When Sir Keir Starmer gave a field to his parents, he used a “life interest trust”. This meant that, as its value grew from £20k to £300k, it was outside his parents’ inheritance tax estate.

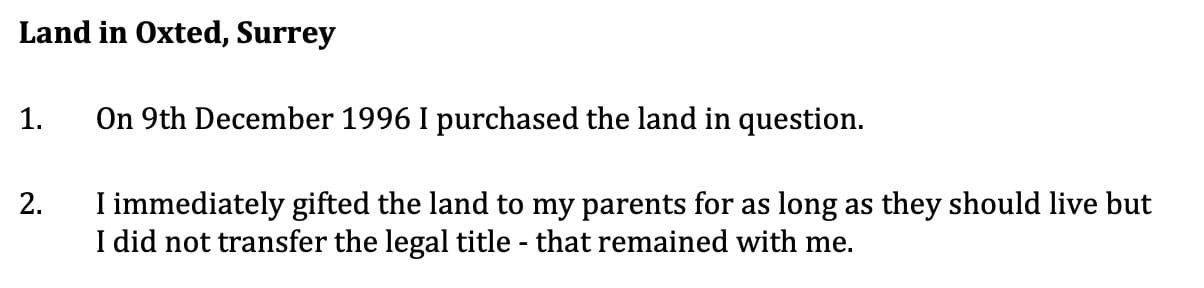

UPDATE: 10am Sunday 28 September. Sir Keir just told Laura Kuenssberg that he didn’t create a trust. That is hard to understand when The Sunday Times has been asking Sir Keir about a trust for a month, and he at no point denied there was a trust. It also makes it hard to explain the form of words Sir Keir used in his letter to the Parliamentary Commissioner: “I immediately gifted the land to my parents for so long as they should live”. To a lawyer, that means a trust.

In 1996, Sir Keir Starmer bought a seven-acre field behind his parents’ house so they could keep rescue donkeys. But the arrangement wasn’t quite as simple as a gift. The wording he later used suggests he created a life-interest trust: his parents could use the field for the rest of their lives, but ownership would revert to him when they died. That structure had the effect of keeping the field outside his parents’ estate for inheritance tax purposes. As things turned out, it likely made no difference, as their estate was probably below the threshold. But was the trust an accidental curiosity? Or a piece of careful tax planning – some would say tax avoidance – that ultimately turned out to be unnecessary?

This is a story I’ve been working on with the Sunday Times. They’ve published their story today – this article gives the technical background, and my view of what it means.

The facts

The history is as follows:

- In 1996, Sir Keir bought a seven acre field adjacent to his parents’ house and garden (long before he became an MP). The price was £20,000. There were donkeys on the field – the purpose of the purchase was so his parents could look after rescue donkeys.

- Sir Keir became an MP in 2015. MPs are required to register land/property in the Register of Members Interests if it’s worth £100,000 or more. Sir Keir didn’t register the field.

- Sir Keir’s mother died in 2015; his father died on 1 December 2018. The net value of their estate (mainly their house) was £374,091. Mr Starmer was an executor of their estates.

- In 2020, the Daily Mail reported that the field could be worth £10m⚠️.

- In January 2022, Sir Keir had the field valued – it was worth more than £100,000 (but nowhere near £10m).

- That means Sir Keir should have declared the field in the Register of Members Interests at some point. Soon after Sir Keir obtained the valuation, his office contacted the Parliamentary Commission for Standards to correct his entry in the register.

- In May 2022, Sir Keir agreed the sale of the field, together with a strip of land previously owned by Sir Keir’s father. Sir Keir’s share of the proceeds was around £295,000.1

- In June 2022 there was an investigation by the Parliamentary Commissioner for Standards into Sir Keir’s failure to register the field, which ended in Sir Keir apologising and the register being retrospectively amended.

The life interest trust

I discussed the sale of the field with the Sunday Times earlier this year. I noticed a phrase Sir Keirr used in his correspondence with the Parliamentary Commissioner for Standards:

Most lawyers will read “for so long as they should live” as meaning Sir Keir created a life interest trust. That was my immediate view, and the Sunday Times instructed a KC who agrees.

Sir Keir has neither confirmed nor denied that he created a trust – but it seems a fair assumption that he did (or surely the story would have been denied). (See the update at the top of this article)

Sir Keir’s office says that, after the Sunday Times started asking questions about the arrangements, Keir Starmer engaged a leading tax KC to advise, and that all tax was fully paid.

How a life interest trust works

If we’re right that Sir Keir created a life interest trust2, then it worked like this:

- Sir Keir was listed on the land registry as owning the field.

- His parents were beneficiaries of the land during their lifetime. They could use it as they wished, and receive any income from the land. But they could not dispose of it.

- When his parents died, the trust ended and the land became wholly owned (legally and beneficially) by Sir Keir.

I suspect a non-lawyer in Sir Keir’s position wouldn’t think to do this. They would either own the land themselves (but let their parents use it) or give it to their parents outright.

Why not just let his parents use it? We don’t know, but we can speculate that they wanted his parents to “really” own the field, rather than just being permitted to use it. That is sometimes important to people.

Why not a gift, and then inherit the land when his parents died? There are at least two possible reasons:

- Parents often wish their children to share property equally, and their Wills reflect that. Sir Keir might expect to receive the field himself; that would require changing his parents’ Wills.

