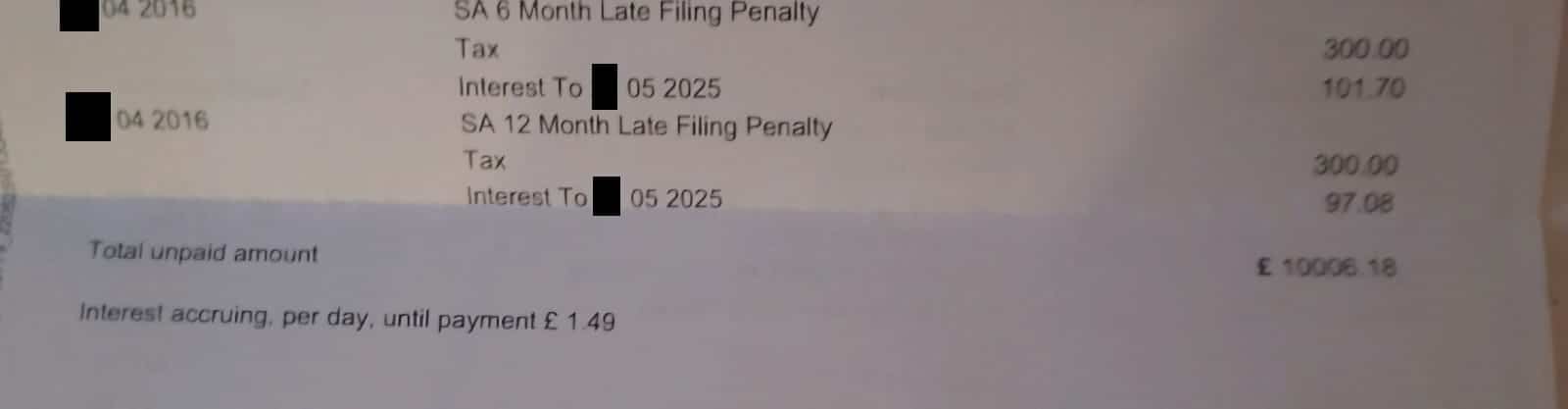

In the past five years, 600,000 people who owe no tax have been charged HMRC late-filing penalties. The penalties start at £100, but can snowball into four- and five-figure debts: one woman with severe mental-health difficulties was pursued for £10,000; another was driven into bankruptcy.

A system that was intended to encourage timely tax filing has become, in the words of retired tax judge Richard Thomas “the most punitive in the world” for people on low incomes.

The previous Government promised to scrap the penalty for a single missed return and cap any bill at £200. These reforms will apply to those earning £50k from April 2026, but there’s no date set for people on low income.

It’s unjust. The Government should act, and stop the most vulnerable in society having their lives made harder by HMRC.

Andrea’s story

Andrea1 suffered from mental health difficulties for many years. During that time, she never earned more than a few thousand pounds – well below the personal allowance, and so never had any income tax liability.

