ZLX is the R&D tax firm notorious for suing a client who wasn’t willing to put in a comical R&D tax claim for installing a fridge. They’ve changed their name to TaxTek – but the game is the same: pretending to be tax specialists when actually hiring a large sales team and “technical specialists” with no qualifications or experience.

We would advise against anyone hiring TaxTek (not to be confused with TaxTek Cambridge, a longstanding reputable adviser). Even someone certain they have a genuine R&D tax claim should steer clear, not least because of the degree of HMRC scrutiny that any association with ZLX is likely to attract.

When a scandal hits a firm of tax advisers, it’s common for those involved to quietly start again under a new name. We’re launching an occasional series – “Same cowboys, new name” – to expose these rebrands.

You can hear the ZLX story in Untaxing, on BBC Sounds. Or you can read our full investigation into ZLX here.

Who was ZLX?

Last year, an R&D tax firm called ZLX became a laughing stock in the tax world. They’d advised a fruit and vegetable wholesaler that they could claim £30,000 in research and development tax relief on the installation of a fridge. When the wholesaler sensibly refused to proceed, ZLX sued them. A Scottish court ruled against ZLX in scathing terms, calling ZLX “comical”, their documents “concocted” and their attempted tax claim as “lacking any reasonable evidential or factual foundation”. When tax specialists discussed the ruling online, ZLX instructed lawyers to threaten them with defamation proceedings; when presented with the evidence of their client’s incompetence, the lawyers ceased acting.

Like other cowboy R&D firms, ZLX wasn’t staffed by tax, legal, or accounting specialists. The only previous experience of its “compliance team” and “technical team” was working in bars, warehouses and as a shop sales assistant. Combine this lack of knowledge and experience with a high pressure sales culture, and poor quality claims were inevitable.

So it was little surprise they’d push nonsense claims like the fridge, and this claim for a vegan doughnut recipe.

After the judgment was published, ZLX’s brand became toxic, both amongst clients and with HMRC (we expect that all R&D claims by ZLX became the subject of detailed HMRC scrutiny).

One response would have been for ZLX to build expertise and become a normal firm providing high quality advice. Another would be for ZLX to conclude they couldn’t do that, and cease operations.

ZLX did something different.

What is TaxTek?

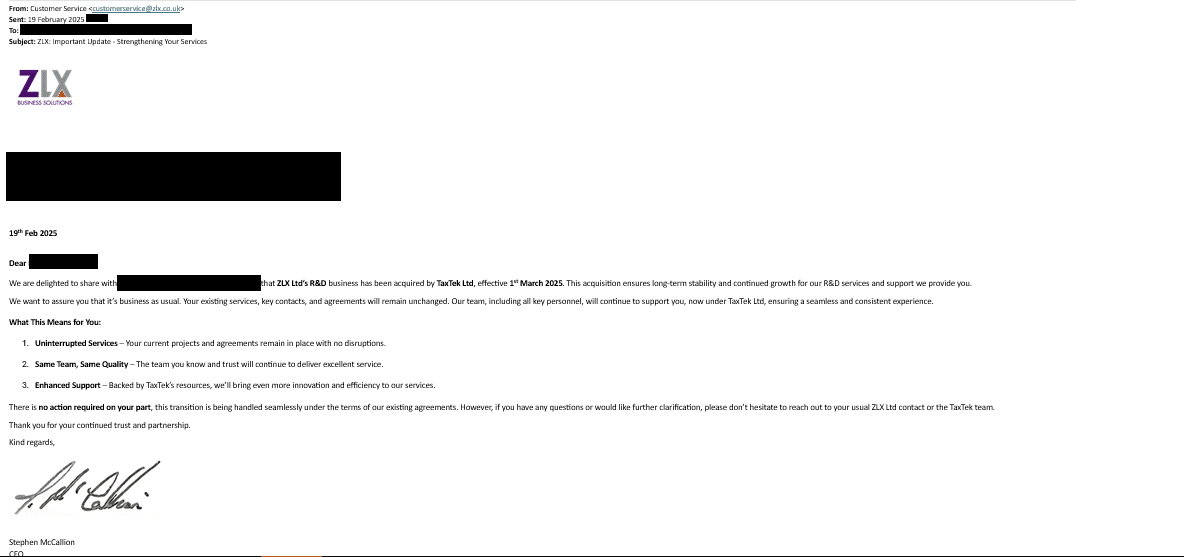

In March 2025, ZLX sold its business to a new company – TaxTek:

Their website is here. The company has no connection with TaxTek Cambridge, a long-established and reputable tax consultancy.

On the face of its Companies House entry, TaxTek’s directors are Kelly Davidson and Colin Barr and it is majority owned by Ms Davidson. The company was incorporated in 2020 and was dormant until late 2024. There’s no obvious connection with ZLX.

But Kelly Davidson married Stephen McCallion in 2023. Ms Davidson has no prior involvement in R&D that we are aware of.

How legitimate a business is TaxTek?

Aside from the connection to ZLX, TaxTek’s website raises some red flags:

- The website content consists of generic text and stock photos.

- No management or staff are identified. That is unusual for an advisory business – clients are usually looking for a trusted adviser they can personally identify.

- No telephone number is given. Again, unusual for an advisory business.

- The address isn’t prominent but is listed. It’s 184 square foot of rented office space, listed as suitable for one or two people🔒.

- It’s a legal requirement for a company’s website to display its legal name. TaxTek doesn’t do this – you won’t see “TaxTek Limited” written anywhere. Strictly that’s a criminal offence. More practically, it’s a sign of a company with poor legal/compliance controls – understandable for many small businesses, but not so forgivable for a company whose business is legal compliance.

- The page on R&D tax credits gives no indication of what “R&D actually means”, or what kind of expenditure qualifies.

- The list of “industries” is peculiar. How can “electronic repair”, “heating system design” or “waste management” qualify for R&D tax relief? Why list “specialist power lifts”?

How much expertise does TaxTek have?

None that we can find.

The two directors of TaxTek appear to have zero R&D expertise. We can find no evidence of Ms Davidson being involved in R&D tax before now. She was briefly a director of a company owned by Stephen McCallion called Conticloud. Despite numerous changes of owner and directors it always filed as a dormant company.

The R&D experience of Mr. Barr, the MD, appears limited to a sales role.

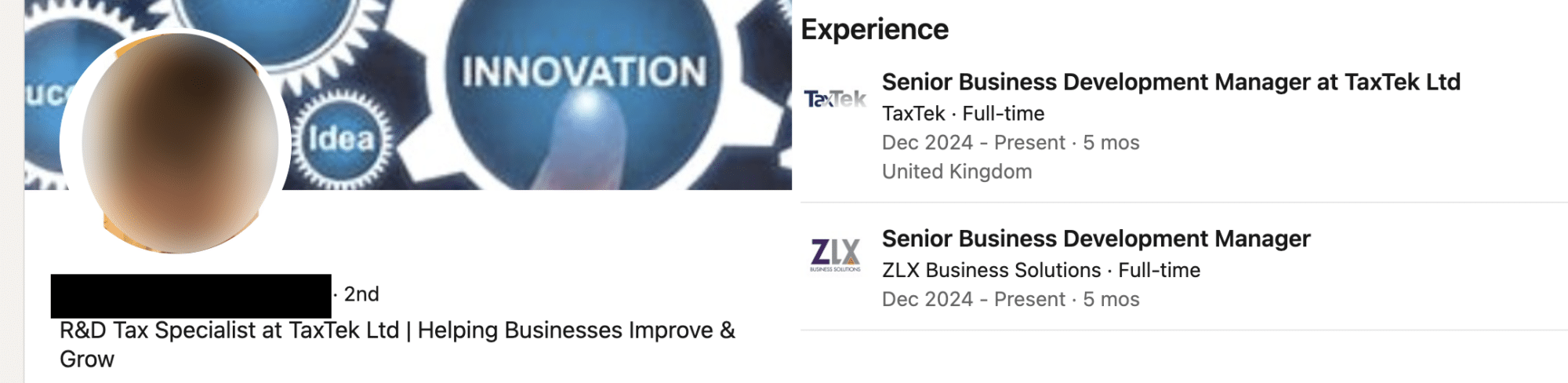

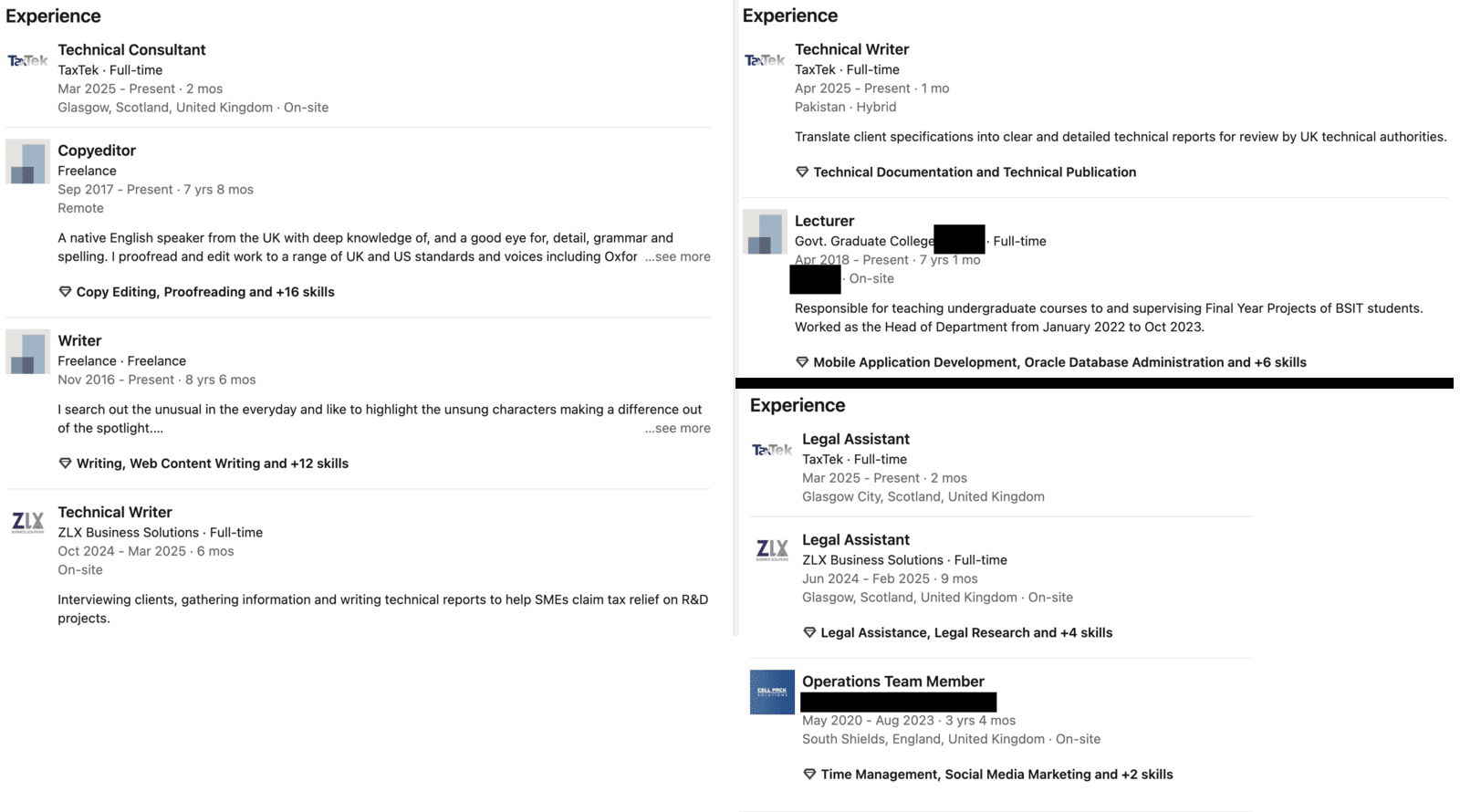

That might not matter if they had assembled a team of experts. But a search on LinkedIn for TaxTek’s employees reveals they’re just playing the same game as ZLX and other cowboy R&D advisers – a team focused on sales with zero expertise.

“R&D tax specialists” who are just sales people:

“Legal assistants” with no qualifications, “Technical consultants” with no technical, legal, tax or accounting experience or qualifications. Plus one “technical writer” whose technical experience has been working as a lecturer in Pakistan (where he continues to work full-time):

The other staff are all in sales or finance roles.

TaxTek offer other tax services, including capital allowances, where they say “All of our services are handled in-house, meaning no outsourcing—everything is managed by our expert team.” We can’t identify any expertise that would enable them to do this.

TaxTek’s response

We wrote to TaxTek seeking comment for this article. They didn’t respond.

This article is jointly written with Paul Rosser, who first revealed the link between ZLX and TaxTek.

Thanks to B on Bluesky for identifying the 18 square foot office space used by TaxTek.

Leave a Reply to David Jarrett Cancel reply