Multiple documents in the Epstein files show Peter Mandelson forwarding confidential Government emails to Jeffrey Epstein in 2009 and 2010.

The leaked material concerned live policy issues of immediate financial interest to Epstein and his circle. This report contains the full text of the most significant known leaked emails, together with a short explanation of the context and value of the emails.

This was all during the same period that Mandelson (via Epstein) advised Jamie Dimon of JPMorgan to “mildly threaten” the Chancellor to reverse a proposed tax on bank bonuses.

The leaks and the assistance to JPM were followed within months by highly valuable job offers from the very sector that benefited from that intelligence – job offers that Epstein procured and assisted with. And those job offers were so lucrative that Mandelson rejected an offer of $3-5m/year.

This article is being updated as the story develops, and further emails are discovered. Latest update: 8 February 2026.

The background

In August 2009 the UK economy was still deep in the aftermath of the 2007–08 financial crisis, with the banking sector severely weakened and credit markets badly disrupted. Bank lending to businesses had collapsed: in the six months to February 2009, net lending by UK and foreign banks to UK businesses fell from £53.5 billion to just £8.6 billion. Small and medium-sized enterprises were hit hardest. It’s the reduction in lending that caused a financial crisis to become a crisis for the rest of the economy.

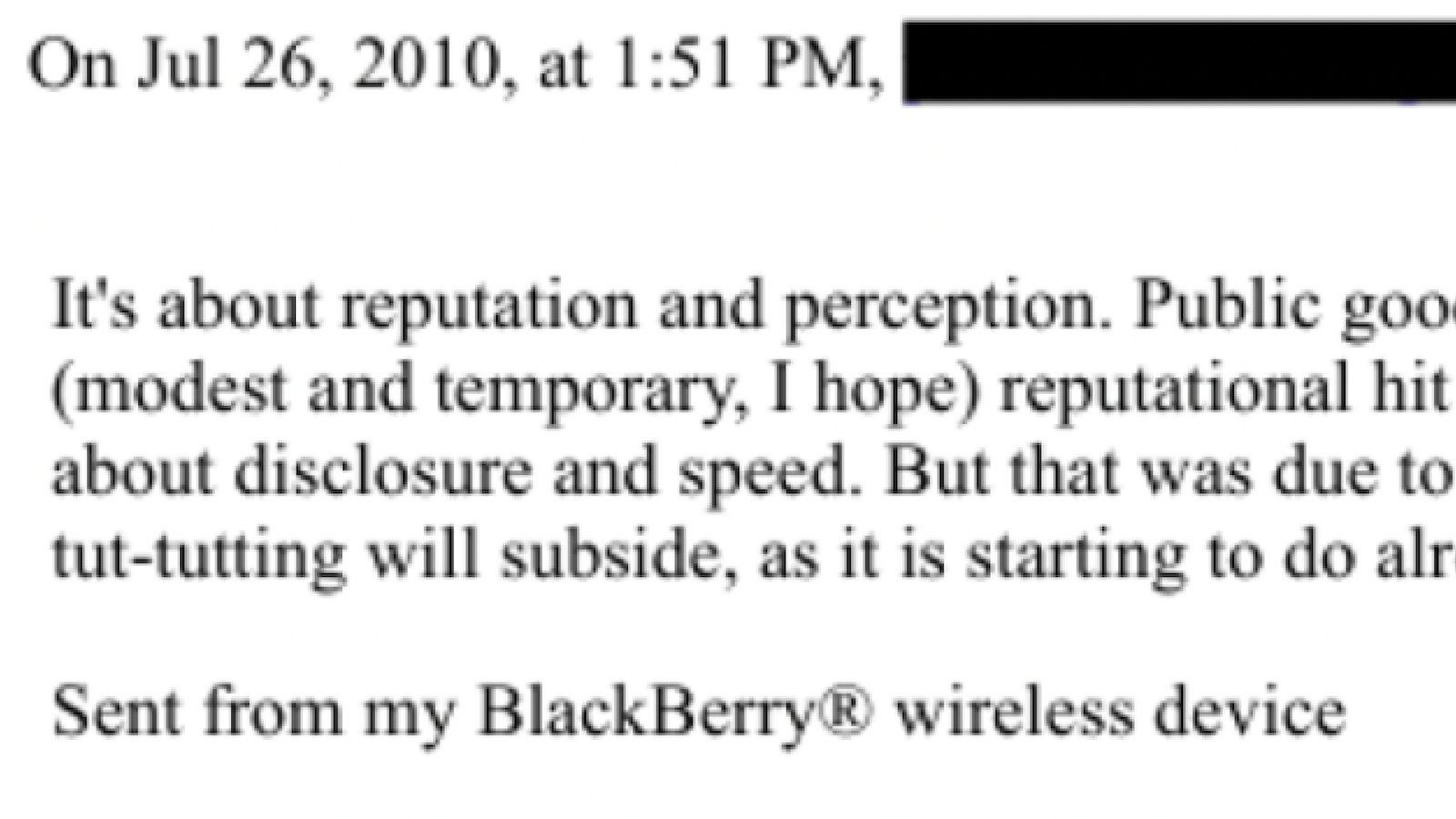

Jeffrey Epstein exchanged hundreds and possibly thousands of emails with Peter Mandelson. In June 2009 he told his girlfriend, Ghislaine Maxwell, that Mr Mandelson was “for all intents and purposes” deputy prime minister:

(Epstein referred to “Petie” frequently when talking about Peter Mandelson to others, and sometimes when corresponding with Mr Mandelson.)

That relationship later paid off.

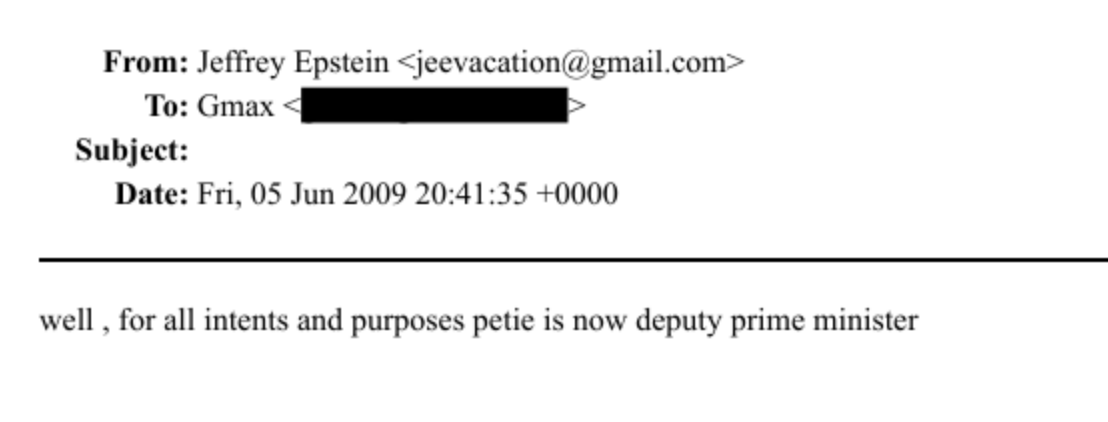

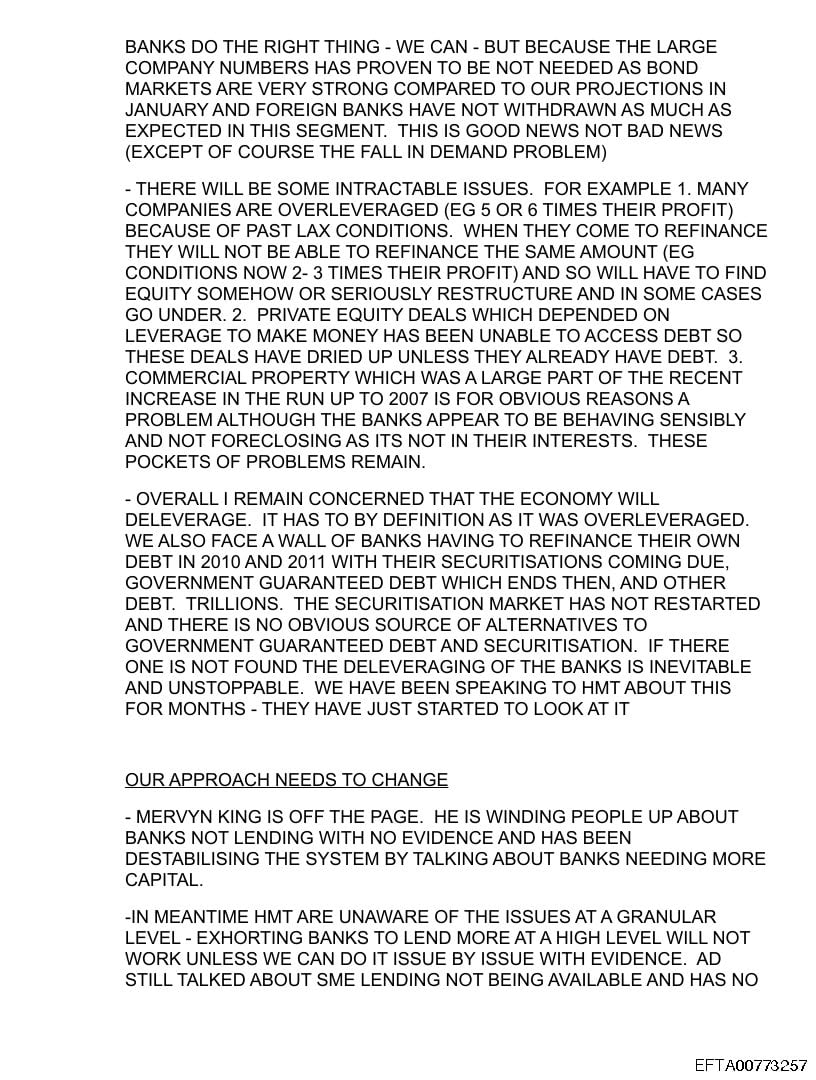

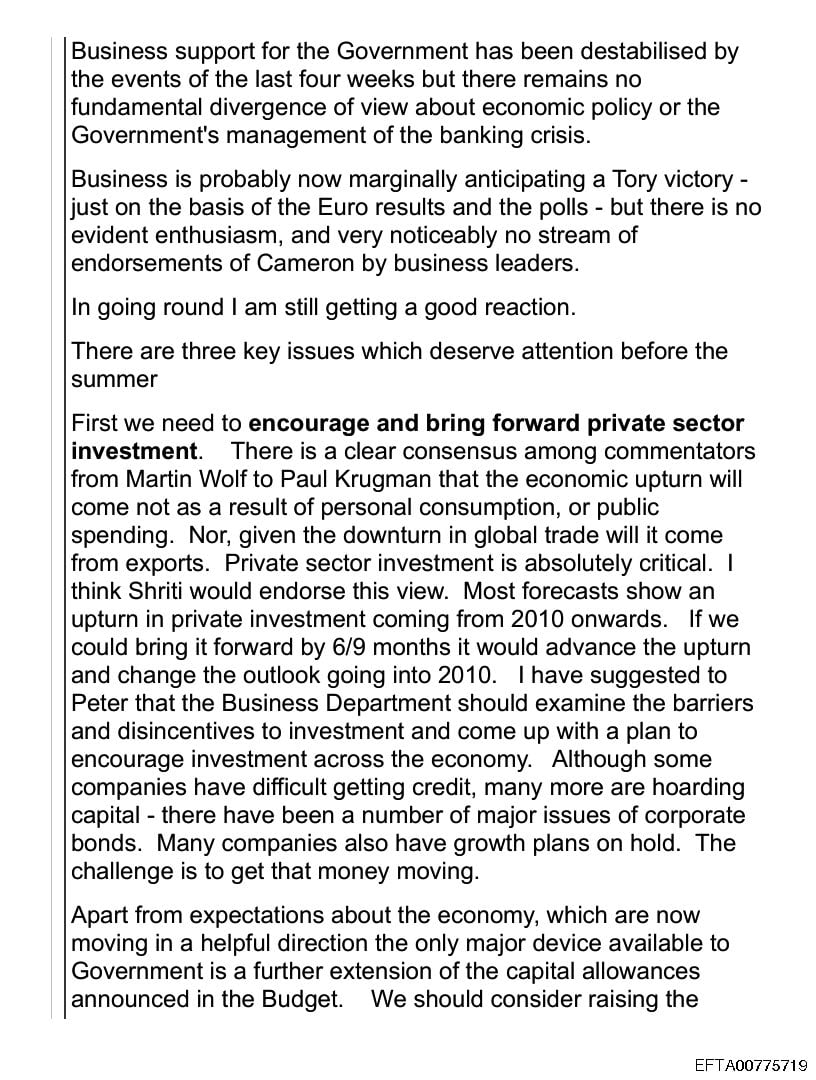

The August 2009 leak

Shriti Vadera was a Minister of State1 who played a key role in the UK’s response to the financial crisis. On 2 August 2009, she wrote a memo (in her characteristic capital letters) with proposals for pushing the banks to increase their lending. Ms Vadera sent it to other advisers in Number 10, plus Jeremy Heywood (the Prime Minister’s Principal Private Secretary) and Peter Mandelson (at the time a senior Cabinet Minister and Business Secretary).

Jeremy Heywood replied, talking about the importance of the non-bank lending market and securitisation.

This was a confidential discussion, which would have been of keen interest to Wall Street.

Four seconds after receiving Mr Heywood’s email, somebody forwarded it to Jeffrey Epstein (whose email address was [email protected]):

The sender’s name is redacted. It could have been any of the recipients, or someone they forwarded the email to. Whilst Peter Mandelson was one of the recipients of the original email from Ms Vadera, his name doesn’t appear on Jeremy Heywood’s reply – but he could have been bcc’d, or the recipient list may be incomplete or have been silently redacted or deleted.

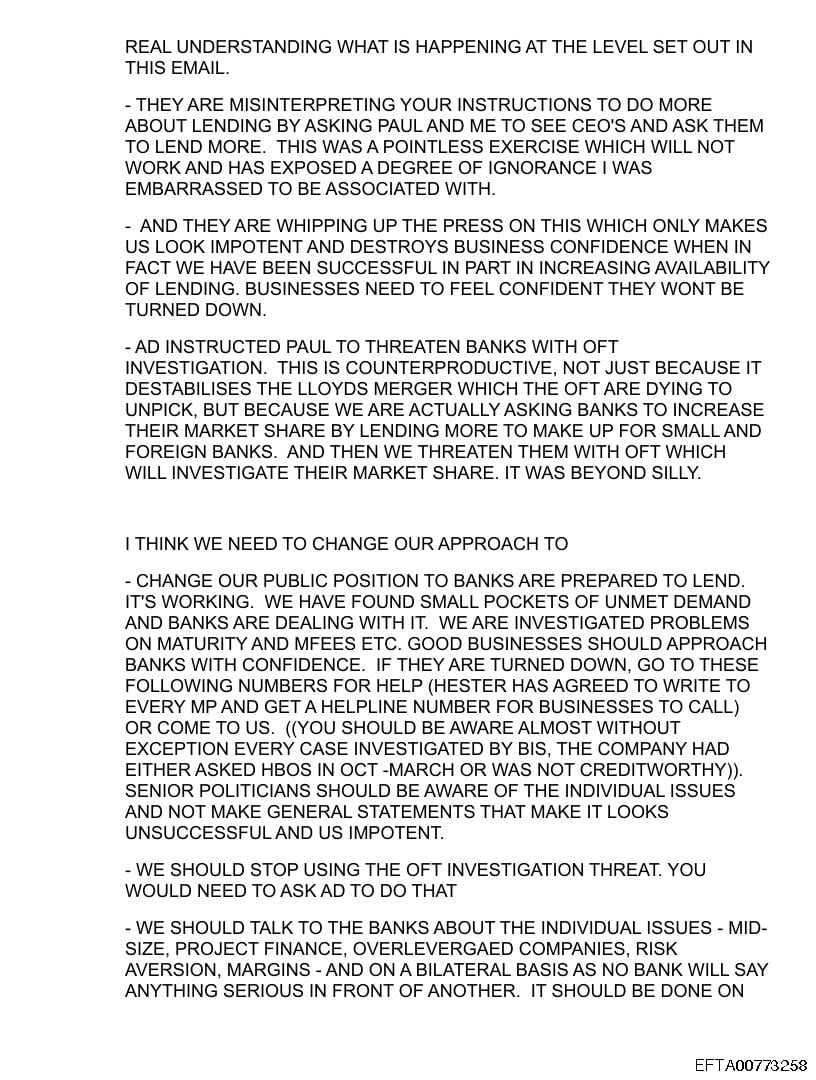

The June 2009 leak

A few months earlier, Nick Butler, a special adviser to Gordon Brown, had sent an email to the Prime Minister with proposals for increasing private sector investment and improving Government finances. He suggested that, instead of focusing on spending cuts and tax rises, the Government should consider disposing of £20bn of “saleable assets” that didn’t need to be in the public sector.

The email was sent to Ms Vadera, Christina Scott (Private Secretary to the Prime Minister) and Peter Mandelson.

Mr Mandelson forwarded it straight to Jeffrey Epstein:

Epstein responded two hours later asking what “saleable assets” Mr Butler was referring to. Mr Mandelson responded that he thought it meant land and property.

It seems likely that Mr Mandelson was also the source of the August leak:

- At the top of both email chains, the sender’s name has been redacted. In the August email this leaves the leaker unidentified. In the June email, Mr Mandelson’s name appears later in the chain. A key piece of information: the redacted sender line at the top of both emails is the same length, which is consistent with both emails having been sent by the same person.

- One small but telling detail is the time shown on the emails. In summer 2009, the UK was on British Summer Time, one hour ahead of GMT. The internal Government emails in these chains are correctly timestamped one hour ahead. But the messages forwarded to Jeffrey Epstein are timestamped at GMT, not British Summer Time.2 That doesn’t mean the sender was abroad. Rather, it suggests the emails were sent from a personal email account or device set to GMT, not directly from a Government email system. In other words, these look like deliberate forwards from a personal inbox, not accidental leaks from an official one. Either both leaks were sent by the same person (Mr Mandelson), or Mr Mandelson and one other person independently used a personal email account or device configured to GMT. The former is plainly the simpler explanation.

- Also consistent (but of course not probative), both leaks were sent by someone who used a BlackBerry and hadn’t turned off the default signature.

- The fact the email from Mr Heywood was forwarded only four seconds later suggests that one of the direct recipients forwarded it. We rather expect Mr Mandelson was one of the recipients (it would be standard Government practice to “reply all”) and that his name has been omitted, redacted or deleted. However if that is wrong, and Mr Mandelson was not a direct recipient then he is surely in the clear; this is something Number 10 should be able to check.

- The Epstein files contain extensive correspondence between Mr Mandelson and Jeffrey Epstein. There is no evidence that we are aware of that any of the other recipients on the August email chain (Shriti Vadera, Jeremy Heywood, John Pond) were in contact with Epstein.

The question can be speedily resolved by obtaining the unredacted email from the US Department of Justice.

It was four months after this that Mr Mandelson worked against his own Government, advising JPMorgan (via Epstein) to “mildly threaten” the Chancellor of the Exchequer.

The 2010 leaks

Mr Mandelson continued to share other confidential information with Jeffrey Epstein throughout 2010. It’s pretty amusing to see Jes Staley congratulate Epstein on predicting the actions of the British Government, when the same thread shows exactly how Epstein could make such accurate predictions:

(Thanks to Sophie for finding that)

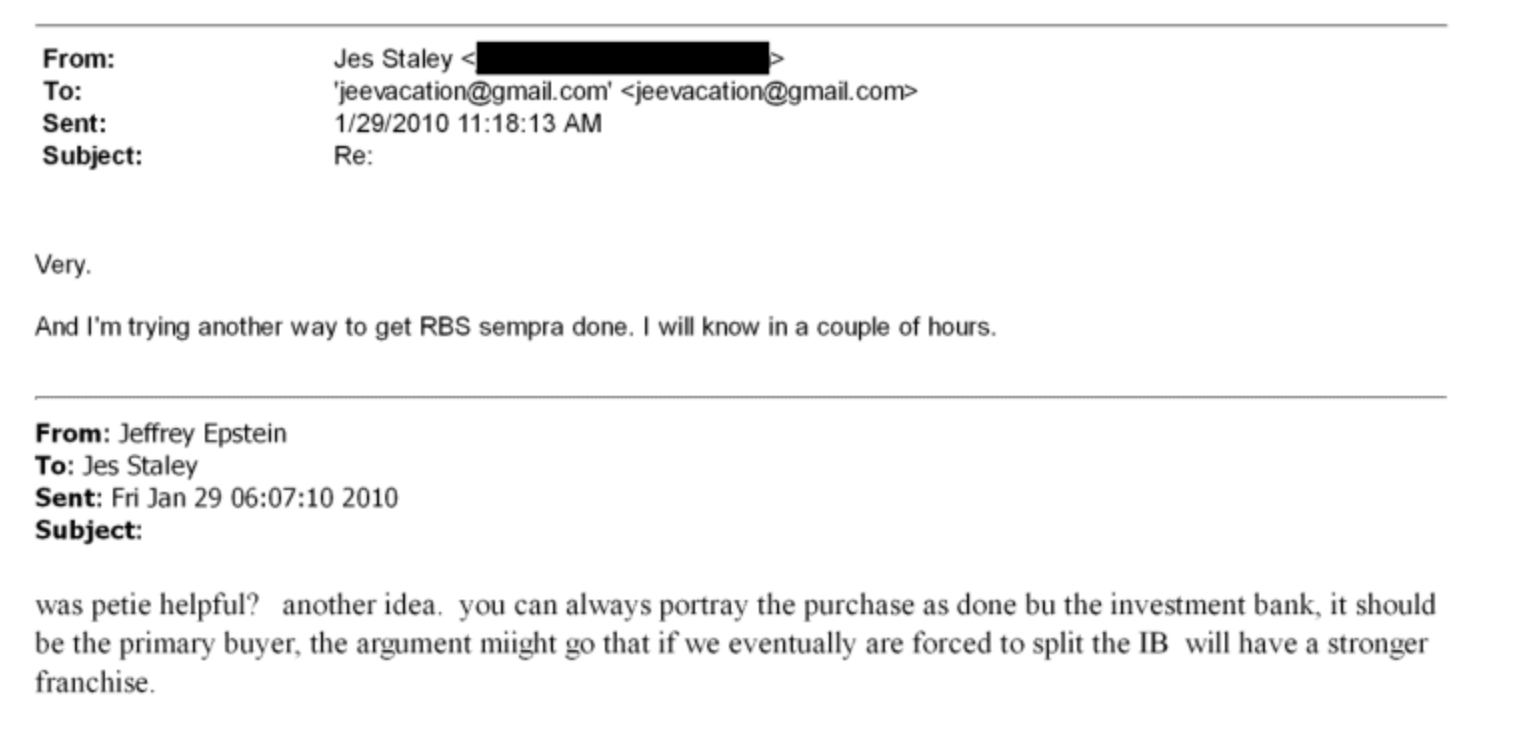

Sempra

In January 2010 there was a discussion between Mr Mandelson, Epstein and Jes Staley regarding JPMorgan’s purchase of the Sempra commodities business from the now-Government controlled Royal Bank of Scotland Group. The deal was announced on 16 February 2010.

It looks highly improper for a serving Cabinet minister to be “helpful” (in whatever way) to a specific private transaction involving a major bank, via an intermediary like Epstein.

