It’s very hard for normal people to understand tax legislation, and it’s often equally hard for tax lawyers, unless they have a deep familiarity with the rules.

Here’s an example, promoted by the Angela Rayner CGT controversy (although I don’t believe this point has any bearing on her position).1 A couple who are not living together in reality can, nevertheless, be “living together” for tax purposes.

An individual is exempt from capital gains tax on their main residence. But spouses who are married and “living together”, can only have one main residence between them.2

So imagine a couple, with no children, who are married, but keep separate houses and live separate lifestyles (as if they’re dating, but they’re actually married). They are not, in the normal meaning of the term, “living together”. Does that mean they can each have a CGT-exempt main residence?

The legislation

HMRC guidance on divorce and separation says what HMRC think “living together” means. But it’s unclear whether this is just HMRC’s view (which has no legal status) or reflects the law. So it’s always important to look at the actual legislation (which, unhelpfully but typically, isn’t cited by the HMRC guidance).

The legislation is in section 222 of the Taxation of Chargeable Gains Act 1992:3

![In the case of an individual living with his spouse or civil partner]—

(a)there can only be one residence or main residence for both, so long as living together and, where a notice under subsection (5)(a) above affects both the individual and his spouse or civil partner], it must be given by both,](https://taxpolicy.org.uk/wp-content/uploads/2024/04/Screenshot-2024-04-12-at-13.20.20.png)

There is nothing in this section, or near it, that suggests the phrase “living together” has a different meaning from normal English, and someone reading this (tax specialist or layperson) would be forgiven for thinking that the usual ordinary meaning can be applied.

But TCGA ends with an interpretation provision in section 288, and in subsection 3 we see:

![References in this Act to [an individual living with his spouse or civil partner] shall be construed in accordance with [section 1011 of ITA 2007].](https://taxpolicy.org.uk/wp-content/uploads/2024/04/Screenshot-2024-04-12-at-13.09.42.png)

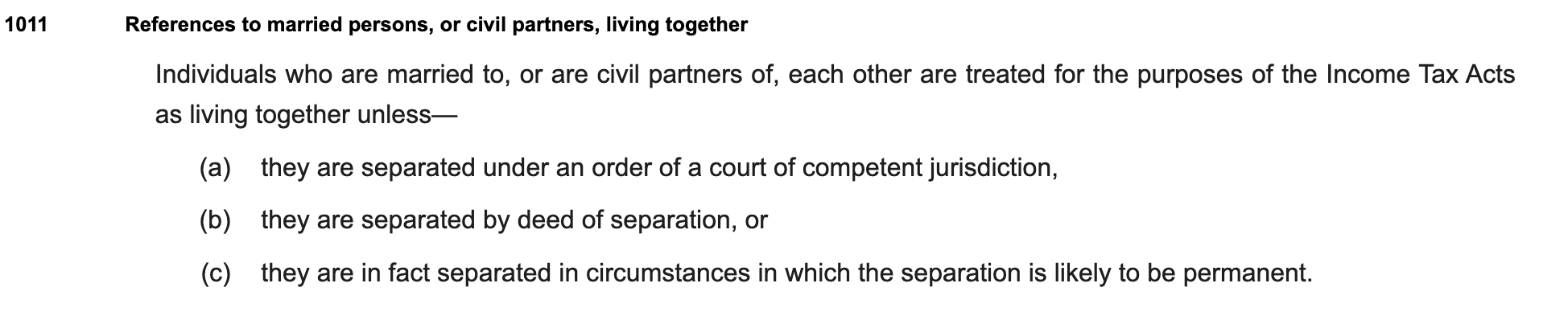

Section 1011 of the Income Tax Act 2007 then says:

So our hypothetical “separate lifestyle” married couple may not be living together in ordinary human terms, but they are almost certainly4 “living together” from a tax perspective, unless they have split up.

They aren’t living together, but they are “living together”. Brilliant.

This is really poor legislative drafting. It’s an area highly relevant to normal people, who often won’t be advised, and yet the way the legislation is drafted is impenetrable; misleading, even. How hard would it have been to add a provision to s222(6) TCGA cross-referencing either to section 288(6), or directly to s1011?

Modern legislation is usually better – there was a “Tax Rewrite Project” in the 2000s which aimed to clarify things, for example by including copious cross-references to defined terms. But in this case it didn’t help – take for example this provision of the ITA 2007 which uses the “living together” term without any hint that it’s defined in s1011.

How could anyone get this point right?

Practitioners working in the area will know this point.

For other practitioners, it is always good practice to check the interpretation provisions at the end of an Act before advising, but it’s easy to forget to do this, particularly when a term doesn’t look like a defined term.5 A non-specialist, particularly one in a hurry, could easily assume “living together” is just a simple factual question, and not check. That’s why it’s so dangerous for a tax adviser to advise outside their area of expertise.

For the layperson, it seems to me almost hopeless. You can’t rely on HMRC guidance, and you can’t dip in and out of tax legislation and hope to find the correct rule. I have no answer to this.

Photo by Taylor Deas-Melesh⚠️ on Unsplash⚠️

Footnotes

For completeness, there are two ways it could in theory be relevant. First, Angela Rayner could have been wrongly advised that the fact she and Mark Rayner lived in separate houses meant that they were not “living together” and they each had a separate main residence exemption. That seems unlikely, but is not impossible if she was advised by a non-specialist. Second, it could be that there are personal circumstances we are unaware of that mean that Angela and Mark Rayner really were separated well in advance of the 2020 date that they announced their separation – but there’s no reason to think that’s the case. ↩︎

That’s not the only CGT consequence of being married. Transfers of assets between spouses aren’t subject to CGT (the original acquisition cost of the asset is “inherited” by the receiving spouse). Again, this is only if they are “living together”. ↩︎

This and the other excerpts I’ve quoted are from the legislation as it stood in 2015, when Angela Rayner sold her property. Tax legislation changes frequently and one always has to look at the legislation as it stood at the time in question (although in this case the changes aren’t material). ↩︎

I say “almost certainly” because it could be argued that s1011(c) applies to a “separate lifestyle” couple. I would say not – my view is that in context it means the couple have split up, but this point is not beyond doubt. ↩︎

In my first week as a tax trainee, a partner (Richard McIlwee, long retired) gave us a fantastic 30 minute talk on statutory interpretation. The key message was “keep reading”. When you’ve read a clause, read to the end of that section. Then read to the end of the chapter. Then read to the end of the Part. Then read the interpretation provisions of the Act. ↩︎

Leave a Reply to Michael Cancel reply