In the last few months we may have given the impression that someone earning £50k, with three children under 18, faced a marginal tax rate of 68%. We may have suggested that this was a disincentive to work, contributed to a shortage of key workers and even held back economic growth. We may have used words like “indefensible” and “disgrace”.

We now realise that our analysis failed to take into account the uprating of child benefit, and in fact the marginal rate in this scenario will be 71%, not 68%. A graduate in this position repaying a student loan can face a marginal rate of 80%.

We also wrongly suggested that someone earning £50k and with six children under 18 faced a marginal rate of 90%. The correct marginal rate is 96%.

We can only apologise for what is an unacceptable error, and would like to make clear for the record that a marginal rate of 71%, 80% or 96% is absolutely fine, and the effect on the individuals involved and the economy as a whole is completely unimportant.

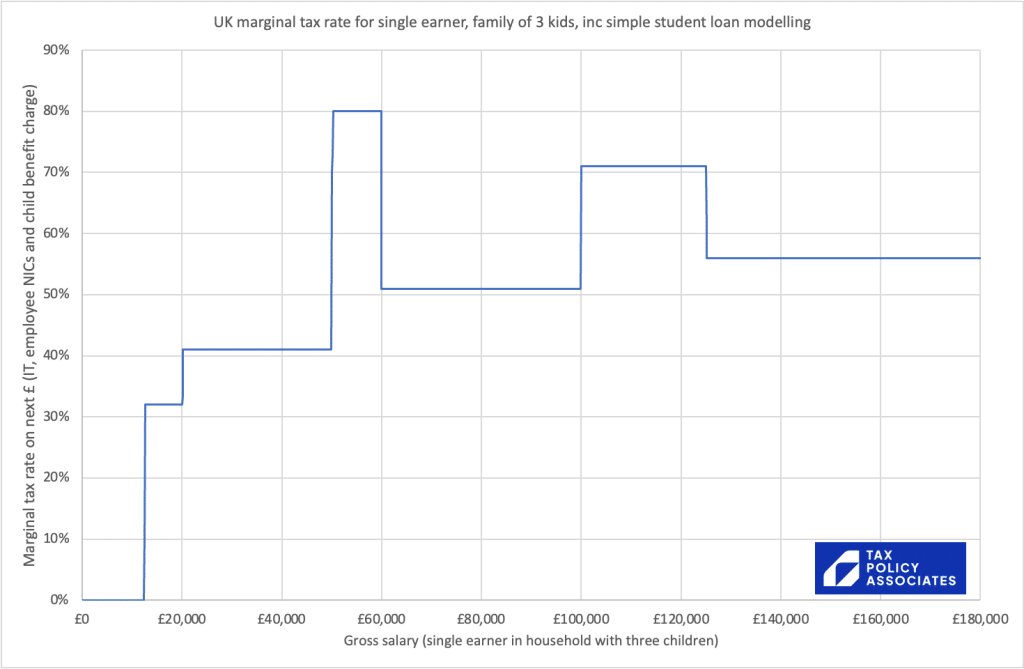

The corrected chart showing the child benefit withdrawal/CBHIC effect:

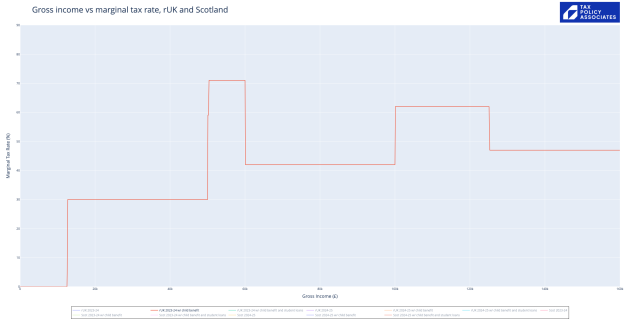

And including student loan repayments:

The spreadsheet model is available here. Note these figures are for the UK excluding Scotland. The Scottish rates are higher.

Leave a Reply to Dan Cancel reply