- If he gave the field to his parents outright, it would have formed part of their estate for inheritance tax purposes. But property in a life interest trust that reverts to the settlor does not, because of section 54(1) of the Inheritance Tax Act 1984.

So in a way the trust gives the best of both worlds: his parents owned the property when they were alive, but with no need to change their Will, and no need for probate when they die. And it potentially avoids inheritance tax.3

(However this is a very complex area, with laws that frequently change. Please don’t take anything in this article as advice.)

Did Sir Keir actually avoid inheritance tax?

This is certainly not a case where Sir Keir failed to pay tax that was legally due. But did the trust reduce the Starmer family’s inheritance tax bill?

Sir Keir’s office told the Sunday Times that “Given the size of the estate, the inclusion or not of the field in their estate made no difference to the estate’s IHT liabilities.”

How plausible is that?

If there had been no trust, and the field had been included in his parents’ estate (at its sale value4, then the net value of the estate would have been about £670,000. That’s significantly less than the £875,000 combined exempt amount from both parents’ £325k nil rate band plus his £125k residence nil rate band and her £100k residence nil rate band.5

In this scenario there was no tax to avoid – his parents’ estate was worth considerably less than the IHT threshold, and nothing he could have done with the field would have changed that.

However those numbers assume that Sir Keir’s mother used none of her nil rate band or residence nil rate band, leaving his father with a £875,000 combined exempt amount. That’s a reasonable assumption, because most married couples hold their home as joint tenants (so it’s inherited automatically and not under the Will) and Will almost all (or all) of their other property to their surviving spouse.6 However if that assumption is significantly wrong – for example because Sir Keir’s mother gave gifts7 of more than £205k to someone other than her husband, then Sir Keir’s father’s estate would probably have had an inheritance liability if the field hadn’t been held on a lifetime trust.

I’d therefore conclude that it’s possible that the trust reduced the inheritance tax bill, but Sir Keir has said it didn’t, and the facts are consistent with that.

Did Sir Keir try to avoid inheritance tax?

The short answer is that we don’t know.

The residence nil rate band didn’t exist in 1996 and Sir Keir could have rationally expected rising property values or even the development potential of the field to result in his parents’ estate being subject to inheritance tax.8 He might have decided that a trust was therefore better tax planning than giving his parents the field. Whether we call that tax avoidance is a political/ethical question, not a legal question (but, either way, it wasn’t something HMRC would be able to challenge).

Or it could just have been an experienced lawyer’s way of giving the field to his parents whilst they were alive, with tax not entering into Sir Keir’s calculation.

Sir Keir hasn’t been willing to explain why he created the trust. All his team would say to the Sunday Times is:

“Keir Starmer’s decision to allow his parents to use a field he bought them for £20k in the late stages of their lives had nothing to do with any tax considerations. He simply wanted to help his parents keep donkeys.”

That doesn’t really answer the question. Nobody’s suggesting he let his parents use a field for tax reasons. The question is whether he created a trust for tax reasons.

My personal view is that, if he did, this wasn’t tax avoidance – because the tax outcome he achieved was the same as if he’d owned the field himself but let his parents use it. That contrasts with some uses of trusts to (supposedly) magically eliminate tax liabilities – they are definitely tax avoidance, and usually don’t work (and may even constitute tax evasion).

However there is no single legal definition of “tax avoidance”, and others may disagree. I’ve written about the difficulty of defining “tax avoidance”.

Some disclosure: I’m a member of the Labour Party; I was previously a member of its senior disciplinary body (the National Constitutional Committee) but have stood down. I have no formal role in the Labour Party, and I advise policymakers in all parties. Generally that’s on “background”/unofficial: my one official role is that I’m a member of the SNP Scottish Government’s tax advisory group. I also participate in Government consultations, and speak to officials and occasionally politicians as part of those consultations (and have done so for many years, under previous Governments).

Many thanks to Gabriel Pogrund and the Sunday Times. Thanks to S for her expertise in trust taxation.

Footnotes

The total price was £320,000, of which about £295,000 related to the field – we know this from the tax summary Sir Keir published for 2022. ↩︎

This is sometimes called a “reverter‑to‑settlor” trust, because the property reverts to the person who created the trust – the “settlor”. A life interest trust is also sometimes referred to as an “interest in possession” trust, although there are interest in possession trusts that are not life interest trusts. ↩︎

A loan would have had the same tax effect – i.e. Sir Keir loans his parents the funds and they purchase the field. But that requires them to sign documents and complicates probate – it’s a less attractive option. A lease (with peppercorn rent) would have been another approach, but if the term was over seven years then it would have to be registered at the Land Registry. ↩︎

That is almost certainly wrong; the value at death was (on a straight-line basis) about 10% less than the sale value, but it gives us a conservative top-end estimate for the size of the estate. ↩︎

The residence nil rate band was created in 2017 but could be transferred from a spouse who had died before then. ↩︎

i.e. in this, very common, scenario the first spouse uses none of their residence nil rate band and little or none of their nil rate band. ↩︎

In her Will or in the seven years before she died. ↩︎

He couldn’t have anticipated future developments in IHT, either the long-term freezing of the thresholds or the introduction of the RNRB. ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply