Anyone can set up a company on Companies House, and say it’s a bank. We’ve written an automated tool that smokes them out. In three minutes, it identified sixteen “banks” with fake assets.

Today we’re publishing our analysis of the sixteen fake banks, together with full instructions on how to use our tool to find companies with fake accounts.

The trick here is a simple one: you need permission from the Financial Conduct Authority to have the word “bank” in your company’s name, but you don’t need permission to categorise the company as a bank on Companies House.

And fraudsters are taking advantage of this “trick” – creating companies, categorising them as “banks”, and filing fake balance sheets that make the companies look hugely valuable.

These aren’t just accounting anomalies. Fake banks can be used to launder illicit funds, deceive investors, and give credibility to fraudulent schemes. We have evidence that some of the firms we’ve identified have done just that; the likelihood is that others are doing it as well – they just haven’t been caught yet.

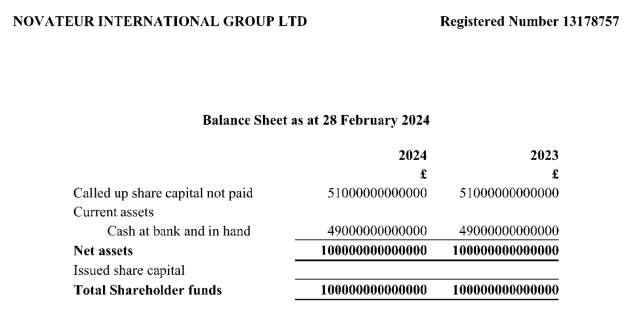

This follows our previous reports: the fake £59bn balance sheet of Avis Capital Limited, and fake venture capital companies including the UK’s largest (and fakest) company, the £100 trillion Novateur International Ltd.

Finding fake banks

Our search tool is conceptually simple. It searches for companies by their standard industrial classification (“SIC”) code, and then looks for anomalously large balance sheets.

We’ve made the tool freely available here, with full installation and usage instructions. You will need some command line experience, and a reasonably powerful PC.

In this video, the tool is used to find companies who categorise themselves as “banks”, have large balance sheets, but aren’t FCA-regulated. That ought to be impossible. Turns out, it isn’t:

And here’s the output from that session. Sixteen companies who list themselves as a “bank” or “central bank” but aren’t FCA regulated, and claim to hold £10m in cash, or have other balance sheet items over £100m.

(You can view the table fullscreen here or download here.)

The fake banks we found

1. Islamic World Economic Cooperation Organization Ltd1

The company claims to have £499.5bn of cash in the bank, which would make it three times as valuable as AstraZeneca. It says its activities include central banking, banking, being an open-ended investment company and being a fund manager. There’s an active proposal to strike it off. It claims to be controlled by a Professor Ali Ehteshami, who lives in Iran.

Ehteshami seems to exist, but isn’t a professor – he has a business selling fake degrees in Iran, as part of which he makes an array of patently false claims about his background. Ehteshami sold the degrees from a “college” that was a UK company, until the company was dissolved last year.

It’s unclear what the purpose of the “Islamic World Economic Cooperation Organisation” is, but it certainly doesn’t own $499.5bn.

2 and 3. Avis Capital Ltd and Avis Global Green Energy Fund.

As discussed in our recent report, these seem to be part of an international fraud.

This claims to be a bank and a central bank. It files accounts as a dormant company with £9.2bn of cash in the bank and £80bn of unpaid share capital. Its website says it is “a UK group SPV registered legally within the United Kingdom with HMRC for gold transactions under Central Banking Registration Number 64110”. There is, of course, no such registration.

This looks very much like a scam.

The company claims in its accounts to have had £648m of liquid assets, mostly in German government bonds which it acquired in exchange for shares in 2022. But if that was true, there would be balance sheet changes reflecting the return on the bonds. The company would have income, and it would have to be audited.

The sole director is an Italian, Damiano de Iuliis. The company is said to be owned by an Italian, Ciro Liccardi, but most of the shares in the company are said to be held by “D&G International Law Firm Sh.p.k.”. We’re not sure it exists (the letters at the end are the initials for an Albanian LLC).

We can’t see evidence of the company’s existence outside the Companies House filings, but the peculiar list of shareholders suggests there is something untoward going on.

