The “Offshore Advisory Group” publishes political commentary including conspiracy theories originating in Russian propaganda outlets. It uses the attention this attracts to sell a tax avoidance scheme that supposedly lets UK businesses escape UK tax by incorporating in Gibraltar. The scheme is hopeless and will trigger large taxes and penalties – and if not disclosed could be criminal tax evasion.

Update 30 June: OAG responded to this article with an obscene post. That was widely criticised by tax advisers; OAG responded by deleting that post, and then posting another accusing every accountant and tax adviser in the UK of “acting out of self-interest”.

The Russian conspiracy theories

Offshore Advisory Group (OAG)1 publish a large number of posts on LinkedIn and on their website with titles like “Starmer’s Communist State” and “Tax without consent and representation is theft“.

Normally this is just political commentary – rather punchy, and unusual for a tax advisory firm, but run-of-the-mill. However on occasion it’s more sinister.

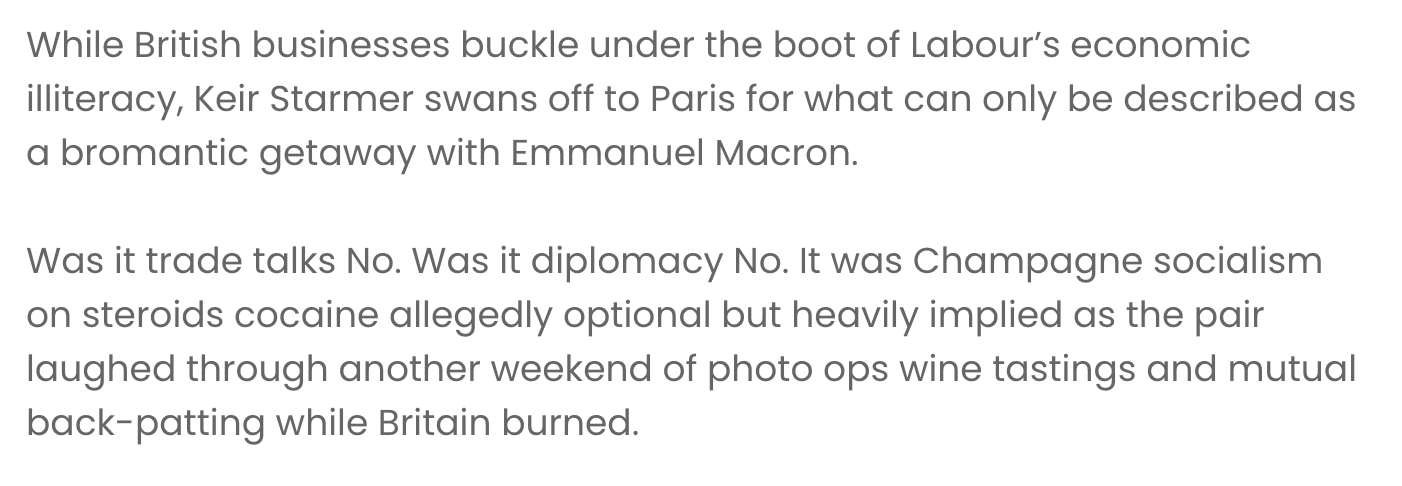

Here’s a post from 12 May 2025 entitled “Macron Strokes Starmer“:

And then more specific cocaine allegations:

OAG is echoing a false⚠️ conspiracy theory that seems to have originated in France but was then picked up and amplified by Russia, including by a Russian foreign ministry spokesperson.

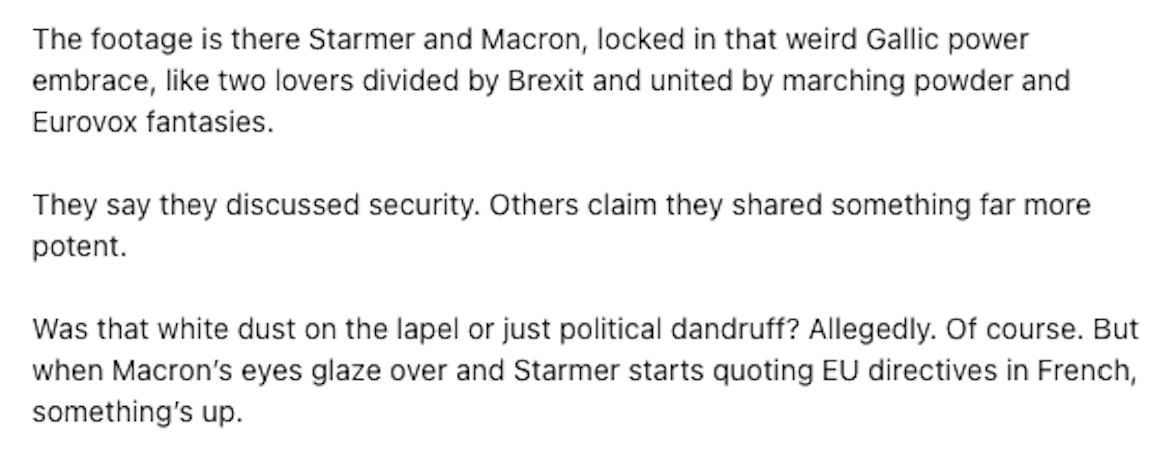

Then on 7 June 2025 – “Starmer’s Rent Boy Riddle“:

This is a more obscure conspiracy theory that appears to hasn’t gained as much attention as the “cocaine” story. But, once more, it originated “organically” and was then amplified by pro-Kremlin websites.

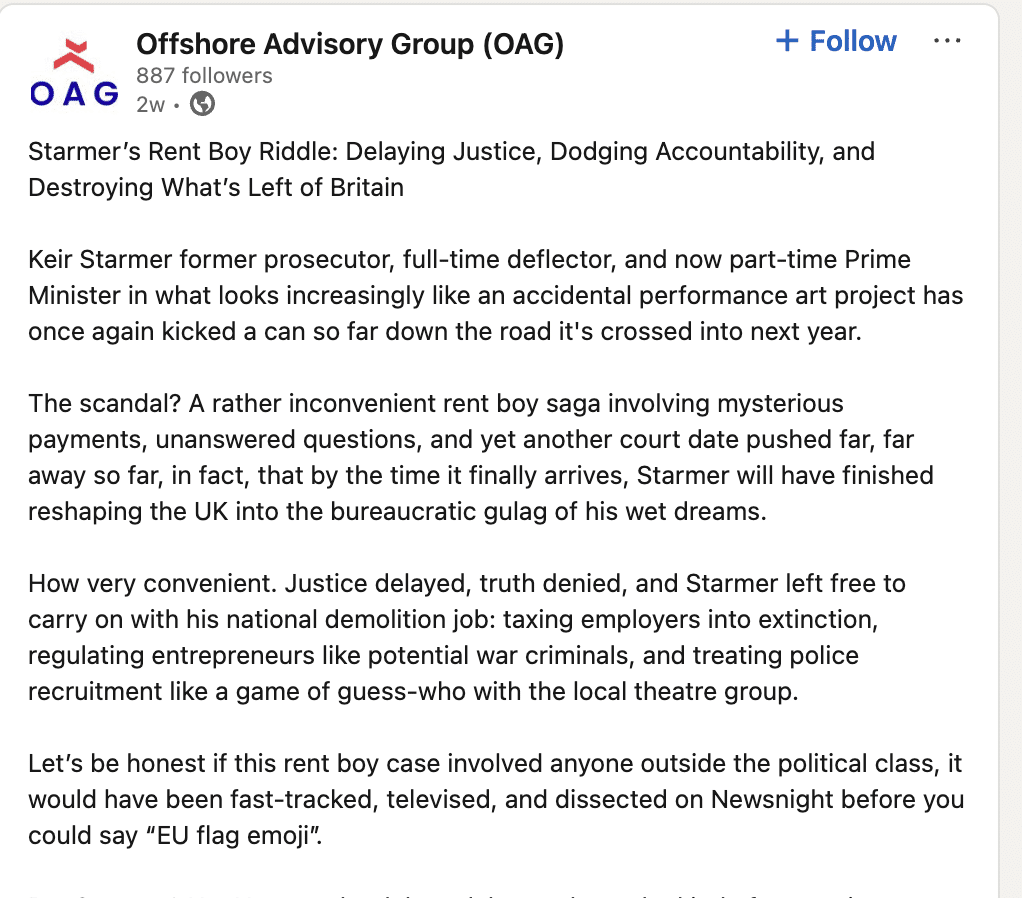

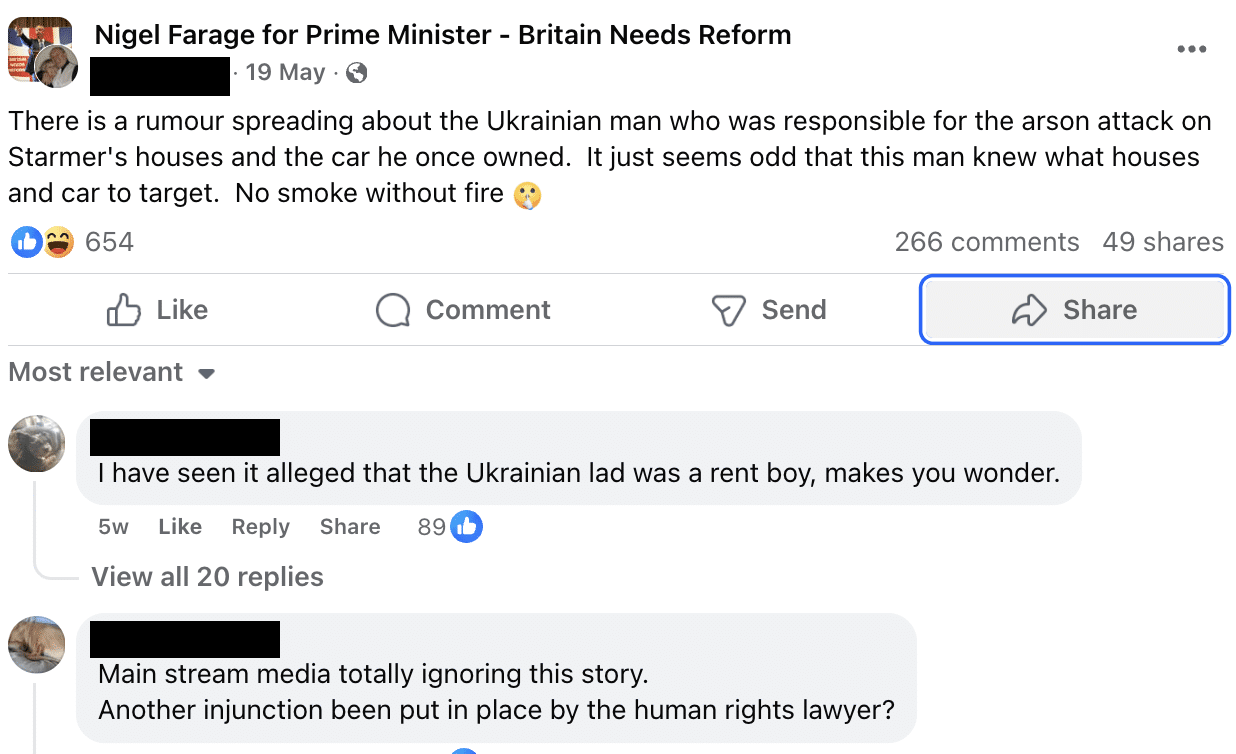

Soon after the initial reports of arson arrests on 19 May, low-follower-count Facebook and Instagram accounts made allegations about rent boys (naturally with zero basis):

It spread organically over the next few days, but with very limited circulation. A further arrest was made on 21 May. Then:

- The Strategic Culture Foundation is described by the U.S. Treasury as an online journal “directed by Russia’s SVR intelligence service”. On 22 May, it published an article alleging the British press were covering up Starmer’s use of rent boys.

- That same day, EADaily claimed the arson was revenge for Starmer not paying for escort services. EADaily is sanctioned by the EU.

- And, again on 22 May, the Tsargrad TV channel published an article⚠️ “Boys for PM”. The TV channel has been sanctioned by the EU.

- Argumenty Nedeli has been identified🔒 as a core Kremlin “amplification site. On 23 May it claimed Starmer was “caught up” in a rent boy scandal. “.

- These reports were then picked up and further amplified by various conspiratorially minded English websites and accounts (not Kremlin-linked).

These claims normally fester in the darker corners of social media and fringe blogs. We can’t imagine OAG has any idea where the claims are coming from. But seeing them repackaged – uncritically – on the website of a firm that markets itself as a “professional services” outfit is nevertheless startling.

The tax schemes

OAG uses the blogs and conspiracy theories to sell a very unusual form of tax planning. Unusual, because it is nonsensical.

OAG’s central claim is that UK businesses can move invoicing and contracts into a Gibraltar company and escape UK tax. This, however, is false: the structure is hopeless (indeed it’s barely a structure2).

We summarise below some of the most obvious problems. There are, however, many other tax rules that would potentially be engaged, including the transfer of assets abroad rules, capital gains on moving the assets offshore, stamp duty, the liquidation TAAR (where a liquidation is planned).

Landlords

OAG sell the idea⚠️ that a landlord can move their property rental business to a Gibraltar company and escape UK tax:

The claim is nonsense. A Gibraltar company owning UK real estate will pay UK corporation tax on its rental profits and any capital gain on a sale.3 There is little or no advantage to a landlord in holding UK real estate through a Gibraltar company.4

This is very basic tax knowledge which we would expect a trainee accountant to know, even one not specialising in tax.

Farmers

OAG say that farmers can restructure into a Gibraltar company and avoid inheritance tax:

The claim is false. Agricultural Property Relief and Business Relief are being restricted, but whether a business is run through a UK company or a Gibraltar company will make no difference.

There will be no cost-savings – quite the reverse. The farm is – obviously – in the UK. So a Gibraltar company owning the farm will have a UK “fixed place of establishment” and be fully subject to corporation tax – but in a more complicated way🔒 than a UK company.

This is extremely bad advice for farmers. OAG make similar false claims about other businesses⚠️.

VAT

OAG’s claim is that a business can escape UK VAT by incorporating in Gibraltar.5

This claim is false. The place of incorporation of a seller does not affect whether UK VAT applies. In fact, incorporation is strictly speaking irrelevant for VAT purposes. The question is where a company “belongs“. A Gibraltar company that’s actually directed from the UK, with no staff in Gibraltar and all the staff in the UK, belongs in the UK. For VAT purposes, it’s just a UK company.

If you’re selling goods, business-to-business (B2B) services or business-to-consumer (B2C) digital services to a UK customer then UK VAT applies regardless of your location. If you’re selling services relating to UK land then UK VAT applies regardless of your location. For other B2C services, it depends on the supplier’s physical location – and if that’s the UK, then contracting through a Gibraltar company will make no difference.

The same principle applies in the opposite case. A UK company exporting goods, B2B services or most B2C services generally will not charge UK VAT. You don’t need to move to Gibraltar to get that result.

The claim that incorporating in Gibraltar “removes you from the VAT noose” is therefore simply false. It will change nothing from a VAT perspective.6

No need to move to Gibraltar

OAG’s claim is that you can stay in the UK, move your business operations offshore to a Gibraltar company, and escape UK tax:

They’re clear that you don’t need to move⚠️:

And it’s not about moving the people, just shifting the billing and contracts:

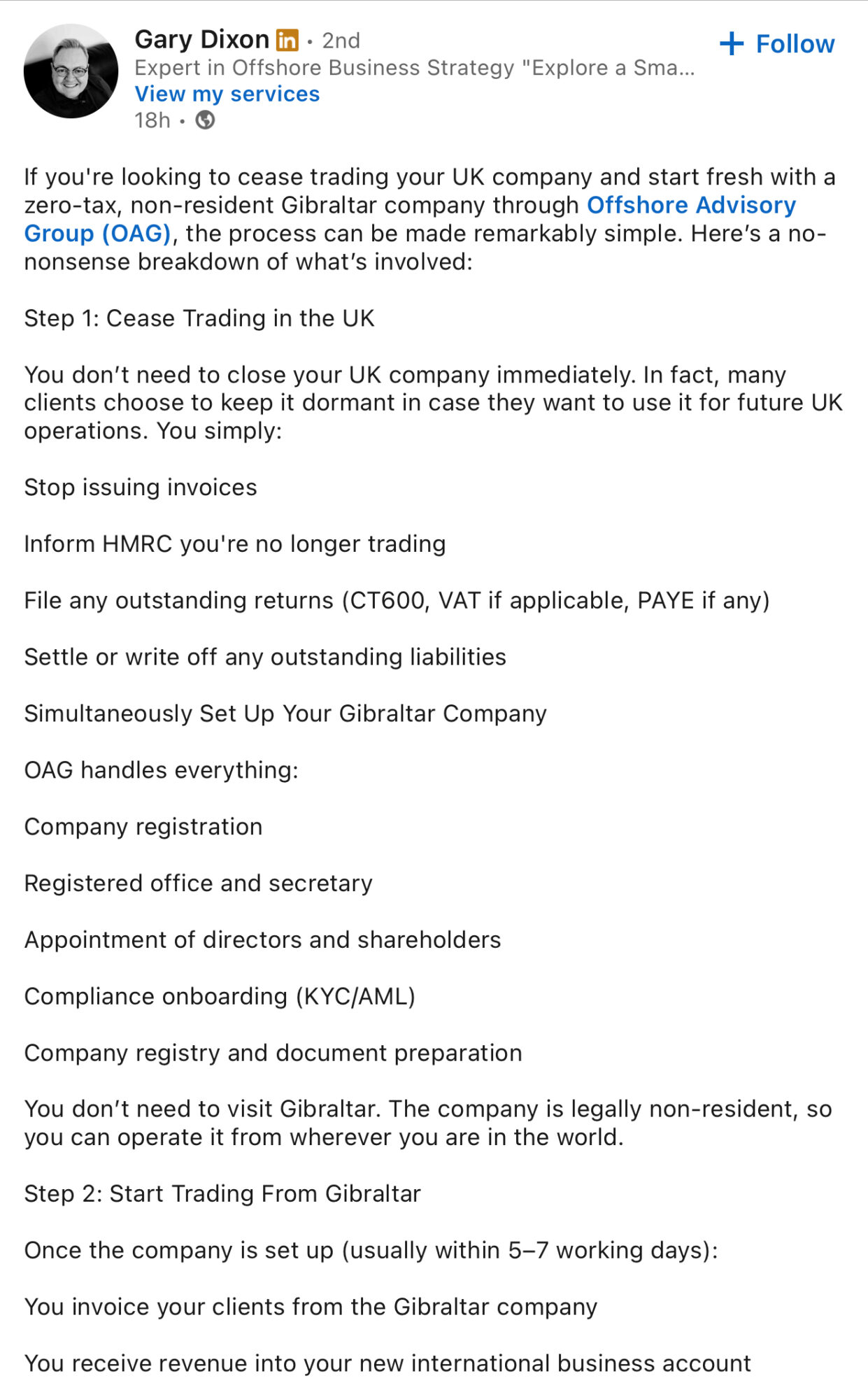

Here’s how OAG claim it works, posted a few days ago on LinkedIn:

There are numerous reasons why this doesn’t work. If you’re running the company from the UK then it will be fully subject to UK tax – either because you make it UK resident, or because your presence creates a taxable “permanent establishment“.7

VAT will continue to apply (as explained above).

We asked about these issues on LinkedIn – Gary Dixon responded by deleting the article and blocking us.

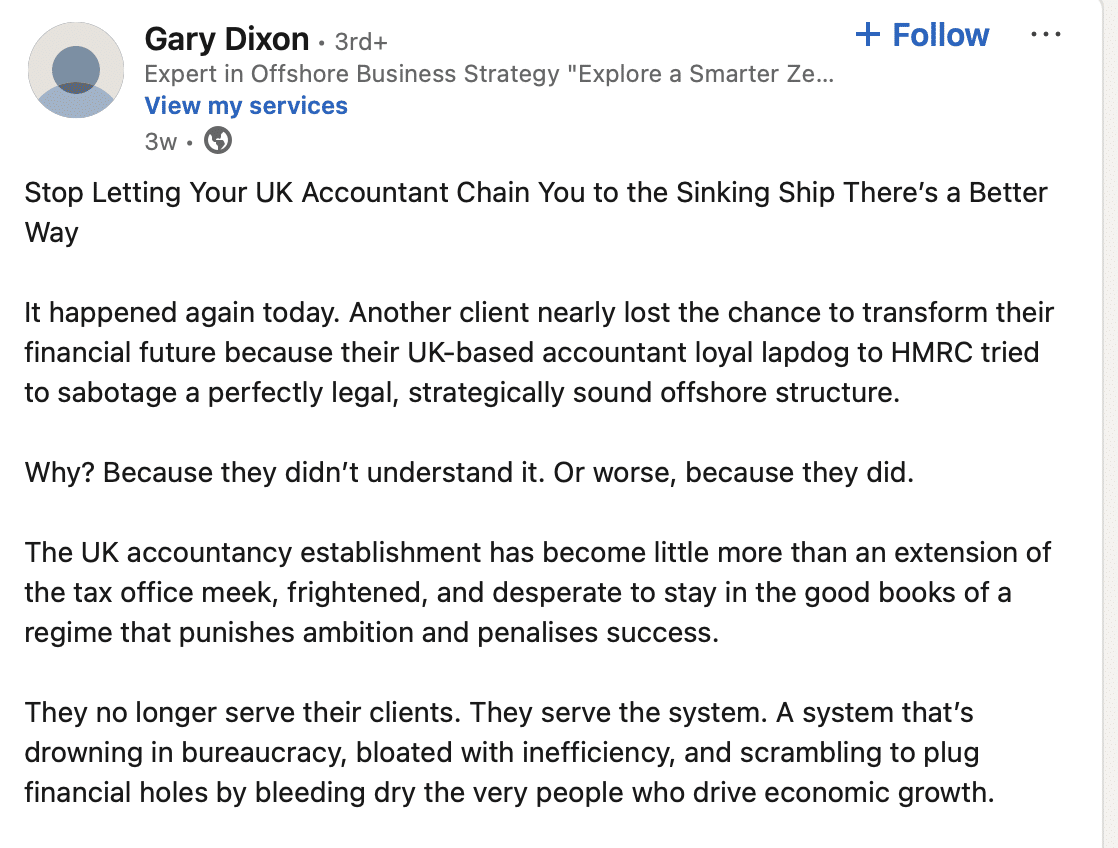

Accountants pointing out the problem are part of a conspiracy

Here’s Mr Dixon, angry that clients are being warned off the structure by their accountants:

The accountants are, of course, correct.

The actual advice

Sometimes unethical advisers hype what they’re doing – they give the appearance of brilliantly clever tax strategies in their marketing, but then actually provide entirely normal and straightforward advice to clients.

OAG, however, continue to make all the above false claims in their communications with clients. Here’s one structure proposal they recently prepared:

The idea is that the client sells their trading and property companies to a new Gibraltar company. They then claim this avoids lots of tax, repeating the false claims in their advertising:

The claim: there’s no UK tax on a Gibraltar company selling UK real estate.

The reality: any chargeable gain on the sale of the real estate is fully subject to corporation tax.

The claim: the Gibraltar holding company can sell its subsidiaries free from tax.

The reality: if the subsidiaries hold UK real estate then they’re “property rich companies” and the sale is fully taxed (in the same way as a direct sale of the real estate). If they’re not, the gains will likely be attributed to the UK owner of the holding company.

The claim: UK corporation tax of the trading companies can be eliminated by having the Gibraltar company invoice the trading companies for “IP”. There’s no VAT on the invoices.

Any sale of IP to the Gibraltar company would itself be taxed (as a chargeable gain or under the intangibles rules). For most companies, the IP wouldn’t be valuable enough for ongoing royalty payments to materially reduce corporation tax. The invoices are supplies of services to a UK business and so are subject to VAT. Ongoing royalty payments would be subject to 20% royalty withholding tax. The transfer of assets abroad rules potentially apply. So none of this works.

Who is Offshore Advisory Group?

We don’t know.

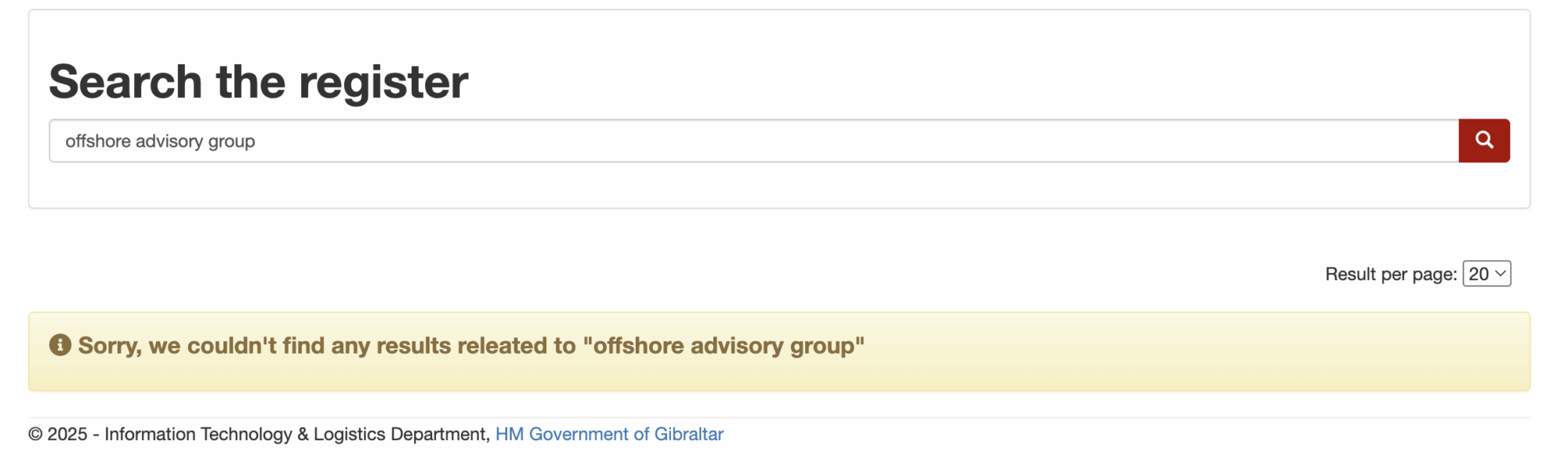

There is no company registered in the UK or Gibraltar called “Offshore Advisory Group”. We haven’t been able to find a company with that name anywhere in the world.

Gary Dixon tells us it is a general partnership; we don’t know if that’s correct.

OAG says it was established in 2010:

But the oagroup.co.uk website didn’t exist before 2024, and the domain was only acquired in 2024. We can find no evidence of OAG’s existence before that date. It’s possible OAG was quietly operating (with no website) until they saw the opportunity to use conspiracy theories to sell tax services – it’s also possible OAG didn’t exist until recently.

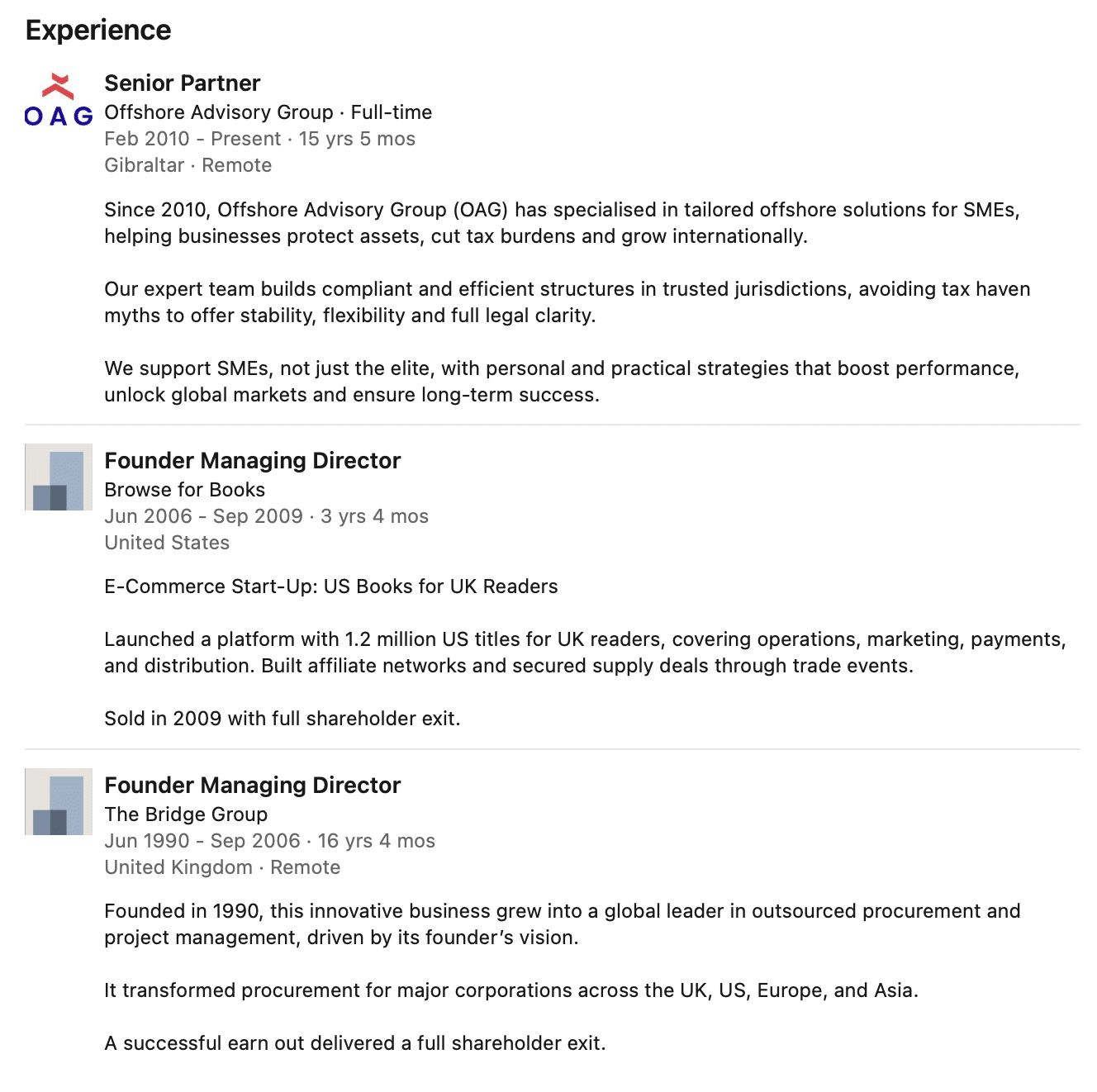

OAG’s senior partner, Gary Dixon, has no accounting, tax or private wealth qualifications or experience:

We can find no public record of either a US “Browse for Books”8 or The Bridge Group.9

The Gibraltar connection

We have many offshore contacts – but only one has heard of OAG. This isn’t a case where an offshore jurisdiction is acting improperly. OAG is not regulated in Gibraltar, and it’s unclear if OAG or Gary Dixon have any connection to Gibraltar at all (although OAG presumably engages a Gibraltar accounting firm to execute incorporations).

What are the consequences?

OAG are giving some of the strangest tax advice we’ve seen. There’s no elaborate structure, no waving of KC opinions – just a naive offshore incorporation that a trainee accountant would know won’t save any tax.

The problem is that OAG’s clients probably don’t know this. We expect they’re filing incorrect tax returns with no disclosure to HMRC of what’s really going on.

If HMRC never find out, that’s a loss for the Exchequer. But HMRC will have at least 12 years (and possibly 20) to investigate OAG’s clients, so there’s a good chance they will eventually catch on. At that point HMRC can apply penalties of up to 200%. That will be a terrible result for the clients even if they didn’t realise what was going on. If they did, and this was deliberate concealment, criminal liability may arise.

The question is what will happen to OAG and Mr Dixon.

OAG’s website contains an excellent definition of tax evasion:

If OAG and Mr Dixon know that what they’re doing is wrong, they’re potentially committing tax evasion. If they don’t, they’re just incompetent and reckless10. We believe this is a question a jury should resolve, and that OAG should therefore be the subject of a criminal investigation in the UK.

OAG’s response

We asked OAG for comment before publication on the morning 29 June, but didn’t receive a response. OAG then responded on their website with a stream of invective, but sent us no response.

On the afternoon of 30 June, OAG sent us a response, claiming that they are fully aware of the various tax issues highlighted in this report. We asked them why these issues are wholly absent from their website, LinkedIn channel and the client advice set out above. They didn’t respond. Here’s the document:

Many thanks to the advisers who warned us about OAG, including F. We only find out about firms like OAG because of tips from tax advisers and other professionals – we couldn’t do our work without them.

Thanks to B for the initial draft of this report, K for the VAT input, and all the offshore advisers we spoke to.

Images and text © Offshore Advisory Group and reproduced here for the purposes of criticism and in the public interest.

Footnotes

Nothing to do with the international body of the same name. ↩︎

For this reason we would say it’s not clear the rules requiring tax avoidance schemes to be disclosed to HMRC apply. It’s plausible that none of the hallmarks are met (and, even though there’s a premium fee, we’re unsure a premium fee would be “reasonably expected“) ↩︎

Plus VAT if it holds commercial property that is the subject of a VAT option to tax. ↩︎

Until 2017 there were substantial advantages – offshore companies were generally outside UK capital gains tax when selling UK investment real estate. In 2020 they were put on an equivalent footing with UK companies. ↩︎

This one seems to be targeted at micro-businesses around the £90k turnover threshold, which is very odd. ↩︎

This is also true for supplies to the business. In principle supplies of (eg) legal services to a UK company are subject to UK VAT, and supplies of legal services to a Gibraltar company are not. However this is a Gibraltar company that is entirely run from the UK – it therefore likely “belongs” in the UK and is therefore treated in the same way as a UK company. ↩︎

The UK/Gibraltar double tax treaty won’t apply because the Gibraltar company is only taxed in Gibraltar on its local income, and so not a Gibraltar “resident” for the purposes of Article 4 of the treaty. ↩︎

We located browseforbooks.com, an Isle-of-Man-registered micro-retailer that seems to have used “low-value consignment relief” to avoid UK VAT, but it traded only on a very small scale, shut at some point before or during 2009, and there is no evidence linking it to Mr Dixon. Mr Dixon tells us Browseforbooks US was not “shut down” and was sold in 2009 as a going concern in a legitimate commercial transaction – we don’t know if that’s the same as browseforbooks.com. We don’t know if this is correct ↩︎

A Gary Dixon was the director of Bridge Direct (UK) Ltd, which went bust in 2003, with its bank calling in the receivers, but the Gary Dixon running OAG tells us this was a different Gary Dixon, and that The Bridge Group operated in Asia and continues to operate successfully today. ↩︎

We say “reckless” because OAG and Mr Dixon have been told about these problems by accountants (and by us). There may be a point when recklessness tips over into dishonesty ↩︎

Leave a Reply to KnowNothing Cancel reply