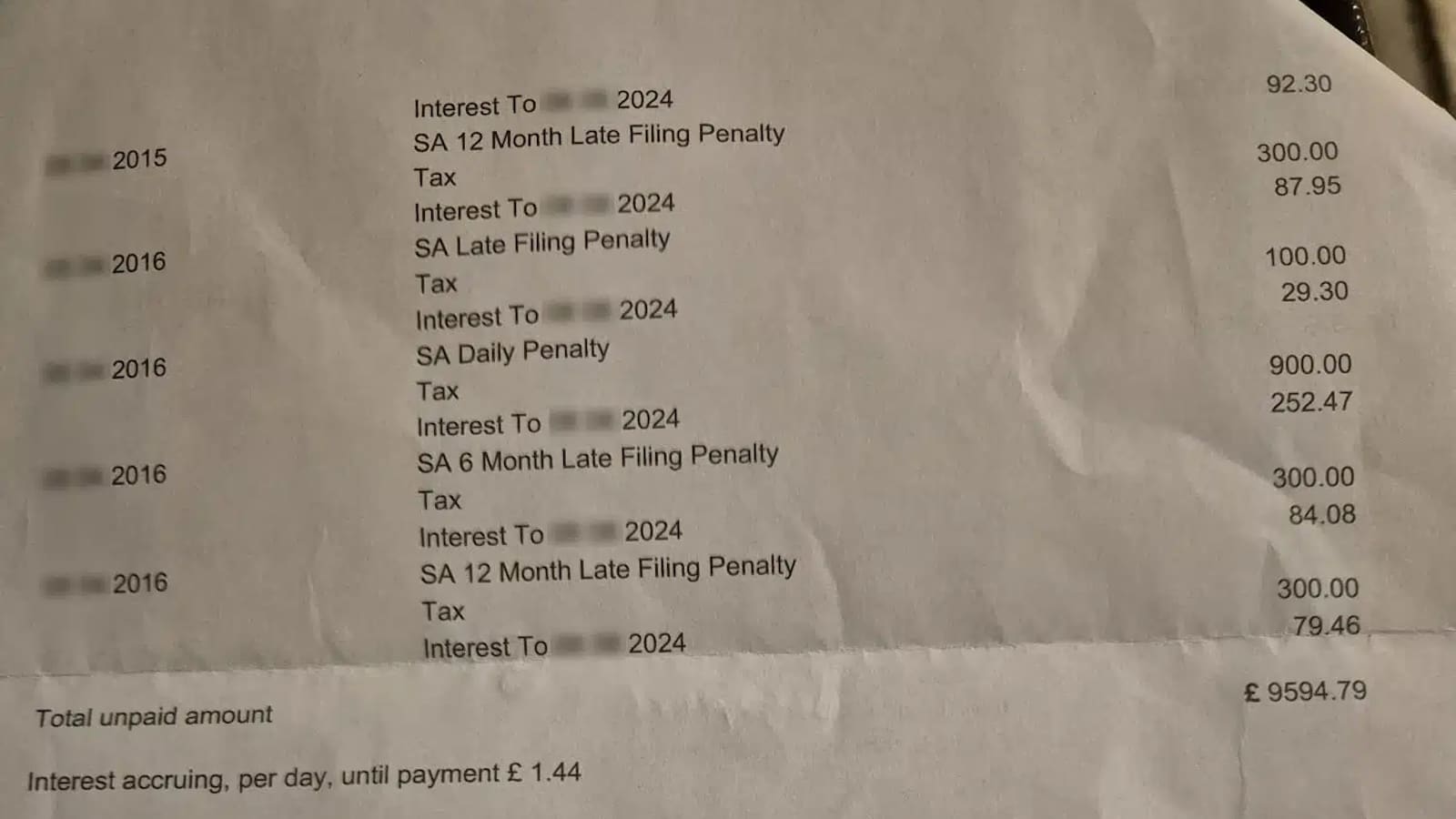

Last year she received a demand from HMRC for £9,595 of late filing penalties – that’s the image above. And then even more:

Over £10,000.

Why?

Some people earning under the £12,570 personal allowance still receive a notice from HMRC requiring them to complete a self assessment. This could be a mistake. It could be because they’re self-employed – even just £1,000 of self-employment income means you have to file a tax return. Either way, if they don’t either file the self assessment form by 31 January or (before that date) tell HMRC they shouldn’t need to self-assess, HMRC automatically applies a £100 penalty.

If they don’t pay, additional penalties will follow, increasing over the following months and eventually reaching £1,600. If the same happens the next year, more penalties will be added on – with interest accruing throughout. And so, after five years, Andrea owed over £10,000 in penalties – despite never owing a pound of tax.

Richard Thomas, the respected retired tax judge, has described the current UK penalties regime as the most punitive in the world for people on low incomes.2

