Here’s our summary of the Budget and a quick take on what the various measures are likely to mean.

(The first draft of this article appeared unusually early, thanks to the OBR accidentally publishing their assessment of the Budget about half an hour before the Chancellor started her speech.)

Key elements

It’s all about fiscal creep:

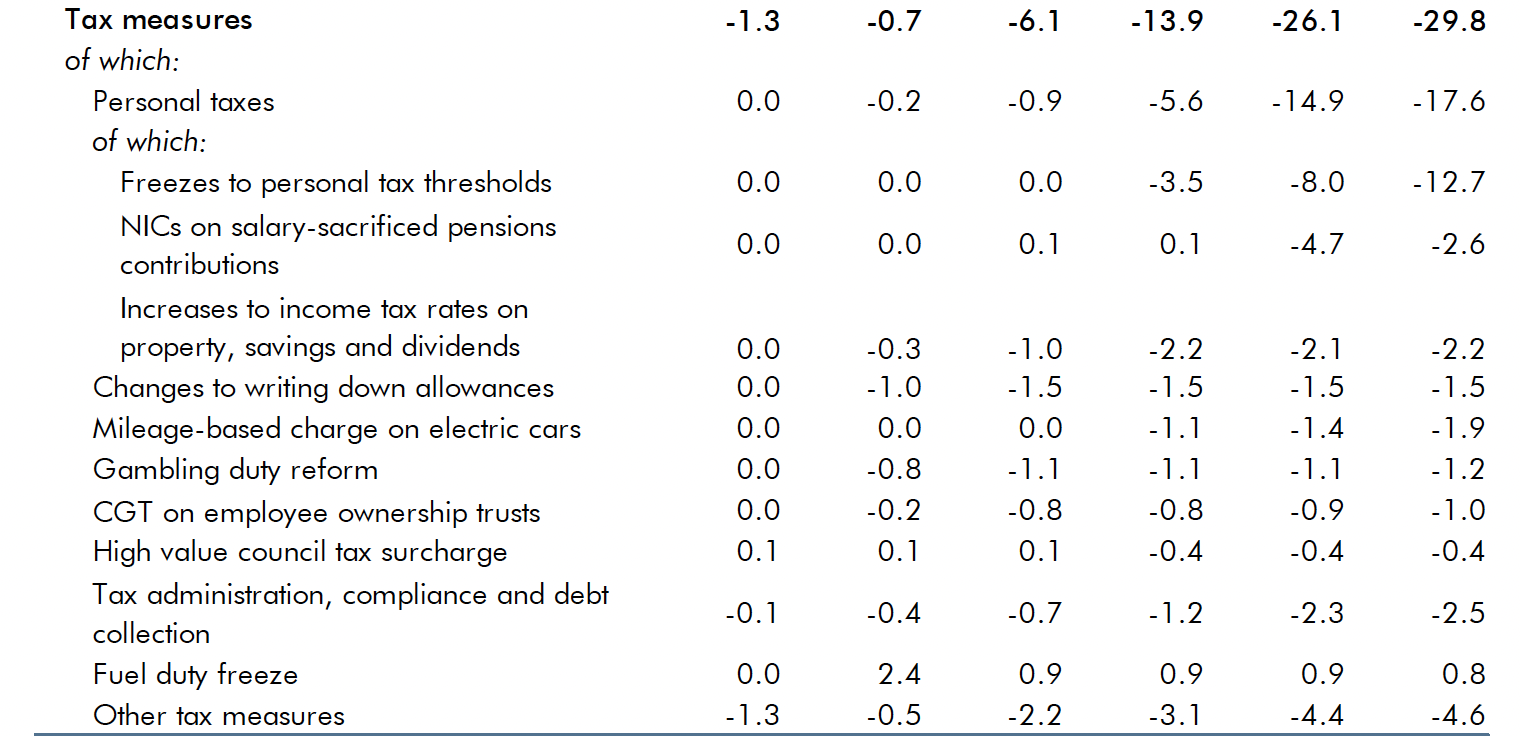

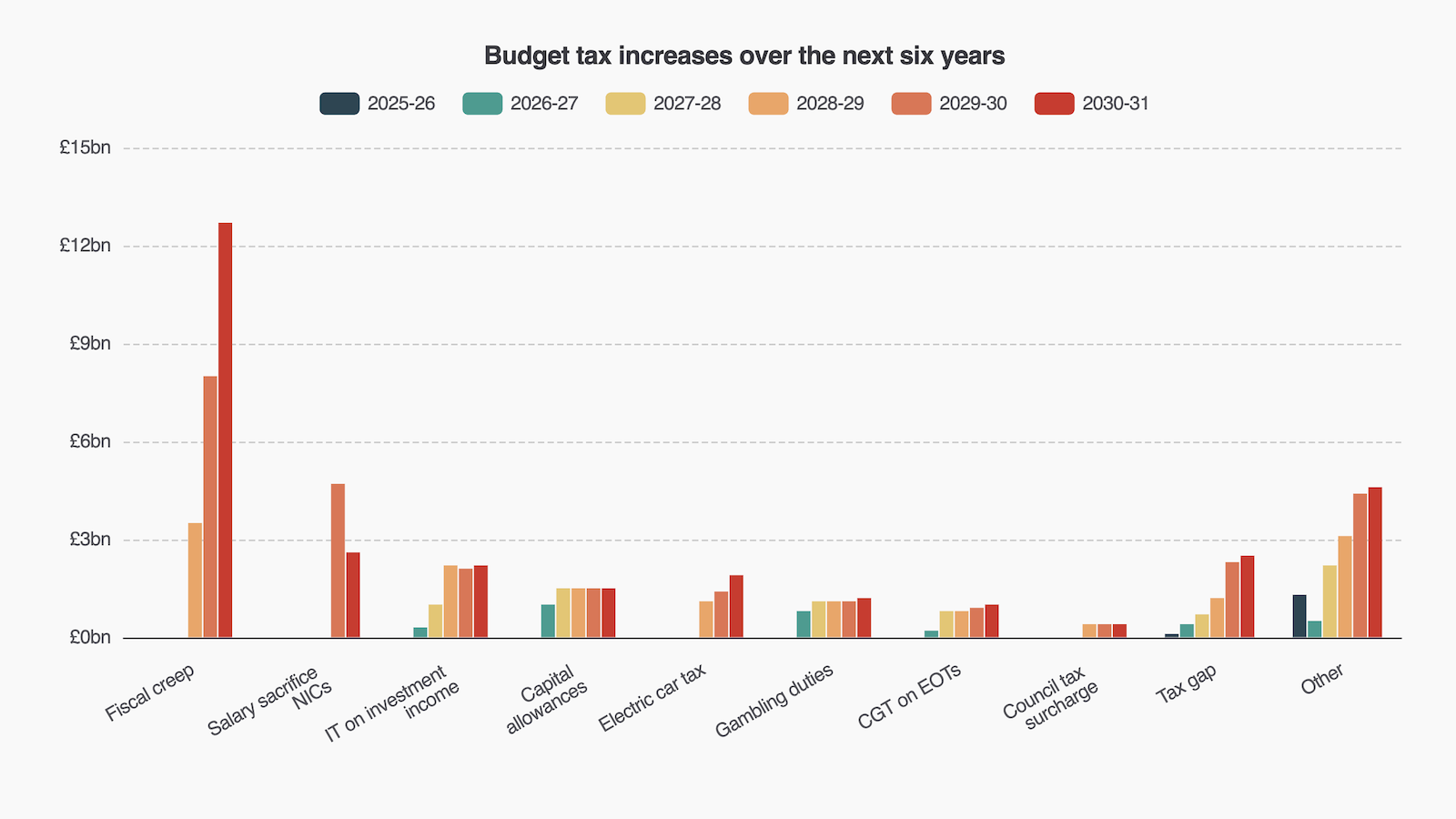

The overall impact is one of the largest medium-term tax rises in recent years – £30 billion a year by 2030/31:

Three measures do most of the work.

First, that “fiscal creep”. Since 2018, successive Chancellors have let tax thresholds become eroded by inflation. The IFS said in 2023 that this was the largest single tax-raising measure since 1979, but after two years’ of further creeping, the OBR’s latest estimate is that fiscal creep will raise £32bn in 2026/27 and £39bn in 2029/30. This is likely the largest overall tax increase from a single policy in the post-war period.1

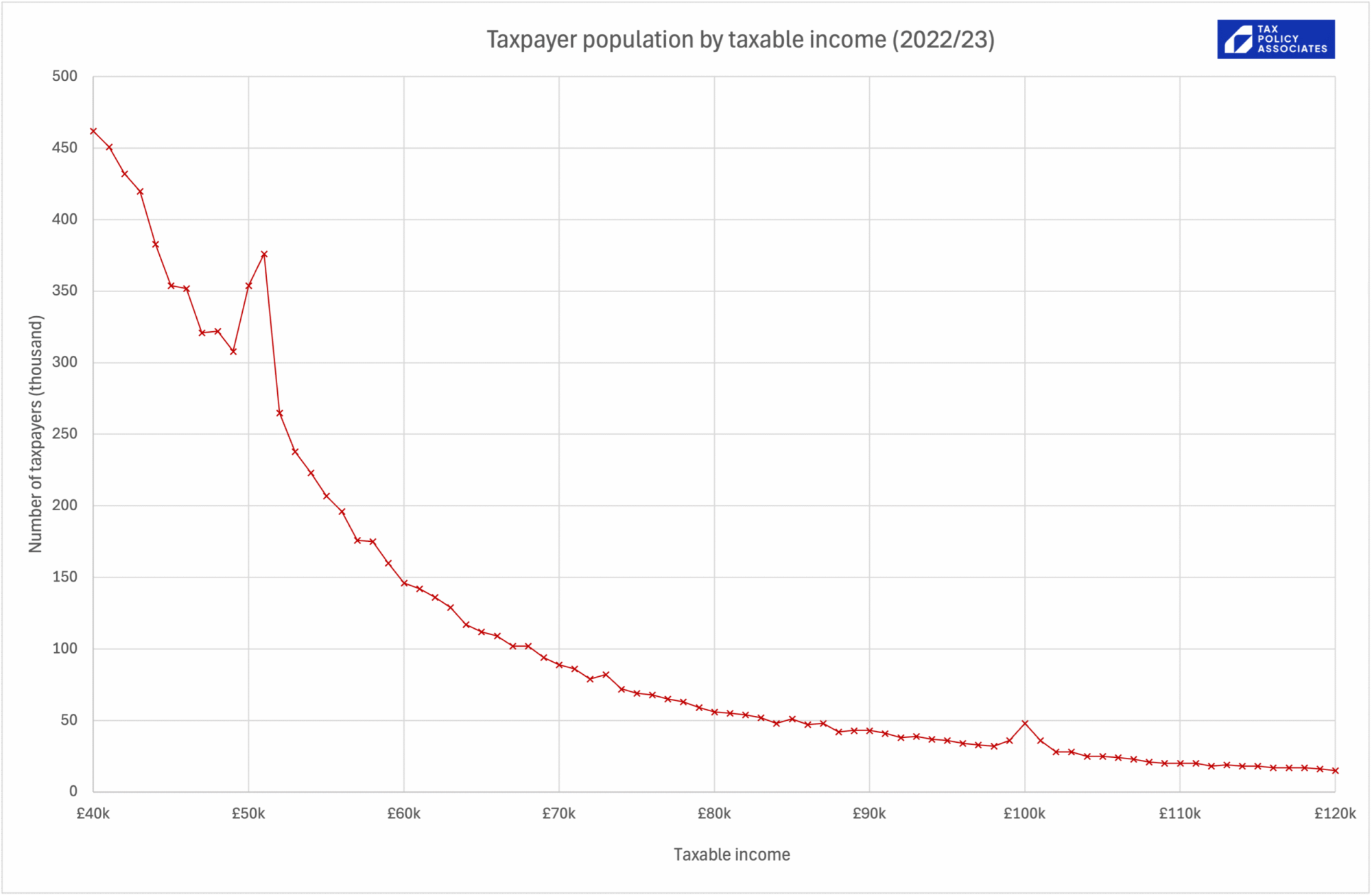

This means median earners have been paying a bit more tax (but less than before the personal allowance was cut in 2011), and many more people have become higher rate taxpayers (paying quite a bit more tax):

