A mining giant claiming £4bn in revenue, certified by a fake auditor on 128 pages of meticulously detailed fake accounts. A bank with a login page that can’t log anyone in. A trust holding $327bn in Tsarist gold that never existed. Even endorsements from the Duke and Duchess of Cambridge, Nadhim Zahawi, and Baroness Mone – all fabricated. And, incredibly, an entirely fake country.

Behind all these elaborate deceptions is a real person – Michail Roerich – and a very real attempt to seize a gold mine in Ukraine. Who is Roerich, and what exactly is he trying to achieve?

This follows our previous reports on companies filing fake accounts, the large number of fake banks filing fake accounts, and the tool we built to identify companies with fraudulent accounts.

The Observer’s report is here.

The mining company

Here are the 128 pages of Gofer Mining plc’s 2019 report and accounts.

The accounts look1 like the accounts of a global mining giant, which is what Gofer’s website says it is. 4,000 staff, operating in 21 countries, and expecting to post £4bn of revenue in 2022. It’s listed on Dun & Bradstreet and headquartered in One Canada Square.

These accounts were filed in 2021 – and Gofer Mining never filed accounts again. Its website also seems to be frozen in 2021. A reader who didn’t know this would be hard-pushed to see anything wrong with the accounts. They are a world away from the fake accounts we have recently investigated, which are full of accounting impossibilities, typographical errors and copy/paste errors.

A careful reader might, however, wonder why there was so little detail, particularly compared with annual reports from other comparable mining companies. If they then made some enquiries, they’d realise something strange was going on. Anyone who knew Canary Wharf would say that there’s never been a mining group headquarters at One Canada Square. Anyone in the mining industry would say the claim to be the only gold miner in Greece and Ukraine is false – and they would have never heard of Gofer. A minerals expert would note that some of the resource figures are out by a factor of at least 1,0002, and that no new mine can be brought into production within a year. A forensic accountant would say the level of growth recorded in the accounts, and lack of detail, is highly suspicious. A capital markets lawyer would be puzzled by the claim to have raised more than £300m from shareholders, without any sign of any capital markets transactions. A mining lawyer would wonder about the lack of any reference to licences or regulatory filings. A banker would know that Barclays would never make a ten year unsecured loan to a new mining company at a 0.5% rate of interest. And nobody would have heard of its Chairman, Sergey Kolpidi, its CFO, Michail Roerich (here calling himself “Michail Sergios Kolpidis“), or indeed any of its board.3

None of this is conclusive; there might just about be explanations for each oddity. And the accounts were audited – whilst isn’t a guarantee of accuracy, but gives us assurance that someone independent has checked that the document is a fair reflection of the business.

So who was the auditor who signed off on the report? Dr James Whitelaw, of Smith Barclay LLP. Here’s one of the partners of Smith Barclay LLP, showing off their client list:

That partner is Michail Roerich. The Michail Roerich who was the CFO of Gofer Mining plc – he was also a director and ultimate owner of Smith Barclay LLP.

That’s just the start of the problem. Neither Smith Barclay LLP nor James Whitelaw ever had an audit licence. There’s no evidence Whitelaw ever existed.

The audit report was a forgery.

And there is almost no evidence that Gofer Mining plc existed at all, outside its Companies House filings and its website. No employees4, no premises, nothing. The document presents 2019 calendar year accounts, and mentions the 2018 balance sheet, but the company was only incorporated on 12 April 2019, and gofermining.com was created one week before that.

Someone went to a great deal of effort to create the Gofer Mining plc report and accounts5 – they’re easily the most impressive fake accounts we’ve seen. We do not know who was responsible, but we can say two things for sure.

First: Michail Roerich is real – although he goes by several names. He’s the central figure in this report.

Second: whilst Gofer Mining plc didn’t exist in any real sense, that didn’t prevent it from trying to control a very real Ukrainian gold mine.

The Ukrainian mine

Almost immediately after it was incorporated, Gofer Mining plc made a serious attempt to seize control of a Ukrainian gold mine. A deal had been signed for the mine to be sold by the Ukrainian Government to Avellana Gold, a real mining company. Gofer Mining plc tried to stop this.

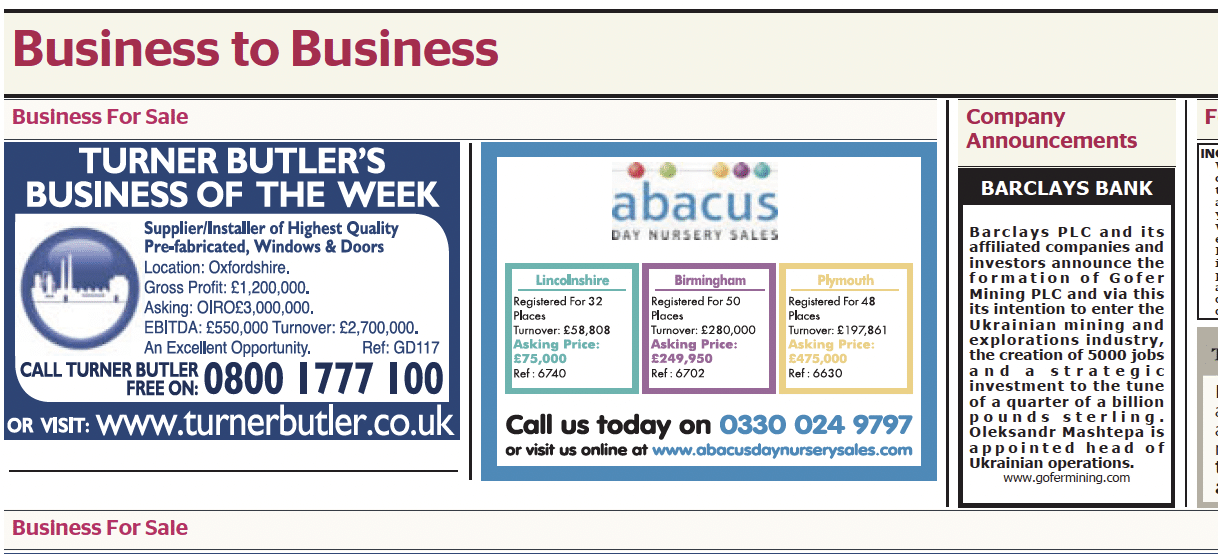

On 16 April 2019, a small advertisement was placed in The Times’ “business to business” classified section. It claimed that Gofer Mining plc had been established by “Barclays PLC and its affiliated companies”:6

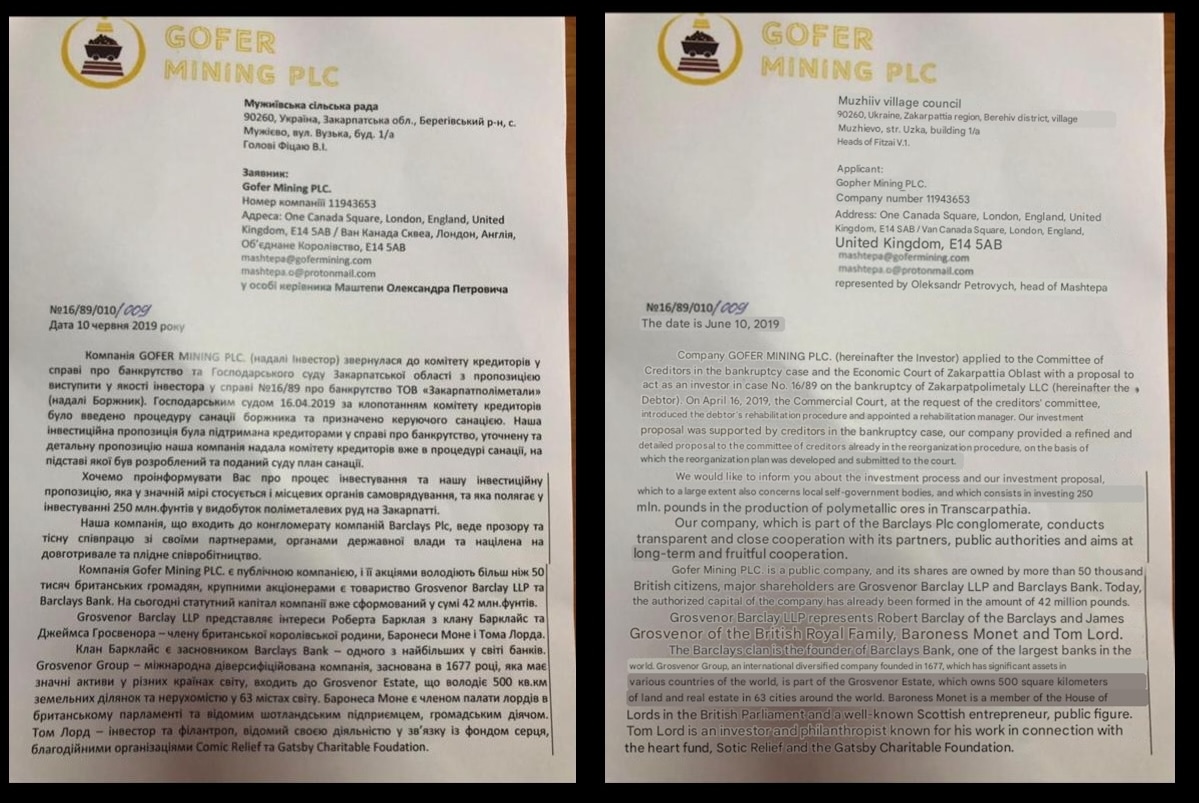

Two months later, according to a reputable Ukrainian journalist’s blog, this letter was sent by Gofer to a village council near the mine (Google Translate version to the right, verified by a Ukrainian speaker):

The claims made in the letter go even further than the classified advertisement, including:

- The company is part of the “Barclays plc conglomerate”.

- Its shares are owned by more than 50,000 British citizens

- Shareholders also include Barclays Bank and a firm called Grosvenor Barclay LLP.

- Grosvenor Barclay LLP is owned by Robert Barclay (of the Barclay family that founded Barclays Bank), the Grosvenor Estate and Baroness Mone.

All the claims here were false. Barclays Bank plc had no involvement; neither did the Grosvenor Estate or the Mone family. Grosvenor Barclay LLP was incorporated a month after Gofer Mining plc. Its members certainly included “Robert Barclay” and “James Grosvenor” – but Robert Barclay died in 1690, and there is no prominent “James” in the Grosvenor family. Another registered member, outrageously, was Baroness Mone’s teenage daughter.

On the back of these false claims, Gofer Mining plc obtained a court judgment, blocking the sale to Avellana.7 This was widely covered in Ukrainian media at the time. The dispute ended when a commercial court and then the Ukrainian Supreme Court ruled in favour of Avellana and against Gofer (although the Ukrainian courts do not appear to have appreciated the fictitious nature of Gofer).

Avellana have a statement on their website and a video from their CEO, Brian Savage. He says Gofer were an “experienced group of criminal corporate raiders”. He added that they had “no mining expertise” and their claim to be backed by a UK bank was a “lie”.8 Savage’s claims are extraordinary, but consistent with our findings. If Barclays credit line wasn’t real, and the accounts weren’t real, then their attempt to control a mine cannot have been real either – or, if real, cannot have been legitimate.

There was at least one other occasion when Gofer Mining plc interacted with the real world. We understand from another mining company that Gofer Mining plc approached them for a deal (unconnected to Ukraine), but couldn’t demonstrate it had funding, and the deal went nowhere.

There may have been more. Gofer Mining plc won The Business Concept’s “Most Innovative International Precious Mining Company 2023”. A meaningless paid award – but evidence that Gofer Mining plc was still active in some sense in 2023.

The listed holding company

Gofer Mining says it’s owned by Gofer Wealth plc. The website is now down, but between 2020 and 2023 Gofer Wealth said it was “the financial services arm of the British conglomerate Gofer Group”. Its incorporation documents show Barclays plc as the sole shareholder. Subsequent Companies House filings claimed it was listed on an EU stock exchange/regulated market. Its accounts show it having £1.7bn of assets.

None of this is true. Barclays plc had no involvement. Gofer Wealth was never listed on any stock exchange. Its accounts show £1.7bn in cash on its balance sheet for five years straight, with no other balance sheet entries. That is, in practice, impossible. Nobody sits on £1.7bn in cash, earning no return and accruing no expenses. And there is no sign at all in its accounts of its ownership of Gofer Mining plc.

The company filed as dormant – which meant it had no transactions. That was again impossible – transactions are an inevitable result of holding £1.7bn cash.

Gofer Wealth’s registered office was 17 Hanover Square, in Mayfair. It’s a serviced office block – but it seems Gofer Wealth was not a paying client. The owners of 17 Hanover Square complained about their unwanted visitor, and so Companies House used its new powers to force Gofer Wealth into a temporary registered office at Companies House itself.9

On the board we again see Michail Roerich – but now he’s calling himself “Michail Sergios Roerich, His Grace the Duke of Commonwealth”.10 More on the “Commonwealth” later.

The magnetic technology company

Magnetic Technologies Group plc’s website11 says it develops and invests into the field of “Magnitology”, and it’s active in 50 countries, with a presence in 25. It says its shares are AIM listed, that it is audited by Grant Thornton, and its European headquarters are in Slough.

None of this is true. There is no evidence of the company’s existence. It’s not AIM listed. Grant Thornton told us they’re not the auditor, and have no relationship with the company. Magnetic Technologies Group plc’s “European headquarters” is actually a co-working office space. The company’s accounts show £5m in the bank, and nothing else – and the lack of any change in the figure implies that there is no money here at all.

Again on the board we see Sergey Kolpidi and Michail Roerich, “the Duke of Commonwealth”.

The Gofer group

There are so many related companies that listing them here would take up pages and pages. The oldest is a shipping business that was incorporated in 2006, filed superficially convincing “audited” accounts12 in 2014, and was dissolved three years later. There’s a charitable foundation, and a company run by Lord Troubach (who does not exist). Perhaps the highlight is Gofer Energy Ltd, which was claimed to be part-owned by Barclays Bank plc, and part by the Royal Foundation of the Duke and Duchess of Cambridge.

It is most unlikely the group is the sole creation of Michail Roerich, given the amount of work involved, and the variety of expertise required to fake the Gofer Mininc report and accounts. Mr Roerich was only 14 or 15 when the first company, Sunlight Maritime Limited (I), was formed. And its 2007 accounts are extremely strange, with the surface appearance of real accounts (including a presumably fake letter from accounting firm Moore Stephens), but then tiny numbers perhaps 10,000 times smaller than they should be. Why would anyone do this? Or was this Roerich’s first attempt at faking a company?13

If others were involved – who Sergey Kolpidi is listed as a director of nine of the companies; Larisa Kolpidou as a director or secretary of no fewer than thirteen. We believe that Sergey and Larisa are Michail Roerich’s parents. In 2004, a Polish news website published an article in which Sergey Kolpidi was identified as having previously been called Sergei Gavrilov, a Russian businessman whose wife was called Larisa and who had been involved in a Polish banking scandal in the late-1990s, following which he was expelled from Poland.14

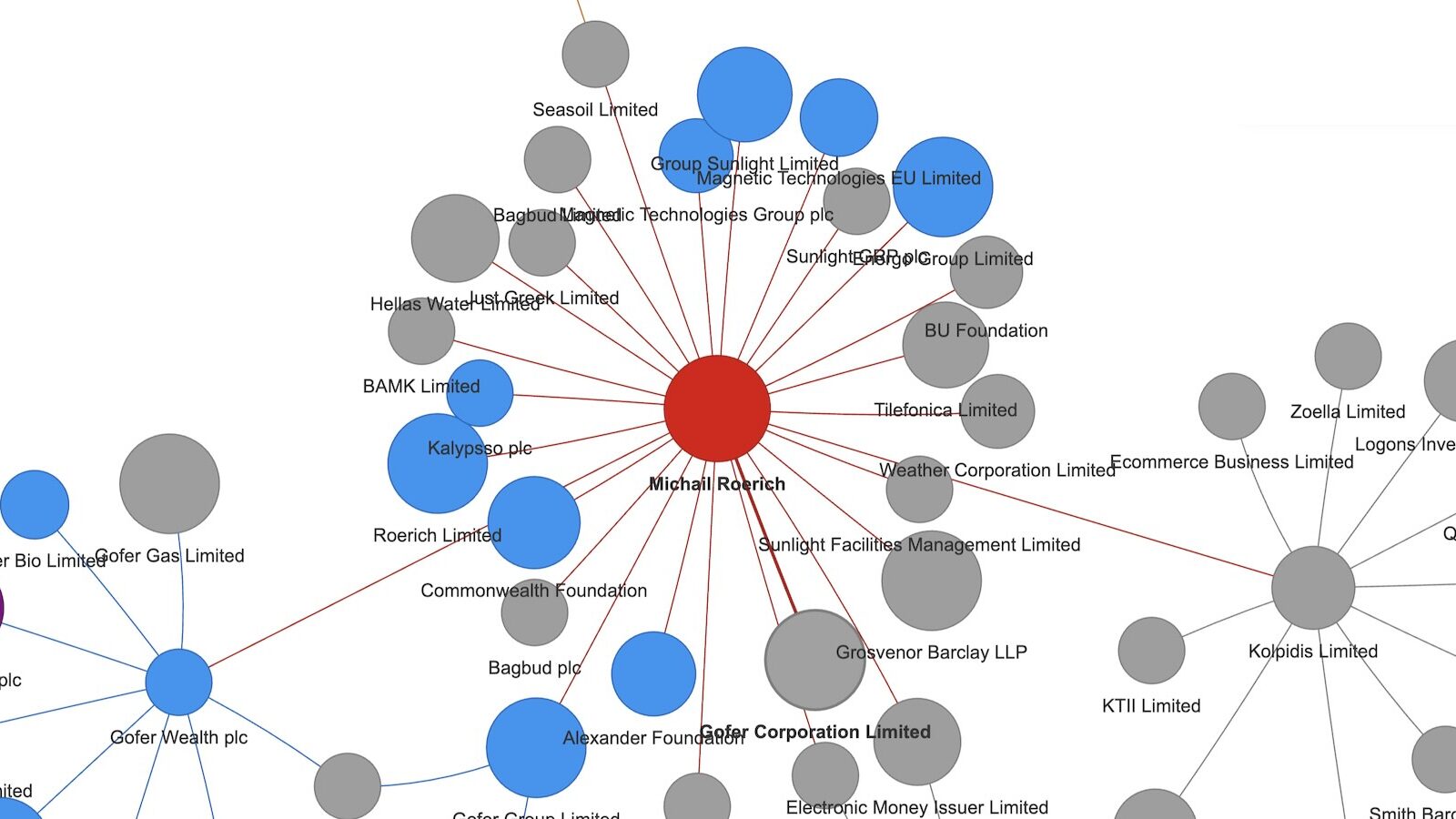

The timeline starts in 2006, but most of companies are short-lived. There is a flurry of activity when Gofer Mining plc is created in 2019.15 This chart illustrates the timeline – click on a bar for company details and Companies House links. Landscape mode recommended on mobile devices; fullscreen version here.

You can explore the connections between the companies in more detail with this interactive chart – click on a company for its full details/links. You can move companies/individuals around, and zoom in and out, to focus on points of interest. Fullscreen version here (recommended particularly for mobile users):

We’ve also put this data in a Google spreadsheet.

We would caution that it is prudent to generally assume that that no director or shareholder (individual or company) mentioned on this chart, or in these companies’ filings, agreed to participate in the companies. In many cases we doubt they exist at all. 16 The sole exception is Michail Roerich, where we are confident that he both exists and was involved.

The fake country and the Ponzi fraud

At this point the story takes a very strange turn.

Mr Roerich has founded the Union State of British Commonwealth – the “sovereign political form of union and alliance of the people of 60 member nations”. Its members include Australia, the UK, Russia and the “Commonwealth of British Ukraine”. Its sovereign is His Serene Highness Michail Roerich-Kolpidis (Duke of Commonwealth). It is supported by a variety of luminaries, including Nadhim Zahawi, a former member of its Financial Group.

It is hardly necessary to add that no country recognises the Union State of British Commonwealth or (so far as we can tell) is even aware of it. Mr Zahawi has no involvement and had never heard of the Union State; likely the same is true for the other named individuals.17

The Union State has a central bank – The Bank of Commonwealth, which claims it is based in Montserrat and is covered by the UK Financial Ombudsman Service (FOS). The Montserrat authorities say there is no such bank in Montserrat. The bank (if it exists at all) is not covered by the FOS.18 It does, however, have a client login page.19

Roerich makes a variety of eccentric claims linked to the Union State, including:

- Roerich controls a trust holding gold bullion that was owned by the Russian Imperial Romanov family in 1916, from which he has given more than three thousand metric tonnes of gold to the Greek and Norwegian people. That’s worth about $330bn20 – comparable to the US Federal Reserve’s entire gold reserves.

- In addition, Roerich has gifted a total of £292bn to the public. This appears connected to another fake UK company – the Commonwealth Foundation, which has a balance sheet claiming £59m of assets.

- Roerich is involved with a “British Office for Ukraine” which claims to be an “independent non-ministerial” department of the British Government. It has a press secretary, a permanent under-secretary for development, and a Twitter account. It creates official-looking documents using the Royal Coat of Arms (potentially a criminal offence).

- That he established an electronic currency (through one of the fake UK companies, Electronic Money Issuer Limited) which is used by half a million Greeks.

- Roerich chairs the “Global Britain Panel” which included (in 2021) the Prince and Princess of Wales and the Duke of Westminster.

These are all very tall tales, but essentially harmless. However the activities of the “central bank” appear rather less innocent.

The Bank of Commonwealth’s Chief Strategy Officer is a man called Shaun Cohen. This is the same Shaun Cohen21 who ran a real estate Ponzi scheme in Texas, defrauding investors out of $135m. The SEC sued and Cohen consented to judgment against him. 22

Mr Cohen is listed as a consultant to a Florida firm called ClearThink Capital, and responded to an email sent to ClearThink Capital confirming his involvement in the Bank of Commonwealth. One of his colleagues at ClearThink, Richard Whitbeck, is listed as Chief Operations Officer of the Bank of Commonwealth.23

Once again, what starts off looking odd but harmless ends up looking rather more concerning. And, perhaps not coincidentally, there is some evidence that the “Commonwealth” is being used for dubious and potentially illegal purposes:

- The Bank of Commonwealth used to be known as the British Technology Bank, which it said was 10% owned by the Bank of England.24. In 2023, the Financial Conduct Authority issued a warning that the British Technology Bank was an unregulated bank targeting people in the UK. We have seen a letter Roerich sent to the FCA complaining about this warning in which he said that, as a central bank, the British Technology Bank was not required to be regulated. The letter also repeated the claim that the Bank of England held 10% of the BTB.

- Roerich’s website promotes “Commonwealth Pay“. The concept is that merchants (such as online retailers) can redirect their payments to Commonwealth Pay, and then will pay only 3% tax on their income “with no further taxes due thanks to the double taxation convention“. There is no such convention. It is not at all clear to us if this is a real product, but if it is then it is likely tax evasion, in the UK and any other country where it is sold.

- And there is a “depositary receipt” which can help you “get financing” or “invest money, risk-free”. And a related “investment bank“25 with a very plausible-looking website offering a variety of financial products. It is, again, not clear if this is a real product or a fantasy – but if real, it looks highly suspicious (and for an unauthorised firm to promote these products into the UK or the EU would in many cases be an offence).

Who is Michail Roerich?

Very little described in this report has real existence, with one exception: a person calling himself Michail Roerich certainly exists.

We know very little about him. Mr Roerich has a Twitter account, a Quora account and a LinkedIn account26 but otherwise, aside from his many web pages and company filings, there is little evidence of his existence.

We can be reasonably confident he physically exists: here he was, three months ago, promoting registration on the “ROERICH marketplace”. It has 29 views:

And one month before that, promoting the “ROERICH Youth Programme for Ukraine” (56 views):

We corresponded with Mr Roerich earlier this week, and asked him why he was involved with so many fake companies.

His response was, in short:

- Roerich is adamant that Gofer Mining plc and the other companies are real. He says that the Gofer group was a victim of political persecution and theft in Ukraine and certain African countries (connected to Russia). He sent us a letter making wild and implausible accusations of involvement by Hillary Clinton and Joe Biden.27

- Mr Roerich admits that he knew Gofer Mining plc’s auditor, Smith Barclay LLP didn’t have an audit licence and was owned by him.28 In our view this is an admission of two criminal offences. He did not explain why, if Gofer Mining plc was a real company, he established a fake auditor for it.

- Mr Roerich also admits that Gofer Wealth plc was never listed.

- When we pointed out that the accounts of most of the companies were crudely faked, Roerich replied that “even if I were to accept and agree that the accounts were improperly created/recorded etc. according to XYZ law, it does not automatically mean they represent fake numbers”. That is a very unpersuasive answer.

- Roerich claims that the cash is real, but can’t be accessed because it is in Ukraine. This is very unlikely to be true. Nobody would hold that much Sterling29 in a Ukrainian bank and, if they did, it would be held via a correspondent banking arrangement with a UK bank.

- Mr Roerich knows Shaun Cohen was accused of running a Ponzi scheme, but seems to believe he was hard done by. It is not clear why he has come to that view, or why he thinks Shaun Cohen is an appropriate person to help run a central bank, even an imaginary one.

- He insists that his many other claims are true, but without providing any extrinsic evidence, or indeed anything beyond vague assertions.30

Our correspondence with Mr Roerich is set out in full here:

The criminal offences

A large number of criminal offences appear to have been committed by Mr Roerich and his (as yet unidentified) associates – all of which have the potential for unlimited fines and imprisonment:

- Knowingly or recklessly providing false information to Companies House is a criminal offence under section 1250(1) of the Companies Act 2006.

- Knowingly or recklessly including false material in an auditor’s report is a criminal offence under section 507 of the Companies Act.

- Failing to file accounts is itself an offence under section 451 of the Companies Act.

- Falsely claiming you are a registered auditor is a criminal offence under section 1250(2) of the Companies Act.

- Dishonestly falsifying accounts with the intent to gain for himself is “false accounting” – an offence under section 17 of the Theft Act 1968.

The first four of these are reasonably straightforward offences to prosecute: there is no need to prove any “dishonesty” or other state of mind beyond the fact that the person knew the accounts were false. Mr Roerich’s admission that he knew the “auditor” of the Gofer Mining plc accounts was unqualified leaves little more to be established. And, whatever he says now, Mr Roerich surely knew the many accounts he filed were false.

What is going on?

It seems reasonably clear that Gofer Mining plc had a real purpose. It attempted to steal a Ukrainian gold mine. We’re also aware of one other attempted mining project.

To some extent this fits in with the pattern of transactions and attempted transactions we’ve seen from other entities with fraudulent accounts. But they usually look to take the money and run – not engaged in protracted court battles.

The other difference between those cases and this one is the high quality of the accounts created for Gofer Mining plc. This likely involved a small team of people, at least one of whom was a native English speaker and at least one of whom had a familiarity with accounting. An adequate website was created (rather less persuasive than the accounts). A fake auditor was established.31 Other companies, such as Grosvenor Barclay LLP, Gofer Corporation and Gofer Wealth plc, were incorporated to support the existence of Gofer Mining plc (but much less effort was taken with those companies).

The supposed financial offerings of Mr Roerich’s “central bank” and “investment bank” could be frauds – we don’t know. The involvement of Shaun Cohen is hard to explain if they are just fantasy, and concerning if they are not.

We have, however, no explanation for the sprawling conglomerate that the Gofer group became – at least 60 companies. We certainly can’t explain the Union State of Commonwealth.

The only person who knows is Michail Roerich, and he isn’t telling.

Why does it matter?

The Gofer network of fraudulent companies has continued for two decades because of well-known failings by Companies House:

- Gofer Mining plc and others failed to file accounts for years. Every company on our list made multiple breaches of company law, but they were treated no more seriously than the late return of a library book. In one case, a document was removed from the registry because of forgery; but the company was permitted to just continue as if nothing had happened. No action was taken against the directors.

- Gofer Wealth plc and others in the group filed impossible accounts claiming huge amounts of cash in the bank, whilst still being dormant and small companies. Companies House could easily create systems to identify false accounts of this type. It doesn’t.

- Gofer Wealth plc used someone else’s premises as its registered office, without their consent. It’s a form of fraud itself but – more seriously – a sign that something untoward is going. However, Companies House again treated it as no more than an administrative slip-up.

- Most seriously, we understand that during the attempt to seize the Ukrainian mine, the British Ukraine Chamber of Commerce wrote to Companies House begging for something to be done about an obviously fraudulent company. No action was taken.

The Gofer Mining plc accounts, on the other hand, present a new and much more difficult challenge to the integrity of Companies House. Companies House can’t be expected to identify that kind of sophisticated fraud (and, by the time the accounts were filed with Companies House, the activity in Ukraine was long over). Assurance should be provided by the audit; but it is trivially easy to forge an audit report.

We’ve spoken to auditors who believe this is a growing problem: real auditors’ names being fraudulently signed onto companies they’ve never heard of, and fake auditors’ names being fraudulently signed onto others. The rise of ChatGPT and other easily available LLMs mean that creating plausible fake accounts and reports is now much, much easier than when Gofer Mining plc’s documents were prepared.

In 1844, when modern auditing began, it was reasonable to trust an auditor’s signature. Today, it isn’t – but given there are straightforward ways to electronically sign and verify documents, we believe Companies House needs to reconsider its approach.

It wouldn’t be hard to create a system where audited accounts have to be submitted by a licensed auditor. Otherwise, in the era of ChatGPT, we are going to see more fake companies like Gofer plc committing fraud, using the credibility that Companies House has given them.

Companies House should act to give the world assurance that “audited accounts” are actually audited accounts.

There are many open questions. Is Roerich’s father really Sergei Gavrilov, a Russian businessman who ran a bank accused of money-laundering? What were the other real-world activities of the Gofer group, aside from the Ukrainian gold mine? What is the connection with Shaun Cohen and ClearThink? What is going on with the British Commonwealth Bank, and why does it have such a sophisticated website? These go beyond the resources and expertise of Tax Policy Associates; we hope others will investigate.

Thanks most of all to K1 for the research on this – almost all the detailed work was undertaken by them. Thanks also to J1 and P for the accounting expertise, T for Companies Act assistance, D for mining knowhow, K2 for practical corporate finance input, VH for the correction regarding the bank javascript, and MS for assistance with Ukrainian language documents. Thanks to J2 for his invaluable review of an early draft, and to JG for his review of a late draft. And thanks to Tom Church of OSINT Industries for additional research.

And many thanks to Michael Savage at the Guardian for all of his contributions to this report, and finding evidence and documents that we would never have tracked down on our own.

Footnotes

Note that the PDF in the viewer is the version of the accounts on Gofer’s website. The copy filed with Companies House is a poor quality scanned image – this is a common fate for pretty accounts that get posted to Companies House. This happens to real listed companies as well as Gofer. However what is unusual here is that the two documents are slightly different. Some pages are rearranged; there may be other more substantive changes. The (pretty) website version was created, according to PDF metadata, in February 2020, but nothing was filed with Companies House until November 2021. ↩︎

See this chart from the Gofer Mining plc report. Gold is measured in grammes per tonne, or parts per million, because it’s valuable enough to be economically mined at grades that low. Lithium is mined at much higher concentrates – typically low single figure percentages of lithium oxide. The chart is probably wrong even if “ppm” is replaced with “%”. It’s an error no mining company would make. ↩︎

This is a small selection of the oddities in the 2019 report and accounts; there are many more. That’s not to mention the website, with its breathless list of corporate and mining deals – which other parties involve deny ever happened, and which aren’t reflected in registries. ↩︎

It is inconceivable that a company can have thousands of employees, but not one can be found on LinkedIn or Facebook, or anywhere outside Gofer Mining’s own website ↩︎

It was prior to the widespread availability of ChatGPT and other LLMs. ↩︎

For context, the full page of the Times is here. ↩︎

Some reports suggest Gofer was ultimately backed by Russia. We have no idea if this is correct. However, Avellana have put the blame on elements of the Ukrainian government; we would also note that Roerich’s own Twitter account appears generally hostile to the Russian Government and its invasion of Ukraine. ↩︎

A short transcript of his video: “Gofer Mining and several other affiliated companies, also recently formed in the UK, are simply an experienced group of criminal corporate raiders and have been supported in their efforts to damage Avellana by corrupt Ukrainian judges and government officials.

They know nothing about the mining business and have no ability to develop, much less operate a mine.

Gofer Mining claims to have a major UK bank [he means Barclays] prepared to fund £250m to develop the project, yet there isn’t any news about the bank’s mining experts visiting the site.

To prove their claim, Gofer Mining paid for a classified advertisement in a London newspaper, fraudulently using the bank’s name and implying they are involved in the project.

If the bank really was involved in financing this size, it would certainly be covered by all of the international news organisations and mining journals, not to mention that one of my many industry friends would have called me and asked about it. ↩︎

Interestingly nobody seems to have notified Gofer Mining plc’s presumably equally false claim that it’s registered at One Canada Square. ↩︎

No longer maintained, so the security certificate is out of date. You can visit the archived version here. The website is much less plausible than Gofer Mining plc’s. ↩︎

James Whitelaw, of Smith Barclay LLP, was again the auditor. ↩︎

The later Sunlight Maritime accounts show much larger and more realistic sums, but have numerous other oddities, not least a P&L which makes very little sense. One particularly weird paragraph says that the company is exempt from the requirement to produce consolidated accounts because its accounts are consolidated in its parent, Sunlight Maritime, company 05726487. But these are the accounts of Sunlight Maritime, company 05726487. We are at a loss for any explanation as to why someone would go to the trouble of fabricating reasonably realistic accounts, and then make this kind of error. ↩︎

The small images of Gavrilov on the Polish website look very similar to the photo of “Sergey Roerich” here. ↩︎

There also appear significant bursts of incorporations in 2012 and 2016; we do not know why that is. ↩︎

The chart shows most recent shareholdings and directorships only. Where a company was dissolved, the chart shows shareholdings as at the date of dissolution. ↩︎

The Union State of British Commonwealth also has a Supreme Court, said to be chaired by Chief Justice The Rt. Hon. The Lord Tupitskiy MCC. The name and photo match Oleksandr Tupytskyi, a Ukrainian judge who is not a Lord – we understand he was the judge who initially ruled in favour of Gofer Mining plc. MCC appears to stand for “Member of Commonwealth Congress“. We don’t know if Mr Tupitskiy is aware of his role, and we weren’t able to contact him. ↩︎

It appears Mr Roerich has had some real world meetings in this capacity; he entered the Bank of Commonwealth in France’s lobbyist register, causing some bemusement. ↩︎

We originally said the login page was fake, and you couldn’t actually login. VH has made a convincing case to us this is not right – it’s an unusual approach, and the hosting doesn’t look like a bank, but it may log in. Our apologies for the error. ↩︎

At the current gold price of $2,832 per ounce. ↩︎

Given the significance of the point, we will set out the evidence demonstrating that this is the same Shaun Cohen, and the evidence of his background.

Cohen’s profile page identifies him as an alumnus of St John’s College (from 1996 to 2000) and George Mason University (with a MA/ADB in Economics) between 2006 and 2009; his experience includes working for an unidentified private equity fund in Plano, Texas (of which he was the founder and co-CEO) between 2008 and 2018.

Cohen’s LinkedIn profile contains matching biographical information and adds that, in his role as the founder and co-CEO of a private equity fund between 2009 and 2018 Mr Cohen had “self-funded and launched one of the nation’s largest private real estate investment companies” and had built a portfolio of US$250m in assets under management. Once again the name of the private equity fund is not revealed.

Public documents show that Cohen worked for a company called EquityBuild, Inc. whilst based in Plano, Texas.

Submissions filed by the receiver in the same US District Court proceedings record that Shaun Cohen had graduated from St John’s College in Annapolis, Maryland with a BA degree in 2000 and had received a Masters’ Degree in Economics from George Mason University in 2009, became Vice-President of EquityBuild Inc in 2009 and served as EquityBuild Finance LLC from 2010. Unless two different people with the name Shaun Cohen had graduated from St John’s College and George Mason University in 2000 and 2009 respectively, and both working in Plano at the same time, we conclude that the Shaun Cohen described in the receiver’s submissions is the same Shaun Cohen described in the profile page on the Bank of Commonwealth website. Finally, it is reasonably clear that the Shaun Cohen in contemporaneous EquityBuild videos is the same man as in the recent profile images. ↩︎

In August 2018, the US Securities and Exchange Commission brought proceedings in the US District Court for the Northern District of Illinois (Eastern Division) against EquityBuild Inc, EquityBuild Finance LLC, Jerome H. Cohen and Shaun D. Cohen “to halt an ongoing Ponzi scheme”. The SEC’s complaint recorded that the defendants “recently started coming clean about their financial distress and inability to repay investors through revenue-producing real estate [but] limited these disclosures only to earlier investors whose interest payments Defendants could no longer afford to make [and] continue to raise funds from new investors by concealing their dire financial condition while promising “guaranteed” returns and annual interest payments as high as 17%”.In a May 2024 judgment (concerning priority over the proceeds of the liquidation of various properties), the United States Court of Appeals for the Seventh Circuit described the Cohen’s Ponzi scheme as follows:

“Jerome and Shaun Cohen ran a Ponzi scheme through their real estate companies EquityBuild, Inc. and EquityBuild Finance, LLC (“EBF”) from at least 2010 to 2018. The scheme began with the Cohens, through EquityBuild, selling promissory notes to investors, each note representing a fractional interest in a specific real estate property. They promised interest rates ranging from 12% to 20%. A mortgage on the respective properties, mostly located in underdeveloped areas of Chicago, secured each of the notes.

…

By overvaluing the properties involved in the scheme, the Cohens generated money that they pocketed as undisclosed fees and used to pay earlier investments. The overvaluation also meant that, contrary to representations, the investments were not fully secured.

As it became more difficult for the Cohens to sustain making interest payments to investors, they found ways to put off those payments and continue their scheme. That mischief resulted in a new business model in 2017. Instead of offering investors promissory notes, the Cohens began offering opportunities to invest in real estate funds. As before, they told investors that EquityBuild would pool investments to buy and renovate properties at exceptional rates of return. The Cohens apparently used much of these later investments to make payments to earlier investors.“

A receiver was duly appointed for the estate of companies called EquityBuild Inc, EquityBuild Finance LLC, their affiliates and the affiliates of Jerome Cohen and Shaun Cohen. ↩︎

Our original draft said that Whitbeck has also confirmed his involvement; this was a misunderstanding between our team; our apologies. ↩︎

For the record, the Bank of England confirmed to us this is not the case. ↩︎

Which, its privacy policy, gives its contact address as 10 Downing Street. ↩︎

Which claims he’s a CIPFA-qualified chartered accountant; that doesn’t appear to be true. ↩︎

We won’t publish it; the letter is ludicrous but also highly defamatory, and we’ve no wish to put such a document into circulation. ↩︎

Roerich says in his defence that he held the LLP as a nominee. That is irrelevant even if it’s true (and it contradicts Companies House filings). ↩︎

The figures cannot be FX conversions from hryvnia into Sterling, as the figures are round and do not change year-to-year. ↩︎

One exception: as evidence of Gofer Mining plc’s reality he sent us a copy of a draft PwC structure paper for the construction of a solar power facility near Zagreb, involving companies and individuals which appear to have no connection to Gofer Mining plc. The document seems irrelevant and is stated to be confidential – so we will not be publishing it. ↩︎

This is hard to explain – it would surely have been more effective to use the name of a well-known real auditor; likely nobody would have spotted this. ↩︎

17 responses to “Who is Michail Roerich, and why did he build the world’s most convincing fake companies?”

An extraordinary story. As someone has already suggested, this looks like a game, one of those computer strategy games. I can certainly believe that there was an original fraudulent purpose, but somewhere along the way a natural fantasist morphed it into this Byzantine structure just for the fun of it.

A great investigation. It is also fascinating to see that those annual accounts are still showing on the Companies House website. https://find-and-update.company-information.service.gov.uk/company/11943653/filing-history

Having a look through the new powers that Companies House has, I’m not sure if it does have the power to remove those documents unless some other process determines they they were “improperly delivered”. If so, that seems like a flaw in the system, as they should at least be able to mark them as suspicious.

Presumably in this case it would be relatively straightforward to show that those accounts fail section 1072(1)(a)(i) of the Companies Act 2006 because they do not give a true and fair view of the assets, liabilities, financial position and profit or loss of the company (the requirement in section 393(1) of the Companies Act 2006).

But which organisation is responsible for making that determination and directing Companies House to remove the information? Perhaps the Financial Reporting Council would be interested under its powers as an authorised person for the purposes of section 456 of the Companies Act 2006.

Many or even most of the Roerich companies were incorporated on a false basis, with obviously false share subscriptions (millions of non-existent pounds) and/or false subscribers (Kate & Will). Under the new s1002A, that’s enough to strike the company off. No court order required.

When there was a failure to file correct accounts (i.e. large companies filing unaudited small accounts, or fake audited accounts being filed) then the registrar could raise an enquiry under s1092A – failing to respond is a criminal offence for the company and every director.

Where documents are inconsistent (which the accounts and capital statements generally are) then the registrar can require this to be corrected under s1093 – again there’s a criminal offence for failing to respond.

It’s not super-clear to me where the power to remove from the register under s1094 would apply, but I much prefer corrections to removals, given the importance of a clear audit trail.

And false accounts and fake audits raise a host of potential criminal offences of themselves, of course, quite outside the Companies Act.

This Linkedin profile look familiar?

https://www.linkedin.com/in/roerich?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=Android app

Many thanks.

There is an excellent new Economist podcast series on scammers, arguing they are a threat to national security.

IMO as well as an “ease of doing business” ranking there ought to be a “Dan Neidle – Ease of registering a fake business hall of shame. ”

I nearly fell for a scammer, a few months ago, tried to report it to Revolut (as they wanted me to send money to a Revolut account). There appears to be no process to report attempted scams, either at the this Bank, or the FCA,

The “report a fraud” forms ask questions like

When did the fraud take place,

from which bank account did you transfer funds.

It would be easy to conclude the politicians who supervise the regulators who deal with banks and Companies House don’t care very much: certainly not enough to do anything about it.

We all need to raise our thresholds of double checking, and review the means by which we do so.

One hack I use is to look into the Terms and conditions” or “privacy policy” of any website and copy paste the entity name into google.

Most real companies will show up.

Dan

Unbelievable!

Great that this time one of your great investigations is out in the media.

Companies House needs to start doing something, rather than just taking money for entries on their register.

Mentioning money, it is quite clear that a considerable amount has been expended – a good question is where is it coming from.

If as you say Michail Roerich is a real person I would expect that a private investigator could track him down.

Certainly in my view something further needs to be done to remove his(and others)incorrect information being viewed at Companies House, find out whether he is just an eccentric, a fraudster who is working more or less on his own, or who else is involved/behind what has been going on.

https://bank.britishcommonwealth.uk/global/group/profile/roerich-michail Says it all really. This feels like a very elaborate game that has got out of hand. Symptomatic of the chaos of smoke and mirrors documented by Adam Curtis in Hypernormalisation. (I see that one of the 211 members of the “British Commonwealth” was supposedly Rishi Sunak and another is Tom Brashaw of the NFU.)

if it’s wasn’t for the Ukrainian gold mine (back in 2019) and the involvement of Shaun Cohen (right now) I’d say it was a game. Perhaps it’s something else plus a game? Or a game that turned into something else? Or something else that turned into a game?

Wish I knew.

Shocking information! I wish someone would have a forensic look into privately owned care homes in the UK. When I read a newspaper report saying something untoward happened in a care home, I look the care home up in Companies House, and often find a spiders web of companies linked to one or more directors, connections with group/holding companies, Midco’s, LLP’s and sometimes an offshore connection.

It requires forensic accounting to disentangle all that, which is beyond my skill level.

Thank you to everyone whose hard work contributed to making this report it was a fascinating, if somewhat alarming, read!

One thought I had whilst reading through is how some of the most outlandish claims – your own soveriegn country[?], a central bank sort of entity, backing of the royals, your own sub-department of HM Government related to Ukraine with official looking logo etc – lends a certain ‘cover’ against sanaction because ‘the authorities’, whomever they may be for the relevant thing in question, will just file it under ‘nutter’ along with the hundreds of other ficticious reports about, hmm, ‘here’s some evidence about the Lord Chief Justice being in an international conspiracy with Lady Gaga the ECB, The Vatican to haud the world’s supply of lemons’ or whatever it may be.

Of course the Ukranian mine court case shows that in this example this network of ficticious companies and entities does have very real world concequences, unlike your run of the mill conspiracy theorist claiming in their capacity as a justice of the Global Supreme Court to have issued a contempt proceeding with which a politician must comply.

That’s not to say of course that those in jurisdictions which more limited access to, and knowledge of, how the global systems of law/politics/financial regulations work won’t be taken in by some of the absurd claims. My point is its more just that I can see why any official who might have happened upon it would just write it off as part of the every growing mountain of junk in cyberspace generated by those whose grip on reality is, lets say, ‘strained’ and hence not worthy of attention as opposed to if the network of claims had been more mundane then it might get perceived as something more sinister.

The other thing that caught my attention was that, given in 2019 banks were freezing accounts for activity that looked even remotely suspicious or fraudulent and had the resources and technology to spot it, Barclays didn’t seem to spot an advert placed in no less a publication than The Times or trigger some kind of fraud response (unless they did and there’s wider context not referenced in the article above/unreported by Barclays).

Whatsmore, it was surprising to me that The Times was willing to print an advert with the heading ‘Barclays Bank’ without authenticating it with Barclays themselves. Given that said advert – however dodgy it may have looked to informed observers – also claimed the bank was entering into what might be percieved as a risky venture in the form of the Ukrainian mining industry, that could *theoretically* (if not in reality as it goes without saying major investors tend to be very well informed people with enormous resources to double check their facts) cause a negative market reaction against Barclays for this ‘news’.

Interesting article. When I looked at the LinkedIn page, I saw he is a second level connection although I cannot see who from my contacts is the link.

It is hard to understand why when a company sets or updates its registered address with Companies House that it does not issue a letter by post to the new address containing a code, that until entered, the registered address is not changed – this would make it very difficult to use a fake address or one not accessible. Along the same lines as requiring auditors to digitally sign accounts or publish accounts directly to Companies House to prove who audited them, the lack of these processes leaves the door wide open to fraudsters. It’s much better to make fraud practically difficult, than to try to identify it later. Companies House is operating like it is still 2005.

Many thanks.

There is an excellent new Economist podcast series on scammers, arguing they are a threat to national security.

IMO as well as an “ease of doing business” ranking there ought to be a “Dan Neidle – Ease of registering a fake business hall of shame. ”

I nearly fell for a scammer, a few months ago, tried to report it to Revolut (as they wanted me to send money to a Revolut account). There appears to be no process to report attempted scams, either at the this Bank, or the FCA,

The “report a fraud” forms ask questions like

When did the fraud take place,

from which bank account did you transfer funds.

It would be easy to conclude the politicians who supervise the regulators who deal with banks and Companies House don’t care very much: certainly not enough to do anything about it.

We all need to raise our thresholds of double checking, and review the means by which we do so.

One hack I use is to look into the Terms and conditions” or “privacy policy” of any website and copy paste the entity name into google.

Most real companies will show up.

Superb work.

the scale of documentation to support fraudulent activity is outrageous . This would suggest the parties involved have had plenty of success in the past and keeps them going seeking bigger fraudulent opportunities. In time of minimum human involvement is setting a scene of ongoing bigger problems

You are absolutely right. ChatGPT and the like make creating fraudulent documents trivially easy.

Thank for that Dan. I will look again when I have more time. But the graph reminded me of a huge and sprawling fraud in NZ where the same person ran a whole lot of companies. It was all complex to trace but basically control came back to the same people. The reason for the proliferation of companies was that money could be borrowed and then made to disappear into a different company under a general security agreement. You could make a grid a bit like your graph but with the arrows to the security agreements. If you could trace an unbroken line (like doing a word search puzzle) you could apparently justify transferring the money. Helpfully, the companies all ran out of a single bank account. Not legal even in NZ but some people get lucky there. Some very large lenders lost a very large amount of money. Any signs of anything like that?