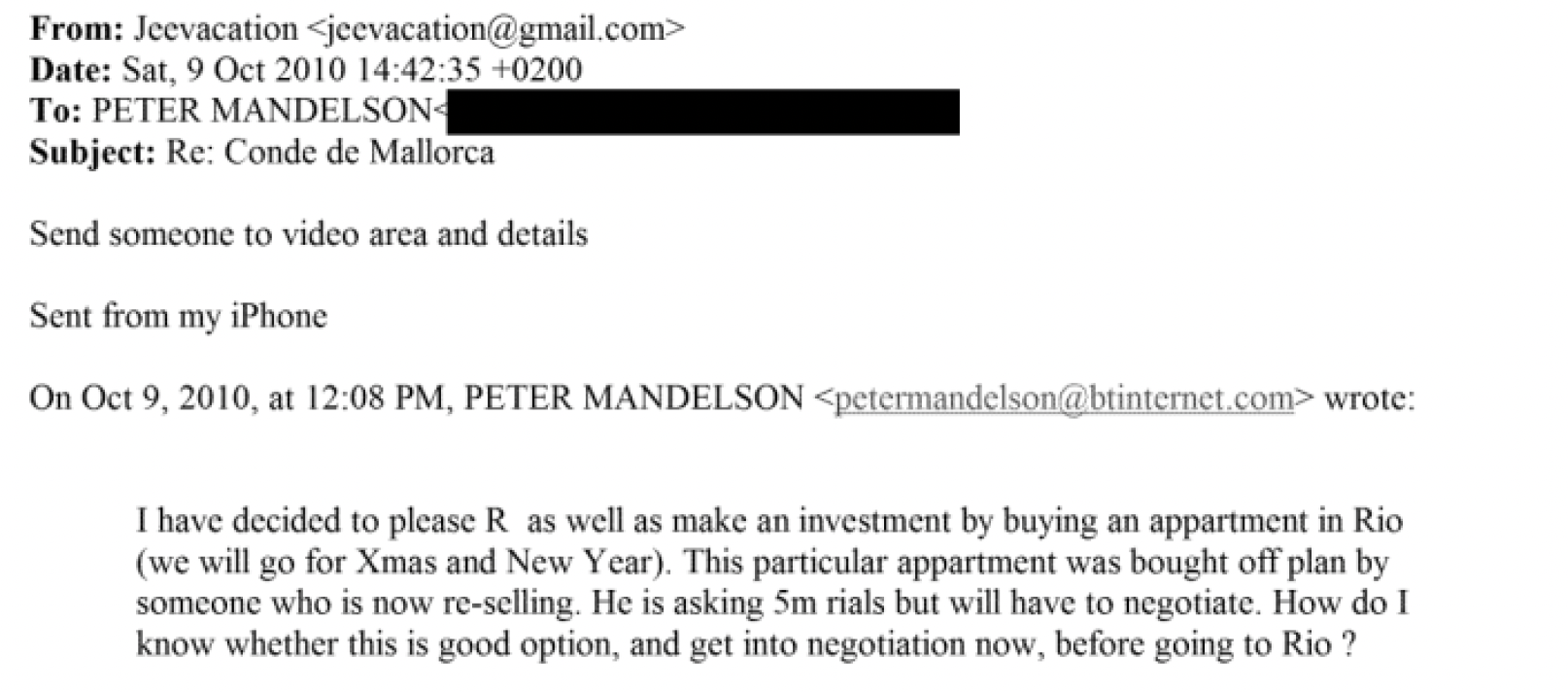

Previously unreported emails – first identified by Tax Policy Associates – show Peter Mandelson discussing with his “chief life adviser”, Jeffrey Epstein, a tax avoidance structure for the purchase of a £2m1 Rio apartment, involving a Panama company.

