UK company law requires every UK company to disclose the individuals who control it – their “person with significant control” (PSC). But the rules are widely ignored. We’ve found that around 50,0001 UK companies hide their true ownership by unlawfully listing a foreign company as their PSC – that’s not permitted. And we’re publishing an interactive map showing all 50,000.

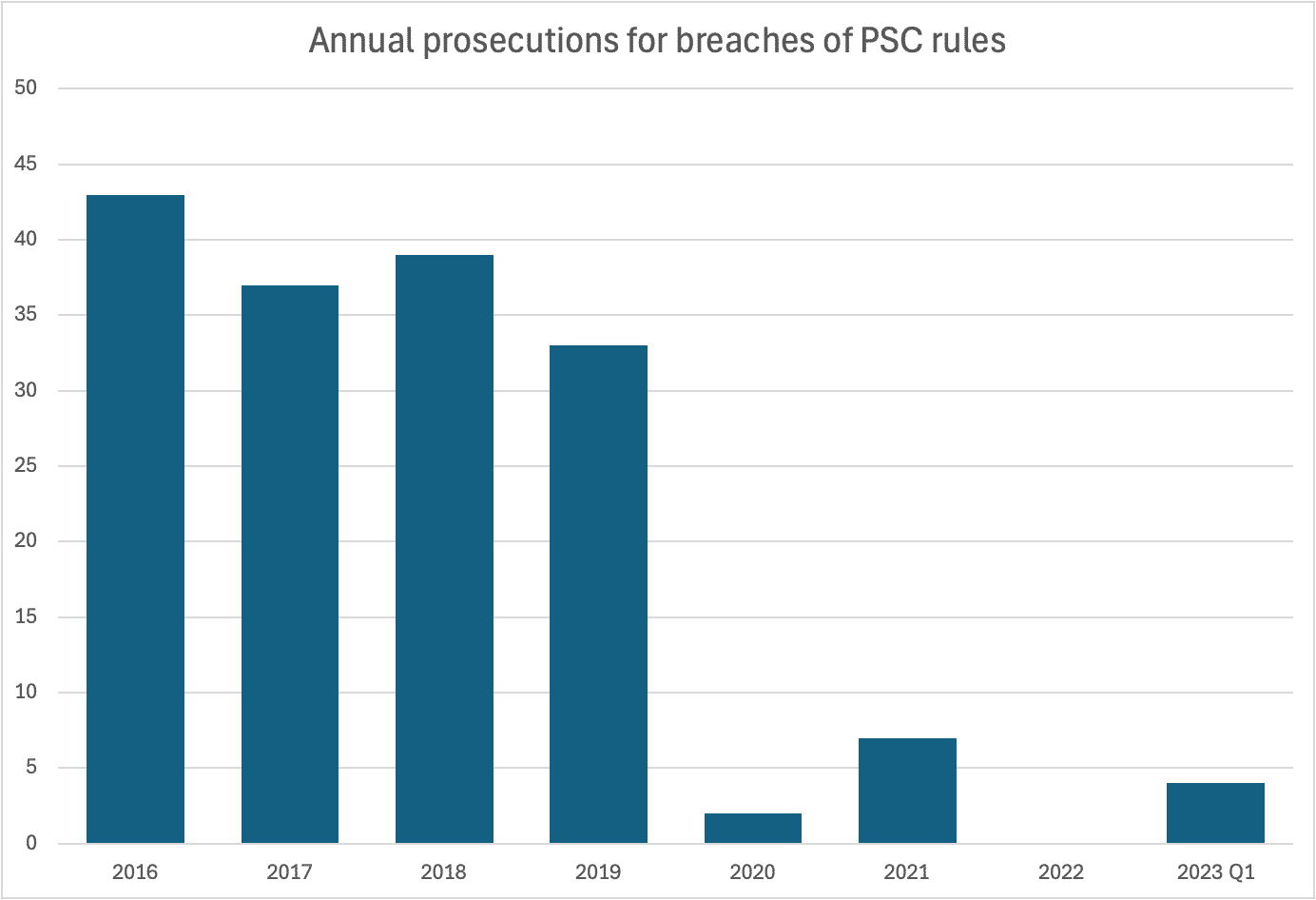

Companies House initially enforced the PSC rules with prosecutions – there were 43 in 2016. But prosecutions dwindled over time, with none at all in 2022, and only four in the first quarter of 2023.

