Law firm Axiom Ince failed in October 2023, with £64m of client money missing – losses ultimately covered by the solicitors’ profession. How could the auditors have failed to notice £64m of missing money? The answer is that the company broke the law, and filed unaudited accounts.

Axiom Ince’s accountants, Adrian C Mansbridge & Co, somehow failed to notice this, and signed off on unaudited accounts. The Institute of Chartered Accountants in England & Wales (ICAEW) described this as “professional incompetence” – and that incompetence will have delayed the moment of reckoning for Axiom Ince, and so increased its losses. The only consequence for Adrian C Mansbridge & Co has been a £4,300 disciplinary penalty.

It’s a double failure of professional regulation. The SRA didn’t spot that a law firm they were already investigating had failed to file audited accounts. The ICAEW gave a “slap on the wrist” for behaviour that realistically merited a suspension or expulsion.

Axiom Ince

Axiom Ince grew rapidly from a series of acquisitions. When the Solicitors Regulation Authority intervened to shut it down, 1,400 people lost their jobs. However, it soon became apparent that this wasn’t a normal law firm failure – £64m of client money was missing. Five men have been charged by the Serious Fraud Office. The Legal Services Board published a report in May identifying a series of failures by the Solicitors Regulation Authority.

The cost of refunding Axion Ince’s clients falls on the SRA Compensation Fund (which is funded by the solicitors’ profession, and compensates clients owed money by a regulated law firm).

There is an excellent timeline of events in this article in Law Society Gazette.

Adrian C Mansbridge & Co and the accounts

Axiom Ince’s accountants were Adrian C Mansbridge & Co1, a firm of chartered accountants and registered auditors, regulated by the ICAEW and ACCA. Adrian C Mansbridge himself2 is not an obscure figure – in 2018 he was chairman of the London Society of Chartered Accountants’ taxation committee.

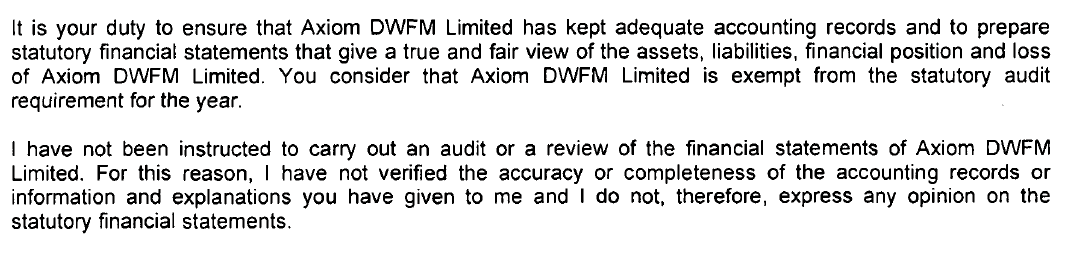

Here’s Axiom Ince’s last set of accounts, filed with Companies House on 7 February 2023:

The company was at that point called Axiom DWFM Limited; it changed its name to Axiom Ince Ltd the following year

Here’s the key part of the accountants’ report:

Small company audit exemption

Small companies are exempt from audit. The rules at the time said that a company would be small if it satisfied two of these requirements:

- Turnover not more than £10.2m

- Balance sheet not more than £5.1m

- Employees not more than 50.

There is a one year grace period – so a company will only cease to be “small” after two successive years of failing to satisfy the requirements.

Was Axiom Ince a small company?