Second, salary sacrifice is being capped to £2,000. We may see this exacerbate the “bumps” in the income distribution, where people can currently use salary sacrifice to stay under thresholds that result in high marginal rates:

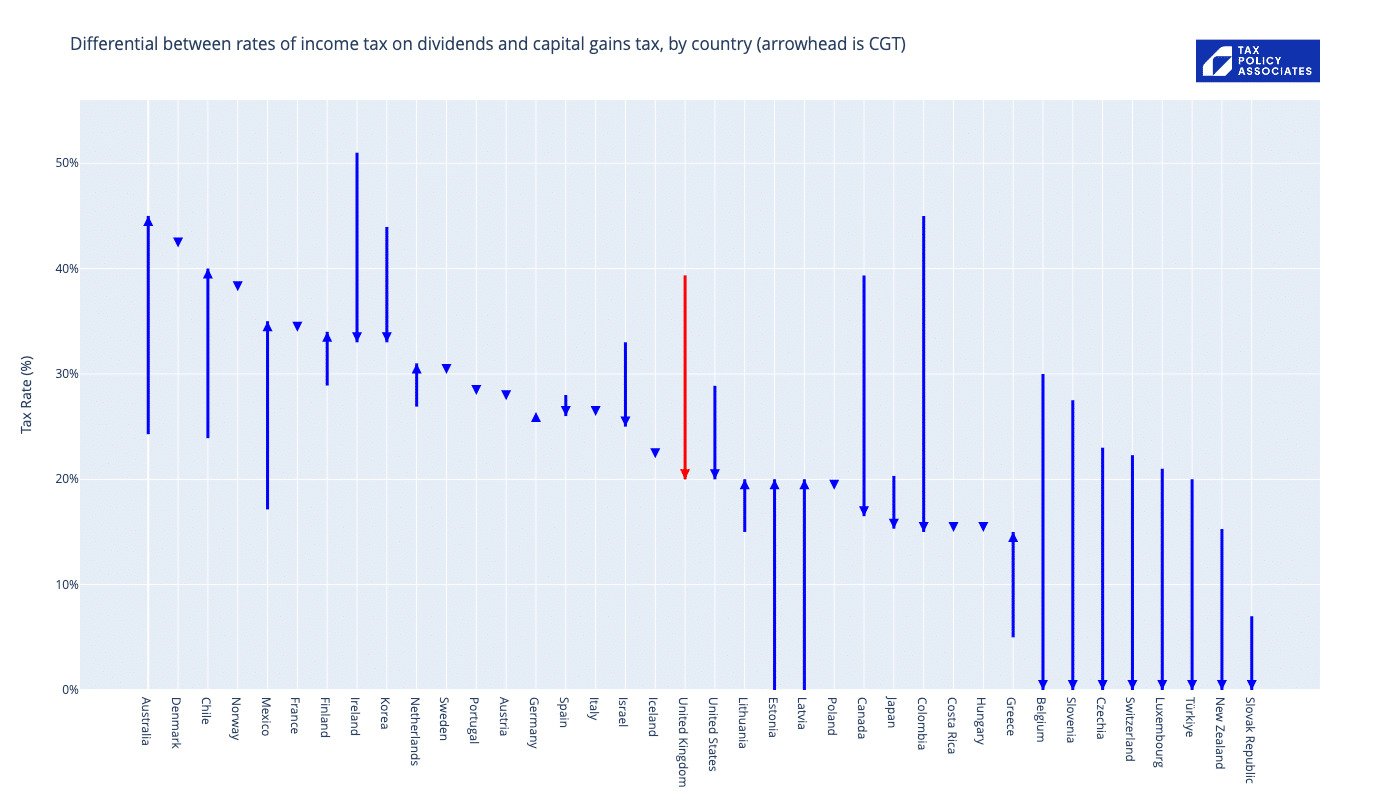

Third, a slight surprise: an increase in income tax on investment income – property, savings and dividends. The political attraction is obvious, and the Chancellor sensibly didn’t put up the top (additional) rate of dividend tax. That’s probably because UK dividend tax is already one of highest in the world. Look at the top of the arrow tails on this chart:

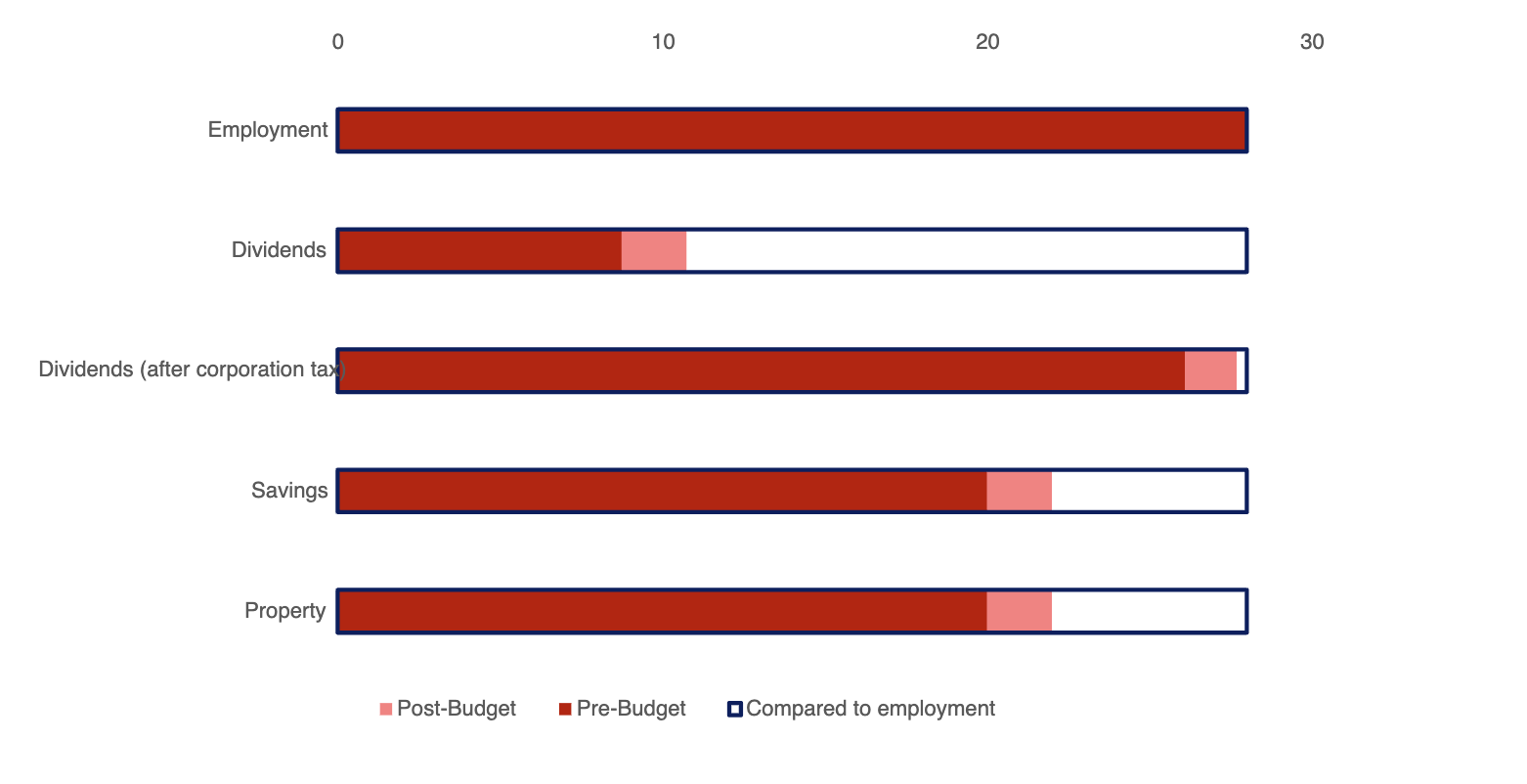

There’s a nice infographic in the Budget documents showing how the different rates of basic rate income tax now look:

