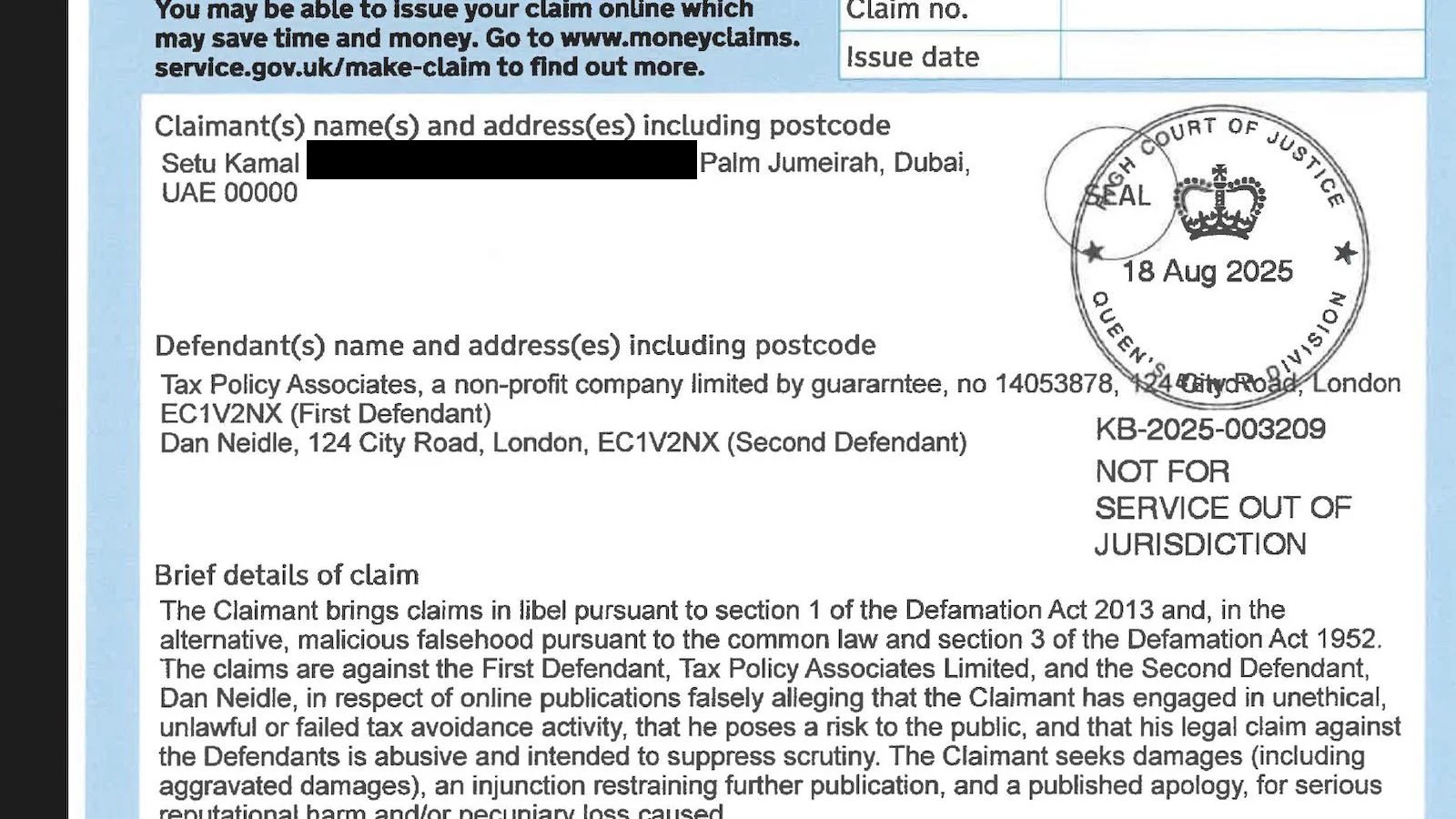

Less Tax for Landlords and The Bailey Group1 sold a landlord tax avoidance scheme involving an LLP “hybrid partnership”.2 We reported back in October that the scheme was technically hopeless; HMRC has written to the clients and invited them to settle. Everyone thought the game was up.

How did Less Tax for Landlords respond to being caught? They denied there was anything wrong with their scheme, paid £100,000 to a KC known for writing tax avoidance scheme opinions, obtained an opinion which appears to be worthless, and advised their clients to disregard HMRC’s offer to make a disclosure by 31 January 2024. We expect that, as a result, their clients will incur significant penalties.

At this point the big question is whether Less Tax for Landlords are recklessly incompetent, or conducting a deliberate fraud on HMRC and their clients. Tax advisers and others will form their own view after viewing the evidence we set out below.

It’s often said that the answer to rogue tax advisers is regulation. Less Tax for Landlords’ accounting arm is regulated, by the Institute of Chartered Accountants in England & Wales. But the ICAEW shows no sign of taking any action.

Regulation isn’t working. Rogue tax advisers are taking advantage of HMRC and their own clients. The question is: what can be done?

In this report:

- The LT4L scheme

- How the LT4L scheme fails

- Worse than just failure

- 1. Tick boxes and have a business plan

- 2. The LLP turns into a trading business

- 3. The LLP turns rental income into trading income

- 4. Gobbledegook about the equity

- 5. More trading activity is introduced

- 6. Aggressive evasion

- Why?

- LT4L's response

- Where does this leave LT4L's clients?

- Why won't LT4L publish the full opinion?

- So was it fraud?

- What should LT4L clients do?

- Who can protect LT4L's clients?