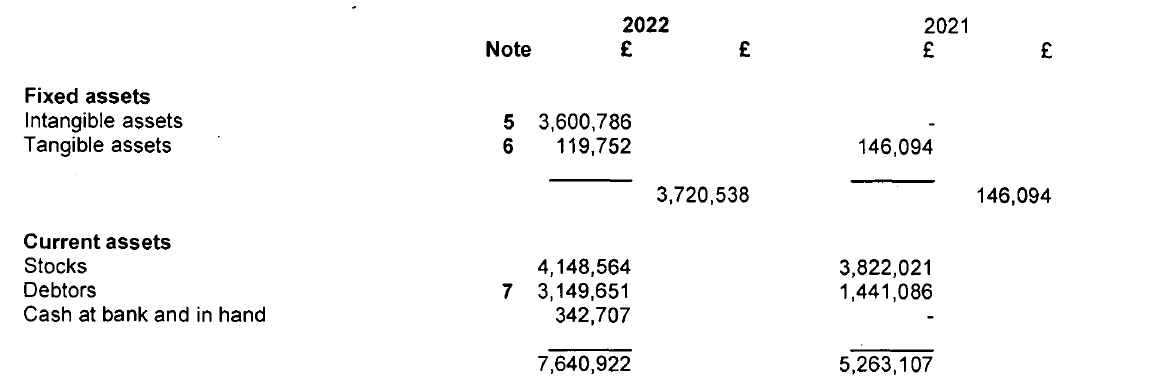

Axiom Ince’s 2022 accounts showed its total balance sheet assets for 2022 and 2021 :

£5.4m in 2021 and £11.3m in 2022 – so the balance sheet requirement was failed for two successive years.

The accounts also stated the number of employees:

The employee requirement was failed for two successive years.

So the company wasn’t small and the accounts should have been audited. It is surely inconceivable Adrian C Mansbridge & Co was involved in any fraud, but we cannot understand how an experienced accountant could have made such a basic error.

The mistake was very significant because, if an audit had been carried out for the 2022 accounts, it is plausible that the fraud would have been spotted, and the £64m losses to the SRA and the solicitors’ profession limited.

A missed opportunity by the SRA

The SRA were already investigating Axiom Ince in early 2023. That investigation included a forensic investigation of the firm’s accounts3 but it seems there was no check of the firm’s statutory accounts.

The SRA therefore didn’t identify that the firm had failed to file audited accounts – a red flag that would have justified immediate action. Instead, Axiom Ince was permitted to remain in business until October 2023.

The Legal Services Board’s report into Axiom Ince’s failure, written by Carson McDowell, is very critical of the SRA’s investigation, and in particular of the SRA’s insufficiently thorough checks of the firm’s accounts in early 2023. However the report does not mention the SRA’s failure to identify the lack of audited accounts. We infer that Carson McDowell missed this point.

