The Friday 4 April episode of Untaxing was the peculiar story of a tax firm, ZLX, that promised a client £30,000 in R&D tax relief for installing a fridge.

The client quickly realised such a claim would be nonsense, and pulled out – but ZLX refused to accept that, and sued them for fees. That ended before a court, which described ZLX’s claim as “comical”. And ZLX’s penchant for litigation continued: when tax advisers discussed the case online, ZLX’s lawyers ordered them to delete their posts.

There was far more to the story than we could pack into 15 minutes. We have evidence of further dubious claims by ZLX, including one involving a vegan doughnut recipe. Plus evidence of the tax qualifications and experience of the key ZLX personnel – they had none, and one of their compliance officer’s only previous employment had been as a bartender.

And we have full details of ZLX’s attempted legal intimidation of the tax professionals who discussed the fridge case on social media.

The episode is available on BBC Sounds.

The fridge

James Mackie Wholesale Limited is a fruit and vegetable wholesaler in Glasgow, supplying supermarkets, hotels and restaurants. In 2021, its owner, Robbie Patterson was introduced to ZLX, who claimed to be research and development tax experts.

The modern small business R&D tax relief was created in 2000, with the laudable aim of incentivising R&D investment. As the name suggests, it’s only available for “research and development”. That term is defined in guidance published by BEIS/DSIT and given statutory force under the Corporation Tax Act 2010. HMRC accurately summarise the rules as follows:

I think most ordinary people would read this, and immediately realise that a fruit and vegetable wholesaler would be highly unlikely to have R&D expenditure that qualified for relief.

But Stephen McCallion, who ran ZLX, told the wholesaler they could claim £30,000 in tax relief.

For installing a fridge.

It was a normal commercial fridge (a “cold room” or “walk-in”). A substantial piece of machinery, costing around £100,000 – but it was not an advance in technology. And it only took the wholesaler fifteen minutes to purchase it and arrange installation.

The accountant

Robbie Patterson signed up with ZLX and, at this point, many small businesses would have trusted the supposed expert and claimed the £30k from HMRC. Mr Patterson did something different: he spoke to his accountant.

The accountant wasn’t an R&D tax specialist, but he knew enough to know that this was not a valid claim. He told Mr Patterson that HMRC would probably pay the £30k, but then chase after it in a few years’ time. That is exactly what happened to thousands of businesses in the next few years.

It was excellent advice from the accountant, and a sound piece of judgment from Robbie Patterson.

The lawsuit

What happened next is hard to explain.

ZLX sued James Mackie Wholesalers. The claim was for the fee ZLX would have received if the R&D claim had gone ahead – £8,000.

The dispute was heard by the Glasgow and Strathkelvin Sheriff Court (broadly equivalent to the English High Court).

The judgment is here. Much of it concerns whether the cancellation fee was ever agreed to by James Mackie (it wasn’t) and whether it was reasonable (it wasn’t). But the sheriff went on to consider whether R&D tax relief was ever available. He was scathing:

and:

James Mackie Wholesale’s accountant saved them from what was, at the least, an entirely invalid R&D tax relief claim. But when we read words like “concocted” in a judgment, then there is a more serious possibility: the accountant may have saved James Mackie from unwittingly participating in a fraud.

There is gossip in the Glasgow legal world that James Mackie Wholesale is not the only client sued by ZLX – but we have been unable to substantiate that.

Who was ZLX?

The fridge case is alarming. Not just that a firm would advise that R&D tax relief was available in such a hopeless case, but that it would be so unaware of the hopelessness of the case that it would take it all the way to a court.

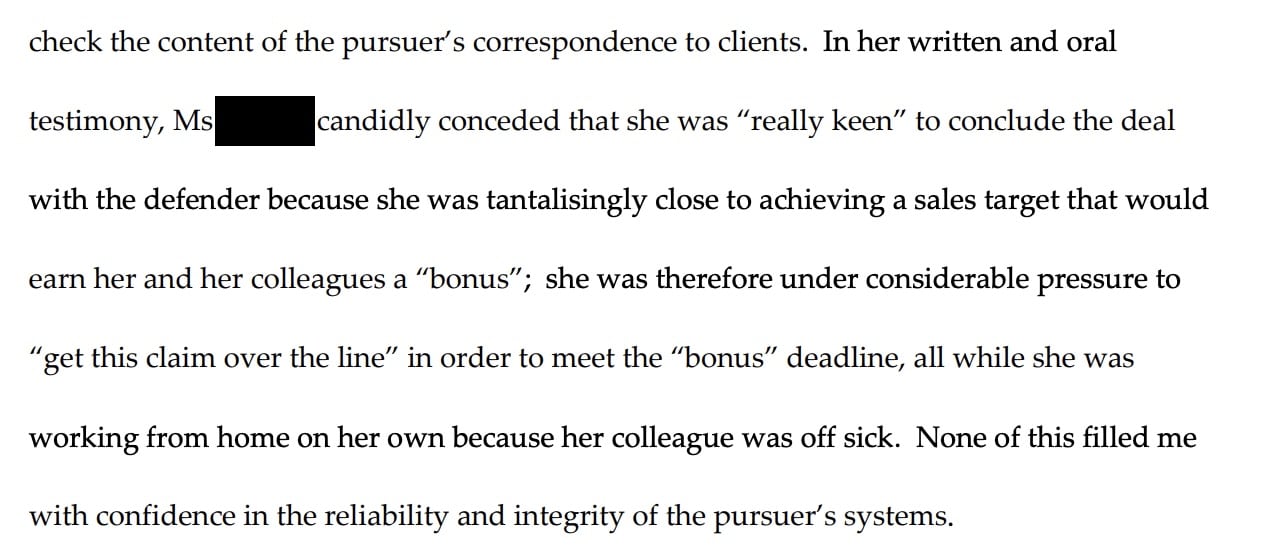

The court judgment suggests that ZLX was a disorganised mess:

Things become clearer when we look at the background of the people involved.

Stephen McCallion himself had no legal, tax or accounting qualifications or experience. That might not matter if he was leading a team of technical specialists.

He was not.

The James Mackie judgment showed that ZLX had a completely unqualified individual trying to progress the R&D claim by arguing with James Mackie’s clearly very competent accountant:

And she was under considerable pressure:

What about the rest of ZLX’s technical and compliance team?

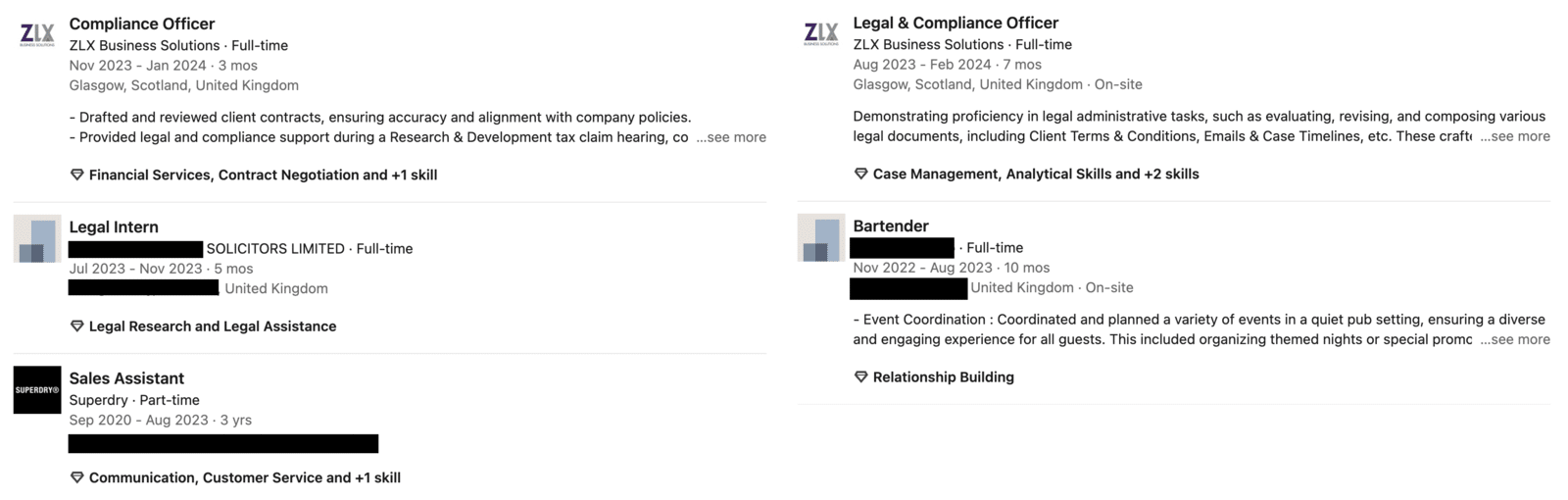

In 2024, ZLX had two people in its compliance team – their previous experience was as a bartender and sales assistant.

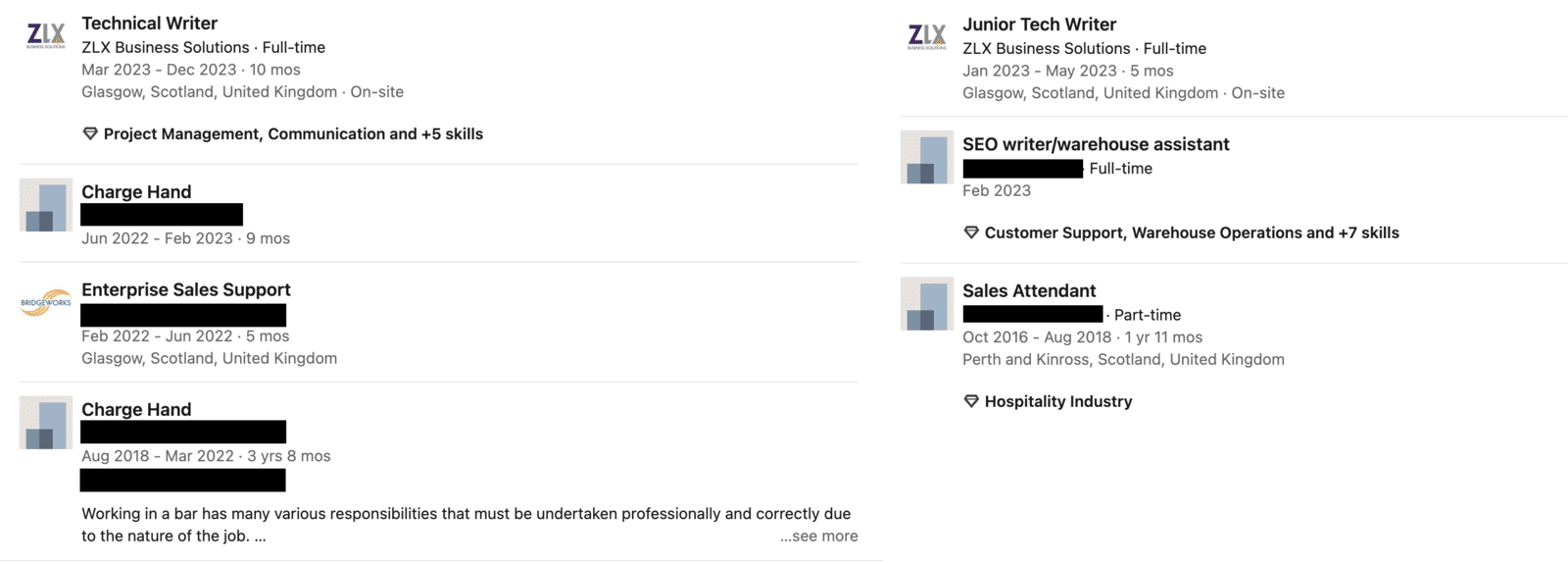

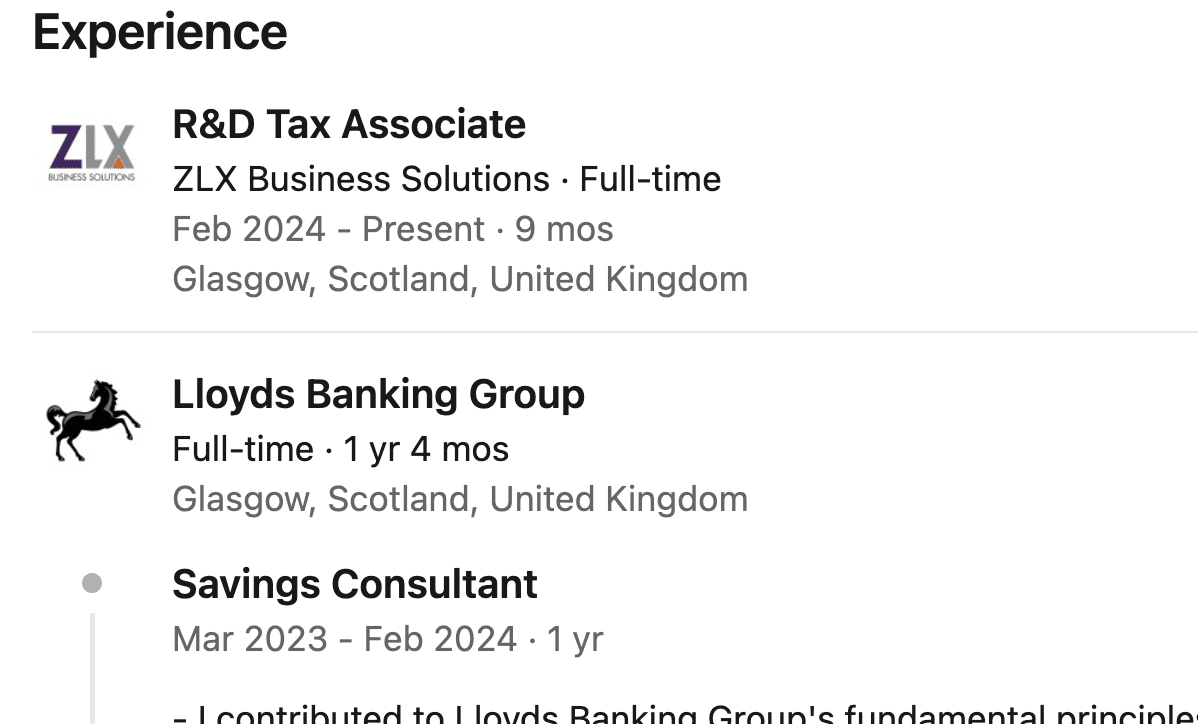

And their technical team – a shift supervisor in a bar (“charge hand”) and a warehouse assistant and sales attendant:1

Their R&D tax advisers also had little or no relevant experience – this is typical:

It’s important to note that these were very junior personnel who bear no moral or legal responsibility for the claims ZLX made. They were under significant pressure and, given their lack of experience, would not have known that ZLX was making improper R&D tax relief claims. The blame lies with those running ZLX.

The ZLX website showed an impressive roster of consultants, operating across the UK. However in reality these were franchisees, who had been assured they didn’t need finance or accounting experience. Given the ineptitude of McCallion himself, we can only imagine the quality of the claims originated by these franchisees.

There is more evidence of serious problems at ZLX in another case involving the company. Stephen McCallion fell out with his former business partner, William Gray. Gray claims that McCallion promised him half the shares in ZLX. McCallion denies there was such an agreement, but says in any event, Gray defrauded him and was incompetent. McCallion alleges, specifically, that Gray failed to have claim forms signed by clients, and failed to have the figures he submitted to HM Revenue & Customs approved by clients, and failed to attach accurate tax computations to clients’ claim forms, and failed to comply with HMRC standards for tax agents. Gray denies this – he says he wasn’t the consultant with responsibility for the claims.

So it appears to be agreed by both sides that someone working for ZLX was acting highly improperly, and potentially criminally, even if the parties disagree on who that was.

What other claims did ZLX make?

We understand that James Mackie was just one of a number of fruit and vegetable wholesalers who ZLX approached. We would be very surprised if any of them had valid R&D tax relief claims.

Since the James Mackie judgment, we have spoken to employees and clients of ZLX, and there is a consistent pattern of claims being driven by sales and fees, regardless of the technical merit.

One employee was so horrified by one claim they saw being finalised that they captured a screen shot – it was a claim involving a vegan doughnut:2

Tax Policy Associates has also seen evidence, which unfortunately we cannot publish, of extremely large claims made by ZLX with no legal basis at all, and claimed expenditure which an experienced accountant described as “fictitious”.

There is additional evidence of illegitimate claims from ZLX’s own website.

Today the ZLX website is down, but, just after the court case, its website boasted of success across an impressive variety of fields:

Soon after the court case they pruned the list:

Coffee and food shops, pubs, bars, auto dealerships, taxi and car rental companies, cleaning and hygiene companies; events and hospitality? All gone. And, not coincidentally, all businesses with little or no prospect of a valid R&D tax claim.

Healthcare

The ZLX website contained a detailed case study involved R&D tax credits supposedly being claimed for an online pharmacy building what seems to be a very commonplace IT system. That does not look like a valid claim.

And this case study showed a hospital claiming a large amount of tax credits. It names the individuals involved, and so we can identify the client as Ramsay Healthcare. We can also see the tax credits on page 19 of Ramsay Healthcare’s accounts – $AUS12.8m (£6m) claimed in 2021. As it’s a large business, we believe they’d have to have incurred more than £45m of qualifying R&D expenditure. That is surprising for a hospital group that, on the basis of its accounts and other publicly available information, undertakes no medical research.

We asked Ramsay Healthcare for comment, warning them that they’d been advised by a company that appeared to have no R&D tax expertise. They didn’t respond.

Football

The Times has reported on surprisingly large R&D tax relief claims by football clubs, some involving ZLX. The ZLX website gave a series of example projects – none of which look likely to have qualified for relief.3

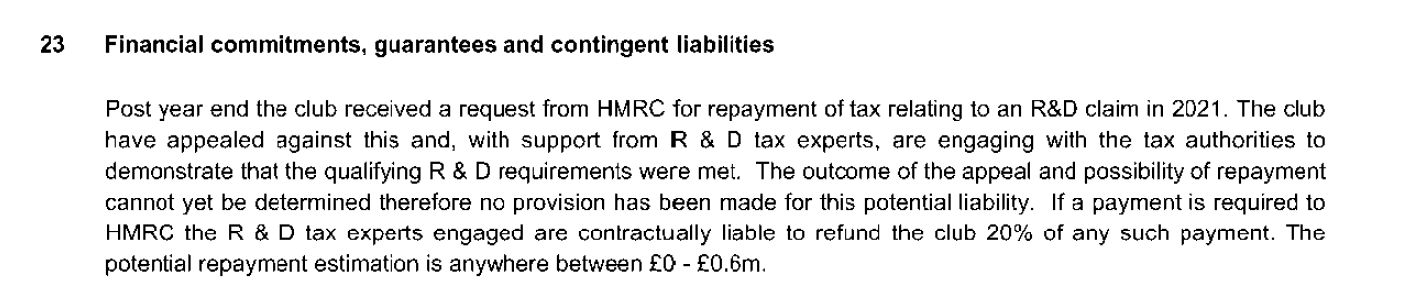

ZLX was an official partner of Dundee United and, as The Times reported, the club made an R&D tax relief claim worth £600k (implying up to two million pounds of expenditure) which the club’s 2024 accounts say HMRC is now challenging:

In 2021, all of Dundee United’s expenses (“cost of sales” in the accounts) came to £6.9m. We regard it as almost impossible that a third of that could have been qualifying R&D.

ZLX also gave £100k of sponsorship to Hamilton Academicals FC in 2022 – the stadium was renamed the “ZLX Stadium”, and Stephen McCallion became a director.4 Hamilton Academical’s accounts for 2022 show £18,596 of fees paid to ZLX, implying the club received £60k worth of R&D tax relief as a result of a ZLX claim.

There are other suspicious case studies on the archived ZLX website, some naming the clients. For example: an esports company, an events production company, and a website development company.

What was it like working for ZLX?

The former ZLX employees we’ve spoken to paint a picture of a business driven entirely by sales, with no consideration as to whether the claims they were making had any merit.

“A very small portion of the claims were for qualifying projects and staff were trained to use jargon, buzzwords, and complex sentence structure to beef up narratives and make day-to-day work sound like groundbreaking R&D.”

“The sales team would often try to claim 100% staff time on R&D. I saw the finance team called out for refusing to process a claim for a consultant who was claiming that 60%+ of chefs’ time at a restaurant was spent on a software “R&D” project (a simple booking and order system).”

“Nobody in the technical writing team in my time at ZLX had any tax qualifications”

“Technical work was being done, but the quality of work was poor and there was no oversight or input by anyone tax qualified on the tech side. Tech writers would meet with clients to discuss projects and put a narrative together, so there was never an instance where the narrative itself was made up. The issue on the tech side was mostly pressure from sales colleagues, consultants, and directors to push through claims mixed with the lack of relevant expertise within the tech team.”

“On the finance side, sometimes consultants would seem to invent figures but these were generally caught and called out by the finance team. The bigger issue was more sales people being on finance calls and pushing clients to over-estimate what proportion of staff time, materials etc were expensed as part of the project.”

“The CEO implemented a rule where if qualifying expenditure was below a certain % of revenue you had to flag it to a director. This happened quite often, as sales colleagues would progress claims even if the client’s accounts showed no expenses for wages or materials.”

“It felt like the tactic of the company was to push through as many claims as possible and just deal with/drag out any HMRC reviews.”

“Some very large claims were made for software (six figures) which seemed to have little merit”.

The SLAPP

The tax world had been largely unaware of ZLX until the fridge case was reported. They subsequently became the target of much criticism and even mockery, online and offline.

Paul Rosser is an R&D tax specialist. He was the first to identify that a firm called Green Jellyfish was making R&D claims so questionable that it looked like an organised fraud. Paul worked with us on putting together a report which led to many of those involved being arrested.

Paul posted about the ZLX case on LinkedIn, saying:

“bonkers any advisor would feel this is the proper way to do business and even more bonkers they would let it get to court for the world, and HM Revenue & Customs to see.”

and (in response to criticism from someone else):

“sadly does seem to be the way a lot of dodgy advisors operate“

Another R&D tax adviser, Rufus Meakin, wrote on LinkedIn:

“Bogus R&D Tax Credit claim for standard fridge installation exposed in court ruling. In an intriguing court ruling R&D TaxCredit advisory firm ZLX Business Solutions was found to have encouraged a fruit and vegetable wholesaler to submit a sham R&D claim for the installation of a standard refrigeration unit.“

Three days later, both received a letter from Jones Whyte, a law firm acting for ZLX. The letters were extraordinary:

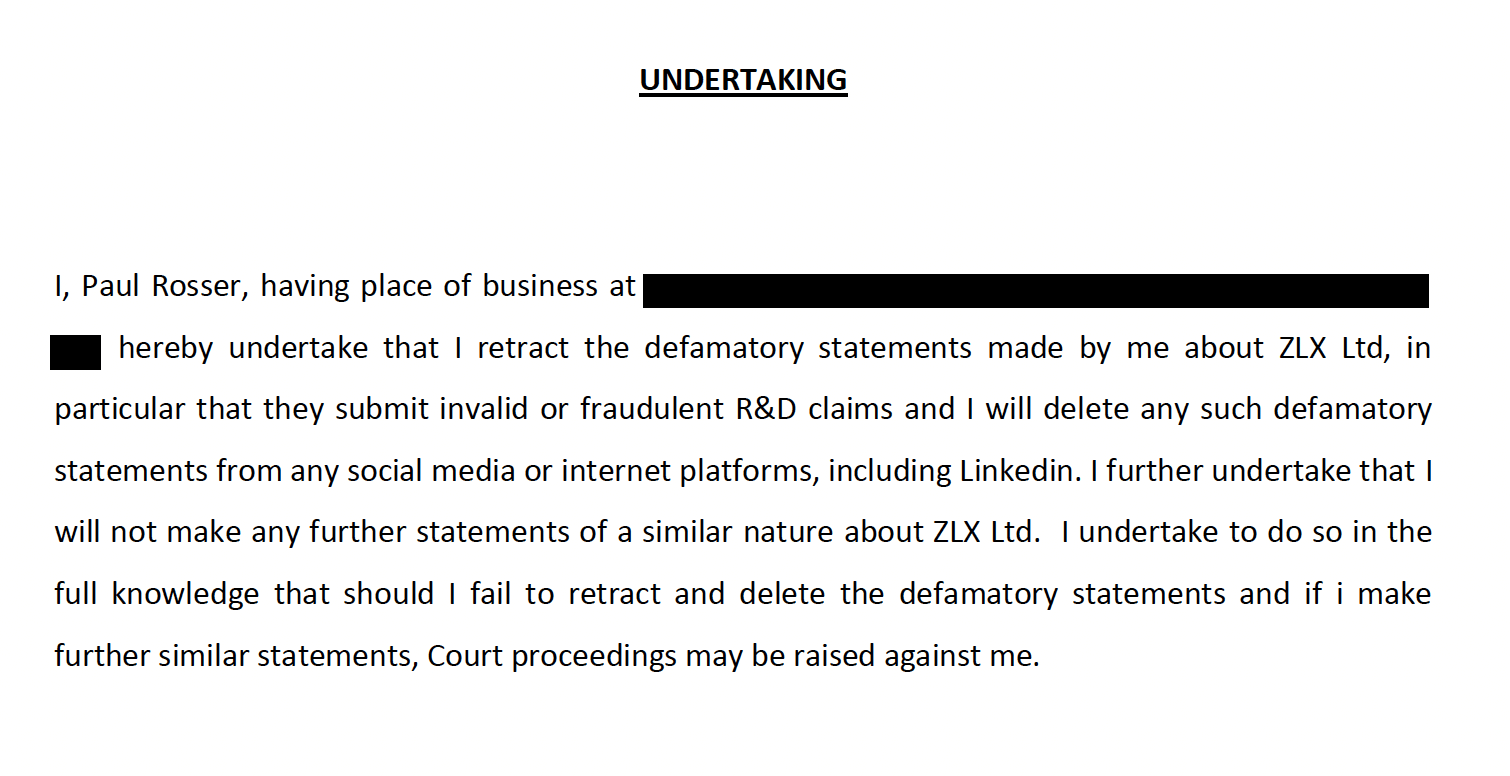

The letters attached “undertakings” which Messrs Rosser and Meakin were ordered to sign:

These letters were extraordinary:

- The letter to Mr Meakin denies that the R&D claim was bogus, that ZLX encouraged James Mackie to make it, and says the court didn’t make those findings. That must be seen as a deliberate lie by Jones Whyte. The court absolutely did make a finding that the R&D claim was bogus and a sham (the sheriff didn’t use those word, but used other words of equivalent strength). And clearly ZLX encouraged James Mackie to make the claim – that was the whole point of ZLX’s failed lawsuit.

- Mr Rosser had said ZLX “submitted invalid/fraudulent claims”. The Jones Whyte letter says ZLX “entirely refutes this”.5 But a court had ruled that the R&D claim would have been invalid, and fraud was a reasonable conclusion to make (see e.g. the word “concocted” in the judgment). Jones Whyte could have reasonably admitted the (attempted) claim was invalid but denied it was fraudulent. But to deny it was “invalid/fraudulent” was improper.

- The letter says Messrs Rosser and Meakin were acting maliciously. It provides no basis for this.

- The letter demands a retraction and apology within 24 hours or “immediate court proceedings” would be raised. That was a bluff. The letter had not followed the “pre-action protocol” required before an English law defamation claim, and indeed was so legally vague that it didn’t even state if it was a Scottish or English claim that was threatened (ZLX are Scottish; Rosser and Meakin are English, and Jones Whyte are based in Glasgow and regulated by both the Scottish Law Society and the SRA).

- Messrs Rosser and Meakin were being ordered to sign undertakings which contained a statement that ZLX did not submit invalid R&D claims. But the James Mackie judgment had established that ZLX had worked very hard indeed to submit an invalid claim for James Mackie Wholesalers. The undertaking Messrs Rosser and Meakin were being asked to sign was false. And – worse- they were unrepresented individuals being asked to sign a legal document without being told to obtain advice.

- The letters were headed “strictly private and confidential”. They claimed to be “without prejudice” and that the letters couldn’t be produced in court, but could be produced by ZLX. Nothing in the letters was confidential. Given they made no attempt to resolve a dispute, it is unlikely they were “without prejudice” – but if they were without prejudice, that goes both ways, and ZLX would not be able to produce them in court. So this was all nonsense.

So a solicitor had sent letters to unrepresented individuals, making false statements that the solicitor should have known was false, making a threat that the solicitor must have known was a bluff, and ordering the individuals to sign a statement that contained a false statement wrongly exonerating ZLX. It was a “SLAPP” – a strategic litigation against public participation.

That is not how law firms are permitted to behave.

Messrs Rosser and Meakin are part of the informal team of advisers we work with. We had been planning to write an article about ZLX so discussed the matter, and agreed Tax Policy Associates would send a collective response, both seeking comment from Jones Whyte and forcing them to retract their legal threats:6

Three days later, Jones Whyte wrote to us saying they were no longer instructed.

We will be reporting the firm to the Solicitors Regulation Authority.

After Jones Whyte ceased acting, we spent some time trying to obtain comment from ZLX and its owner, Stephen McCallion. He eventually sent us a bizarre email in which he made a number of claims contradicted by the court record, most including that he had never advised that installing a fridge would qualify for R&D tax relief.

We challenged Mr McCallion on this and he sent us a longer reply, in which he complains that the Sheriff believed James Mackie’s account over his, and that in fact Mr McCallion believed tax relief was available because James Mackie had developed a “bespoke chill unit with specific qualities relating to the increase of the shelf life of James Mackie’s products”. We do not believe this for several reasons. First, the Sheriff had ample opportunity to hear evidence and reach a conclusion. Second, it is not credible that a fruit and vegetable wholesaler would develop its own refrigeration technology. Third, if Mr McCallion really had believed this, he would have dropped his lawsuit as soon as it became clear James Mackie had undertaken no such development.

Mr McCallion’s reply is here:

Messrs Rosser and Meakin were not the only people threatened by ZLX. We are aware of three other cases; likely there are more.

The bigger picture

The James Mackie fridge ended up costing HMRC, and the wider body of taxpayers, nothing. But similar meritless claims by ZLX and others have cost the UK billions of pounds.

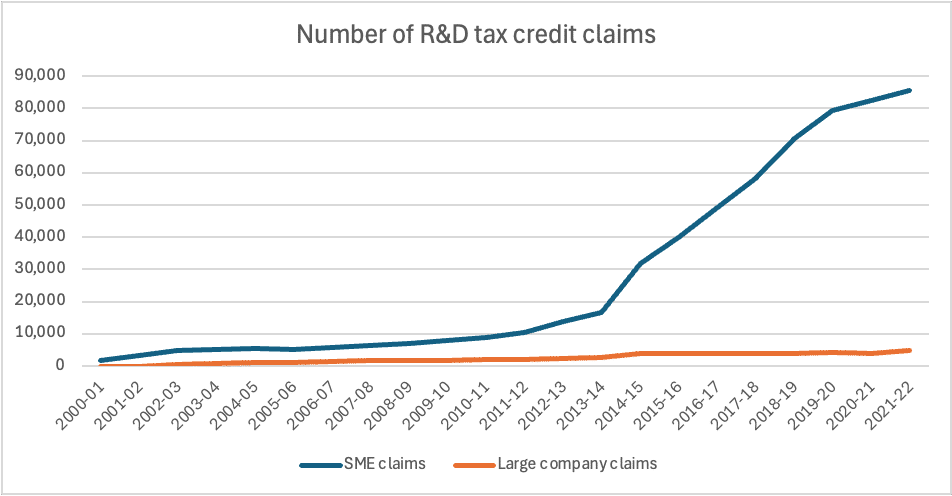

Here’s the number of R&D tax relief claims over the last 25 years:7

That explosion in small business claims after 2014 was because of firms like ZLX.

HMRC has published an analysis of R&D tax relief claims made in 2020/21. They found that half of all claims were incorrect in at least some respect. One quarter of claims were fully disallowed. Another 10% were fraudulent (5% by value). For SMEs, HMRC estimated that 25.8% of all claims by value were wrong or fraudulent. For large companies, 4.6%.

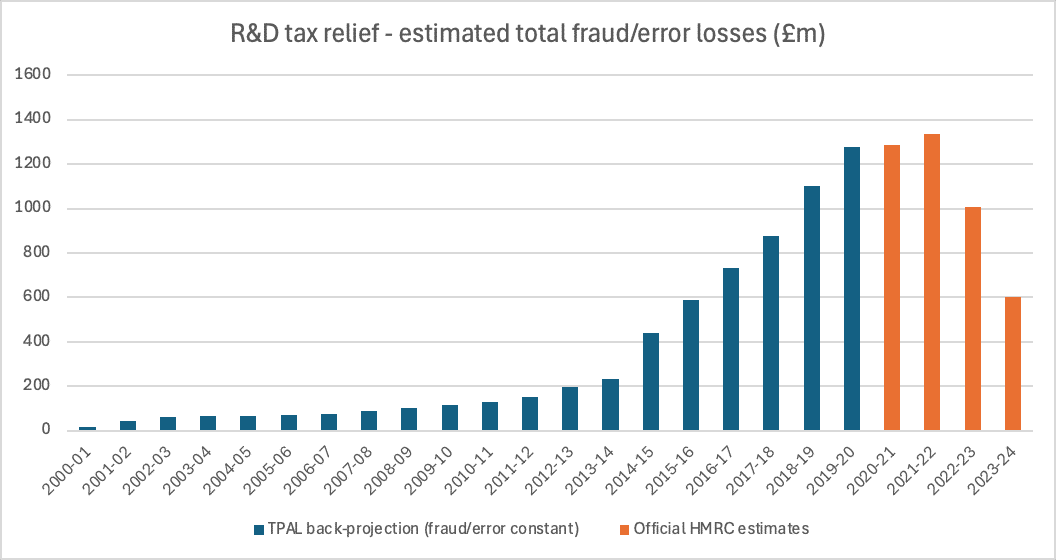

We analysed that data and estimated the total lost tax since 2000 – if we apply that 2020/21 level of fraud over all the tax relief data, the figure for lost tax is £10bn:

The future

R&D tax relief has been a scandal. Billions of pounds have been lost to wrong and fraudulent claims. And, much more recently, HMRC has reacted to this dismal history by blocking many claims which are in fact valid.

There are lessons which need to be learned:

- We cannot create reliefs like R&D tax relief. It’s generous, vague, and impossible to police – a dangerous combination. Better to have narrowly focussed reliefs which are only available to a much smaller number of businesses doing really serious R&D. The smaller number means the scheme can be more generous, and that HMRC can realistically pre-clear R&D before companies commit to it.

- We need regulation of tax advisers like ZLX, and criminal and civil charges pursued against people who recklessly or intentionally rip off their clients and HMRC. After the Spring Statement, the Government launched a consultation which is very much going in the right direction.

- As with many other bad actors, dodgy tax advisers abuse libel law to silence their accusers. They face no consequences for this. That has to change.

We expect HMRC is already investigating R&D tax relief claims made by ZLX. However we believe there should also be a criminal investigation. Creating a firm staffed by unqualified former-bartenders, pushing people to make sales at any cost, and “concocting” technical reports was (at a minimum) reckless. It was foreseeable and perhaps inevitable that wrong R&D tax relief claims would be made. Whether this was “dishonest”8 is something that a jury should decide.9

Image by ChatGPT 4o.

Thanks to Paul Rosser of R&D Consulting and Rufus Meakin of MSC R&D. Paul tells the story in his own words here – he deserves full credit for discovering and pursuing a series of R&D tax credit scandals over the last couple of years

Thanks also to V and C for their R&D tax relief expertise. And thanks to all the former ZLX clients and employees and their tax advisers who gave us their stories (despite ZLX’s reputation for bullying its critics).

Thanks most of all to Robbie Patterson – without his business sense and persistence, we’d never have heard of ZLX.

Footnotes

There was a third individual who we haven’t been able to identify. ↩︎

We don’t know if the claim was actually made, but it’s shocking that this would make it past an initial short conversation. ↩︎

Specifically:

“Long term fitness levels and wellbeing of the clubs elite athletes”. That is very vague. Any project in this area would need specific goals as to the improvements they were attempting to achieve, and scientific/technological reasons why the results would be uncertain. It’s not clear what those could be.

“Injury prevention and rehabilitation methods”. This would need medical-style trials to be able to accurately determine if the methods offered a measured improvement against existing methods. The advisers we spoke to were sceptical that this was realistic for all but the largest clubs.

“Dietary and nutritional advancements”. Again very vague, and proper trials would be required to gauge the improvement sought over existing knowledge in the public domain.

“Stadium and Training Pitches”. It seems very unlikely any expenditure here would be qualifying.

“Stadiums Spectator Interaction” and “Media and Multi-media”. These are an extremely well-developed area, e.g. apps, electronic billboards. It would be surprising if a football club were to make a scientific or technological advance.

“COVID Compliance Measures”. Absent novel medical research, this will just be the same kind of measures implemented across the country during Covid. The fact something is complicated and difficult does not make it qualifying R&D expenditure. ↩︎

Although that directorship ceased in January 2024. ↩︎

This was complicated by the fact that ZLX’s lawyer had misspelt his own email address in his letter; I am omitting the back-and-forth where we tried to work out how to email the firm. ↩︎

All data from official statistics available here. ↩︎

The subjective element of the test for dishonesty (see Ghosh (1982)) was removed by Ivey [2017] for civil cases, and that decision was confirmed to apply to criminal cases in Barton [2020]. The fact that a defendant might plead he or she was acting in line with what others in the sector were doing, and therefore did not believe it to be dishonest is no longer relevant if the jury finds they knew what they were doing and it was objectively dishonest. ↩︎

The leading textbook of criminal law and practice, Archbold, says: “In most cases the jury will need no further direction than the short two-limb test in Barton “(a) what was the defendant’s actual state of knowledge or belief as to the facts and (b) was his conduct dishonest by the standards of ordinary decent people?” ↩︎

11 responses to “Untaxing: the £10bn fridge – the full story”

Having listened to Steve McCallion’s rebuttal to this piece ( https://www.linkedin.com/posts/stevemccallion_for-months-ive-stayed-quiet-i-was-advised-ugcPost-7359126183034204160-bnhl?utm_source=social_share_send&utm_medium=member_desktop_web&rcm=ACoAACiDV4IB-Jg-Kij2RuWQ4Wd1nHLuJHShRiw ) I have some thoughts.

In the video, the interviewer states “The aim isn’t to spin it, it’s transparency…” and In the post it says “This podcast isn’t about denial or deflection. It’s about truth, context, and the very real personal cost of being caught in the crossfire of a public narrative.”

After listening to the video this is my takeaway. This humble Fridge Scientist is just trying to make a living in the industry of Fridge Science and for all his hard work is being persecuted by amorphous, unspecified, but definitely evil forces where he is literally unable to do anything to put an end to these vicious lies! This really is a terrible story of persecution and grit and determination in the face of injustice; and Fridge Science! My favourite part, that I wholly agree with, is when the host said “some people are calling for a criminal investigation into this.” Now, of course we don’t know who these people are, but I for one take this to not be a totally implausible scare tactic (as critics may say), and a completely legitimate and accurate representation of what some people are in fact justifiably saying.

Honestly, I can see how installing a single fridge would demand £30,000 worth of Scientific Research, and anyone who says otherwise opposes industriousness, standing on your own two feet, and hard work! This is why people just can’t get ahead in this country.

Another thing I really like about the video is how the guy speaking is unnaturally staring at the ground awkwardly which some cynics would say looks as if he is reading off a prepared statement written on the floor. However, I personally think it only adds to the earnestness of this hard working man who is so keen to make clear his earnest backstory of overcoming the demographic odds to lead several leading businesses which is completely relevant to the question of the legitimacy of a £30,000 charge for installing a single fridge.

Personally, as a fridge owner, I have a fridge with a door that’s come off. It’s really annoying. I could just fix it with duct tape or something for £5, but to be honest, it’s so frustrating, that I would probably pay a contractor a value of at least, and indeed at most £30,000 to produce a fridge where the door simply opened when you pulled it. The naysayers may laugh at the prospect of “fridge R&D”, but really when was the last time that we had innovation in the fridge industry. Fridge-tech stagnation has become so normalised, that the idea of putting “AI” in a smart-fridge was even the butt of a joke in the brilliantly written and hilarious tech-economics expose “Silicon Valley” by HBO. We need more Galileo’s and Brunel’s to challenge the uncritical norm of the liberal elites scoffing at “fridge R&D” to get this country back to its Victorian roots of industrious industry growth and money making, and doing things. It’s PC gone mad.

Hi guys, You’ve mistakenly referred to DSIT as DIST in the article.

thank you – fixed!

Healthcare paragraph. Second link to case study goes to the same destination as the first link.

A tour de force in reporting on tax fraud and SLAPPs. Very well done!

Thank you Dan, and the others you mentioned for their contributions. A most fascinating read but heart-breaking that it isn’t fictional. I do hope that HMT are watching.

The result of another piece of political grandstanding in a Budget statement without any consideration of the practical issues by either the politicians or senior mandarins

Great report but depressing as the same type of playbook as Green Jellyfish, whose directors were indeed arrested but the companies have now been put into liquidation and so I expect neither the taxman nor the creditors will be seeing anything. There is almost no ‘teeth’ to the official response,once the ‘horse has bolted’ so what’s to stop anyone else with low morals doing the same?

But, and sorry to beat the same drum again, the point remains that almost all of these dodgy schemes rely on HMRC doing something that no sane organisation was that was being ripped off- so to continue an ill conceived policy of ‘pay first, ask questions later’. Almost acting like a silent partner in the overall schemes…

Until that is changed, I am afraid you are going to keep writing these reports and us as taxpayers are going to keep subsidising the dodgy advisory industry.

Until there is a proper public enquiry with powers to name and shame those involved in government who sanctioned this policy (which I bet the dodgy advisory firms can’t believe) these things will keep happening.

The same basic problem existed in most of the Covid loans, and look what happened there. There needs to be a public enquiry into HMRC and whoever in Government authorised the setting up and retention of ‘pay first, ask later’. You would be an ideal champion to pressure for this.

Dan – huge thanks again to you and all your collaborators on this; and shame on professional legal firms who send threatening letters without seemingly doing any due diligence

Fascinating analysis. This is Dan at his best.

Great report. To me it’s as much about where the legal profession has gone as well. It’s a SLAPP in pursuit of an anlawful activity. You have also finally found a use for AI illustration. “Give me a Filthy Lucre Fridge and I’m not saying please because you are a computer”