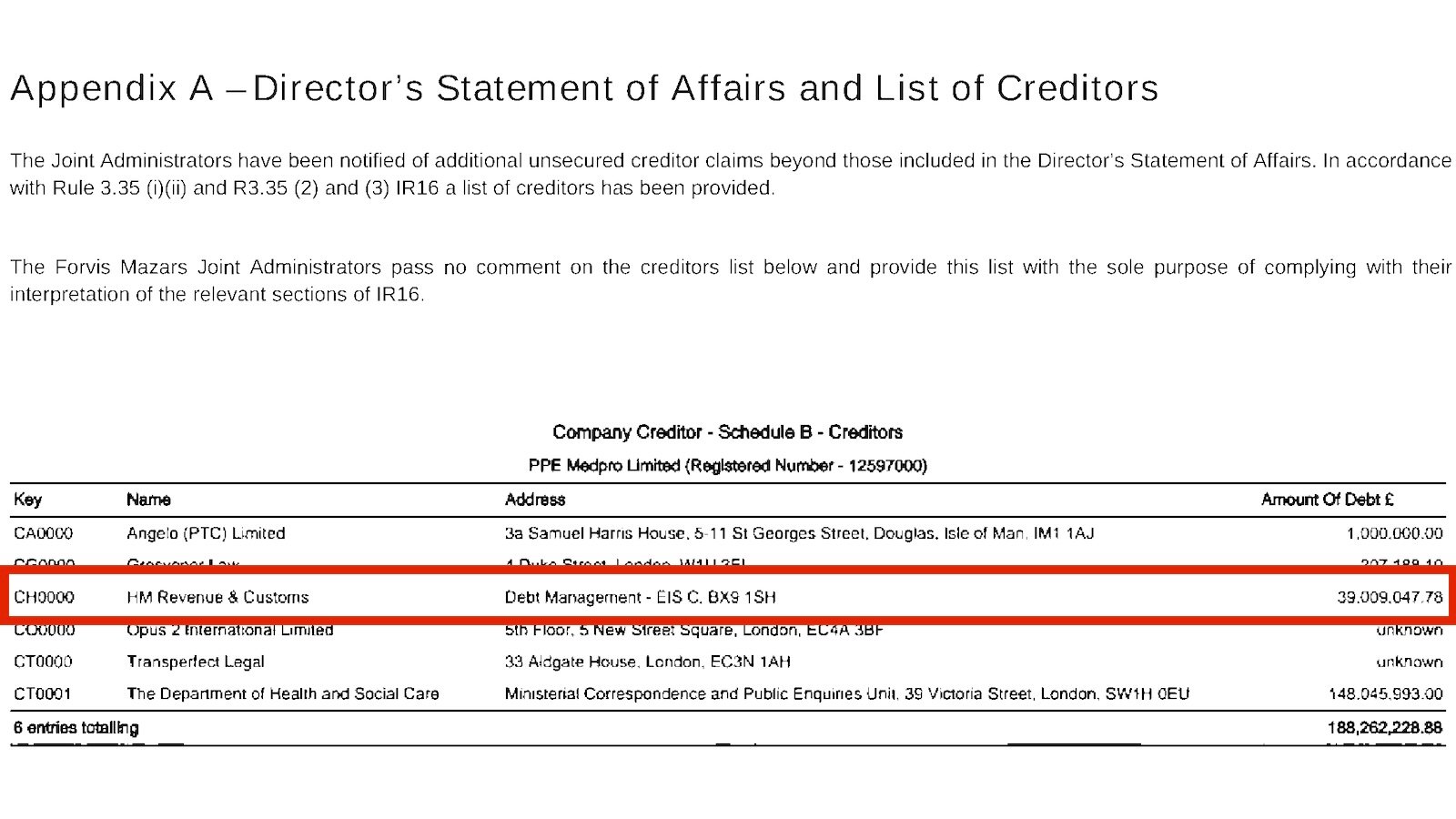

PPE Medpro is the company which provided £200m of PPE to the Government in dubious circumstances, of which £122m was faulty. Reports suggest it made £65m profit – but we can’t know for sure. Its finances are a mystery, because it was allowed to file only abridged accounts.

Why? Because under UK law, PPE Medpro counted as a “small” company. The definition of “small” is a relic of a European compromise nearly fifty years ago. It looks at balance sheets and headcounts, not just turnover — meaning a firm could, in theory, book trillions in sales and still be “small.”

That’s absurd. This report sets out a simple fix: require full accounts from firms of real scale, while keeping genuine small and micro businesses out of red tape.

When a £200m company is “small”

Something’s odd about PPE Medpro’s accounts for the year it made £200m from selling PPE to the Government. There’s a balance sheet, but no director’s report and no profit and loss account. We don’t know how much revenue it received, or how much profit it made.

Why?

Because the company classified as “small”.

The intention of the small company exemption is that we shouldn’t be over-regulating small companies. That’s a perfectly rational policy. It is, however, much less rational that a £200m business also qualifies for the exemption.

But PPE Medpro absolutely did qualify, because of the strange way the small company definition works.

That’s an anomaly, but one that’s far from unique to PPE Medpro. Most of the fake companies and tax avoidance scheme promoters we’ve investigated use the same exemption. They’re not breaking the rules – the problem is that the rules are irrational.

The rules

The rules say that a company is “small” if it has any two of the following:

- a turnover of £15m or less

- £7.5m or less on its balance sheet

- 50 employees or less

It’s then not required to prepare audited accounts, or publish a profit and loss (P&L) account, showing its turnover, expenses, tax and profit.

We don’t think many people would describe a £200m turnover as “small”. But it’s the “any two” in the small company rule which is critical. In its 2021 accounts, PPE Medpro had a balance sheet of £5m1, and three employees.2 So PPE Medpro’s large turnover didn’t stop it being small, because it satisfied the other two conditions. Indeed it would have remained “small” even if it had a trillion pounds of revenue..

There are more relaxed rules for “micro” companies, who can file very abbreviated accounts. A company will be a micro-entity if it has any two of the following:

- a turnover of £1m or less

- £500,000 or less on its balance sheet

- 10 employees or less

Again, £1m doesn’t seem very “micro” – and, again, you can still qualify as a “micro” company with a trillion pound turnover, provided the balance sheet and number of employees is small.

The history

How did we end up with such a weird set of conditions for the small company accounts exemption?

Until the early 1980s, all UK companies had to file full accounts with Companies House. The Companies Act 1981, implementing an EU directive, first allowed “small” companies to file abbreviated accounts without a profit and loss account or directors’ report. Later Acts – particularly the Companies Act 2006 and subsequent regulations – progressively relaxed the rules further, introducing micro-entity and abridged accounts. Over the next few years3, requirements were loosened further so that, today, small companies can file “abridged” accounts and micro companies “micro-entity accounts”.4 HMRC still receives the profit and loss accounts for all companies, but Companies House does not.

Prior to Brexit, the UK wasn’t free to create its own rules for when a company could file abridged accounts. We had to adopt the small company definition which originated in Article 11 of the Fourth Company Accounts Directive (now in the EU Accounting Directive). The “two out of three” was a classic EEC/EU compromise from back in 1978, and – like many such compromises – has become badly outdated but is very hard to change.

Back in the 1970s it was reasonable to assume that large businesses had lots of staff and big balance sheets. The modern world of digital and financial companies, globalisation, contractors and intermediaries breaks those assumptions – it’s common to see trading businesses with large revenues but tiny head-counts and light balance sheets. Conversely, we often see financial businesses with large balance sheets but small revenues and head-counts. These kinds of companies are “large” by any sensible definition, but “small” by the actual definition – so they get to file abridged accounts. Only after two years of not being small are full accounts required.

This breaks the basic deal of incorporation: you receive the benefit of limited liability, but in return you disclose the key elements of your business to the world (and, in particular, to your customers and counterparties). It’s self-evidently good for business that (e.g.) someone considering contracting with a firm can immediately see its accounts online. And it’s self-evidently bad for transparency that some companies which are realistically “large” like PPE Medpro, get to shroud their affairs in secrecy.

The Government’s solution

The recent focus on anti-corruption measures prompted the last Government to pass the Economic Crime and Corporate Transparency Act. This requires that all companies have to file a profit and loss account from 2027. The concept of “abridged” accounts is eliminated, and all companies will be required to file their accounts electronically using commercial software (the current simple web-filing option would disappear).

This has caused considerable disquiet for some businesses.

There have been concerns about privacy. Trade bodies have warned that publishing even a summarised P&L could expose margins to customers and larger suppliers and weaken negotiating power. That is unpersuasive – full P&Ls were published prior to 2006, and there’s no evidence this was problematic.

There have also been concerns around cost. This is more persuasive. Companies already prepare full statutory accounts for HMRC every year as part of their CT600 corporation tax return – and most large companies will already do this using commercial software, so uploading to Companies House will simply involve pressing a button. Some small and micro companies will not; so the new rules really would mean more cost and bureaucracy.

It’s therefore easy to understand why there were reports in the press back in July that the Government may be about to scrap the changes. Nothing has happened yet – the regulations are still in place requiring full P&L to be filed by 2027.

The evidence

The conventional economic view is that financial openness promotes more efficient resource allocation – and there are a large number of studies that observed this effect in practice.5

But there’s also a downside. There’s convincing evidence from a pan-EU study, that requiring small companies to disclose financial accounts can (at the margin) reduce their innovation. And a recent study of German firms found that, for very small firms, the costs can exceed the benefit.

This suggests that we shouldn’t be looking for a “one size fits all” solution, but that we should calibrate different levels of reporting to different types of firm. And it’s critical that the administration is as straightforward and frictionless as possible.

A more nuanced solution

The principle is straightforward: if you want limited liability, you owe the public basic transparency. The only carve-out should be for businesses that are genuinely small – not firms turning over hundreds of millions. And even small businesses should provide basic information.

So here’s our proposal: to qualify for exemption from filing full accounts, a company could be required to meet all of a turnover, balance sheet and employee condition. The thresholds could (for example) be set at turnover of £1m, balance sheet of £1m and ten employees. Once a threshold is breached then full accounts should be required immediately, without a year’s grace period. The aim should be that a coffee shop qualifies but the likes of PPE Medpro do not.

And companies that qualify for the exemption should be required to state their turnover and profit (but no other details from their P&L). That should all-but-eliminate compliance cost, but ensure that key financial information is made available.

Finally, the threshold for mandatory audits should also be an “all” test, with (for example) all companies with turnover of £20m, balance sheets of £10m or 60 employees required to obtain audited accounts.6

Photo by Jakub Żerdzicki on Unsplash

Footnotes

Current assets £4.972m and net assets £3.890m – it’s the gross amount that “counts” for this purpose. ↩︎

The thresholds were lower in 2021 than they are today, but even at today’s higher thresholds, PPE Medpro would clearly be “small”. ↩︎

Regulations in 2013 introduced micro‑entity accounts, and regulations in 2016 created the “abridged” preparation option and “filleted” filing choice for small companies. ↩︎

Both with the option of omitting their profit and loss account; an option that’s almost always taken. ↩︎

There’s also evidence that an audit requirement reduces dividends (presumably because companies are required to be more conservative in determining whether they have sufficient profits). ↩︎

It seems fair to raise each of the thresholds above where they are at present. ↩︎

![32 [F1 General false statement offence] [F1 False statements: basic offence]

[F' (1) It is an offence for a person, without reasonable excuse, to—

(a) deliver or cause to be delivered to the registrar for the purposes of this Part any document that is misleading,

false or deceptive in a material particular, or

(b) make to the registrar, for the purposes of this Part, any statement that is misleading, false or deceptive in a

material particular.](https://taxpolicy.org.uk/wp-content/uploads/2023/12/Screenshot-2023-12-28-at-11.41.07-640x118.png)

Leave a Reply