You can jump straight to the interactive map here, but please do read the limitations and caveats below – the map provides an accurate overall picture, but no conclusions should be drawn about an individual company without a manual review to check the position carefully.

UPDATED 24 March; significant updates – view the UK companies on the map, show links between companies, much better UI, more refined scope (excluding worldwide listed companies).

The PSC rules

Historically, Companies House showed who the shareholders of a company were, but stopped there. So if, for example, a company was owned by a tax haven holding company, you wouldn’t be able to ever find out who the ultimate shareholder was.

This all changed in 2016 – rules were put in place requiring companies to identify their “persons with significant control” – meaning the actual humans who were able to tell the company what to do.2 Normally this would be the ultimate shareholder – but sometimes there would be someone who wasn’t a shareholder, but who nevertheless could ensure that the company always adopted the activities they desired. They too would be a “person with significant control”.

So, let’s say a secretive oligarch establishes a UK company with some local directors. The shares in the company are held by a Panamanian company, and that in turn is held by the oligarch’s personal chef. Pre-2016, any Companies House search stopped dead in Panama. But today, the company should register the oligarch (not the Panamanian company, and not the chef) as the “person with significant control”.

And that’s the whole point of the rules – to enhance corporate transparency and help stop the abuse of companies for nefarious purposes.

How are the rules ignored?

Some people, like Douglas Barrowman, arrange for their companies to report a false PSC – often an employee (i.e. analogous to the personal chef in the oligarch example).

Others simply fail to file a PSC at all.

But a common approach – sometimes an error, sometimes intentional, is to file a foreign company as the PSC. So, in the oligarch example, the Panama company would be listed as the PSC. This, however, clearly isn’t permitted. The PSC has to be an actual living breathing person. Listing a foreign company as a PSC breaks the whole purpose of the rules – that we should be able to find out who really owns a company.

There are a few exceptions:

- UK companies – they can be listed as a PSC… the idea is that you can then check the PSC for that company.

- Companies which are widely held, so that no one person has more than 25% of the shares or voting rights in the company.

- Companies listed on a stock exchange/regulated market.

There is a useful summary of the rules from law firm Clifford Chance LLP.

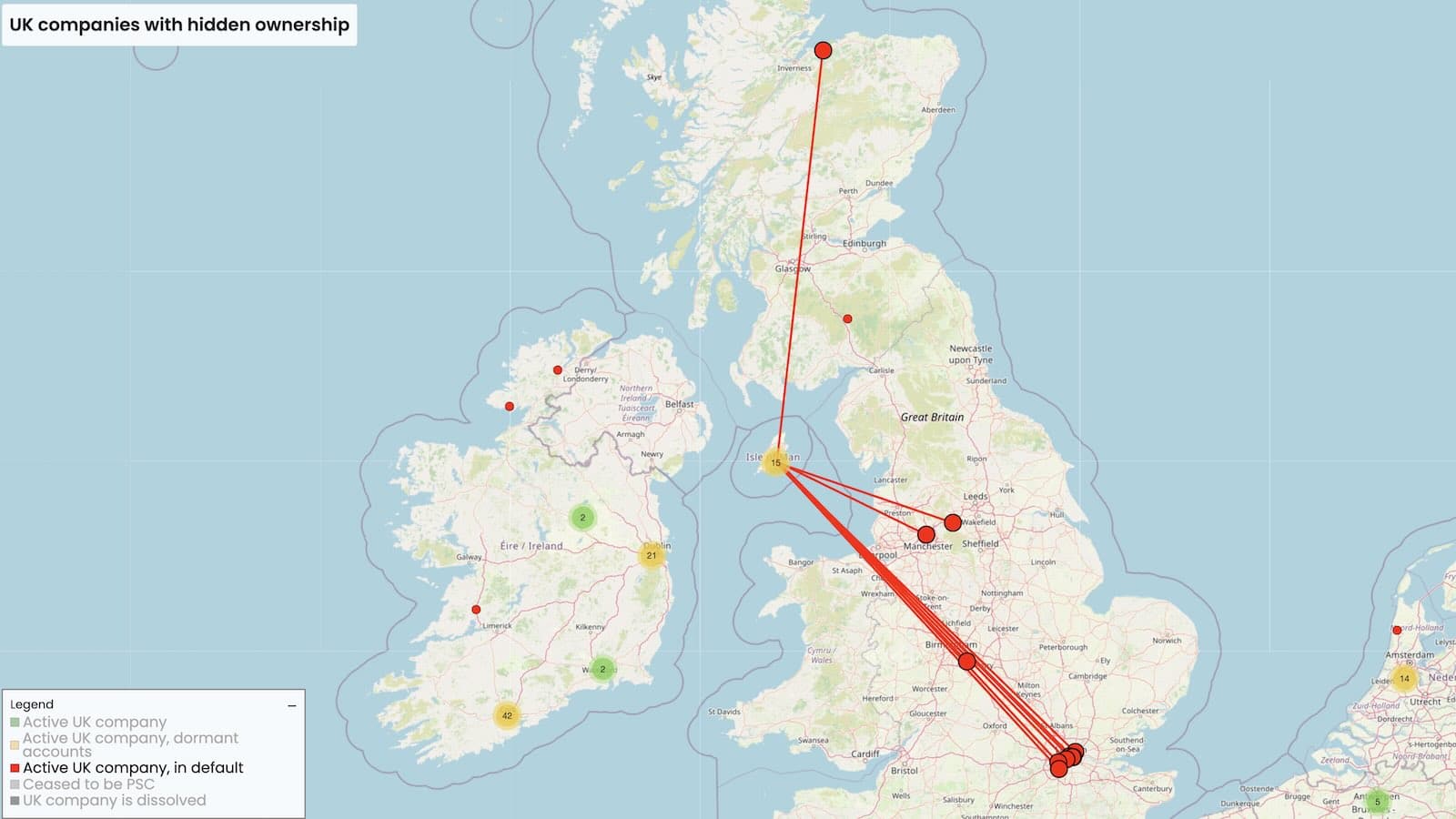

The map

Our map shows all the location of all the foreign companies that are listed as PSCs, hiding the true ownership of a UK company.

There are about 50,000. Not all will be illegitimate – we discuss the limitations of our approach below. However we believe the vast majority are breaking the law.

Each dot is a PSC for a UK company. The dot is:

- Green where the UK company is an active company

- Orange where the UK company files dormant accounts (in most cases it will really be dormant, but many fraudulent companies file as dormant to avoid scrutiny)

- Red where the UK company is listed by Companies House as being in default in some way – either it failed to file its accounts, mail sent to its registered office is being returned, or its registered office is being disputed (i.e. it is “squatting” at someone else’s address – often a sign of fraud).

- Grey where the foreign company has ceased to be a PSC. This could be because they realised their error and corrected the register.

- Black where the UK company is dissolved.3

Click on a company/dot to show its details.

Click on the coloured dots in the legend to enable/disable the different categories – when the map loads, dissolved companies and former PSCs are not initially shown, but you can click on them and change that. Or, for example, you can deselect the green and orange dots, and just show the red – companies which may be in default.

Search for companies using the search window at the top right. The code will search through both UK and foreign companies, and show you all the PSCs matching your text. Click on one and the map will jump straight to it.

Click “share” to generate a link that will take others to the company you’ve identified – it saves location and popup state.

You can view a full screen version here (previously we embedded the map on this page, but a number of people said that wasn’t working very well).

Note that the app runs locally on your device, so any searches you make are only visible to you.4

An example

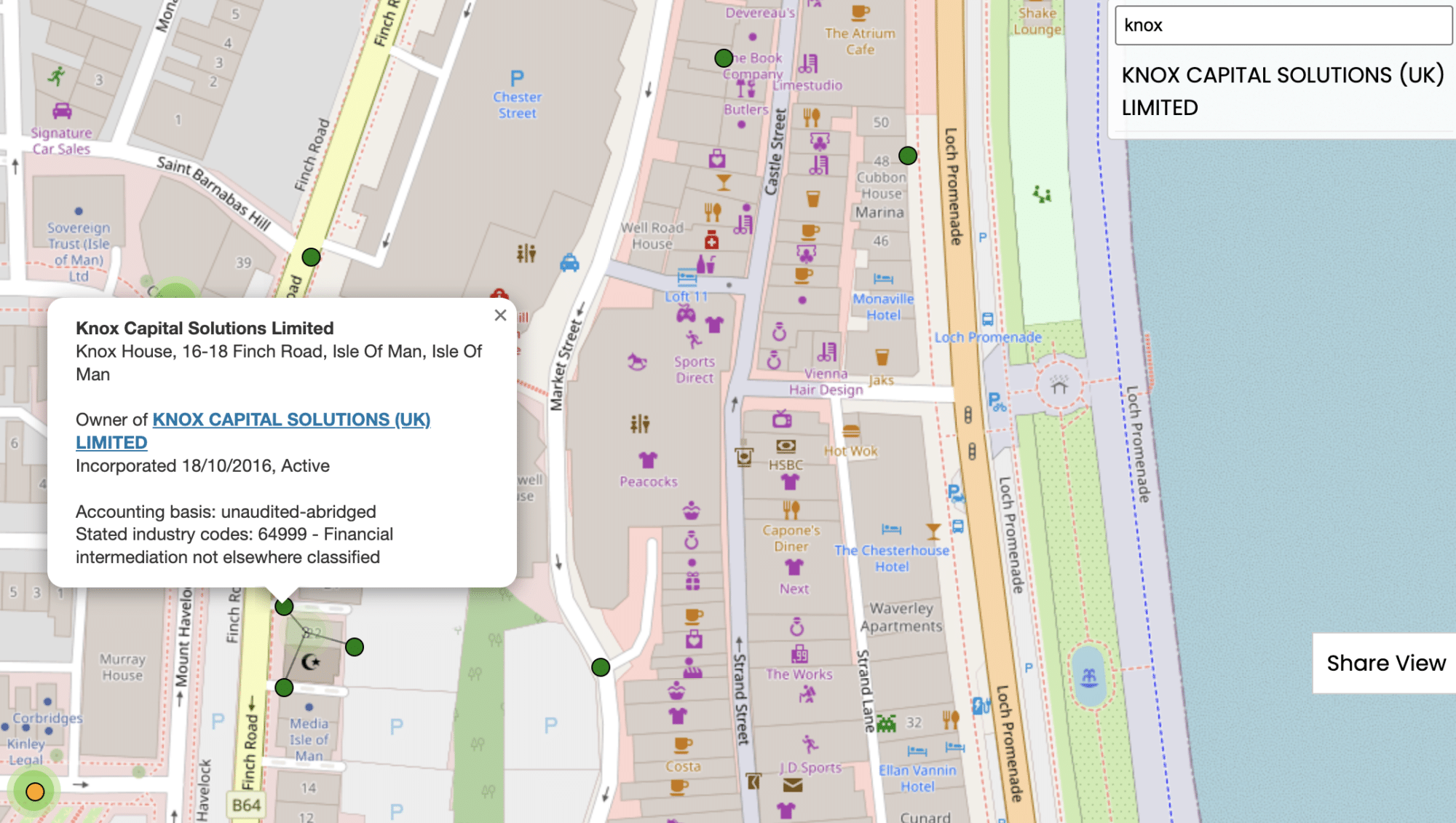

Douglas Barrowman has a reputation for hiding the ownership of his companies. His most well-known business is the “Knox” group. So let’s search for Knox (this link replicates my search):

Sure enough, Knox Capital Solutions (UK) Limited is listing an Isle of Man company as its PSC. We can’t see any lawful basis for this.

What are the limitations of the map?

To create the map we analysed Companies House PSC data to find all the PSCs that are foreign companies. We excluded listed companies5 and US stock exchanges. There’s no obvious source for global listed companies – we ended up using this.6 We then geolocated each PSC and UK company.

This is an imperfect approach:

- Companies list their addresses in many different ways; often they make mistakes (typos like “Enlgand”). We tried to deal with this, but weren’t completely successful. So we have accidentally included some UK PSCs which are not breaking the law; they just didn’t enter their address correctly. That’s why you see a handful of PSCs on the map in the UK.

- Whilst we’ve tried to exclude listed companies, the process is imperfect and some will have slipped through, e.g. because of differences in spelling between different lists, or because the named PSC is not itself the listed company.

- A company that’s widely held (with no person holding 25%) has no PSC. Some widely held UK companies incorrectly show their immediate foreign holding company – there is nothing untoward going on here, but they will show up on this map when they really shouldn’t. So, for example, the US company Chatham Financial Corporation is shown as the PSC for Chatham Financial Europe, Ltd. Chatham is employee owned – nobody has 25% ownership – and so the PSC entry should expressly say that there is no PSC. Hence Chatham’s entry is technically wrong, but clearly not a case where someone is hiding ownership… it doesn’t really deserve to be on the map.

- The map includes dissolved UK companies. That is intentional, because people shouldn’t be able to walk away from a company and leave breaches of company law unfixed (although, rather unsatisfactorily, there is no way to correct entries for dissolved companies, and Companies House currently makes no effort to correct them). But dissolved companies, and former PSCs, are switched off when the map loads – you can enable them by clicking on the legend.7

- The geolocation won’t always be accurate, particularly when (as is often the case) companies provide incomplete or incorrect addresses.

- With this large number of companies there’s no possibility for reviewing the entries manually – so it’s all dependent on the code, and that can easily make mistakes. Nobody should make any firm conclusion about any individual company listed without checking it out carefully.

However the vast majority of the 50,000 companies on the map don’t fall in any of these categories.

Are criminal offences being committed?

We should be forgiving in many cases. Companies House lets companies submit any old nonsense in their PSC filings. Many people just don’t understand the rules. The Companies House systems should pop up a warning if a company tries to enter a foreign company as the PSC.8

Nevertheless, most of the dots on the map represent a criminal offence. There’s a specific requirement that, where someone knows they control a company, but they haven’t received a notice from the company requiring them to provide information, then they have to tell the company that they do in fact control it. If they don’t do this, then they commit an offence – with up to two years’ imprisonment, and an unlimited fine.

There is also a general offence of filing false documents with Companies House; if the documents were filed recklessly or intentionally then it’s punishable by up to two years in jail.

We wouldn’t suggest that there should be 50,000 prosecutions, or even 1,000 – but the most serious cases, involving either actual fraud or substantial companies (who should know better) should not just be ignored.

One serious problem: these rules, like all UK company law, are essentially unenforceable against foreign directors. That should change. We should require companies with no UK directors to appoint a UK law firm or other regulated professional as their agent, responsible for their filings.

How many PSC breaches are prosecuted?

Almost none. We obtained data from the Crown Prosecution Service showing prosecutions for breaches of the PSC rules from 2016, the year the rules came into force:

The full FOIA response is here. We have written to request updated data.

The code

The underlying data, html, javascript and css files that create the webapp are all licensed under the usual Creative Commons BY-SA 4.0 licence (unless it says otherwise). In short, you may freely use any of this for any purpose, and adapt it how you wish, provided you attribute it to Tax Policy Associates Ltd.

The scripts that generated the data can be found on our GitHub.

Many thanks to J for the original idea, P for help with javascript, and R and A for feedback. Thanks most of all to the authors of the javascript libraries that power our map: jQuery, Leaflet and LZ-String.

Footnotes

The original version of the map showed 65,000. We’ve since refined the approach and excluded companies that we believe are likely to be compliant; that reduces the number to 50,000. ↩︎

The legislation starts here, and is fairly easy to read – there’s also useful (statutory) guidance ↩︎

This wasn’t in the first version for technical reasons; we’ve now added it. ↩︎

The app does save a cookie so you only see the tutorial once, but does nothing else with it. ↩︎

It’s easy to find all the companies listed on the UK stock exchange. An important point we missed in the original map is that some UK companies are owned by foreign companies which are listed on a UK stock exchange. This isn’t a small effect – there are about 600. They were wrongly included in our original map and are now excluded. Our apologies. ↩︎

Some of these won’t be on regulated exchanges, but as a practical matter we think that the great majority will be widely held in any event. ↩︎

Thanks to those who suggested this approach ↩︎

Perhaps along the lines of “you should not do this unless you have obtained legal advice. The consequences of getting this wrong could include prosecution. Type ‘I understand and accept this’ to continue.” ↩︎

25 responses to “Our webapp shows 50,000 UK companies hide their true ownership”

You must surely be aware that all Isle of Man companies require to have their beneficial ownership declared and registered with the relevant Isle of Man Government department.

There is no anonymity of ownership permitted.

Almost all developed countries now have registers of beneficial ownership of this type, where access is available to local law enforcement and regulators, but not to the public. But as far as the rest of the world is concerned, Isle of Man companies’ ownership is a black hole. Even for HMRC and other tax authorities it is not straightforward to obtain beneficial ownership information. For banks conducting AML, journalists and others, it’s impossible.

But the point of this article is that UK company law doesn’t permit anonymous ownership of UK companies, whether via entities in the IoM or Timbuktu. Those who register an IoM company as the beneficial owner are committing a criminal offence.

The lack of prosecution action will be a funding issue. Dan, do you have any thoughts about how the law could be enforced without reference to expensive Court process?

it can’t. It’s an investment: fund a few high profile prosecutions now, reap the benefit later.

just looking on the Isle of Man and found it interesting that one is located on REDACTED BY DAN. that is owned by a family member and very much doubt he would be into this? way that someone can log a company to a place without owners knowledge?

it’s possible! Could be fraud; but he could also have just misunderstood the rules

(I redacted the address to protect the family member, in case it is nothing to do with him.)

This is interesting. Can this be licenced for other jurisdictions also?

it’s open source – anyone can use the code provided they attribute to Tax Policy Associates Ltd

Great work. Isn’t there a huge opportunity for AI to synthesise the data; scour the internet for all info relating to all 65k companies to find out who represents them, who their lawyers are, what their activities are, likely turnover etc. Produce a list of commonalities (eg lawyers, owners) prioritise this needing attention and fire off letters. This exercise is tailor made for AI. Outsource to AI specialists if necessary.

We’ve gently experimented with this and found it’s hard. The AI either wrongly identifies innocent structures as suspicious or misses actual bad stuff. Perhaps because there’s nothing in the training data that differentiates between such cases? One could construct a good set of data and fine tune an LLM but that would be hard – it may be that there are some people (audit firms!) who have the data to do this, and they may well be already doing it… but naturally only for their internal use.

Great work as always. It is clearly a “political” decision either taken within Companies or the CPS or government not to enforce this law more strictly. If you can find 65,000 lawbreakers, Companies House could find them just as easily and could, if they were so-minded, impose automatic penalties or could issue a striking-off notice on the company for non-compliance. You have detailed how HMRC imposes automatic fines on people who fail to submit a self assessment return on time even if they don’t owe any tax. Levying fines or penalty payments to have a striking off notice withdrawn could raise far more money than it would cost to have a robust system. But, of course, this government, like its predecessors, likes to promote light touch regulation as being good for the economy. And that seems to include letting crooks register companies with virtually no checks on them.

This is great work. Is there a way to search for the UK company name here? I’m not finding a way to search by name when I know the name of either the UK company or PSC, and can’t click on every dot.

will work on that!

Dan

This is valuable mapping, but your analysis and editorial line is imperfect.

As a company secretary, I’ve spent a LOT of time since 2016 dealing with PSC misconceptions and correcting errors. This has included correcting errors by lawyers at big law firms (to remain nameless).

Anecdotally, many overseas parent companies and their advisors genuinely don’t realise that they can’t be registered as PSCs until this is pointed out to them by someone like yours truly. It doesn’t help that Companies House’s own systems allow unlisted overseas companies to be registered as PSCs (despite this being illegal).

It’s therefore not just about Companies House getting better at prosecutions – they need to rework their IT and review procedures so that anyone filing a PSC02 is either forced to enter a UK company’s details or those of a listed company from one of the relevant stock exchanges. No other options given. All filings should also be reviewed by a human and rejected if they don’t meet requirements. That in itself will help even before getting into prosecutions.

Nitpicking on two of your examples:

“There was also no way to exclude widely held companies. So, for example, the US company Chatham Financial Corporation is shown as the PSC for Chatham Financial Europe, Ltd. That is correct, because Chatham is employee owned – nobody has 25% ownership.”

No, this is wrong analysis (I checked the filing). The US company can only be correctly registered as PSC if it genuinely meets one of the PSC conditions AND is listed on a recognised stock exchange. If nobody truly has over 25% ownership, there is a separate statement to register stating the company has ‘no registrable PSCs’. Again, a common misconception at play.

“The list includes dissolved companies – that is intentional, because people shouldn’t be able to walk away from a company and leave breaches of company law unfixed.” True but also unfair as there no practical way of fixing that breach without restoring the company. Companies House will not accept filings against a dissolved company. I imagine there are many dissolved companies out there who genuinely made the wrong PSC statement in error pre-dissolution, with no evil intent.

Thanks – really useful comments. You are of course correct on the widely held point – I’ve corrected it. We should also show dissolved companies differently – will work on that. And I do think Companies House should insist that correct PSC entries are made for dissolved companies (and, for that matter, that overdue accounts are still filed).

Also agreed that the Companies House website shouldn’t just let you submit a foreign company without flashing a big warning that in almost all cases this will be incorrect and unlawful.

You’re welcome – correction noted!

And sorry for sounding grumpy. PSCs are a sore point/nightmare for CoSecs. There’s plenty of errors and GIGO (Garbage In Garbage Out) in this area – not just the failures mapped in your article.

Is there any spce for GLEIs?

Dan, as I’ve noted before, perhaps the mother country could choose to learn from their overseas territories rather than (often) paternalistically castigate them.

Cayman, so often “bashed” any time the media talk about nefarious dealings of this sort, has c120,000 registered companies.

However, despite that large number of entities, Cayman only represent 716, or 1.1%, of the 65,000 companies on your global list. Given that the vast majority of entities registered in Cayman are, in fact, related to global companies, many of which are listed, I would imagine that this takes that number of 716 down to a very low number indeed.

You also note the vanishingly small amount of companies in the UK that are prosecuted for this. Compare and contrast to the rigorous regulatory regime in Cayman.

As a Caymanian, then, I’d love for the UK to shift their conversations with Cayman to “how can we learn from you” rather than “do what you are told”.

Well said.

on a quick scan, most of the Cayman companies aren’t global listed companies – they’re just non-compliant/fake PSCs…

Companies House is a disgrace. Why does Govt not increase the cost of company registration to fund proper investigation and sanctions against these miscreants?

They have. On 1 May 2024.

The map is picking up former PSCs as well as current ones. So there are number of examples of UK companies that appear to be currently compliant but were (seemingly) not at some point in the past. It seems somewhat unfair to castigate those who now appear to have now got their houses in order…

that’s a fair point – should probably put those in a different colour to show they are former PSCs

Please do (and see my longer comment!)

Up until 4 March 2024 (and possibly even after), it would have been impossible to remove a wrong PSC filing without a court order. So the practical solution in most cases was to terminate the wrong entry from the date of registration, meaning they will still show up as former PSCs in your analysis.

Really not fair to castigate those companies who have done their best to put things right.