ITV News has just broadcast an investigation: gambling company Sky Bet has migrated its business to Malta to avoid around £55m of tax each year. We provided technical support for the investigation, and this report goes into further detail of what precisely Sky Bet has done.

Sky Bet provides a vague explanation of why they moved to Malta (“a number of strategic and commercial reasons”), but this is untrue: they moved to Malta to avoid UK tax. This report sets out the details of what Sky Bet is doing, how much tax it will save, and whether (and how) HMRC should be trying to stop it. And we propose a way to reform gambling taxation so that businesses like Sky Bet no longer have an incentive to move offshore, and those that have moved offshore could have an incentive to return.

Sky Bet

Sky Bet is a gaming company. It was part of Sky plc (the media group) but since 2018 has been owned by Flutter Entertainment, an Irish company that’s probably the world’s largest internet gambling business.1 The rights to the Sky Bet sporting business used to be held by a UK company, Hestview Limited.2

Looking at Hestview’s 2024 accounts, the company’s tax position looked broadly like this:

- Sky Bet paid general betting duty on its “net stake receipts” (broadly speaking, receipts from gamblers minus payouts). The rate is 15% (fixed odds/totalisator) and 10% for spread bets. Let’s assume (for the sake of this example) the average for Sky Bet is 13%. So on Sky Bet’s £580m3 of net stake receipts it paid £75m.

- After other expenses, Sky Bet’s profit was £156m, on which it paid corporation tax at 25% – £39m

- Hestview also had a £132m marketing budget – this will include advertising and sponsorship (including its £15m/year sponsorship of the English Football League). The advertisers and sponsors would charge Sky Bet UK VAT at 20% – costing Sky Bet £22m in VAT.4

So Sky Bet’s total tax bill is about £136m (ignoring employee tax and second/third order effects).

Sky Bet’s owner, Flutter, at some point decided it wanted to reduce its tax bill – and this is why Hestview’s 2024 accounts say they decided to move to Malta:

But it looks like there was a last-minute change of mind.5 Instead of setting up a Maltese company, Sky Bet set up a UK company, SBG Sports Limited6, with a Maltese branch (this is clear from documents filed with the Maltese company registry).7

It’s not just a brass plate on an office building, but an actual headquarters, with its senior staff all physically now based in Malta.89

- SBG Sports Limited would need a licence from the Gambling Commission. It obtained one in October. It’s unclear if the Gambling Commission knew SBG Sports Limited would actually have most of its operations in Malta.

- The c£75m of general betting duty still applies – since 2014, betting duty has applied on all betting by UK customers, regardless of where the supplier is.

- SBG Sports Limited is subject to UK corporation tax on its profits, but can elect to be exempt from tax on the profits of its Maltese branch. Those Maltese profits would then be subject to Maltese corporate income tax, not UK tax. Malta has a 35% corporate tax rate – so it looks like they’d pay more than in the UK. The reality is very different.10 For international companies the rate isn’t really 35% at all – if the profit is paid as a dividend to a holding company shareholder, it receives a refund of 30%.11 The actual rate is 5%. That means instead of paying £39m of corporation tax, Sky Bet would be paying £8m.12 The “flexibility” of Maltese tax rules mean in practice they could pay much less.13

- UK advertisers and sponsored businesses no longer add UK VAT to their invoices to SBG Sports Ltd in Malta. Instead, SBG Sports will “reverse charge” Maltese VAT (because VAT in this case applies in the location of the purchaser, Sky Bet). SBG won’t be able to recover that VAT. The rate is 18% – so (assuming the marketing budget is still £132m), VAT costs Sky Bet £24m.

On the face of it, the total tax bill is now £107m. The relocation to Malta has saved at least £29m of tax.

That may, however, be just the start. Sources in the gaming industry tell us some people are going further and avoiding the VAT bill as well – and it’s being promoted by Maltese advisers.

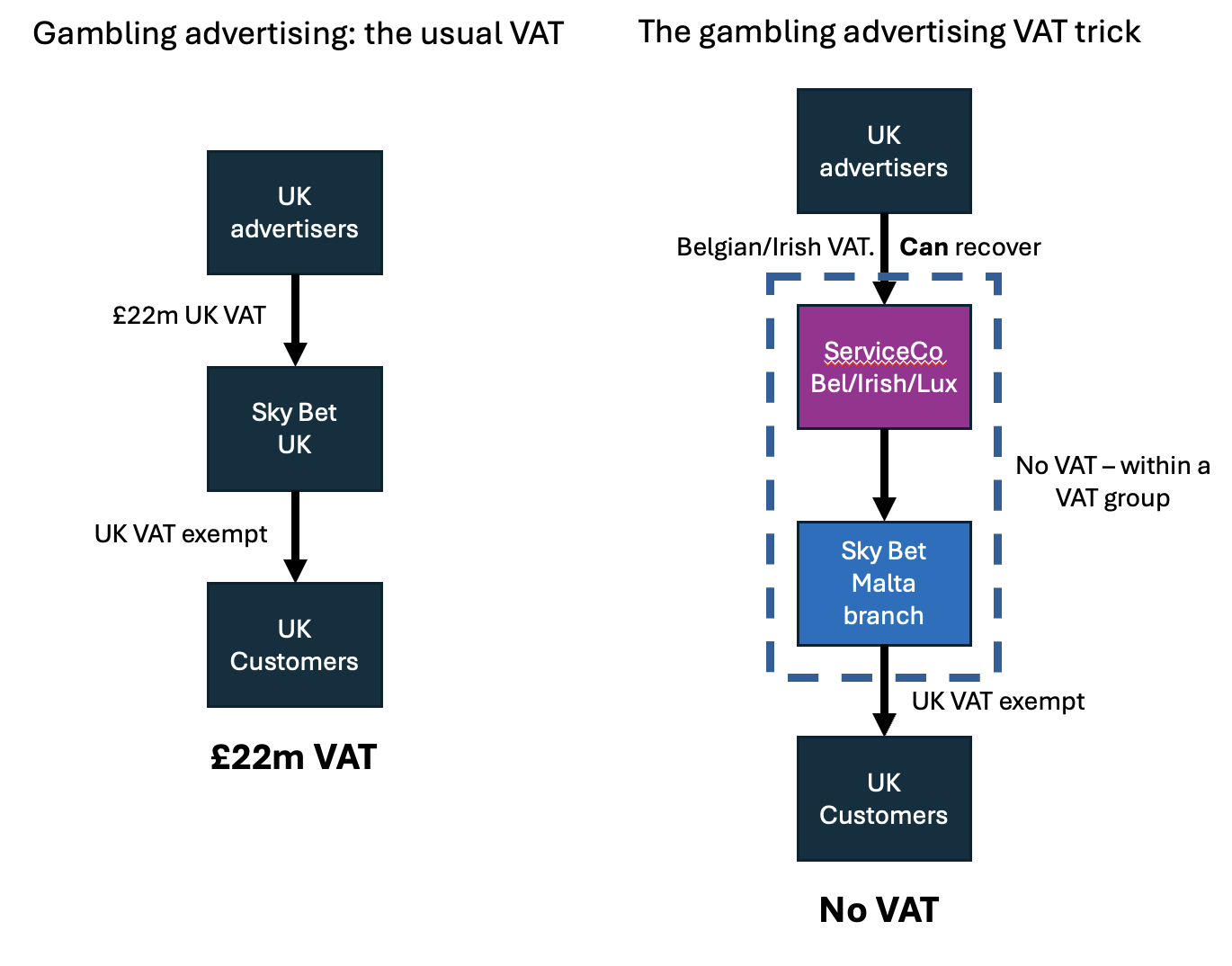

Our hypothesis is that Sky Bet is doing something like this:

- Instead of SBG Sports Limited buying the advertising/sponsorship, it set up a new company (“ServiceCo”), perhaps in Belgium, Luxembourg or Ireland.

- ServiceCo says its business is managing Sky Bet’s advertising. So it registers for VAT in Belgium/Luxembourg/Ireland.14 There are actual people there, and they really do manage the advertising. SBG Sports Limited pays ServiceCo a commercial fee for doing this.

- ServiceCo buys advertising and sponsorship – in theory there’s Belgium/Luxembourg/Irish VAT on this. But, because ServiceCo claims to be an advertising business, it can recover this VAT. ServiceCo therefore has no VAT cost.

- ServiceCo then supplies the advertising on to SBG Sports Limited’s Malta branch. There are various ways to do this without triggering additional VAT – most likely ServiceCo sets up a branch15 in Malta which joins a VAT group with SBG Sports Limited’s Maltese branch. Thanks to a very handy legal interpretation by the Maltese authorities, the whole of ServiceCo (the branch and Belgian/Luxembourg/Ireland HQ) and the whole of SBG Sports Limited (the UK headquarters and the Maltese branch) become part of the VAT group.16 This means the advertising/sponsorship bought by ServiceCo is now on-sold by ServiceCo to SBG Sports Limited as an “intra-group supply”, and completely outside VAT.

The structure looks something like this:

We asked Sky Bet specifically to confirm or deny that it was taking steps to eliminate its VAT charge; we received a generic statement which declined to comment on the specifics. It’s therefore our working assumption that Sky Bet is avoiding that £24m of Maltese VAT. On that basis, the relocation is now saving £55m or more of tax every year.

Our team of experienced advisers would not have advised a client to adopt this structure; it is aggressive and likely susceptible to both HMRC challenge and/or change of law. The following sections consider how such challenges and changes could be made.

What can HMRC do to recover the corporate tax?

The starting point is that, under current law, if a business genuinely relocates to another country then it no longer pays UK tax on its profits.17

There are, however, important points of detail that we would expect HMRC to consider:

- Usually if a business moves from a UK company to a foreign company there will be an immediate capital gains tax charge based on the increase in value of the business and its assets. Hestview Limited was in business for many years so we’d generally expect there to be a large “latent” capital gain. Probably for this reason, the snippet from the accounts above says that an IP licence was granted (as opposed to a sale of the business/IP). So what we expect is happening is that Hestview Limited is retaining ownership of the intellectual property that drives the business, but licensing it to SBG Sports Limited.18 That would be in exchange for a licence fee which would be subject to UK tax. The UK’s “transfer pricing” rules require that such a fee is on arm’s length terms – we expect HMRC would seek to argue that the licence fee should be a very significant percentage of SBG Sports’ foreign profits. That, however, would undo the corporation tax saving – so likely either SBG Sports has some more sophisticated structuring in place19, or will run arguments to minimise the licence fee.20

- We understand that the senior staff of Hestview really have moved to Malta. However a large number of other employees remain in the UK. We would expect HMRC to consider whether an adequate amount of profit is being allocated to the UK business.21

- It’s not uncommon for structures to be carefully designed on paper, but then the actual implementation to fall short. So, for example, if SBG Sports’ key decision-makers decide they are bored in Malta, and spend more and more time in the UK, then it may be that more of SBG Sports Ltd’s profits become attributed to the UK.22

Which is a long way of saying that a genuine relocation to Malta which still pays arm’s length (and probably very high) IP royalties to Hestview in the UK will be hard for HMRC to challenge – but such a structure would also present only limited tax savings for Sky Bet. A structure which aggressively tries to minimise the royalties paid to the UK would be more financially attractive for Sky Bet – but greatly increases the prospect of a successful challenge.

What can HMRC do to stop the VAT avoidance?

It’s important to note that we do not know if Sky Bet is using the VAT avoidance structure outlined above – this is our speculation (which Sky Bet pointedly did not deny). However we are reasonably certain that at least one other group is currently using a structure of this kind.

The EU and UK VAT systems are not supposed to enable businesses to magically make their VAT cost disappear. It is entirely proper for the UK to find any way it can to block this kind of structuring, either under current law or by changing the law.

Under current law, we’d expect HMRC to investigate whether the advertising services supplied to entities like ServiceCo are really being supplied to Belgium/Luxembourg/Ireland, or to a “fixed establishment” in the UK. This again will in large part come down to how carefully the structure is implemented.