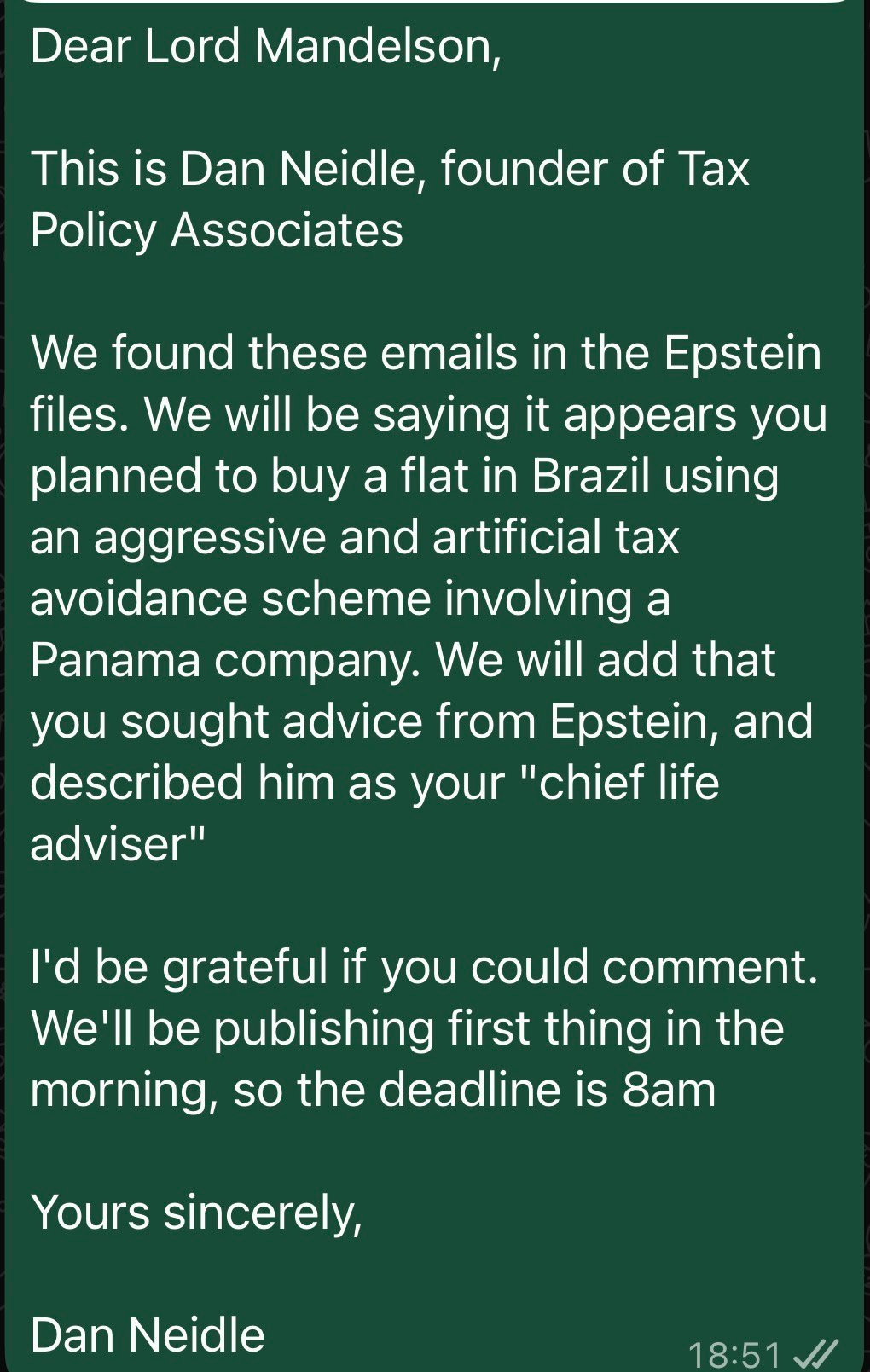

Mr Mandelson told us that he has no recollection of the proposal, or knowledge as to the authenticity of the documents. He added that neither he nor his husband have ever owned property in Brazil, and that he has no association with any company in Panama, and holds no funds offshore.

After receiving that response, we identified a company, incorporated in Rio de Janeiro for the purpose of holding real estate, of which Mr Mandelson and his husband were the directors. Mr Mandelson has denied to us that he held Brazilian property through the company.

The emails

The email chain starts in October 2010, with Peter Mandelson deciding to buy an apartment in Rio, and sending emails asking for advice from his “chief life adviser”, Jeffrey Epstein:

The purchase price of R$5.35 million was equivalent to about £2m.

