On 9 December 2009, Chancellor Alistair Darling unveiled a one-off 50% tax on bankers’ bonuses. New documents from the Epstein Files reveal that a serving cabinet minister privately advised JPMorgan on how to fight back. Peter Mandelson, then Business Secretary, counselled Jamie Dimon on how to threaten the Government into softening the tax. Those exchanges were channelled through Jeffrey Epstein.

We worked on this story with the Financial Times.

The lobbying

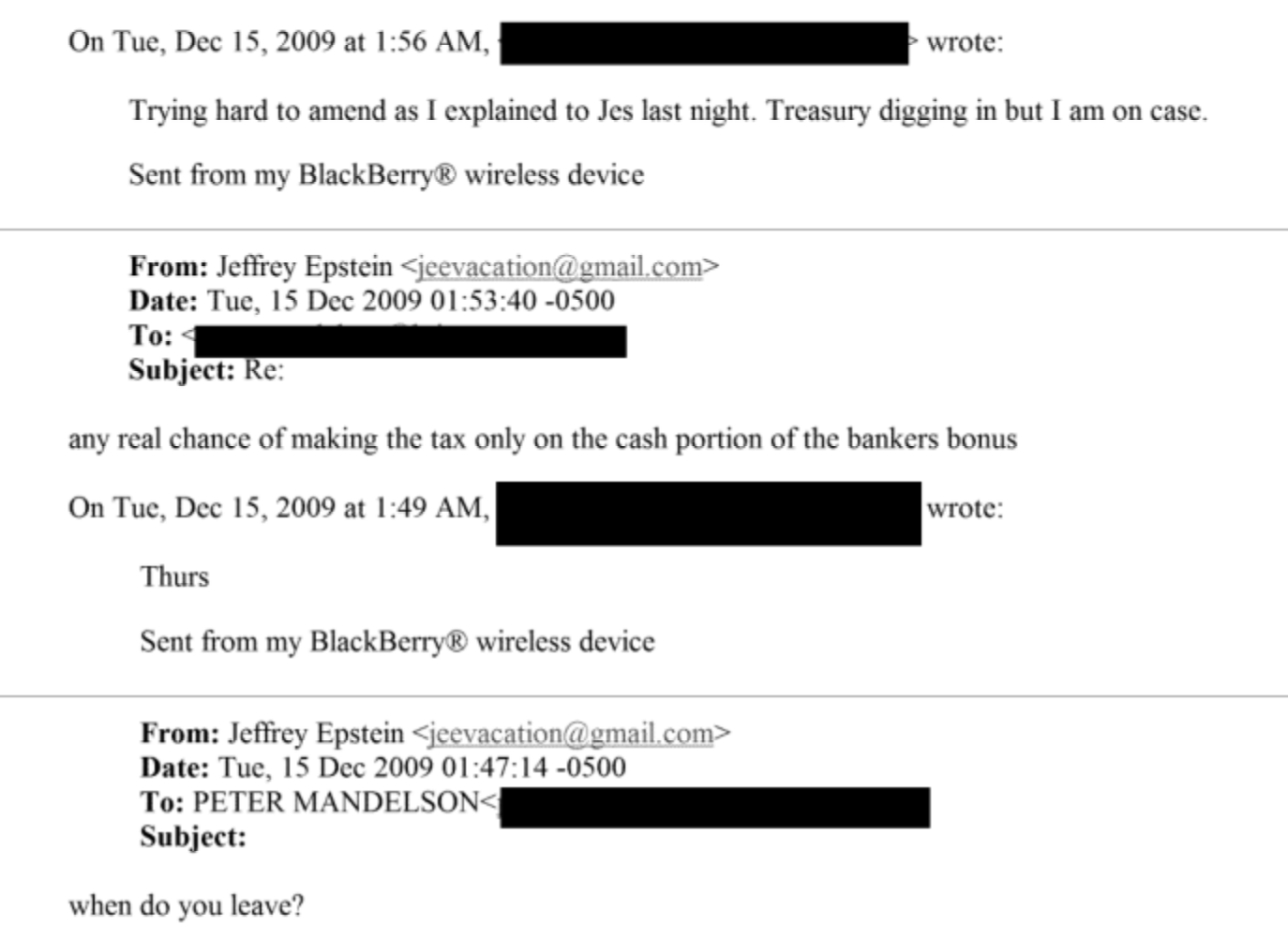

