Some people on social media are convinced that Jeremy Hunt avoided tax when he bought seven flats through a company in 2018. We’ve analysed the transaction and believe it’s clear that he didn’t.

Here are the claims (click to expand):1

Probably originating from this piece in the Mirror in 2018, itself based on this Telegraph report:

The basic accusation is that Jeremy Hunt “exploited a Tory loophole“ when he bought, through his company, seven flats in Ocean Village in Southampton.

These are different from the false claims that Hunt avoided tax when he sold his education business – we wrote about these back in 2022.

Hunt’s transaction

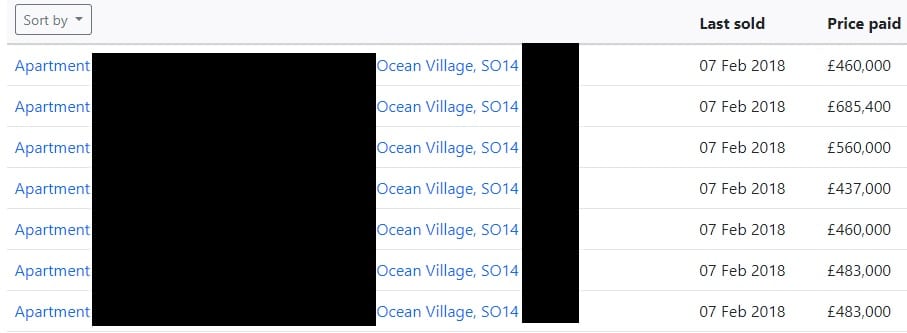

In 7 February 2018 Hunt’s company, Mare Pond Properties Limited, acquired seven apartments. We can see the price paid data on the land registry or from various other online sources:

i.e. a total price of £3,568,400.

How much stamp duty land tax (SDLT) was payable on that?

The actual SDLT result

SDLT rates are very different for residential and commercial property.

Residential property is taxed at escalating rates from (in 2018) 0% to 12%, with an additional 3% if you were acquiring a second (or further) residential property.2 Commercial property, on the other hand, is taxed at much lower rates, which only reach 5%.

So was this a residential or commercial purchase?

One might expect the answer to be obvious: it’s residential, because these were flats that people would live in – and therefore there’s SDLT of around £450k.

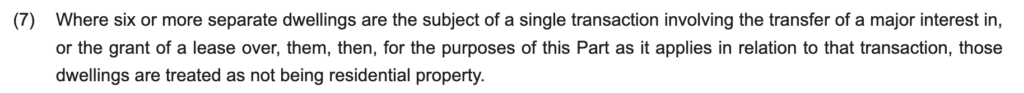

But here the obvious answer is wrong, because of section 116(7) Finance Act 2003:

This is the 6+ rule. If you buy six or more dwellings, then it’s treated as a purchase of non-residential property. So you get lower rates, and no 3% additional tax. The rule was included in the original SDLT legislation back in 2003.

And those were the facts here. Hunt’s company was buying seven dwellings from the same seller on the same day in a single transaction.

This means that, instead of £450k, the SDLT due would be £167,920. We can be reasonably sure this is what happened, because it’s consistent with the fixed assets reported in Mare Pond Properties Ltd’s accounts.3

The Mirror and the social media posters therefore all understate the benefit to Hunt of the 6+ rule. He didn’t save £100,0004 – he saved almost £300,000.5

But the critical point is that this wasn’t a choice – s116(7) applies automatically. Hunt didn’t “claim” the 6+ rule – the way the rule works made this inevitable. It wasn’t actually possible for Hunt to pay £450k SDLT.

The alternative SDLT result

Whilst it’s not possible to opt out of s116(7), Hunt’s company could have obtained a different SDLT result if it had claimed “multiple dwellings relief” (MDR).6

MDR means that, when you buy multiple properties at once, instead of applying SDLT to the overall purchase price, you can opt to pay the average SDLT for each property.7 That will usually result in less tax, because the average property will be in a lower band than if the full purchase price was taxed.

An example:

- Say you are buying one £2m property (as a second home) plus one £20k property.

- On the face of it (using 2018 rates, including the 3% surcharge), SDLT on the overall £2,020,000 transaction is £217k.

- But if you claim MDR then you instead work out SDLT on the average property price of £1,010,000. That would be £75k.

- MDR gives a result of 2 x £75k, i.e. £150k

- MDR has saved you £67k.

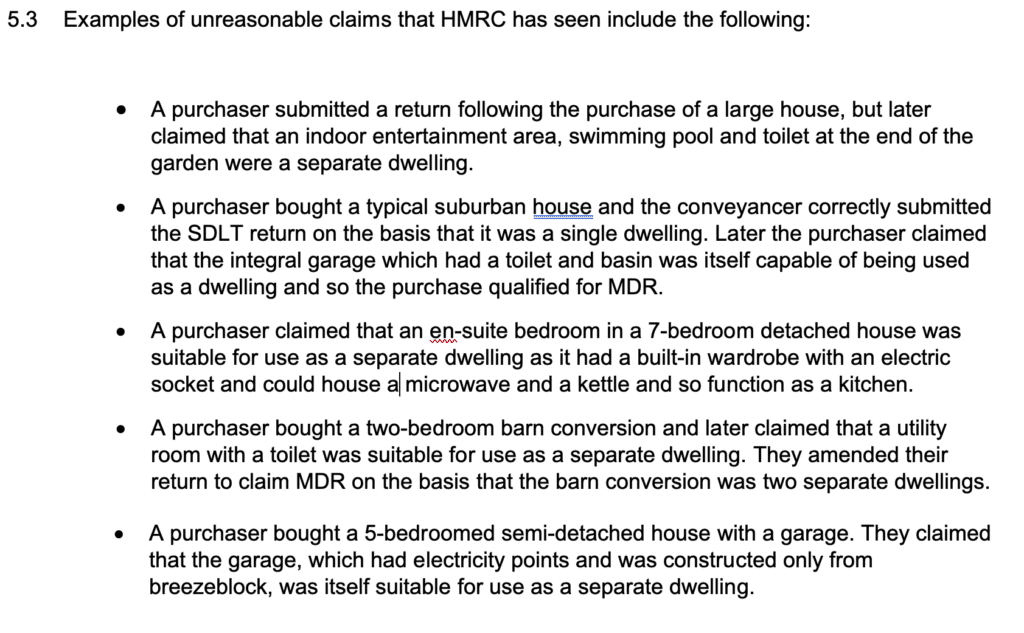

This might be a straightforward transaction, but it could also be avoidance, where the £20k property is an artifice created to reduce the stamp duty. Here are some examples HMRC has seen:

Because of HMRC’s concern there was widespread abuse, MDR was abolished earlier this year.

What if Jeremy Hunt had claimed MDR?

We can calculate the result like this:

- The average price paid for his seven properties: £510k

- SDLT on a £510k property would have been £31k

- MDR therefore gives a result of 7 x £31k = £215k.

So if Hunt had claimed MDR, his company would have paid £48k more tax.

Why in this case does MDR give a worse result? Because the 6+ rule converts residential properties to non-residential, and that’s more valuable than the MDR effect of applying lower bands.

Did Jeremy Hunt avoid tax?

We would say clearly not.

He bought seven flats and paid the SDLT on that transaction. He didn’t make any kind of claim or election.8 The fact he benefited from the 6+ rule is a natural consequence of how the tax system works. It’s not just the legal outcome, it’s the fair outcome – whether or not you think the 6+ rule is itself fair.9

Now if he’d bought five flats plus one teensy-tiny property just to get within the 6+ rule, then it would be fair to say he avoided tax. But he didn’t.

The fact Jeremy Hunt could have paid more tax by claiming MDR is hardly relevant. There are often things one can do voluntarily to trigger more tax; the failure to do that isn’t tax avoidance.10

There is no single definition of tax avoidance, but we’ve written an FAQ explaining the conventional view is that tax avoidance is using “loopholes” or other features of the tax system to save tax (“obtain a tax advantage”) in a way that wasn’t intended by Parliament. The 6+ rule was absolutely intended by Parliament.

Some people will disagree with that. But we can’t see any coherent definition of “tax avoidance” that includes Jeremy Hunt. He literally did nothing.

Many thanks to S, who researched and wrote almost all of this article (but the views expressed are the views of Tax Policy Associates).

Daily Mirror front page © Reach Plc, and reproduced here for purposes of review/criticism.

Footnotes

We very often look at claims that businesses or politicians avoid tax. Sometimes this follows queries from journalists; sometimes tips from professionals or the public. The great majority of the time we conclude there is no avoidance. Where the accusation hasn’t been publicised, we don’t generally publish our conclusion that there is no avoidance. Where the accusation is published or, as here, gaining traction on social media, we generally do. ↩︎

When a company acquires, in some cases there can be a 15% flat rate but not, as here, when it is acquiring to lease out the properties. ↩︎

The accounts show “fixed assets” of £3,751,666 for 2018. Accounting rules require assets to booked in their historic costs – meaning that this figure will reflect the purchase price, stamp duty and other costs. £3,751,666 = £3,568,400 + £167,920 + £15,346. Suggesting that we have the correct figure for stamp duty, and Hunt’s other costs (legal etc) were £15k, which is in the right ballpark. ↩︎

The £100k is the figure from escaping the additional 3% SDLT, but the 6+ rule also saves the higher residential rates. ↩︎

i.e. compared to the standard SDLT result, with no 6+ rule and no MDR. ↩︎

A tweet I posted last week suggested Hunt had used MDR. That was incorrect. ↩︎

Subject to a minimum SDLT amount of 1% of the overall purchase price – that’s relevant if the average falls below the threshold at which SDLT starts to apply. ↩︎

As an aside, he also didn’t properly declare his interest in the flats in his Parliamentary disclosure, or to Companies House. ↩︎

The likely intended purpose of the 6+ rule, in conjunction with the 3% surcharge, was to continue the Osborne policy of encouraging large-scale professional/institutional landlords, and discouraging small-scale/”accidental” landlords. However there certainly is an argument that the 6+ rule is an unjustifiable relief for landlords. ↩︎

Indeed if he had claimed MDR we would have been suspicious that there was something untoward happening; going out of one’s way to pay more tax is a red flag. ↩︎

16 responses to “Did Jeremy Hunt avoid SDLT in 2018?”

“But the critical point is that this wasn’t a choice – s116(7) applies automatically. Hunt didn’t “claim” the 6+ rule – the way the rule works made this inevitable. It wasn’t actually possible for Hunt to pay £450k SDLT.”

Please clarify, since according to

https://www.gov.uk/hmrc-internal-manuals/stamp-duty-land-tax-manual/sdltm29905

“In some circumstances a purchaser may choose to apply FA03 S116(7) whereby the purchase of six or more dwellings in a single transaction may be treated as a non residential transaction for the purposes of SDLT. If both options are available, the purchaser is free to choose whichever route is more SDLT efficient.”

It was only automatic post 2024 when MDR was eventually abolished?

So what you’re saying is if he bought 6 flats he’d have paid x tax but if he bought 7 he automatically pays y tax where y is less than x. So he could have bought 6 but chose to buy 7, and he was shocked to find he couldn’t pay tax at x rate. He of course could have said I’m a financial guy in the government so I’ll only buy 6 so it doesn’t look like I’m avoiding tax. But of course he was completely unaware of any of it until it happened.

nope, if he’d bought 5 the residential rate would have applied; buying six meant it didn’t.

I think this article misses the point. The point is Jeremy Hunt benefited from an obscure tax relief benefit, that on the face of it benefits the wealthy, that was put in place while he was a secretary of state, and therefore had influence over government policy.

I.e. he benefited from a policy brought into effect while he was a senior member of government that specifically benefits a small group of people in a targeted way.

No one if claiming he didn’t comply with tax law, just that in this instance tax law was suspicious written in a way he benefited from.

no, please read the article. It wasn’t put in place when he was secretary of state – it dates to 2003 when SDLT was created. And SDLT taxed the wealthy much more effectively than the stamp duty that preceded it.

This article seems extremely pro tax dodging.

Yes, the dodging of tax was built into the process, that doesn’t make it okay or good.

“He didn’t do anything wrong because he went through the corrupt process that’s in place” oh that’s fine then.

He should have paid £450,000 in tax just like anyone that bought them 1 at a time would. But of course, 1 set of rules for the rich, 1 set of rules for the poor

“pro tax dodging”. Come on.

Yes Dan. The law obviously favours the rich. One rule for the regular folks, and another for the rich who can buy multiple homes at the same time.

Time to change the laws.

a rich person buying an expensive home pays SDLT at the full residential rate. This rule doesn’t favour the rich – it favours large scale landlords. That was the policy intention behind it. You can criticise that, but attacking a cartoon version of reality doesn’t help.

It favours large scale landlords, in this case Mare Pond Propeties, of which Jeremy Hunt has a controlling interest. Therefore it benefits Jeremy Hunt who is, by average standards, fantastically rich/wealthy. So yes, no tax evasion. But it is benefitting the rich ultimately.

I am not convinced by the possible explanation for the 6+ rule in footnote 9. So far as I am aware the rule has been there since SDLT was introduced in 2003. This was under the then Labour government so pre-dates Osborne by 7 years. Moreover, at the time there was very little difference between the rates applying to wholly residential property and the rates for non-residential/mixed use. It is only from 2011 onwards that the rates started to diverge, with the residential rates becoming progressively higher over the years since. So while the 6+ rule can be hugely beneficial now, in 2003 it would probably have made very little difference to the amount of tax payable – which makes it even more of a puzzle why they thought it was worth including in the original legislation. I did not advise on stamp taxes back then so can offer no insights I’m afraid!

Why is it like that though? Why do you pay a lower rate if you bulk buy?

Simplistically, because that’s what Parliament decided. For the underlying ‘why’, footnote 9 suggests an answer (there might be more clues in the papers and debates at the time).

Most bulk purchasers of houses are by the rental sector, which often funds the construction of the properties too. If 12%+ rates of SDLT applied then fewer of those large rental developments would be financed and built, and the housing supply would be reduced. Rental property businesses in the UK already operate on finer margins than in the past due to interest costs rising (I have been told by clients in the sector that moving from 1% SDLT to 5% on student housing on 1 June 2024 has meant that previously viable deals are not happening).

One further consequence of corporate ownership is – at least for the two properties worth over £500k (and probably now for the others if they have increased above that threshold) is that the company will need to comply with the ATED rules. Assuming the properties are let out commercially then relief should be available for that. But the relief has to be claimed and there are various situations (occupation by a close family member) whereby you might end up with ATED to pay

Good article, Dan. The standard of tax reporting in the UK is often woeful, and that Mirror article is a perfect example.