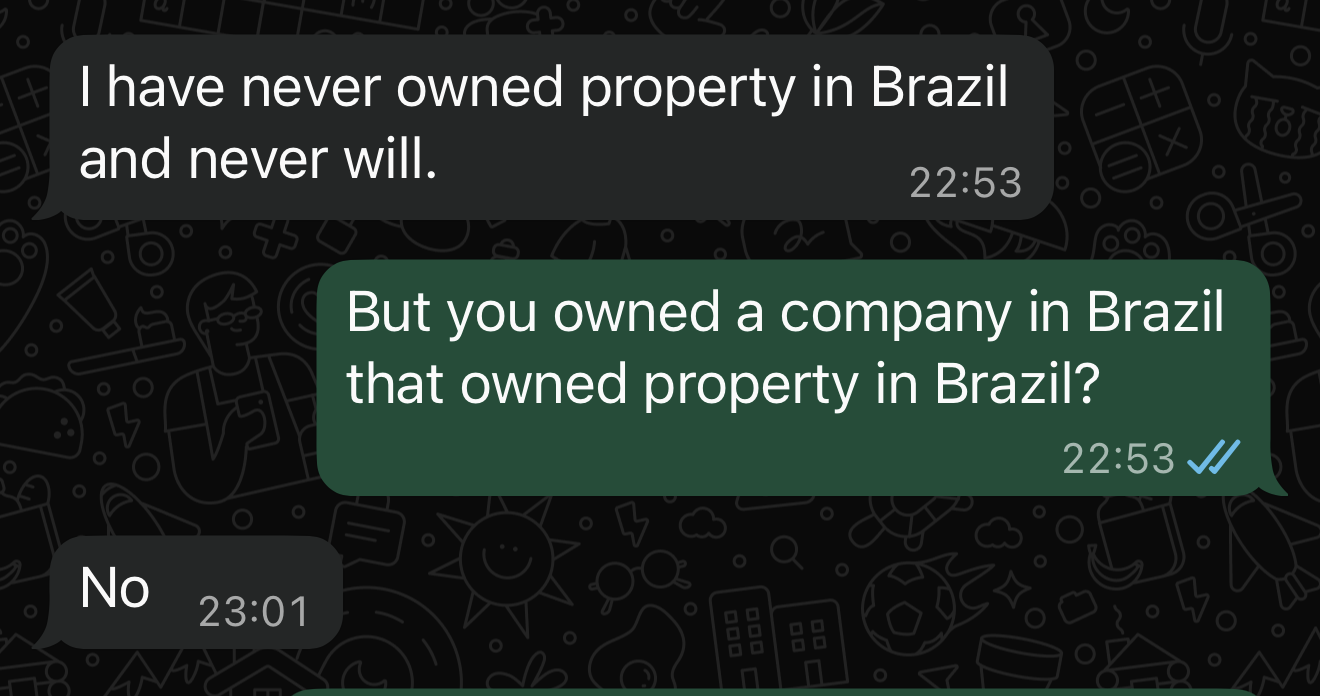

About three weeks later, the documents show Mr Mandelson receiving approval from HSBC Private Bank for a loan of £1.68m to acquire the Rio apartment, secured on Mr Mandelson’s £2.4m London home.

