New polling evidence from Tax Policy Associates and WeThink shows that half the public doesn’t understand a basic principle of income tax: the way that tax rates apply to income above a threshold. Our polling suggests that 50% of people believe that, once you hit the higher rate threshold, the 40% higher rate applies to all your earnings.

UPDATE October 2024 – we ran a new poll with completely different wording, testing the same point. The results were consistent.

If you live in England1or Wales or Northern Ireland, earn £50,269, and get a £1 pay rise, you’ll pay an additional 28p in tax – 20% income tax and 8% national insurance.

The £50,270 you’re now earning puts you at the top of the basic rate tax band. Get another £1 pay rise and you’re now in the higher rate tax band – and you’ll pay an additional 42p in tax – 40% income tax and 2% national insurance.2It used to be slightly more because of the High Income Child Benefit charge, but that’s now moved from £50k to £60k. However that doesn’t change the point of this article – the additional tax is still less than the £1 of additional earnings

The important thing is that the higher 40% rate applies only to your income above the £50,270 40% threshold. But it’s often suggested that many people don’t appreciate this, and think that the 40% applies to all your income – so that the £1 pay raise results in a massive additional tax bill.3In other words, a marginal tax rate of over 100%. There are some points in our income tax system where that actually happens, but not here. And stamp duty land tax used to work in this way. That is a very significant misunderstanding – but how common is it really?4A similar misconception used to exist regarding the Lib Dem policy in the 1990s and 2000s of putting a penny on income tax to increase funding for education. It was often said that many voters believed this meant exactly 1p more tax, rather than a 1% increase in the rate of income tax. I dimly recall there may have been an opinion poll confirming that this was a widespread belief, but I can’t find it now, and the story may be more myth than reality.

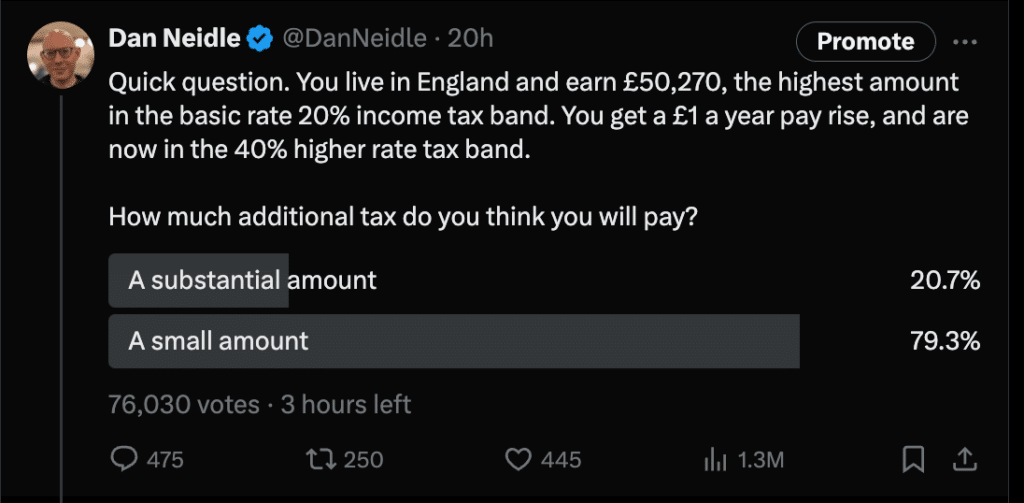

I was surprised at the results when I tested this with a Twitter poll:

This should be taken as nothing more than entertainment – Twitter polls are useless as a measure of public opinion.5i.e. because Twitter is not an accurate reflection of the population, my followers on Twitter are not an accurate reflection of Twitter users, and people clicking on the poll weren’t an accurate reflection of my followers. Twitter polls are fun, but are mostly useless. There is an excellent explainer on this here. Thanks to WeThink, we can now do rather better.