The LT4L scheme

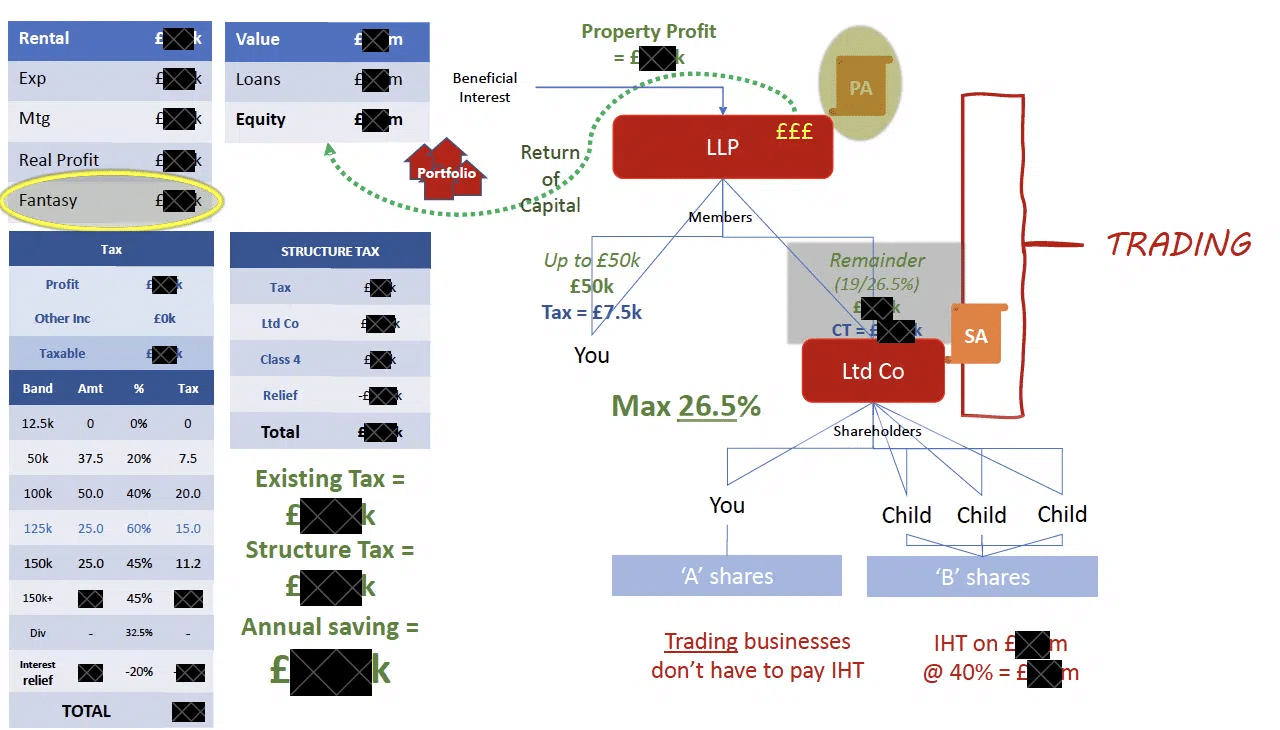

On 4 October 2023 we published a detailed report into a tax scheme marketed by Less Tax for Landlords, the trading name of the One Consultancy Group (OCG). The idea was:

- Landlords would declare a trust over their properties in favour of a limited liability partnership (LLP)

- The landlord and their spouse would be members of the LLP; there would also be a newly incorporated company as member, owned by the landlord/spouse

- The LLP diverts most of its profit to the company.

LT4L made some very impressive claims about the structure:

- There was no need to tell the mortgage lender.

- After two years, the structure is entirely exempt from inheritance tax thanks to business relief.3

- The diversion of LLP profits to the company means rental income is taxed at the corporate rate of 19-25%.4

- The trust means the landlords’ obligation to make mortgage payments “shifts to the LLP”, meaning the company as LLP member obtains full tax relief for mortgage interest. The “section 24” restriction on landlords claiming tax relief is avoided.

- No CGT or SDLT on establishment, without needing to qualify for any special reliefs.

- The properties are “rebased” for capital gains tax. In other words, when they’re sold, only the capital gain after incorporation of the LLP is taxed. Pre-incorporation gains disappear.

- Instead of taking profits out of the LLP, you can take capital out instead, and you won’t be taxed.

- There’s no need to disclose the structure to HMRC.

- If the structure triggers unexpected tax, then their clients are protected by an unusual insurance arrangement – LT4L claim they have a “written note” from their insurers stating they are happy to cover all interest, penalties and extra tax payable if HMRC do not agree with the way the structure was set up.

How the LT4L scheme fails

We couldn’t believe the scheme when we first saw it. Every aspect fails:

- Declaring a trust over the rental properties without the mortgage lender’s consent (or even telling them) will in most cases default the mortgage. The structure was described to us by an experienced broker as “almost unmortgageable”.

- Rental property businesses almost never qualify for inheritance tax business relief. The LLP structure doesn’t change that.

- The mortgage obligation doesn’t “shift to the LLP”. It remains with the landlords – who now lose their 20% credit.

- The “mixed partnership” rules mean you can’t get a tax benefit by allocating profits to a corporate partner in an LLP.

- The allocation of profits to the corporate partner means there will be up-front capital gains tax. There’s no CGT rebasing.

- SDLT will be due at the point that income profits are allocated to the corporate member. LT4L’s unusual structuring potentially results in a higher SDLT liability than would result from a simple incorporation.

- The structure can incur additional SDLT every time the profit allocation changes. LT4L’s clients could have unknowingly racked up years of SDLT liabilities.

- The structure is disclosable under DOTAS, the rules requiring tax avoidance schemes to be disclosed to HMRC. That is obvious, given that the structure was mass-marketed and its main benefit is to avoid tax.

- Members are taxed on profits as they are made; when and how they are taken out is irrelevant. This is a basic principle of LLP taxation.

- HMRC do not in fact agree with how the structure was set up, but there is no automatic payout from LT4L’s insurers. That’s because there never was a special “written note”; they just have the usual professional indemnity insurance. To get any benefit from that, an LT4L client has to lose an argument with HMRC, sue LT4L (with the insurers arguing LT4L’s case, not the client’s), and win. This is not easy, even if (as we believe) LT4L’s advice is plain wrong.

We went into the issues in detail in our report of 4 October 2023. That same day, HMRC issued a “Spotlight” saying that the scheme didn’t work,5 and then wrote to taxpayers and agents inviting them to make a disclosure by 31 January 2024.

Worse than just failure

Many tax avoidance schemes fail, indeed these days almost all of them do. The unique thing about Less Tax for Landlords is that nobody has been able to explain why they thought their structure worked. It’s not a case where they have an argument, and that argument is wrong. It’s that they don’t appear to have had an argument at all.6

We can illustrate this if we focus for the moment on the claim that the structure is exempt from inheritance tax after two years.