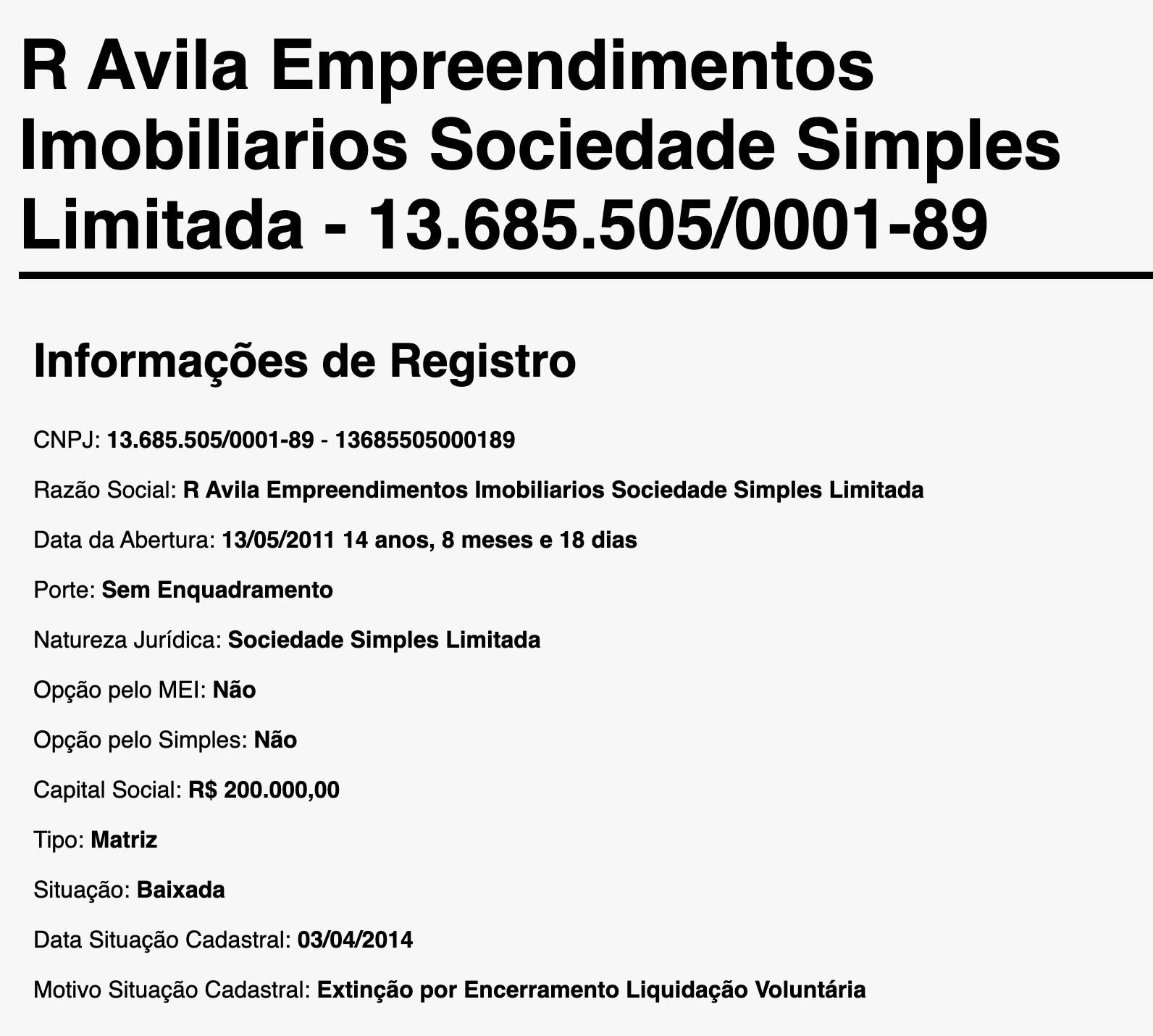

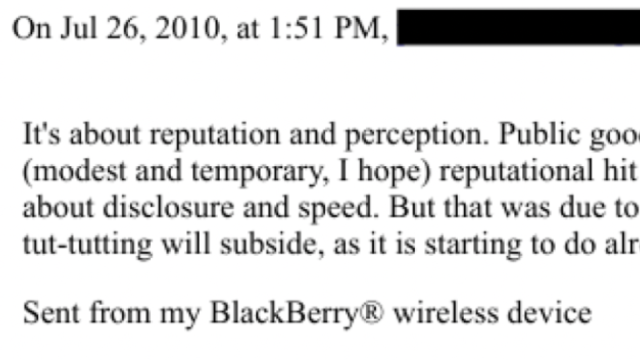

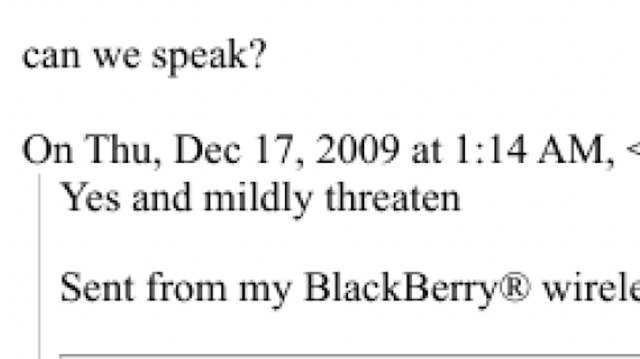

Things progressed slowly, which is not unusual in Brazilian property transactions. In March 2011, Mr Mandelson wrote to Mr Epstein describing a highly unusual tax structure:

The email appears to be cut-off at the bottom, and we’ve been unable to locate anything further on this matter in the Epstein files.

“Reinaldo” was Mr Mandelson’s then partner, now husband, Reinaldo Avila da Silva.

What was the proposal?

The proposed structure was:

- Incorporate a Brazilian company (Sociedade Limitada.2

- The owners would be Mr Mandelson and Mr Avila da Silva, plus a newly incorporated Panama company, owned by Mr Mandelson.

- Mr Mandelson would pay for his shares in the Brazilian company with US$50,000, which might also have facilitated a residence permit.

- The Panama company would lend money from its London account to the Brazilian company.

The email doesn’t state how the Panama company obtains its money; presumably it was to be from Mr Mandelson, funded in part from the loan from HSBC Private Bank. There is no evidence HSBC was aware of the Panama structure.

In our view, and that of the Brazilian advisers we spoke to, the arrangement looks like a highly artificial tax avoidance scheme. The effect of the structure was to hide the true nature of the arrangement – a gift from Mr Mandelson to Mr Avila da Silva. The Brazilian advisers believed the Brazilian tax authorities would have challenged the structure, if they had become aware of it.

It’s important to stress that Mr Mandelson has denied that he implemented the structure, and indeed said he cannot recall it (but see below).

What was the purpose of the structure?

The stated concern in the email was potential tax exposure in both Brazil and the UK.

