Last week we published a report on how a small number of tax barristers facilitate tax avoidance schemes that are, in our view, more properly described as tax fraud. The barristers design the schemes, and/or issue opinions that the schemes work, despite the dismal history of such schemes in the courts over the last 25 years. They achieve this by making unrealistic assumptions of fact and ignoring inconvenient laws and judicial principles.

After we published our report, we wrote to the Bar’s regulators, the Bar Council, and other representative bodies, as well as the most well known sets of tax chambers.

The good news is that the regulators and the Bar Council are taking this seriously, with draft guidance on the way. However, the leading tax chambers are in denial, with only one (Gray’s Inn Tax Chambers) providing us with comment before publication of this article. Update: other chambers responded after publication, and their comments are included below.

Here are the responses in full.

The regulator

The Bar Standards Board is the disciplinary body for the barristers‘ profession. We’ve been speaking to them on these issues since early 2025. They told us they’re working on tax guidance for the profession and will be consulting on it shortly.

A spokesperson for the BSB told us:

The Bar Standards Board will always and have always assessed the reports we receive or other information of which we become aware suggesting that barristers are facilitating tax fraud. We are also currently undertaking work on professional ethics and considering further guidance for the profession on how our Core Duties apply to the issues highlighted in the report.

The Legal Services Board is, essentially, the regulator of the legal regulators. It regulates the Bar Standards Board, the Solicitors Regulation Authority, and other similar bodies regulating legal professional services. They told us:

The Legal Services Board (LSB) expects all legal service regulators to ensure that the professionals they oversee act in the public interest and uphold the highest standards of integrity. We take seriously the suggestion that a small number of barristers may be providing legal opinions that facilitate tax schemes which may be fraudulent.

“It is the role of the Bar Standards Board (BSB) to ensure that barristers comply with their professional duties, which include acting with honesty, integrity, and independence. Where there is evidence that these standards are not being met, the BSB must take appropriate action.

“We will continue to hold the frontline regulators, including the BSB, to account for their performance. As part of our focus on professional ethics and the rule of law, we are also developing new expectations for regulators to help ensure that those they regulate uphold their professional ethical duties.

The representative bodies

The Bar Council is the Bar’s professional body and governing council.

They told us:

The report calls for the Bar Standards Board to make it clear that it is a disciplinary matter for a barrister to provide an opinion which facilitates a tax scheme that has no realistic prospect of success, specifically where the assumptions in the opinion would breach a barrister’s core duty to act with honesty and integrity. The Bar Standards Board is independent of the Bar Council. However, the Bar Council would support such a statement from the BSB. In our view, if a barrister were to give tax advice which facilitated a tax scheme which they knew was doomed to fail, this would breach several of the core duties in the BSB handbook. Additional rules are not required because this would already be a breach, but the Bar Council would support such a reminder from the BSB. We understand that the BSB is planning to consult on these issues and we will engage fully with the consultation.

The Revenue Bar Association is the professional association for tax barristers. Their response:

The RBA does not condone the actions of counsel who give advice which they know to be wrong or are reckless as to whether it is wrong. We are clear that this would be a breach of the Bar Standards Board’s (“BSB”) Code of Conduct, which mandates that counsel must act with honesty and integrity (Core Duty CD3) and must not behave in a way which is likely to diminish the trust and confidence which the public places in the profession (Core Duty CD5).

We also note that such conduct could amount to a criminal offence, which could be prosecuted by HMRC. Indeed this was pointed out in the RBA’s response to the HMRC’s consultation document, ‘Closing in on promoters of marketed tax avoidance’ (published 26.03.2025, paras 12 and 17).

Where unsatisfactory conduct is identified, the BSB are best placed to obtain the full picture, investigate matters and discipline counsel appropriately. Importantly, they have the power to address issues of privilege and confidentiality which might otherwise impede a fair investigation. We understand that the BSB will, and has in the past, investigate where allegations of misconduct of the type you describe have been reported to it.

The RBA, in contrast, is an association, consisting of members who practice in Revenue law. It does not have the power, means or authority to investigate members or their work. That said, we do not condone such actions and would seek to expel any member who has been struck off by the BSB.

The Chambers

Barristers practice in chambers – unincorporated associations which let the barristers share premises and administration.

We wrote to eleven of the best-known chambers specialising in tax.

Here’s the response from Gray’s Inn Tax Chambers:

We are not aware of the identities of the “small number of KCs and junior barristers”, to which your article refers and, in any event, we do not comment on the behaviour of particular barristers. It is plainly wrong for any barrister to deliver a legal opinion which does not genuinely and honestly reflect their view, or which rests on assumptions known to be untrue, or which deliberately ignores relevant case law or applicable statutory provisions.

After we published this report, 5 Stone Buildings sent us a response:

We are not in a position to comment on the practice of any particular barrister in any other chambers; but we can say that all our members share the view that opinions should reflect the genuine views of the barrister and should be formed on a realistic view of the facts, and a sensible approach to statute and case law. All our members take seriously their duties under the BSB’s Handbook and we would hope that such an approach is shared across the profession.

We would hope that every chambers would be happy to make similar comments regarding the propriety of issuing a false opinion. However, none of the other chambers provided us with any comment.

Old Square Tax Chambers, initially told us “Chambers has no comment to make”.

That was not surprising:

- Old Square Tax Chambers’ most senior member, Robert Venables KC, has a reputation for approving and designing tax avoidance schemes that have no realistic prospect of success. He is currently being prosecuted for tax evasion (in relation to his own tax, not that of a client).

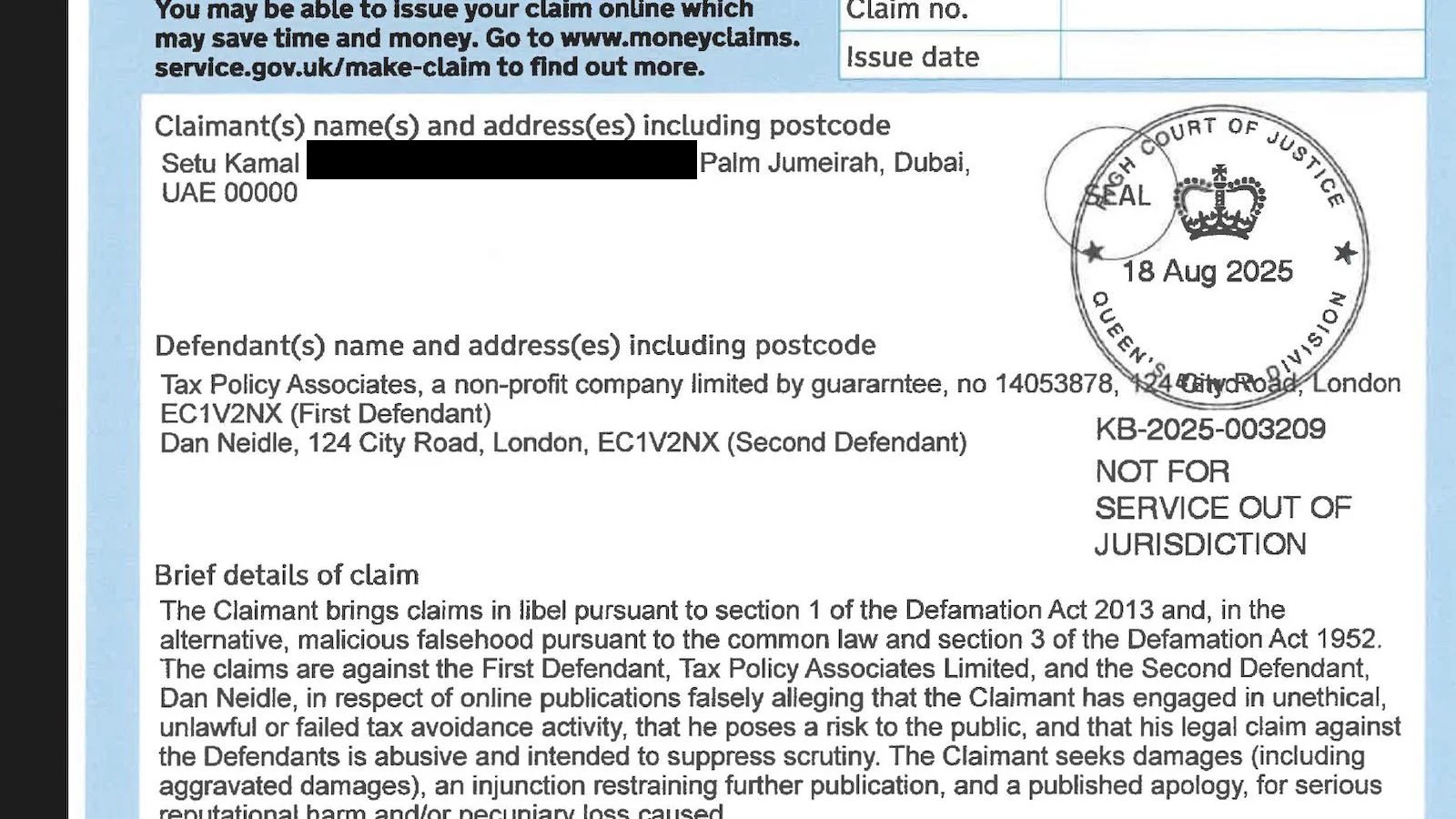

- Another member, until 2024, was Setu Kamal. Mr Kamal was the first barrister named by HMRC as a designer of tax avoidance schemes which do not work. Mr Kamal is currently suing Tax Policy Associates and Dan Neidle for libel.

After we published this article, Old Square sent us this:

The question on which you asked for comment was, ‘whether your Chambers regards the behaviour of these barristers as appropriate’. The reference to ’these barristers’ was to individuals to whom you had referred, but not named, in your previous report, ‘Rogue barristers are enabling a billion pound tax fraud – and the Bar won’t act’, published on 16th January 2026. We note that, in your article of 21st January 2026, you did not publish this question, so that you did not give the relevant question to which we declined to comment. This Chambers does not comment on alleged behaviour of individual barristers.

However, as a Chambers, we condemn any instance in which a barrister gives an opinion in which s/he has no honest and genuine belief; that is based on facts known to the barrister to be false, or as regards whose veracity the barrister is reckless; or that puts forward a legal analysis that the barrister knows to be untenable, or knows to ignore applicable legislation or case-law. Any such opinion would be a breach of the core duties of honesty and integrity. We regard honesty and integrity as forming part of the foundations of the independent referral bar, and therefore as being qualities that every barrister must apply to every instruction s/he is given.

Field Court Tax Chambers sent us a late response:

FCTC does not approve of the behaviour of barristers who produce fraudulent opinions or opinions which they know to be wrong or who are reckless as to whether they are wrong or not.

None of the other chambers sent us a response. Those were: Pump Tax Chambers, Devereux Chambers, 11 New Square, Blackstone Chambers, One Essex Court and Temple Tax Chambers.

We believe most of these chambers have no members who are involved in issuing false opinions. But we expect almost all their senior members know exactly who is involved.

Our conclusion is that most of the Tax Bar are in denial. We may see attempts to block or water down draft guidance when it’s issued by the Bar Standards Board. That would be a serious mistake.

Photo of the Royal Courts of Justice by sjiong, and from wikimedia.

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply to SIAN DICKENS Cancel reply