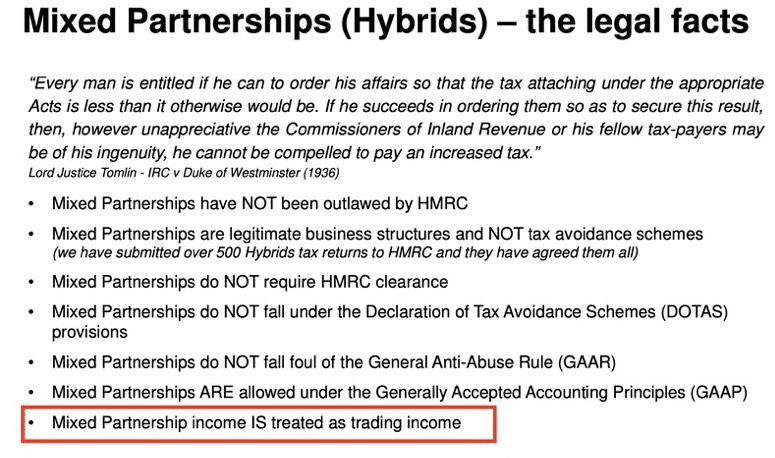

Here are six answers that Less Tax for Landlords provided to clients and advisers asking questions. People familiar with inheritance tax and the tax concept of “trading” will see immediately they are nonsense (The Chartered Institute of Taxation have published a clear summary of the actual position7). But we believe even a non-specialist will see that the explanations given are contradictory:

1. Tick boxes and have a business plan

This was the original confident claim:8

“[the business] is outside of your estate for inheritance tax, as long as you tick various boxes”

Why?

“because the HMRC recognizes that there is a trading relationship between you all, and that you’ve got a written business plan and that you’re managing it and that your sole purpose is not to avoid tax but to maximize your wealth to tax efficiently as possible, the whole thing becomes inheritance tax free.”

A trading relationship between the participants, a business plan, not having a tax avoidance purpose – all these things are irrelevant to whether inheritance tax applies. There are no “boxes” to tick.

2. The LLP turns into a trading business

If you don’t like that, here’s a completely different explanation:9

“The LLP structure that we set up is not investing in property. It does not own the property. The property is owned by the individuals. The LLP has taken advantage of that ownership and it is available… after two years, that LLP turns into a trading business according to HMRC, not according to us, according to HMRC. And at that point, after two years, the equity of those properties inside that LLP are then outside of the estate for inheritance tax after two years. “

Pure nonsense. The LLP does have beneficial ownership of the property. The LLP does not “turn into a trading business”. HMRC has certainly not said this, or anything like this.

Here’s another version of the same claim from a document LT4L sent to a client, with a badly drawn rectangle supposedly showing that something, somewhere, somehow is trading:10

3. The LLP turns rental income into trading income

Less Tax for Landlords often used this slide:

And sounded very confident:

In reality, an LLP doesn’t transform its income into trading income.

4. Gobbledegook about the equity

Some advisers asking LT4L to explain their structure received this explanation:

“The LLP holds the equity and not the properties – so it cannot be classed as investment. The owner of the properties does not qualify for BR on the properties, but on the equity.”

We have no idea what this means.

5. More trading activity is introduced

When we were researching our report, we asked LT4L how they justified their inheritance tax claims. This was their response:

“We do not work with all landlords, at least not in relation to a Mixed Partnership structure, and for those we do work with, we look to help them commercialise their operation and introduce more trading activity into their business model.”

You can’t “introduce more trading activity” into a rental property business and qualify for business relief.11 So this approach would fail; however we have been unable to find any LT4L clients who were helped to “introduce more trading activity”. This statement may just have been a lie.