There has never been a UK tax on buying foreign property. There is UK tax if a UK resident sells foreign property, or receives foreign rental income, and UK inheritance tax applies to foreign property. But whilst the Panama structure might disguise the income/gains, it likely wouldn’t prevent it being technically taxed in the UK.

Two Brazilian taxes are mentioned. If Mr Mandelson and Mr Avila da Silva bought the property jointly, then this would probably be treated as a gift to Mr Avila da Silva, subject to the 4% Rio de Janeiro state tax on gifts and inheritances (Imposto sobre Transmissão Causa Mortis e Doação).3 The proposed arrangement meant that there was still a gift in substance (as Mr Avila da Silva would own shares in the company holding the apartment) but it was disguised as a commercial loan.

The Brazilian advisers we spoke to couldn’t identify what the 6% tax in the email was referring to. 4 It’s possible this was a miscommunication and referring to a different issue.

It is quite possible that Mr Mandelson was misdescribing, oversimplifying, or misunderstanding the precise tax issues he was concerned about. Brazilian tax is notoriously complex, and the email was Mr Mandelson’s own summary of what sounds like a preliminary discussion with a Brazilian adviser. We would therefore caution against reading the tax content too literally.

What matters, however, is not whether the analysis was correct, but what the proposed response was. Mr Mandelson appeared very comfortable with using an artificial Panama structure to avoid tax in Brazil and, possibly, the UK.

Mr Mandelson’s response

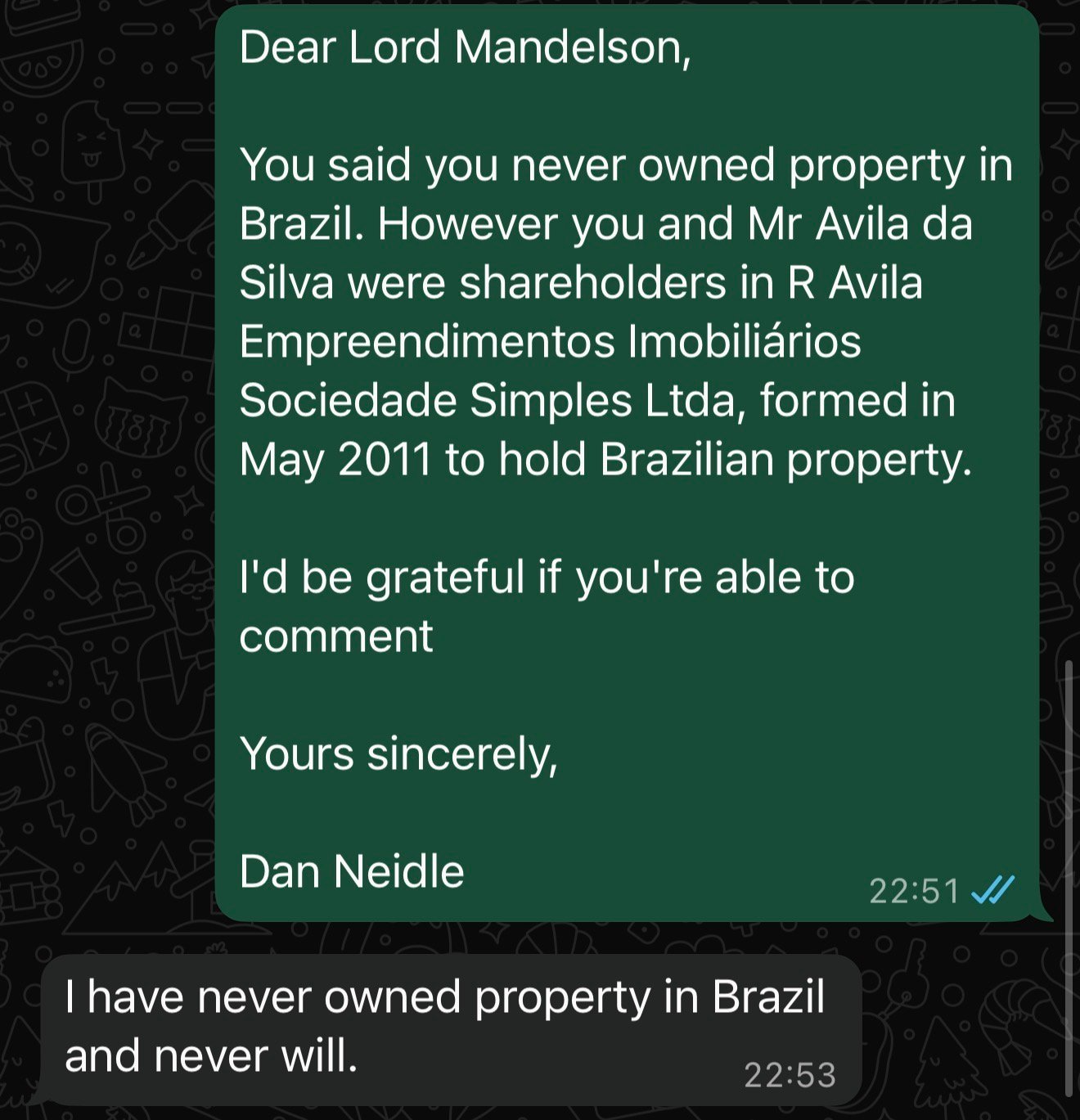

We wrote to Mr Mandelson asking for comment:

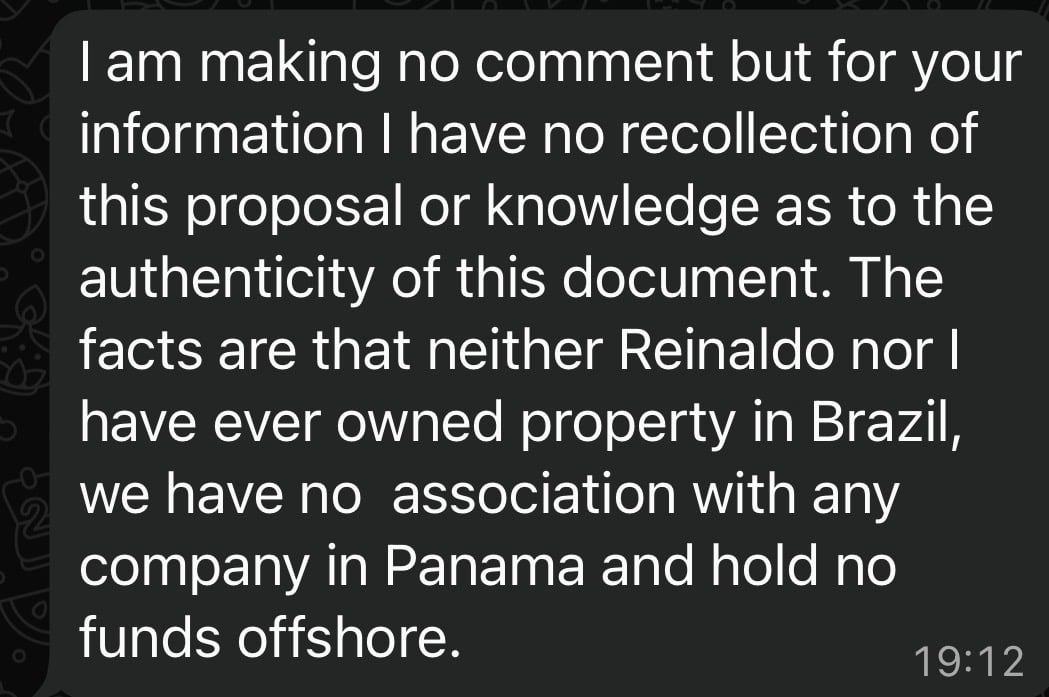

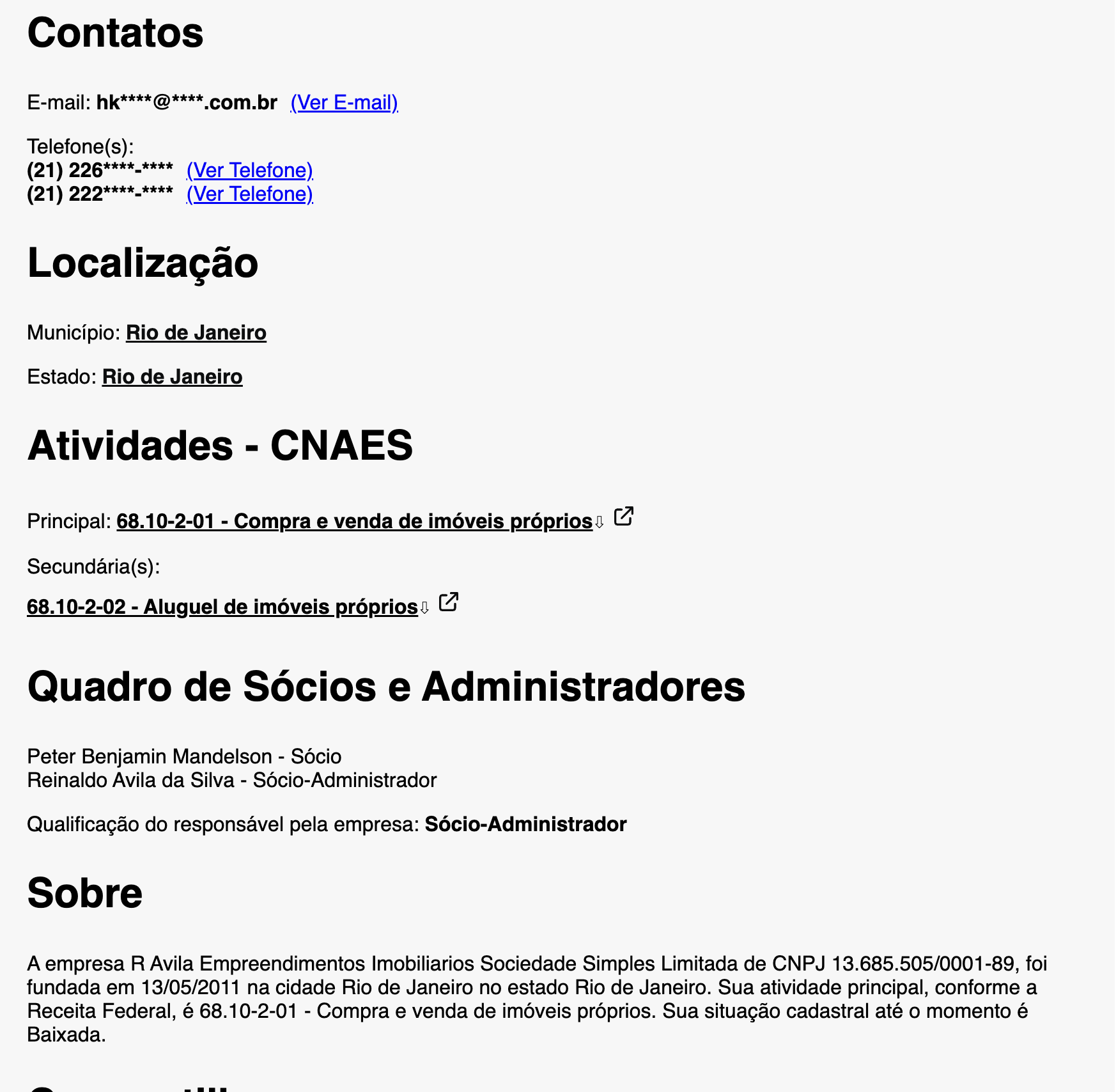

After this exchange, we identified a company🔒 incorporated in Rio de Janeiro in May 2011 for the purpose of purchasing and selling real estate. Its shareholders were Mr Mandelson and Mr Avila da Silva. The company was liquidated in April 2014:5

We asked Mr Mandelson. He denied owning Brazilian real estate through the company:

We subsequently located the notarised incorporation documents, which include Mr Mandelson’s signature:

At this point we don’t know what the Brazilian company actually did, and whether it held any property. However the company records are inconsistent with the Panama structure described in the email (because the Brazilian company doesn’t have a Panama company as a shareholder).

There are probably three possibilities.

- The emails are fake, created by an unknown third party, Jeffrey Epstein, or someone in the Epstein investigation. The company is either fake or unrelated. This seems very unlikely given the notarised incorporation documents.

- The emails are authentic, but the Rio purchase never progressed, and the company was incorporated but never used. It is, however, surprising that Mr Mandelson cannot recall that he came close to spending £2m on an apartment in Rio.

- The emails are authentic, the Rio purchase happened, but the Panama structure was not used.

Many thanks to B and P for providing, at very short notice, their Brazilian tax insight and expertise. Amazing work from G finding the Brazilian company, and from J and L locating the incorporation document.

Footnotes

Successive drafts of this report had currency errors, for which our apologies. ↩︎

The alternative type of corporate entity, a Sociedade Anônima (S.A.), is unlikely – it’s usually only used by large businesses. In 2011, Brazilian law strictly required a Sociedade Limitada) to have at least two owners (the Brazilian term sócios translates to “partners” but this was not a partnership). See page 230 of this law review. ↩︎

The tax applied to cash gifts to a person domiciled in Rio. Mr Avila da Silva is Brazilian; presumably there was a concern at the time that, despite living in the UK, he was Brazilian domiciled, or alternatively that the situs of the assets brought the gift within the scope of ITCMD. ↩︎

There was a 6% tax on tax on financial operations (Imposto sobre Operações Financeiras) which applied to cross-border foreign currency loans, but it’s not obvious why there would have been such a loan in a vanilla structure where Mr Mandelson and Mr Avila da Silva acquired the property directly. On the other hand, the tax would appear apply to the proposed structure, which might be one reason why it didn’t proceed. ↩︎