Recent history has been that HMRC has failed to successfully challenge this kind of avoidance. VAT is a creation of EU law, and EU law has only enabled tax authorities to attack the most highly artificial types of VAT avoidance. So, for example, the UK Government passed legislation in 2019 aimed at stopping “offshore looping” by insurance brokers – routing arrangements through an offshore company to avoid VAT. That’s fairly close to the structuring we believe Sky Bet may have used. A tax tribunal recently held in the Hastings case that the 2019 legislation was contrary to EU law, resulting in a £16m VAT refund for Hastings.23

The upshot is that, as one adviser told us – “VAT avoidance is okay even if ‘blatant’ – as long as you do it right”. This should change. There’s no reason, post-Brexit, that UK VAT rules should accept that “blatant” VAT avoidance is “okay”. The Government should legislate:

- overriding those features of EU law which facilitate VAT avoidance (and make this retrospective, preventing further claims based on Hastings), and

- enabling HMRC to require UK businesses invoicing offshore companies to apply UK VAT in cases where HMRC can identify that abuse has taken place. The offshore company could then claim a refund to the extent that foreign VAT is actually paid.

Is it lawful?

It is common for reporting on corporate tax avoidance to say that there is no suggestion that tax planning is unlawful. That is not necessarily the case here.

There appears to have been an element of concealment in how Sky Bet/Flutter has described the arrangement. The public version is that the relocation to Malta is being executed for “strategic reasons” (and more on that below). Sky Bet’s staff weren’t told that tax was a factor. However, ITV’s source at Flutter is clear that tax was in fact the real motivation:

“Tax was the elephant in the room. It was absolutely understood, across everyone affected, indirectly affected or even aware of it… that this was about tax.“

Our industry sources, and our panel of experienced tax experts, believe that this is likely correct.

If Sky Bet told HMRC that the arrangement wasn’t driven by tax, but it in fact was, then that was improper and potentially unlawful.

Ending offshoring by gaming companies

The current situation is irrational. It’s easy for a business providing gaming to UK consumers to move offshore, and save large amounts of corporation tax. That loses tax revenue; it also puts UK-based operators at a commercial disadvantage, giving them a large incentive to move offshore. This is not in the UK’s interest.24

It would be easy to reverse this: the Government could equalise all UK duties and tax for onshore and offshore businesses that provide internet/remote gaming services. There are two ways this could work.

- The first and “neutral” way would be to raise gaming duties for internet gambling, make the duties non-deductible for corporation tax, but instead make them fully creditable against corporation tax (and foreign corporate taxes).25 Say the rate of betting duty was 19.6% – Sky Bet’s UK business in 2024 would then have paid £58m of corporation tax plus £56m of gaming duty.26 That’s £114m in total – the same as it paid under the current rules. But if Sky Bet had moved to Malta then it would have paid £8m of Maltese corporate tax plus £106m of gaming duty – again £114m. The corporate tax advantage of moving offshore has disappeared.27 In fact staying in the UK, or moving back to the UK, would save most businesses money – because operating in tax havens like Malta tends to be awkward and expensive.

- The more aggressive approach would be to credit corporation tax but not foreign taxes. So moving to Malta would increase Sky Bet’s taxes, and offshore gaming companies with UK customers would reduce their tax if they moved to the UK. This kind of approach would be prohibited by EU law if we were still a member of the EU; but of course we are not.

Either approach would put an end to offshoring by internet gaming companies, and encourage relocation to the UK.2829

Sky Bet’s response

We asked Flutter, Sky Bet’s owners, for comment. They sent this reply to us and to ITV News:

“Flutter paid more than £700 million in taxes to HMRC last year and we employ over 5,000 people across the UK including almost 2,000 in Leeds and 600 in Sunderland.

As with most global businesses around the world, we are constantly striving to remain competitive and efficient and to give ourselves the best chance of success in an incredibly challenging environment.

The challenge we face is only made harder by the recent Gambling Act Review, the significant rise of illegal, unregulated black-market competitors and the possibility of tax rises in the Budget.

In June this year, after migrating Sky Bet onto the same technology platform as our other brands, we decided to move a number of commercial and marketing roles to our commercial centre in Malta – where Flutter already employs over 750 people.

This decision was made for a number of strategic and commercial reasons and will have some tax implications. But Flutter is committed to the UK and Sky Bet will continue to pay UK corporation tax on its profits.“

This is unconvincing. The new SBG Sports Limited was established in May 2025, long before the various Budget rumours started circulating. Any measures arising from the Gambling Act Review – new duties or regulation – will apply to gambling businesses with UK customers, regardless of where they are based.

We told Sky Bet we thought they were saying something that wasn’t true, and if they had given a false explanation to HMRC then that could have serious consequences. They didn’t like our characterisation, but didn’t provide any further explanations. They haven’t denied putting a scheme in place to avoid the VAT.

All of this adds to our sense that Sky Bet is hiding the true reason for its move.

Many thanks to Joel Hills at ITV – this story only exists because he spotted the Malta migration. And thanks to A O, K and M for their insights on the gaming industry and its tax treatment.

Footnotes

Initially Sky plc sold to CVC, retaining a 20% stake. Then CVC and Sky sold out to Stars Group in 2018 for $4.8bn. ↩︎

Historically, Hestview was the UK-licensed bookmaker in the group and the entity that licenced the “Sky Bet” brand from Sky plc. The accounts say Hestview was the “economic beneficiary of the Sky Bet brand”. It seems the position is now that SBG Sports Limited runs the sports betting business, Bonne Terre Ltd (a company incorporated in Alderney – part of Guernsey with particularly favourable gaming regulation) the egaming/casino business, and Hestview has retained “free to play” business. ↩︎

We are using round numbers throughout but they are representative of the actual figures. ↩︎

i.e. because sports betting is VAT exempt in the UK and so Sky Bet cannot recover the VAT. If this was (eg) a supermarket buying advertising then it would recover it. A further point of detail: if any advertisers were outside the UK then Sky Bet would “reverse charge” the VAT – so the UK Sky Bet business would always be subject to irrecoverable UK VAT on its marketing spend. ↩︎

Or possibly an error in the accounts, with someone writing “SBG Sports (Malta) Limited” instead of “SBG Sports Limited, Malta branch”. Either way, we can find no record of an “SBG Sports (Malta) Limited” in the UK, Malta, or anywhere else. ↩︎

“Sky Betting and Gaming” ↩︎

A branch isn’t a legal entity – it’s just a place where you operate. Banks often have branches because of the way bank regulation works (e.g. most of the world’s largest banks have branches in London). Some other regulated sectors do this too (insurance in certain cases). But outside of this kind of case, branches are unusual, and often a sign of tax/VAT avoidance. ↩︎

This is probably why they picked Malta rather than Alderney, even though Alderney tax and regulation is more straightforward (and in practice usually zero tax). You can’t realistically move dozens of employees to Alderney – the island is just too small. You wouldn’t be able to achieve the “substance” that is realistically required to escape UK corporation tax and VAT. ↩︎

Possibly the intention is that the company becomes Maltese tax resident. The UK/Malta double tax treaty has an old-fashioned “place of effective management” tie-breaker. Modern treaties have an anti-avoidance provision created by the OECD BEPS Project which means that tax authorities have to agree any shift in corporate residence. However our industry sources expected that wouldn’t be the planning here, and the entity was in fact intended to remain UK resident with a Maltese branch. More on the reasons for this below. ↩︎

Malta is not a normal country – only a few years ago, a journalist investigating corruption was murdered by a car bomb. The EU Commission shouldn’t permit Malta to engage in aggressive tax competition, like having a de facto 5% rate of corporate tax, and manipulating VAT grouping rules. However it seems unlikely we’ll see any action in the short term. ↩︎

Of course a branch doesn’t pay a dividend – SBG Sports Limited, the UK company, would pay the dividend. We’re assuming that “counts” for Maltese purposes (perhaps because they regard the dividend as having a Maltese source, and/or reflecting the underlying Maltese corporate income tax. We don’t know who currently owns SBG Sports – it was initially Bonne Terre in Guernsey/Alderney). ↩︎

Of course assuming profit is still £156m. ↩︎

In principle the tax benefit should be greatly limited by Pillar Two, the OECD 15% minimum tax. We’re still in the first few years of implementation, so it’s hard to say what is happening in practice here. One possibility is that Sky Bet really is paying 15% tax on its profits (in Ireland or some other jurisdiction); in that case VAT may be central to the structure. The other possibility is that a structure and/or accounting methodology is being used that minimises the impact of Pillar Two (and that may be linked to the unusual decision to use a Maltese branch rather than a Maltese company). We expect this kind of question will have answers in a few years, but for now all we have is intuition: and our intuition is that Sky Bet/Flutter are doing something to mitigate the 15%. ↩︎

On the basis it makes taxable supplies to SBG Sports Limited. ↩︎

This branch would solely be a tax play. ServiceCo has maybe a couple of people doing something that can be justified as a real activity (for example managing advertising for a particular (small) part of Sky Bet’s business). ↩︎

Malta has acted in a predatory way here, only permitting VAT groups for sectors where cross-border tax avoidance will be attractive, with advisers being fully aware that they can use this VAT grouping for avoidance purposes. The EU Commission clearly doesn’t like this, but thusfar hasn’t acted. ↩︎

There are numerous exceptions, of course, particularly if the business is ultimately owned by a UK individual or company, or if it holds UK real estate. However for a foreign-owned trading business, the general proposition is broadly correct. ↩︎

Which then makes the IP available to its Maltese branch. ↩︎

There are clear signs of that. Why use a branch rather than a Maltese company? One reason is – we would speculate – that it means that there’s no Maltese VAT on licence fee payments, because the IP is routed from Hestview Limited, via SBG Sports Limited’s UK headquarters to its Maltese branch. The UK companies would likely be VAT-grouped (so no VAT there). The arrangement between SBG Sports Limited in the UK and its Maltese branch would be an intra-entity transaction, and therefore not subject to VAT. It’s possible that the branch is also part of the direct tax planning. ↩︎

This is the opposite of the structuring used by many foreign companies with businesses in the UK, where they seek to maximise the licence fee paid by the UK operating business to the foreign owner of intellectual property. ↩︎

And there will be branch allocation issues unless SBG Sports Ltd is Maltese tax resident. However we wonder if the intention is in fact that the company remain UK tax resident. If they are careful about substance, the diverted profits tax (originally announced as a “Google tax“) wouldn’t then apply, because SBG Sports Ltd would be a UK company with a foreign branch, not a foreign resident company. ↩︎

And if it is intended to be Maltese tax resident, it may accidentally become UK tax resident. ↩︎

Hastings UK was making supplies (back office insurance related) to a non-EU insurer. Until 2019, these supplies were “specified”, meaning that there was VAT recovery, even though these services would be exempt in the UK. Hastings – and many others – took advantage of that by “looping” supplies to UK clients via non-EU entities, solely to achieve recovery. The law was changed in 2019 to stop these structures – recovery would only be permitted where the ultimate customer was outside the EU. The FTT decided in Hastings that EU law prevented UK VAT law from looking at the ultimate recipient of supplies. The “Offshore Looping Order” was held to be ultra vires because it wasn’t compatible with the Principal VAT Directive – the UK couldn’t restrict input tax recovery by looking through to the ultimate insured when the Directive didn’t. ↩︎

This is regardless of our position on whether we should encourage or suppress gaming generally; the question is whether the gaming industry that we do have should be onshore or offshore. ↩︎

It would only be the corporation tax on the gaming-duty-relevant profits that was creditable. ↩︎

The corporation tax figure is 25% x its 2024 profits (ignoring its deduction for gaming duty). The gaming duty figure is 19.6% of £580m, minus the £58m of corporation tax. ↩︎

It might be argued this breaches the UK’s double tax treaty with Malta. That is probably incorrect, because gaming duty is not a tax on profits. However the point is academic: even if gaming duty were (for some reason) regarded as a tax on profits, there’s no route to any appeal under UK tax law, because gaming duty is not one of the taxes which can be overridden by tax treaties. ↩︎

One side-effect of moving from corporation tax plus duties to pure duties is that operators with lower margins would pay a higher effective rate, and more efficient/higher-margin operators would be favoured. Given the essentially similarity of internet gaming businesses, this is significantly less problematic than it would be to (for example) tax digital companies on a gross revenue basis. ↩︎

An additional step that could be taken is to amend the diverted profits tax so section 86 applies to artificially structured foreign branches of UK companies. ↩︎

Leave a Reply to Dan Neidle Cancel reply