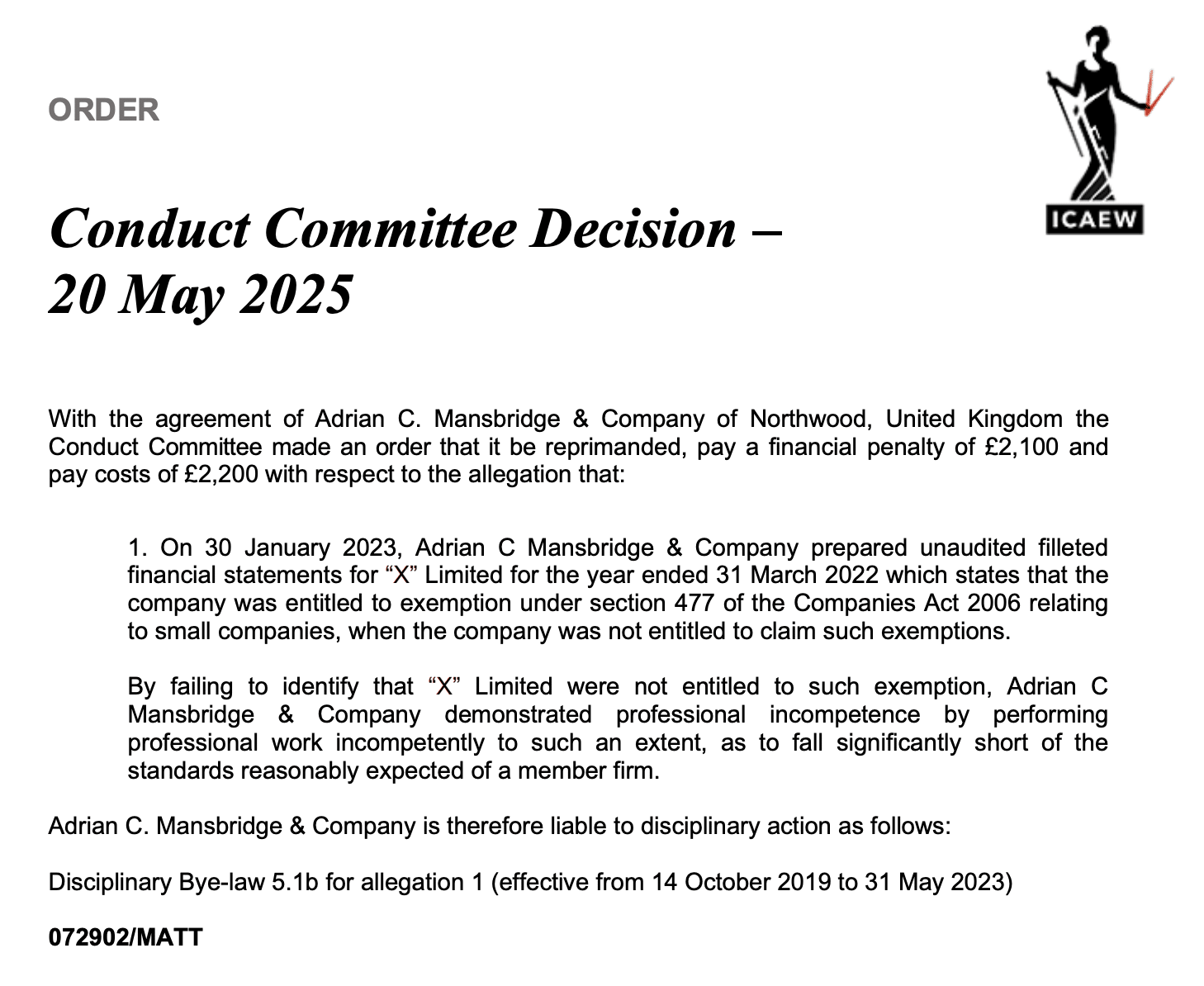

The consequence for Adrian C Mansbridge & Co

At some point, the Institute of Chartered Accountants in England and Wales became aware of the error, and pursued disciplinary proceedings against Adrian Mansbridge & Co.

The result:

This outcome is surprising for two reasons:

First, the company is not named (although we are confident it is Axiom Ince4). The ICAEW’s usual policy is that third parties involved in disciplinary matters should not be named, for their own protection. In this case that makes no sense: Axiom Ince has ceased to exist, and the many affected stakeholders have a strong public interest in knowing what happened. No public interest was served in anonymising this case.

Second, the penalty is extraordinary. The ICAEW finds that Adrian Mansbridge demonstrated “professional incompetence”. The result was that Axiom Ince continued to misapply client funds for another ten months. Yet the only consequence was a reprimand and penalty/costs of £4,300. That seems disproportionately lax. The ICAEW’s own sanctions guidance says that “audit work of a seriously defective nature” should trigger a £20,000 penalty. Failure to identify that an audit is required seems “seriously defective” to us. Indeed financial sanctions seem inadequate; suspension or expulsion seem more appropriate.

We have to wonder if the ICAEW’s Conduct Committee was aware of the wider context around Axiom Ince, or just saw this as a technical breach with no material consequences.

The response from the firms and regulators

Adrian Mansbridge & Co did not reply to two requests for comment.

The ICAEW said they couldn’t comment on a specific case, but that it’s their standard policy to anonymise the names of all third parties.

We asked the SRA, the LSB and Carson McDowell if they were aware that Axiom Ince had unlawfully failed to file audited accounts; they each told us they were unable to comment.

The consequences

It may be that there is potential for the SRA Compensation Fund to recover some of its losses from Adrian Mansbridge & Co’s insurers (although we haven’t analysed the prospects for such a claim).5

The ICAEW should review its disciplinary processes. The way it’s applying its anonymity policy does not make sense, and there is something seriously wrong with the penalty applied in this case.

And Companies House should have automated measures in place to detect companies which unlawfully fail to file audited accounts. We’ll be reporting more on this soon.

Thanks to our researcher K, who found the ICAEW disciplinary decision.

Footnotes

Note that the firm appears to be a trading name of Adrian C Mansbridge himself. Whilst there is a company – Adrian C Mansbridge & Co, Ltd – it is dormant. ↩︎

Not to be confused with the solicitor Adrian Mansbridge. ↩︎

See paragraph 93 onwards of the Legal Services Board’s report, starting at the bottom of page 19. ↩︎

We found the decision by searching against Adrian Mansbridge’s name. The accountant’s report date and balance sheet date match Axiom Ince. The ICAEW would not comment on specifics but did not deny that the reprimand refers to Axiom Ince. Adrian Mansbridge did not reply to our request for comment. ↩︎

The SRA has already taken action against the former owner of Axiom Ince to recover some of its cost, but as far as we are aware no action has been taken against Adrian Mansbridge & Co. ↩︎

37 responses to “Axiom Ince: a £64m failure; a £4,300 penalty for their accountants”

No comments on the merits here, but it might have been helpful to say what penalties are available under that sanctions guidance for what was actually found – this was (obviously) not audit work so referring to penalties for defective audit work seem off the point. An analysis of the relevant parts of the TR under which the report was issued might have been helpful too, though you’d hope the case itself had caused the Institute to question whether its technical guidance needed revising.

The accountants’ report here references ICAEW’s Technical Release 07/16 AAF which is intended to give guidance to Institute members when they compile financial statements for their clients.

Paragraph 31 of the TR says ‘In considering whether financial statements are misleading, professional accountants consider whether the financial statements appear to be appropriate in form and free from material misstatements that appear obvious to them as a result of, for example… mistakes in the application of, or non-disclosure of known departures from, any relevant statutory, regulatory or other reporting requirements’.

Firstly apologies if what i am saying is inappropriate to this thread, as this may have been covered somewhere else.

To me this leads to the bigger issue should Accountants been subject to fines for advising clients to be involved in tax avoidance schemes?

I have only been involved in private practice for 6 years after 30 years in the Revenue.

It seems whilst taxpayers have ended up with huge bills, those who advised have got away scot free.

Whenever I am asked at work, I always end up doing the research and if something is too good and doesn’t ‘smell right’ I tell my firm to stay well clear.

I agree. Promoters and advisers have received large fees but on consequences, whilst HMRC and their own clients lose fortunes.

Hello Dan, congrats. on yet another suitably concise but fully informative report. So much easier for your (I suspect) many readers like me who start to glaze over when too much in the way of fine technical detail punctuates the narrative.

Personally, over recent years I’ve come to the conclusion that the more snappy or buzzy the name is, the more likely that an outfit is a bit, ahem, dubious. Personally, if I wanted an accountant, J. Smith & Co., Chartered Accountants, in peeling gold leaf on a varnished brown door two flights up in an Edwardian office building, would probably do me. The mere name “Axiom Ince” would put me to flight. Likewise, I believe that any firm of lawyers calling themselves “Something Something Law” would send me scuttling back to W.H.Rumbold & Co., Solicitors and Commissioners for Oaths, of Station Chambers, Little Kimble, Bucks.

Incidentally, 50-odd years ago when I used to travel fairly regularly to Upminster to try to woo a young lady (ultimately unsuccessfully – her Dad was a Plod and made no secret of his view that I was completely unsuitable – he was right of course, if you’re of a respectable law-abiding frame of mind) and distinctly recall a firm of solicitors right opposite the station entrance with the glorious legend (in the aforementioned gold leaf, natch) ROLLEY, PINNEY & MUMMERY , Solicitors and Commissioners for Oaths, on their door. I kid you not !! Does any fellow ageing misfit amongst your readership remember this firm? If so, please let Dan know; I promise you I haven’t made it up!

If HMRC uses tax geared penalties, then ‘cost of failure’ penalties may be an idea.

1% of the cost of the failure by the regulated firm. – £64m loss, £640k penalty.

Perhaps fixed ranges for simple failures and percentages for serious failures.

I am by no means a legal or financial expert but I so work for a government regulator and, in my personal experience some of the main root causes of non-compliance are one of or a combination of:

1. Attempts at financial gain

2. Incompetence

3. Lack of management oversight

All three seem to be at play in this case.

I do find Companies House a really helpful resource in my work, as it often gives a fuller picture of the company than I would normally get, and is often the earliest indicator of serious issues in the area I regulate. I find this newsletter helps me gain a deeper understanding of issues in the area I regulate.

Sounds like they failed to identify that an audit was required. Being a chartered accountant, they were expected to have the professional competence to identify this. Whilst this remains the primary responsibility of the company’s directors. The firm shows it has an audit registration with ACCA.

It appears that the firm had not necessarily agreed to opine on whether the company could apply audit exemptions or atleast the report does not contain such opinion.

ICAEW seems to have identified this as a competence issue, which sounds right to me. if the company did not go under, would icaew decision make sense if it was simply an oversight from the firm. The question which then follows is whether icaew was required to consider if the firm had carried out an audit under an ACCA registration, whether this would have revealed a fraud or missing client money.

Client money is reported to the SRA, so rather than finding a link from lack of audited accounts to client money, is it not clear that the sra should have issued sanctions for the client money.

Thanks for the great job Dan, I will follow this with great interest

The ICAEW happily hands out much larger penalties for seemingly less damaging/egregious behaviour.

For example, in the latest set of hearings someone was excluded for two years and forced to pay costs of £9,000 for plagiarising in a mock exam (https://www.icaew.com/about-icaew/regulation-and-the-public-interest/public-hearings#)

Whilst Mansbridge & Co have covered themselves technically in their report, any decent practitioner has a checklist which would flag that an audit is required and this breach of standards should have warranted a far more serious penalty.

The ICAEW is quickly becoming an institution I’m embarrassed to be a member of.

Surely the issue is what was in the accountants’ report required under the Solicitors’ Accounts Rules rather than the Companies Act reporting? My understanding is that these reports are not made public.

Was the same accounting firm involved in both the Companies Act and SAR reports?

yes – unfortunately none of that is public. For me the significance of the Companies Act accounts is that the failure to provide audited accounts should of itself have been regarded as deeply suspicious.

ICAEW cannot make up its mind what it is. A regulator or promoter of its members interests.

As a member not sure about the latter and you article suggests it is not performing on the former.

The SRA is as I understand it responsible for monitoring of the periodic Solicitor Client Accounts certifications. In that case where was it on that given the missing client millions?

I am not saying this was the case here, but when you look at the level of fine imposed, it could be argued that some firms may see fines as just a cost of doing business because it is more profitable to focus on fee earning rather than spending time meeting regulatory obligations, and paying minimal fines if and when caught by regulators!

a hypothetical rational but amoral accountant would absolutely take that approach…

ICAEW’s professional conduct department do seem to focus on the specifics of a technical breach of regulations with very little consideration given to the consequences of a breach.

There are many cases in the accountancy press where fines of tens of thousands of pounds (plus similar costs) have been imposed for breaches where no member of the public has been harmed. Here, there has been massive harm to the general public yet no consideration is taken of this at all.

As a practising accountant/auditor for 40 years, now retired, I am gobsmacked by this. The first thing an accountant should do on any assignment is to ascertain what level of scrutiny is required by them. Surely the most basic Companies Act checklist would have covered this. They are registered auditors for goodness sake!

it is indeed deeply weird.

This is very much not my practice area. The reprimand is extremely odd in that the reported allegation is he prepared accounts which say the company is entitled to exemption. That’s not quite what the accounts say. The accounts says Axiom told him they’re entitled to an exemption. It does not say anything about whether he agreed that they were, or advised them they weren’t and was told to prepare them on the basis anyway. There’s a whiff of “I’m instructed” to the accounts – used to say “I’ve been told” without taking any ownership or endorsing it. It seems close to the wind but perhaps it can just about not be misleading – although I’d be deeply uncomfortable and wouldn’t put my name to that statement in that context. One does wonder whether the institute came to grief in how they put the allegation as in fact it’s not his conclusion. It’s just about possible his insurers said “take the reprimand as they’ve made a pigs ear of the allegations, before they fix them and say these were misleading and try to hold you to account for far more”. But query why the institute agreed this. All very odd.

that is odd

the allegation surely should have been that he accepted instructions the company was entitled to an exemption, when it was clear from five minutes’ review of the accounts that it wasn’t.

