The Green Party says it will raise £50bn in tax from the “richest”. But their proposal will probably end up affecting half of all households. Whilst some of the very wealthiest will pay no additional tax at all, there will be people on fairly ordinary incomes facing marginal tax rates of 70%. The Greens should go back to the drawing board.

This is twice in one day we saw a political party proposing a tax change that’s kiboshed by the tricks and gimmicks embedded in the income tax rules. It’s time we had real political focus on ending those tricks and gimmicks for good.

Here’s Carla Denyer, co-leader of the Green Party, on Question Time yesterday:

“Capital gains tax, the tax you pay on assets, so that’s pretty much the wealthy that have those, you pay less tax than the income you get from work. We think that’s unfair, so we would equalise those and we would also remove the cap on national insurance that means that the richest pay less. Those three 1 changes together would raise over £50 billion by the end of the next Parliament.”

The casual viewer may have come away with the impression that the Greens will be raising £50bn by taxing the wealthy.

That’s mostly true for the Greens’ proposal to raise capital gains tax. It would indeed affect mostly the wealthiest. Complete equalisation with income tax could perhaps raise £8bn.2

However it’s not an accurate description of where most of the £50bn is coming from.

The Green proposal

What does “removing the cap on national insurance” mean?

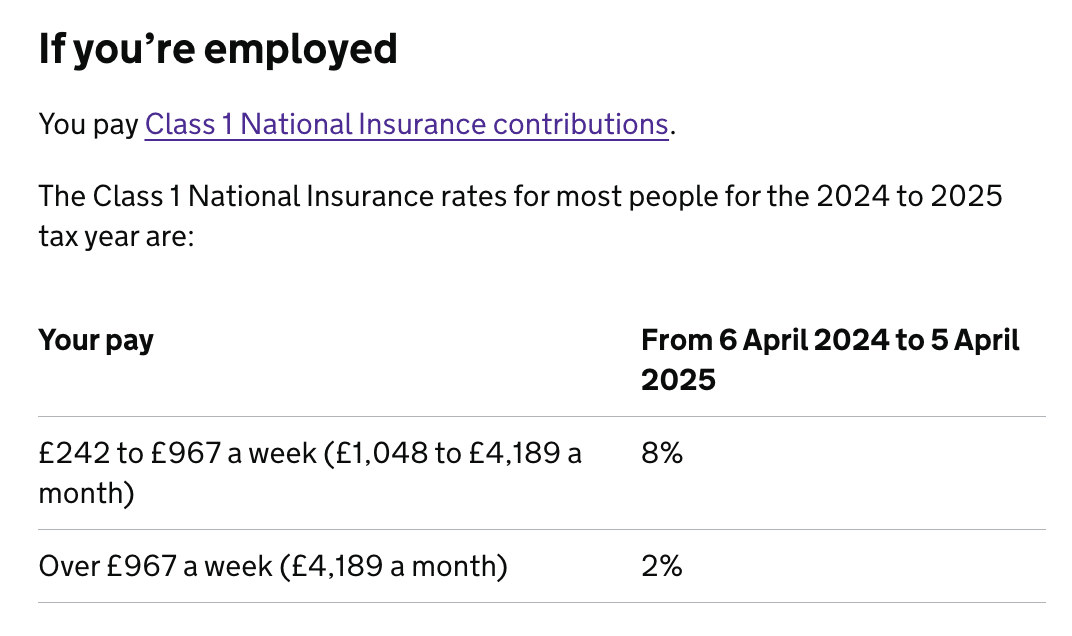

Here are the current Class 1 rates:3

£967 is the “upper earnings limit”. There used to be no national insurance past that point; it’s now 2%. “Uncapping” means removing the limit so that the 8% rate continues to apply past £967 a week.4

We should, however, discard the pretence there’s something special about national insurance. It’s just income tax by another name, with an antiquated weekly calculation, a complicated history and a funny national accounting treatment. A realistic approach looks at the overall combined rate of income tax and national insurance.