Note that this is one of the more uncommon “fake account” companies that doesn’t file accounts as a dormant company. That feels sensible if you want to fool people – filing “dormant” accounts might raise questions.

Its website and LinkedIn and Facebook pages say it’s a “leading investment banking company” and is regulated. It has the credible address of 40 Bank Street in Canary Wharf.

But the company is entirely unregulated, and has for five years filed accounts showing that it’s dormant but somehow nevertheless holds £100m in the bank (on which it receives no income).

The company is owned by a Pakistani “investment expert”, Dr Hassan Khan, who claims to have personally funded the £100m. There are a number of other UK directors, but we would query if they actually exist.

This has every sign of being an investment fraud.

7. Terra Nova Holding Group Ltd

The accounts claim the company is sitting on £95m cash, although there’s no sign of any income. It filed only one set of accounts in four years.

There are a number of businesses called “Terra Nova”, most of which appear legitimate, and none of which trace to this company – so the purpose of the company is unclear.

Its accounts for 2020 and 2021 showed £80m of fixed assets. In the 2022 accounts this magically changed to £80m of cash, retrospectively rewriting the 2021 accounts.

The company’s registered office was originally 20-22 Wenlock Road, London, a well-known virtual office address. This apparently wasn’t authorised, so last year Companies House used its new powers to change the registered address to the default address of Companies House itself. The company promptly changed it back to 20-22 Wenlock Road, London. And did this twice, for some reason.

The company has one director – Dr Adalberto Caccavelli, an Italian living in France. Mr Caccavelli owns the company, and is also company secretary, but there are two additional current company secretaries, something that our team has never seen before.

Again, it’s not clear what the purpose of the company is.

9. EULERM Ltd

This is, according to its website⚠️, the global market leader in credit insurance. Our contacts in that market have never heard of it.

The company seems more than a vanity website/plaything, because in 2020 it applied for and obtained a Legal Entity Identification Number – something that’s required for a company to enter into regulated transactions.

EULERM Ltd was incorporated in 2020 by a Cuban resident, Imara Frometa Matos, who claimed to pay EUR72m for her shares. The 2021 accounts claimed the company was just sitting on the cash. It was still sitting on the cash in 2022, according to the accounts, but had magically changed to sterling – £72m.

We assume this is a scam of some kind.

10. Ban Credit Ltd

This is a dormant company whose accounts claims it’s had £30m of cash in the bank for every year since 2011. No interest, no expenses. It has one director, Ihor Karpau, a Belarusian resident in the UK, and one owner, Alena Khaletskaya, also a Belarusian resident in the UK.

We can find no other trace of this company.

11. GB Morgan Ltd

According to its website, GB Morgan “was established in 2018 as a result of co-operation and merging in between a group of companies and field expertise as a new era of digital offshore investment banking, money markets, FX and cryptocurrencies investment”.

In reality, it’s a dormant company established in 2020 with (supposedly) $10m of cash, which has just been sitting in the bank ever since. Its most recent accounts show $26.5m of cash, and no other balance sheet items.

The similarity of the company’s name to JPMorgan may not be an accident.

The company’s sole director and owner is Ismail Shaikhoun, an Egyptian living in Turkey who says he’s an “arbitration counsellor”.

Rather brilliantly, the company’s majority shareholder is itself, which is unlawful.2

The website’s certificate is invalid, so – if this is a fraud – it may have ended, or have been aborted.

The company claims to be a “central bank”.

It was incorporated with £2 of shares. It issued 12 million unpaid shares in 2011, and properly accounted for them as not paid for the next few years. Then, from 2015, it started accounting for the £12m as if it was actual cash in the bank. The company has always been dormant, and given the lack of any balance sheet changes, the company is most unlikely to actually have £12m cash.

We don’t know if this is an accounting error or fraud. But one thing is clear: Goldbank UK Limited is not a central bank.

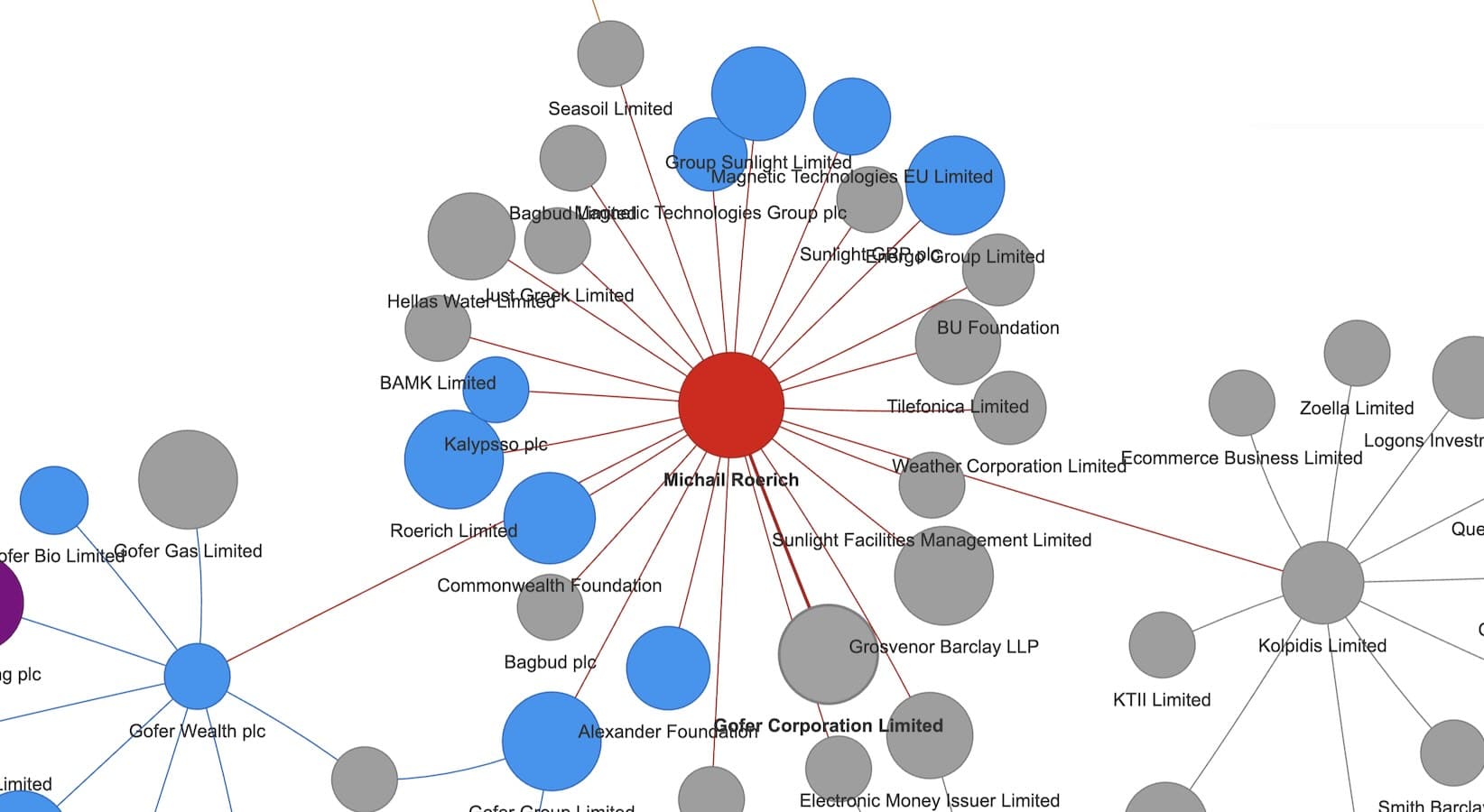

This one is more complicated and, if it’s a fraud, is a much more sophisticated effort.

1 Stallion Ltd doesn’t file as dormant – in fact it’s filed audited accounts showing £4bn of assets, a £12.5bn turnover and offices on four continents. Its registered office is in a terraced house in Bolton, and its website⚠️ is very basic, and under construction. 34

The accounts have the surface appearance of normal audited accounts. But they contain numerous oddities5, not least a reported audit fee of £888m.6

The companies’ claimed activities vary wildly between website, page 5 of the accounts and page 9 of the accounts.7

So who audited these transparently fake accounts?

Nobody. The accounts name an individual auditor and an audit firm, but it’s a lie: neither ever saw these accounts, and the named individual never even worked at the named audit firm.8

The company claims to be owned by a Mrs Marrine Isaq, who lives in the UK. She holds £4bn of shares, but it’s not clear where they come from – there are no records of shares being issued.9

The accounts say the company is owned by “BCGI International Group LLC” which claims to be incorporated in Abu Dhabi, but isn’t. BCGI has a fake website, and claims to own four more companies:

- At the same address as 1 Stallion Ltd is Avantulo SA Ltd, another vague oil/gas company but an even larger one: £26bn turnover, £12.5n share capital. We’ve spoken to someone who received a business proposition from this company (which they wisely turned down).

- Also at that address, e-bank Ltd. Despite the name, it’s not regulated by the FCA. This appears to be its website⚠️. It claims to make £952m of turnover – all from the UAE – with nine employees. It has almost zero profit. To have the word “bank” in your company name, you need a “letter of non-objection” from the Financial Conduct Authority. Query how that happened in this case.

- And previously at that address, but now dissolved, Kinpro Holding GmbH Limited. The dissolution would have been a huge disappointment to BCGI (if they existed), as the documents claim they’d invested £8.5bn into it.

- Next door is “XYZ Investment Holdings Ltd“. The accounts claim it’s a financial business with a £15bn turnover and £5bn of net assets, but this is rather spoilt by other text which says “Our strategy is to create shareholder value through being a leading international supplier of components to the door and window industry”. Its previous name was “Stallion Holdings Ltd” and, under that name, it has its own fake website⚠️ and a fake bank website. We called their phone number; it gives the option of “sales” or “customer services”, but both just go through to a maillbox. Surprisingly, the VAT number on the website really is registered to Stallion Holdings Ltd.

- And there is a BCGI International Group Ltd, whose balance sheet shows it’s worth £650m and has a turnover of £190m (but it still files unaudited accounts).

These companies all falsely claim to be audited by the same firm as 1 Stallion. They also all name that same firm as their company secretary – the firm tells us that’s not true (and we believe them).

These companies are connected to Stallion Financial Investments plc, which was incorporated in 2016, claimed a £12m balance sheet (we expect fraudulently), and applied to the FCA in 2017 for permission to carry on regulated business. This was refused because the company stopped responding to the FCA’s questions, and Stallion Financial Investments plc failed to file accounts and was dissolved soon after.

They responded by establishing a new company a year later, AR Worldwide Services Ltd which applied for, and obtained, FCA registration as a small payment institution. This is an area notorious for money laundering risk. We know AR Worldwide Services Ltd is connected, because its first director was Stallion Holdings Ltd10 It is worrying that the FCA did not notice that one of the directors of AR Worldwide was a company with obviously false accounts, and with a name very similar to that of a company whose application they had rejected in suspicious circumstances.

AR Worldwide Ltd’s Companies House entry shows its owner is a man called Ahmed Shah Rasooli. We would generally not trust any of the names listed on these companies to represent real people – but in this case it would seem likely that the FCA conducted at least some checks in 2019, and therefore that Mr Rasooli is really involved in the company.

The phone number on AR Worldwide’s website doesn’t work. Their regultory registration also covers “Prompt Remit”, who have their own (partly unbuilt) website. Both claim to operate out of this office in Harrow – there is certainly a payments business there, but we don’t know if it is actually connected to AR Worldwide.

Linked to all these companies is an individual called Ali Hassan, who gives his address as 102 Chorley Old Road, Bolton – the same address as most of the companies are registered too. Fake companies are often registered to addresses owned by completely unrelated people. However, in this case we can be reasonably confident the address is linked to Hassan, because he made a planning application for that address, in the name of Stallion Financial Holdings Ltd (which doesn’t appear to exist).

The first draft of this report said we didn’t know if these companies were created for fraud or as the product of someone’s fantasy. However the additional information we’ve received (the bank website, VAT registration, and the attempt to win business for Avantulo SA Ltd) makes reasonably clear this is a fraud. The domain records for the two Stallion Holdings websites suggest the fraud is ongoing.

Another company claiming to be a central bank – it looks like it actually may be a scam cryptocurrency exchange.

The company was previously called “TDSL Finban UK Ltd” and was the subject of a warning from the FCA in December 2022. It almost immediately changed its name to “TSDL Financial Corporation UK Limited” and in 2024 changed its name again to ADCOF Exchange.

The website⚠️ which says it is “Revolutionizing Global Monetary through blockchain for Digital Assets management First Exchange operates on cutting-edge robotic and AI systems”. But the website is mostly unbuilt – many of the links (e.g. “about us”) goes to a separate website with placeholders. It’s only really the homepage that works.

The odd style of wording on the website is repeated in the accounts. They look like accounts for a real company, but the grandiose descriptions of their activity is at odds with the small reported turnover of £1m. The high level of intangibles is not explained; nor are the references to “off-ledger funds” (odd for a non-bank). And the numbers in the balance sheet are all very round – not how real balance sheets look.

The website suggests the company is regulated – it is not.11 Its consumer-facing activities, and the financial instrument-holdings described in its accounts, suggest that it should be.

The company may have falsely claimed to have had a banking licence.

ADCOF/TDSL is run and owned by a variety of individuals in Singapore, India and Dubai.

Finally we get to a real, non-fraudulent company. P&O Property Accounts Ltd is an administrative company in the P&O group, ultimately owned by Dubai World.

It appears in this list because, for unknown reasons (possibly a harmless mistake), it was incorporated with the SIC code for “bank”.

The website says it’s the “bank of humanity”, offering various crypto products, but with a strange lack of the legal, contact and privacy information you’d see on a real bank or crypto exchange.

The company filed bizarre accounts in October 2024 claiming that, as at 30 June 2023, it had £50m exactly of investments, £183m of current assets, and £239 of creditors. Not £239m, or £239k, but £239.

The company claimed to have lost £250m yet it somehow also claims to be a small company which doesn’t need to file audited accounts. That means turnover of no more than £10.2 million, and assets worth no more than £5.1 million. Needless to say, you cannot lose £250m on a turnover of less than £10.2m.

Then, two months later, it replaced these with amended accounts for the same period. Investments were now £5bn (exactly). Creditors were £4.95bn – unexplained, but conveniently cancelling out the increase in investments.

We spoke to one forensic accountant who said he’d never seen more obviously fraudulent accounts.

The company says it’s owned by a Filipino man called Paul Armand Infante Monozca. The directors are a variety of other individuals – but in reality query if any of these people exist.

The directors also run a company called Formula Green Corporation Ltd, which appears to have similarly fake accounts.

Update: the company has written to us complaining about this article. Their head of Public Affairs told us they’re not fraudulent, but she wasn’t able to explain the numbers in the accounts, the way the numbers changed so dramatically, or why they filed as a “small” company. We will keep an open mind as to whether this really is a fraud, or merely people with no understanding of law or accounting.

17. Genius Bank Ltd

This company has a billion shares, each with a value of £0.000001 each – so £1,000 in total. The high number of shares triggered our code to shortlist the company, but there are no signs of fraud. It is, however, an unusual arrangement, and it’s unclear how the company was permitted to incorporate with the word “bank”.

The company’s been dormant for the seven years since it was incorporated, and is owned by a French woman living in the UK.

We’re guessing it’s an aborted startup, and entirely legitimate.

18. Suria Global (L) UK Trusted Limited

This is another more complex and sophisticated arrangement.

The company’s website describes the business as providing “financial and high-level networking resources for large scale opportunities in South East and North Asia, Australia, New Zealand and Pacific Islands, Europe and ultimately in the United States of America”. This doesn’t mention the UK, but the title of the website is “Suria Global (L) UK Trusted Limited”, which is peculiar.

The UK business has a separate website⚠️ which says it “maintains a strategic office” at 27 Old Gloucester Street London WC1. It’s not very strategic, because it’s a postal address, shared by (amongst others) House of Burlesque. The website is unusual for a bona fide business in what it lacks: the company legal name and registration number, any identifiable individuals, or a privacy policy.12

The websites are superficially plausible, much more so than the others in this report. But our contacts in the hedge fund and investment world thought the text was were deeply suspicious: not just the vague language, but the lack of any kind of sector focus. And none of them had heard of Suria.

The accounts of Suria Global (L) Trusted Limited present £100m of current assets, but this is illusory. The incorporation documents show that the £100m were shares issued to the sole shareholder/director, Omar Yassin Bin Abdullah, for nothing.13 And that explains why, year after year, the company reports £100m, with no income or expenses. The cash doesn’t exist.14

But this isn’t just a paper company.

Suria Global (L) Trusted Limited owns a Malaysian company called Suria Global (L) Ltd (although there’s no sign of this in the UK accounts). That Malaysian company previously owned an Australian company called Suria Global (L) Pty Ltd, which went into liquidation amidst accusations of fraud. Its sole director and shareholder was a John Ata Alan Lutui (we don’t know how that is consistent with Suria’s supposed ownership). Lutui failed to attend the court and an arrest warrant was issued; he promptly fled Australia for the US.

We’ve have heard from a reliable source that Suria has very recently been touting for business.

So our assumption is that this is an active fraud.

We wrote to Suria asking for comment, and didn’t hear back.

The limitations of our approach

The approach taken by our automated tool is exceedingly simple. It catches just one type of fraud: suspiciously large balance sheets. There are myriad other accounting frauds it can’t begin to identify.

Inevitably, our approach will also shortlist companies that (like P&O Accounts) are entirely innocuous. So please use the tool with care.

There are also two significant technical limitations.

First, the tool only searches accounts filed last year. If a company didn’t file last year, it won’t see its accounts. And the tool isn’t designed to deal with more than one year’s of accounts. It could be modified fairly easily to look across multiple years – at an obvious cost of storage and speed.

Second, and most importantly, the tool can only access accounts filed electronically. A more sophisticated approach would deal with accounts submitted by post15 – that’s as many as a third of all companies. There is, however, one benefit of this limitation – larger/complex companies tend to be unable to submit electronically and have to post their accounts to Companies House. So our approach means we are using a set of accounts that omits many legitimate large balance sheets. Of course, if this report becomes widely known, and Companies House doesn’t change its approach, then we may find fraudsters moving to posted accounts to avoid easy electronic scrutiny.

The response from Companies House

A spokesperson from Companies House told us:

“We take fraud against the register seriously and all allegations are fully investigated.

Companies are responsible for filing accounts that are compliant with the law. Where incorrect, suspicious, or fraudulent filings are made, we will take appropriate action. We proactively share information with other relevant government agencies and law enforcement.

“We are developing systems and processes to enable more checks to determine the accuracy of information delivered to us before it is placed on the register.”

How should the law change?

But we believe some of our findings in this report suggest the law should change.

First, companies should be prohibited from choosing the category of “bank”, “central bank” (or other SIC codes that relate to regulated business), without a letter from the Financial Conduct Authority (in the same way as a letter is already required if you want your company to have the word “bank” in its name). Falsely using the word “bank” is a criminal offence under section 24 of FSMA – certainly for the company and plausibly for Companies House as well.

Second, the current rules exempting small companies from audit are too generous. A company can have a balance sheet of any size at all – even £100 trillion – and , as long as it has fewer than 50 employees and a turnover no more than £5.2m, it’s a “small” company and doesn’t need audited accounts. That creates a loophole that’s being ruthlessly exploited to create fake companies that look like they’re worth a fortune. It’s easy to fix16 – amend the legislation so that a company with balance sheet assets over (say) £10m always has to file audited accounts, regardless of how recently this happened and regardless of turnover and number of employees.

Third, to prevent this new rule being subverted, Companies House should introduce verification that a named auditor has actually audited the company’s accounts. As we note above, there are signs that some companies are already faking audits. We’ll be writing more about this soon.

What should Companies House do?

Nobody expects Companies House to undertake a detailed audit of the millions of registered companies. But they should be able to use an approach similar to ours to identify companies with obviously suspect accounts.

Swift action can then be taken:

- The Companies Act imposes civil penalties where the accounts rules are not followed. A company that’s filed false accounts for years will have incurred multiple £3,000 penalties. These should be immediately charged.

- The directors have committed a criminal offence unless they can show they “took all reasonable steps” to comply with the rules. That defence seems unlikely to be available for companies with false billion pound balance sheets. The consequence is an unlimited fine and even potential imprisonment.

- Most important: Companies House has a duty to ensure the integrity of its records. It should use its powers to remove the false accounts from the register. People using the register will then be alerted to the fact the company has not filed accounts.

- It would be sensible for the false accounts to be still available for viewing, but with a health warning that they have been withdrawn.

The fraudulent use of UK companies will continue until there are clear adverse consequences for fraudsters.

There’s no excuse for inaction. Companies House has the data, the legal tools, and now the evidence. The question is: will they act?

Many thanks to the accountants and forensic accountants who assisted with this report, particularly P and J. Thanks also to J (a different J) for looking through an early draft. And thanks to yet another J who provided us with some important information. Thanks to S for the research on the fake Iranian professor.

Thanks again to Companies House and the Financial Conduct Authority for their commitment to public access and open data. It’s very possible that other countries have registers as full of frauds as Companies House; but Companies House’s openness means that we in the UK are unusual in being able to spot the frauds so easily.

Footnotes

A quick note: we provide links to websites for many of these companies. Please exercise extreme caution before clicking on them, given the risk they could contain malware – we would not recommend using a normal desktop browser. We use a dockerised Firefox browser through a VPN. All the website links are set to “no-follow” so we don’t boost their google rankings. ↩︎

Companies can buy their own shares for certain limited purposes, but at that point they must be cancelled (unless acquired out of distributable profits and held “in treasury”, which these clearly aren’t). ↩︎

The website gives an email address, but emails sent to it just bounced. ↩︎

There is a real “Stallion Group⚠️” – a West African manufacturer, but its website shows no UK operations and we don’t believe it has any connection to 1 Stallion Ltd. There’s also a Stallion Finance and 1 Stallion Capital, both of which appear unrelated. ↩︎

Some examples:

Profit of £190k on a turnover of £12.5bn is very unlikely, and would normally require some explanation. Turnover jumping from £811m to £12.5bn in a year is again very unlikely, and would usually be explained.

The operations are outside the UK so ordinarily dividends would be received; there’s no sign of them – subsidiaries aren’t even mentioned.

The accounts show £784m of tangible assets; £516m of capital allowances are claimed; there is an almost identical figure for non-deductible expenses. There is no sign of any return on investments of £583m. Share capital increased from £100m to £4bn with no explanation and no issuance of shares.

The auditor is far too small for a company of this size. The registered office address is misspelt.

The company lists numerous global offices and substantial operations in Africa, the Middle East, and beyond, but there’s no sign of this in the financials. The office locations change from page to page. The head office in Dubai does not appear to exist. There are numerous typos. The company claims to have 198 employees. We can’t locate any of them. The figure implies turnover per employee of around £63m. For context, Shell has turnover per employee of about £2m, and this is remarkably high. JPMorgan, about $500k. All in all, the accounts have every appearance of a forensic accounting examination question. ↩︎

That suggests to us that this section of the accounts was copied from real accounts with audit fees of £888,164; the fraudsters then added a ‘000’ so everything would be a thousand times more impressive, but forgot to dial down the audit fees. ↩︎

The business description on the website (a “financial intermediary dedicated to providing innovative solutions to meet your financial needs” is completely different from the description on page 5 of the accounts (“management, trade commission of oil & gas commodities, government securities derivatives and financial instruments”) and different again from that on page 9 (“exploration, procurement, and trade liaison activities”). ↩︎

The firm once provided tax advice for a related company, and presumably that’s when its identify was stolen – but sloppily: the accounts give the wrong address for the firm. We won’t name the firm or individual here – it seems unfair to associate either with a fraudulent use of their name. ↩︎

The company was incorporated with £1 of share capital. There are no records of further shares being issued. Mrs Isaq, lives in the UK and is registered as controlling the company. Until 2024, £3.9bn of shares were held by GCGI Group International LLC and £100m by Ali Hassan, a British citizen living in the UK. The accounts show the shares as fully paid up – Mrs Isaq is a very wealthy woman. ↩︎

Misspelt as Stallion Holding (without the “s”) Ltd in its registry entry, but the company numbers are the same. ↩︎

Compare, for example, with other crypto exchanges. ↩︎

Interestingly, even most of the fraudulent websites we see have a privacy policy; such is the fear of GDPR. ↩︎

A real person wouldn’t do this, save perhaps for a very short period, because it creates a large legal liability. Mr Abdullah owes £100m to the company – an exceedingly unwise thing for a normal person to do. Of course, he may not exist at all. ↩︎

It’s a breach of accounting rules to show unpaid shares as current assets. Under FRS 102, “current assets” are assets that a company could realise within a year. ↩︎

Which means interacting with the Companies House API, downloading a PDF and scraping it. Not that difficult, but much much slower. ↩︎

Potentially only requiring a Minister to put Regulations before the House of Commons ↩︎

Leave a Reply