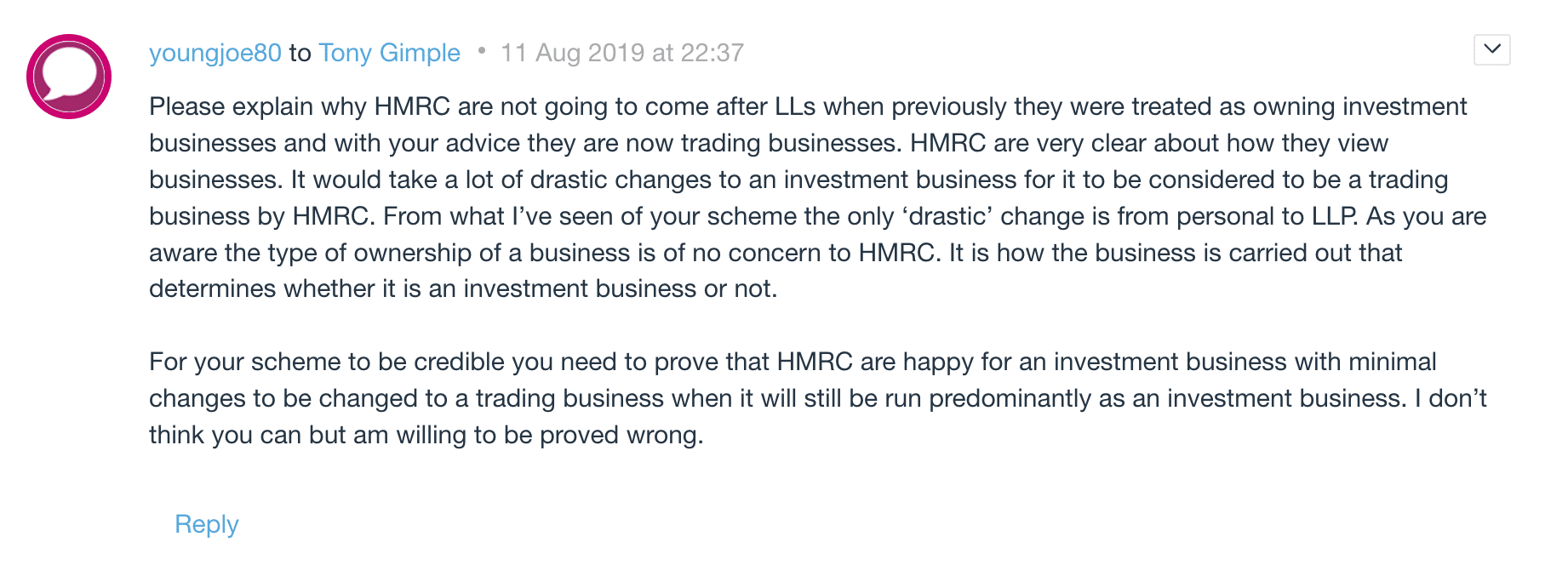

6. Aggressive evasion

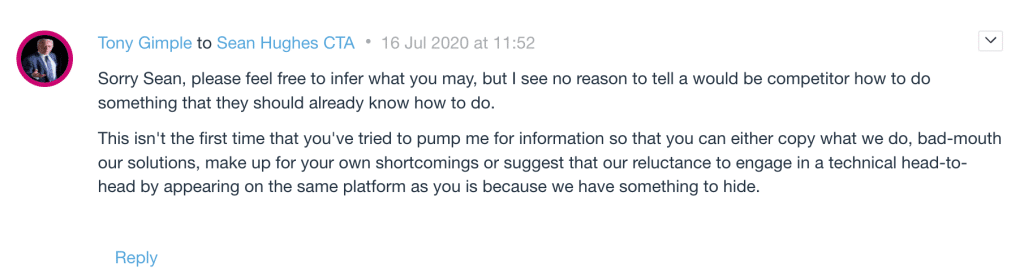

Over the years, many tax advisers asked Less Tax for Landlords how their scheme magically qualified for business relief. That often went like this:

Or this:

That confidence has now disappeared, and Mr Gimple’s correspondence with us makes clear he never understood the technical tax basis for the structure. He tells us he relied on Vajahat Sharif who ran the associated law firm (which includes STEP qualified practitioners), and Chris Bailey, who ran the accounting and tax advisory side of the business.

Mr Sharif has told us that he and his staff don’t in fact have any tax expertise, and he never advised on any element of the hybrid partnership structure. We believe Mr Sharif when he says he has no tax expertise, because he promotes himself on LinkedIn as “Head of Terrorism, National Security, Political & Complex Crimes at Tuckers Solicitors”.12 It is impressive that he can combine this with being “Group Head of Legal” and head of compliance for OCG Group (which owns/runs Less Tax for Landlords). We’d assume it’s two different people with the same name, but it isn’t.

Mr Sharif says he had no involvement in the LT4L tax avoidance structure. A letter was recently sent to LT4L’s clients from Sharif and the other directors concerning the structure; Mr Sharif says he didn’t authorise that letter, but hasn’t taken any steps to correct it.

Mr Bailey is a qualified accountant, but from the videos and documentation we have seen, it is apparent that he either has no tax expertise or is lying (we do not know which it is). Bailey was disciplined by the Association of Chartered Certified Accountants in 2020 for failing to provide audit files when requested. He provided a series of excuses for this: he first said he needed more time, then claimed the clients were audit-exempt, then claimed the files were offsite, and finally blamed a software issue. He was found guilty of misconduct. The ACCA accepted that the failure to disclose was not deliberate; it is not clear how they came to this conclusion.

We believe Mr Gimple, and don’t think he was dishonest. However, he had no technical tax qualifications or experience, was selling a scheme he didn’t understand, and aggressively responded to criticism from people who were qualified (without, it seems, ever wondering what precisely was going on). This strikes us as reckless.13

The justifications for the other key elements of the structure were equally nonsensical, with no reasonable basis ever provided for thinking capital gains were rebased, or that the diversion of income to the corporate member would escape the mixed partnership rules. Over the years, many advisers queried the structure – nobody received a coherent explanation.

And the other people who never received an explanation were LT4L’s clients. As far as we are aware, not a single LT4L ever received a technical explanation of why business relief applied, or indeed a technical explanation of any other aspects of the structure.

It is, in short, astonishing.

Why?

The LT4L structure has been the subject of widespread comment by tax professionals. We are not aware of a single adviser, anywhere in the UK, who believes the LT4L structure had any prospect of success.

At this point there are three possibilities.

- First, Less Tax for Landlords have alighted on a structure so brilliant that nobody else is able to understand it. They are right and we are all wrong.

- Second, LT4L were incompetent and negligent to an astonishing degree.

- Third, key personnel at LT4L either knew the structure didn’t work, or were wilfully blind to it not working, but sold it anyway. In other words: they defrauded both HMRC and their own clients.

We are going to discard the first possibility.

To assess the likelihood of the second and third possibilities, let’s look at how LT4L responded to the Spotlight.

LT4L’s response

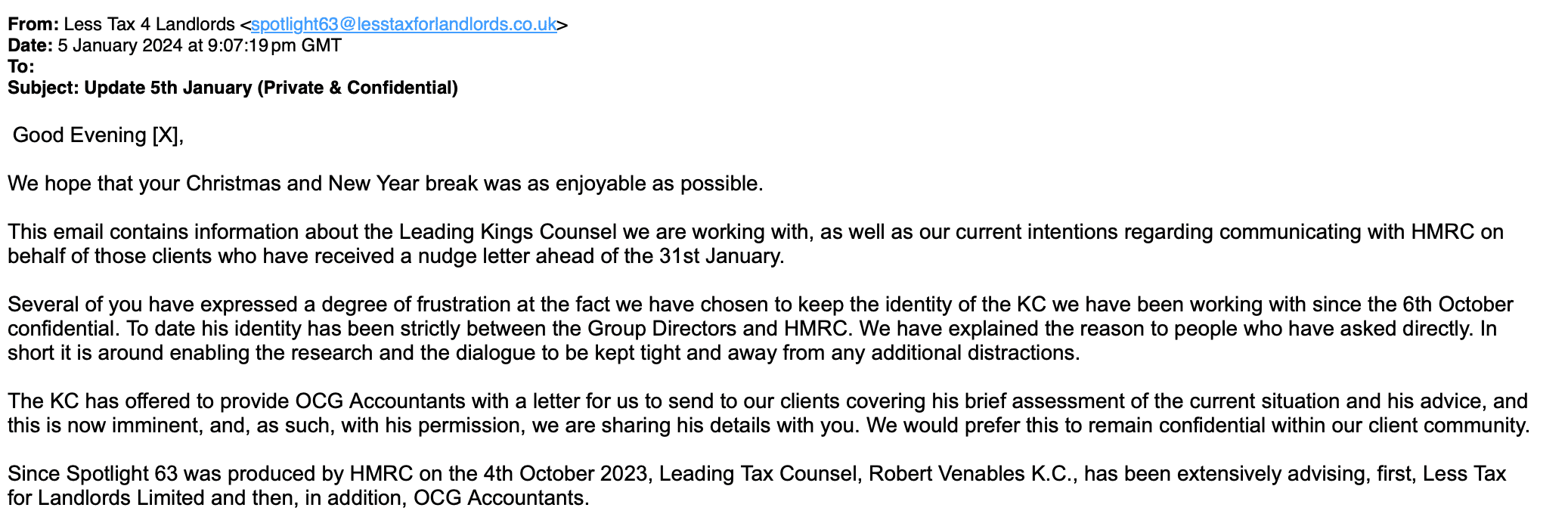

Here’s what LT4L have been up to, since October, in their own words:

Less Tax for Landlords didn’t admit wrongdoing and continued to represent their clients. It’s an impossible conflict of interest.14

LT4L then admitted that the chosen counsel is Robert Venables KC.

