Angela Rayner’s leaked tax memo to Rachel Reeves outlines a raft of new revenue raisers. In this post, I look at each proposal, and ask whether it makes sense, and whether it would raise the claimed amount.

The original report from the Telegraph sets out the detail of the memo – see also coverage from the FT here and the BBC here).

My take is that about half the proposals make sense from a policy perspective (if we want to raise additional funding) and could raise £1.5bn.

The Good

Close the commercial property stamp duty loophole – £1bn

We all pay stamp duty land tax if we buy residential property. Commercial property is also subject to stamp duty, at the lower rate of 5%. But in practice it’s often avoided by the simple method of putting the property in a company, and selling the company instead of the property.

This barely qualifies as a “loophole” because it’s such a standard way of selling real estate, and successive Governments have accepted it. Tax legislation prevents outright abuse (e.g. moving real estate into a company and then selling the company right away) but doesn’t prevent it.

I wrote about the issue here, and guesstimated that the yield from closing the loophole would be around £1bn.1Unfortunately we lack the data to come up with a proper estimate. There is good data on commercial real estate transaction volumes (about £40bn in 2023) but the HMRC figure for non-residential stamp duty revenue (about £3bn) can’t be directly compared, because the scope of SDLT is much broader than the commercial sales tracked by BNP and others. for example: the £40bn figure is high-value purchases only (£1m+). The HMRC figure includes all purchases, plus lease extensions and other non-purchase transactions. And the £40bn is only actual commercial real estate; the HMRC figure includes agricultural transactions, mixed transactions, and purchases of rental property portfolios (because of the multiple dwelling relief exemption, now abolished). So we can’t calculate the “missing” SDLT by comparing these two figures.

Stamp duty is a terrible tax, and I’d much rather abolish it. But if we’re to keep it, it’s only fair it should apply to everyone. This is a good way to raise a useful amount of money.

Increase the annual tax on enveloped dwellings – £200m

People used to use the same “loophole” when buying residential property, until it was somewhat closed in 2013. I say “somewhat” closed because, instead of simply charging stamp duty when people bought a company containing residential property, such “enveloped” real estate became stung with an annual tax – the “annual tax on enveloped dwellings” (ATED).

