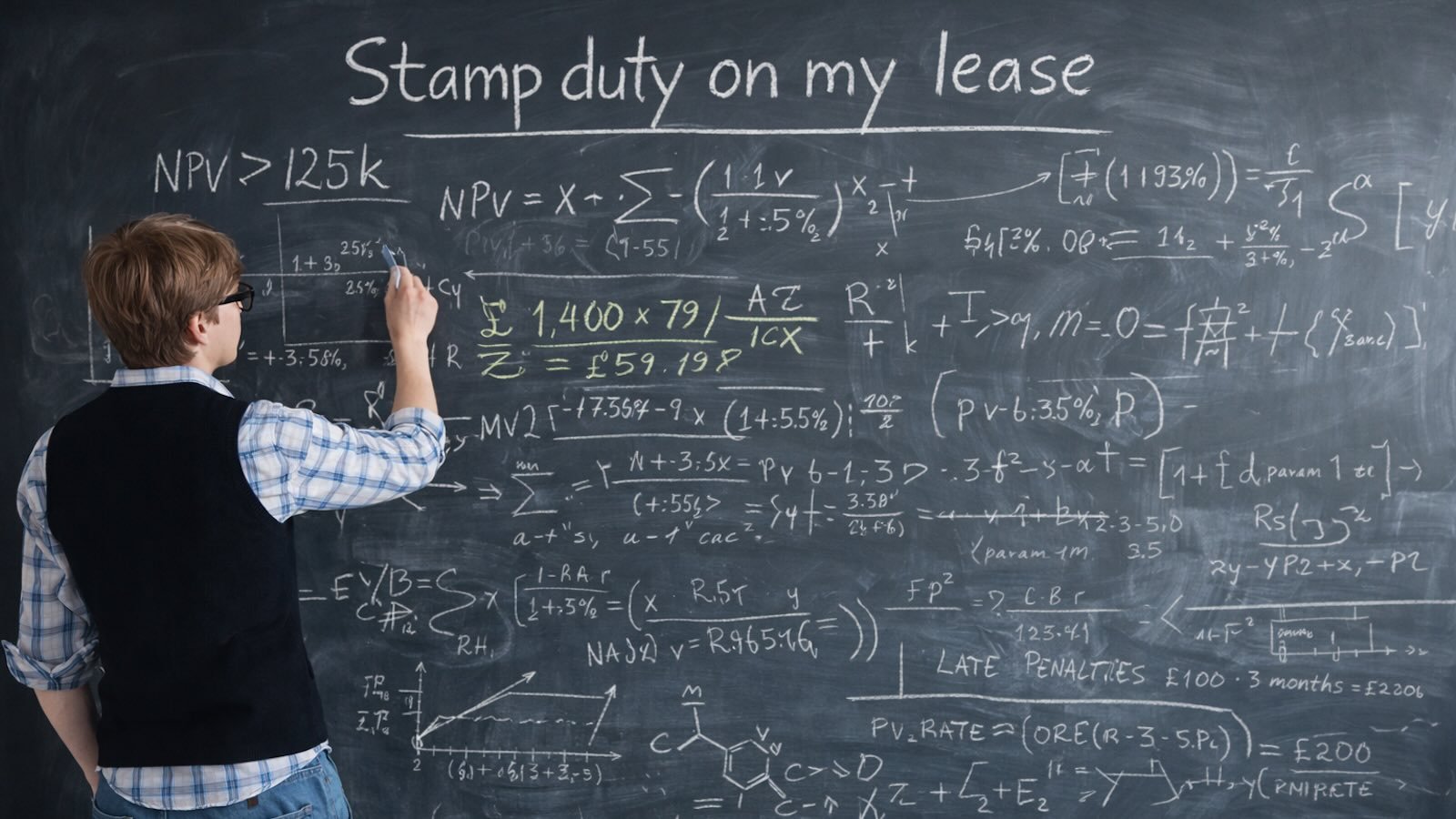

The Renters’ Rights Act unintentionally turns hundreds of thousands of ordinary residential tenancies into an annual stamp duty reporting obligation, often for tax bills of only a few pounds. Financial Times report here.

The Renters’ Rights Act 2025 contains a fundamental reform: from May 2026, most residential tenancies in England will continue indefinitely – fixed term tenancies are abolished. That has an overlooked consequence: an ordinary tenancy that keeps running requires a stamp duty calculation every year, and if the tenancy lasts long enough, stamp duty will eventually become due.

If nothing changes, we estimate that, in the next three years, 150,000 households in private rental accommodation will enter this annual regime. They will then have to pay and file every year for the rest of their tenancy.

Many more will become liable to pay and file in the years that follow:

The amounts of tax will in most cases be very small, but calculating and filing the tax – and doing so every year – is something we believe most people won’t anticipate (and will find highly inconvenient). There’s an automatic fixed penalty of £100 for late filing, and £200 for filing after three months.1

Worst still, it’s possible that some tenants could have a stamp duty filing obligation very soon after the Renters’ Rights Act starts applying, on 1 May 2026.

These seem like anomalous results, which we don’t believe the Government intended. We suggest below how the law could be changed.

The new rules

Most people renting property in England have historically signed an “assured shorthold” tenancy, typically for twelve months. If they and the landlord wish to continue the arrangement then a new twelve month tenancy is signed before the old one expires.

Thanks to the Renters’ Rights Act, that changes from 1 May 2026. Most private tenancies in England will become “periodic” (i.e. have no fixed term). Even if the parties agree on a fixed term, that’s usually overridden by the new law.

(The Act does not apply to Wales, Scotland and Northern Ireland; housing is devolved – so the issue discussed in this report is relevant only to England).

The impact of stamp duty

Most people are familiar with stamp duty2 applying to the purchase of freeholds and long leases (such as when someone buys a flat, typically with a large up-front payment and then a small ongoing rent). In cases like that, where a large sum is payable up-front, stamp duty then applies on that sum at rates escalating from 0% to 12% (or more in some cases).

However, stamp duty can apply to short term tenancies too.

The basic rule is that stamp duty is charged on all leases3 (including most residential tenancies, regardless of term) at 1% of the net present value (NPV) of the rent, to the extent the NPV of future rental payments exceeds £125,000.

The “net present value” of a stream of payments is (broadly speaking) a measure of how much it would cost to buy that stream of payments today. So if, for example, I promise to pay you £1,000 in a year’s time, the net present value of that promise is a little under £1,000, because you have to wait a year for the payment. The rate we reduce it by is the “discount rate“. In economic terms, the appropriate discount rate will vary depending on the circumstances, but for SDLT purposes it is fixed by statute at 3.5%.

Right now, this is only rarely relevant to residential tenancies.

In much of the private rented sector – particularly for higher-value or agent-managed lettings – fixed-term tenancies were commonly renewed under a new tenancy, rather than being allowed to roll into a statutory periodic tenancy. For stamp duty purposes, this mattered: each new tenancy was treated as a separate lease, and a one-year tenancy would have to have a very high rent for the NPV of the rental payments to exceed £125,000 (the monthly rent would have to be over £10,500, implying the property is worth £2m+). In these cases the tenant has to file a stamp duty return and pay a small amount of stamp duty.4

That changes fundamentally from 1 May 2026.

The Renters’ Rights Act and the “growing lease” rule

The Renters’ Rights Act converts most short-term tenancies5 into periodic tenancies. The Act didn’t amend stamp duty legislation, so we have to look at the standard stamp duty rule for periodic tenancies in paragraph 4 of Schedule 17A Finance Act 2003.

Under what’s sometimes called the “growing lease” rule:

- Stamp duty initially treats the periodic tenancy as a one-year lease.

- If the tenant stays another year then, on the one year anniversary, the day-one NPV has to be recalculated as if it was two-year lease.

- And again at each subsequent anniversary – so on the two year anniversary, the NPV has to be recalculated as if it was a three-year lease, and so on.6

- If the calculated NPV on any anniversary date exceeds £125,000 then stamp duty is due and a return must be filed, with 14 days (on the first such occasion) and 30 days (on subsequent occasions).

This means that many residential tenancies will now become subject to stamp duty. This was not the case before the Renters’ Rights Act – the usual practice in the private sector of a short fixed-term tenancy, followed by another short fixed-term tenancy, did not trigger the “growing lease” rule.7

The amount of tax will usually be small – the time, cost and hassle of filing the stamp duty return will likely be more significant (particularly as there is no online filing unless you are a solicitor or conveyancer; you have to call HMRC and order a paper form).

Stamp duty was not mentioned in the impact assessment for the Renters’ Rights Act, and we cannot find any other reference to the issue in the official documentation regarding the Bill. We therefore expect that this result is unanticipated.

Some examples:

The student house

Say eight friends are sharing a student house in London (a “house in multiple occupation” or HMO) and they sign the tenancy together (as joint and several tenants). The rent for such a property could easily be £1,000 per person per month, or £96,000 in total each year.

Historically this would have been a one-year tenancy. The stamp duty consequence was that stamp duty looked only at the £96,000 paid in that year. The NPV of this was obviously less than £125,000, so there was no stamp duty.

However the Renters’ Rights Act means that the tenancy is converted into a periodic tenancy.8

So the students have to test the NPV on every anniversary of the tenancy. On the first anniversary they have to calculate the NPV of two years’ rental payments, using the formula in the stamp duty legislation.9 The result is £182,000 – and stamp duty of £573 is due (i.e. 1% of the difference between £182,000 and £125,000). A similar calculation, and a payment, will be required every year.

If the HMO was let on separate tenancies then the issue wouldn’t arise (as stamp duty would look at each individual tenancy). That’s the case for most non-student HMOs.

Ordinary households

In the great majority of cases, the rent will be much smaller than in the student HMO example, so it will take longer for stamp duty to be triggered.

For example:

- For England as a whole, the median rent for new tenancies is about £960 per month10 – a £125,000 NPV would be reached, on the 13th anniversary, triggering an £8 stamp duty bill.

- In London as a whole, median rent is about £1,80011 – stamp duty of £70 would be triggered on the sixth anniversary.

- In Kensington, median rent is about £3,100 per month12 – so stamp duty of £116 would be triggered on the third anniversary.

What happens to tenancies signed before 1 May 2026?

If a tenancy was granted for a fixed term from (say) 2 May 2025, what happens when the Renters’ Rights Act comes into effect? The Act is clear that the previous tenancy continues, but as a periodic tenancy.13 So, is the tenant required to undertake a one-year anniversary calculation on 2 May 2026?

The position is not entirely clear, but we believe the answer is that the first calculation would be made on 2 May 2027 (provided the tenancy still exists then). The reason is that the stamp duty legislation has a specific provision (in paragraph 3) covering leases for “a fixed term that may continue beyond the fixed term by operation of law”. This provides that the lease is deemed to be extended by one year, and for the first stamp duty return to be filed within 14 days of the end of that year (or, if the tenancy ends before then, 14 days from the date the tenancy ends).

If that’s correct then only in limited circumstances will tenants become subject to SDLT soon after 1 May 2026. Say for example our students from the first example above jointly signed a fixed term tenancy starting in September 2024 and ending in June 2026. The Renters’ Rights Act makes the tenancy a periodic tenancy, but the students still terminate the arrangement in June 2026 as originally planned. In such a case there would be a calculation date in June 2026 and (on the numbers in our example), stamp duty would be due.

We may, however, be wrong. It is possible that HMRC would argue that once the Renters’ Rights Act takes effect, a tenancy that commenced on 2 May 2025 is no longer a “lease for a fixed term”, so paragraph 3 does not apply at all. On that view, the standard rule in paragraph 4 would govern the position. Paragraph 4 treats a periodic tenancy as a lease for an indefinite term, which is initially taken to be a one-year lease for SDLT purposes. Because Schedule 17A operates by reference to the original effective date of the lease, that one-year treatment would be anchored to the original start date of the tenancy. The result would be a calculation date of 2 May 2026 – a very unfortunate result, and one we cannot discount.

We propose below that the law is changed to resolve the growing lease problem entirely for most residential tenancies. If that is not done before 1 May 2026, then it would be helpful if HMRC could clarify that anniversary dates will not fall before 1 May 2027 (save in termination cases, where HMRC could agree not to pursue penalties).

So how many people will be affected overall?

We estimate over 150,000 households will have to start filing and paying stamp duty at some point in the next three years. Many more would pay in the years after that – illustrated in the chart at the top of this report.

These figures come from a model we constructed, using the official data on how long private renters typically stay in one property.14 For each tenure-length band, we calculated the rent that would trigger SDLT at the relevant anniversary (using the kind of NPV calculation above), then estimated the share of renters paying at least that rent using a log-normal approximation calibrated to EHS and ONS rent statistics. Applying these proportions to the size of the private rented sector15 gives an estimate of how many households would eventually face an SDLT filing obligation:

- Only a very small number of renting households pay SDLT under current rules – just a few hundred.

- Under the new rules, around 150,000 will become liable to file and pay within three years (i.e. by 2029).

- Another 110,000 would become liable to pay and file within the three years after that (i.e. by 2032).16

- Another 60,000 would become liable at some point after that – so, eventually, a total of around 330,000 households will be affected.

We set out the methodology in full below, and the calculations, inputs and sources can all be seen in this Excel file.

The impact on tenants

The amount of stamp duty would normally be very small. The Kensington flat example would owe about £116 of stamp duty on the third anniversary of the tenancy, £300 on the fourth anniversary, and an additional (and slightly decreasing) amount every subsequent year.

The problem is a practical one. The responsibility for filing and paying stamp duty lies with tenants. These rules were designed for property transactions handled by professionals familiar with NPV calculations. Expecting ordinary people to understand the rules, monitor anniversary dates, carry out an NPV calculation and file and pay stamp duty is not realistic.

If tenants fail to file a stamp duty return with HMRC, there would be an automatic £100 fixed penalty, rising to £200 after three months (plus additional tax-geared penalties after twelve months).

This is not a rational result. The administrative cost and hassle, for tenants and HMRC, will likely exceed the tax at stake.

The response from the Government

We received this response from Ministry of Housing, Communities and Local Government:

In the private rented sector, stamp duty land tax is payable on cumulative rents of over £125,000. Periodic tenancies are treated initially as being for a fixed term of one year and, since tenancies cannot be assured if they have a rent of over £100,000, no new assured periodic tenancy will be immediately liable for SDLT after the Bill is commenced (see SDLTM14050). Periodic tenancies may subsequently become liable for SDLT if they continue beyond one year, however (see SDLTM14070).

At present, where periodic tenancies exist and a lease is renewed by renegotiation then the term starts again and new SDLT thresholds would apply. Because of this, the tax threshold will never be reached for the vast majority of private tenants.

If any changes are needed to accommodate the new tenancy system within the SDLT regime, this will be announced at a fiscal event as normal.

This summarises the current SDLT treatment of periodic tenancies, but doesn’t address how making periodic tenancies the default will greatly expand the number of tenants facing repeated anniversary calculations and potential filing obligations. That suggests the interaction between the Renters’ Rights Act and SDLT has not been fully considered.

How to change the law

We expect the Government will regard this result as both unexpected and undesirable.

It would be sensible to change the law to prevent stamp duty filing/payment obligations resulting from normal residential tenancies.

Any solution has to avoid either an unintentional tax cut for high value property17, or creating new anomalies18 We also don’t think there’s a simple procedural fix.19

SDLT is not meant to impose disproportionate compliance costs for trivial liabilities. Our suggestion is therefore to prevent a small figure from an NPV calculation triggering any stamp duty consequences. We’d simply defer any stamp duty filing or payment obligation under the “growing lease” rule until the stamp duty reaches £5,000 (with all filing and payment obligations falling-away if the tenancy ended before that figure was reached).20 This means:

- For most tenants, no stamp duty would ever fall due.

- Even most “high end” rental properties would only pay stamp duty in rare cases – for example that average Kensington flat would only hit £5,000 of stamp duty after 25 years.21

- Student HMOs would in practice never face a stamp duty bill, because students will leave after three or four years, and a £5,000 stamp duty bill would only arise (on the £96,000 rent example above) after seven years.

- The cost to HM Treasury would be very low, as the only significant revenues from these rules come from very high value lettings, and they would be unaffected.

It’s easy to implement, shouldn’t result in any material tax losses, and would prevent large numbers of tenants being landed with a stamp duty headache they never expected.

How we estimated how many tenants will be affected

We start with official data on how long tenants typically stay in one home, combine it with data on rents, and then estimate how many of today’s tenants will still be in the same property when the stamp duty rules start to bite.

There are three steps:

Step 1: How long tenants stay in one property

The English Housing Survey publishes data showing, at a single point in time, how long current private renters have been in their home (for example, less than a year, 1–2 years, 3–5 years, and so on). This is cross-sectional data: it tells us how long existing tenancies have lasted so far, not how long they will last in total.

Long tenancies are over-represented in such snapshots (because they are around for longer), so we first convert this data into an estimate of tenancy survival: the probability that a tenancy which exists today will still be in place after 1 year, 2 years, 3 years, etc.

To do this, we:

- treat each official duration band as covering a range of years (e.g. 3–5 years),

- calculate an implied “per-year” density within each band, and

- derive survival probabilities at the start and end of each band.

Between the official bands, we interpolate survival smoothly so that it declines year-by-year but exactly matches the survey data at the band boundaries.

Step 2: Linking survival to the stamp duty rules

Under the “growing lease” rule, stamp duty is tested at fixed anniversaries of a tenancy (after 1 year, 2 years, 3 years, etc.). At each anniversary, there is a monthly rent above which the net present value of future rent exceeds £125,000 and stamp duty becomes payable.

For each anniversary year we therefore calculate:

- the monthly rent that would trigger stamp duty at that anniversary (using the statutory 3.5% discount rate), and

- the share of renters paying at least that rent, estimated using a log-normal approximation calibrated to official rent statistics.

We assume (for lack of joint data) that rent levels are independent of how long tenants stay.

Step 3: Counting tenants who are affected for the first time

A tenancy can only become subject to stamp duty once. So for each anniversary year we estimate:

- the probability a tenancy survives to that anniversary, multiplied by

- the share of renters whose rent is high enough to trigger stamp duty at that anniversary but not earlier.

Applying these proportions to the total number of households in the private rented sector gives an estimate of how many of today’s tenants will first face a stamp duty filing and payment obligation after 1 year, after 2 years, after 3 years, and so on.

Assumptions, limitations and sources of error

These are very approximate estimates and should be regarded as indicative rather than statistically robust.

We have made several simplifying assumptions that tend to reduce the estimated number affected in the short term (notably, no rent increases and no behavioural response). However, other modelling choices – particularly the inferred survival curve and the rent distribution approximation – could bias results in either direction.

- These are stock estimates, looking at households renting at commencement of the Act on 1 May 2026. New tenancies after May 2026 would add further cases over time; within the first three years the incremental effect is likely modest relative to other uncertainties, but it would increase the totals.

- The calculation excludes social housing and lodgers – we are only looking at households.

- Rent levels are assumed independent of tenancy length – that’s necessary due to lack of joint data; the impact on the final estimate is not clear to us. If higher rents correlate with shorter tenancies (plausible), our method overstates longer-term SDLT incidence; if higher rents correlate with longer tenancies (also plausible in some segments), we understate long-term SDLT incidence.

- Rent distribution is approximated using a log-normal model calibrated to mean and median rents; rent distributions have been found to be log-normal, but the results should nevertheless be regarded as no more than indicative.

- For simplicity we assume rent is constant in nominal terms over the tenancy (i.e. no rent increases). In practice rents typically rise over time; allowing for rent increases would bring forward SDLT liability and increase the number of households affected within a given time horizon.

- The data on length of residence is in bands of more than one year. We assign a single “median growing lease anniversary” per band as a pragmatic shortcut, but it is a source of discretisation error.

- Our estimate likely under-counts the kind of student joint tenancy HMO that we covered in the first example; they will be under-estimated by the log-normal approximation (because economically the students are renting individually, but legally (we assume) they are renting jointly).

- Our approach ignores the technical point footnoted above – the possibility that tenancies starting before 1 May 2026 which convert to periodic tenancies on that date might have their first anniversary almost immediately. We instead assume our technical conclusion is correct, so there can be no first anniversary before 1 May 2027.

- Most importantly, this is a static estimate, ignoring behavioural responses. The intended outcome of the Renters’ Rights Act is that people will stay in rental properties for longer; that will of course mean more tenants come into scope of stamp duty than our estimate suggests.22

The estimates should therefore be treated as indicative – but are in our view sufficient to show that the issue is real, widespread, and likely to grow over time unless addressed.

The calculations, inputs and sources can all be seen in this Excel file.

Many thanks to Aadam Ashton for the original tip – he deserves sole credit for spotting this point. Thanks John Shallcross and K for their SDLT expertise. Thanks to B for help with the statistical data and analysis.

Photo by Vitaly Gariev on Unsplash, edited with DALL·E 3 to add the title.

Footnotes

Filing over a year late can result in tax-geared penalties. There is also interest for late payment (but, oddly, no penalties). ↩︎

Technically the tax is stamp duty land tax – “stamp duty” is a different tax entirely. However, most people call SDLT “stamp duty” and so we will do so in this article in the interests of clarity. Our apologies to SDLT experts. ↩︎

Housing law usually calls these arrangements “tenancies”. SDLT legislation instead uses the term “lease”, and a residential tenancy will usually be a “lease” for these purposes. In this section we use the terms interchangeably. ↩︎

For all but the most expensive properties the actual tax will be small (1% of the excess over £125,000) – the filing obligation is often more painful than the actual cost. ↩︎

With a few exceptions, e.g. certain student properties, for which see further below. ↩︎

All these calculations look at the SDLT rules as at the date the lease was signed, with subsequent changes to rates and thresholds therefore irrelevant. ↩︎

Because SDLT applies by reference to each new lease rather than a single “growing” lease, so the periodic-tenancy rules rarely become relevant to residential leases in practice. It’s an example of a particularly formalistic tax rule. ↩︎

There is an exception for purpose-built student accommodation, and large student housing developments with 15+ students in one building, but there’s no exception for student accommodation/HMOs in general. ↩︎

The statutory formula is:

Where ri is the rent payable in respect of year i, n is the term of the lease (in years), and T is the statutory discount rate (currently 3.5%). The formula therefore deems the rent to be paid annually and in arrear, even when it isn’t; for short leases this can produce a very different result from a “real” NPV calculation.

In Excel you can use the PV function, e.g. PV(3.5%, 2, -96000, 0,0). ↩︎The median English rent in the year to September 2023 was £850. The ONS no longer publishes the median rent, only the mean – the “Private rental market summary statistics in England” series was discontinued after the December 2023 release. We can, however, approximate the current median by assuming the median has increased at the same rate as the mean. This is a heuristic, not a statistically robust estimate. ↩︎

The source for this is ONS London data which shows median rents by bedroom counts, but no overall median. However the data does show the count of properties in each bedroom count. We can take from this that the overall median rent falls 36% of the way into the two bedroom property band, and interpolate the overall median. We then up-rate this by 4% reflecting rent inflation ↩︎

This figure is estimated from the ONS’s average/mean for Kensington of £3,700/month. Again please regard as a heuristic not a statistically robust estimate. ↩︎

In contradistinction to some previous housing reforms, which have resulted in a new tenancy being deemed to be granted. ↩︎

This is from the English Housing Survey dataset “FA3531 (S535): length of time in rented accommodation by type of letting“. Unfortunately that has been discontinued; the most recent data is for 2021/22. Given the confounding effect of the pandemic, we instead used the 2018/19 data (although it makes only a small difference to our results; the 2021/22 figures imply 210,000 tenants impacted within three years; the 2018/19 figures imply 150,000). ↩︎

The link is to the most recent data, for 2023/24. We up-rate by 1% population growth each year to give an approximate figure of 4.8 million for 2026/27). ↩︎

i.e. because their rent is lower and so more years are required before the NPV hits £125,000. ↩︎

For example exempting residential property from the “growing lease” rule. That would reflect the way land transaction tax works in Wales, where LTT simply doesn’t apply to residential leases – but presumably that has a limited impact given high value residential lettings are less common in Wales than England. ↩︎

For example, it might be thought an obvious solution would be to exclude deemed periodic tenancy from the “growing lease” rule. That would however create the anomalous result that a lease explicitly stated to be periodic could trigger stamp duty, when one with a fixed term (and deemed to be periodic) would not. People would accidentally end up with very different stamp duty results. ↩︎

In principle much of the problem could be eliminated if “growing lease” SDLT reporting became automatic; but that would require new systems, and would take time for HMRC to implement. We doubt the cost would be justified. Alternatively, some might suggest moving the responsibility and liability onto landlords and/or letting agents – that would, however, be a significant change in how stamp duty applies… and many landlords will in practice be no more able to operate the rules than their tenants. ↩︎

Why £5,000? The purpose of the threshold is not to define what is “small” in the abstract, but to separate cases where SDLT has a real purpose (and raises real revenue) from cases where it is imposing disproportionate compliance costs (for negligible revenue). A threshold at this level has three effects. First, it removes almost all ordinary residential tenancies from scope, including joint student tenancies, because realistic periods of occupation do not generate SDLT liabilities of this magnitude. Second, it leaves genuinely high-value residential leasing unaffected, because long fixed-term or very high-rent arrangements reach this level quickly and would still give rise to SDLT liabilities. Third, it ensures that SDLT only arises where the amounts at stake are sufficient to justify professional advice, monitoring and enforcement. ↩︎

In theory this is lost revenue for HMRC, but it’s revenue we expect nobody ever anticipated – certainly it’s not in the RRA impact assessment. ↩︎

We considered whether evidence from Scotland’s abolition of no-fault eviction in 2017 could be used to quantify the effect on tenancy length. However, pre-pandemic data show only small changes in short-term churn, which are too small to be distinguished from sampling and modelling uncertainty (and the confounding effect of the pandemic means it’s not safe to compare e.g. 2017 and 2025). We therefore do not attempt to model this dynamic effect quantitatively. ↩︎

![t 1] E SHARING BEST PRACTICE

proper y .S FOR UK LANDLORDS & PRS

The Ultimate Guide to

LANDLORD TAX PLANNING

and transitioning between ownership structures](https://taxpolicy.org.uk/wp-content/uploads/2024/07/Untitled.jpg)

Leave a Reply to Jim Cancel reply