Basic rate dividend tax is therefore (taking corporation tax into account) no at the “right” rate – and additional rate dividend tax already was.

All these measures are back-loaded:

Fourth, a significant HMRC compliance package, which the OBR seems to accept will materially reduce the tax gap:

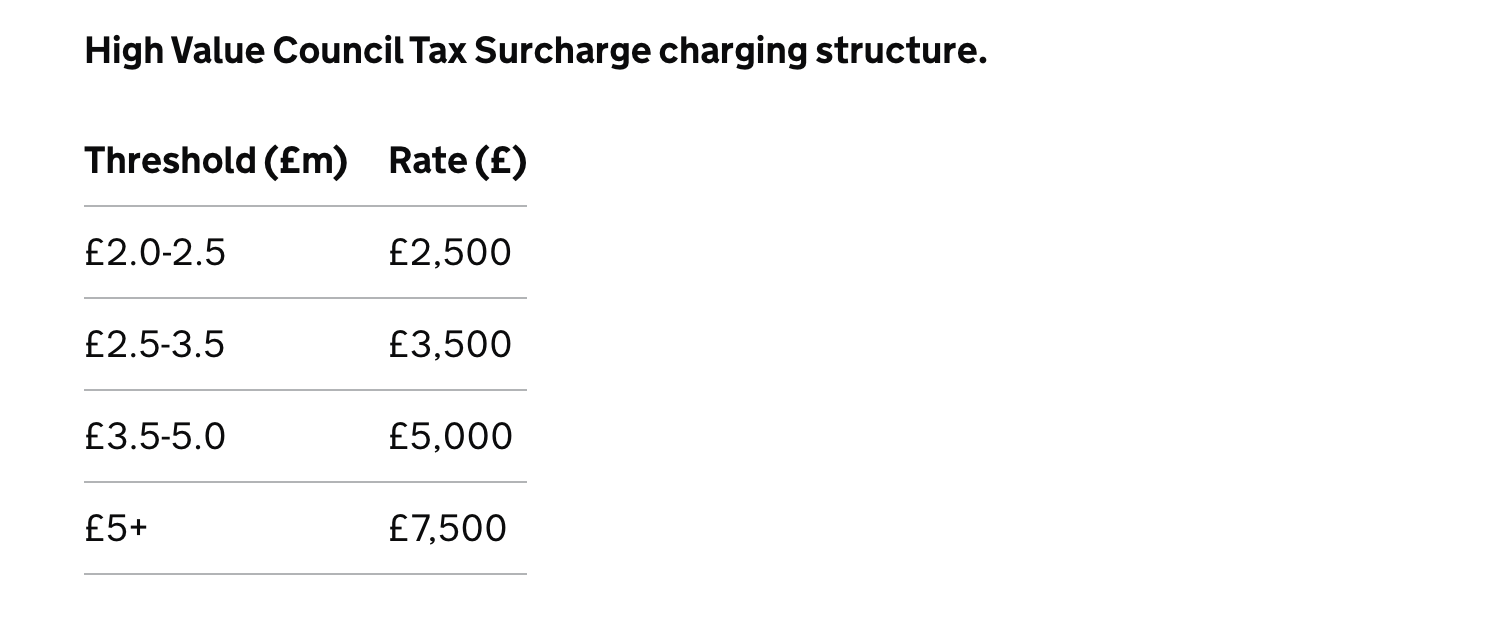

Fifth, a council tax surcharge:

My immediate reaction is that it’s fair that expensive houses pay more council tax. The current system is inequitable – a tax that looks like this can’t be defended:

It would have been much better to revalue council tax and add more bands. Given that is seen as politically too hard, the Government instead created a new tax working off a fresh valuation basis:

The oddity is the limited number of bands. That probably makes valuation easier, but means there is a sharp discontinuity at the boundaries (and so lots of appeals around the £2m point) and that £100m properties don’t pay more than £5m properties. So the curve created by the new tax is an improvement, but still looks a bit odd:

Economists usually assume that an annual property tax is “capitalised” into prices – buyers factor in the future stream of payments. On that basis, a £7,500 annual charge cuts the value of a £5m property by perhaps £200k to £300k, i.e. 4-6%. However that’s if people are rational calculating machines – obviously they are not. Stamp duty on a £2m property is £150k; on a £5m property it’s £500k. These ridiculous numbers are why stamp duty should be abolished and replaced with an annual property tax. But their sheer size means buyers may not regard the prospect of £2,500 to £7,500 annual taxes with enormous trepidation.

The tax will apply from April 2028. It will be collected by local authorities (together with council tax), with the revenue going to central Government, and central Government compensating local authorities for the admin cost.

The tax doesn’t raise much – £400m. That was the correct decision. A “proper” percentage mansion tax would have had a much more serious impact on the property market. It would also have been unfair to people who happen to own property today, as they would have taken the hit (with the economic effect rather like one-off tax on property wealth). We absolutely should have a proper percentage-based property tax, but that has to be part of wholesale reform, meaning abolishing stamp duty. Having both would be inequitable, and do damage to an already very troubled property market.

Sixth, what is I think a sensible introduction of a mileage tax for electric cars:

There’s a consultation document – the tax will be a new kind of tax for the UK, and that always takes time to design and build. Perhaps sugaring the pill, a consultation on allowing EV charging to be installed across pavements (safely) without planning permission.

Seventh, a reduction in capital gains tax relief for disposals to employee ownership trusts. This was a measure intended to encourage employee ownership. It has been abused in some quarters – and costs much more than originally anticipated.