This is an illuminating choice. Venables’ reputation is for providing opinions on avoidance schemes.15Jolyon Maugham once wrote an insightful and influential blog about the “boys who won’t say no” – the handful of tax KCs who frequently issue technically dubious opinions on avoidance schemes. Venables is generally considered to be one of those KCs. He’s not the man you go to if HMRC are unreasonably challenging your entirely commercial structure (not least because he has no credibility with HMRC).

We understand from a source that LT4L paid £100,000 for the Venables advice.

LT4L wrote to their clients last month summarising Venables’ opinion. We are publishing a copy of the LT4L letter; it is stated to be confidential, but we believe there is a public interest in publishing it, given it reveals highly unethical behaviour by LT4L. We also believe public scrutiny of LT4L’s actions is in their clients’ interests.

The first and most important thing Venables says is that clients can’t rely on his advice. If Venables gets it wrong, LT4L’s clients are stuffed:

This is standard practice for KCs writing avoidance opinions. The people who actually need to rely on the KC’s advice, can’t. This is why “the boys” happily issue opinions that other advisers wouldn’t touch – it can never come back to them.

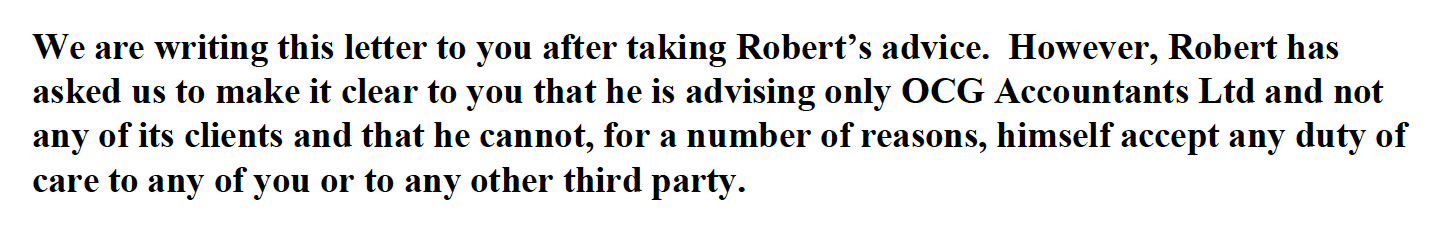

The other key reason is that “the boys” will often make assumptions of fact which are unrealistic, and mean they are advising on a structure which is not quite the same as the actual structure. Like this:

This is not how the structure was sold to LT4L’s clients. The whole point was to allocate large amounts of income to the corporate member to obtain a tax benefit. LT4L presentations show almost all the rental income being allocated to the company, leaving the individual LLP members only enough to use up their 20% income tax bracket:

Other advisors, who are merely bad, think there is a 15% limit to the profit that can be allocated to the corporate member.16 LT4L think there is no limit:

So Venables is assuming away the actual structure, either because he has been mis-instructed, or because that’s the only way he can come to the “right” conclusion.17 Everything that follows is therefore worthless.

Mixed partnership rules

These are the rules which undo attempts to allocate income to a corporate member of an LLP/partnership which go beyond a fair return on services or capital provided. Less Tax for Landlords made a series of nonsense claims about these rules. What does Venables have to say?

HMRC have claimed that income which was in fact allocated to the corporate member is deemed to be taxable income of the individuals which should have been declared as such.

HMRC have mentioned the “mixed partnership” rules and the “income stream” rules.

Robert has advised us that he has seen nothing in HMRC’s arguments which justifies the view that taxable income has been under-declared and does not see how their claim can be established on either basis.

There is zero content here.

LT4L were previously very confident the rules didn’t apply as long as your “main reason” for the structure wasn’t tax avoidance and they are “used for business purposes”:

As we explained in our original report, this is not at all what the rules say. The mixed partnership rules and transfer of income streams rules clearly apply. Bailey appears to have no understanding of the legislation.

But Venables is silent on LT4L’s original justification, and provides no basis for thinking the structure works. It is possible, again, that he is misunderstanding/misdescribing the structure.

We have heard from a source that LT4L are in fact submitting client tax returns for 2022/23 on the basis there is no allocation of profits to the company. If that is correct it is very disturbing, because it suggests they know their structure is indefensible, and are conceding most/all of the benefit of the structure for future periods, but concealing this from their clients.

Any reallocation of profits can also trigger SDLT charges – more on that below.

Inheritance tax

The prospect of an inheritance tax exemption after two years was the big benefit of the LT4L structure. But on this, Venables provides no advice at all. We are aware of former LT4L clients where HMRC is asserting seven figure inheritance tax liabilities, but all LT4L have to say is:

HMRC have also raised the question of inheritance tax.

To the clients where this is a current issue, separate steps are currently ‘in progress’ with HMRC and unless you have made some gift of your rights over the LLP, Robert sees this as being currently academic. He notes that in any event your self-assessment return has nothing to do with inheritance tax.

Clients who paid thousands of pounds for advice from LT4L which claimed to enable an inheritance tax exemption, should be pretty unhappy that the issue is now described as “academic”. It’s a striking change from their breezy confidence of a few months ago.

Stamp duty land tax

Here’s what LT4L are saying about Venables’ advice:

HMRC have not claimed in their letters to us or to our clients, in the “factsheet” or in Spotlight 63 that any stamp duty land tax should have been paid on the transfers of the properties to the LLP.

Robert had advised us that no stamp duty land tax should have been due on such transfers, except perhaps in exceptional circumstances. We shall be contacting separately our clients whose circumstances may be exceptional.

It’s another bait and switch. The problem isn’t SDLT when the properties go into the structure; it’s SDLT when the profit-sharing ratios change. Every change potentially triggers a tax charge, and the changes are often large.

HMRC didn’t mention this point in Spotlight 63, but we understand they are currently investigating it.

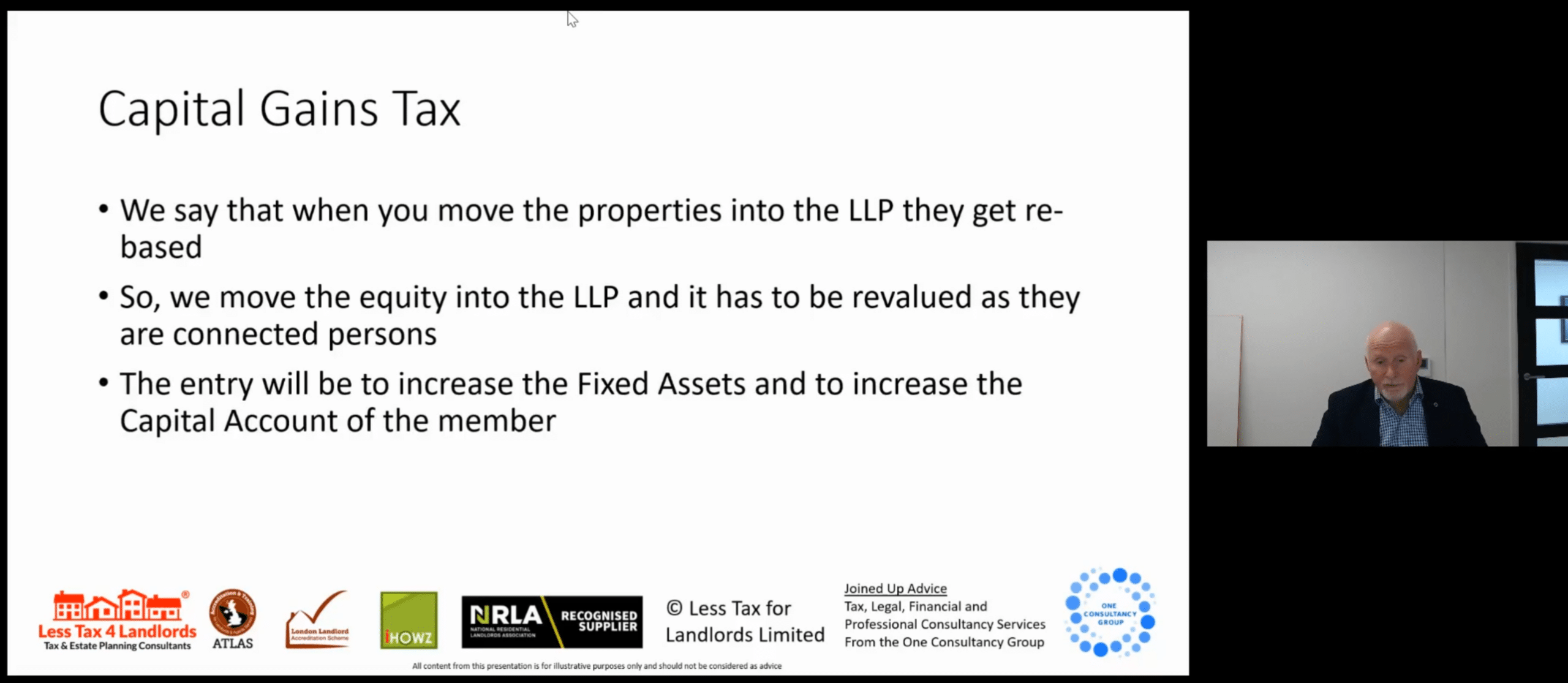

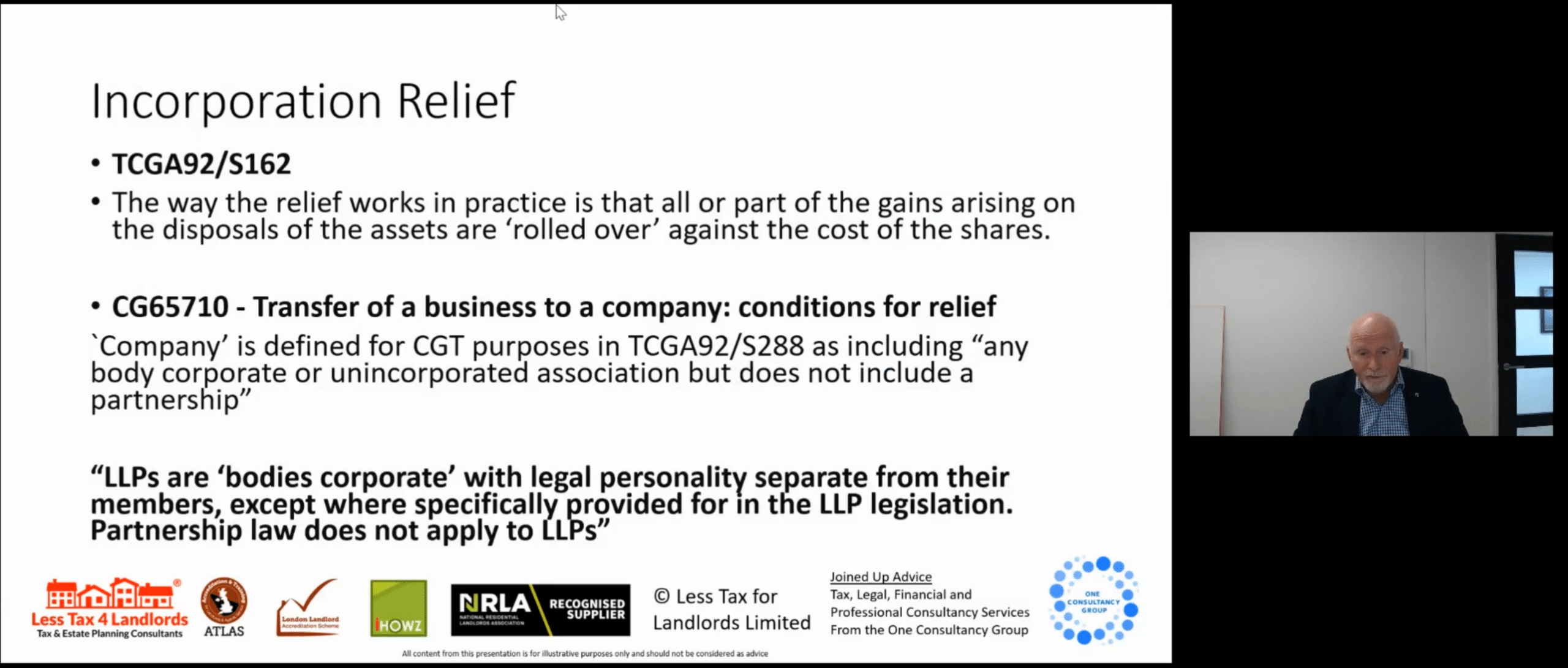

Capital gains tax

Here’s LT4L/Venables:

HMRC appear to accept that there was no capital gains tax payable when the properties were transferred to the LLP.

Robert has advised us that in general that must be correct, although he adds that there may be a small number of our clients who may require more specific contact relating to their specific circumstances.

Once more, a failure to engage with the actual problem: LT4L promised that the structure would “rebase” assets so that, when you sell a property, you’re only taxed on gains since it went into the LLP:

They explained this through gobbledegook:

There is no rebasing when property is moved into an LLP.

One of Bailey’s many errors was to believe LLPs were treated as corporates for capital gains tax purposes:18

This is an amazing mistake for any accountant to make (but one Bailey makes consistently). We’re aware of former LT4L clients with high six figure liabilities as a result of LT4L’s incompetence.

It’s fairly obvious why LT4L don’t want Venables discussing these issues.

Disclosure of Tax Avoidance Schemes

The “disclosure of tax avoidance scheme” (DOTAS) rules require promoters of tax avoidance schemes to notify HMRC. HMRC then provides a scheme reference number which the promoter has to give its clients to put on their tax return. This is the kiss of death if you’re trying to market a scheme, so promoters generally find bogus legal rationales for not disclosing.

The LT4L scheme plainly was disclosable, because its “main benefit” was obtaining a tax advantage, and the scheme was mass-marketed and highly standardised.

LT4L didn’t disclose, because they thought their LLP scheme (created wholly for tax reasons) was comparable to the kind of LLP commonly used by accounting and law firms (it isn’t) and “a business structure is not a tax avoidance scheme” (which just ignores the way the rules work).

Spotlight 63 is very clear that HMRC believe DOTAS applies. The LT4L/Venables advice doesn’t mention DOTAS. We would speculate that’s either because LT4L didn’t ask the question, or because they asked the question but didn’t like the answer.

Where does this leave LT4L’s clients?

In a terrible position. They are being advised to do nothing…

“HMRC have suggested that you should amend your self-assessment return for 2021/22.

Robert does not see how it could be to your advantage to do so. He can see that it would very probably be to your disadvantage and to the advantage of HMRC

…

HMRC have suggested that you should make a “declaration” to them and have threatened an enquiry into your self-assessment return for 2021/22 if you do not do so by January 31st 2024. They have not specified what the “declaration” should concern.

Robert does not see how it could be to your advantage to make such a declaration, even if you knew what it was you were supposed to declare. He sees the threat of HMRC making an enquiry into your self-assessment return if you do not do so by January 31st 2024 as a hollow

one.”

… but being given no explanation that would let them form a reasonable belief this is a correct course of action.

The likely outcome will be penalties. Robert Venables KC has this to say about penalties:

HMRC have suggested that unspecified penalties might be due from you.

Robert does not see how that can presently be the case.

Again, there is zero content here. Penalties are very likely due for taking all the unsupportable positions we refer to above, and then for failing to correct returns when HMRC has given taxpayers an opportunity to do so.

Why won’t LT4L publish the full opinion?

Often people don’t publish opinions they receive from KCs because that would cause the opinion to lose legal privilege. HMRC could then obtain a copy of the opinion, the instructions and other supporting documentation.

But this ship has likely sailed. By publishing the summary, LT4L probably waived privilege in the opinion itself.19

Another possibility is that the full opinion is embarrassing, particularly if LT4L actually put Chris Bailey’s amazingly wrong technical claims to Venables.

Another is that the opinion would reveal how Venables is being instructed to not actually advise on the key questions.

A taxpayer cannot reasonably proceed on the basis of an empty summary of advice which reveals none of the reasoning, and may indeed be on an entirely incorrect basis. LT4L clients should be demanding the full instructions and opinion. LT4L will probably refuse.

However LT4L will likely be unable to refuse a formal request for the Venables papers from HMRC. Similarly we expect they will be unable to resist disclosing the documents in the (very likely) event they are sued for ngeligence by former clients.

So was it fraud?

We don’t know.

This may have been a case of people acting in good faith, but just getting the tax position extremely wrong. That is quite hard to credit given the number of apparently qualified people working for LT4L, the number of unrelated errors they have made, the number of people who pointed out their errors over the years, and the length of time they sold the structure. Nevertheless, it remains a possibility.

In our judgment the more likely scenario is “wilful blindness” – that Chris Bailey, the qualified chartered accountant who appears to be behind the scheme, had no real expertise in tax, somehow bluffed his colleagues into thinking he did, and pressed on despite all the criticisms made by other advisers. If that’s what happened, then it could amount to fraud against HMRC and LT4L’s clients – that depends on whether a jury would consider Bailey’s actions to be “dishonest”. We discussed how courts approach this question here. In this scenario, those around Bailey were not dishonest, just reckless/negligent.

The people who run LT4L are in greater legal jeopardy now. They have a detailed analysis of their structure which demonstrates it to be hopeless, and they know HMRC agrees. But, instead of admitting error and acting in the best interest of their clients, they are deep in denial, if not cover-up, and continuing to collect £450 per month in fees from around 450 LLPs – i.e. c£2.5m/year. This behaviour may amount to dishonesty even if the earlier behaviour did not.

There is an additional question around LT4L’s repeated claims that they had special insurance which provided complete protection for their clients, with coverage of “£2m per case”:

These claims are almost certainly false,20 and if LT4L knew the claims were false then that could amount to fraud by false representation. We asked LT4L to explain these statements; they declined.

What should LT4L clients do?

LT4L clients should urgently obtain independent tax advice to regularise their tax affairs, plus independent legal advice to preserve their ability to sue LT4L if (as is likely) they have suffered loss.

We can’t recommend individual advisers due to the risk of a conflict of interest, but there are now a number of reputable legal and tax advisers who are familiar with the LT4L scheme and able to act.

However we fear that most LT4L clients will have no way of knowing they are being badly misled.

Who can protect LT4L’s clients?

Right now there is nobody protecting LT4L’s clients from what we believe to be incompetent advice that will cause them significant financial harm.

Who could act?

- Chris Bailey is regulated by the ICAEW. We reported him to their professional conduct department, and urged swift action to protect LT4L’s clients. It looks like no swift action is being taken. The ICAEW is in danger of completely undermining the concept of self-regulation.

- HMRC are enabling LT4L’s behaviour by continuing to treat them as a normal adviser, and allowing or even encouraging them to coordinate their clients’ responses. HMRC should write directly to the clients, warning them that LT4L promoted an undisclosed tax avoidance scheme, and suggesting the clients obtain independent advice.

- HMRC should commence a criminal investigation into Chris Bailey and Less Tax for Landlords.

The question is whether the ICAEW and/or HMRC will step up.

Tax Policy Associates is committed to accuracy and we will promptly correct any errors of fact or law in this article. We will not, however, retract our legal opinions in the face of abuse, legal threats and vague non-specific denials.

Thanks to M and L for a helpful discussion on fraud and dishonesty, P for a detailed analysis of the tax evasion caselaw, and K for advice on privilege and collateral waiver. Thanks to S for his insightful review of our original draft. And thanks again to the many people who helped with our original investigation into Less Tax for Landlords.

Footnotes

The Bailey Group was acquired by SKS in September 2020. We understand from SKS that Chris Bailey continued to run the practice until November 2022, and after that point other SKS personnel discovered the nature of the scheme Bailey had been selling. SKS tells us they obtained counsel’s advice and started trying to remedy the position for their clients before the publication of Spotlight 63. So SKS appear to be acting properly and in good faith (although that won’t remove the Bailey Group’s liability for its historic actions). ↩︎

We’ve heard anecdotally that other firms sold similar schemes, but we haven’t seen any evidence to support this. ↩︎

The relief used to be called “business property relief”, and many advisers still refer to it as BPR. This is, however, incorrect – it’s a mistake we made in our original LT4L report, but we will be using the correct nomenclature going forwards. ↩︎

The rate is 19% for profits under £50,000, with a “catch-up rate” of 26.5% on profits up to £250,000, so that the overall effective rate smoothly transitions into the full rate of 25%. ↩︎

This was no small step. HMRC don’t issue a Spotlight for every piece of tax planning which merely doesn’t work; HMRC only Spotlight what they see as particularly egregious and hopeless tax avoidance schemes ↩︎

In this respect Less Tax for Landlords are significantly worse than Property118, whose schemes are poor quality tax avoidance, and who clearly aren’t qualified to advise on tax structures – but we have no reason to suggest they are engaged in intentional fraud. ↩︎

Update 1 March 2024: for some reason the link is down, so we’re linking to an archived version ↩︎

You can find the full versions of some of these videos on YouTube; most are freely available⚠️ on the LT4L website once you’ve registered (but that means we can’t link to them). All the videos are © Less Tax for Landlords, and republished by us for the purposes of fair dealing/criticism and in the public interest. ↩︎

This is from a June 2021 webinar, hosted by Benham & Reeves; they asked us to remove their logo from the video, and we agreed to that. Many people in the landlord real estate world cosseted and promoted Less Tax for Landlords; Benham & Reeves are a long way from being the worst offender. ↩︎

The way they phase the business relief test as referring simply to “trading” is not quite right. A business will usually qualify for business relief unless it consists wholly or mainly of of one or more of dealing in securities or shares, land or buildings, or making or holding of investments”. So what LT4L really need to show is that the insertion of the LLP means that the business no longer consists wholly or mainly of the business of making or holding of investments in land. That is in practice not something they will be able to do. ↩︎

Only in “exceptional” cases will a property rental business qualify for business relief. Taxpayers have failed to qualify for business relief even for an actively managed business of letting holiday cottages; in the words of the recent Grace Joyce Graham judgment, it is only “the exceptional letting business which falls on the non-investment side of the line”. In the Graham case, the deceased “lavished” personal care on guests, including making them home-made food, providing them with fresh crab and fish, arranging linen and towels, making cream teas, and organising weddings and other events. The Tribunal thought this was an “exceptional” case but that, even then, it only “just” qualified for business relief. ↩︎

Mr Sharif has indeed acted on major terrorism cases, although it’s perplexing that Tuckers’ website lists Mr Sharif as a “senior caseworker”. ↩︎

It is important to note that Mr Gimple cannot be blamed for the actions of Less Tax for Landlords after Spotlight 63 was published, given he retired from the business in 2020. He now runs a firm called “Chancery Law and Tax” which claims to be “one of the UK’s leading providers of Legal Services” but employs no solicitors, barristers or qualified tax advisers. ↩︎

i.e. because it’s probably in their clients’ interests to say that they were mis-sold a scheme which had no technical basis – they may then be able to avoid penalties, or even argue that the scheme should be disregarded. Less Tax for Landlords are obviously not going to run that argument. They’ve a clear incentive to claim that HMRC are wrong and their scheme works, and so keep the clients on their books (paying an annual retainer of around £1,800, which for over 500+ clients is a significant sum) and reduce the risk of negligence claims, or even time them out. ↩︎

The contents of these opinions are generally not publicly available. One exception is the Hyrax case – see in particular paragraph 80 of the judgment. Venables provided an opinion the structure wasn’t disclosable to HMRC under the DOTAS rules. The tribunal had no difficulty coming to the opposite conclusion. ↩︎

The 15% figure used by Property118 and others is, we believe, meant to suggest that the allocation to the corporate member reflects an arm’s length return on services provided, and is therefore disregarded under section 850C(15) ITTOIA 2005. But where the services are personally provided by an individual member of the LLP then s850C(17) disapplies subsection 15. You can’t, in fact, allocate even 1% to the corporate member in such circumstances. ↩︎

There is a question whether it is appropriate for a barrister to advise on the basis of assumptions that are unrealistic, particularly when the barrister knows his advice will be shown to unrepresented individuals. It’s possible of course that Venables did not know the original purpose of the structure; but then, what did he think it was for? ↩︎

Bailey also ignores the fact that incorporation relief requires shares to be issued, which an LLP patently can’t do. ↩︎

Under the doctrine of “collateral waiver”, sometimes described as the “cherry-picking rule”, a summary of the content of advice will generally waive privilege in all of the advice and instructions. See the PCP Capital Partners case. ↩︎

In reality almost all professional indemnity insurance includes an “aggregation clause” which means that the coverage from one error, or series of errors, would be £2m across all their clients. That’s a huge difference. ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply