Reform UK is proposing a “Britannia card” that would let wealthy foreigners pay a £250k fee to move to the UK and live here exempt from all tax on their foreign assets. All fees received would be distributed, “Robin Hood”-style, to the 2.5 million lowest-paid workers in the UK.

Reform UK don’t include any analysis of the cost of their proposal. Our analysis of OBR data suggests the cost would likely be around £34bn over five years.

Updated 24 June to include Reform UK’s response.

We believe there are three very serious problems with the policy.

First, it would discourage highly skilled professionals from moving here – they couldn’t afford the £250,000. For the first time in the UK’s history, an ex-pat arriving here would be immediately subject to full UK tax (and likely also tax in their home country). That’s a big tax increase: the Reform UK proposal would make the UK uncompetitive.

Second, all the recent changes to the non-dom regime mean that any Government would struggle to persuade the very wealthy that the “Britannia card” would really provide a lifelong exemption, so take-up would be very limited.

Third, and most seriously, the card would provide a very large and expensive tax windfall to a small number of very wealthy people who are already here. Office for Budget Responsibility data shows that this would amount to £34bn of lost Government revenue over five years. That would have to be funded by either tax increases or spending cuts.

A short history of non-doms

People born abroad but living in the UK, and who plan to return abroad1 are “non-doms”.

For decades, non-doms were only subject to UK income and capital gains tax on their UK income and gains. Offshore income and gains were only taxed if “remitted” – i.e. brought into the UK. This favourable method of taxation was called the “remittance basis“. And, if they died, a non-dom was only subject to inheritance tax on their UK assets.

But this all changed in the 2010s:

- In 2008, the Government reformed the non-dom rules and introduced a £30,000 fee. Anyone who’d been on the remittance basis for seven out of the previous nine years would have to pay £30,000 each year to keep that status. About 5,000 people paid the fee.

- In 2012, a new £50,000 annual fee was introduced for people who’d been on the remittance basis for 12 out of the previous 14 tax years.

- In 2015, an even higher band was introduced: a £90,000 annual fee for people who’d been on the remittance basis for 17 out of the previous 20 tax years.

- There were significant reforms in 2017. From that date people who had been UK-resident for 15 out of the previous 20 tax years were automatically considered “deemed UK‑domiciled”. But a specific “safe harbour” was created2 – before becoming UK domiciled, a person could settle their non-UK assets into an offshore “excluded property trust” – and these assets would (with care) remain outside UK income, capital gains and inheritance tax indefinitely. This was therefore a less dramatic change than it appeared to be. At the same time, the £50,000 fee was increased to £60,000. There is an excellent House of Commons Library briefing paper on these changes.

- Then in 2024, the Conservative Party announced they’d scrap the non-dom regime and introduce a modern exemption system – the Foreign Income & Gains (FIG) regime. The concept of domicile would be completely abolished and replaced with a simple count of years resident in the UK. New UK residents would be entirely exempt from tax for four years; then subject to income and capital gains tax in the usual way. Inheritance tax would apply after ten years. Property settled into excluded property trusts before April 2025 would remain untaxed, but after that trusts would cease to shield property from tax.

- Labour enacted this regime, but with one significant change: the benefit of excluded property trusts would disappear completely – historic trusts and future ones.

- All of this has caused a significant number of very wealthy non-doms to leave the UK. The figures that have been reported are not reliable, but it’s clear from numerous discussions I’ve had with private wealth, banking and legal contacts that the effect is real.3

- Labour may be about to row-back on some of the reforms, by softening the most difficult part of the package for many non-doms: inheritance tax fully applying after ten years. My suggestion would be, after ten years, gently phase in inheritance tax, so it initially applies at a 4% rate and then goes up by 4% every year until it reaches 40%.

KPMG has written a good explanation of the rules as they stand today.

The Reform UK proposal

Reform UK is proposing to go back to the pre-2017 position, with non-doms able to pay a fee and retain the benefit of being a non-dom forever. The fee structure is, however, very different – a one-off £250,000 payment for a “Britannia card”.4

And there’s an entirely new element: the £250,000 payments will be redistributed as a cash payment to the approximately 2.5 million workers earning a full-time salary of less than £23,000. Reform UK’s “low end” estimate is that 6,000 people would buy a “Britannia card” – on that basis the policy would generate £1.6bn, meaning a £600 payment to each low-paid worker.

We have seen a complete copy of the Reform UK proposal. It doesn’t contain any analysis of the cost.5

The full paper is here:

The problems

There are, however, several significant problems with the proposal.

It would deter high earners from coming to the UK

Whilst the proposal makes the UK more attractive to the very wealthy, it makes the UK much less attractive to the highly skilled and highly paid professionals we want to attract into the UK – for example doctors, coders, senior scientists and entrepreneurs. The effect of the Conservative and Labour reforms6 is that these new arrivals would be exempt from tax on foreign income for four years without paying anything. That’s attractive because high earners will often have assets/savings back home, and having those savings taxed in the UK is unattractive.7

The Reform UK proposal makes new arrivals fully taxable immediately – that makes the UK look uncompetitive compared to many other potential destinations. Countries like Ireland, Denmark, France, Belgium and The Netherlands have special tax regimes for an arriving worker’s first few years.8

The Reform UK proposal doesn’t give any grace at all to new arrivals, unless they pay £250,000 – and that will only make sense for the very wealthy. So it will tend to deter highly paid professionals from moving to the UK.

The measure will, for the same reasons, impact the approximately 30,000 expats living in the UK who currently file on the remittance basis but don’t pay the remittance charge.

A large windfall gain for a few people – and so a £34bn cost

The proposal would give a windfall gain to a relatively small number of very wealthy people who were planning to stay here and pay UK tax, but will now pay the £250k fee instead. That’s tax that now won’t be received, and there will be no wider economic benefit (because these people were already going to be here).

The amounts involved are very large. The Office for Budget Responsibility’s assessment of the recent Conservative and Labour non-dom reforms says they raise a net £33.9bn from 2026/27 to 2029/30 (most of which is from the Conservative March 2024 reforms). The OBR’s figures contain “behavioural adjustments” reflecting their expectation that 25% of the most wealthy non-doms (with excluded property trusts) will leave the UK, and 12% of other non-doms. 9

The £33.9bn reflects tax raised from a small number of very wealthy people who would opt to buy a Britannia card and so pay no tax – it’s therefore revenue immediately lost by Reform UK’s proposal.

At first sight the cost would appear to be reduced by all the people who are non-doms under the current rules, but won’t pay the £250,000 to buy a Britannia card – they’ll now be paying tax. But that ignores “Laffer curve” effects. The experts we spoke to believe the four year FIG regime is revenue generative – there would be a net economic and tax cost of deterring highly paid (but not ultra-high net worth) people from coming to the UK. Reform UK’s proposal takes us past the peak of the “Laffer curve”, and what appears to raise revenue in a static analysis would actually lose it.

There is an additional negative factor: Reform UK are providing a much more generous regime for the very wealthy than was in place before March 2024. There are non-doms who’ve been here for many years who aren’t currently eligible for the remittance basis, but would apply for the Britannia card, and essentially zero their tax bill.

Both these factors would tend to increase the impact beyond the OBR £33.9bn figure.

We therefore believe its fair to say that Reform UK’s proposal would cost around £34bn if it was enacted before 2026/27. That sum would therefore likely have to be funded by some combination of spending cuts and tax rises.

It will attract very few wealthy new arrivals to the UK

Reform UK is hoping the proposal would attract a significant number of new arrivals to the UK – people who previously would have paid no UK tax, and will now pay the £250,000.

A critical point to note: because Reform UK would be redistributing all the £250,000 fees, none of the revenue reduces the £34bn impact on the public finances identified above.

We can put an reasonably accurate ceiling on the number of people who’d apply by looking at how many people paid the £30k and £50k annual remittance basis fees. 5,100 people10 paid the annual £30k charge for non-dom tax benefits when it was introduced, declining to 2,400 people paying the £30k and £50k charges in 2024. The £250k will (obviously) be attractive to a smaller number of people – it’s more expensive both as a lump-sum payment and if we compare it to the net present value of ten years’ of £30k charges (around £220k, at an 8% discount rate).

We can also look at the numbers taking advantage of the (broadly comparable) Italian €200k flat tax scheme for wealthy migrants into Italy (€100k before this year). From 2017 to 2023, around 4,000 people used the scheme. The similar Portuguese scheme attracted around 2,000 high net worth individuals over ten years.

However, Reform UK are expecting 6,000 people to apply for a card every year. That looks very optimistic given the international data and historic UK figures.

There is a more fundamental difficulty, which all the private wealth advisers we spoke to believe would lead to a very limited number of new arrivals.

The problem is that a proposal of this kind might have been realistic decades ago, but the numerous changes in the non-dom rules in the last 20 years mean that few would believe that their £250k would really give them a lifetime of tax exemption in the UK. High-net-worth individuals crave tax stability and predictability when making long-term decisions about their residence – but no Parliament can bind its successors. It follows that, unless ultra-high net worth individuals believe Reform will have a majority for two or more terms, they are very unlikely to move to the UK in the expectation the “Britannia card” will survive long-term. That’s particularly so in light of recent experience of countries making similar generous offers which are later rescinded – Spain lured highly paid foreigners with “Beckham’s law“, but in the 2020s began aggressively asserting tax against people who’d used it. Portugal recently restricted its generous non-habitual residence regime.

We therefore conclude that, even if the proposal was self-funding in principle (rather than losing £34bn) it would likely still be non-viable thanks to the history of non-dom tinkering by other political parties.

Redistributing the proceeds

A full discussion of the administrative and logistical challenges of executing millions of small payments to low-paid workers is outside the scope of this paper. This will include how to identify them, how to deal with intra-year changes in income, how to update eligibility each year, how deliver the payments securely, how to prevent fraud, and the administrative costs associated with these issues.

Reform UK’s response

Zia Yusuf of Reform UK has published a response on X. It’s a disappointing response that spends more time on insults than substance.

Mr Yusuf starts by complaining that we published this report before seeing the Reform UK paper. He can’t have read our report – as it says above, we reviewed a full copy of the paper. We respected Reform UK’s embargo and didn’t publish the paper until 9am, but this report always made clear we’d reviewed the a full copy.

On the substance of Mr Yusuf’s post:

The four year exemption

Mr Yusuf disagrees that Reform UK’s proposal abolishes the current four year exemption. Again, he hasn’t read this report. We explain that Reform UK have to abolish the four year exemption, otherwise there won’t be many new arrivals paying £250k for a “Britannia card” – they’ll just wait four years. And Reform UK’s calculations assume that they receive the money up-front.

So Mr Yusuf has a choice. Reform UK can keep the four year exemption, but then amend their projections to include a four-year time lag, with a much smaller payout to the 2.5 million low-paid workers. Or they can lose the four year exemption, and admit that they are raising tax on an important class of high skill workers.

Which is it?

Stability of the regime

Mr Yusuf disagrees with our claim that nobody is going to buy a ten year card when the non-dom rules changed four times in the last ten years. He doesn’t explain why, and once more doesn’t appear to have read this report. He has no answer for the problem that no law can bind a future Parliament (because there isn’t one). He doesn’t engage with the recent experiences of other countries offering special tax deals. He doesn’t respond to the key point that, if Reform UK is the only party supporting the proposal, then nobody is going to buy a ten year card unless they believe a Reform UK Government will have a workable majority for two terms.

There is no evidence, in the paper or in Mr Yusuf’s reply, that Reform UK have thought at all about how to make a credible ten year offer.

The “already here“ problem

Mr Yusuf fails to engage with the problem that the Britannia card will be available to wealthy people who are already here, and weren’t planning to leave. For these people, it would be irrational not to buy a Britannia card – but that results in lost tax, and no economic upside (because they were already here).

We use OBR figures to estimate the extent of the problem – £34bn if we look only at Reform UK’s reversal of the 2024 and 2025 non-dom reforms. More if we include the reversals of the other post-2015 reforms (although putting a figure on that is difficult).

At this point Mr Yusuf says the OBR figures are “obsolete and irrelevant”. The challenge he has is that £34bn is a very large number. Even if the OBR were out by a factor of twenty (which is surely impossible) that means £1.7bn of lost tax. And the revenues generated by the Britannia card would not plug that fiscal hole – they’re redistributed as cash payments. So even in this rather far-fetched scenario, Reform UK’s proposal leaves a fiscal hole.

Mr Yusuf demonstrates his lack of understanding with this point:

People usually respond rationally to tax incentives. It is rational for a wealthy individual already in the UK to pay £250k to be exempt from tax on foreign income and gains – likely it would pay off in one year. They have nothing to lose, and tax savings to gain.

It is not rational for someone living abroad to migrate to the UK on the promise of a ten year tax exemption, when the history of the non-dom rules is one of requent change, and when other political parties would (if they came into power) likely scrap the Britannia card.

No tax proposal can afford to ignore incentives – they’re fundamental to economic behaviour.

The accuracy of OBR projections

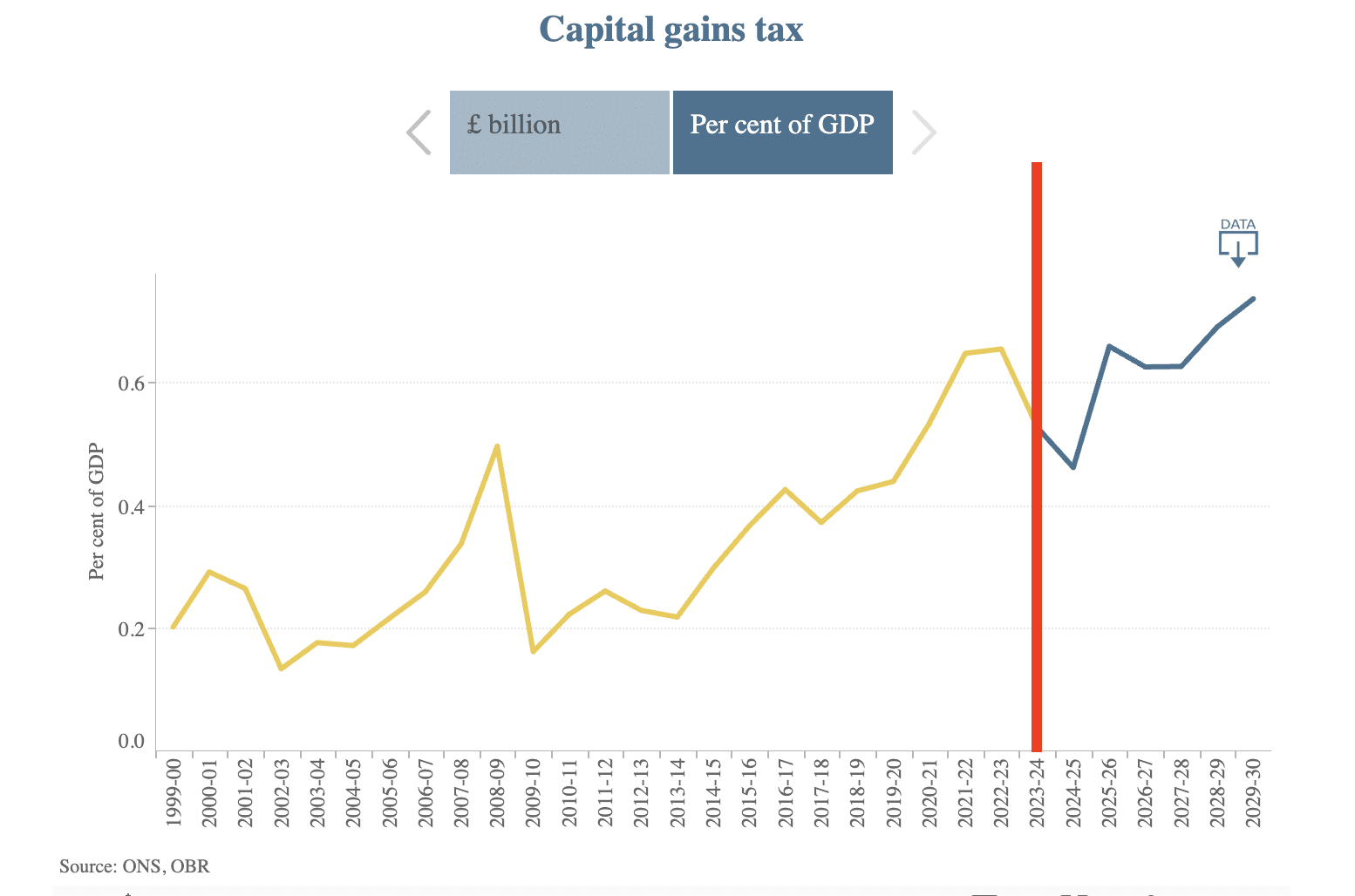

Mr Yusuf cites recent CGT figures as evidence that the OBR makes overly optimistic projections of Labour cannot make tax projections. He is relying on an article in the Telegraph which blamed the October 2024 Budget for a March 2025 correction to OBR projections. However if Mr Yusuf read the OBR report he’d see that the OBR actually expects a short term increase in CGT revenues as a result of the Budget, with people crystallising gains ahead of increased rates coming into force:

There was a decline, but that took place in 2022/23 and 2023/24 – well before the change in Government:

(Note that government accounting mostly books CGT receipts the year after they occur, so most of the 2023/24 CGT receipts relate to 2022/23). The OBR says this is simply a return to the long-run trend which is likely correct; CGT receipts are notoriously volatile.

This is all a very bad mistake, and a revealing one. A political party preparing for Government should be analysing OBR reports in detail. It’s very concerning that Mr Yusuf doesn’t appear to have read them at all.

The rate of CGT

It’s a side issue, but Mr Yusuf seems to think we supported the increase in CGT in the Budget. We did not. We were (and are) against increasing the rate of capital gains tax without reforming the tax to create an investment allowance. As things stand inflationary gains are taxed, deterring investment. We wrote about CGT reform here. Mr Yusuf cites that report, but once more appears to not have read it.

Photo of Nigel Farage by Gage Skidmore.

Footnotes

This is a very crude summary of what a “non-dom” is – the actual law is complex and uncertain, based on common law rather than any legislation. There is a good summary from the Chartered Institute of Taxation here. ↩︎

Often called a “loophole”, but given it was clearly intended, it wasn’t in any sense a “loophole”. ↩︎

Advani, Burgherr and Summers found only a limited response by the very wealthy to the 2017 changes in the non-dom rules. However we believe that was because of the safe harbour/loophole in the 2017 changes. The current changes have no safe harbour and so we should expect a much larger response. ↩︎

It’s not clear to us from the Reform UK paper whether this is a once-and-forever payment, or once every ten years. It’s also not clear if the card will be available to people who are here – the document says at one point that it’s for newcomers or returning leavers, but the sell has very much been about stopping the non-dom exodus – “halt the exodus and in fact reverse it“. ↩︎

It also appears to misunderstand the history – it makes the (common) criticism that Labour’s changes deter non-doms, but doesn’t acknowledge that the Reform UK proposal also reverses the Conservative Party’s 2024 changes. ↩︎

And the old non-dom rules, but the new rules are clearer, simpler and preferable for many professionals. ↩︎

Particularly in the first year when two countries’ taxes would apply. But even after that things can be complicated, for example because tax-free savings products in one country (other than pensions) are usually not tax-free in another. The old non-dom rules also meant that such assets/savings were free from US tax, but the complexity of the rules (and the remittance concept) meant they were less useful to “normal” people than the new FIG regime. ↩︎

On the face of it, Reform UK could fix this by retaining a four year exemption, with the £250k only payable after that. However that would mean their “Robin Hood” redistribution only happens after four years – which likely undoes the immediate political attraction of the policy. ↩︎

See paragraph 1.17 of this document for details of the behavioural response adjustments, and Table 1.3 on page 8 for the figures. ↩︎

28 responses to “The £34bn cost of Reform UK’s “Britannia card” proposal”

Great paper (the Tax Policy Associates one, not the Reform one!). One minor comment: it is stated that the law of domicile is “complex and uncertain”. Not really. The complexity of the law of domicile is as nothing compared to, for example, the current law of residence. The law of domicile has a few points of ambiguity, but generally, it is not uncertain. The uncertainty, such as there is, tends to come from factual questions concerning individuals’ mental states, not from the law itself. (Sorry if this sounds hair-splitting …)

thanks! I’m thinking of cases like Henks and Shah…

These people are populists who will say anything so long as it both appeals to their voter base and gets them media attention. Surely the point is that the spell has been broken in the UK and would the targets here really trust the politicians to maintain a steady regime; although the same point might be made about Greece and Italy as to how stable their “non dom” regimes are and I read that income tax is coming to the Gulf, which is probably a harbinger for states like Dubai. For the super rich tax avoiders the world may be becoming a very small place

A helpful analogy might be the “new customer offer” often used by mobile networks — discounts or benefits available only to new subscribers, not existing ones.

The twist here is that existing customers (resident non-doms) aren’t blocked from switching — they can opt into the new deal if they choose (and they will).

Great analysis. It’s a shame reform couldnt work with you instead of against you.

This is how i would reply if I had an account on X :

What you’re missing, Zia, is that you’re treating non-doms already living in the UK and non-doms living abroad as if they’re the same group — they’re not. Different incentives, different behaviours. Whether that’s confusion or deliberate framing, others can judge.

thanks! Yes, a lot of the misunderstandings in this area come from treating non-doms as one group, when they are extremely diverse. With this proposal there’s the additional complication of non-doms here vs non-doms abroad. And this then gets very messy, because the paper is unclear whether the card is available to those already here, but Mr Yusuf’s public statements are very clear that it *is* available to those already here.

So this doesn’t feel like a very well thought-through proposal.

If reform are suggesting they will keep the 4 year exemption,it seems very optimistic to expect many new arrivals will be attracted by the prospect of reducing their tax payments in 4 years time. Hypothetically, If reform were elected and a new arrival came to the UK in their first year of parliament, we would be very close to a general election by the time they are able to consider the option.

Make it at card that costs £250,000 per annum.

For this you get:

An annual right to reside in the UK.

You are exempt from all other UK income tax.

You are exempt from inheritance tax.

The card is per person NOT per family.

If the card is cancelled by the government then there will be a guarantee that there will be a further four years where the card and it terms continue. Effectively a notice period. Nobody will buy the card and invest in the UK if there isn’t some stability.

If you don’t renew the card then you either leave the UK or if you have previously paid five card years, then you are eligible to apply for UK citizenship provided that you meet all immigration criteria, which must include financial stability and returning to normal Uk rules re income tax, the exception being inheritance tax which will be on UK assets only.

The windfall payments will be allocated to those paying income tax, earning less than £23,000 PA and not receiving any other form of benefit in the previous tax year.

Or

Set up a National Sovereign Fund

Or

Set up a Apprenticeship Funding Scheme

You cannot give a guarantee to anyone which a new government could not overturn so this would not work

I’d be astonished if the net tax take generated by the changes to the Non Dom regime amount to £34bn over 4 years – absolutely amazed. Be interesting to know the assumptions in the model that produced these figures.

Whilst I’m not defending the reform proposals, I do query the following from the above analysis

“The measure will, for the same reasons, impact the approximately 30,000 expats living in the UK who currently file on the remittance basis but don’t pay the remittance charge.”

How can this be when by the time such a measure was introduced, there would have been no remittance basis for over four years, and hence they would be the arising basis like everybody else.

So if you’re one of these 30k people, you’d either be stuck with the arising basis,so no change from today, pay the £250k fee (which means you probably are very wealthy with lots of non-UK income and assets) or leave (and to be honest they would probably have left already).

While not wishing to sound sarcastic, it is hard to imagine that much thought has gone into this beyond aping the Trumpian golden visa.

Worse still, was this dreamed up by a handful of semi-tax-literate wealth geezers as it sure looks that way.

The problem for those of is who are ‘serious’ is that Reform doesn’t need to be serious. It just needs to look like it is making the right noises.

You obviously think otherwise, but the erosion of the non-dom incentives have been unequivocally bad for the UK and the pretence that the latest changes are going to deliver a net gain to the fiscus is fantasy.

The non-dom incentives were central to making the UK a global financial centre. Their removal, together with the embrace of toxic tax and regulatory provisions has turned the UK into a hostile banking and investment destination.

One need look no further than the shrivelling LSE.

On this subject, not only should the government be making it attractive for the young professionals and highly skilled to move to the UK, they should be ensuring that the country is an attractive destination for accrued wealth…and you don’t do that by trying to apply a 40% inheritance tax on the super-wealthy, quite aside from CGT, potential double tax burdens &&. It’s not rocket science.

Brexit is the biggest cause of the downturn of the lse

Good to see that Reform have not even noticed the Italian flat rate has been €200,000 for new arrivals since last August…

they also missed that the Italian regime only applied to *new* arrivals. They quite deliberately didn’t hand out a tax exemption to people already in Italy.

We could save £65 billion GBP a year by getting rid of our 3 biggest albatrosses,Scotland,Wales and Northern Irand.

We could save more by clearing out 450,000 civil servants ,House of Lords abolitionand reducing the Monarchy to the size of the Monarchy that prevails in Lichtenstein.

Local authorities are too numerous and suffer from 80% overmanning.

They are also too numerous and should be reduced to 15 super unitaries for as long as we have a Union.

Then there is the 50% fraud in Adult Social Care and SEN .

The police are grossly inefficient with only a 6% arrest and conviction rate .

All these constabularies need to be reduced to a National police force with 15 divisions .

Sink estates should be patrolled by robot dogs.Then there is the NHS also not fit for purpose ,the 6th biggest employer in the world.

Plenty of savings can be made and we should put exports on a war footing and introduce workfare for the economically inactive

The “robot dogs” bit makes me pretty confident that’s satire, but on the internet nobody ever really knows for sure.

Sorry, delete the ‘£’ sign, it should be 6K to 10K each year!!

By definition, people will only pay the upfront lump sum if they consider it would be financially advantageous to them. Thus it would give an upfront tax revenue in return for losses later. Spending this in any way just leads to issues down the line.

Is there not also a confusion between the presumably one off gain from sales of the card and the continuing annual promise of payment to the poor?

Possibly! I wasn’t clear if they are saying it’s an annual promise…

The assumption made by Reform is that the card will be one-off for the relevant wealthy foreigner; but a few thousand will be sold each year (a range of £6k to £10K) thus generating an annual windfall for low earners.

unclear why they think that, when there were never more than 5,000 people prepared to pay £30k for non-dom status. Not 5,000 arriving per year, but 5,000 period.

A cynic might think they started with a headline number of £1k that this “policy” would pay out to the people they think might vote for them if they bribe them enough and made up all the other numbers based on that figure.

A full time annual salary for anyone over 21 on minimum wage (£12.21 per hour) is £23,809, (12.21×37.5×52) (assuming full time hours of 37.5 hours per week ), so who are the full time workers on less than £23,000 pa who would receive Reform’s Britannia card money?

good question! Possibly they have the wrong number!

The £23,000 figure is from this analysis alone – the original paper only mentions “roughly 2.5 million lowest‑paid full time workers” – at no point do they put a figure on it.

The UK’s Low Pay Commission reckons there are about 1.9 million workers on or below minimum wage, including those on NLW and the various age related bands. So the lowest 10% of full-time earners in the UK actually includes some (around 600,000 according to Reform’s calculation) who are paid MORE than the minimum wage.

Hello Dan. This is Reform, so the detail won’t matter much to them. All they want is media framing of the policy as “cash to lower paid workers”.