I know nothing about the size of the accountancy firm but I find it surprising that a firm the size of Axiom are using what appears to be a one person accountancy firm. Are there any rules about this? It reminds me of the tiny accountancy firm involved in the Madoff affair although the losses there were orders of magnitude greater.

to be fair, it was a pretty small business until it exploded following a series of acquisitions. So the accountants possibly got over their head?

But this is nothing compared to P&O: https://www.theguardian.com/business/2025/jun/13/po-ferries-hires-tiny-four-person-accounting-firm-to-replace-kpmg

I believe their accountants were replaced by a larger well known firm more suited to the task but before the latter completed their work.

The bigger problem is that any SRA right of recovery against the accountants is worthless because their compulsory insurance limits are so low. No ‘adequate and appropriate’ requirement.

Another issue is that the iCAEW is.a members’ club. Fines for not go to HM Treasury. They do ring fence them for disciplinary purposes but it is still indirectly subsidising the bar bill. Solicitors pay for regulation on top of fines, not out of fines.

thanks – what are the insurance limits, out of interest?

if the gross fee income of a firm is less than £800,000, the minimum limit of indemnity in each policy year for any single claim and in the aggregate, must be equal to two and a half times its gross fee income, with a minimum of £250,000.

To be fair, a tortious claim by the SRA against the accountants would be complex. Caparo has arguably been overtaken – but notable that in that case the shareholders had no claim against the auditors. A claim by the SRA is a step further removed and would undoubtedly raise questions about contribution, as well. So not a straightforward matter by any stretch.

Thanks! I was assuming/hoping there was some form of subrogation that the Fund could use…

There is precedent in Law Society v KPMG (re the £8m which went missing from Durnford Ford) and £36m had already gone before the 31 March 2023 accounts. I don’t believe case law since Caparo would make any difference, nor would any insurer with a policy providing a £250k limit spend money arguing it on a claim of this potential.

My first impression was that it would be a reasonably sized practice still operating as a partnership, but it does appear to be just two people: http://www.acmco.co.uk/about-us/

the precise nature of the business is unclear. That page describes it as a “company” but the company in question is dormant. I guess it could be a general partnership? Or a sole trader with an employee.

Dan

It is a “sole trader” according to ICAEW.

https://www.auditregister.org.uk/firm/firmdetails/3715000

thank you!

I’m constantly amazed at how lax supervision and regulation are in the so-called ‘professional’ industries. I hold a PhD in engineering and have designed structures all my life. But my calculations are checked internally by someone not involved in the project and then checked by the certification authority and the also the client (or client rep). All parties do all they can to ensure errors don’t arise. We need evidence-based professionalism not eminence-based professions.

The potential for AI to fix this is enormous, BUT is there the will to do so ?

Nonsense. My company recently added automated LLM (technical name for the currently most popular style of “AI”) conducted MR reviews*

40% of the time it has useful suggestions, 30% of the time it complains about irrelevant details, and 20% it makes impossible requests, such as suggesting the usage of a non-existent feature of a language.

I fail to see how the “wheel of fortune” approach could help in law, where correctness is much harder to prove than in most computer science problems. At best you’d have a mountain of false positives and nitpicks mixed with some real issues for humans to check

*A MergeRequest is when a software developer submits their work for inclusion in the product. It’s reviewed and approved by other developers familiar with the project to hopefully spot issues before they make it to the Quality Assurance department.

I humbly suggest you dig deeper into AI and beyond what is available to the general public. I can assure you that domain-specific LLMs (and other variants of AI) are already in active use in law, accounting, medicine and other domains and rapidly demonstrating their value.

Good spot – thanks for this write up; as a member of ICAEW I find this penalty by them on the firm involved derisory

As a fellow member of the ICAEW, I agree that this is a helpful and enlightening report. If professions are to regulate their members, they need to have appropriate penalties for misconduct or incompetence. Audits exist for a reason – to allow the public, shareholders, and regulators to have a credible assessment of the financial state of a business. If there is no enforcement, what is the point?