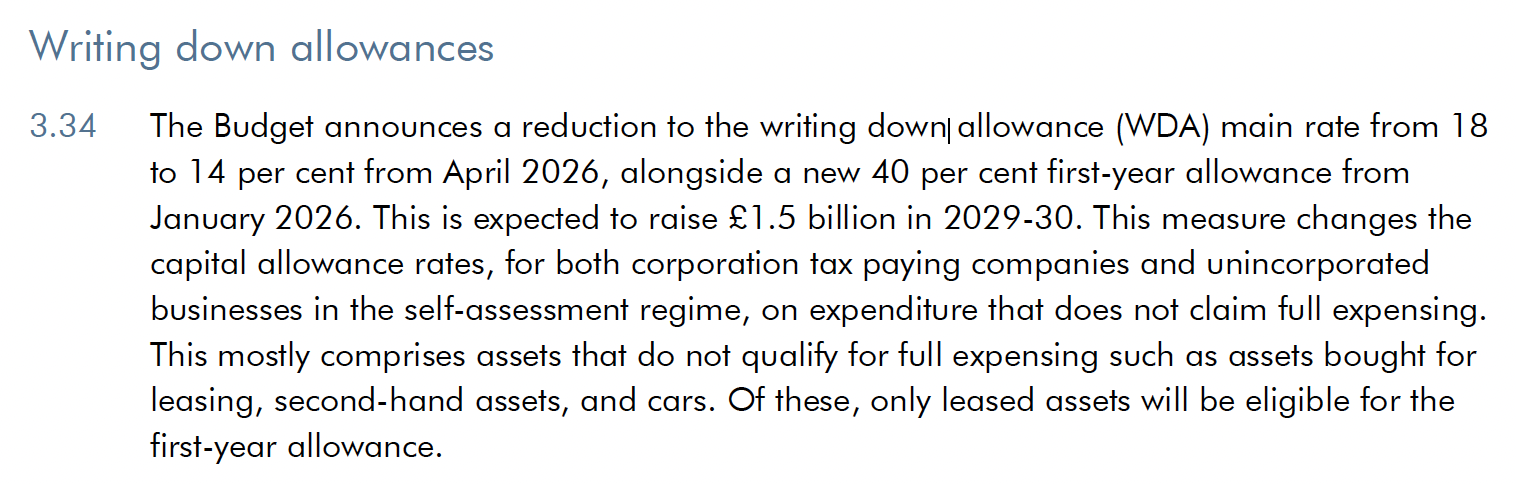

Eighth, a reduction in writing-down allowances, which allow businesses to claim tax relief when they buy capital items. There’s “full expensing” (immediate complete tax deduction) for plant and machinery, but some items don’t qualify, and must be written off over time (perhaps the most important example is second-hand/used plant and machinery). This change slows down the rate. It will therefore (at the margin) reduce investment in such items.

The final big item is, as widely expected, an increase in gambling tax:

Then some smaller measures:

- Closing the loophole that meant that some taxi firms (think: Uber) paid a lot less VAT than they should. This will be portrayed as a “taxi tax” but it’s really just fairness and common-sense – all taxies should have the same VAT rules.

- As expected, closing “low value consignment relief”, which exempts imports of £135 or less from customs duties. The intention was always to avoid disproportionate duty and administration charges. The problem is that the relief has essentially been weaponised by the likes of Shein, making UK retailers uncompetitive.

- The expected expansion of the higher air passenger duty for private jets, to include large private jets as well as smaller ones.

- The Energy Profits Levy (or “windfall tax”) to remain in place until at least March 2030. I expect it will in reality become a permanent feature of the tax system.

- A consultation on letting elected mayors introduce tourist taxes. The question is how much they will adversely impact the already-under-pressure hospitality sector. Will be writing more about that soon. The (obvious) lesson of the council tax second home surcharge is that local authorities are so strapped for cash that they will maximise any opportunity they have to make additional revenue, regardless of the merits of the tax.

- Changes to the sugar levy, intended to reduce the amount of sugar in drinks – it’s not immediately clear if this will raise additional revenue.

The overall result: by the end of the decade, the UK tax take hits 38% of GDP – the OBR says that is an “all time high”.

Tax cuts

There were a few:

- A temporary three year holiday from SDRT/stamp duty on shares for new listed companie. No details yet. It’s good to see focus on this – stamp duty is a damaging tax, and higher than the similar taxes imposed by comparable countries. But I’m sceptical it will be effective. Investors and companies look further out than a few years.

- As announced in last year’s Budget, a reduction in business rates for retail, hospitality and leisure businesss, paid for by an increase in business rates for businesses with larger properties (including, but not limited to, the warehouses used by the likes of Amazon).

The Budgets we were never going to see

Quite a lot of complaints are from people expecting Budgets we were never realistically going to see. Three types in particular:

A Budget that cuts spending.

The Spending Review was in June and it seems unlikely any of those decisions will be re-opened. The attempt to find £5bn of welfare savings was a failure, with Labour MPs and much of the public opposed. Whilst many politicians are in favour of generic spending cuts and “efficiency savings”, it’s much rarer to find anyone active in politics (as opposed to think tanks) committed to a specific programme to constrain or even shrink the size of the state.

A Budget that raises income tax

The kind of Budget I and other tax wonks and economists would prefer: where any immediate “black hole” and need for fiscal headroom was resolved with transparent increase in income tax. Every economist I’ve spoken to, Left or Right, believes this would be the least damaging tax increase.

But it is also one of the least popular.

So it’s hardly a surprise that’s not what we saw.

A Budget that introduces totemic taxes on the wealthy

The “wealth tax” (meaning a percentage tax on assets of the wealthy) is very popular, particularly in a three-second conversation. When, however, there is a need for revenue to finance current spending, a tax that will likely raise nothing before 2029 is not an attractive option (quite aside from the many serious practical and technical problems with the tax).

We will not see a wealth tax under this or probably any other conceivable government.

Thanks to Beth Rigby at Sky News.

Leave a Reply to Graeme Cancel reply