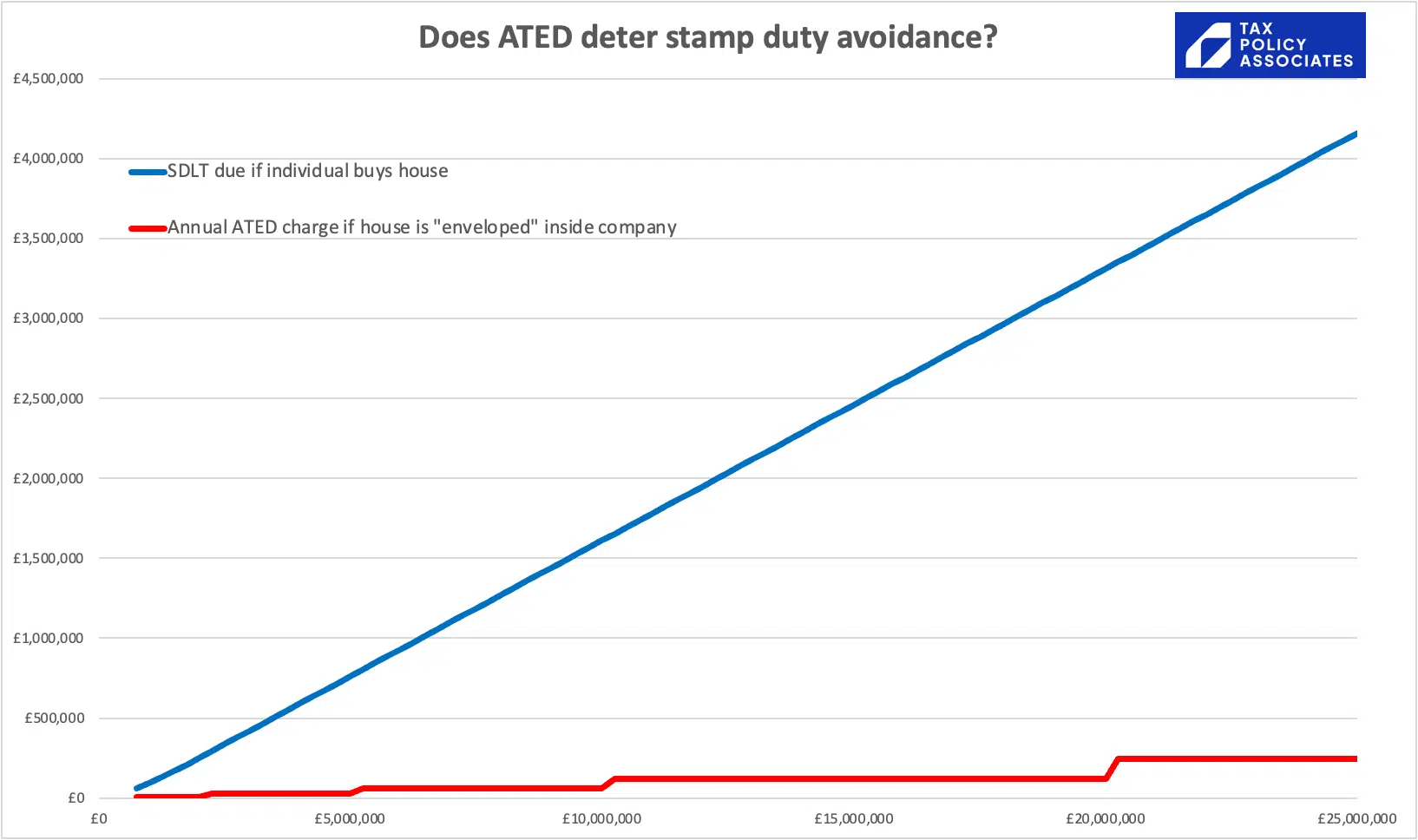

But there’s a quirk: ATED is only slightly proportional to property values. This is effective at discouraging “enveloping” for relatively low value real estate, but not at all once we get into seriously valuable property. We can compare the effects with this chart:

So ATED is too low to do the job it was designed to do. The enveloping “loophole” is still worthwhile, and the more expensive the property, the more worthwhile it is.

The sensible solution is to close the loophole properly, and make stamp duty apply on the sale of companies holding residential real estate (just as I think we should for companies purchasing commercial real estate). But if we don’t want to do that (or want a stopgap while we finalise how we’re going to properly sort things out), let’s just increase ATED.

I wrote about this here, and suggested that tripling the rate would raise around £200m.

Remove the inheritance tax exemption for AIM shares – £1bn

There has, for years, been an inheritance tax exemption for holdings of private businesses – business relief.

Business relief is usually justified by a desire to prevent family companies from being broken up when the founder dies. Much harder to understand is why the exemption extends to most shares listed on the Alternative Investment Market (AIM). It’s a pure subsidy for a not very successful stock market. And it created an amazing avoidance opportunity: buy a portfolio of AIM shares (or pay someone else to do that for you), live for two years, and escape inheritance tax.

Business relief was somewhat restricted in the Budget – only the first £1m is completely exempt; remaining holdings are 50% exempt and 50% taxed. AIM shares are 50% exempt and 50% taxed from the start, i.e. with no £1m exemption.2Many thanks to Hugh Goddard for spotting an error in the original version of this article, which suggested that AIM relief benefited from the £1m exemption. It does not.

So AIM shares remain a pretty good inheritance tax avoidance opportunity. The Rayner memo is right to identify this as a problem.

But the reported £1bn revenue estimate in the memo is not correct. The whole of business relief cost £1.4bn, prior to the Budget, and the Budget changes removed about a third of this. So abolishing business relief would probably yield around £1bn, and that may be where the £1bn figure comes from.3Although there would likely be significant tax planning/avoidance in response, reducing the yield. But Ms Rayner isn’t proposing that – she’s proposing abolishing AIM relief. Given the reduction in AIM relief raised £110m, we’d be looking at somewhere under £100m rather than £1bn.