The polling evidence

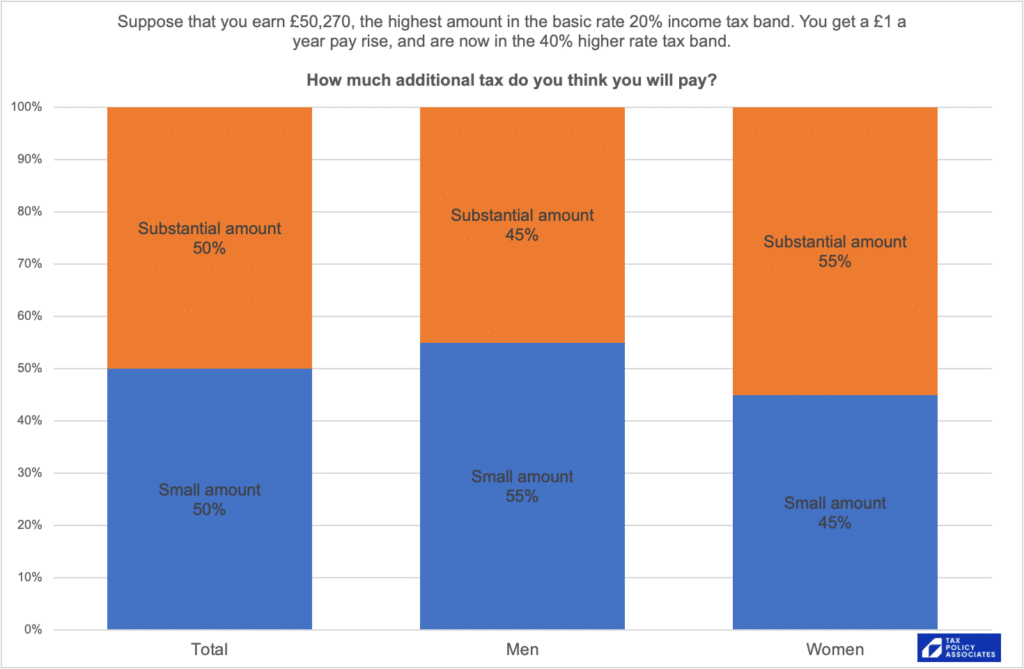

WeThink kindly included this issue as part of their regular opinion polling (they polled 1,164 people, before weighting).

Our question was:

“Suppose that you earn £50,270, the highest amount in the basic rate 20% income tax band. You get a £1 a year pay rise, and are now in the 40% higher rate tax band. How much additional tax do you think you will pay?”

The options we gave were:

- “a small amount of extra tax”, or

- “a substantial amount of extra tax”6Note that we forced people to make a choice, and didn’t provide a “not sure” option. The question of whether “forced choice” is the best approach has a long history… I have no expertise in this, and was happy to be guided by the experts at WeThink.

I think it’s clear that the correct answer is “a small amount”.7Depending on how you read the question, the additional tax might be 14p, 20p, 40p, or 42p – but I don’t think that matters.. the amount is “small” in each case. The only exception is if you have significant savings, due to the loss of £500 personal savings allowance you’re a higher rate payer. For someone with around £12,000 of savings outside an ISA that could mean the £1 tax increase costs them £200 (£500 x 40%). But 50% of the public doesn’t agree:

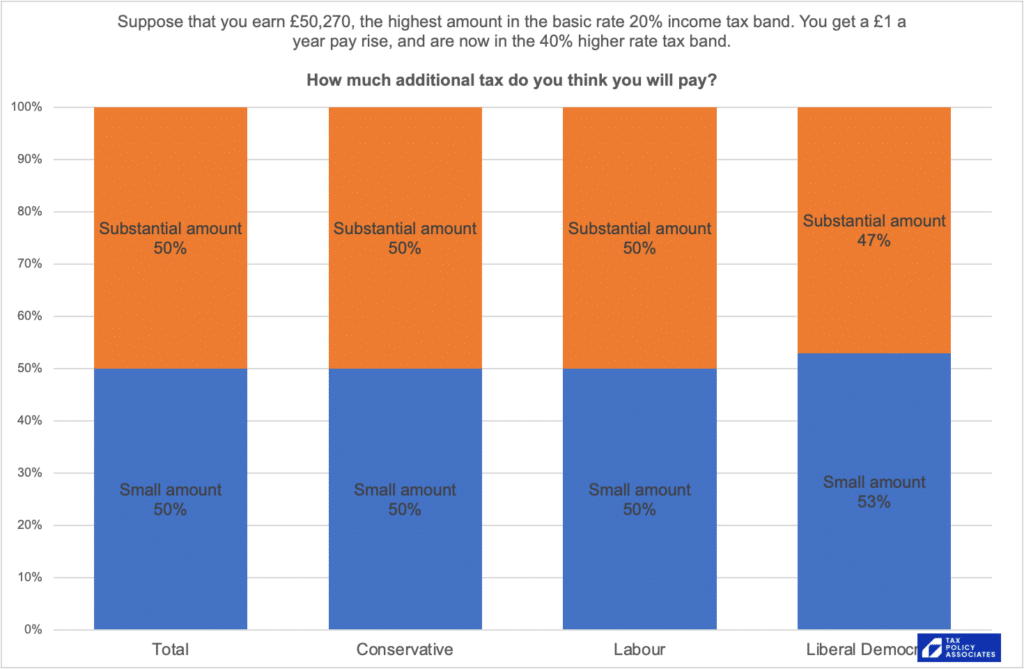

What about supporters of different political parties?

Given their very different demographics we might expect to see different results. We don’t:8The Lib Dem result is subject to larger uncertainties given the smaller number of respondents – there’s no statistically significant difference between the Lib Dem result and the Labour/Tory result.

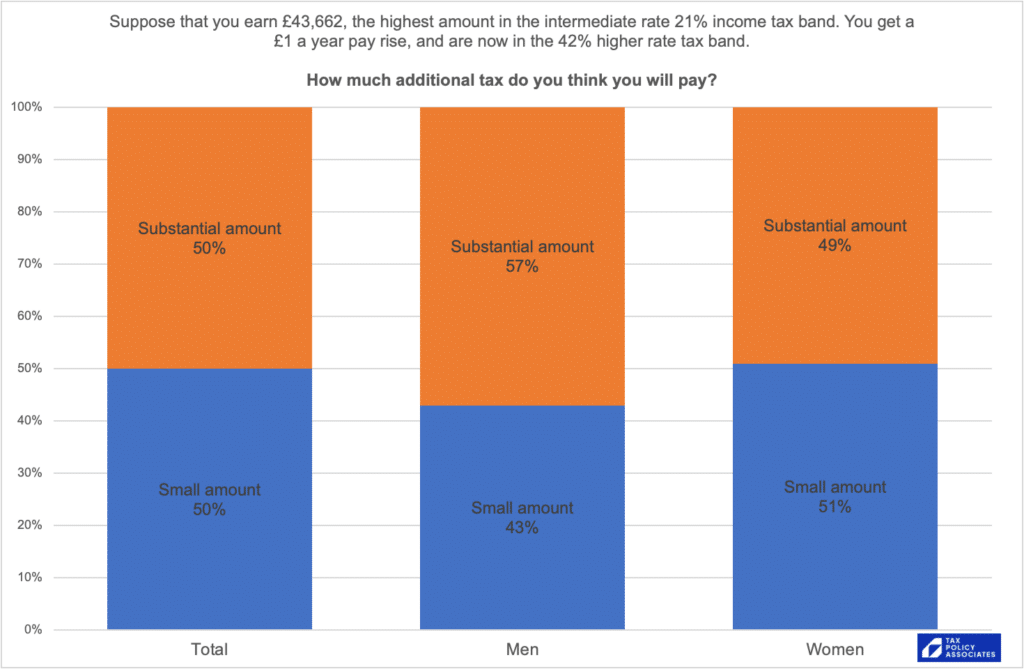

Scotland

The Scottish rates are different. There is a 21% “intermediate rate” income tax band for earnings up to £43,662, and then a 42% “higher rate” tax band.

But the level of public understanding is almost identical:

How does the result vary with income, education, etc?

One obvious response to his data is to say that, as only a small proportion of the country pays the higher rate, it stands to reason that only a small proportion understand it.

If that were really what’s going on then we’d see a wide variation across polling subgroups, with higher awareness of the correct position amongst graduates, people living in London, and others who statistically are more likely to earn £50k. But we don’t see this at all in the data – the 50-50 breakdown is true across almost all the subgroups.

That said, we don’t right now have enough data to say this definitively – many of the subgroups are too small for statistical validity. So WeThink have kindly agreed to run some more polling so we can get enough data to do proper justice to the question, look in detail at the subgroups, and test the question by reference to income levels.

We’ll be returning to this issue soon.

Why is this important?

It used to be that only a small number of people paid higher rate tax – that is no longer the case. By 2027/28, the IFS has estimated 14% of adults will be in this tax band, which equates to about a quarter of all individual income taxpayers. It’s reasonable to expect that about half of all households will include someone paying higher rate tax at some point in their lifetime. So the higher rate is more important than it ever was.

Our poll findings shouldn’t cause concern that people are paying the wrong amount of tax. Employees are paid by PAYE, which deducts the correct tax automatically. The self employed either use HMRC’s self assessment system (which calculates the tax due) or use an accountant.

There are, however, other potential consequences of a widespread misunderstanding as to how income tax works.

First, and perhaps most importantly, there are anecdotal reports of people turning away work because they believe entering the higher rate tax band will cost them large amounts of money. If that’s true for even a small percentage of the population, then it’s a problem for the individuals in question and the country as a whole. We’d suggest it’s something that HMRC and policymakers should investigate. (We are unlikely to be able to look into this ourselves with further polling, due to the statistical limits of polling samples.)

Second, it would be sensible to assume that other basic tax concepts are equally misunderstood. Policymakers, media and others communicating about tax (including Tax Policy Associates) should try to bear this in mind.

Finally, it means that we should be careful when looking at opinion polling on tax questions: the responses may be based upon fundamental misunderstandings of the question.

Many thanks to Brian Cooper and Mike Gray at WeThink/Omnisis for their generosity in running polls for us pro bono. They ask for nothing in return, and don’t even ask to be credited.

Photo by Mika Baumeister on Unsplash

- 1or Wales or Northern Ireland

- 2It used to be slightly more because of the High Income Child Benefit charge, but that’s now moved from £50k to £60k. However that doesn’t change the point of this article – the additional tax is still less than the £1 of additional earnings

- 3In other words, a marginal tax rate of over 100%. There are some points in our income tax system where that actually happens, but not here. And stamp duty land tax used to work in this way.

- 4A similar misconception used to exist regarding the Lib Dem policy in the 1990s and 2000s of putting a penny on income tax to increase funding for education. It was often said that many voters believed this meant exactly 1p more tax, rather than a 1% increase in the rate of income tax. I dimly recall there may have been an opinion poll confirming that this was a widespread belief, but I can’t find it now, and the story may be more myth than reality.

- 5i.e. because Twitter is not an accurate reflection of the population, my followers on Twitter are not an accurate reflection of Twitter users, and people clicking on the poll weren’t an accurate reflection of my followers. Twitter polls are fun, but are mostly useless. There is an excellent explainer on this here.

- 6Note that we forced people to make a choice, and didn’t provide a “not sure” option. The question of whether “forced choice” is the best approach has a long history… I have no expertise in this, and was happy to be guided by the experts at WeThink.

- 7Depending on how you read the question, the additional tax might be 14p, 20p, 40p, or 42p – but I don’t think that matters.. the amount is “small” in each case. The only exception is if you have significant savings, due to the loss of £500 personal savings allowance you’re a higher rate payer. For someone with around £12,000 of savings outside an ISA that could mean the £1 tax increase costs them £200 (£500 x 40%).

- 8The Lib Dem result is subject to larger uncertainties given the smaller number of respondents – there’s no statistically significant difference between the Lib Dem result and the Labour/Tory result.

23 responses to “Half the British public doesn’t understand income tax”

There is a good explainer of “marginal rates” of tax here: https://taxpolicy.org.uk/2024/06/18/what-are-marginal-rates-and-why-do-they-matter/

I’m afraid that question seems very poorly designed to me.

If someone wants to show that a significant number of people think X, then prima facie X should appear in the question asked.

Why not ask “Would the 40% rate apply to £50,271 or to £1?” (or that question without the last three words)?

I am not convinced that we can draw strong conclusions without a clear picture of what “a small amount” and “a substantial amount” might mean to survey participants.

To put it in Hancock’s Half Hour terms, is it only a sample, or is it nearly an armful?

Is 42 pence a small amount? Is £1 a small amount? Is £10 a small amount compare to £50,000? Or are we comparing 42 pence to £1, in which case some might readily say that is a substantial amount of the relevant sum.

I wonder what survey results you might get if you asked a question like “Your pay goes up by £1, crossing the threshold into the earnings band for 40% higher rate income tax. After tax, does your take home pay (a) increase by about 60 pence, (b) increase by much more than 60 pence, (c) increase by much less than 60 pence, or (d) fall.”

I wonder whether the phrasing of the question is causing some psychological ‘laziness’; not because it’s unclear, but because it’s straightforward and the 40% part is so clearly signposted. “You… are now in the 40% higher rate tax band” could prime readers only to think of a block of 40%, which maybe is distracting them from the wider context of the question. That at least explains to me why the results don’t seem to vary with education or income.

I admit that I say this because I’ve been reading ‘Thinking, fast and slow’. Still, I would be interested to know how much the results would differ if the wording of the question somehow forced readers to think carefully about what is being asked.

I wonder if the answers to the question would have been more accurate if the question used actual £ amounts, rather than the vague “small amount” and “substantial amount”.

I agree that no-one should describe the amount in question as substantial, but using adjectives encourages people to answer using intuition rather than calculating the answer. Putting the difference at £10 allows all the answers you proposed to fit under the threshold.

Specifying that “you earned no interest income” might defuse the worries of people who have personal experiences of tax cliffs – such as the people impacted by a full withdrawal of carers allowance who seem to be in the news now.

We considered that, but if we present multiple £ options then experience suggests that people who don’t know the answer will pick the middle one!

Is it that they don’t understand, or that they were only thinking about the impact of tax on their marginal increase in take home pay?

My feeling is that would require someone to have a very sophisticated view of tax and a pedantic mind… plenty of such people out there, but I doubt 1% of the population!

I’d contend that there’s a sufficient level of ambiguity here to have meaningfully affected the results. The presence of the answer “a substantial amount” is likely to lead anyone who does understand marginal tax rates to question “of the £1?” in which case they may well choose that answer because 42p is a substantial amount of £1.

I also don’t think this interpretation requires a particularly sophisticated view of tax, nor does it require the reader to be especially pedantic. £1 is the last absolute financial value mentioned in the question and therefore the freshest in the mind when reading the answers, so it wouldn’t be surprising to find that many respondents are considering “substantial” to mean in the context of £1 rather than the £50,270 (or otherwise).

I fear any framing of the question will have some ambiguities, but I feel that your reading requires both a sophisticated understanding of marginal rates (which few people have) and an unsophisticated view of what “amount” must mean.

I suspect you’d find similar levels of misunderstanding across many aspects of public policy from immigration to health statistics.

Btw The public, and some journalists, don’t understand CGT either. But it doesn’t stop very firm opinions being expressed. Especially if it involves Angela Rayner.

I think a lot of people are turning away extra work but the final paragraph is the one that makes the most sense. Anyone who believes that even 28% is not a ‘small amount’ is assumed not to understand how income tax is calculated.

I had this misunderstanding when I first entered the world of work.

I subsequently corrected this misunderstanding when a colleague (a solicitor) had the same misunderstanding.

These results are not surprising to me. Better education on taxation at an early age is sorely needed.

A couple of thoughts on that suggestion, Tony. First, government doesn’t produce P60s. Employers do. Second, a breakdown of tax paid for the preceding tax year, especially for someone whose income had not crossed the higher rate threshold, would not readily bring out the point that we have a marginal system where the higher rate applies only to the portion of income above the threshold. And it would be especially unhelpful, if not downright misleading, for those trying to extrapolate from that preceding year, where the higher rate threshold was not crossed, to the following year, where it might be. I suppose govt could require employers to produce personalised “what if” projections with P60s, showing the effect of a series of illustrative wage rises assuming rates and thresholds all stayed the same but (1) not so fun for the hard-pressed employer, not least in raising earnings expectations that may be unrealistic, never mind having to crunch the numbers; (2) could be regarded as a misleading signal about deduction rates for the current year (NI rates have changed in year very recently); and (3) I suspect most recipients wouldn’t engage with them anyway.

How about simply showing the build up of the tax number on the P60. 20% rate and 8% NI on income up to x = a, higher rate and 2% NI on income from x to y = b, 45% rate and 2% NI on income from y – z = c. It would be a lot clearer what the impact of future earnings changes are without having to bother with projections.

This kind of transparency would be really beneficial.

Hello Dan,

Could you explain this bit please: The personal savings allowance drops from £1,000 to £500 once you’re a higher rate payer. Probably costing you, at most, £8 (£500 x 4% x 40%).

I agree that it does drop from £1,000 to £500 once you are a higher rate taxpayer. But I don’t understand the “Probably costing you, at most, £8 (£500 x 4% x 40%)” part.

I could read it as you saying that people have, on average, £500 in a deposit account getting 4% interest then they get £20 of interest per year which is £8 of tax at 40%. However, if my assumption of £500 saved at 4% is right then the £20 would fall within the £500 personal savings allowance and so there would be no additional tax.

Also, your “Possibly up to £8 of additional tax, at most” doesn’t tie in with my £500 at 4% assumption as that would be more like “probably up to” as it is possible that the extra tax could be £200 – being [1,000 basic rate PSA – 500 higher rate PSA] x 40%.

My assumption that you mean £500 at 4% is probably not right as a quick google suggests that, for people with savings, average savings is higher.

apologies – this was my mistake… now corrected!

This misunderstanding has been happening for decades. A freelance work colleague wouldn’t take anymore work after the 20% boundary because she believed it applied to all her earnings. I didn’t know enough about tax then to put her right.

A few years back the Govt started adding a pie chart breakdown of its spending on tax letters (I can’t recall which one but haven’t seen one recently). Surely, they cd do something similar on P60s that shows payments by banding breakdown?

[Tongue in cheek]

LibDem women seem statistically significantly better informed that other sections of the public. There are all sorts of possible explanations, but they may simply be brighter andbetter educated (and possibly wealthier too!).

There are plenty of pensioners who seriously resent paying 20% tax on their part time earnings now that the state pension takes many of them very close to the Personal Allowance.

there are plenty of people who seriously resent paying tax on their income, but it’s unclear why pensioners should pay less tax than anyone else.

As someone who’s recently had to explain this to my mum mum, I empathise with the pensioners working part-time hours (likely on an hourly rate), as effectively overnight once they reach state pension age their work is valued at 20% less and they see that in their payslip.

It’s a mindset thing, and mostly avoidable if instead their state pension was reduced instead (like a private pension would be, and have a tax code applied).