In the current, 2024/25 tax year, this looks like this for an employee:5

- No tax on incomes below the £12,570 personal allowance.

- £12,570 to £50,270 – a combined income tax and employee national insurance rate of 28%

- £50,271 to £125,140 – a combined rate of 42%

- Above £125,140 – a combined rate of 47%.

The Greens are therefore proposing that the third of these should rise to 48%, and the fourth to 53%.

However things aren’t that simple. The personal allowance starts to be withdrawn (“tapered”) when your income hits £100,000, and is gone by £125,140. This means that the marginal rate in the £100,000 to £125,140 range is much higher than the headline rate.

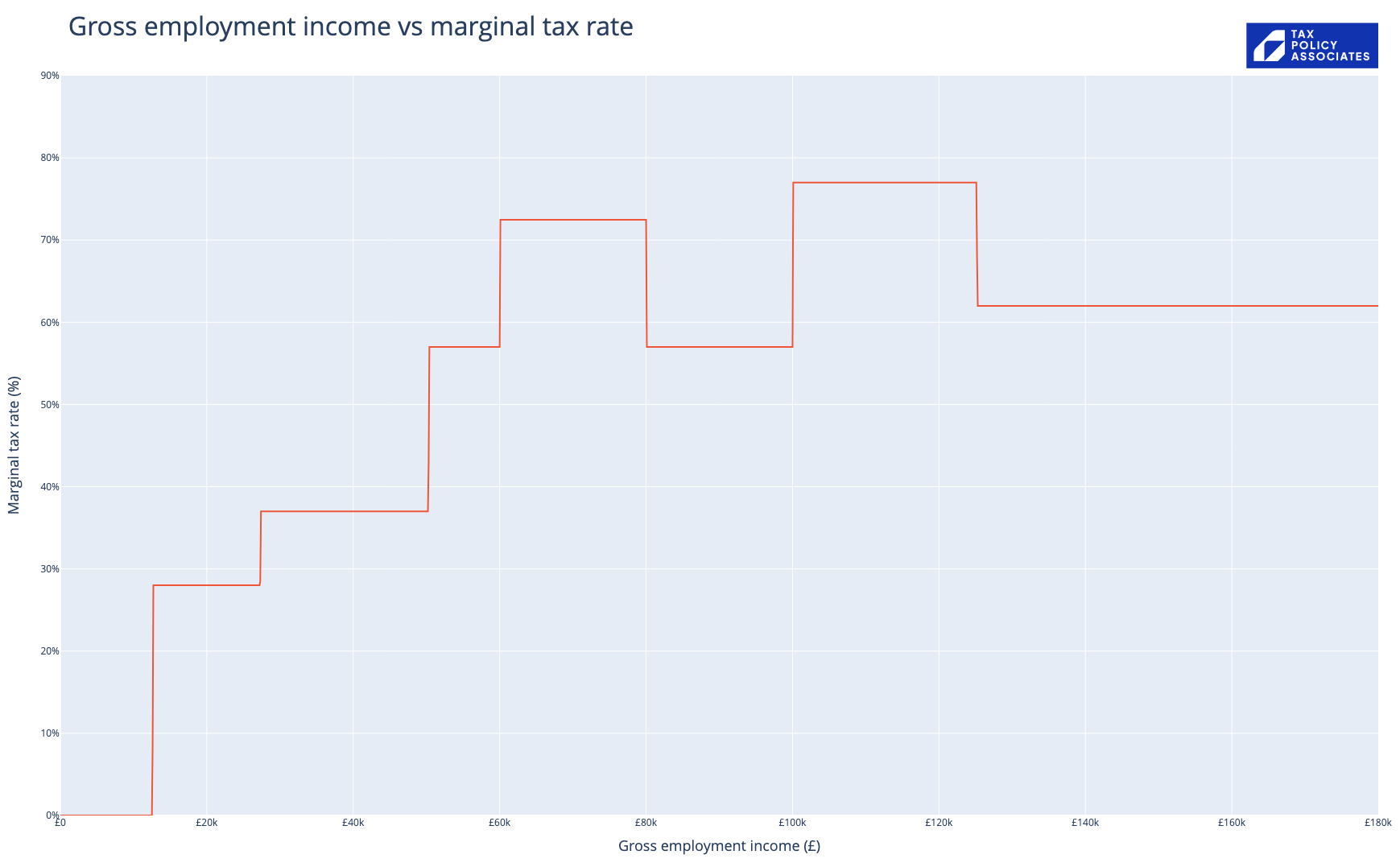

This chart shows the effect, as things stand today (blue) and under the Green proposal yellow):

There’s an interactive version of the chart here that lets you select different scenarios and touch/mouse over the chart to get exact figures.

This is not the only factor that means the actual marginal rate is higher than the headline rate. There are a series of poorly thought-through tricks and gimmicks that have this effect, most significantly child benefit withdrawal and student loan repayments.

Here’s the marginal rates under the Green proposal for a graduate with three kids under 18:

So a graduate earning £60,000 with three kids pays a 72% marginal rate, and everyone earning £100k-£125k pays a 77% marginal rate. I don’t think this would be sensible or sustainable. There are many people (think: hospital consultants) who would prefer to reduce their hours than earn just 23p in the pound.

Uncapping national insurance was a perfectly rational policy in the 90s, but it’s not viable today unless the various tricks and gimmicks in the system are fixed or removed.

It’s remarkable that this was the second proposal yesterday which was undone by a failure to understand the complexity in the tax system. That says something about the need for reform.

Who would pay this?

The Green proposal will affect quite a lot of people.

£50,270 is not that far above the average London salary. And, by 2027/28, one in five taxpayers, and one in four teachers will be affected; I expect a majority of households will have someone who earns that figure at some point in their life. To say this is a tax on the “richest” is not particularly accurate.

But some very wealthy people won’t be affected much, or even at all. The big problem with increasing national insurance is that it only affects wages. The retired don’t pay it. Investors don’t pay it. Landlords don’t pay it. It’s a funny choice of tax rise for a progressive political party. It’s a bit odd, because only three years ago the Greens were proposing abolishing national insurance and rolling it into income tax. Perhaps Ms Denyer got the policy wrong. Or the more cynical version: they chose to raise national insurance because they think people don’t understand it.

One of Jeremy Hunt’s best decisions was starting to phase out employee national insurance. No sensible political party should be looking to reverse this, and particularly not one of the Left.

Some suggestions

I have three suggestions for the Greens:

- The tax rise should apply to income tax, not national insurance, so it impacts landlords/investors as well as working people

- Realistically you have to scrap the child benefit and personal allowance clawback at the same time, or you end up with indefensibly high marginal rates. Student loans also need thought.

- Be clear about what this proposal is, and who it applies to, instead of suggesting it’s a tax on the “richest”.

It’s great that there’s a political party offering people the choice of significantly higher taxes and significantly higher spending. However this needs careful consideration to ensure the result is fair and workable. And it also needs the Greens to be clear and honest about what they’re proposing, and who it affects – and I don’t think Ms Denyer’s description of this policy was.

Video (c) British Broadcasting Corporation and reproduced here as fair dealing for the purposes of criticism and review.

Footnotes

I initially thought “three” was a mistake, but possibly she says “three” because she forgot to mention the Green Party’s wealth tax proposal. ↩︎

However that would give us one of the highest rates in the developed world; a more modest increase would seem sensible and/or one that was combined with a return to an indexation allowance (which prevents inflationary gains being taxed). ↩︎

The self-employed pay slightly less ↩︎

Uncapping the upper earnings limit was a key element of Labour’s “shadow budget” for the 1992 general election. The “shadow budget” in general, and this proposal in particular, are often blamed for Labour’s loss, although whether that is correct is contested⚠️. ↩︎

Ignoring Scotland for the moment, and also ignoring weird marginal rate effects ↩︎

Leave a Reply to Bill Weathers Cancel reply