Remove the dividend allowance – £325m

We all have a personal allowance of £12,570 (it’s reduced for those earning £100k, and eliminated for those earning £125k).

We also have a £500 dividend allowance – dividends on shares held outside ISAs and pensions would normally be taxed; but the first £500 is tax free.

The Rayner memo proposes eliminating it, and says that would bring in £325m. The figure comes from the HMRC “ready-reckoner“, which estimates changing the allowance by £100 yields £65m – they’ve multiplied £65m by five. That won’t be quite right4The “ready-reckoner” is really only good for small changes; completely abolishing the dividend allowance will likely not have the same result as five times a 20% reduction in the allowance. For example: we may see a greater taxpayer response (as was seen for previous changes), reducing the yield. The distribution of dividends may be non-linear, i.e. with lots of people receiving just a few £ of dividends each year, increasing the yield. Administrative costs may increase once very small amounts of dividends are taxed, reducing the yield., but should be a good approximation.

The dividend allowance was introduced at £5,000 in 2016 (£6,800 in today’s money), and then cut by a series of Budgets, eventually to £2,000. Eliminating the allowance altogether is the obvious next step.

I would however pause to check whether there are people receiving a very small amount of dividends, and the administrative cost (for them and HMRC) of making them file tax returns will be disproportionate. Possibly a dividend allowance of £100 makes more sense than no dividend allowance at all.

The not so good

Reinstate the pensions lifetime allowance – £800m

The pensions lifetime allowance was a £1m cap on the total amount of tax-exempt pension savings an individual could build up in their lifetime without incurring extra tax charges.

The lifetime allowance was abolished by the Conservative Government in 2023. Labour had previously pledged to restore it, but changed its mind in June 2024.

£1m sounds like a lot of money – and it is. But many people want to use their retirement savings to buy an annuity guaranteeing retirement income. In 2023 the level of annuity rates meant that £1m would buy a couple a pension of £40,000/year. This isn’t oligarch territory. And it’s hard when you’re (say) 50 to plan retirement savings in a way that avoids hitting a particular number in fifteen years time.

But none of these are the reason Labour changed its mind. The reason was simple: doctors.

Senior NHS doctors have a “final salary” pension scheme, where their annual pension is calculated as the years they worked multiplied by their final salary. As this calculation approached the £1m cap, doctors had a powerful incentive to work fewer hours to avoid hitting the cap (and the 55% tax that resulted).

At one point Labour suggested special lifetime allowance rules for doctors. But that looked unprincipled and unfair – other highly paid professionals faced similar problems, and no tax rule should encourage people to turn away work. There is a good IFS analysis here of the issues around reintroducing the annual allowance.

These problems haven’t gone away, and so it seems unlikely Labour is about to change its mind about changing its mind on the lifetime allowance.

We have an annual limit on pension contributions, which is reduced significantly for high earners. If we want to prevent the very wealthy building-up massive tax-free pensions, this is a much fairer approach than the lifetime allowance.5Although it’s unfair in many ways. People who earn a high income for a few years do much less well than people with the same overall income spread over more years.

Freeze the additional rate tax threshold – £2bn by 2033

Gordon Brown introduced a 50p additional tax rate in 2009 for people earning £150,000. It was then cut to 45p by George Osborne in 2013.

£150k in 2009 is about £240k in today’s money. But today, the additional rate threshold isn’t £240k – it’s £125k.

And it’s worse than that, because the marginal rate between £100k and £125k is actually higher – 62% – because of the way the personal allowance “tapers” for incomes over £100k. Today, about 3% of income tax payers pay the 45p or 60p rate.

The current plan is to continue to freeze the additional rate taper until 2028, and then uprate it in line with inflation. Ms Rayner’s memo proposes freezing it past that point.

Freezing tax thresholds is not good tax policy. It’s a large tax increase, but a hidden one. It undermines the progressivity of the tax system to have the highest rates paid by more and more people. And it doesn’t affect the seriously rich, just the moderately high earning.

Increasing bank taxation

It’s politically very easy to tax banks.

The problem is that they are already highly taxed. Banks pay normal corporation tax of 25%, plus a bank surcharge of 3%, plus a bank levy of 0.1% of their balance sheets.

This leaves the UK with the highest rate of tax on banks amongst major economics, and Lloyds Bank as probably the greatest single corporate taxpayer in the UK. It’s certainly not the most profitable company in the UK.

There isn’t a principled argument for increasing bank tax any further. The fact banks lobbied against increasing the surcharge doesn’t make them wrong (and JPMorgan is right to say that punishing JPMorgan for the sins of UK banks before the financial crisis is unfair).

What we should be doing is looking at making bank tax more rational. Why is there a surcharge and a bank levy? Why not raise the same amount from one tax? I wrote about this here.

Raise rates on dividend tax

The top rate of income tax on most income is 45%. So on the face of it it’s odd that the top rate of income tax on dividends is 39.35%.

There are two justifications.

The first is that dividends are paid out of company profits that have already been subject to corporation tax at 25%. So the overall effective rate is 54.5%.6Start with £100 of corporate profit. Corporation tax is 25% for large companies (less for small companies), leaving £75 to be paid as a dividend. That £75 is taxed at 39.35%, i.e. £29.51. So total tax out of the £100 is £54.51, or about 54.5%.

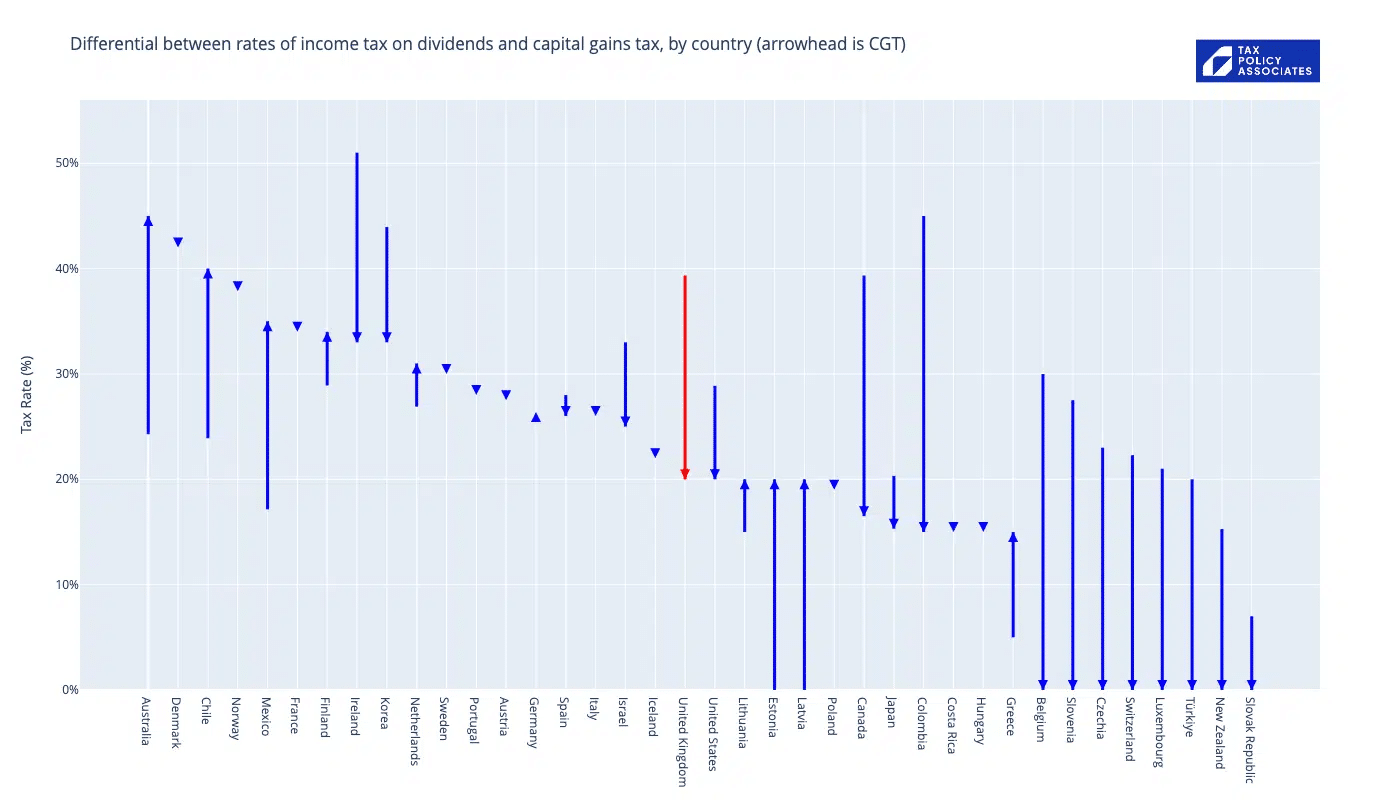

The second is that we want to encourage people to invest in companies, and too high a rate of dividend tax won’t do that. For this reason, most countries tax dividends significantly less than normal income. The UK is a bit of an outlier in how high our dividend tax is. This chart, prepared before the Budget7so the UK CGT rate shown is out-of-date – it’s now 24%, not 20%., compares share CGT and dividend income tax rates across the OECD:

The tail of the red arrow is the UK’s dividend tax rate. It’s one of the highest in the OECD. So the case for increasing it is not persuasive.

- 1Unfortunately we lack the data to come up with a proper estimate. There is good data on commercial real estate transaction volumes (about £40bn in 2023) but the HMRC figure for non-residential stamp duty revenue (about £3bn) can’t be directly compared, because the scope of SDLT is much broader than the commercial sales tracked by BNP and others. for example: the £40bn figure is high-value purchases only (£1m+). The HMRC figure includes all purchases, plus lease extensions and other non-purchase transactions. And the £40bn is only actual commercial real estate; the HMRC figure includes agricultural transactions, mixed transactions, and purchases of rental property portfolios (because of the multiple dwelling relief exemption, now abolished). So we can’t calculate the “missing” SDLT by comparing these two figures.

- 2Many thanks to Hugh Goddard for spotting an error in the original version of this article, which suggested that AIM relief benefited from the £1m exemption. It does not.

- 3Although there would likely be significant tax planning/avoidance in response, reducing the yield.

- 4The “ready-reckoner” is really only good for small changes; completely abolishing the dividend allowance will likely not have the same result as five times a 20% reduction in the allowance. For example: we may see a greater taxpayer response (as was seen for previous changes), reducing the yield. The distribution of dividends may be non-linear, i.e. with lots of people receiving just a few £ of dividends each year, increasing the yield. Administrative costs may increase once very small amounts of dividends are taxed, reducing the yield.

- 5Although it’s unfair in many ways. People who earn a high income for a few years do much less well than people with the same overall income spread over more years.

- 6Start with £100 of corporate profit. Corporation tax is 25% for large companies (less for small companies), leaving £75 to be paid as a dividend. That £75 is taxed at 39.35%, i.e. £29.51. So total tax out of the £100 is £54.51, or about 54.5%.

- 7so the UK CGT rate shown is out-of-date – it’s now 24%, not 20%.

28 responses to “The Angela Rayner tax proposals – how much sense do they make?”

One way of raising more taxation never talked about is actually to get a tax authority (HMRC) who are actually effective and accountable for their actions.

My experience (and from talking to some experienced hands who I know who still work there) they are not.

Completely disagree with your suggestion on taxing dividends and having a lower threshold of £100.00 when the lower tax rate on dividends is 8.75%

Currently if you have over £500.00 and below £10000 and don’t complete a tax return you are supposed to contact them and they would adjust your tax code.

(From working there, I am sure the reason they do it this way is that they are happy to get it from those who submit tax returns and realise for those who don’t it is not worth the costs – for example £800.00 would only raise £25.00 and HMRC are not going to start a compliance check for that!)

That being said it would be better to just tax dividends at source, (however it would be quite interesting to know how many ‘taxpayers’ this would effect who don’t use their personal allowances).

Would it not be fairer and more transparent to raise the basic rate of income tax by 1%. It feels like a lot of the changes in the tax system in the last 10 years have been over complicated and usually aimed at higher rate taxpayers. The landlord interest disallowance, personal allowance abatement, removal of child benefit, nursery hours cliff edge, etc etc… these are all very complex, a lot of people unintentionally make errors, and most of them hit higher rate, not additional rate tax payers hardest.

If every tax payer paid an extra 1% surely that’s fairer. (I know it will never happen)

Are you correct about AIM shares benefiting from an additional £1m Business Property Relief in future? I’ve not seen that anywhere else?

And with regard to pensions, a key objective should be to encourage people to provide for their old age. Yes, the amount put aside should be capped – ideally by way of amount contributed. But repeated changes to the regime in themselves act as a disincentive to save – the inclusion within one’s Estate being a significant one.

And I’m surprised that there is so little attention paid to treating Trusts more like Estate assets.

All this tinkering will complicate matters further. As if they’re not already devilishly complex already

The simplest way to raise more tax efficiently across the broadest base is to increase the rates by a penny or two on each tax band as the Scots have done.

Simples

Am I reading the chart right? Do we have a higher dividend tax rate than every country in the OECD apart from Denmark, Ireland, Korea and Colombia?

Whys is this sort of thing never publicised? Given the way our press reports things, I bet most people think we have a low rate and that business owners or investors (aka fat cats) are getting off easy and not paying their “fair share”.

Not as far as I can see. The graph of OECD income vs dividend tax rates seems to put the UK slap in the middle of absolute CTG rates.

It appears to be based on misreading the graph. The article text says “The tail of the red arrow is the UK’s dividend tax rate. It’s one of the highest in the OECD. So the case for increasing it is not persuasive.”

But the graph itself says CGT is the arrowhead. Not the tail. And indeed Income tax is 40% (tail) and CGT is 20 or 24% (arrow head).

There are two things shown on the graph. At the head of the arrow is the CGT rate, while the tail of the arrow shows the dividend rate.

As you note our CGT rate (although now slightly higher at 24% vs 20%) is broadly in the middle of the pack.

However Steve asked about our dividend tax rate, and that is very near the top end on an international comparison, with only the countries he lists having higher dividend rates.

The other thing you can see from the graph is the length of the arrow, which shows the difference between dividend and CG rates and therefore how much tax benefit there is if you can turn one type into the other (e.g. don’t pay dividends but keep the cash in the company so you get a higher gain when you sell it, taxed at a lower rate). Would be interesting to compare length of arrows with complexity of tax systems, as long arrows probably lead to lots of anti avoidance rules.

Restricting what can be paid into pensions (and potentially reducing the £60k annual allowance) feels fair and reasonable if the money needs to be raised but as you mention they really should stop tinkering with the idea of an LTA on the actual pension pot, which makes personal financial planning virtually impossible given the uncertainty of investment returns (and it feels extremely unfair to further penalise a cohort of younger savers who are likely not going to get much/any state pension when they come to retire and so will need to rely on private pensions even more)

Restricting pension contributions to low level can have significant adverse effects on the self employed / freelancers who may have very variable incomes year to year. On bad years you do not have the funds to put into a pension, you just have enough to feed your family. We need to be able to catch up our pension contributions in the good years

I believe in the section on lifetime allowance, the second 2023 should read 2024

ATED tax should be abolished

When. Company buys a residential property it pays the additional rate of stamp duty so it does not avoid stamp duty at all. It then pays an annualised tax whilst it holds property if used by persons connected to the company. So if anything companies are caught twice.

Deal with the problem of subsequent selling of shares rather than tripling of ATED as you suggest

The UK tax burden is making people resentful and many of us are planning to retire and give up ours businesses which will have the opposite effect for tax raising!

If I understand correctly, the value of private pension funds is not included in the estate for IHT. If this is true, then removal of the LTA is effectively a tax loophole to avoid IHT- ie, save as much as possible into a pension fund that can be inherited IHT free. Have I understood correctly?

The 2024 autumn budget introduced a change. From April 2027 personal pension funds will be included in an estate for IHT purposes

Are most tax rates max’d out? Time to increase tax revenue by increasing earnings (personal and corporate)?

It’s reasonable to assume imbedding AI into companies and employees skills would increase the UK GDP and reduce govt dept costs.

Perhaps tax incentives (or penalties) for companies and govt bodies to invest in AI.

Why not have a single £500 exemption for all passive income (eg mainly dividends and interest) for all other than additional rate payers. Need some exemption to avoid HMRC being overwhelmed dealing with trivial liabilities.

Does this scream of ever more tinkering? Exemptions here, threshold freezes there, tweaking everywhere.

Is this just a function of a complex society and as living standards rise, tax will just keep getting ever more complex. I wonder if AI could end up helping here.

tinkering perhaps – but most of the ideas identified as “good” are removing exemptions or setting everyone on the same footing – so not os much tinkering as simplifying.

Slightly unrelated but would appreciate your thoughts. Ed Balls said today that the optimal WFA approach would be to “restore it to everyone and withdraw it through the tax system from the highest-income pensioners”. How could this work? Only through extending NI to pension income, or is there some tricksier way?

another bloody cliff edge in the income tax system, I expect, albeit a small one.

‘Easiest’ way might be to treat winter fuel allowance as being taxable income. Also runs into a familiar problem that WFA is per household and income tax is individual level.

In a few years it will also be noticed that whilst the state pension is taxable, pension credit (almost as much £) is not taxable.

The IHT changes to undrawn pensions will raise way more than the reinstatement of the LTA. The red book estimated nearly £1.5bn per year in 2029-30. The estimates probably also understate the behavioural changes too. It forecast £0m for 2024/25 and the measure comes in from 6 April 2027. But there is already evidence of people taking more out of pension today (so, paying income tax, perhaps more VAT, etc).

A quick comment on ATED. There is an exemption for enveloped property that is rented out at market rates and not occupied at any time by anyone connected to the company owning the property. Secondly ATED only applies to dwellings valued in excess of £500K.

Question. Is there a chance of these beng removed/amended?

Super interesting article, thank you.

What would you think about reintroducing the Lifetime Allowance on private pensions but exempting public sector pensions (the doctors!). This would reduce the tax blow on NHS workers whilst capping tax relief avaliable elsewhere.

The obvious example is the 2022 Judicial Pension scheme. To entice high paying barristers into working as judges the pension on offer was moved to tax-unregistered status, meaning no active accrual for the purposes of the old Lifetime Allowance or Annual Allowance. This stopped big tax bills from pension accrual, though member contributions didnt receive tax relief.

Reintroducing the Lifetime Allowance means a death tax could be reimposed without introducing pensions into the estate, which is proving to be tricky.

feels unfair and unprincipled. Many private sector workers already feel aggrieved that public sector pensions are so valuable/expensive, and this would just magnify that.

I really like the idea that doctors have a greater incentive to work for the NHS (paying it back / paying it forward) rather than seeing the same patients in private practice.

That would be tantamount to the government assigning “importance” to doctors over other professions. Why should doctors be favoured over other learned professions such as engineers, lawyers, dentists, head teachers etc who are equally subject the absurd tax cliff-edges ands are equally in demand for their skills??

Indeed, it’s a very bad principle to favour any career over any other through the tax system and it’s even worse to favour public sector worker pensions over those (almost invariably less generous) secured by private sector workers.

There has been so many changes to pension reliefs and taxation that more changes will discourage pension provision which is bad for future generations and the State itself.