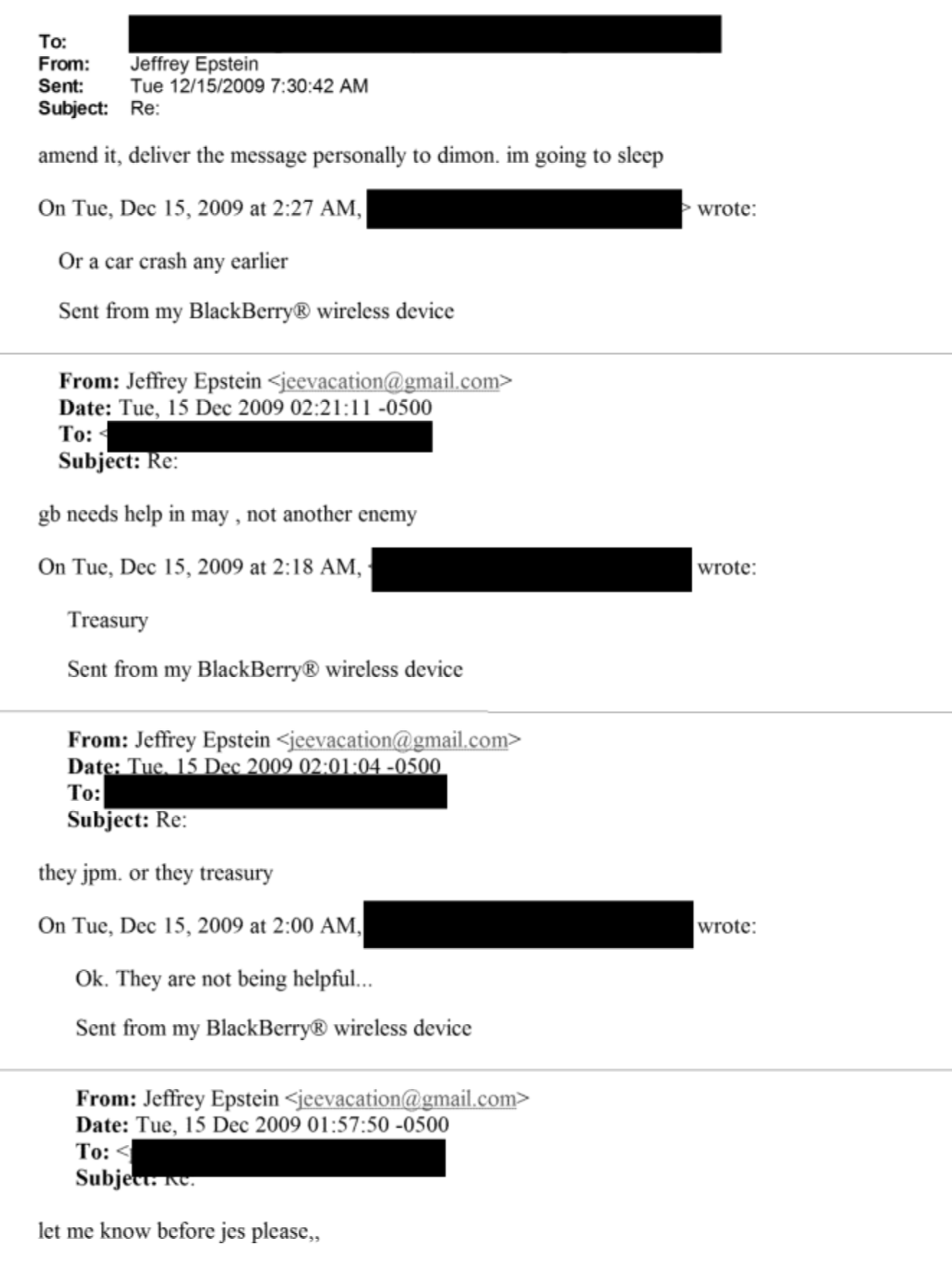

On 15 December, Mr Epstein asked Lord Mandelson if the bank payroll tax could be amended so it applied only to cash bonuses (not the, much more valuable, non-cash elements such as share options). Lord Mandelson replied that he’d explained to Jes Staley (then a senior JPM executive, with close links to Epstein) that he was trying hard to amend the tax. Mr Epstein said Lord Mandelson should let Epstein know of any result before Lord Mandelson spoke to Mr Staley:

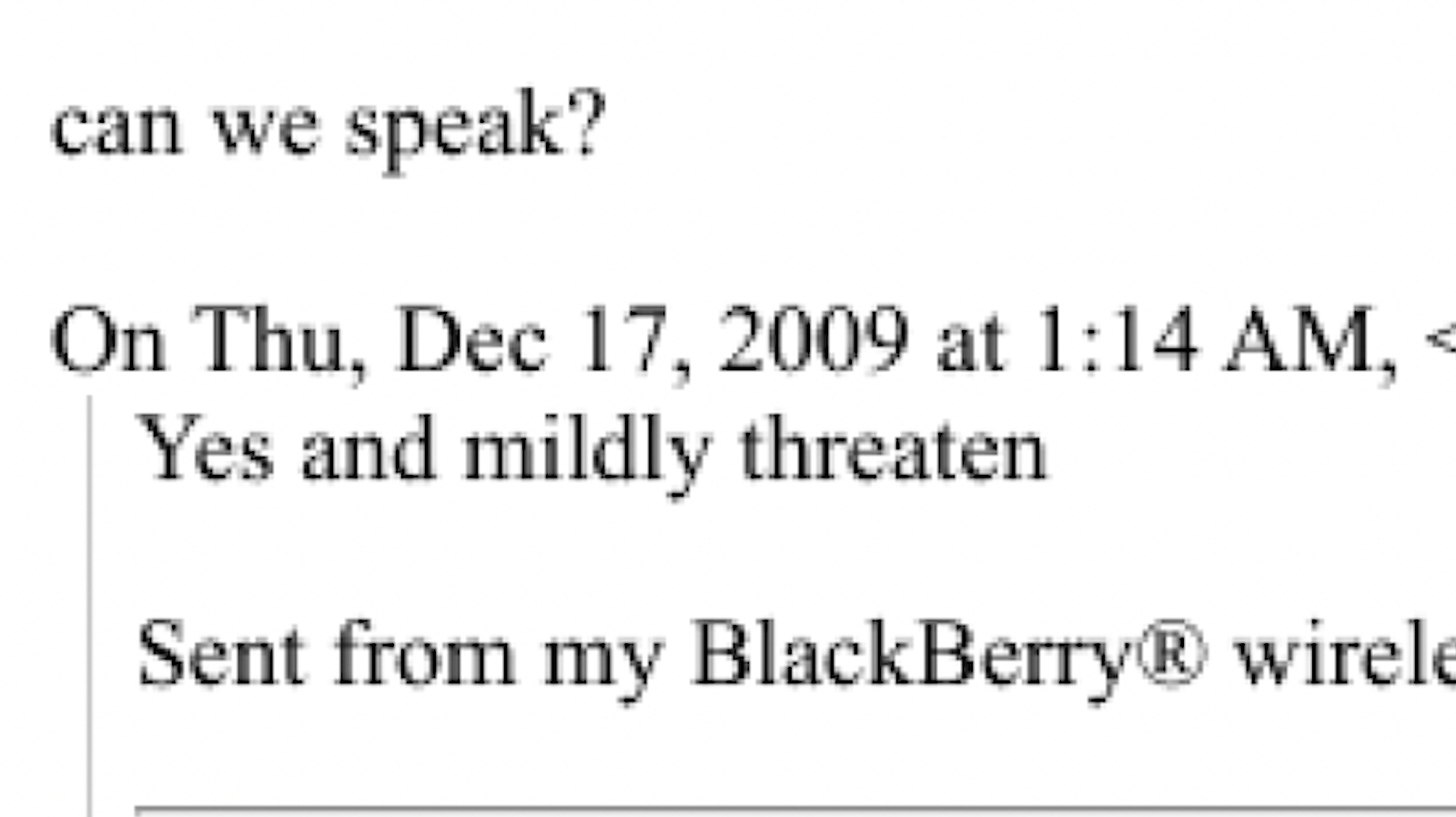

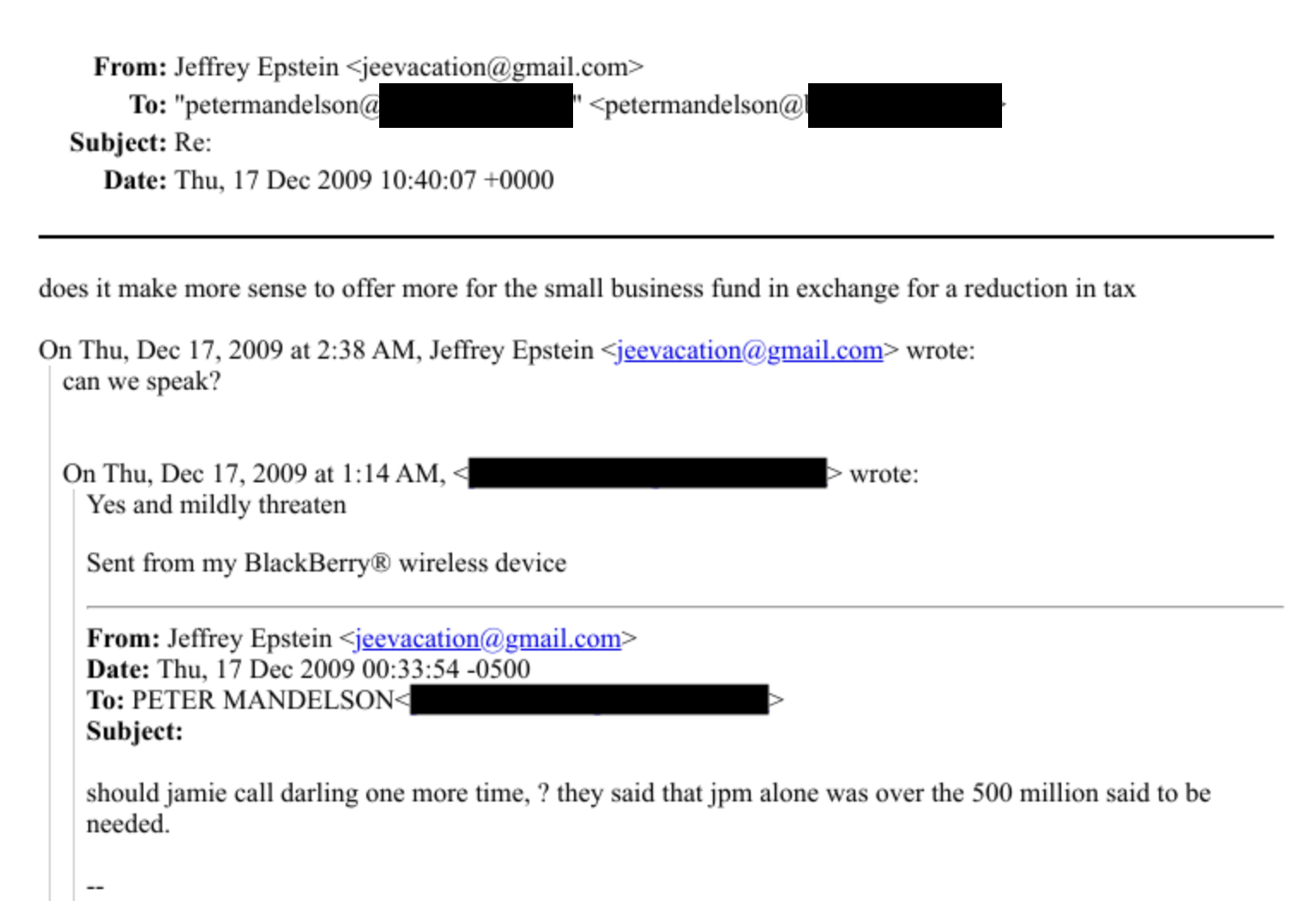

Then, on 17 December 2009, Mr Epstein asked Lord Mandelson if Jamie Dimon should call the Chancellor one more time.1 Lord Mandelson responded that Jamie Dimon should “mildly threaten” Alistair Darling (presumably threatening to pull business/personnel out of the UK):

Mr Epstein suggested instead offering more for the small business fund – a bank-sponsored fund for small companies.

That may be linked to this reported call, of around the same time, from Mr Dimon to the Chancellor, which does appear to have involved a “mild threat” to significantly scale down its plans to build a new headquarters in the UK.

However, the Government did not back down.

After the election

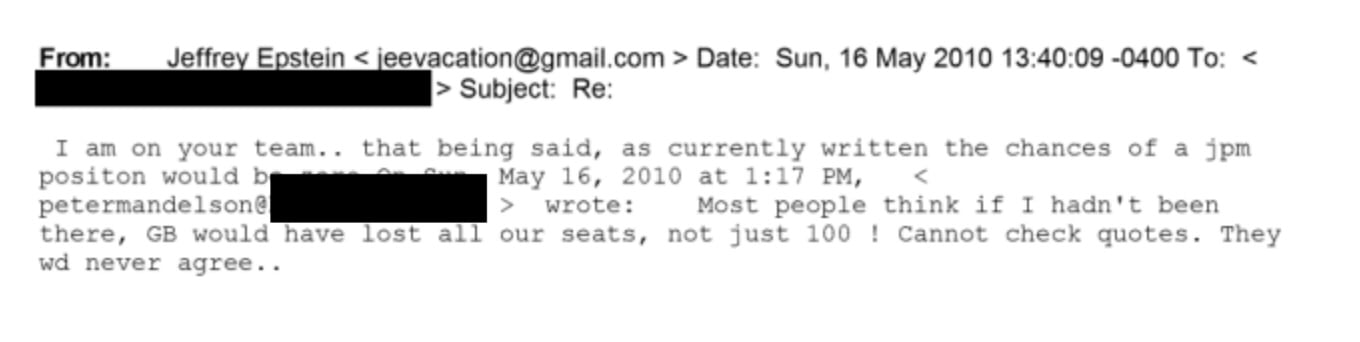

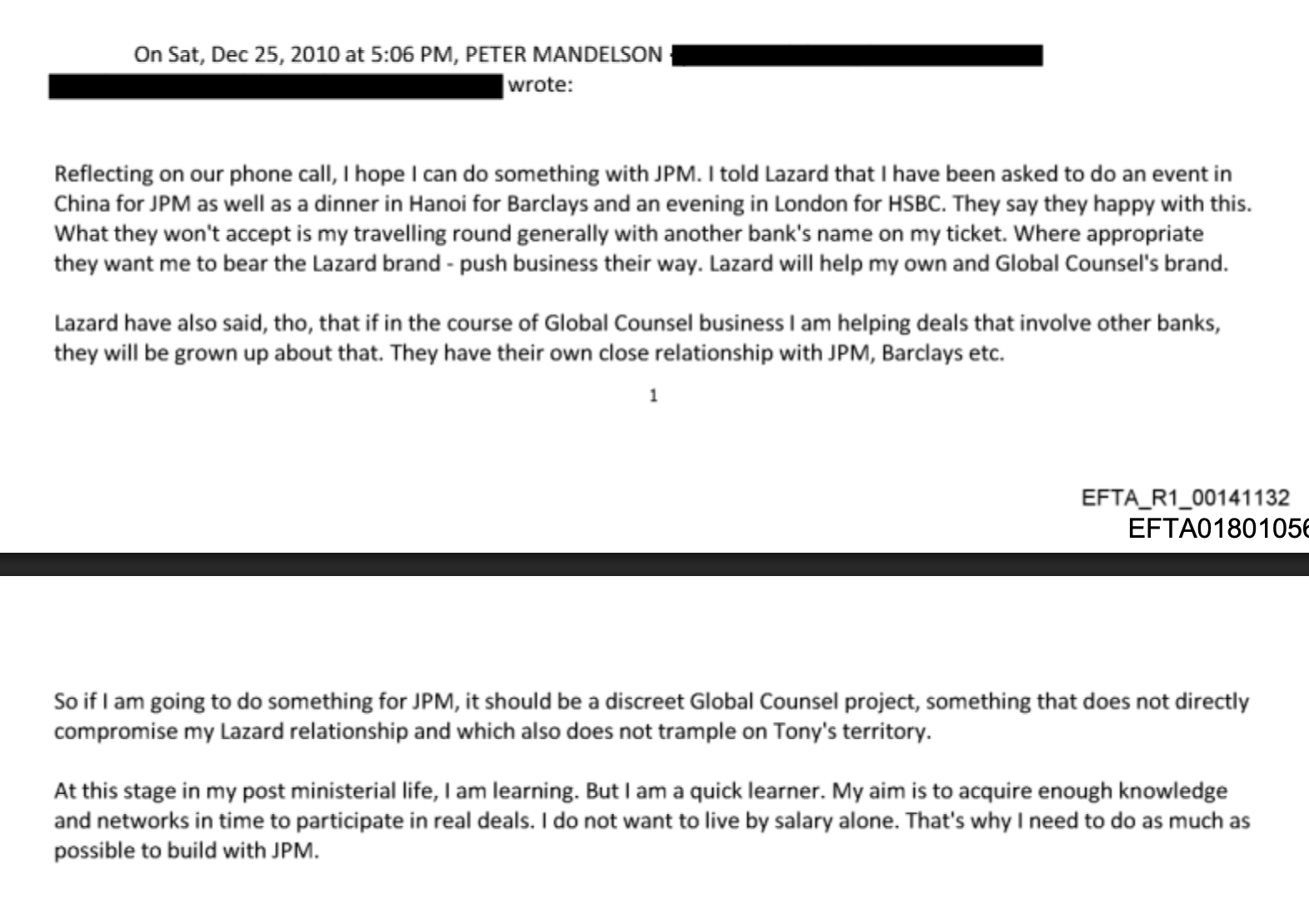

After Labour lost power in 2010, Lord Mandelson founded lobbying/consultancy firm Global Counsel. Subsequent email exchanges with Mr Epstein (and a phone call on Christmas Day) appear to show Lord Mandelson positioning for work and perhaps even a position with JPM (with Mr Epstein playing down his chances):

Lord Mandelson said: “My aim is to acquire enough knowledge and networks in time to participate in real deals. I do not want to live by salary alone. That’s why I need to do as much as possible to build with JPM”.

Lord Mandelson’s response

Lord Mandelson told the FT:

Every UK and international bank was making the same argument about the impact on UK financial services. My conversations in government at the time reflected the views of the sector as a whole not a single individual.

This doesn’t explain Lord Mandelson’s actions. It’s quite extraordinary for a serving Government minister to advise a foreign bank to threaten the Chancellor in order to reduce its UK tax bill.

Thanks to K for research, and many thanks to Jim Pickard at the Financial Times.

Footnotes

Mr Dimon’s reported comment that JPM’s bill would be over the total revenue the tax was expected to raise reveals the problem with the tax. The intention was to reduce bonuses as well as raise money – £550m was the projected figure. That kind of dual purpose is often problematic – the need for revenue ends up undermining the quasi-regulatory purpose. So whilst the Government expected it would incentivise banks to reduce bonuses, JPM’s response illustrates what actually happened: competitive pressure (from banks in other countries, and non-banks in the UK) meant that bonuses did not reduce much at all. The tax therefore raised significantly more than anticipated – £2.3bn. Our view is that this was a badly designed tax – its short timescale was distortive and unfair, and it failed to achieve its stated policy aims. A financial activities tax would have been more rational and, probably, more effective. ↩︎

Leave a Reply to Dan Neidle Cancel reply