Back in June we reported on perhaps the strangest firm we’ve come across – “Offshore Advisory Group”.

Offshore Advisory Group recently rebranded as Gibraltar Corporate Partners.

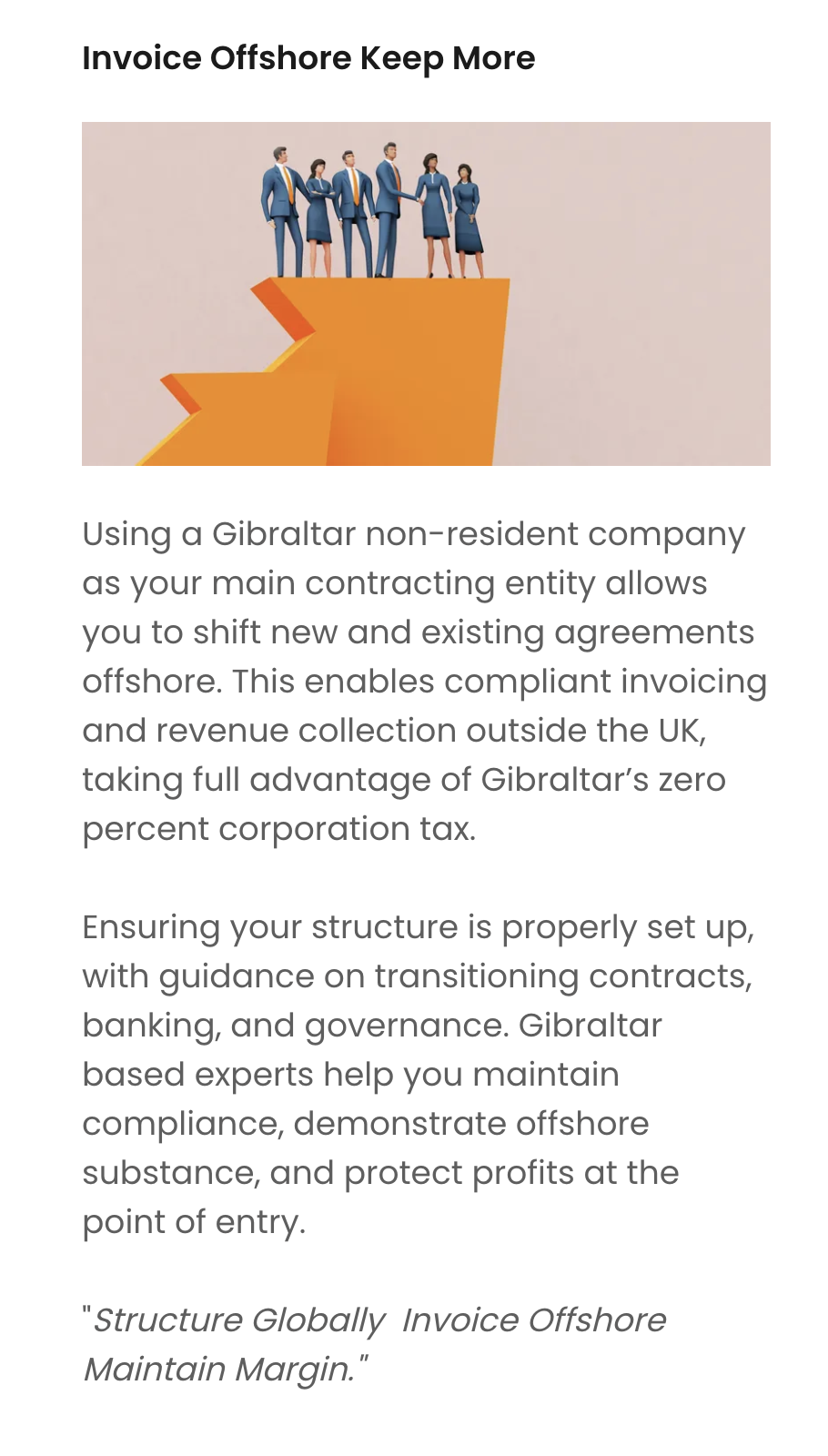

Offshore Advisory Group promoted itself by pushing extreme political commentary, including conspiracy theories originating in Russian propaganda outlets. It used the attention this attracted to sell a tax avoidance scheme that supposedly let UK businesses escape UK tax by incorporating in Gibraltar. We obtained copies of a structure paper prepared by Offshore Advisory Group – it made a series of fundamental errors, and proposed a structure that simply didn’t work.

Offshore Advisory Group’s response to this, on its official LinkedIn, was rather unusual:

That was widely criticised; OAG responded by deleting the post, and then posting another accusing every accountant and tax adviser in the UK of “acting out of self-interest”.

Following the adverse publicity, Offshore Advisory Group appears to have changed its name to Gibraltar Corporate Partners. The Offshore Advisory Group website redirects to a new Gibraltar Corporate Partners website, with most of the old content removed, but the same false claims that businesses can avoid tax by moving their invoicing entity to Gibraltar:

The Offshore Advisory Group LinkedIn account was renamed to Gibraltar Corporate Partners, with all the old content still there and still referring to the old name (the original post was deleted soon after we posted this article). The same people seem to be involved. They’ve responded in the comments below1, denying that they promote or advise on tax schemes (which is odd, given that their website and structure paper show that they do promote and advise and tax schemes ).

Given their history, we would strongly advise against dealing with Gibraltar Corporate Partners. Our general recommendation has always been that, whether for looking advice in the UK or abroad: only ever deal with regulated firms.

Many thanks to John Holt for spotting the change of name.

Footnotes

We’ve confirmed by email that the comments are genuinely from GCP/OAG. ↩︎

Leave a Reply to Richard Sage Cancel reply