You can find the official Receita Federal CNPJ certificate by searching in the Brazilian company registry for company reference 13.685.505/0001-89. The certificate confirms registration and status only; details such as partners’ names come from separate public filings with the state commercial registry (JUCERJA), which commercial databases aggregate and republish. ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15.png)

![To: jeevacationg@gmail comieevacation@gmail com]

From: Peter Mandelson

Sen: Sun 11/7/2010 2 34 57 PM

Subject: Fwd Rio apartment

Sent to my bank manager Gratetul for helpful thoughts from my chiet ite adviser

Sent from ms 1Pad

Beuin tonvarded message

From: Peter Mandelson Po :

Date: 7 November 2010 14 29 12 GMI

Subject: Rio apartment

as we discussed, | am considering a purchase of an apartment in Rio It isin

a block under construction in [panema [tis being re-sold off plan bs the onginal

purchaser Asking price ts § 350 000 nals | am told that this value will rise on

construction and will follow Rio property prices up in coming sears

Tcan forward property details to vou m nest few dass but | would be grateful for advice

trom sou on how HSBCPB in Rio can assist in helping me take the decision on

this particular property and ina purchase [also need some advice on tas

mplications in Brazil and UK

Lam minded to place ownership, once secured. in Reinaldo’s name and advice on this

would also be welcome

Please let me know whether and how sou can help on this

Best regards from Beying

Peter

Sent from my iPad](https://taxpolicy.org.uk/wp-content/uploads/2026/01/upload_73f957b3-5d51-4d36-9449-a9bef95c2947.jpg)

![To: jeevacation@@gmail com[jeevacationgggmail.com]

From: PETER MANDELSON

Sent: Wed 12/1/2010 10:07:26 PM

Subject: Fw: Re: Rio apartment

I cannot tell you how nervous this makes me. Going to bed now

On 24 Nov 2010, at 16:34, EE wrote:

Peter,

| am pleased to confirm that | now have approval to provide you with a loan on the following headiine

terms:-

Borrower You

Amount £1.68m

Purpose Assistance with purchase of holiday home in Rio

Term 5 years

Repayment £24,000 per quarter

Security Mortgage over 4 Park Village West

Valuaton The property wall be valued by one of the bank's panel valuers, at your cost.

We require a minirnum valuation of £2.4m

Interest 2.25% over 3m LIBOR - 1. approx. 3% p.a. at the present time. This 16 a

discount to our revised standard pricing of 2.5% margin, and unfortunately | am unable to reduce tt

further

Fee 0.75% (£12,600)

Other For the duration of the facilty, it1s a conditon that you maintain a maumum credit

balance with us of £100.000

Please advise iffhow you wish to proceed. As you may recall, from the end of this week | will be on

holiday untd 13th December, but Sam will be able to take matters forward in my absence.

Regards

HSBC Private Bank

ASSOCIATE DIRECTOR | Media & Entertainment

HSBC Private Bank (UK) Limited, 78 St. James's Street, London. SW1A 1JB](https://taxpolicy.org.uk/wp-content/uploads/2026/01/upload_f224aa92-4eca-4653-bdd8-1e8a40477fab.jpg)

![To: jeevacation@gmail.comfjeevacation@gmail.com]: Jeffrey Epsteinfjjeevacation€@gmail.com}

From: Peter Mandelson

Sent: Wed 3/30/2011 3:41:59 PM

Subject: on

A lawyer in Rio has pointed out two problems in Reinaldo purchasing the Rio flat by means of a

cash transfer from me: we would be liable to taxes in both UK and Brazil, and the purchase itself

would be liable for two forms of property taxation in Brazil, 4° and 6°o respectively of the full

purchase price. This would be prohibitively expensive.

The lawyer suggests the following scheme which he has operated for others. He would

buy‘create an offshore company in Panama and this company would open an account with

HSBCPB in London. We would also create a Brazilian company which would have the

Panamanian company as a partner (shares held by Reinaldo and me). The Brazilian company,

managed by Reinaldo, would purchase the flat. The flat purchase would be financed by means of a

loan from the Panamanian company's account in London to justify the offshore (non-taxable)

ongin of the moncy.

The lawyer proposes that | invest US$S0,000 to buy the shares of the Brazilian company (making

a residence permit in Brazil also possible).

The company would be liable for tax at 20 on the property purchase (rather than 4% and 6°o).

The company would have a Brazilian bank account (Safra or HSBC 7). The lawyer would have

power of attorncy to sign legal documents etc.

As directors of the Brazilian company, Reinaldo and | would have joint control over the property.](https://taxpolicy.org.uk/wp-content/uploads/2026/01/image-4.png)

Leave a Reply to Andy Cancel reply