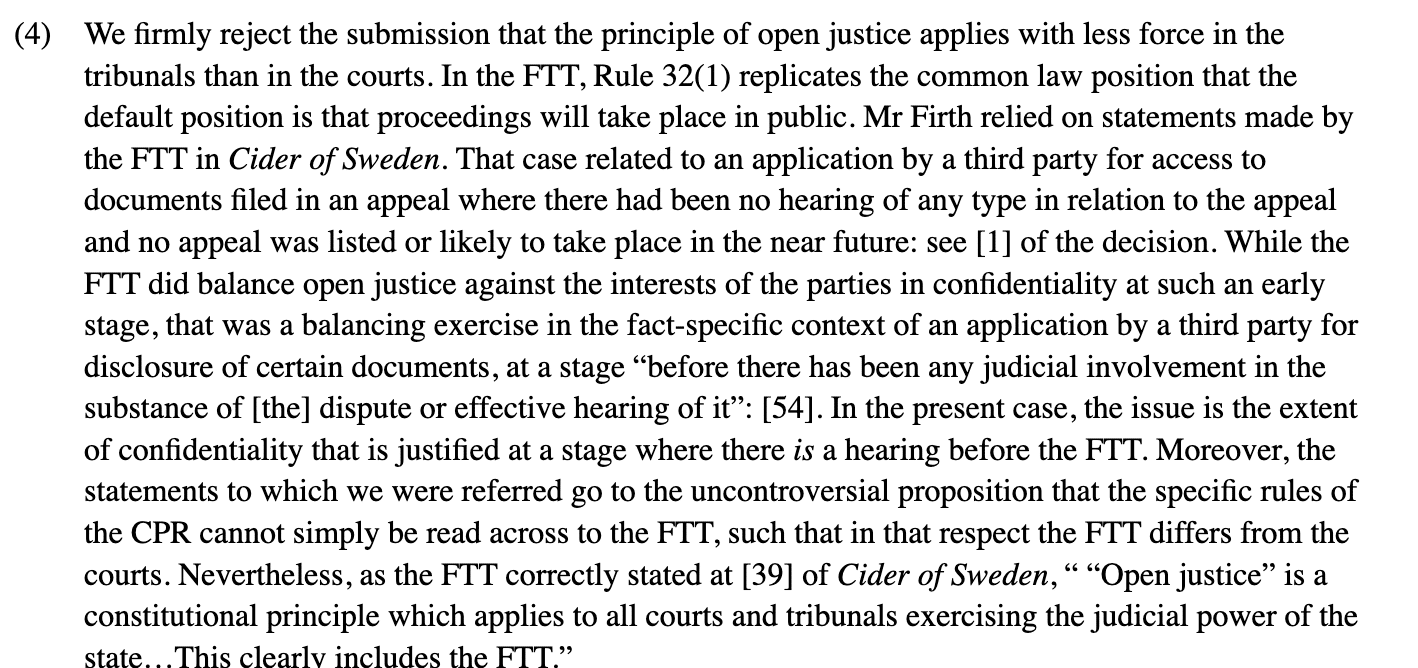

HMRC appealed to the Upper Tier Tribunal. In a forceful judgment⚠️, the UTT said the First Tier Tribunal had made “material errors of law” which resulted in “a blanket derogation from open justice by the backdoor”:

and:

The UTT said the taxpayer’s name would be published two weeks after the appeal deadline passed. The taxpayer didn’t appeal – given the strength of the UTT judgment, his prospects would have been bleak. He did something else…

The new application

The mystery taxpayer is so desperate to keep his name out of the papers that, when it became clear he wouldn’t obtain anonymity, he dropped his original appeal against HMRC’s tax assessment,5 and then applied to the tribunal to preserve his anonymity forever.

This goes back to the incentives point – the mystery taxpayer was only willing to appeal against the tax assessment if he could do so anonymously. Which is precisely why such anonymous appeals should only be permitted in exceptional circumstances.

HMRC is opposing the taxpayer’s application. We applied to the Upper Tier Tribunal for copies of the application and HMRC’s response, and the UTT kindly agreed to provide us with the documents, on the condition we didn’t publish them.

We can however say that we regard the taxpayer’s application as weak; he asks for anonymity whilst not identifying a single reason why his case merits it. The taxpayer then pleads a series of cases which are either irrelevant, or relate to circumstances where there was a genuine reason to seek anonymity (mental illness, a stillborn child, and someone who didn’t want the fact they’d worked as a stripper to become public). HMRC’s response to this is robust and comprehensive.

We have made our own short submission, which we are able to publish. We don’t repeat the points in HMRC’s response, but make two additional points of general public policy (PDF version here):

We understand that the Times and the Press Association have also received copies of the UTT documents, and may be making their own submissions.

Who is the taxpayer?

We don’t know for sure.

The judgment does not reveal the identity of the taxpayer, other than that he is a man. Nor does it say what the underlying dispute is – but our team is reasonably confident that, on the basis of the details that are provided in the judgment and certain other materials in the public domain, it relates to a mass-marketed tax avoidance scheme.

We have gone further, and used those materials to narrow down the identity of the taxpayer, but we don’t believe it would be responsible to publish our findings at this stage. However, to prevent unfair speculation, we will say that we don’t believe the taxpayer is a current or former politician. We won’t respond to any other queries about who the taxpayer might be.

The role of HMRC and the courts

HMRC deserves plaudits for pursuing this appeal so robustly. If it hadn’t, then the anonymity would have stood, and nobody would have known about it (given that the original FTT decision doesn’t appear to have been published). HMRC went further, and asked for the Press Association to be sent copies of the tribunal documents.

It is, however, disconcerting that nobody was aware of the original 2021 anonymity judgment. We would suggest:

- Tax Tribunals should follow the approach of the High Court in the Zeromska-Smith case, and serve copies of applications for anonymity on the Press Association (i.e. to enable the media to oppose such applications).

- HMRC doesn’t appear to have requested service on the media in the original 2021 hearing – we believe it should always do so.

- When anonymity is granted by the First Tier Tribunal, HMRC should ensure that the judgments become public. We should all have a right to know the extent to which anonymity orders are being applied for and granted.

Update 23 May 2024: there has now been another unrelated anonymity decision – L v Commissioners for HMRC. HMRC took a neutral position on the point, and the FTT’s findings of fact make the decision to grant anonymity look reasonable. However it is still perturbing that no notice was given to the media, and so this was in practice an uncontested application.

Many thanks to George Peretz KC for his pro bono assistance in this matter (George successfully acted for HMRC on one of the few tax confidentiality cases).

Thanks also to our frequently collaborator M, and above all to Ian Richardson at Grant Thornton in the Isle of Man – he was I believe being the first person to spot the UTT judgment, and alert us to this case (but it has, we believe, nothing to do with the Isle of Man).

Most of all, thanks to the Press Association, and to The Times and News Group Newspapers, for intervening in the appeal as third parties.

Photo by Alexandre Lallemand on Unsplash

Footnotes

Unless they can figure it out from public sources. ↩︎

In theory. You have to find out where it is, or obtain a link to a video conference – one commenter below has had difficulty doing this. ↩︎

i.e. because appealing has an expected return of £3m. That’s the £100m cost of not appealing minus 95% x the £101m cost in the scenario where I lose, minus 5% x the £1m cost in the scenario where I win. £100m – (95% x £100m + £1m) – (5% x £0m + £1m) = £3m. ↩︎

See paragraph 53 of the Upper Tier Tribunal judgment⚠️. ↩︎

At least he claims that’s what he’s doing. It appears to be in some doubt whether he actually has dropped his appeal and/or agreed a settlement. ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply