Political parties’ local branches are failing to pay tax on their commercial income – even when that income is funded by taxpayers.

All the political parties talk about the tax gap – the £40bn difference between the tax that should be paid and the tax that isn’t. So we’d expect the political parties to lead by example – but we’ve found a widespread failure by the parties to pay tax themselves.

Political parties aren’t taxed on donations and subscriptions. But they are taxed on commercial income. And many local Labour, Conservative and Liberal Democrat parties across the UK earn commercial income by renting out spare office space. In the majority of cases, the local parties pay no tax at all on this income. In another quarter of cases, they pay less tax than we’d expect.

In many cases the office space is rented to the local MP, who claims the rent as a Parliamentary expense. Most of this isn’t taxed at all.

The amounts involved are small, but the principle is real: political parties should pay tax on commercial income, like everyone else.

The principle

There is a £40bn “tax gap”. In other words, about £40bn of tax which should be paid, isn’t – through some mixture of non-compliance, mistake, fraud and tax avoidance.1 All the political parties talk about the importance of reducing the tax gap.

So we’d expect the parties to go out of their way to ensure that they, and their local parties across the country, pay all the tax that is due.

The reality

The political parties campaign across the country through local constituency branches – e.g. Constituency Labour Parties, Conservative Associations and local Liberal Democrat parties. Many, particularly longstanding branches, have their own premises – and often they rent out some of their space to get additional income.

We analysed 630 sets of accounts submitted by local parties to the Electoral Commission to find how many local parties receive rental income, and how many pay tax on it.

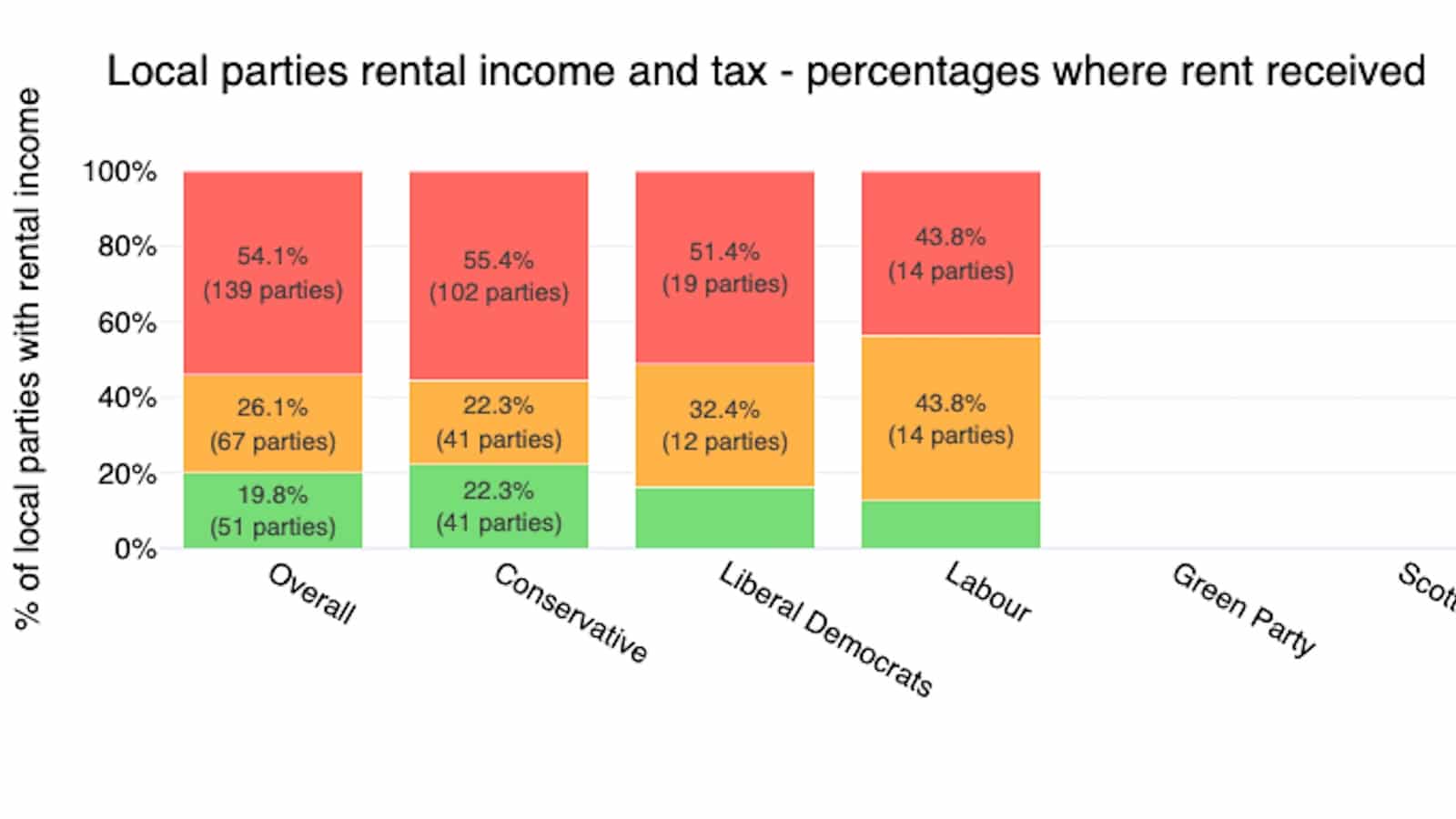

We found that most of those receiving rental income pay no tax at all; most of the rest pay less tax than we’d expect:2

Which parties are most likely to fail to pay tax?

Local Conservative associations are most likely to have rental income, but (of those with rental income) the proportion paying and failing to pay tax is similar across all parties.3

We’d therefore caution against drawing any partisan conclusion from the data.

Where a local party was successful in electing an MP, and has spare office space, then in most4 cases we find that the office space is let to the MP, with the rent funded from Parliamentary expenses. There is an obvious potential for abuse, with taxpayers’ money funding a local political party in circumstances where the space couldn’t be let commercially (or where the rent is greater than a market rate would be). The Independent Parliamentary Standards Agency (IPSA) therefore requires that any such arrangement must be commercial, with a market rent charged.

If we focus on the cases where the accounts disclosed that the local party was renting space to the MP:5

This is perhaps the most concerning, given that here it is taxpayers’ money going to a local political party. (Although we expect that in most cases the MP won’t be aware of the issue; MPs are rarely involved in the management of their local constituency party.)

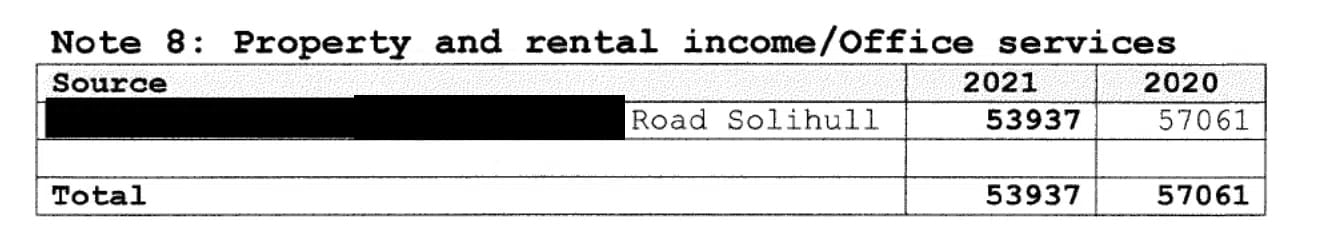

The biggest recipient of rent to pay no tax in 2021 was Solihull Conservative Party, which received £53,937 but paid no tax at all.

The biggest recipient of under-taxed rent was Brentford and Isleworth Labour Party, which received £64,711 on which they paid £5,275 tax – about 8% of rental income. That is surprisingly low.6

The next biggest was Bristol and South Gloucestershire Conservative Party, who received £57,508 on which they paid £1,240 corporation tax – a very low 2% of rental income.

The parties receiving the largest amounts of undertaxed rent paid for the local MP by Parliamentary expenses were Uxbridge and South Ruislip Conservative Association (£30,946 rent with 4% of that paid in tax), Chelmsford Conservative Association (£25,242 rent with no tax paid) and Islington South and Finsbury Labour Party (£23,856 rent with no tax paid).

The local party that received the most rent was Aylesbury – £225,448. But it pays tax in full.7

Other notable entries: Rishi Sunak’s Richmond and Northallerton received £38,556 of “office services” (which we assume to be a rent-like payment) in 2023, but only paid £50 tax.

The accounts mostly date from 2022 and 2023. Individual constituency parties could have changed their tax status since – but we expect that the data as a whole remains representative, given that we’re unaware of any change in practice by local parties since those dates. More significantly, because the data is pre-election, there are cases where the MP subsequently lost their seat.

This table shows every single local party that receives rental income. Those paying no tax are highlighted in red, those where tax is less than 15% of rental income are highlighted in amber, those paying more than that are in green.

Clicking on a local party’s name will go straight to its accounts. You can use the search box at the top to find constituencies, and click column headings to reorder the table.

You can view the table full screen here, and download the underlying data here.

We explain the methodology below. As it involved a mostly-automated review of the accounts, we would recommend against drawing any conclusions about an individual local party without first verifying the position in its Electoral Commission accounts (by clicking it in the table).

Background – local parties and tax

Much local political campaigning is carried out by local political parties affiliated to one of the main political parties. For example, Cities of London and Westminster Conservative Association is affiliated to the Conservative Party. Most local parties operate as unincorporated associations – essentially membership clubs.8 So they’re not registered with Companies House, if their income or spending exceeds £25,000, they have to file their accounts with the Electoral Commission (here are the London/Westminster Conservative Association’s most recent accounts).9

Political parties don’t pay tax on donations they receive – just as we individually aren’t taxed on gifts that we receive.10 However they are taxed on commercial income, and many local parties rent out spare office space.11 An unincorporated association that receives commercial income must notify HMRC and then start filing for corporation tax. It will then pay tax at the small business rate of 19% on the rental income it receives, less expenses (provided they “wholly and exclusively” relate to the rental business.12

When we look at the accounts it becomes reasonably clear that local parties are simply failing to understand how corporation tax works.

Here, for example, is the Solihull Conservative Association:

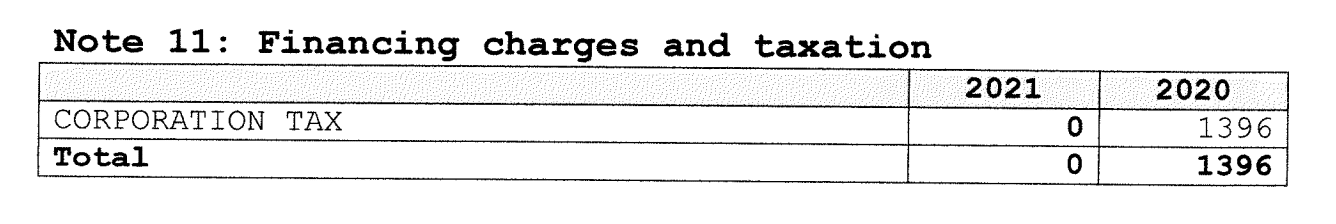

But no tax whatsoever was paid in 2021, and only a very small amount in 2020:

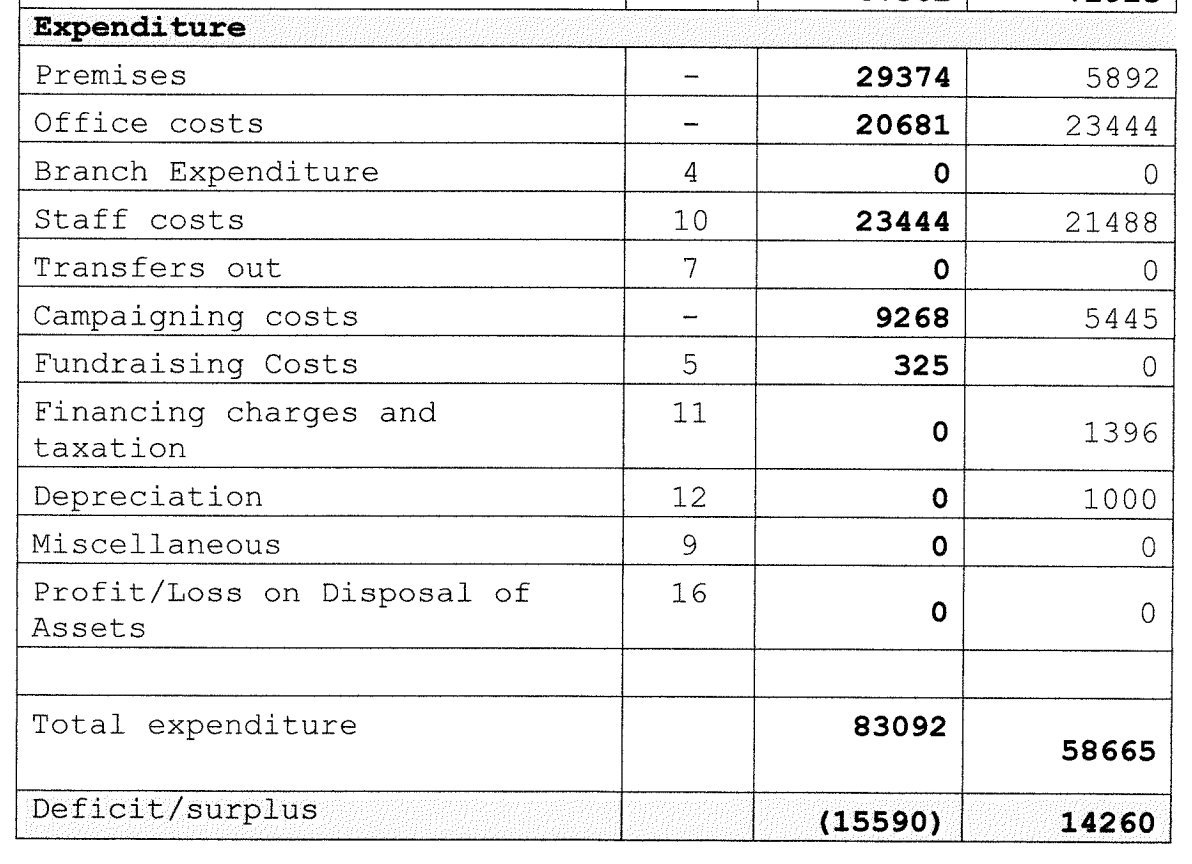

Those figures make no sense if we look at the expenditure:

It seems in 2020 they took the £57,061 of rental income and deducted almost all of their premises costs, office costs, and staff costs, leaving (they thought) £7,347 of profit – thus the £1,396 corporation tax payment. But they weren’t entitled to do this – only expenses incurred as part of their rental business should have been deductible – meaning a portion of the premises and office costs. It is not permitted to deduct political costs – meaning most of the staff costs, office costs, and the premises costs that don’t relate to the rented part of the premises.

Then in 2021 they had much higher premises costs for some reason, leaving them with a loss and (they thought) no corporation tax at all. But again, most of their expenses weren’t deductible.

Across the UK, these kind of errors amount to about £240,000 each year, including about £65,000 where the rent was paid by Parliamentary expenses. Of course that will be a much larger total number over time – well over £1m in total and £300k for the rent paid by Parliamentary expenses and untaxed by local parties.

In overall tax terms these figures are insignificant. It’s the principle that matters: our political parties should comply with tax law, particularly when they take a public stand about other people not paying tax.

And it’s only fair to add that some party branches seem to be paying too much tax. There are five local branches where the tax paid is precisely 19% of the gross rent, which implies zero expenses of any kind, and is unlikely to be correct:

Our methodology

We scraped the Electoral Commission website to download all the accounts for “accounting units” (the formal term for local parties).13

There were over six hundred14 – more than can easily be reviewed manually. So we initially used text recognition/searching to screen out accounts which clearly showed no rental income, and then used the Google Gemini AI/LLM15 to quickly review the hundreds of remaining accounts to identify cases where there was rental income but no tax.

The code we used for the scraping and analysis is on our GitHub.

There are limitations to this approach.

- Most importantly: LLMs make errors. We hand-checked a sample of the data, and we only identified one error, caused by an incorrect classification that was in part an error in the underlying account.16Since publication, readers have kindly identified two further errors, both now corrected.17 However we would caution anyone using our data to not make any assumptions about its accuracy without checking the relevant accounts by hand.

- We are dependent on accounts filed with the Electoral Commission by local parties. Local parties whose income and expenses are below £25,000 don’t have to file. So whilst there are over 2,000 local parties in the UK18, only 636 have filed accounts for 2021 or later years. Those 636 will logically be somewhat19 more likely to receive rental income than the others, but no more or less likely to properly file a corporation tax return. So there will be (at least) hundreds more local parties receiving untaxed rent who our analysis is unable to find.

- There are many local parties whose income is higher running up to an election (local or national), taking them over the £25,000 reporting threshold, and subsequently falls. So, for most of the local parties in our analysis, the most recent accounts are a few years old. We decided to use 2021 as a cut-off: accounts earlier than that were discarded.20 We expect the variable income is donations (from the central party, members, trade unions etc) and the rental income is largely unaffected by the electoral cycle. We therefore believe it’s reasonable to extrapolate our findings for other years.

- This means that many accounts are for local parties whose constituencies changed name, merged or disappeared in the 2023 boundary review. We only list the names of MPs where a constituency name was unchanged. However, in most cases those local parties have continued under the new name (but haven’t submitted accounts).

- Another complication: there are fewer “accounting units” than constituencies because many local parties span multiple constituencies or indeed entire regions.

- We’re not taking carried forward losses into account, because we have no way to do this. For small companies/associations, corporation tax profits can be fully sheltered by carried forward losses. However it’s not clear to us that a local party would ever have material losses from its property rental business.

Why aren’t they paying tax?

On the basis of the discussions we had with some of the local parties, we believe the most common reason is simply: they don’t understand that they should be filing and (in most cases) paying corporation tax. Most local parties are staffed by volunteers and it’s probably unrealistic to expect them to appreciate their corporation tax responsibilities. More blame should lie with the national parties, who should be ensuring their local affiliates understand their obligations.

Bob Egerton in the comments makes an intriguing suggestion. Between 2002 and 2006 there was a 0% “starting rate” of corporation tax, for profits under £10,000. So in 2002 most and perhaps all local parties ceased having any corporation tax liability. By the time the starting rate ended in 2006, the institutional memory of paying tax could have been lost.

We have received a few other answers from local parties as to why they haven’t paid tax. We don’t believe any are correct, but set them out here for completeness.

- Political parties don’t pay tax. That is incorrect. They absolutely should pay tax on rental income. Some people told us that rental income used exclusively for political purposes is exempt from income tax – that is also incorrect. Some local parties responded to us by citing section 989 of the Corporation Tax Act 2010, which is strange given that the exemption in section 989 relates to “agricultural societies”. This may be a consequence of people using ChatGPT, as it seems ChatGPT “hallucinates” a political exemption which does not in fact exist⚠️.

- The amounts are too small. But there’s no level of income below which you don’t have to pay corporation tax. Individuals have a “personal allowance“; companies and unincorporated associations don’t.

- This isn’t rent, it’s “reimbursement of office costs” (a term sometimes used in the accounts, particularly where the space is being rented to the local MP). However, it doesn’t matter how the term is described – if income is generated from property then it’s taxable, and a corporation tax return should be filed. And IPSA, the Parliamentary body which sets the rules on Parliamentary expenses, requires that an MP renting office space from a local party must pay market rent: not more and not less. So the MP will necessarily be paying more than a mere reimbursement of costs – we’re therefore not sure why this term is used.

- The rental activity isn’t profitable so there’s no tax. In most cases that is unlikely. Most local parties own their property outright, so they don’t have rental or funding expenses. By definition, any market rent will exceed other associated costs (electricity, internet, etc). It is conceptually possible that some of the rental businesses will be loss-marking (particularly if the rent is well below a market rate), but even a loss-making business has an obligation to notify HMRC and file a corporation tax return. And rent charged to the local MP is required to be a market rate. But in any event, none of the local parties giving us this justification had actually filed a tax return.

The response from the political parties

We wrote to the Labour, Conservative and Liberal Democrat parties asking for comment.

The Labour Party told us:

“We are reviewing the guidance we provide to Constituency Labour Parties about potential tax liabilities. We will work with both HMRC and the Electoral Commission to support CLPs and will help to coordinate any questions they have for CLPs.“

The Conservative Party told us:

“Central party guidance to local associations makes clear that some income may be liable to corporation tax. Local associations make payments which will depend on the circumstances of the case. Such qualifications may not be obvious from the accounts.“

The Liberal Democrats responded specifically to the Westmorland, Furness and Eden case:

“We’ve looked into the case you have highlighted and are confident no tax was owed. We would always expect local parties to comply with all the relevant rules and regulations and pay taxes where they are due.“

However it’s our understanding that neither Westmorland nor the other zero tax parties are filing corporation tax returns. We asked the Lib Dems if that was incorrect and received no response.

What should happen

The national political parties should remind local parties of their obligation to file a corporation tax return when they receive rental income (or other commercial income).

Local parties who receive rental income should immediately notify HMRC and file for their current and historic accounting periods.

There are statutory penalties for late filing, starting at £100 where a company/association misses the filing deadline, and rising to 10% of tax due. HMRC can raise “discovery assessments” to assess and collect historic tax. Where, as seems likely in these cases, the failure to pay tax is “careless”, HMRC is able to go back six years.21

Thanks to Sophie Barnes from the Telegraph – this story emerged from discussions regarding her story about MPs renting office space from their local associations🔒. Thanks to P and L for their expertise and experience in voluntary sector/unincorporated association taxation, to K for help with the coding, to M for their deep knowledge of local political parties, and to J for their insightful comments on a late draft.

Footnotes

Contrary to popular belief, tax avoidance is a small component of the tax gap. ↩︎

“Low tax paid” here means the tax paid is less than 15% of the rental income – that’s our rough estimate of what the typical tax result should be once expenses are taken into account. ↩︎

The differences that we see between parties are statistically insignificant given that (aside from the Conservative Associations) the number of local parties is relatively small. ↩︎

We analysed 630 accounts across all local parties (because that 630 had at least £25,000 of income or expenditure, and so were required to file accounts with the Electoral Commission). Of those, 258 local parties had rental income. All things being equal, we’d expect somewhere over 1/3 of those parties to have been successful in electing an MP. So we’d expect that 258 to represent over 86 MPs. We find 58 MPs who rent property. On that basis we believe it’s reasonable to conclude that the majority of local parties who rent out property and have a local MP rent at least some of the property to the MP. ↩︎

There are others. Lewisham West and Penge CLP‘s accounts show rental income, but the notes to the accounts are missing – so we can’t say if the rental income is coming from the MP. We don’t know if this was an error by that constituency Labour Party or by the Electoral Commission. And most MPs/constituencies are outside our data analysis because their constituency parties’ turnover was too small to require accounts to be filed. ↩︎

It would be understandable if the local party was itself renting the space, and so this was a sublet. There would then be a large expense (the local party’s own rental payments). But this isn’t happening. Possibly they’re deducting all their office expenses from the rental income, which isn’t permissible. ↩︎

Indeed its tax is 23% of rental income, higher than the small company statutory rate of 19%. That could be because the rent was higher in the previous year; corporation tax is due nine months after the end of the year, and most local parties’ accounts filed with the Electoral Commission are prepared on a cash basis not an accruals basis. ↩︎

The same is not necessarily true of the national parties. A 1981 House of Lords decision, Conservative and Unionist Central Office v Burrell, held that the national Conservative Party (at least at the time) was not an unincorporated association, because nobody could become a member of the Conservative Party directly (but, rather, became members of their local Conservative Association). ↩︎

These are required to be full accounts; much more detailed than a small company has to file with Companies House. ↩︎

Although in one respect gifts to political parties are favoured – they are “exempt transfers” and never subject to inheritance tax. Gifts to individuals are “potentially exempt transfers” and become subject to inheritance tax if the donor dies within seven years. There is also a specific VAT exemption for services provided by a political party to its members, although we are doubtful there are many such services in practice. ↩︎

A legal complication is that an unincorporated association cannot own real estate, or indeed any property. The property is always held by one or more individuals/companies as nominee/trustee for the unincorporated association. Usual practice for UK political parties is to have one entity which acts as a nominee or “bare trustee” for real estate held by the party itself and by local branches. Where this happens, the rental income remains the property of the local party, and so it’s the local party that is taxable and not the trustee. A recent exception will be the Reform Party, which is a company and so can hold property itself. ↩︎

Generally local parties won’t pay VAT, because they’re below the taxable threshold of £90,000 (for this purpose we look to the local party and not the national party). Even the single local party with rental income over £90,000 will only charge and account for VAT if the property has opted to be taxable (rather than the default option of land being VAT-exempt). ↩︎

It’s unfortunate this is necessary – it would be easier if the Electoral Commission made it easier to download accounts in bulk. ↩︎

This is a subset of the total number of local parties, because accounts are only required when income or expenses exceeds £25,000 – see below. ↩︎

We used Gemini rather than OpenAI/ChatGPT simply because Gemini is essentially free to use. ↩︎

A trade union donation was ambiguously classed as “income” in one local Labour Party’s accounts, and the LLM took that to mean it was rental income even though it was clearly from the context that it was a non-taxable donation. We manually corrected this. ↩︎

One was the Perth and North Perthshire SNP branch, where a rental expense was misclassified by the LLM as income. The other was the Bath and North East Somerset Lib Dem branch, where a clear reference to tax in the accounts was entirely missed by the LLM. Both errors are quite hard to explain, and add to our view that great care should be taken when using LLMs for tax/accounting matters. ↩︎

i.e. because there are 650 constituencies and most will have at least three active local parties) ↩︎

We say “somewhat” because rental income is, in all but a few cases, much smaller than £25,000. In the main it’s the amount of donation income which determines whether a local party is above/below the £25,000 threshold. This will be determined in particular by how marginal a constituency is. So the relationship between rental income and turnover is (we anticipate) not very strong. ↩︎

That doesn’t dramatically change the result; if we’d gone back to 2020 there would have been only six additional local parties included in the analysis. ↩︎

HMRC can go back twenty years when there’s been a deliberate failure to pay tax – we doubt that’s the case here. ↩︎

Leave a Reply