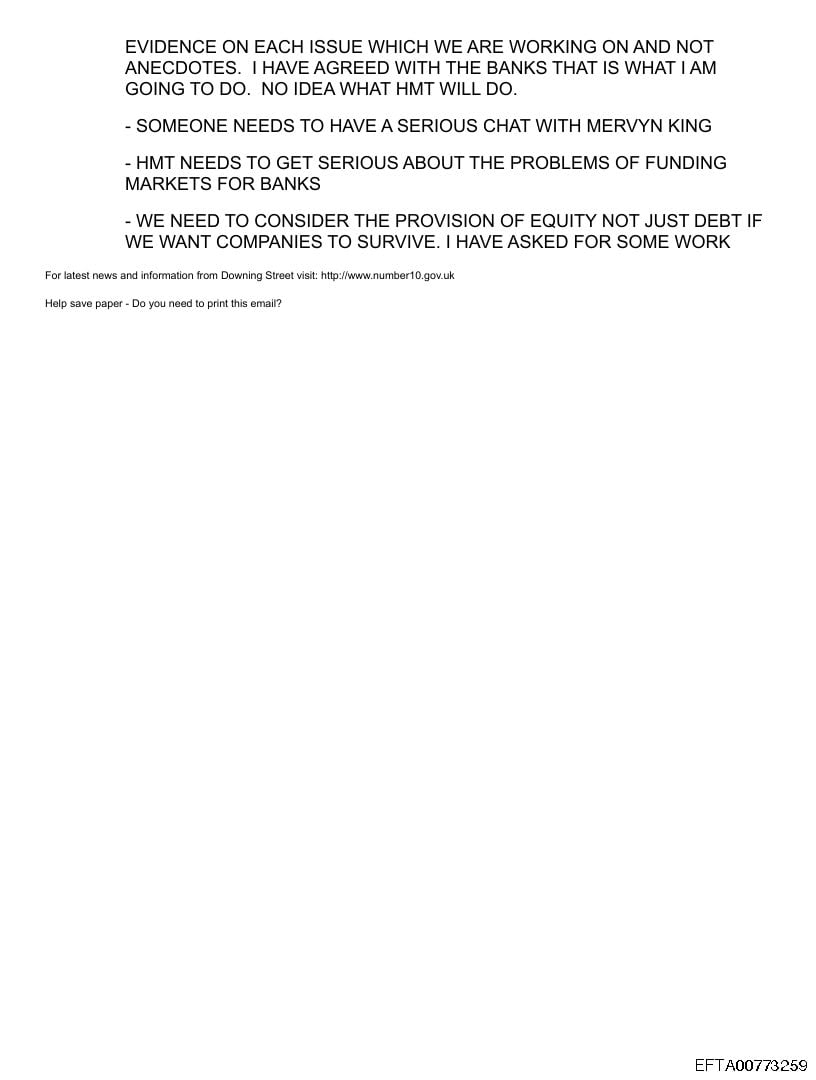

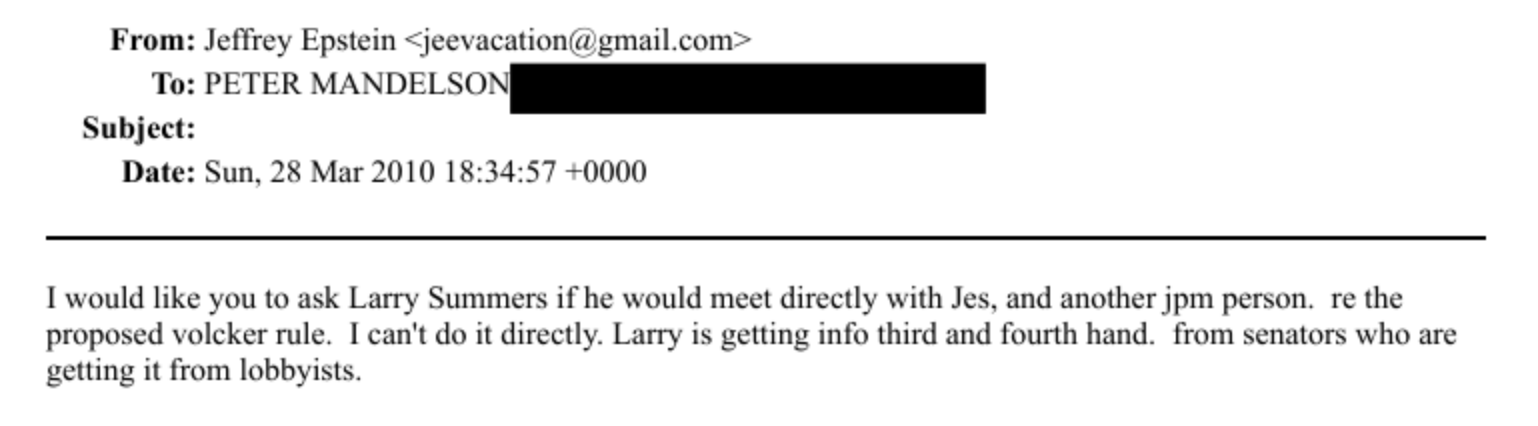

US financial reform

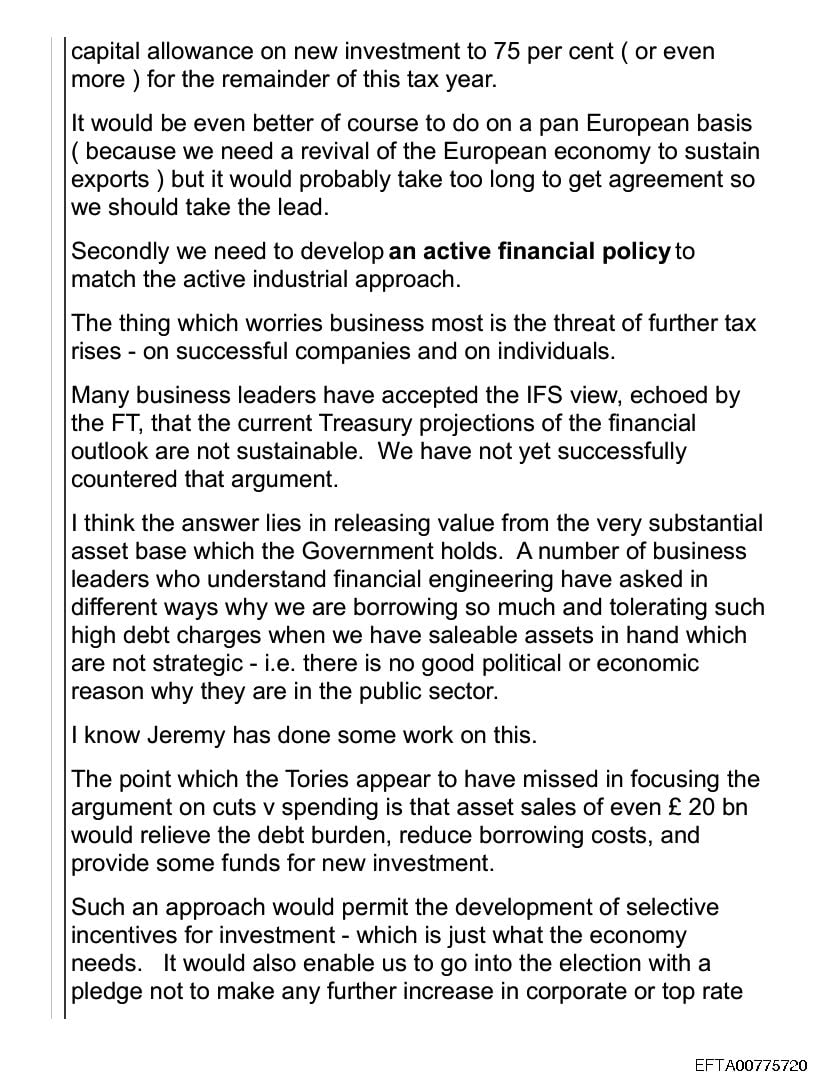

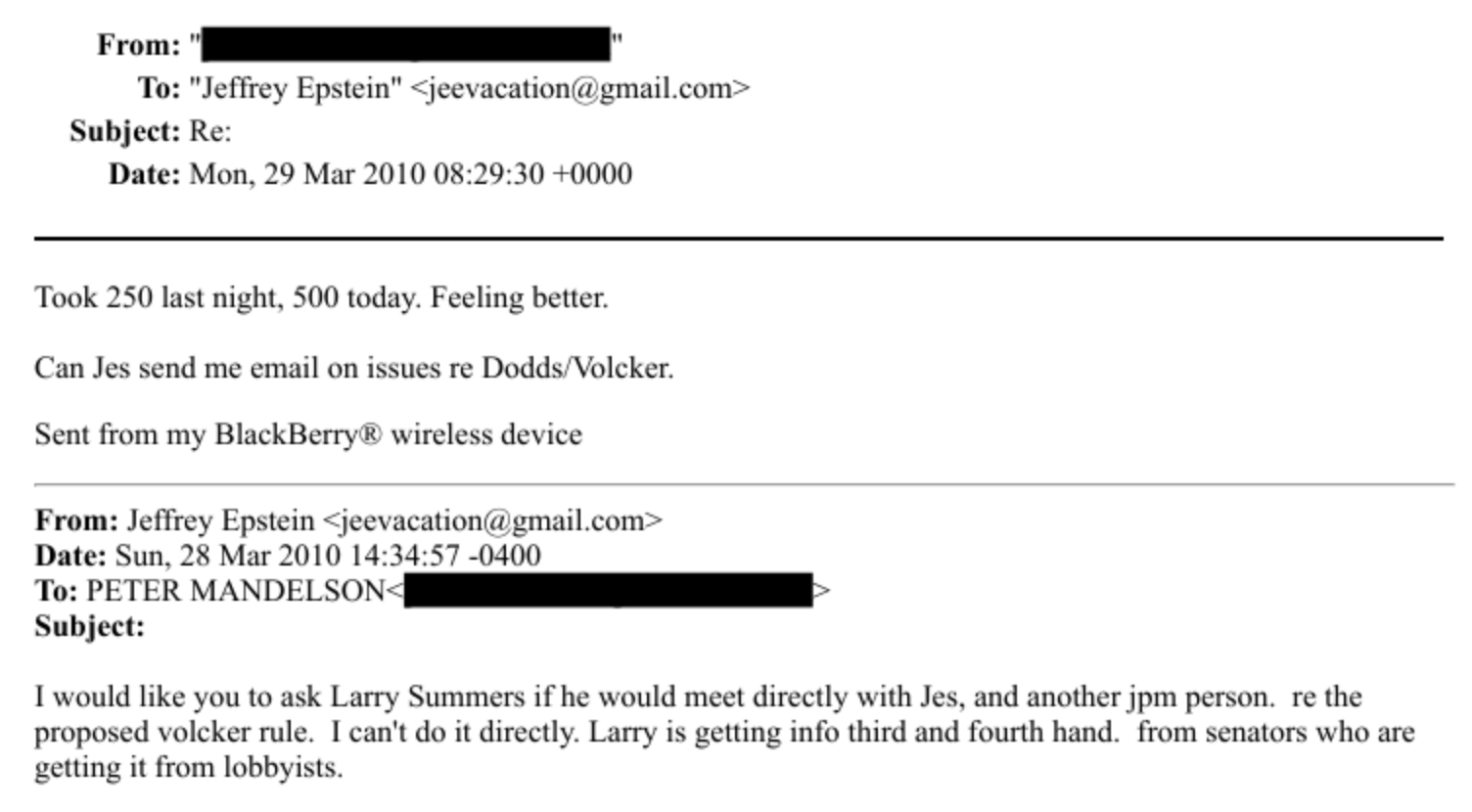

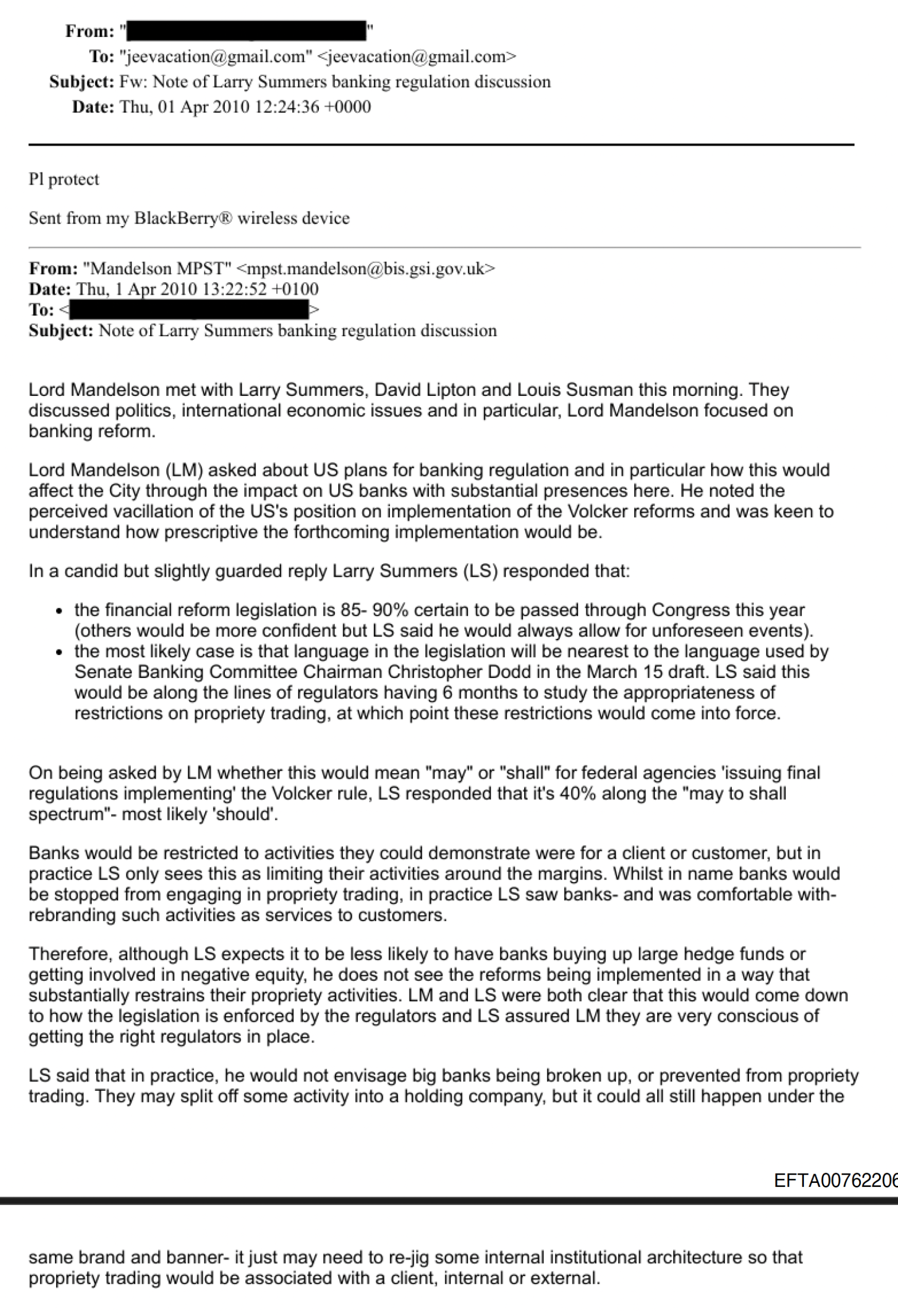

On 28 March 2010, Jeffrey Epstein asked Mandelson to lobby Larry Summers3, President Obama’s chief economic adviser. He wanted him to ask Mr Summers to meet with Jes Staley of JPMorgan to discuss the proposed Volcker rule (which would, broadly speaking, prevent banks taking trading positions). Epstein said that he (Epstein) couldn’t do this directly.

Mr Mandelson wasn’t feeling well, but when he recovered the next morning, his response was to ask Staley to produce a briefing note.

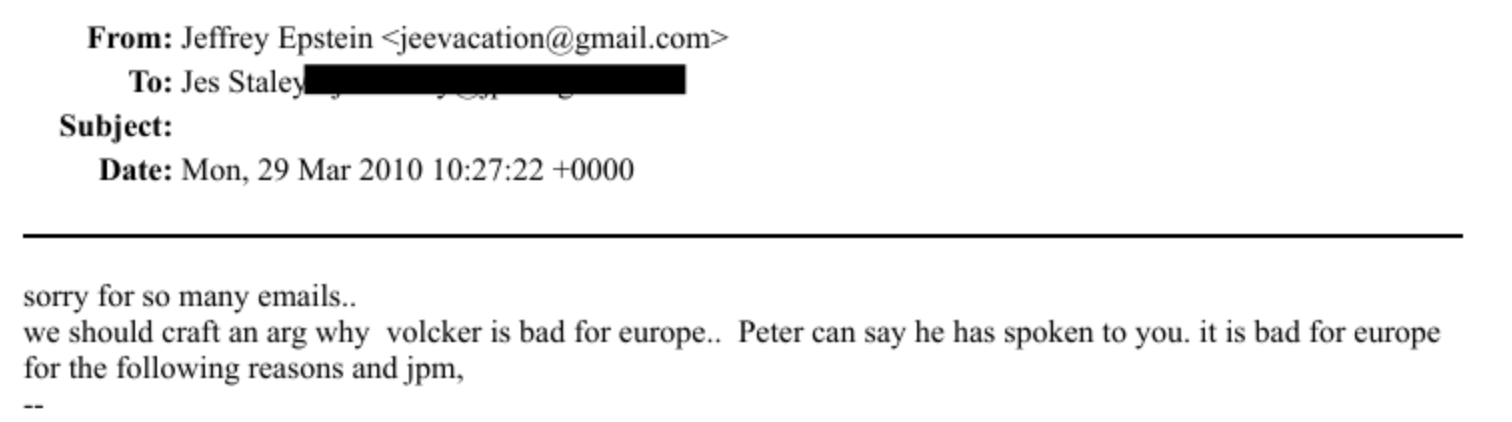

Epstein asked Staley to do this, and to “craft an argument why Volcker is bad for Europe”:

Staley prepared that note, and Epstein forwarded it to Mr Mandelson.

(These emails were found by Jim Pickard of the Financial Times.)

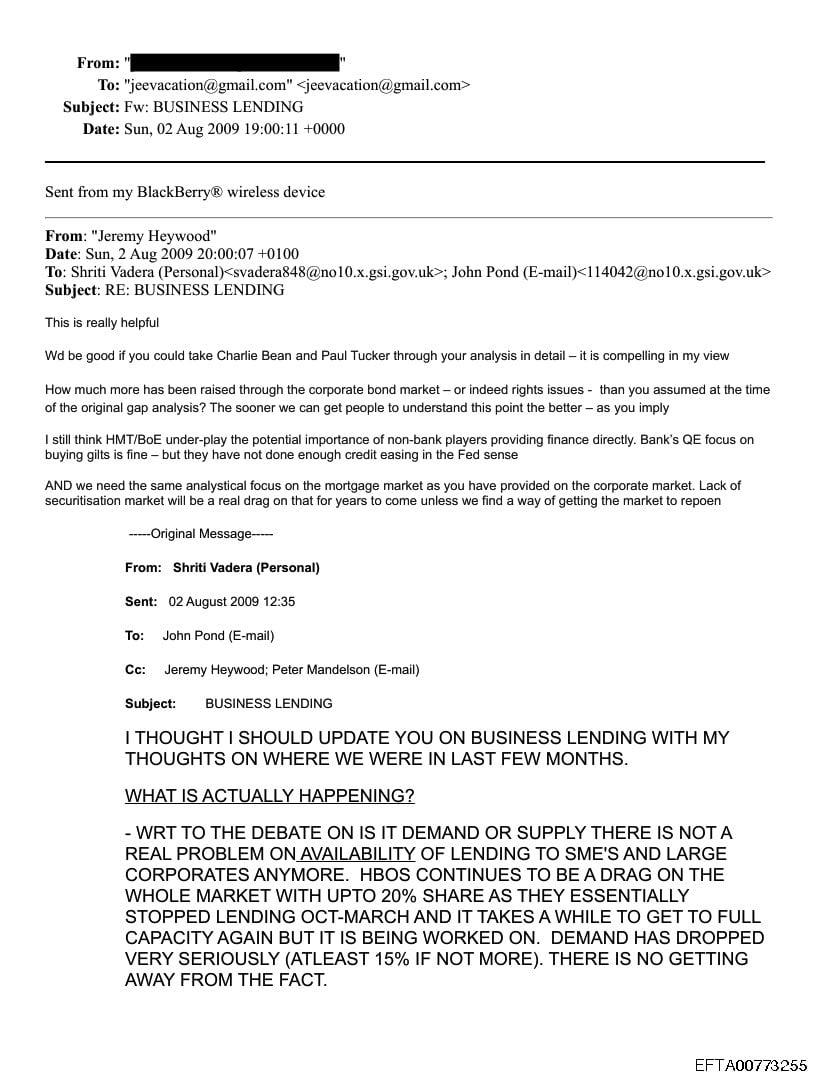

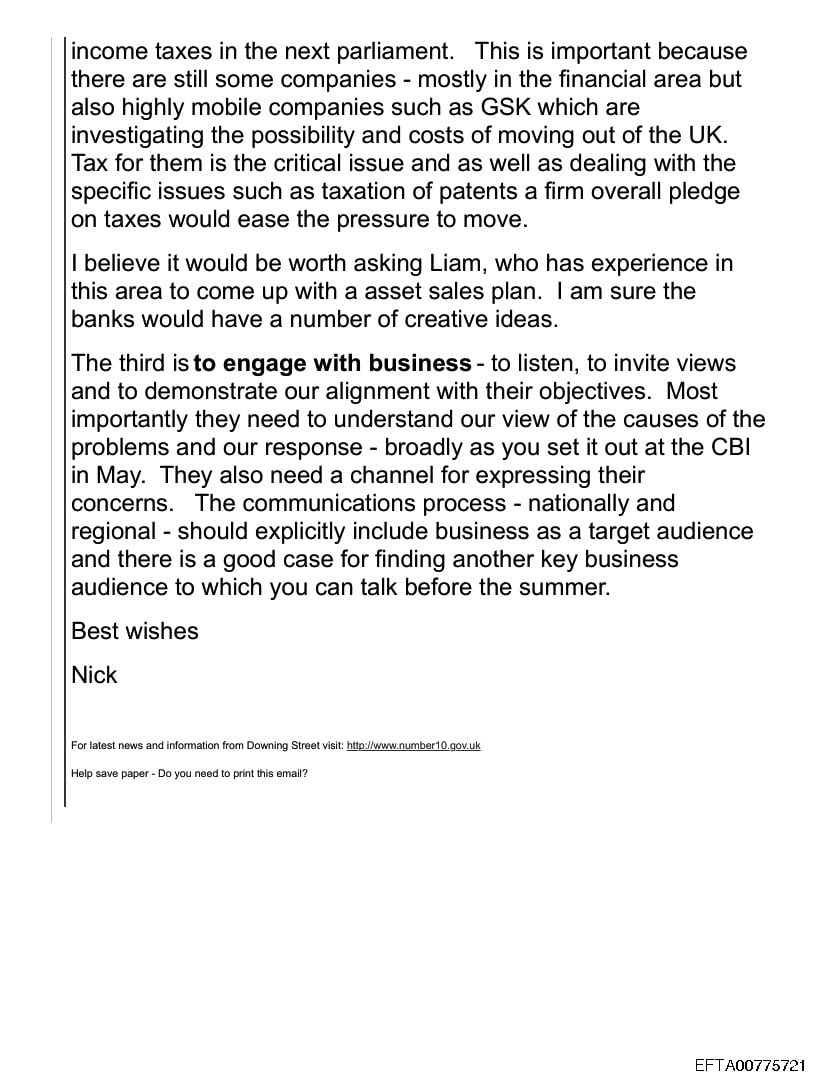

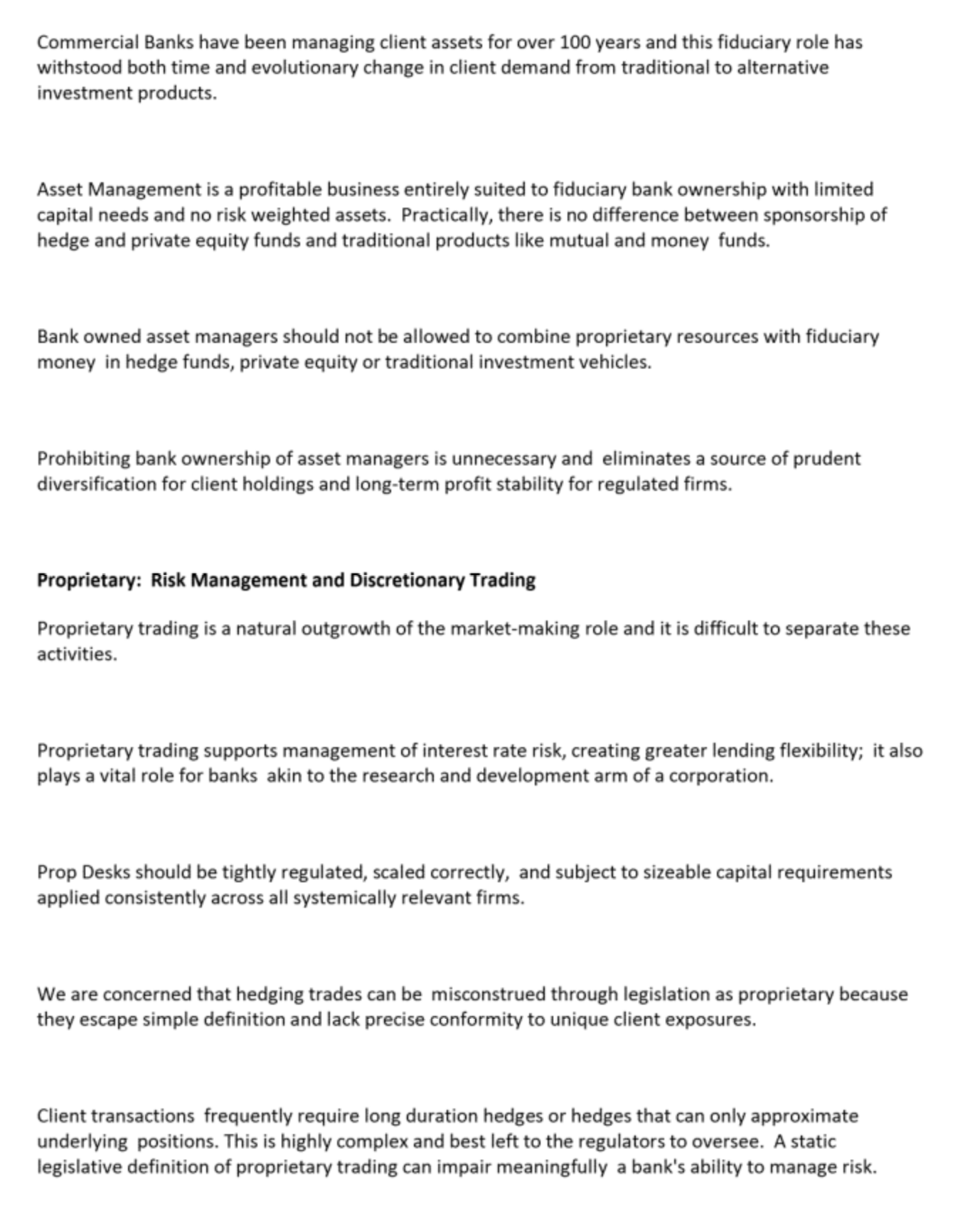

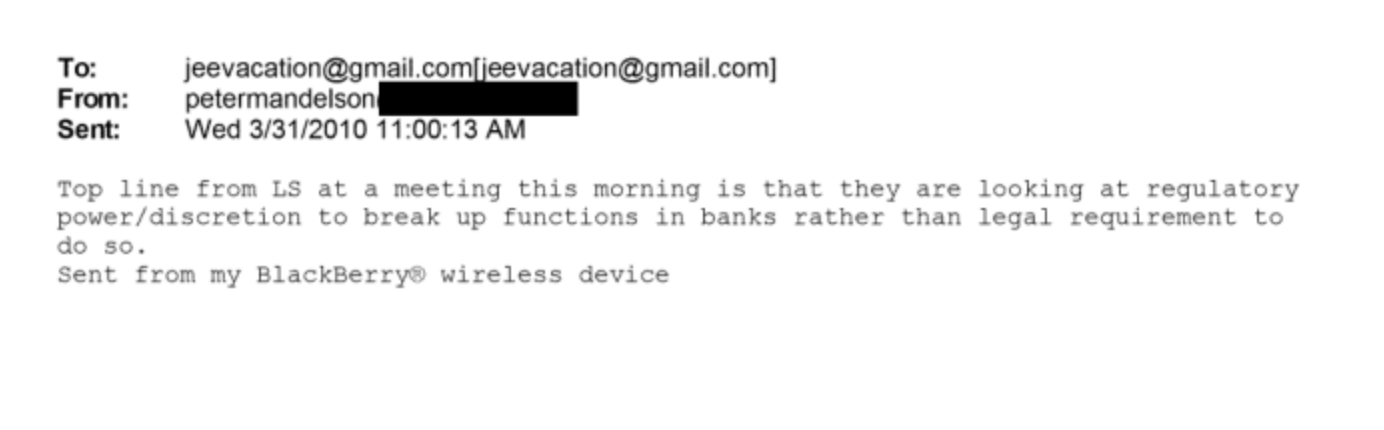

Three days later, 31 March 2010, the Chancellor of the Exchequer met Larry Summers, and Mandelson sent Epstein a short summary of the meeting straight afterwards.

(Thanks again to Sophie)

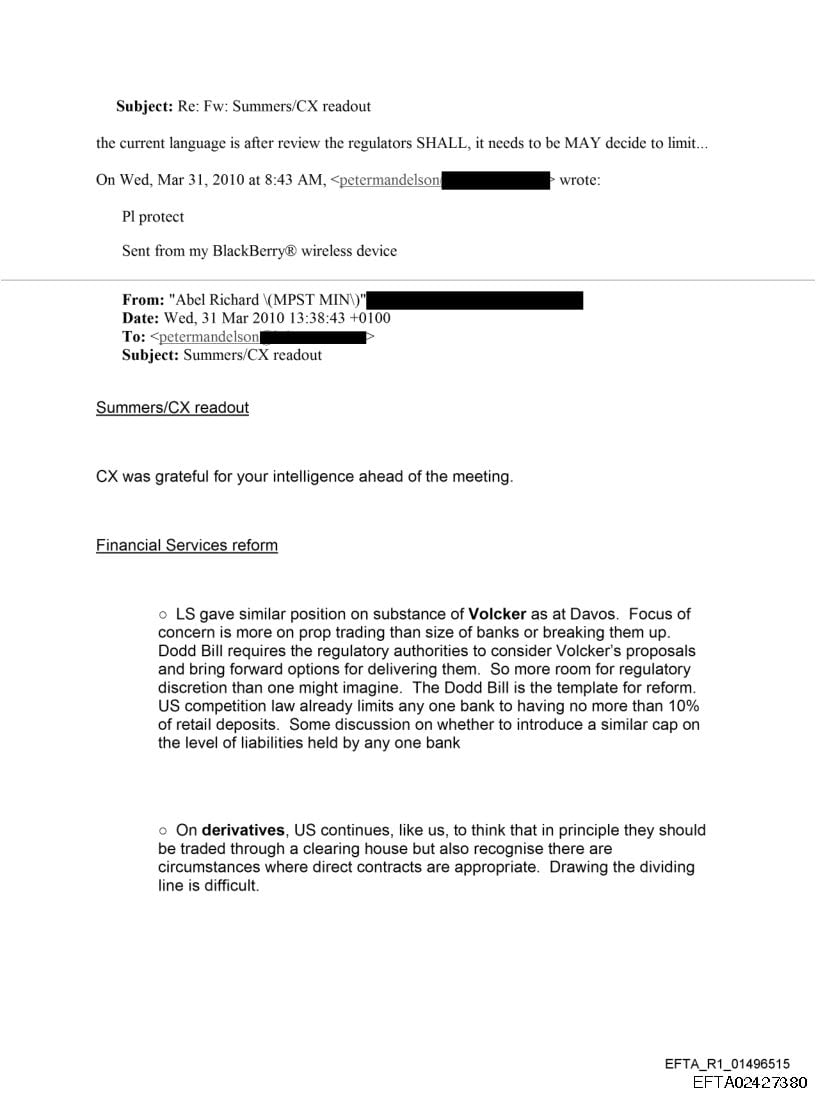

Mr Mandelson’s principal private secretary subsequently sent him a formal note of the meeting.4 It contained high level details of the new banking regulation and taxation that Mr Summers and the US Administration were seeking to enact, and some discussion of how the US should engage with France and Germany. Mr Mandelson forwarded the note to Jeffrey Epstein five minutes after receiving it.5

Epstein responded with suggestions as to how hedge funds should be taxed, and then detailed questions about the drafting of the new US rules (“may” vs “shall). Mr Mandelson was meeting Larry Summers for breakfast the next morning – there is a possible implication that Mr Mandelson would discuss the questions with him (but that is not clear, and there’s nothing on the point in the subsequent notes).

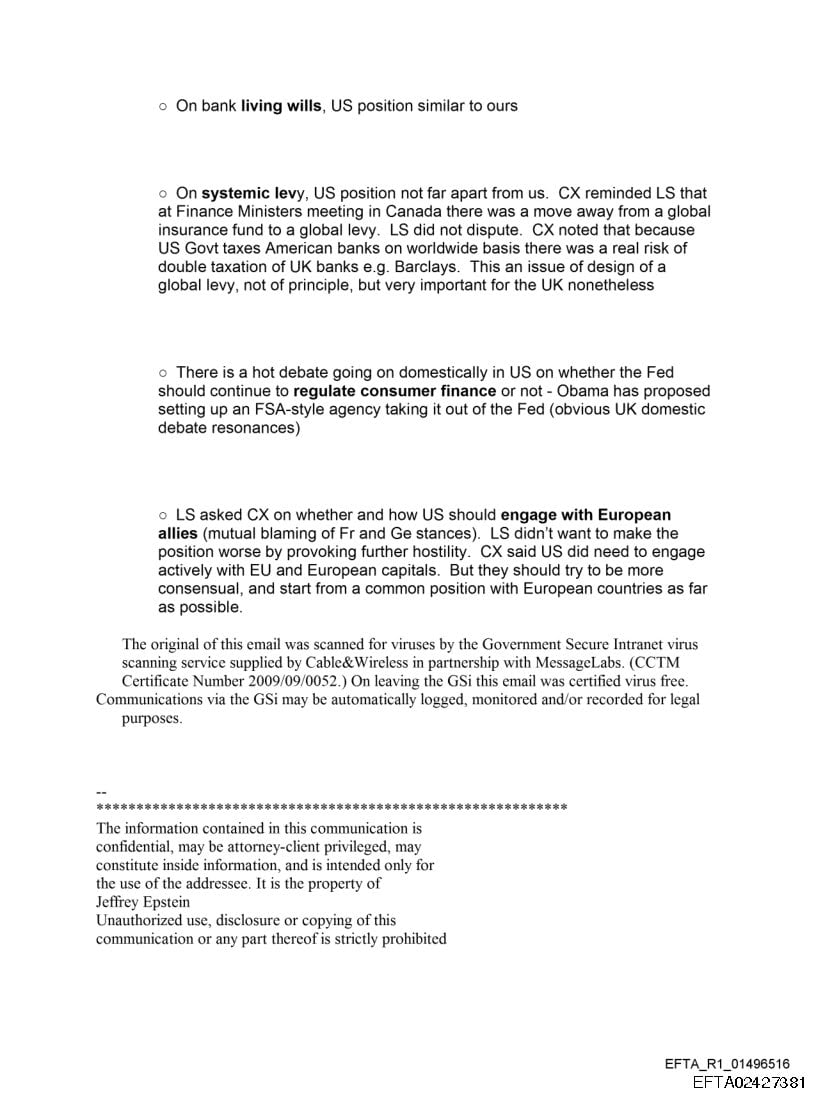

The next day, 1 April 2010, Mr Mandelson had that meeting with Larry Summers. Mr Summers shared some fairly candid views on the likely form any new banking regulation would take. At 1.22pm, Mr Mandelson’s private secretary sent a note of the meeting to Mr Mandelson. Within two minutes, Mr Mandelson forwarded it to Jeffrey Epstein:

(These emails were found by Gary Gibbon and the Channel 4 News team).

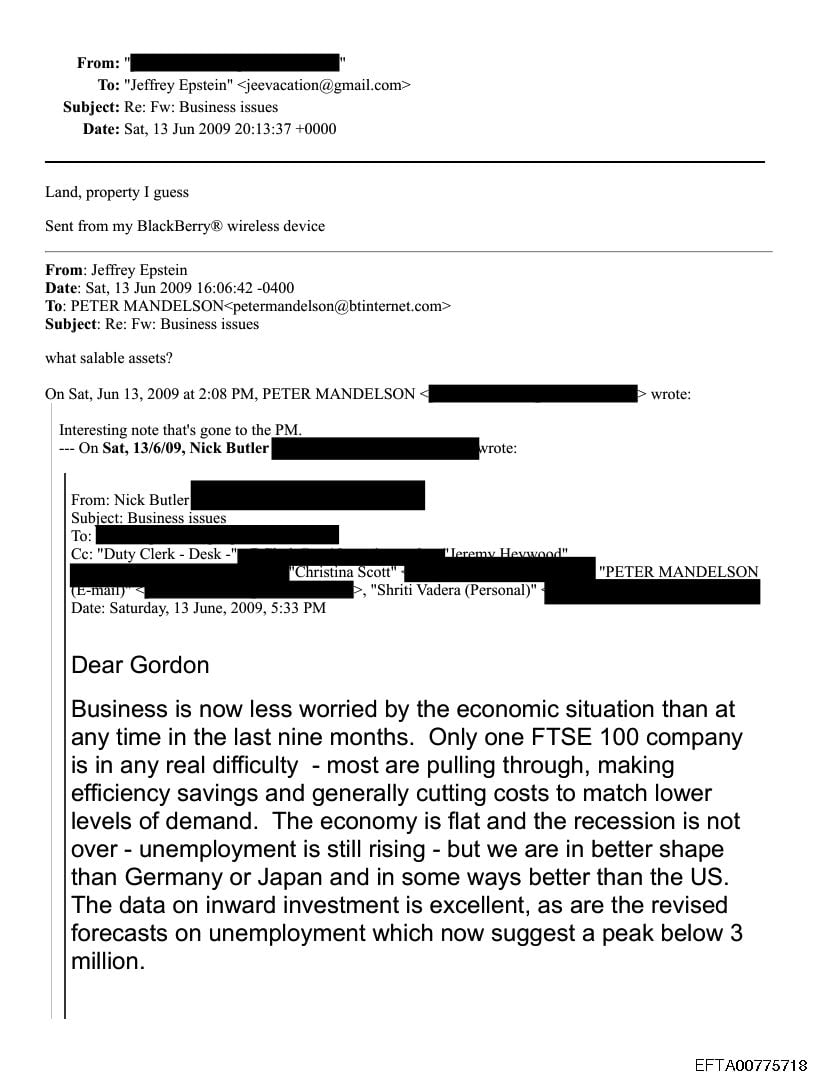

The €500bn Eurozone bailout

On 9 May 2010,6 Mr Mandelson wrote to Epstein confirming market rumours of the €500bn bailout of the Eurozone. Mr Mandelson said the bailout would be announced that night, and it was:

Steven Swinford of The Times found this email.

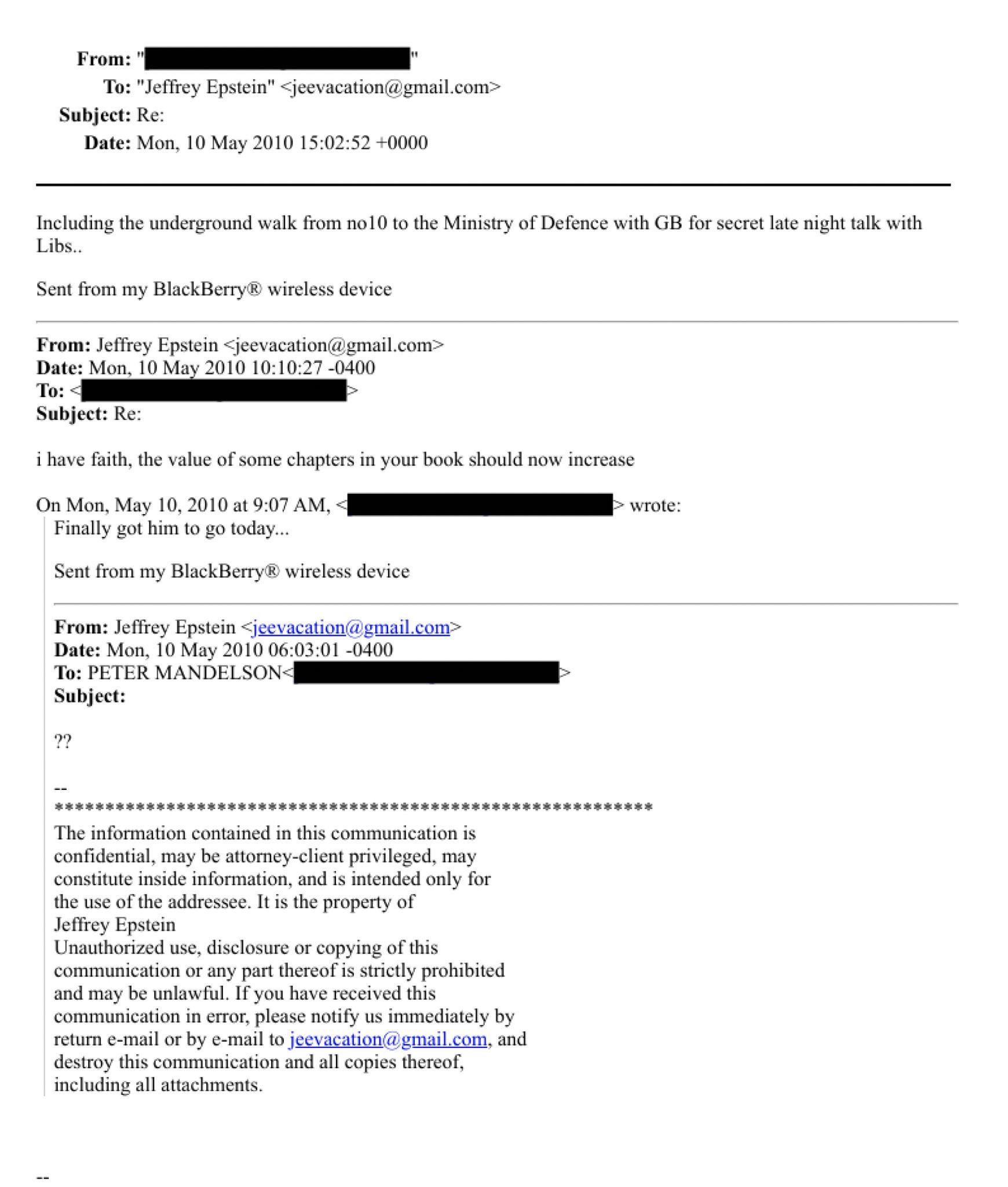

Gordon Brown’s resignation

A few days later, Mr Mandelson gave Epstein advance notice of Gordon Brown’s resignation.

We can be reasonably confident7 that Mr Mandelson’s first email was sent at 10.07am on 10 May 2010. Gordon Brown’s resignation wasn’t public until about 7.19pm that evening.

This email was found by Gabriel Pogrund of the Sunday Times.

How did Epstein view Mandelson?

We perhaps get a clue from this exchange. Epstein and businessman/lawyer David Stern talk about Mandelson as if he’s on retainer:

The context was Terra Firma’s troubled private equity acquisition of EMI, which all-but destroyed the historic music group. Citi had financed the acquisition, and were about to enforce and acquire EMI from Terra Firma.8

Jeffrey Epstein casually suggests Mr Mandelson could help; David Stern responds that in his view it’s too early. There is no surprise or confusion at the way the serving Business Secretary is name-dropped into the discussion. That suggests that both Epstein and Stern viewed Mandelson as someone whose political influence and contacts could be deployed if and when it became useful.

Two weeks later, Epstein did reach out to Mr Mandelson. It’s unclear whether they spoke.9

And here, the Epstein-Mandelson relationship looks like the relationship of a client to their lobbyist, with Epstein asking Mandelson to set up a meeting between Larry Summers and Jes Staley:

Was there a quid pro quo?

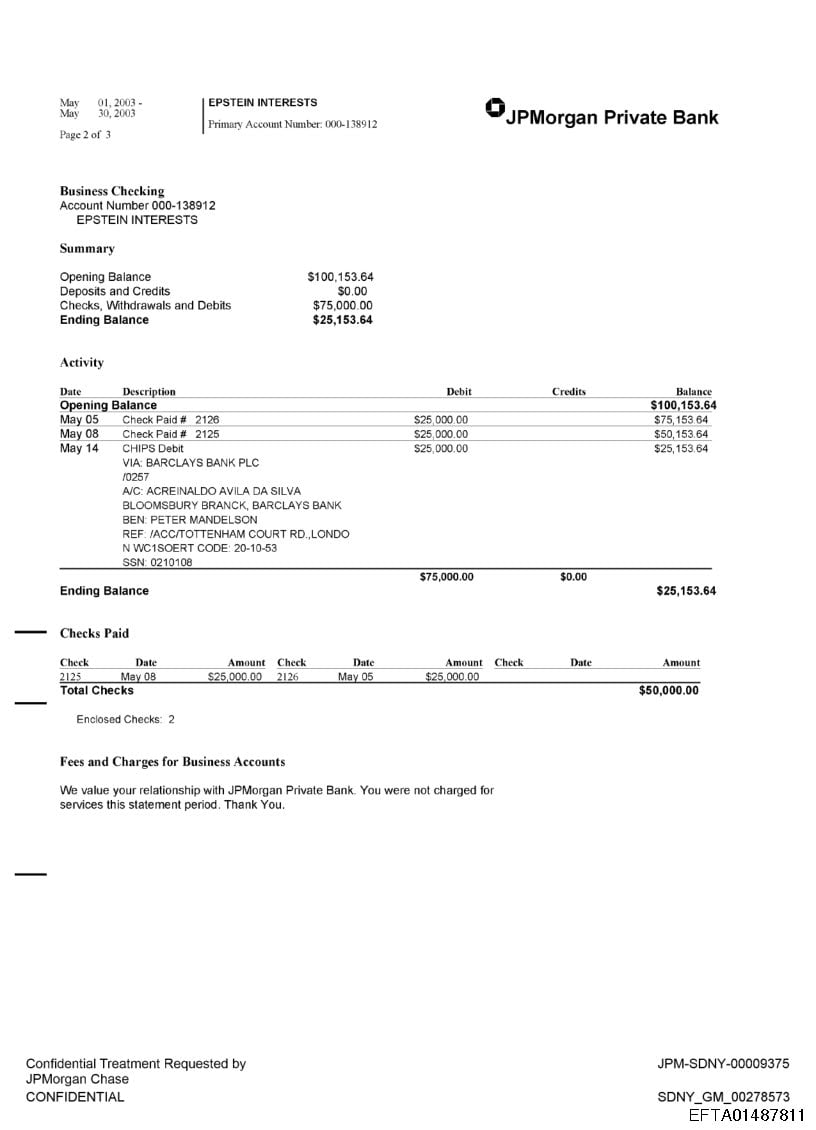

The payments

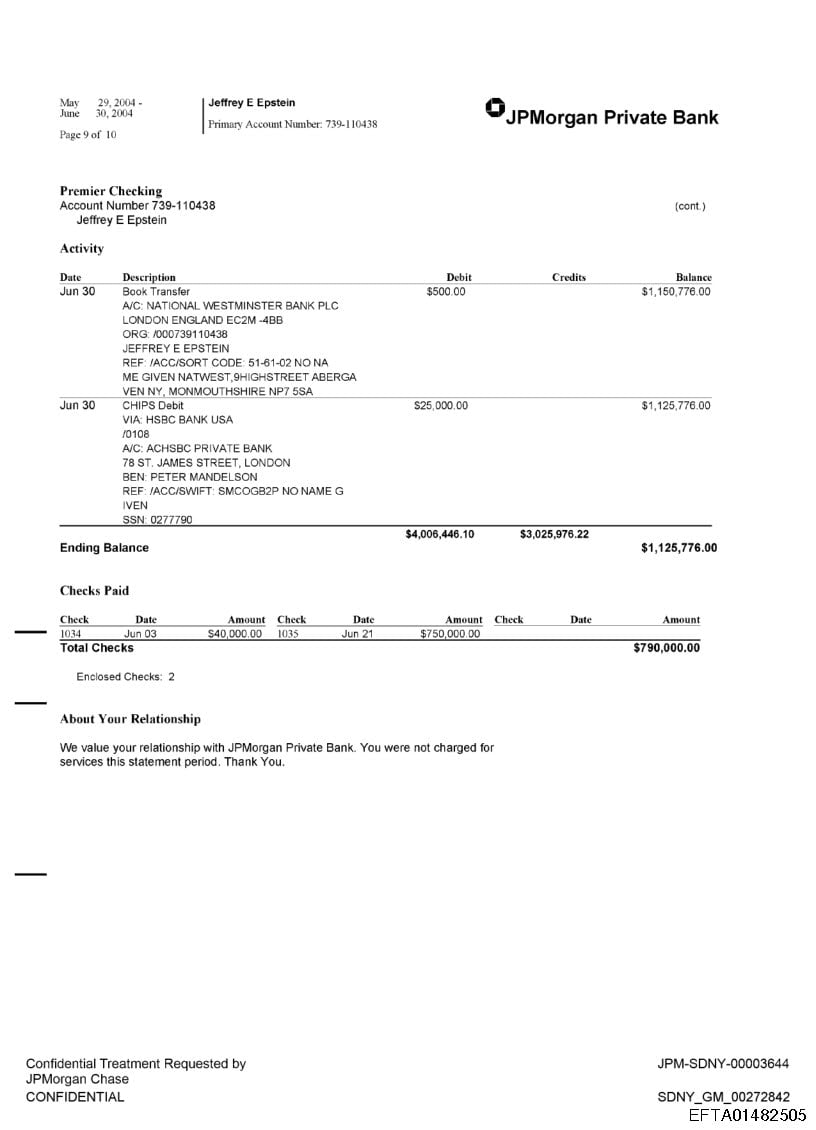

We know that in 2003 and 2004, Mr Epstein wired a total of $75,000 to Mr Mandelson:

We don’t know what the payments were for, or if there were others. Mr Mandelson says he can’t recall the payments, but hasn’t clearly denied receiving them. The bank statements look genuine.

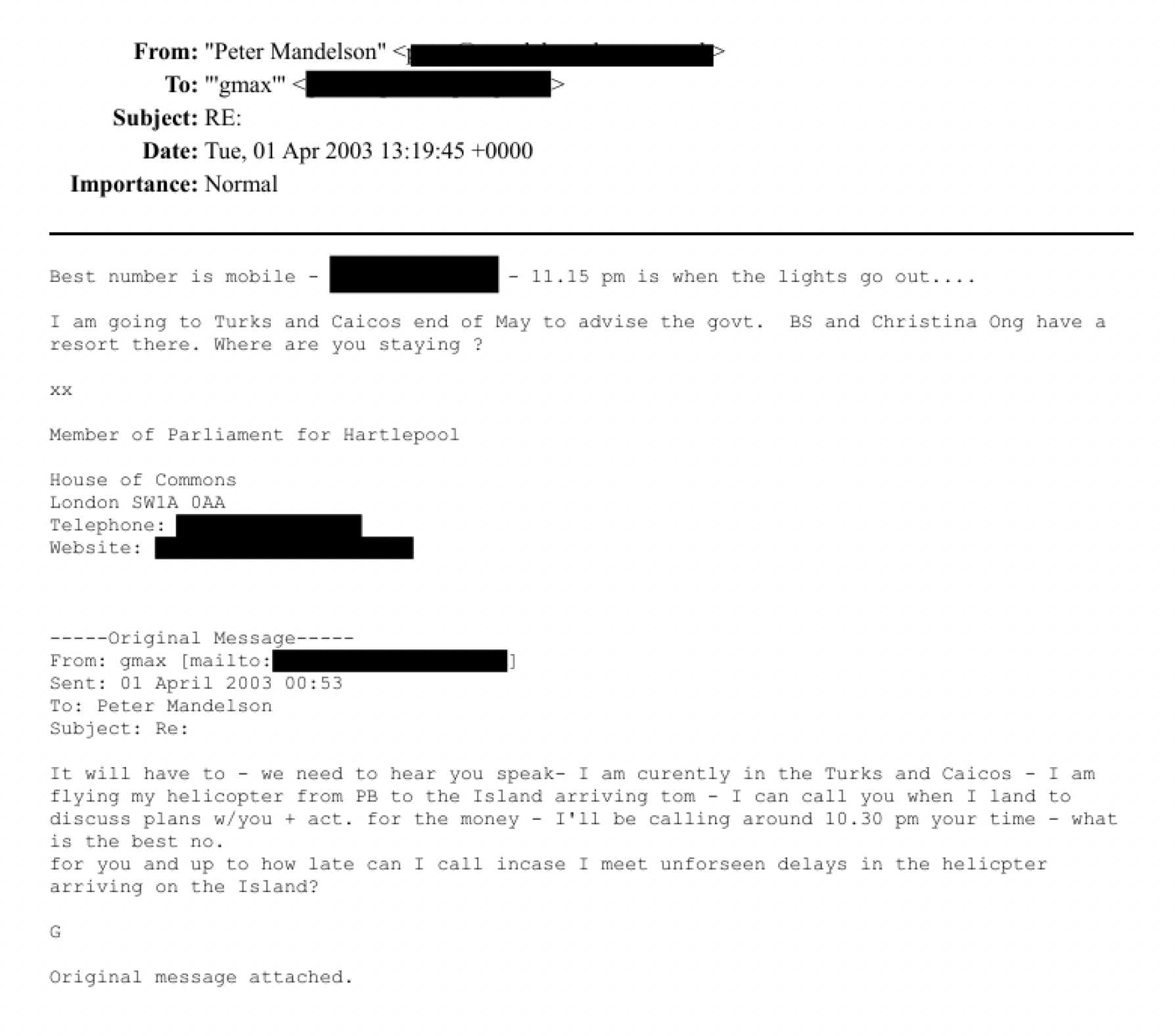

A month before the first payment, Ghisliane Maxwell sent Mr Mandelson an email which might have included a request for his bank account number (it says she wants to discuss the “act. for the money”):

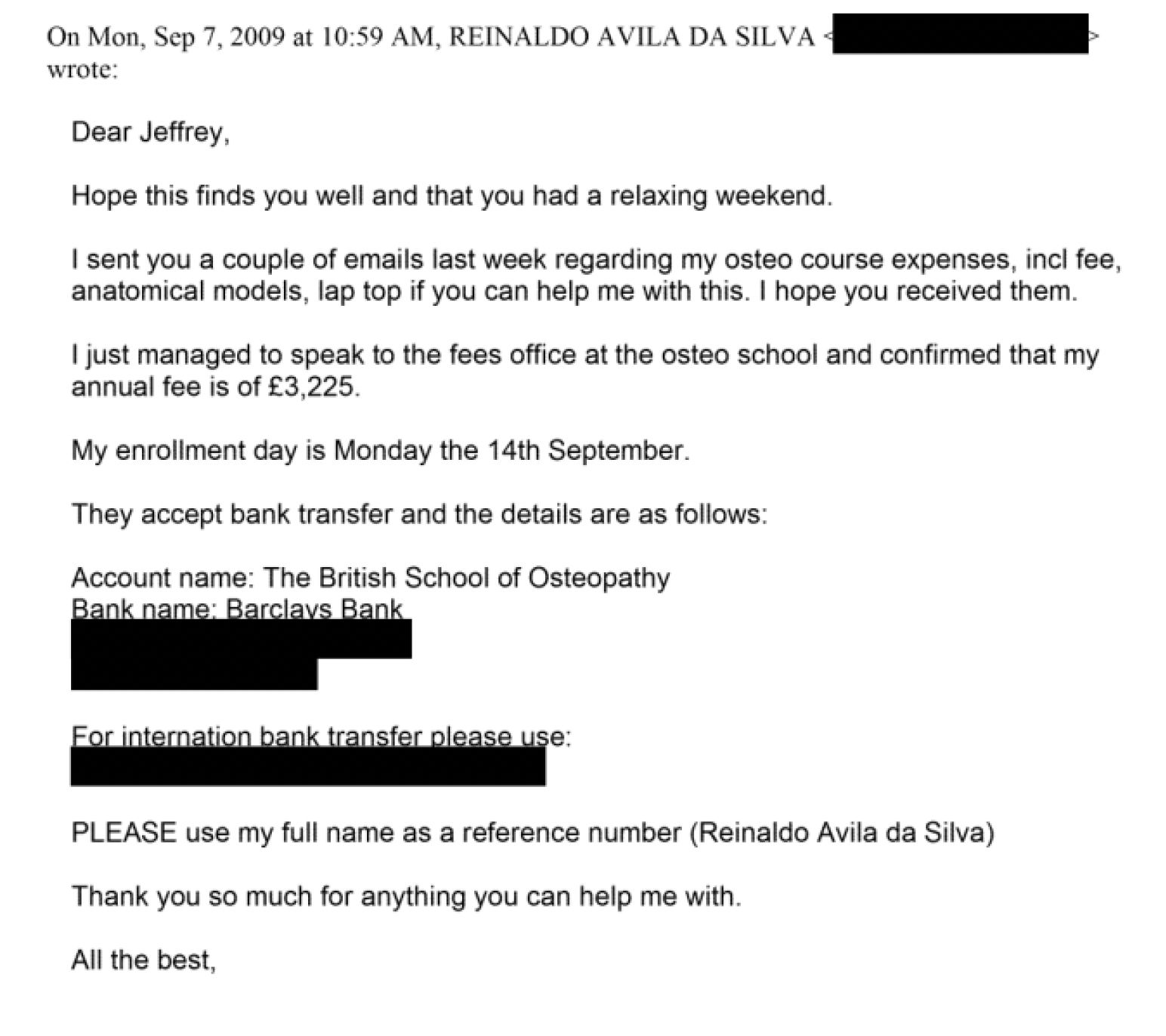

This was of course years before the email leaks. However at around the same time as the leaks, Mr Mandelson’s then-partner was receiving payments from Jeffrey Epstein to fund his osteopathy course:

Mr Mandelson has claimed he thought it was a bursary from Epstein’s foundation. There is no evidence of this in the emails. It appears to have been an entirely personal arrangement, and the evidence suggests Mr Mandelson knew that at the time:

The job opportunities

Far more lucrative than the cash payments was Jeffrey Epstein’s help in obtaining a high-paying job.

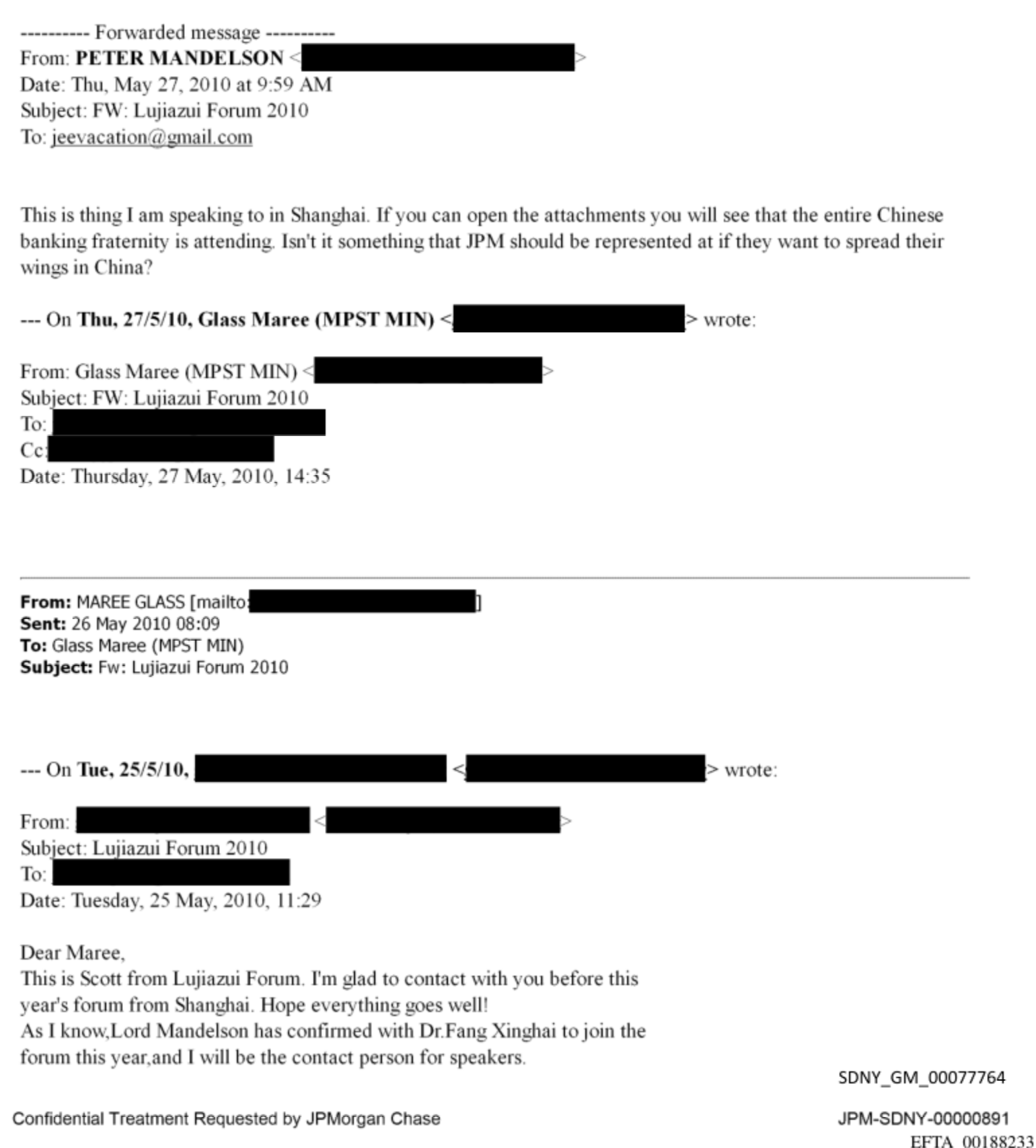

The email in the Epstein files suggest that Mandelson had a particularly close interest in JPM, speaking to Jes Staley both directly and via Epstein (but of course we only see the emails to/from Epstein). Mandelson also looked for commercial opportunities for JPM – for example forwarding an email he’d received inviting him to a business forum in Shanghai:

And here we see Mandelson, a serving Cabinet minister, endorsing JPM involvement in a friend’s commercial listing:

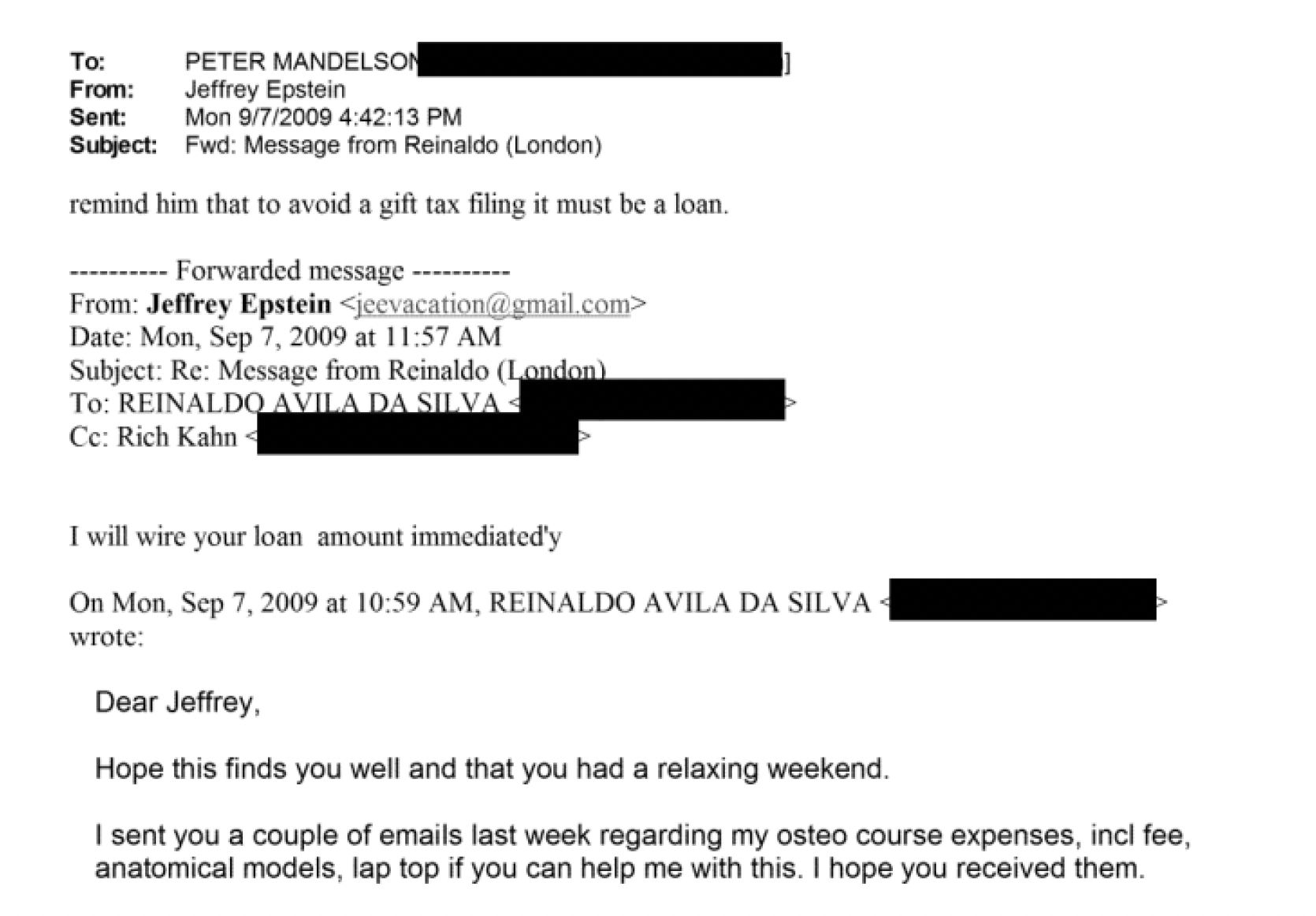

Soon after the 6 May 2010 election, when Gordon Brown was still Prime Minister, Staley told Mandelson that supporting Mr Brown would be “bad form commercially”. We take that to mean “would be bad for your future job prospects”:

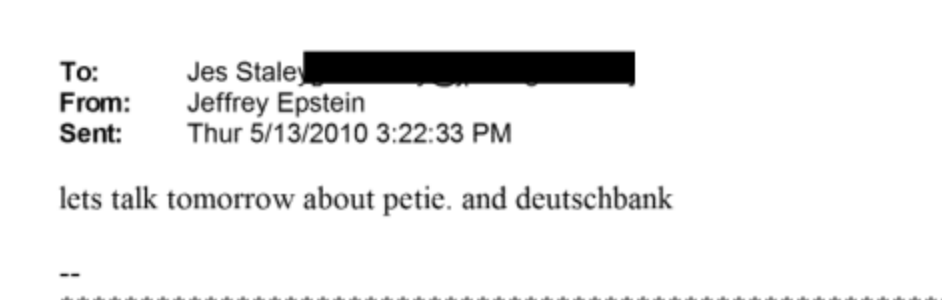

Then, two days after the change of Government in 2010, Epstein wrote to Jes Staley – it appears they were discussing a potential Deutsche Bank job for Peter Mandelson:

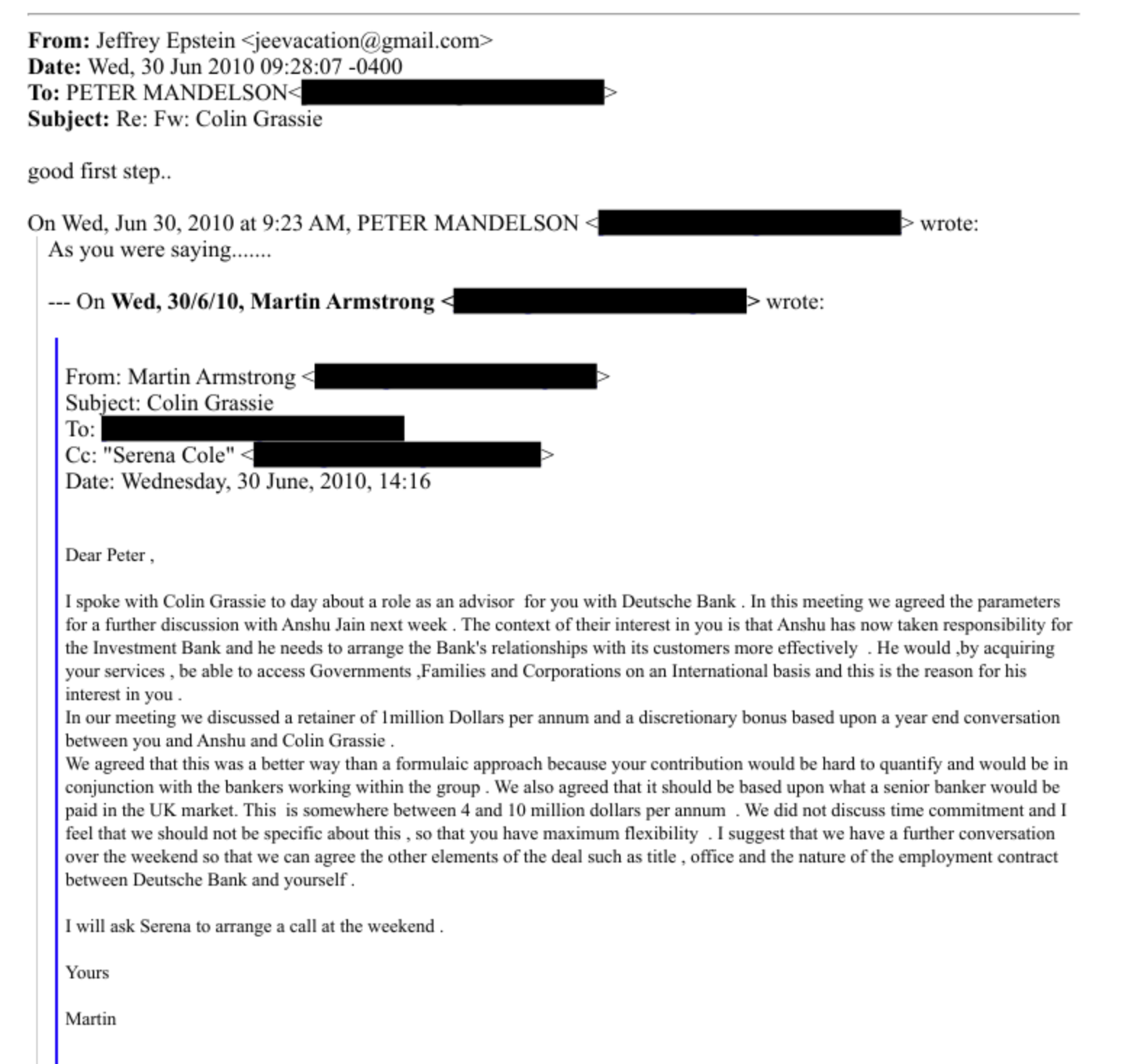

That appeared to pay off in June, with Deutsche offering Mr Mandelson $4-10m/year. The CEO’s stated reason for the hire was to “be able to access governments, families and corporations”:

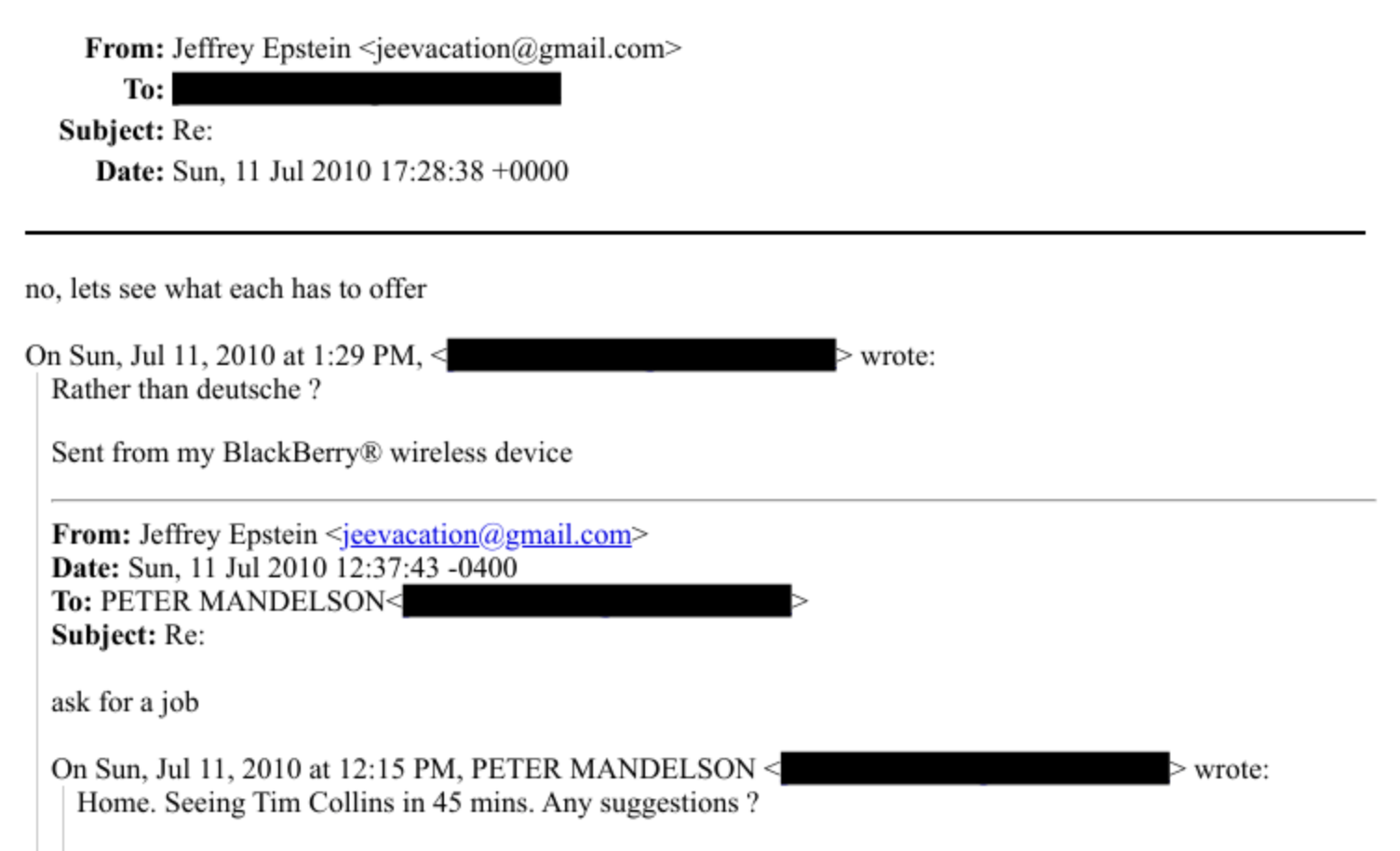

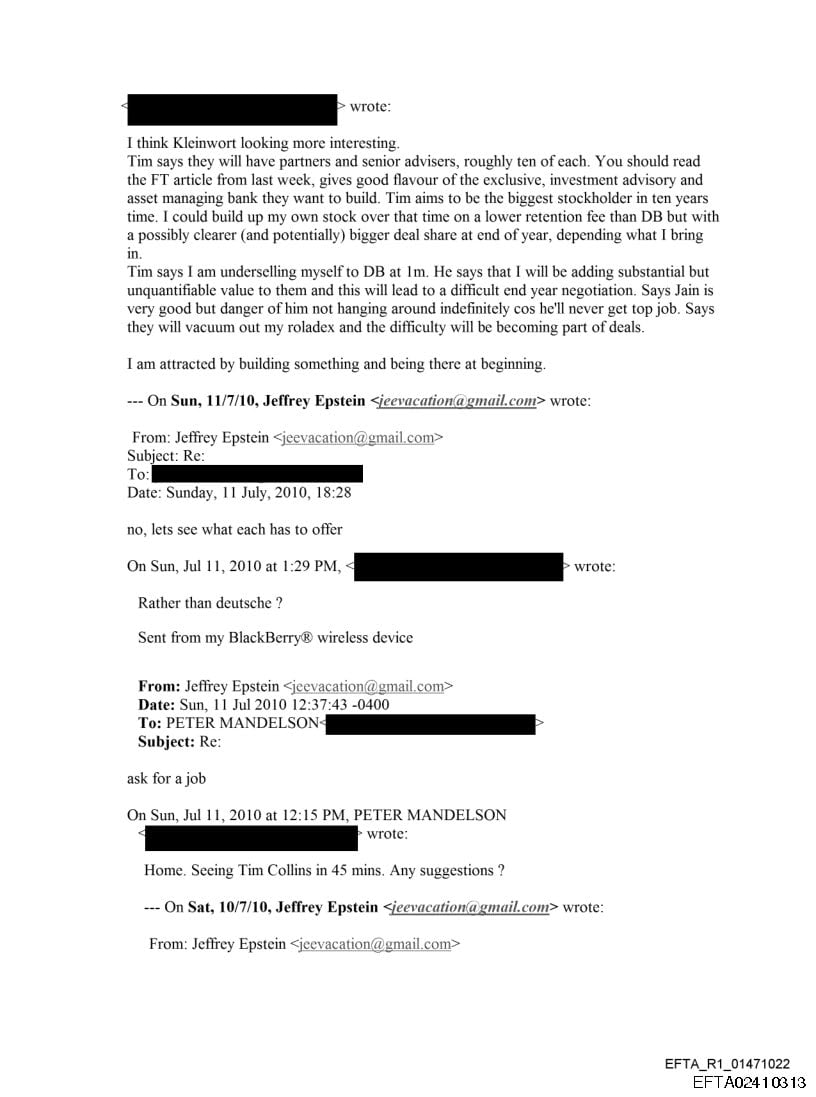

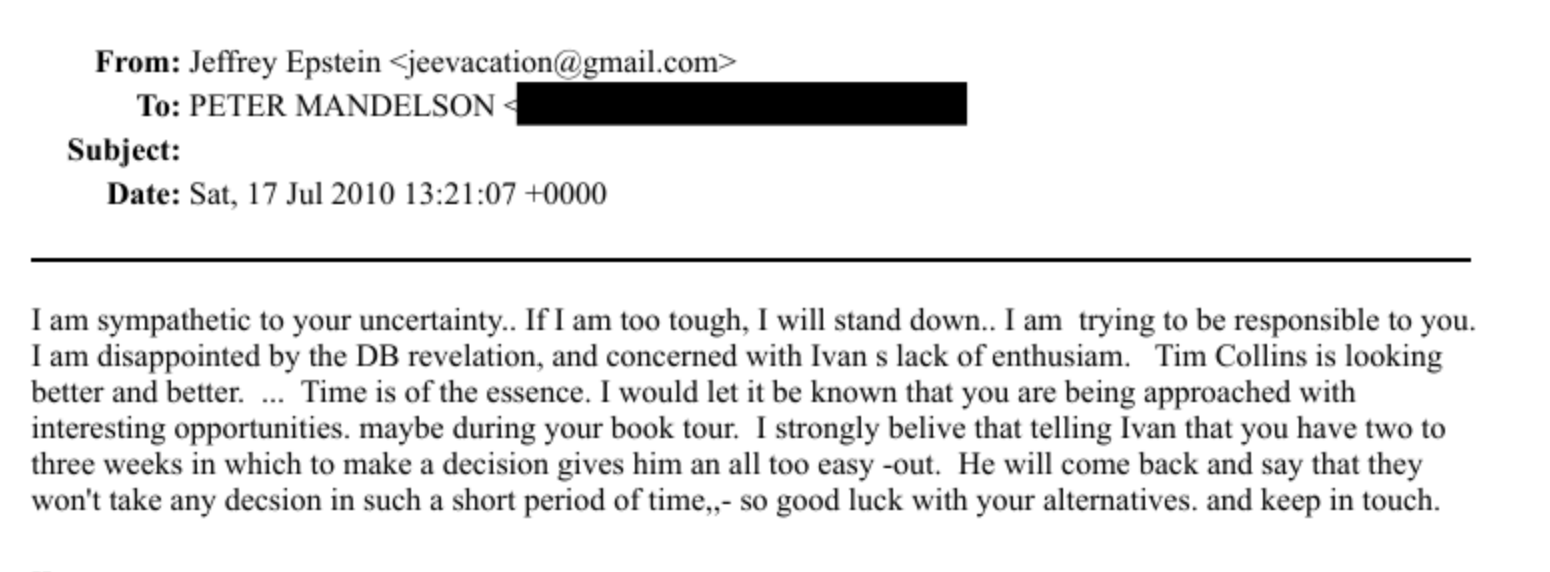

But in July, Mr Mandelson was still looking:

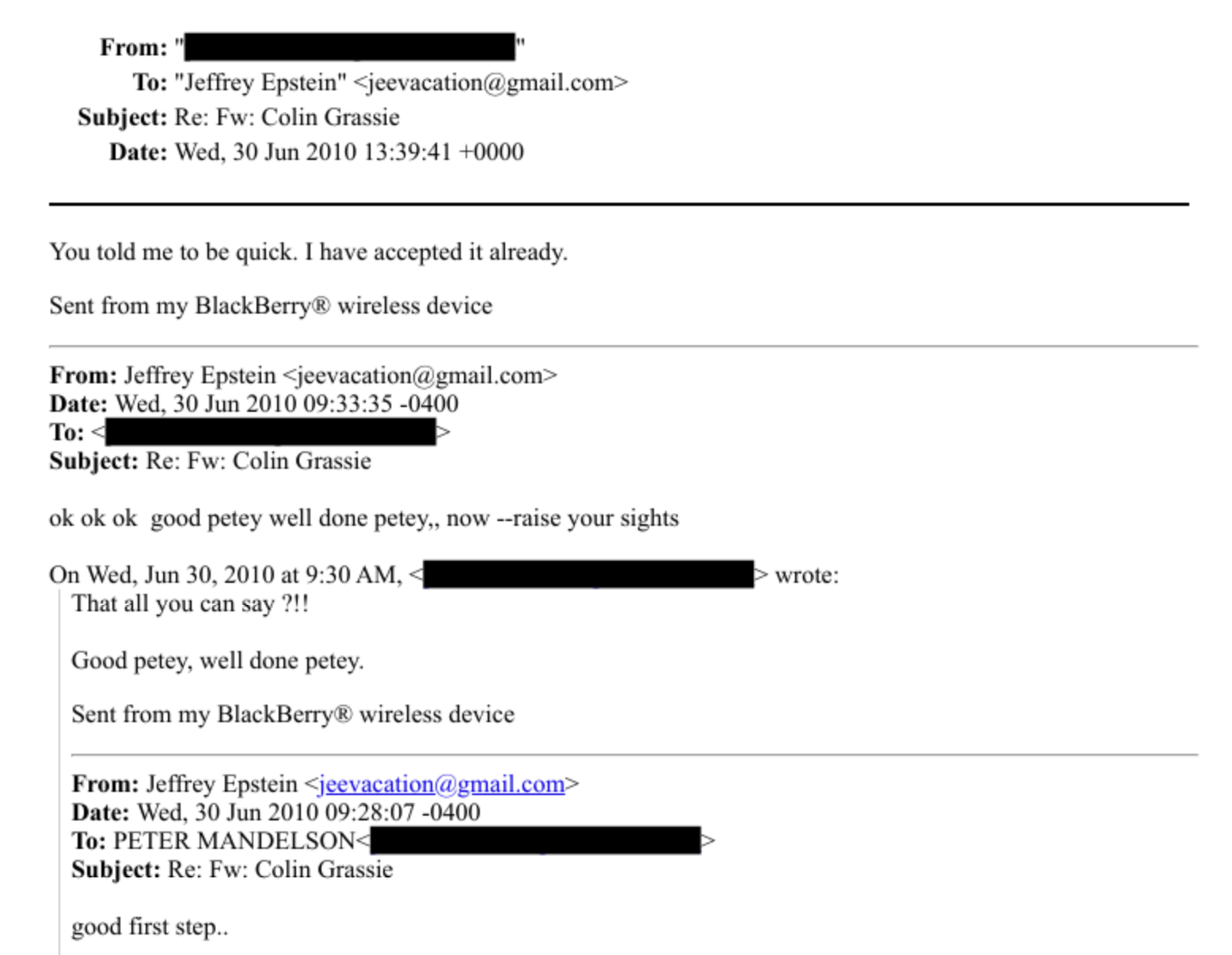

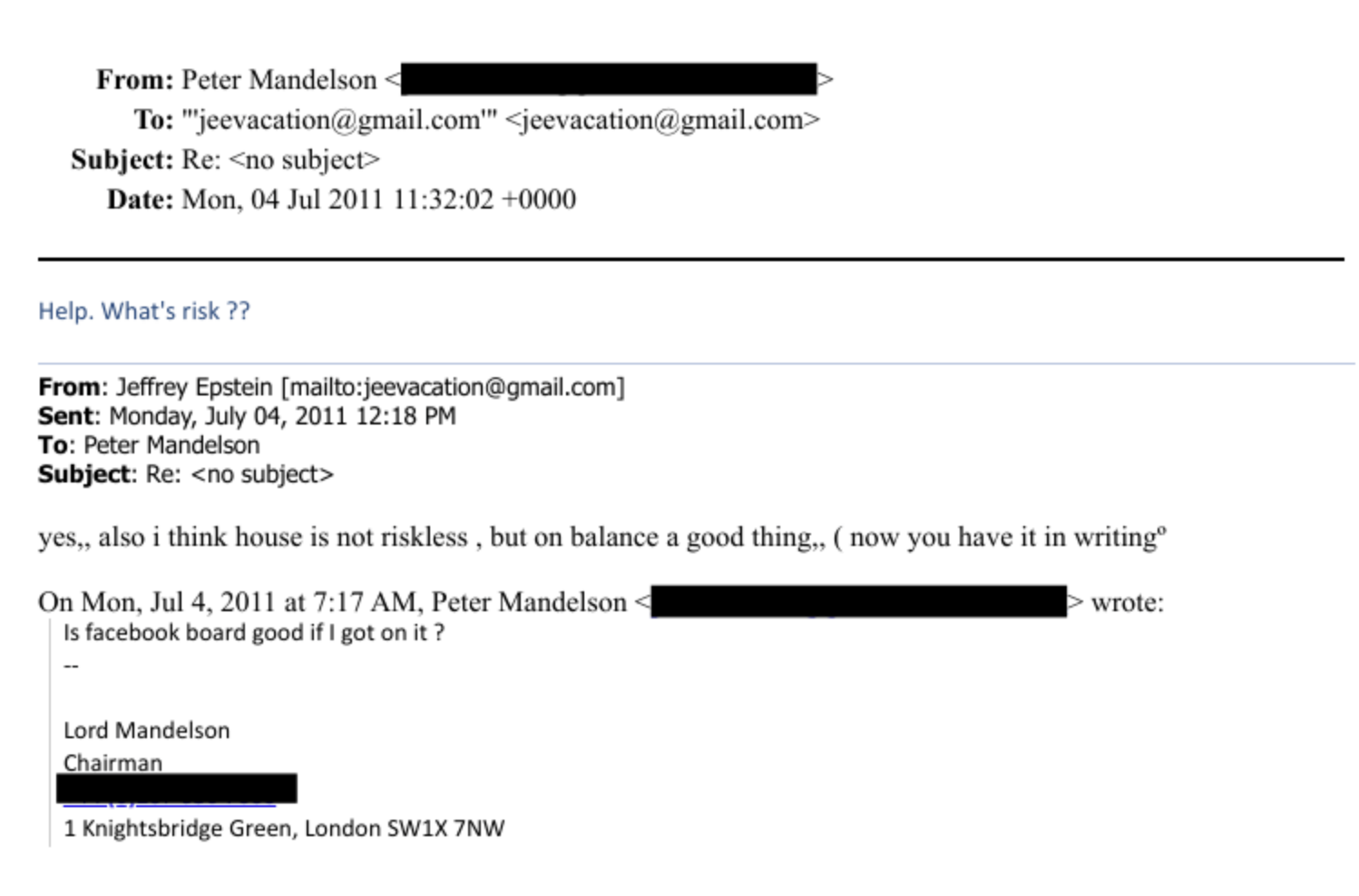

And he thought he could do better than Deutsche Bank’s $3-5m:

And some unknown “DB revelation” intervened:

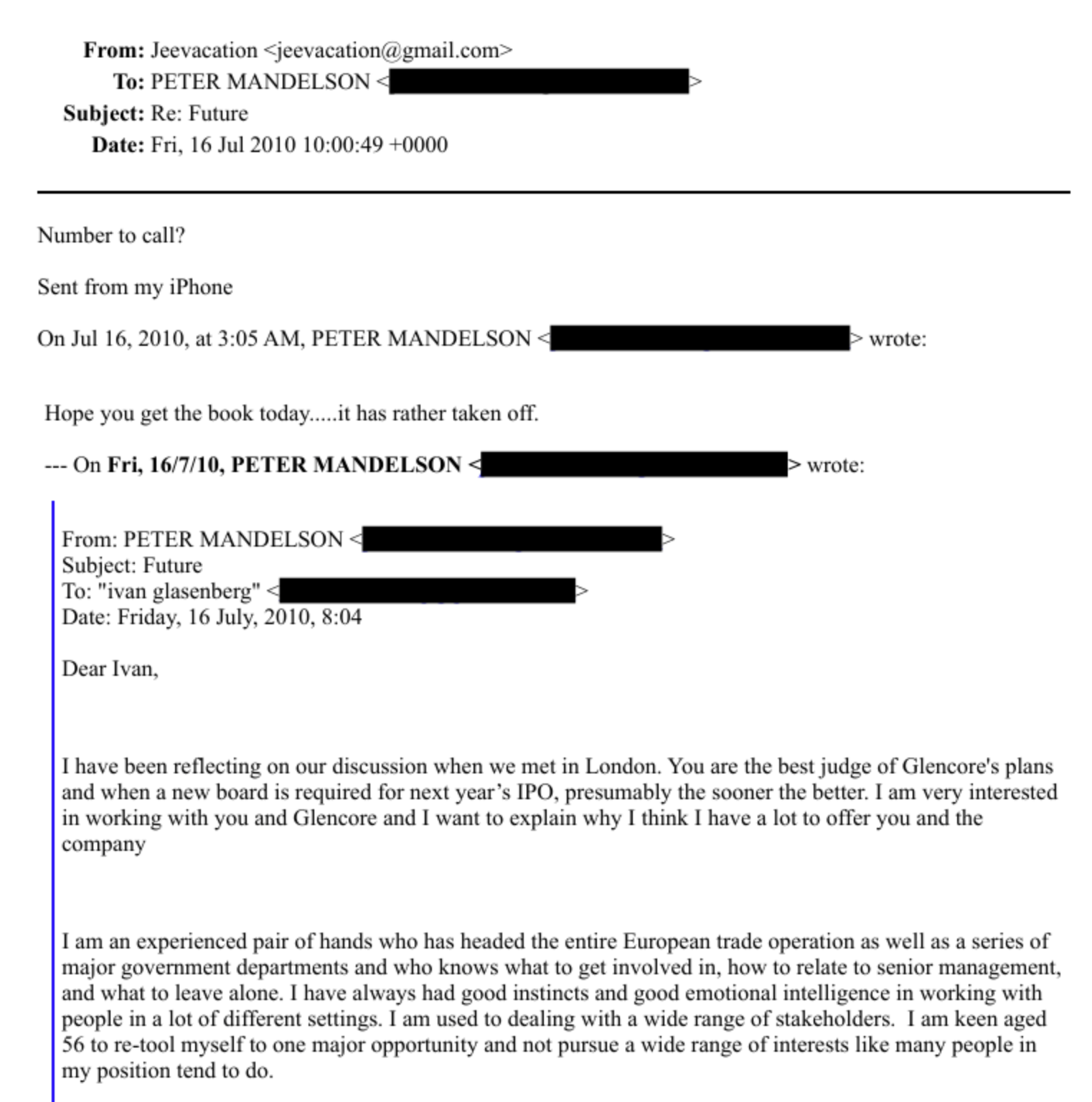

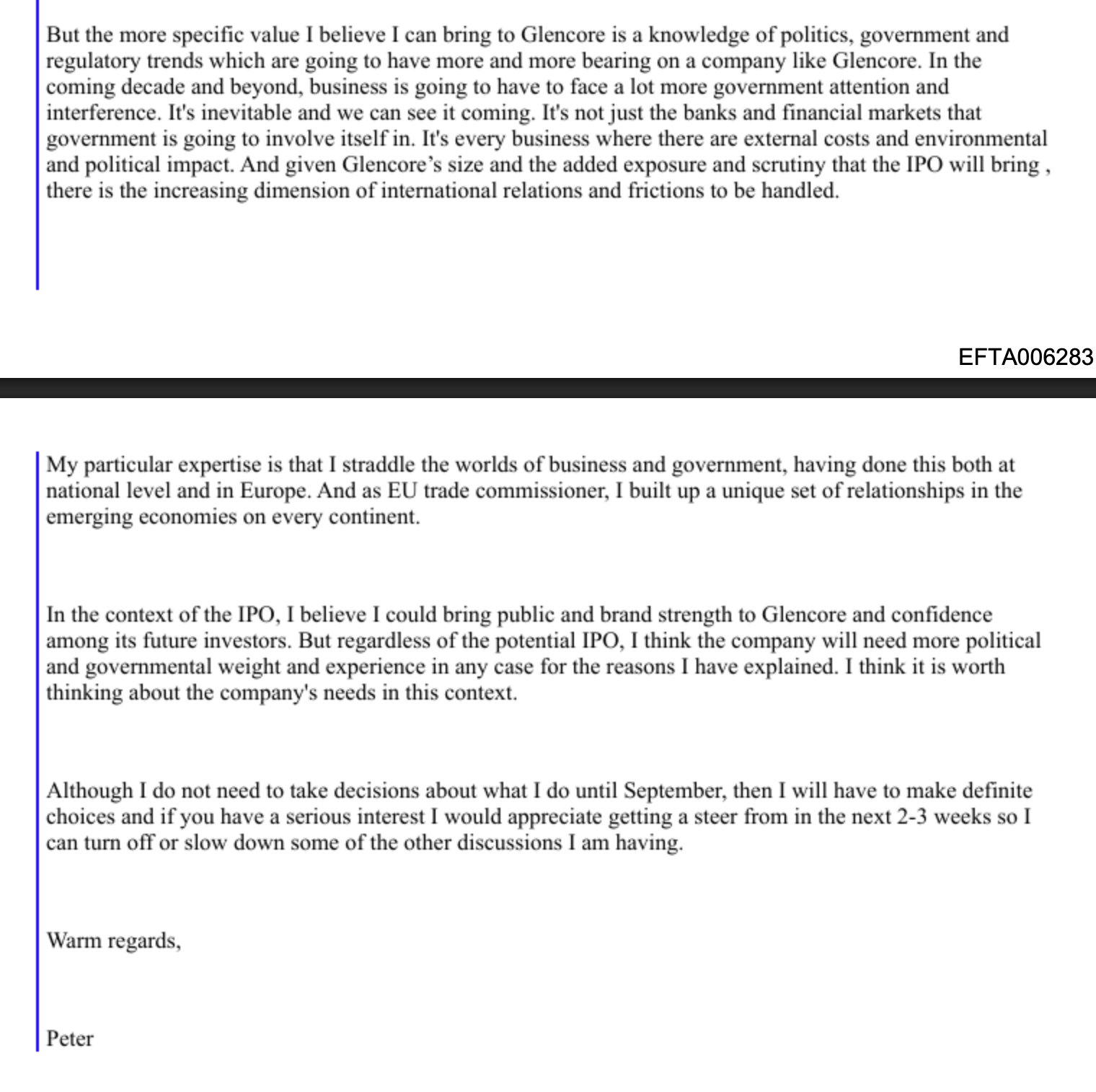

And here he is approaching Glencore (a letter we’d suggest is not very well written or persuasive; Epstein was much better at this):

They’re talking about advisory roles for a reason. Ministerial rules required that ministers must seek advice from the Advisory Committee on Business Appointments (ACoBA) about any appointment/employment they wanted to take up within two years of leaving office. So Mr Mandelson had to obtain permission for most jobs (which might well not be forthcoming) – but advisory roles were technically out of scope of the rules in force at the time.10

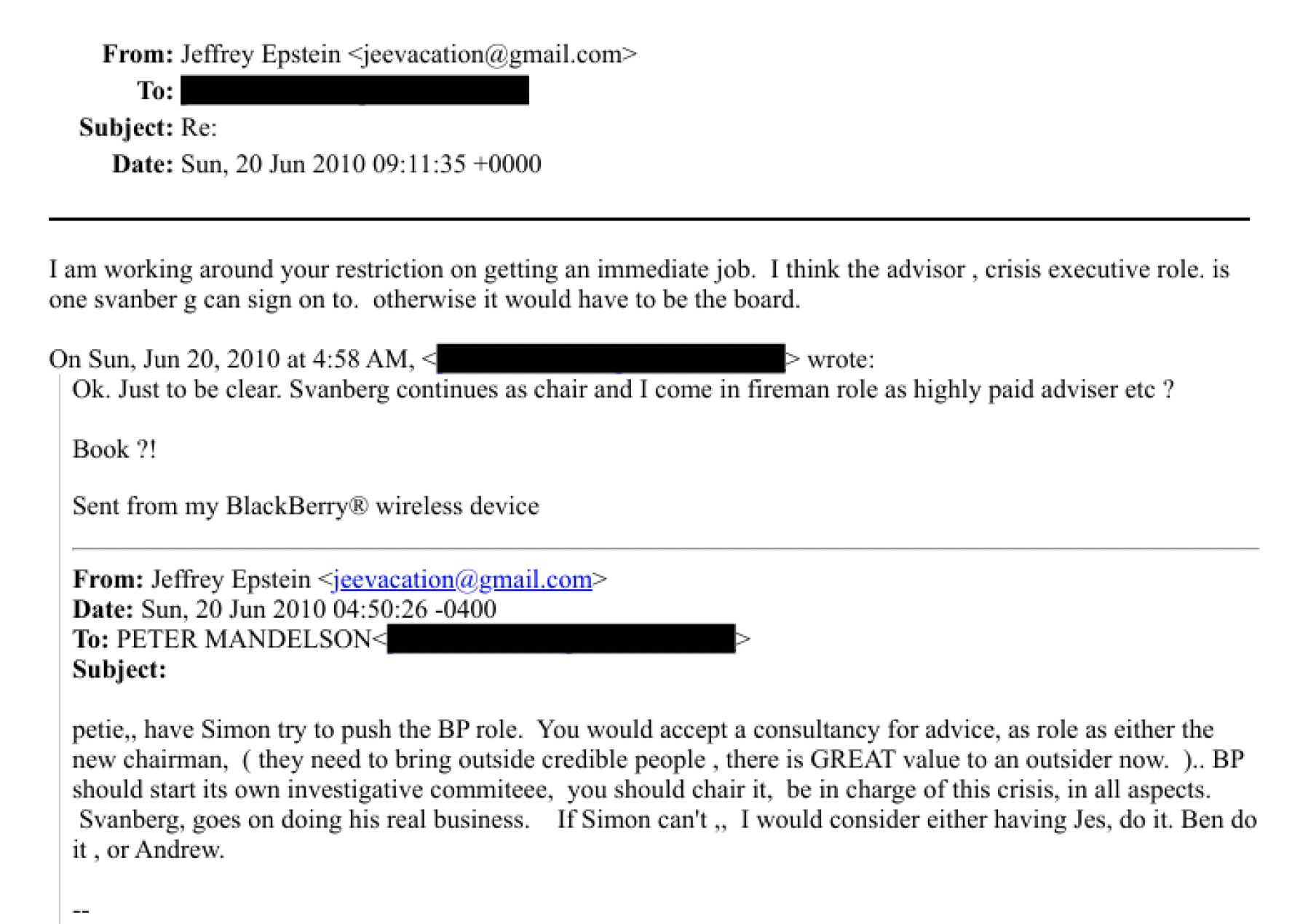

Mr Mandelson and Jeffrey Epstein were fully aware of the ACoBA restriction. This email shows Epstein telling Mr Mandelson he was “working around your restriction” (here they appear to be discussing a role advising BP on the fallout from the Deepwater Horizon oil spill).

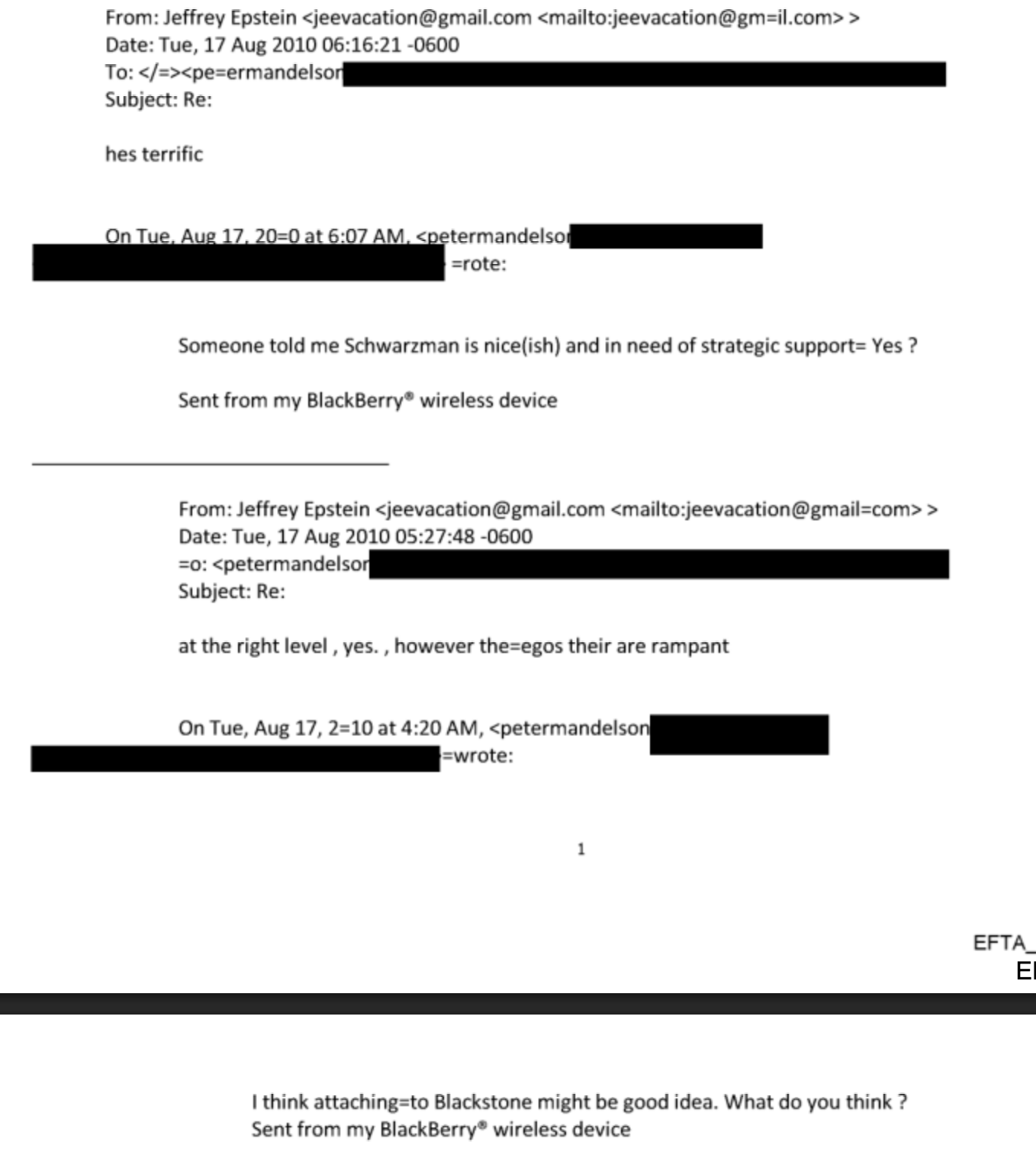

By August Mandelson and Epstein seem to be just throwing ideas at each other – first discussing Blackstone:

And then Barrick, the gold and copper mining company:

At some point Mandelson decides he doesn’t want a full-time job, because he wants to build his own “Global Counsel” business. He wants a one-day-a-week job that still pays millions. That ends up being with Lazard, the financial adviser and asset manager.

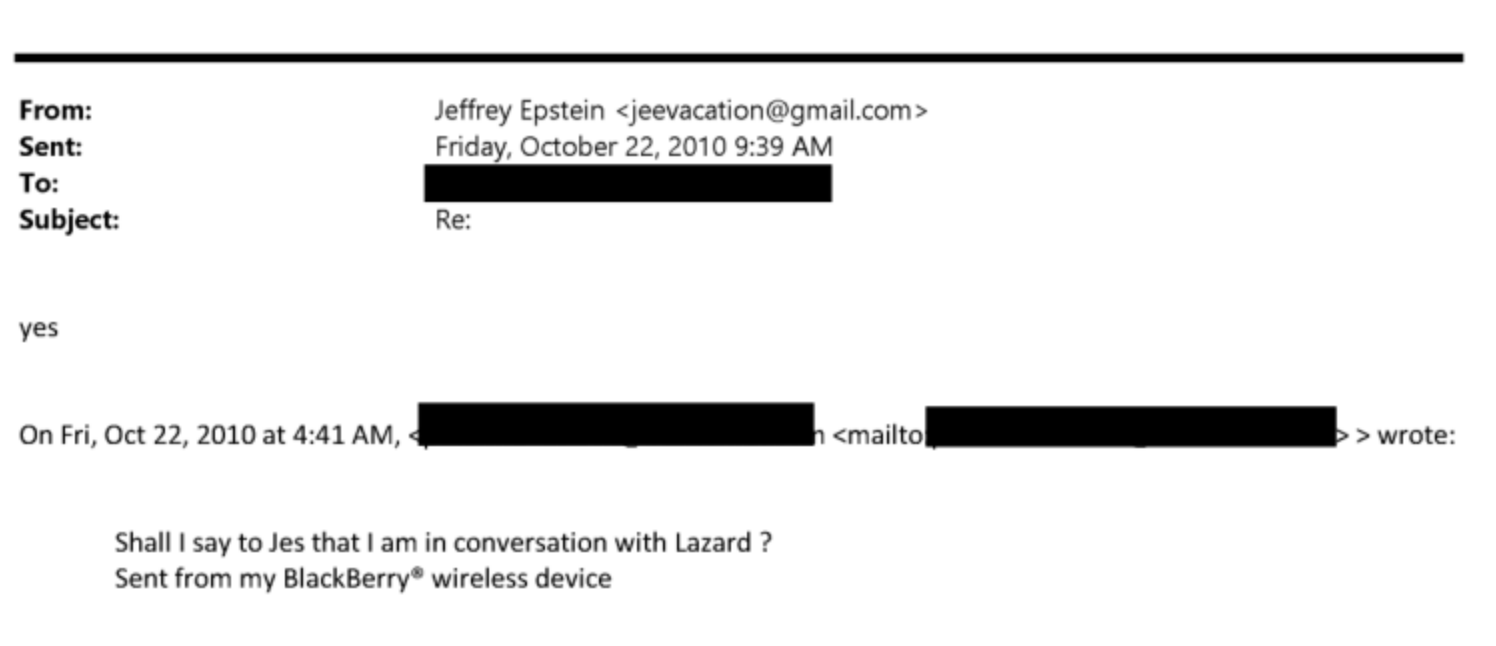

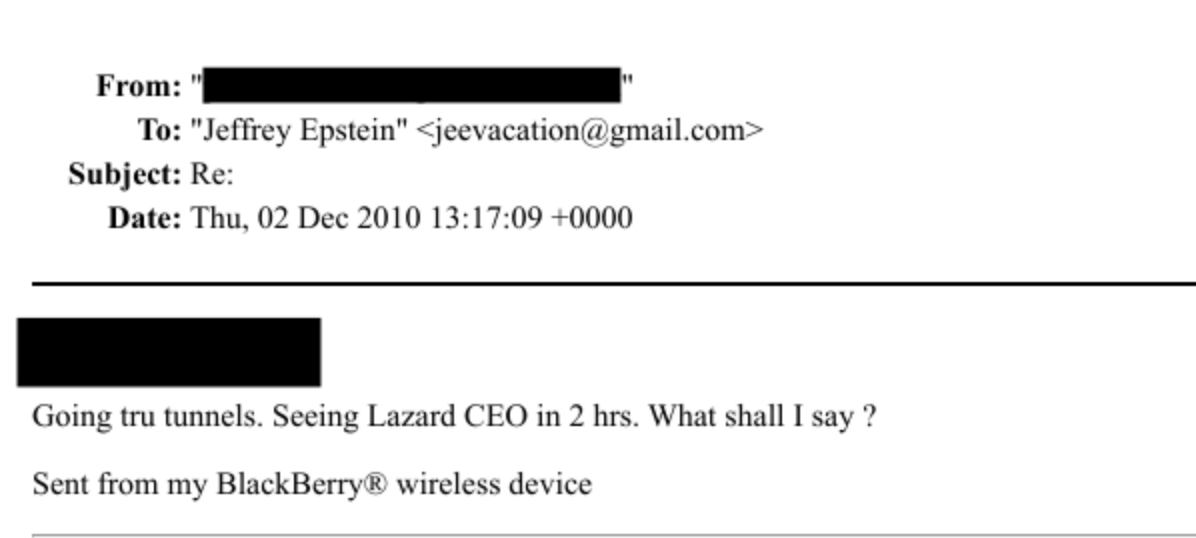

At the start of the engagement with Lazard, Mandelson doesn’t seem to know anything about them – he asks what Epstein thinks of the firm. He relies on Epstein throughout the process, asking for advice on whether to tell JPM he’s speaking to Lazard, and even what to say when he meets the Lazard CEO:

It was announced in January 2010 that Peter Mandelson was becoming a senior adviser to Lazard. Press reports🔒 at the time speculated he could be earning “as much as $1m per year”. The Lazard role was one day per week; Deutsche Bank was full time – but the emails above suggest his actual earnings likely exceeded that figure.

After the two year ACoBA period ended, he was appointed Chairman of the international arm. As ACoBA Chair has said, the rules are “next to useless”.11

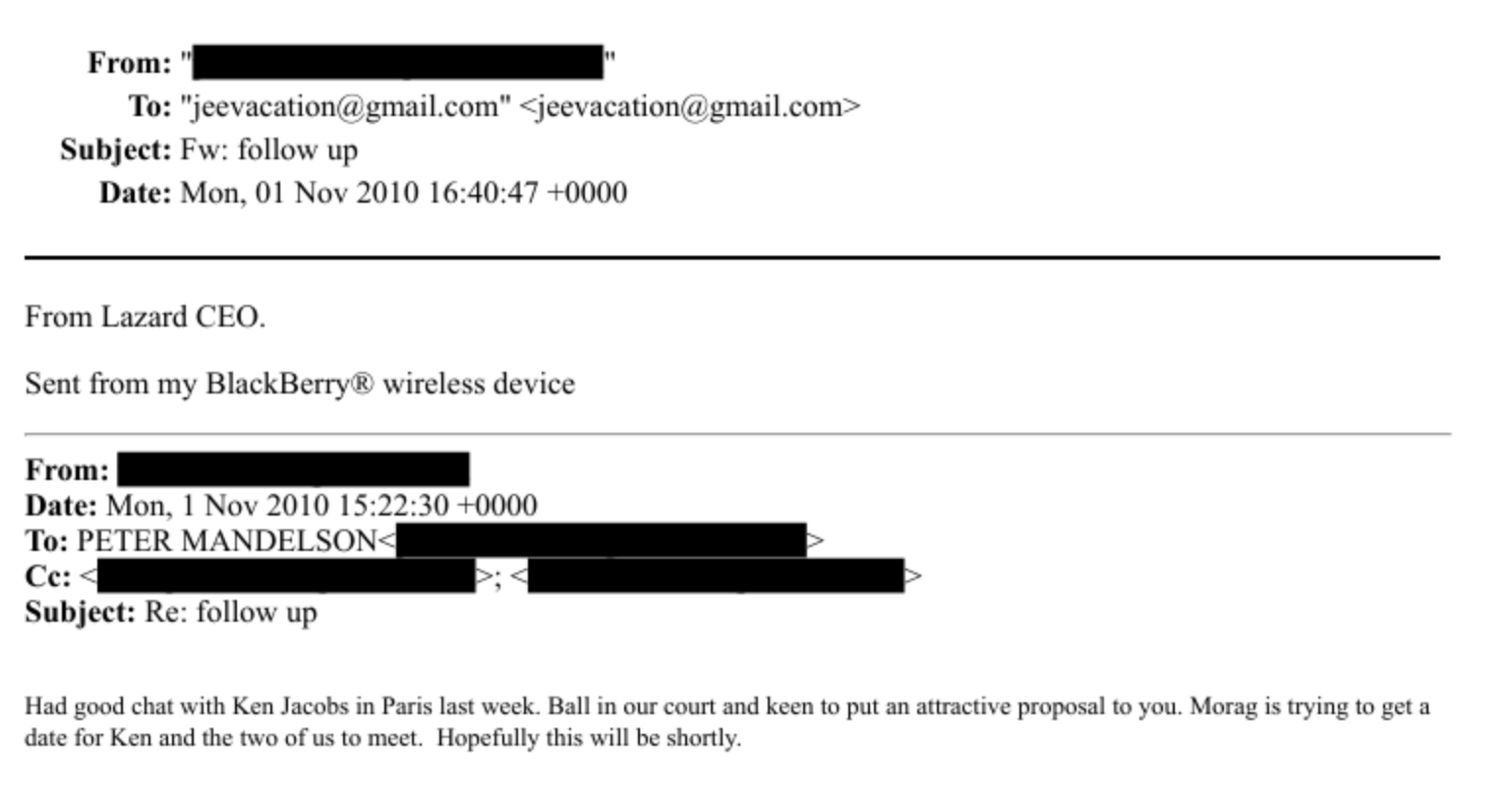

Mandelson kept looking for more opportunities, with Epstein’s help. Here he is in 2011, asking whether he should try to get on Facebook’s board:

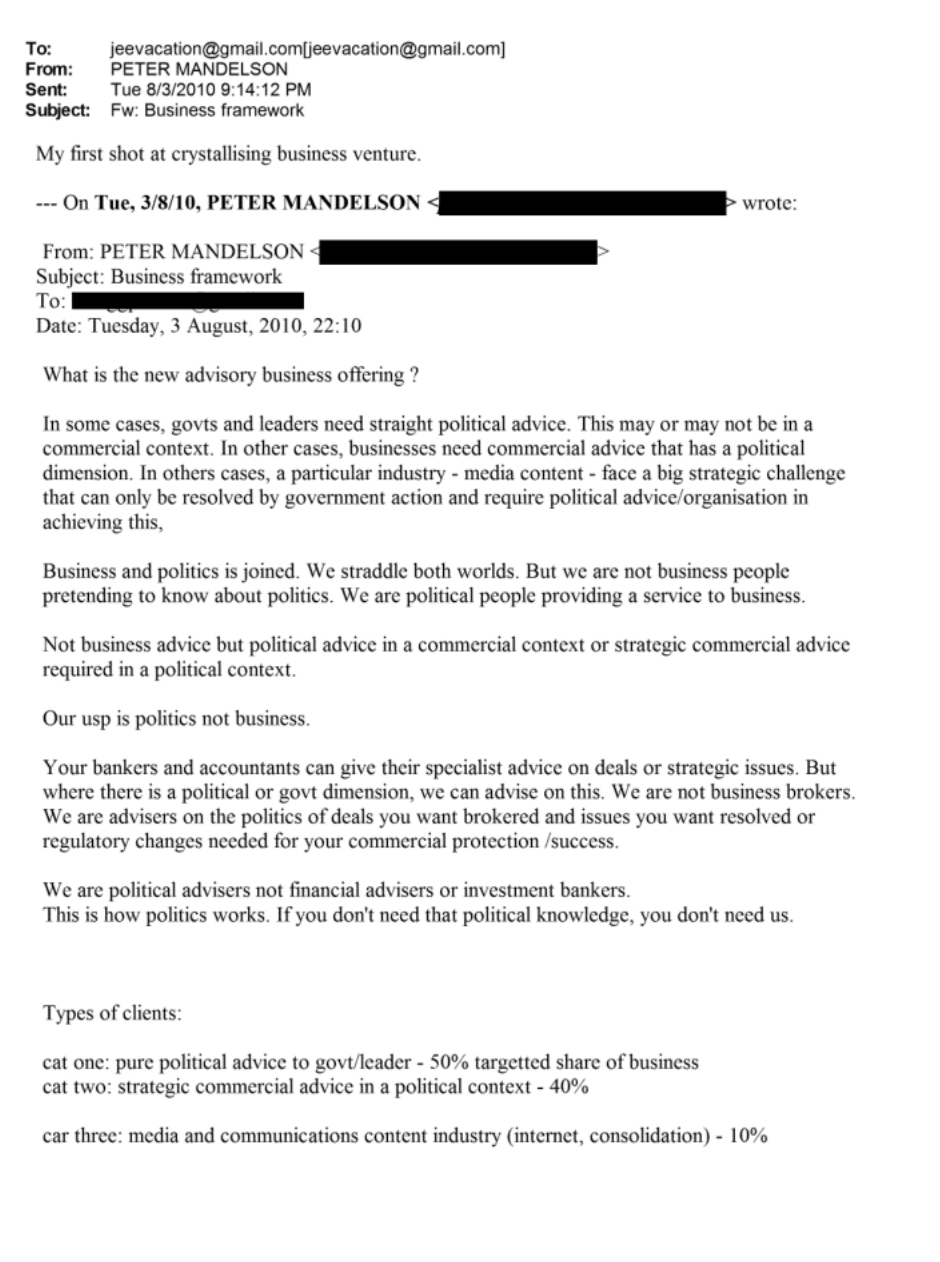

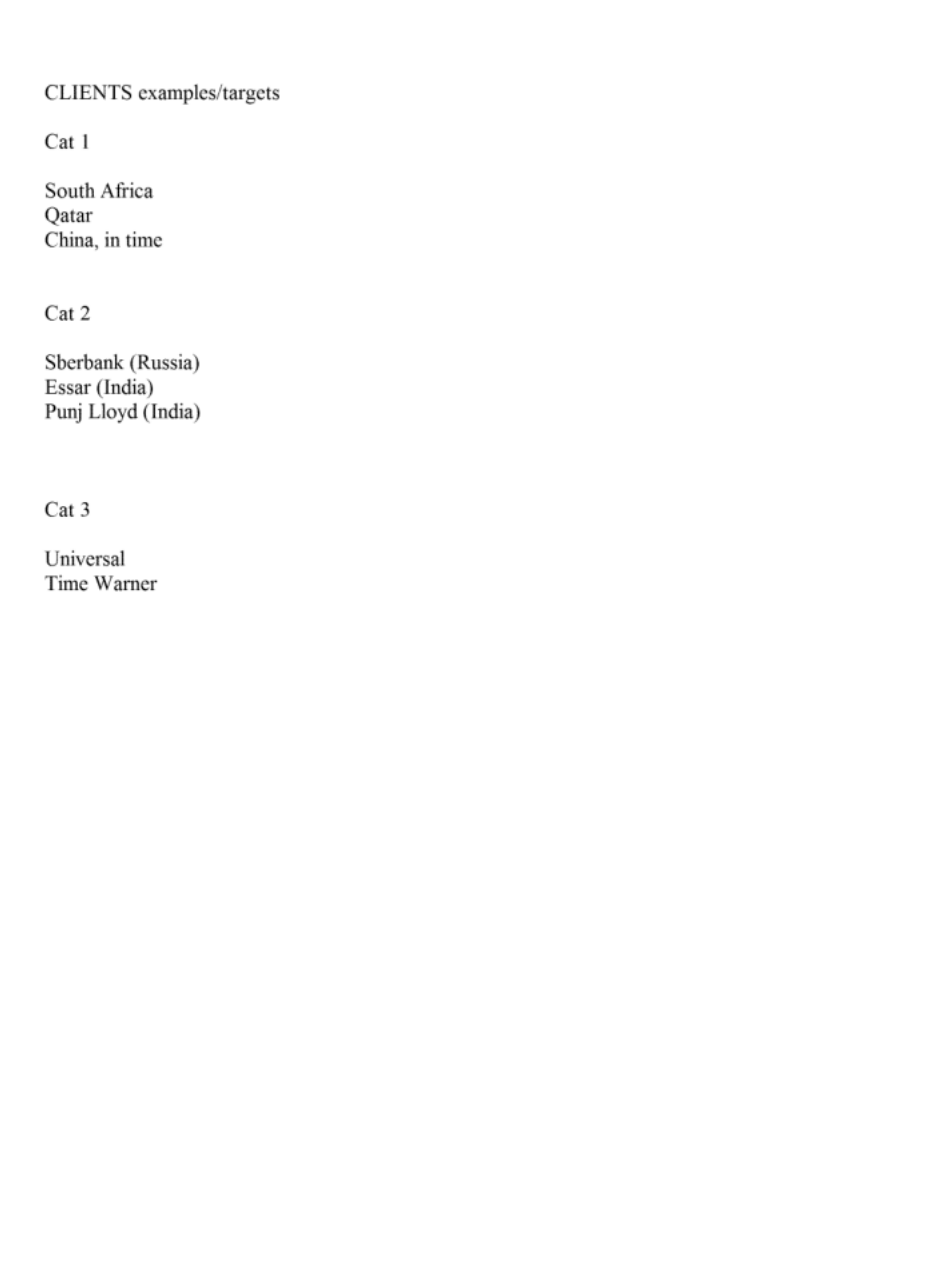

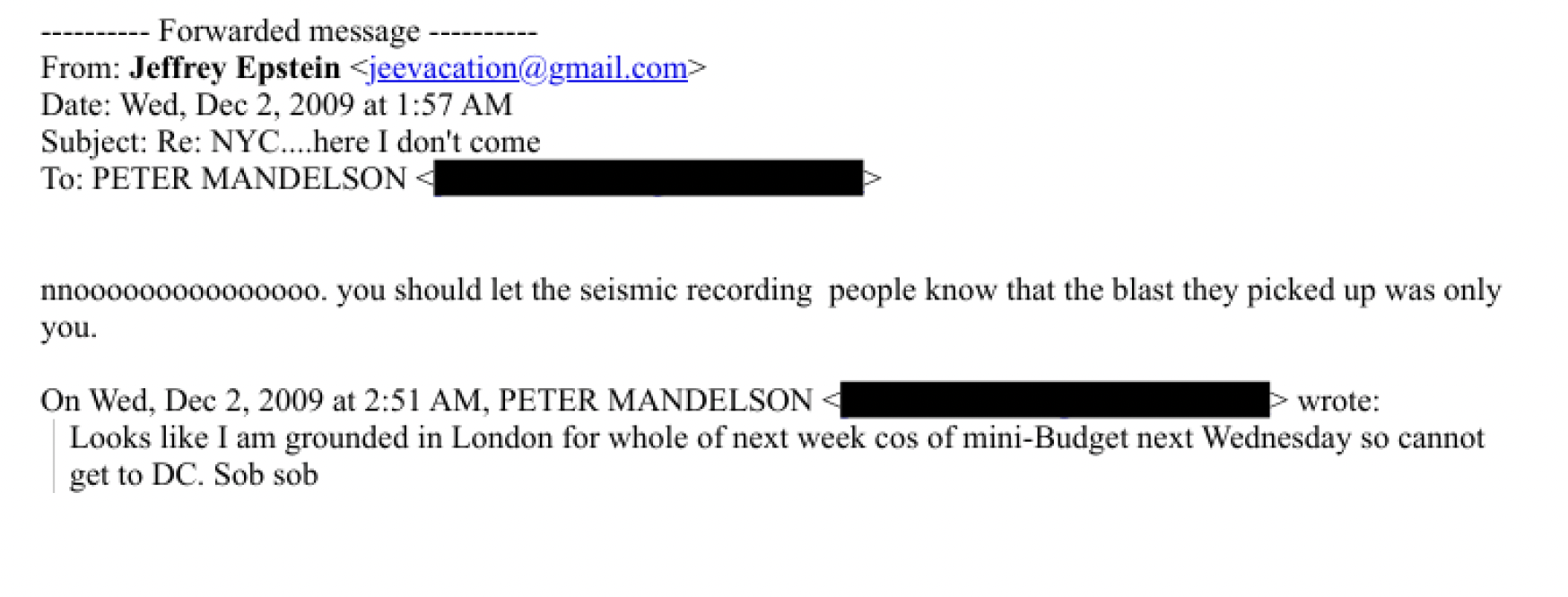

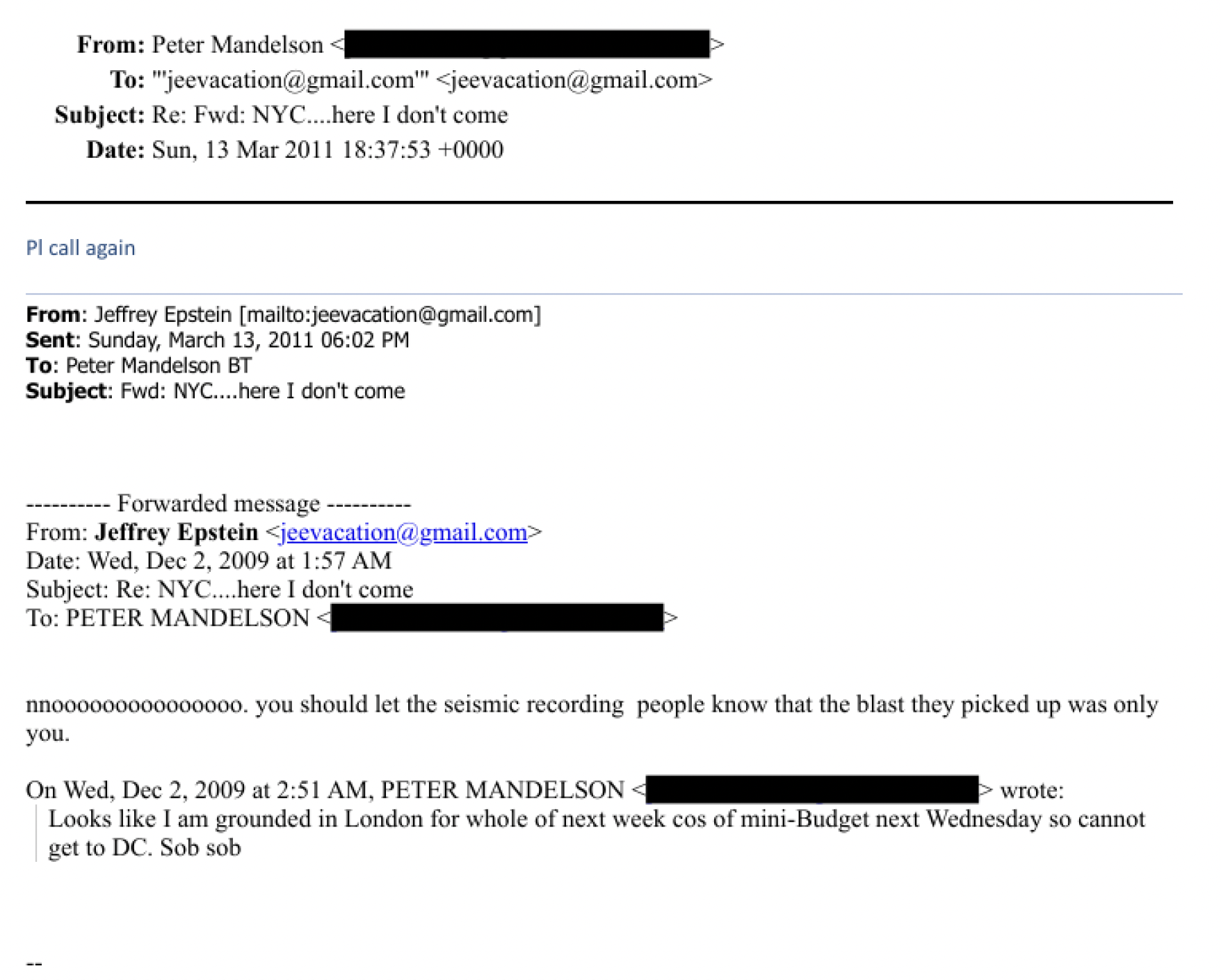

And naturally Mandelson sought Epstein’s advice at the very earliest stage of establishing his consultancy, Global Counsel:

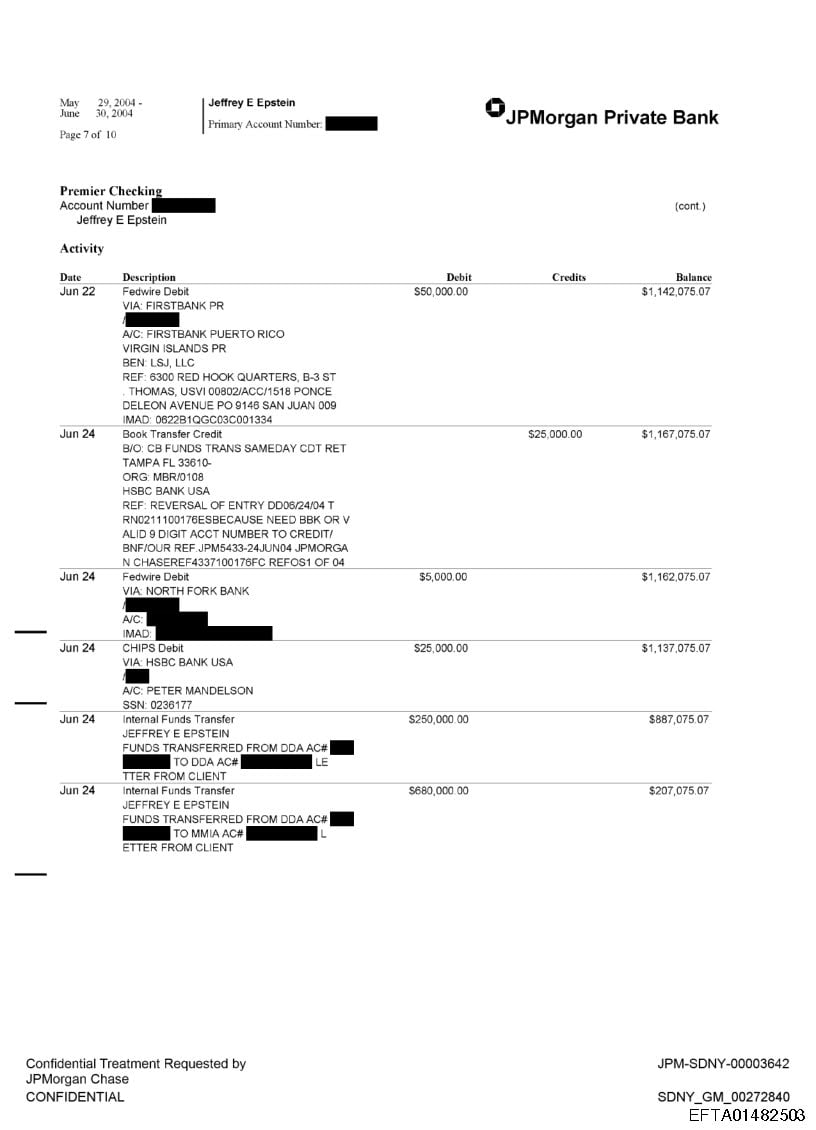

The cover-up

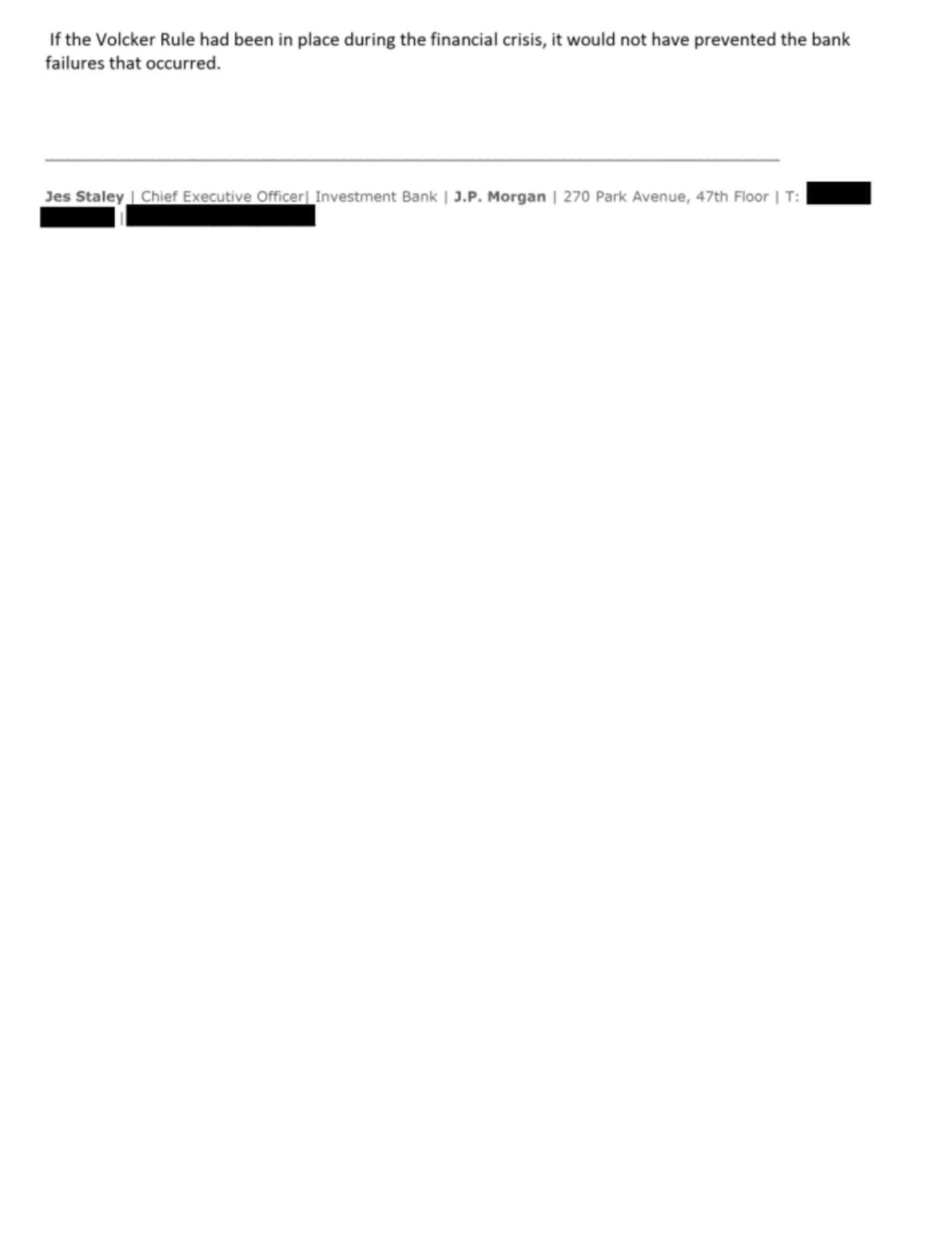

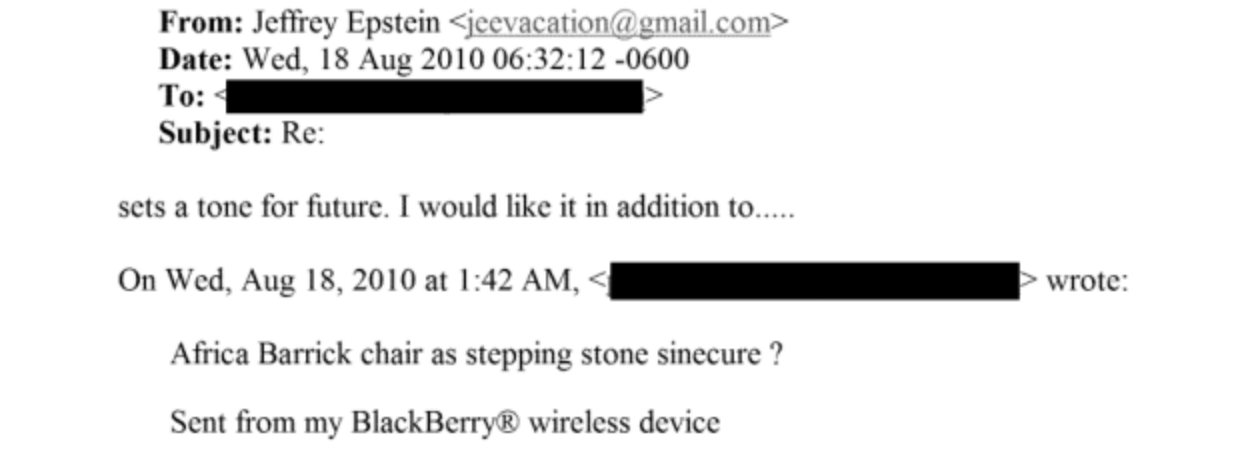

In 2011, reports started to appear that Mandelson had been meeting Epstein. The Telegraph picked up a Florida court application that Epstein had made to leave his house arrest, in order to meet a senior British Minister in New York:

Mandelson had tried to meet Epstein, but had to cancel, saying “NYC… here I don’t come”:12

When the Telegraph story broke, Epstein and Mandelson seem to have liaised to get their story straight – they hadn’t in fact met:

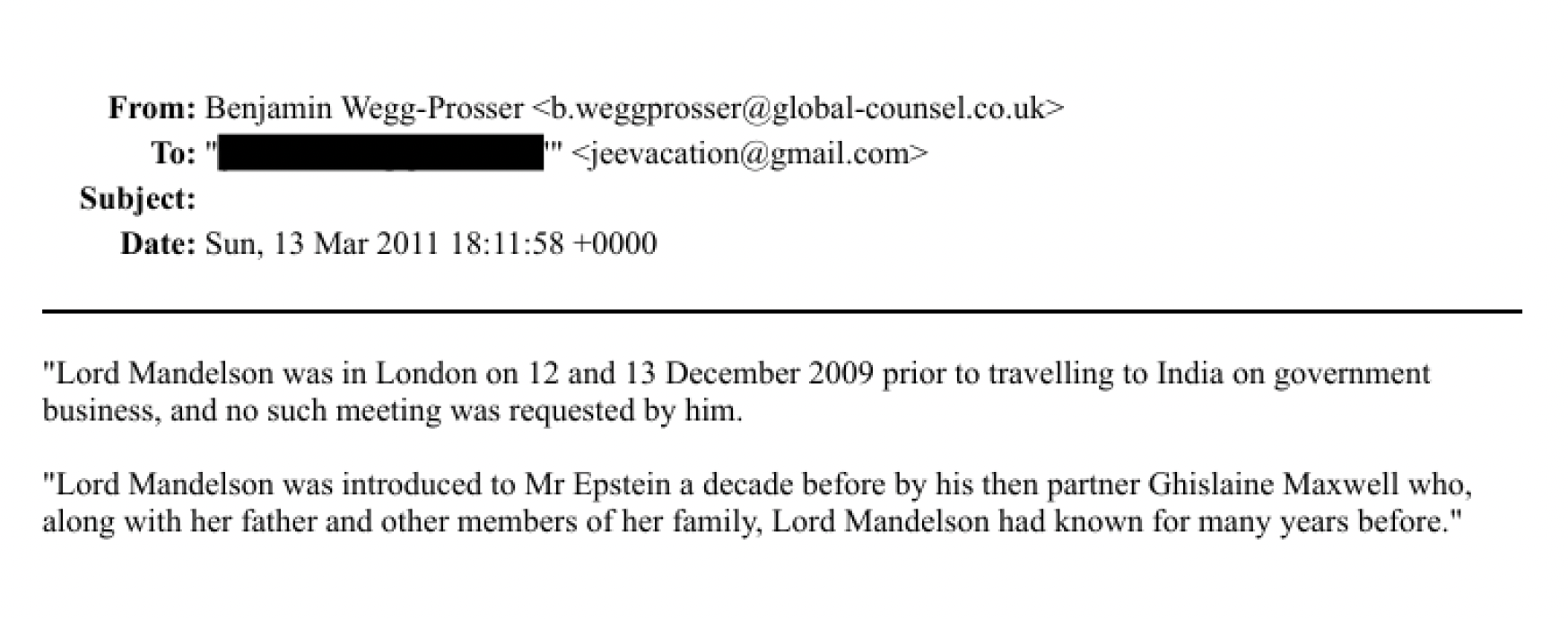

The co-founder of Global Counsel, now its CEO, prepared a statement denying the meeting, and suggesting that Mandelson barely knew Epstein. He then checked this statement with Epstein himself:

That was a highly deceptive statement; we view it as part of a cover-up.

(Thanks to Ali Lyon at CityAM who found the Wegg-Prosser email.13)

We believe the evidence shows that Jeffrey Epstein was pivotal to the creation and development of Global Counsel. There is much more on this in CityAM and the Financial Times.

The complete picture

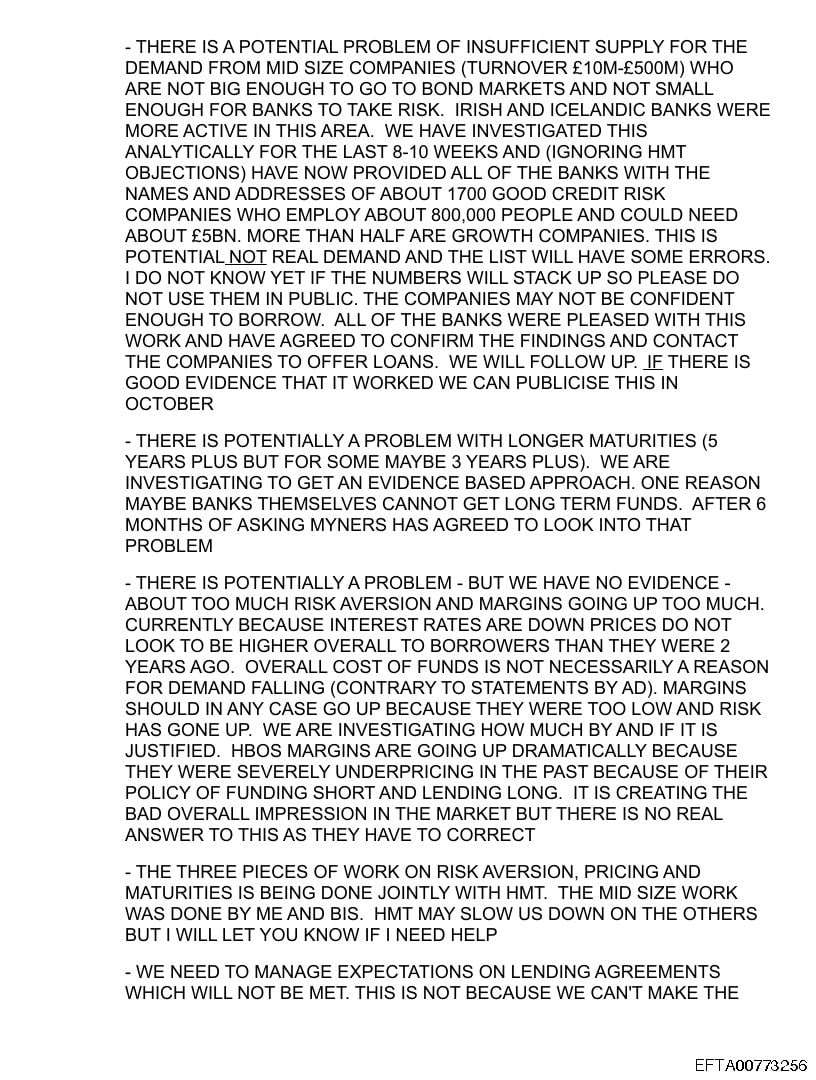

Peter Mandelson wasn’t bribed by Jeffrey Epstein, and certainly wasn’t blackmailed by him. We believe the evidence suggests that Mr Mandelson provided intelligence and lobbying because he thought it was in his own commercial interest. He was correct. The payback was far greater than $10,000 of osteopathy tuition fees – it was Mr Mandelson’s subsequent highly lucrative career, and the (even more lucrative) creation of Global Counsel. All of which was enabled and assisted by Jeffrey Epstein and his network of contacts.

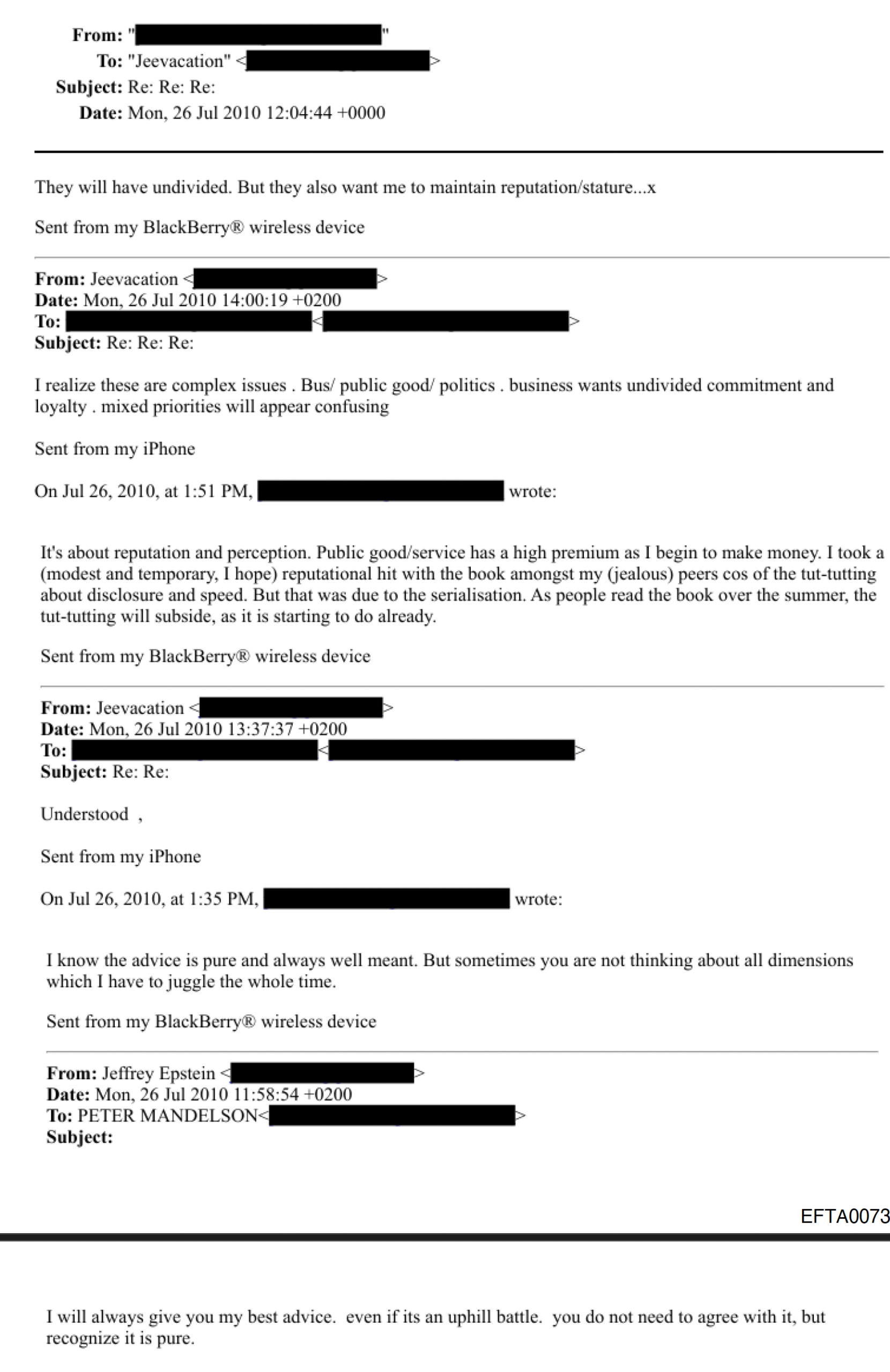

As Mr Mandelson said to Epstein, “it’s about reputation and perception”:

Thanks to K for additional research.

Footnotes

Sitting in both the Department of Business and the Cabinet Office, and in practice often an adviser to Gordon Brown. ↩︎

i.e. both messages (June and August) show the forward/reply header times in +0000 even though the UK was on BST (+0100) on both dates; meanwhile the embedded No 10/UK participants’ messages correctly show +0100. ↩︎

Summers had his own connection to Epstein which, whilst highly unsavoury, doesn’t appear to have involved leaking documents. ↩︎

The Chancellor thanked Mr Mandelson for his “intelligence ahead of the meeting” – query if that “intelligence” was the Staley talking points. ↩︎

The email from the PPS was sent at 1.38pm British Summer Time – the time offset is visible in the header. We know that Epstein’s emails are on New York time (GMT -4), because one of his emails has the time offset visible in the header. Mandelson’s emails don’t have a stated time offset, but the given times of the exchanges between him and Epstein only make sense if the email times are from the same time zone. That could be because Mandelson was in New York, but more likely it’s because Epstein’s gmail account was automatically translating the emails into Epstein’s time zone. ↩︎

This was after the 2010 General Election but the day before Gordon Brown resigned. ↩︎

Because the email at the top of the page has a timestamp showing that (as noted above) Peter Mandelson’s blackberry is operating on British Standard Time, without an adjustment for daylight savings time. ↩︎

Disclosure: our founder, Dan Neidle, advised Citi on its enforcement/acquisition. ↩︎

Epstein and failed to arrange a deal to help out Stern/Terra Firma. He tried to bring in his friend, Tommy Mottola (former head of Sony), and unknown other parties – but it seems they thought (correctly) it was easier to do a deal once Terra Firma were out of the picture. ↩︎

See paragraph 16 on page 8. ↩︎

Following the Boardman Review into the Greensill Scandal, ACoBA was abolished. ↩︎

The US court had refused the application, but it looks like Mandelson and Epstein were trying to meet regardless; it’s unclear how. ↩︎

Ali was not credited in the first draft of this article; we missed CityAM’s article. Our apologies. ↩︎

![To: jeevacation@gmail.com[jeevacation@gmail com]

From: Jes Staley

Sent: Sun 1/24/2010 4 22 38 PM

Subject! Re Fwd Fw MONITORING PA - DARLING WARNS US OVER WAR ON WALL STREET

You called t

From: Jeffrey Epstein

To: Jes Staley

Sent: Sun Jan 24 10:01:46 2010

Subject: Fwd: Fw: MONITORING PA - DARLING WARNS US OVER WAR ON WALL STREET

CONFIDENTIAL

Date’ Sun, Jan 24, 2010 at 9:59 AM

Subject: Fw: MONITORING PA - DARLING WARNS US OVER WAR ON WALL STREET

To: Jecsteation gmat com

Fyi

Sent from my BlackBerry® wireless device](https://taxpolicy.org.uk/wp-content/uploads/2026/02/Screenshot-2026-02-05-at-20.13.17.png)

![To: Jeffrey Epsteinjjeevacationg@gmail com]

From:

Sent: Sun 3/28/2010 6 48 06 PM

Subject: Re

Tecan say this to him: Fam feeling peculiar and going to have something to eat Do you want to

call at home in half hour 7

Sent from my BlackBerry ® wireless device

From: Jetires Epstein - jeevacation’a gmail com >

Date: Sun, 28 Mar 2010 14 34.57 -0400 ‘

To: PLIER MANDEL SN, SS

Subject:

I would like vou to ask Larry Summers if he would meet directly with Jes, and another jpm

person. re the proposed voleker rule. Fean't do it directly Larn is getting info third and fourth

hand trom senators who are getting it from lobbyists](https://taxpolicy.org.uk/wp-content/uploads/2026/02/image-13.png)

![To: yeevacation@gmail com[jeevacation gmail com]

From: petermandel

Sen: Tue 3/30/2010 8 08 15 PM

Subject: Fw

Sent trom my BlackBerry & wireless device

From: Jes Staley

Date: Tuc, 30 Mar 2010 14.26 24 -0400

To: Peter Mandelson [i -

Subject:

Peter, What follows are some brief speaking points that we would use in discussing the Volcker plan

with Summers. We can speak to them when we talk tonight.

The Federal government's guarantee of bank deposits enhances consumer confidence in our financial

system.

Although deposits play a lesser role as a funding source folowing decades of bank disintermediation, it

1s sensible for government (as any guarantor would want) to seek limits on how funds sourced from

their guaranteed deposits are exposed to risk.

Well-managed US banks with prudent controls to protect chent interests, including depositors’, already

do this respecting the intent of existing affiliate restrictions and with internal procedures separating

proprietary and fiduciary activities.

Updating regulation to the reality of global modern markets should not disadvantage U S institutions or

create structural conflicts in relation to their Asian or European counterparts.

Fiduciary: Asset Management

Regulations that protect clent investments from other banking activities have proven successful during

recent financial crises.](https://taxpolicy.org.uk/wp-content/uploads/2026/02/Screenshot-2026-02-03-at-13.38.37.png)

![Jeffrey Seal com]

Wed 3/31/2010 1:26 47 PM

Subject: Re Fw SummersiCX readout

AL [lam tomorrow

Sent from my BlackBerry # wircless device

From: Jetirey Epstein « jeevacation’¢ gmail.com>

Date: Wed. 31 Mar 2010 09-25°35 -0400

To:

ject: Rev Fw: Summers. CX readout

where will the bills language be changed to "may" from shall, - in Dodds markup by amanagers

amendment by Chris Dodd himself or an amendment on floor." are you still scemg LS for

breakfast

On Wed. Mar 31. 2010209. AM, - I ror.

Jamie sa CX. friendly No time for me but he did autograph the book | am reading about

himt

Sent from my BlackBerry « wireless device

From: Jeffrey Hpstein = jas Greet valent

Date: Wed. 31 Mar 2010 09:09:17 -0400

T

Subject: Re Fa: Summers. CX readout

Ownership of hedge tiznds secms of little risk as compared to proprivtary trading. if they were

o limit prop trading wouldnt that be enough. why limic the asset classes to mutual funds in a

complex environment? clients fect more comfortable know ing that the bunks are giving the

biessing lo certain alternative investments they will merch go offshore with no oversight

right in the uks lap. On another now did tony sce farey or jamiv .2 i know you asked to see

jamie is it mportant to you”

On Wed, Mar 31, 2010 3 9-03 AM, {I co:

Welcome any other fine tuned questions to him

Sent from my BlackBerry wireless deview

Fram: Jeffrey Epstein jeccucitt ro paar oem

Date: Wed. 31 Mar 2010 08:48°43 -0400

1

EFTA_R1_01496514

EFTA02427379](https://taxpolicy.org.uk/wp-content/uploads/2026/02/hedge-funds_Page_1.jpg)

![To: Jeffrey Epsteinjjeevacation@gmail com]

From:

Sent: un 5/9/2010 10 14 50 PM

Subject: Re

Just leasing NolQ. will call

Sent fromims BlackBerry ® wireless device

From: JeHrey Epstem : jecsacation’¢ gmail com *

Date: Sun. 9 May 2010 18 13°20- 0400

Subject: Re:

are you home

On Sun. May 9.201030 520 PM, I ot

Sd be announced tonight

Sent fromm BlackBerry & wireless device

From: Jettres Epstem iets a a eer

Date: Sun, 9 May 2010 Ve 3016 0400

To: PrT?R MAND? $0’

Subject:

sources tell me $00 b cure bailout , almost compelte](https://taxpolicy.org.uk/wp-content/uploads/2026/02/euro-bank-bailout.jpg)

![To: Jeffrey Epsteinjeevacation@gmail.com]

From: David Stern

Sent: Wed 2/10/2010 6:07:25 PM

Subject: Re: EMI

My friend is the right hand man to Guy Hands, boss of Terra Firma, the EMI owner.

Ihave a meeting scheduled with him for Friday.

Tomorrow [ will speak to fnends at morgan stanley and ingenious media (media focused

corporate finance yroup) who apparently have followed this situation quite closely.

In my view Ibis too early to get Mandelson involved before 1 know morc. It scems that the debt

mountain is too big, covenant breach is imminent and citigroup want to take control.

On 10 Feb 2010, at 18:01, Jeffrey Epstein wrote:

who ts your friend.. 1 am interested. Do we necd help -mandelson?

On Wed, Feb 10, 2010 at 3:57 AM, EE wrote:

Troubled industry but related to P:

EMI (music) necds approx USS 190m to sunive or may be taken over by Citigroup.

Terra Firma own EMI, my friend is in charge of this investment.

Should | talk to them ?](https://taxpolicy.org.uk/wp-content/uploads/2026/02/Screenshot-2026-02-03-at-14.35.55.png)

![To: Jeffrey Epsteinjeevacation@@gmail com]

From:

Sent: Fri 9/10/2010 10 32 25 AM

Subpect: Re

And meet a nice rich chinaman and live happily ever after talking of which, have you

permanently stopped the Reinaldo sub?! | may have to put him out to work on the streets

Sent from my BlackBerry ® wireless device

From: Jeftres Epstein - jeevacation‘’a gmail com >

Date: Fr. 10 Sep 2010 06.12.55 -0400

To: PLIER MAND! SN i

Subject: Re

after dancing with everyone at the party, hopetullly you will take someone home STAY . you

should move there for two years and associate with JPM. [ts a home run](https://taxpolicy.org.uk/wp-content/uploads/2026/02/Screenshot-2026-02-06-at-23.13.54.png)

![To: jeevacation@qmail com[jeevacationg@gmail com]

From: PETER MANDELSON

Sent: Sun 4/4/2010 9 31:40 PM

Subyect: Fw Nal

Hope Jes can send warm response to this informal email...

--- On Sun, 4/4/10, PETER SIANDELSON

From: PETER MANDELSON -

Subject. Nat

1 ee —

Date: Sunday. 4 April, 2010, 22:30

Jes,

I've been following my friend Nat Rothschild's plans to list a vehicle on the LSE

and i'm very happy that JPM are now planning to get involved as book runners

alongside CS. i think it's a great idea from what | see of the global mining business

(and their prices).

| hope it all goes well.

best Easter greetings to you and the family

Peter](https://taxpolicy.org.uk/wp-content/uploads/2026/02/Screenshot-2026-02-08-at-21.54.39-1.png)

![To: Jeffrey Epsteinfieevacation@gqmail com]

From:

Sent: un

Subect: Re

Think has to be bye GB

He has now gone to church !

Sent trom ms BlackBerry ® wireless device

From: Jettrey Fpstein - joes acation‘’y gmail.com:

Date: Sun, 9 May 2010 05:31:41 -Q400

Subject: Ke:

bye.bye smelly?

on Sun, Mey 9, 2010 « +10 1 SS ......

GB absolutel determined to forge ahead. Wants to know shat E want personally - stay in UK

or go back to Europe?

Sent from my BlackBerry &® wireless device

From: Jettrey Epstem = jectacae is ovaib cent”

Date: Sat. 8 May 2010 20:01:20 -0400

Subject:

jess view is that you must be seen as a statesman, and not a personal -man. of gh, supporting eb

will be seen as bad form commercially, he has lost the confidence of the public, jpm is vers

voncemed that the pound could be the next currency to falter. and big time. uncertainty 1s not

in Sour favar.](https://taxpolicy.org.uk/wp-content/uploads/2026/02/image-12.png)

![Jettrey Epstein[ieevacaton@gmail com]

PETER MANDELSON

Mon 7/12/2010 11 34.28 AM

Re

really, what was that 7?

read the limes

- On Mor

12/7/10, Jeffrey Epstein wrote:

From. fetliey Epstein jeevacationi gmail.com

Subject: Re.

To

Date, Monday

July. 2010, 12.33

F enjoyed the guardian spot

On Mon. Jul 12.2010 at oS 4M, - i ot:

Have you seen Times seral and new online + today *

Seat from my BlackBerry ® wireless device

From: Jefltey Fpstein ¢y..5 ws bot

Sum. Ti Jul 2010 1eeS3$3 -0400.

itis only in the begining. do nol Jet others know, you will take away all our negotialoin

posture

On Sun, Jul 11, 2010 at 4.24 PM. iii:

That wasn't DB offer, It was | plus an end sear share which may be 2-5

Sent from my BlackBerry # wireless device

From: felfiey kpstein io) Go ty mat vem

Date: Sun, 11 Ju 2010 15°S4-47 0200

Subject: Re

db s offer was | million but with a 4-10 million total., DO NOT CONFIDE other offers

sith Tim.

On Sun, Jul 11, 2010 at 341 PM, PETER MANDELSON

EFTA_R1_01479021

EFTA024 10312](https://taxpolicy.org.uk/wp-content/uploads/2026/02/underselling-and-ask-for-a-job_Page_1.jpg)

![To: jeevacationg@gmail comijeevacationg@gmail com]

From:

Sent: Thur 7/8/2010 2 14 37 PM](https://taxpolicy.org.uk/wp-content/uploads/2026/02/upload_cc17703a-efbf-423f-b478-086b01cca81d.jpg)

![To: yeevacation@gmail com{jeevacation@gmaii com]

From:

Sent: Tue 12/21/2010 9 55 32 AM](https://taxpolicy.org.uk/wp-content/uploads/2026/02/Screenshot-2026-02-03-at-20.09.41.png)

![T | Privacy and cookies | Jobs | Dating | Offers | Shop | Puzzles | Investor | Login ¥ | Register ¥ | Subscri

The Telegraph °

Thursday 11 July 2019

Home Video News world Sport Business Money Comment Culture Travel Life Women Fashion Luxury Tech Film

Politics Investigations Obits Education Science Earth Weather Health BRZIM Celebrity Defence Scotland

Queen Elizabeth II Prince Philip} PrinceCharles Prince William Duchess of Cambridge Prince George Prince Harry

HOME » NEWS » UK NEWS » ‘THE ROYAL FAMILY

Mystery over Jeffrey Epstein’s meeting with a Labour

minister The Telegraph ~,

Fi Caxncps Own = 4,4M owatynap

Asenior Minister in Gordon Brown’s Government arranged a meeting with

convicted paedophile Jeffrey Epstein while he was being held under house

Latest Video»

arrest at the end of an 18-month jail term.

The Royal Family Oo (>)

News » USA»

Politics »

Robert Mendick »

Jason Lewis »

Disabled great- Elderly wombat

in The Royal Family grandfather denied rescued after being

stairlift and forced to attacked

crawl

K>)

Joining forces: Harry e

in the US Sponsored

When media meets

medicine

Jeffrey Epstein

The Telegraph

Front

Bhs] =r Newsletter

Sign up to our Frontpage news email

By Jason Lewis, Robert Mendick and Jacqui Goddard

in Florida

9:00PM GMT 12 Mar 2011

Surpassing Victoria:

33 fun facts

The disclosure comes in the wake of the controversy over the Duke of

York’s close friendship with the disgraced financier. in December, the

Duke was photographed walking through central park with Epstein

following his release from jail, triggering demands for him to quit his post

as the UK’s Special Representative for International Trade and

Investment.

Sponsored Features»

A court transcript raises new questions about the reach of Epstein’s power

and influence.

The legal documents reveal that Epstein applied to a US judge for special](https://taxpolicy.org.uk/wp-content/uploads/2026/02/image-23.png)

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply