Update: there have now been arrests. Comments on this post are closed.

Here’s a nice looking website⚠️ for accounting firm Turner & Abel:

The mystery

There are some signs that all isn’t right.

- The company was created in July 2024.1 But fair enough – people start new firms all the time.

- The website lists no staff. That’s very odd for an accounting firm – it’s a business where reputation and client relationships are everything. Firms often start with barebones websites, but the website hasn’t been updated since it was created in July.

- Despite the “let’s talk” button, there’s no phone number.

- The Turner & Abel website says “You’re paying for qualified finanical (sic) and legal experts to build the best possible case for your innovation”. We can’t identify any qualified legal or financial professionals working for the firm.

- In fact we can’t identify any staff at all. No staff are visible on LinkedIn. Someone gave Turner & Abel a LinkedIn account, but didn’t do anything with it. Zero followers. Zero employees. No text. That’s not how people launching a new firm normally behave.

- The website has three testimonals, from Pixelbox, Tolemy Pharmaceutical and Bosen. We can find no evidence any of these companies exists. There is a Ptolemy Pharmaceutical and a Tolemy Bio, but they have different logos (and of course slightly different names). There is no manufacturing company called “Bosen” (there’s a Bosen Ltd, but it’s a mail order company). Pixelbox also doesn’t appear to exist, except in Wisconsin🔒.

- The three companies’ logos are also curious. The Pixelbox logo is taken from a stock image library – and, astonishingly, the name also comes from the stock image. The Tolemy logo comes from an image stock library. The Bosen graphic is in a few places on the internet, e.g. this blog. All three logos are all in the same colour.2 Reverse images searches don’t find the three logos anywhere else on the internet.

- The privacy page is unfinished⚠️, with template “suggested text” left in place throughout.

- The GDPR link just goes back to the homepage.

So it seems reasonably clear the firm is fake.

Why create a fake firm?

I’ve hidden the biggest clue.

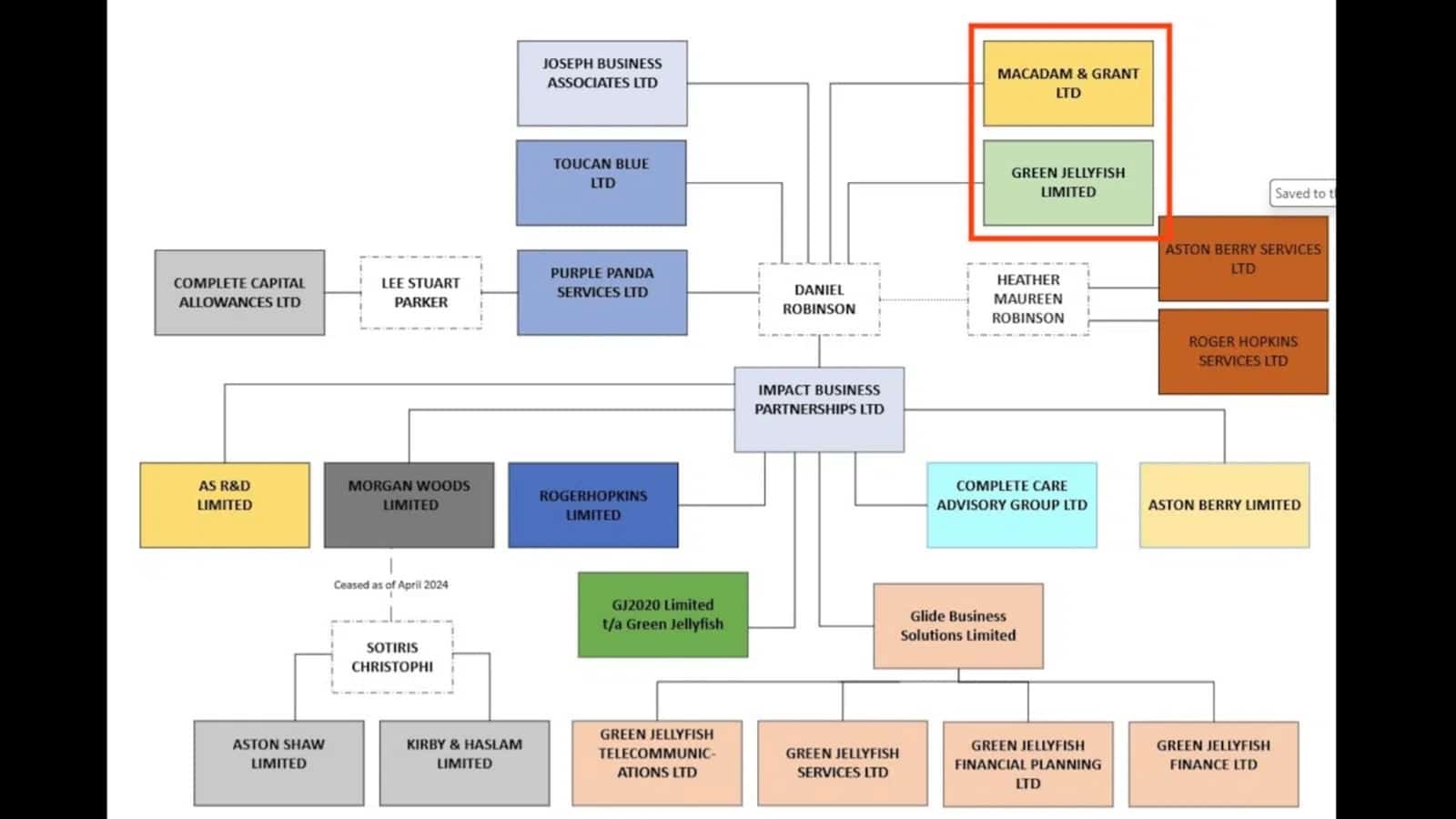

The company doesn’t give its office address on the website (which is illegal). That’s probably because that would give the game away. Its registered address is 46 Rose Lane, Norwich. The same address as Green Jellyfish, the R&D firm which we’ve accused of making hundreds of fraudulent R&D tax relief claims.

It’s not just coincidence. The website code shows that Turner & Abel has the same webmaster as Green Jellyfish’s affiliate, Kirby & Haslam.3

And we’ve heard the full story from sources at Green Jellyfish. The company made hundreds of fake R&D tax relief refund claims, claiming thousands of pounds for businesses that didn’t actually do R&D. At some point HMRC identified this, and started blocking refunds where Green Jellyfish was the agent.

So the answer was to create Turner & Abel and use it to make the claim. That’s what Turner & Abel did, and perhaps still does.

Who owns Turner & Abel?

On paper, the company is owned and run by Matthew Woolham. But we understand he’s just a junior sales manager who doesn’t make any business decisions. People should be more careful before they agree to become a company director, but in the circumstances of this group, Woolham’s ownership of a fraudulent company doesn’t necessarily make him a fraudster.

Green Jellyfish and its associates appear to intentionally hide the true ownership of their companies. That’s a criminal offence – but the individuals behind these companies (particularly Scott Herd, Daniel Robinson and Steve Christophi) probably have more serious problems than this right now.

Are there other front companies?

At least two – Coleman Clarke Services Limited and Clearview Accounting & Finance.

Coleman Clarke’s website⚠️ is similar to Turner & Abel’s, and similarly suspicious. Again the website illegally doesn’t provide the registered addressl it doesn’t even provide the legal name of the entity. However the registered address at Companies House gives the game away. Again the owner has no obvious connection to Green Jellyfish.

Clearview has been extensively used by Green Jellyfish and its affiliates but is hard to spot. The registered address is different, and there’s another owner with no obvious connection to Green Jellyfish. The company appears to have undertaken legitimate business; but more recently it’s been used as a “name” by Green Jellyfish staff, for making calls to clients, and for submitting claims to HMRC.

Comments are now closed for legal reasons. Our apologies.

Footnotes

Turner & Abel Limited was previously named “Admin & Business Solutions Ltd”. ↩︎

The Turner & Abel users.json⚠️ file shows that the Turner & Abel has the gravatar hash 18f89a4653223cd15cfcde8eea0c3cb7. The webmaster of Kirby & Haslam has the same gravatar hash⚠️. ↩︎

6 responses to “Turner & Abel – a fake accounting firm fronting for the Green Jellyfish R&D fraud”

The trouble is, it’s the companies who falsely claimed the tax relief, not their “advisers” who get shaken down by HMRC.

There is an element of due diligence required when one receives a phone call out of the blue telling you you’re entitled to free cash, so they are not absolved of all responsibility. However, if you are lead to believe the adviser is correct and you act in good faith based on the information they give you, then they should share the penalties.

HMRC seem have a very interesting attitude to dealing with promoters of illegal tax avoidance schemes – it just puts their name on a list for a year and that’s that. They should be shutting down those firms.

I wonder who supervises Turner & Abel Limited for AML

Go to T&A’s privacy policy page and it’s clearly a copy and paste of a working document with suggestions for others to comment on and which says the site’s address is https://dev89.turnerandabel.co.uk if you go to https://dev89.kirbyandhaslam.co.uk you’re on the K&H site. Same goes for https://dev89.greenjellyfish.co.uk

that’s just how the server is configured: IamAbanana.greenjellyfish.co.uk also works

Agreed – and it’s robbing us, the tax payers, not really HMG.

It’s very frustrating. You can sort of understand why these crooks feel so confident, when the authorities are so slow.

In other circumstances, powers have been used to immediately shut crook sites down, certainly from the Internet. Srely HMRC and the Police are looking?

But there is a reason why people adopt the Phoenix-ing approach, the pre-packs etc – it as often as not works with the only real ‘penalty’ being disqualification as a director, like that matters when all you need is a patsy.

The local regional newspaper is a few hundred yards from Rose Lane. There has been zero reporting around this scandal in the EDP.

If someone robbed a bank, they would be all over it, but robbing the Government is just not newsworthy. Depressing, even more so when I will be fleeced come Budget day rather than these debts being collected