The scale of the problem

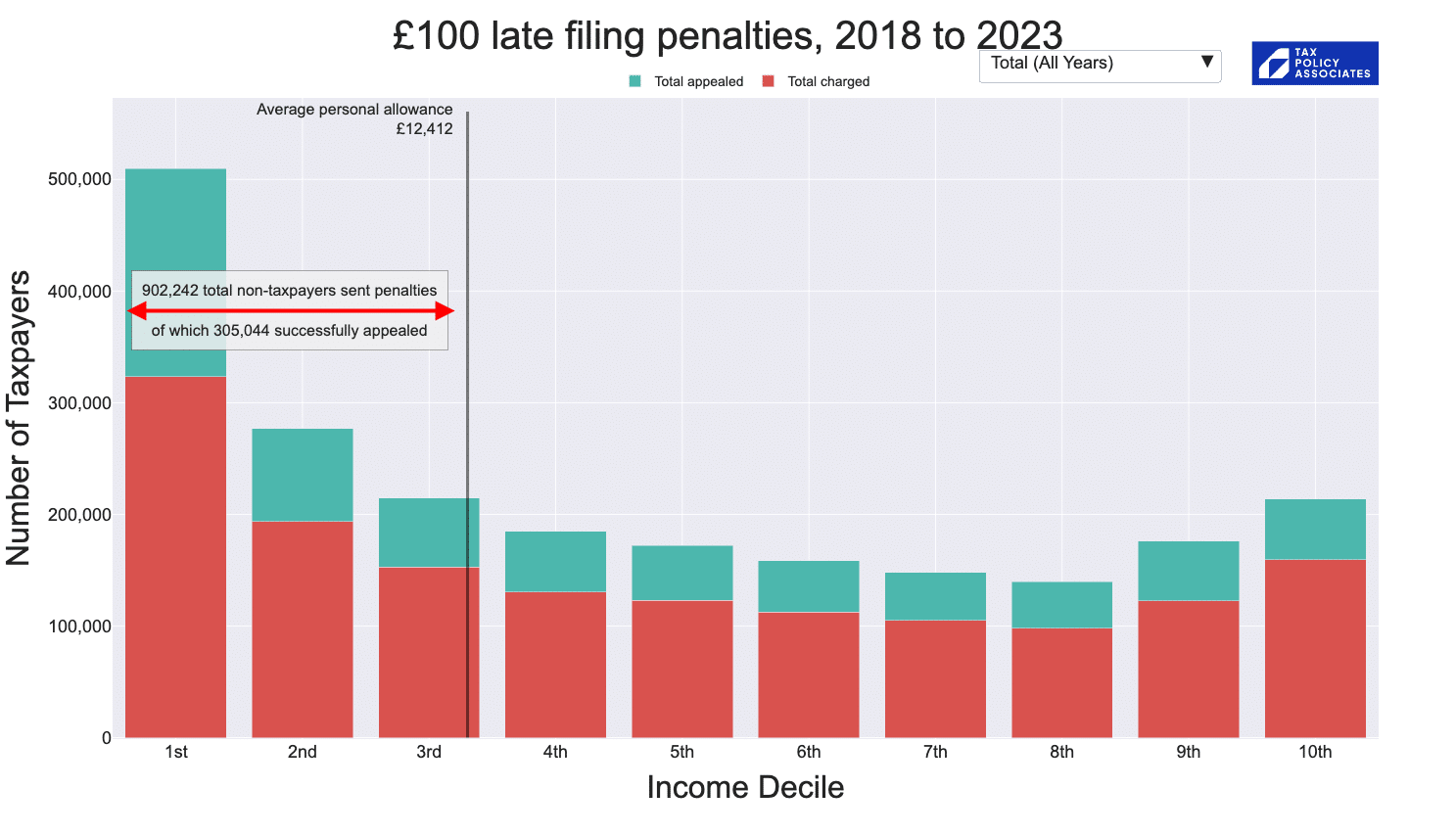

Over the last five years, 600,000 penalties were charged to people like Andrea, earning too little to pay income tax.3 This chart shows late filing penalties by income decile:

The chart shows the imbalance starkly: roughly 600,000 penalties charged to taxpayers with no income tax liability – outstripping the 400,000 penalties issued to everyone in the top three income deciles combined. In other words, those who owe nothing are, by far, the group most likely to be fined.

We’ve heard from hundreds of people impacted. Some were coping with a bereavement. One had been diagnosed with terminal cancer. Many had mental health challenges. All felt crushed by the mounting penalties; one declared bankruptcy.

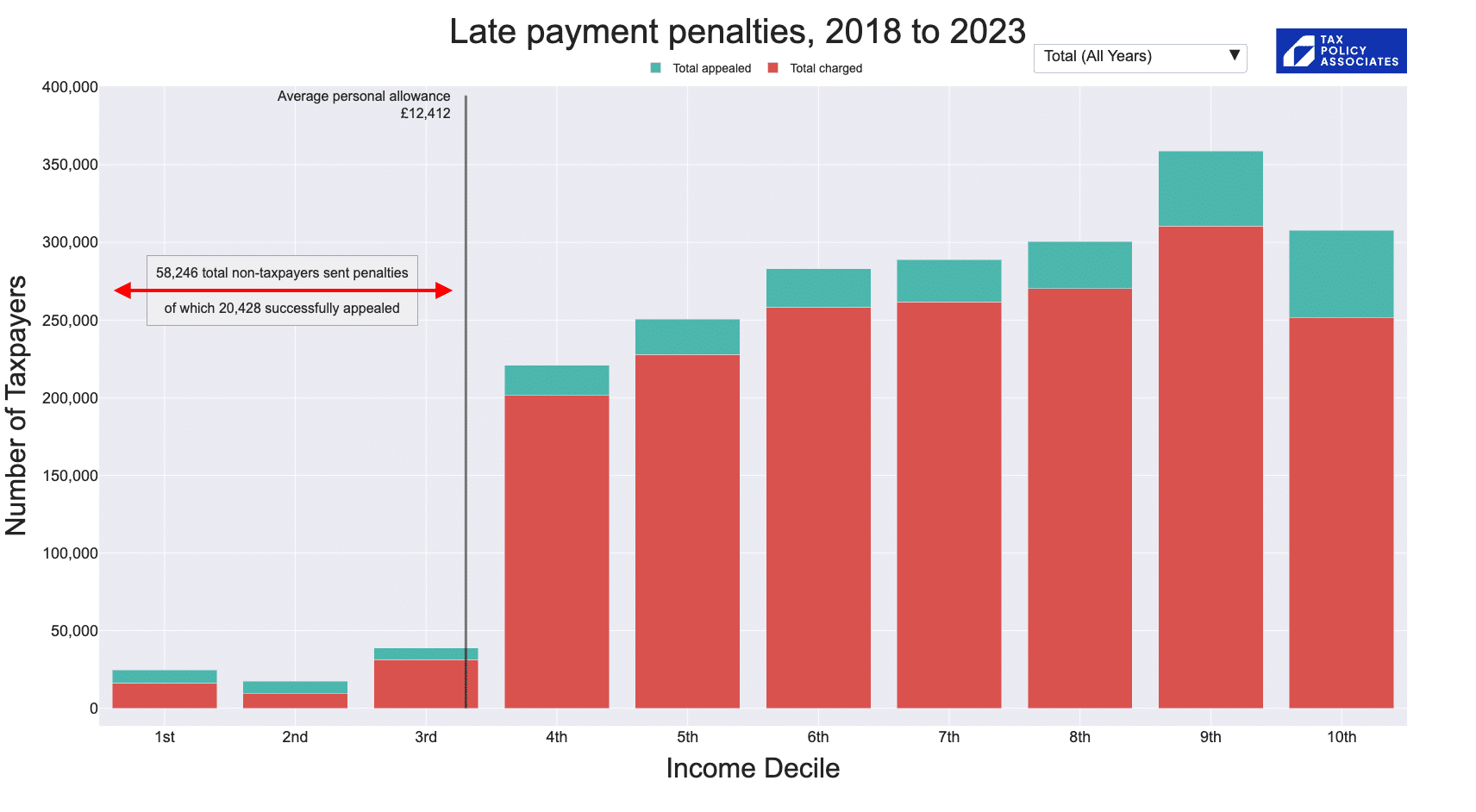

The injustice is made even clearer if we look at penalties issued for late payment of tax, again by income decile:

There were very few penalties issued in the first three deciles – because these individuals only rarely have tax liability.4

The source for the data is this Freedom of Information Act response from HMRC. You can see individual years, and look at the late filing data in detail, in this interactive version of the chart (best viewed in landscape on mobile). The late payment data can be viewed interactively here.

Why does this happen?

When the modern self assessment system was created, a late filing penalty would be cancelled if, once a tax return was filed, there was no tax to pay.

However the law was changed in 2011, and now the penalty will remain even if it turns out the “taxpayer” has no taxable income, and so no income tax liability. At the time, the Low Incomes Tax Reform Group warned of the hardship this could create, but their advice was not followed.5

Why don’t they just file on time? Or appeal?

Since our first reports on this issue, we’ve been inundated with people’s stories. These are disproportionately vulnerable people, often with serious physical or mental health difficulties, living chaotic and difficult lives, sometimes with literacy problems, and often without a settled address.

The same reasons which mean they miss filing deadlines mean they often don’t notify HMRC they shouldn’t be on self assessment6, don’t lodge an appeal, and may take months before they pay the penalties (racking up additional penalties in the meantime).

A successful appeal is not a success – it means that someone with limited time and resources has had the time and stress of navigating what is to many a complex and difficult administrative system.

Are things getting better?

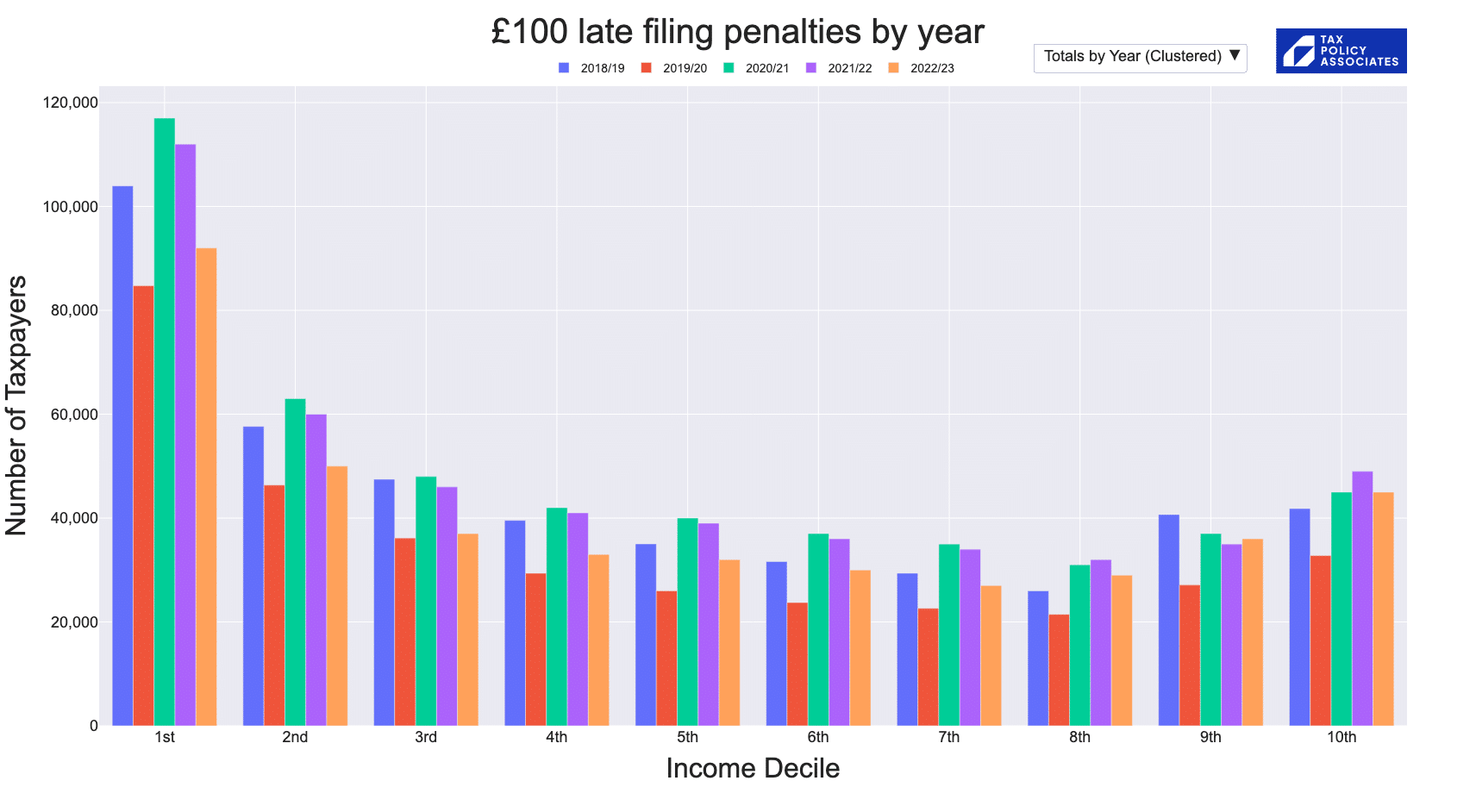

When we published our first article on this issue in March 2023, I thought there would be pressure for change. But I was wrong. We now have 2022/23 figures, for penalties charged in January 2024 – after we published our report:

Nothing has changed.7

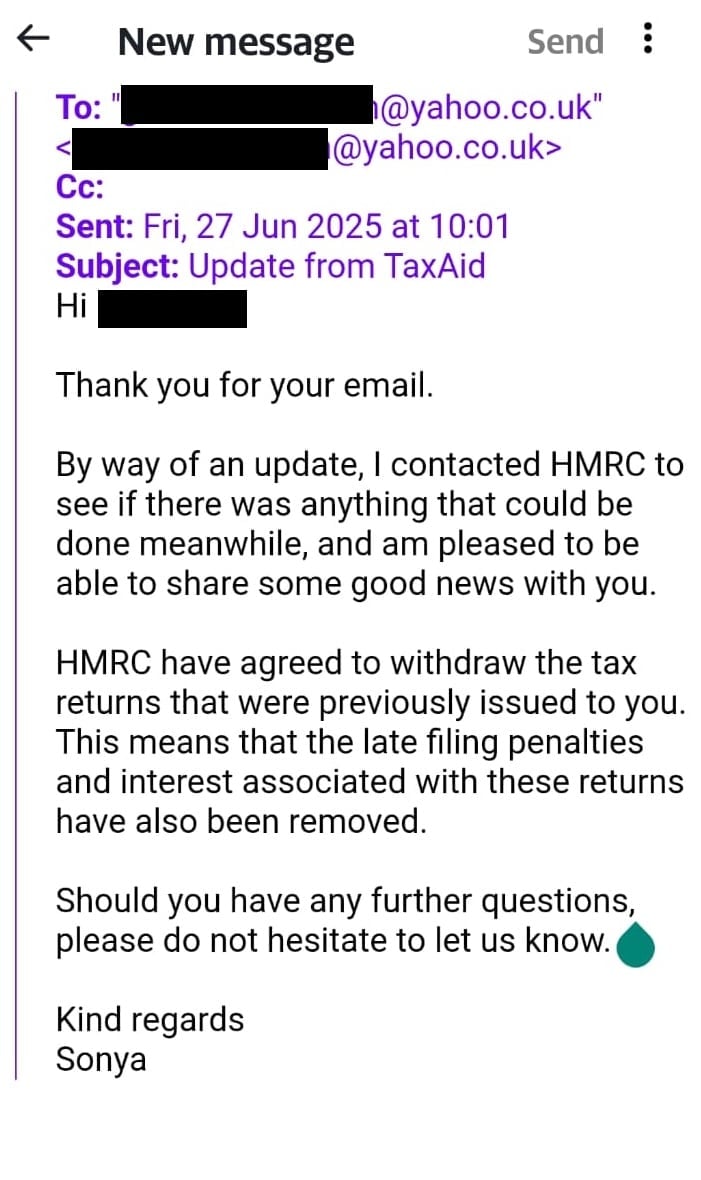

What happened to Andrea?

Andrea’s partner approached us, and we referred Andrea to TaxAid – a charity, staffed by volunteer tax professionals, which provides free tax advice to people in need. I wasn’t sure what they could do, because Andrea was well past the deadline for appealing against her penalties.

Last week, Andrea received this email:

This is amazing news for Andrea, and a tribute to the brilliant work of TaxAid.

But it shouldn’t be necessary.

How to fix it

As part of the Making Tax Digital project, the rules around penalties are changing.

There will be no penalty for the first missed deadline. There will be a £200 penalty for the next year (and any subsequent years).8 And – critically – penalties for late filing can never go beyond £200, so the days of five figure penalties will be over.

This would be a huge improvement. However there is currently no timescale for implementation. Making Tax Digital was itself delayed, and will apply to businesses and individuals with income above £50,000 from April 2026, to those with income above £30,000 from April 2027, and to those with income above £20,000 from April 2028. There is no timescale for implementation for those with income below this.

This means that the very people who are suffering most under the current rules – people on low income – will stay on the current rules, even whilst others move onto the new and fairer regime.

The Low Incomes Tax Reform Group asked HMRC last year to find ways of implementing earlier, for example by using its discretionary powers to waive penalties for people missing a deadline for the first time.

We agree.

The data provides compelling evidence that the Government should go further, and restore the law to how it was before 2011. Nobody should face a late filing penalty when they don’t owe any tax.9

This is one tax reform that should be easy for any Labour Chancellor. The cost would be less than £6m per year.10 There would be a real benefit to some of the poorest and most vulnerable in society.

Many thanks to HMRC for their detailed and open response to our FOIA requests on penalties and income levels. And thanks to all the tax professionals who alerted me to this issue – otherwise I never would have become aware of it.

All the data and code for the interactive charts is here. Our past reporting on this issue is here.

Please consider supporting TaxAid and its sister charity Tax Help for Older People. There’s a joint donation page here.

Footnotes

Not her real name. ↩︎

That doesn’t mean 600,000 people – often it will be the same people receiving penalties each year. ↩︎

Why not “none”? That’s unclear – the first two deciles should contain nobody who actually owes any tax. It could be an HMRC error. It could be that the late payment penalties relate to a different year. We’re not sure. ↩︎

See paragraph 4.4.1 of their response to the 2008 HMRC consultation paper on penalties, repeated on page 5 of the more recent LITRG paper here. ↩︎

This is made worse by the fact that HMRC’s standard letter notifying a taxpayer of penalties doesn’t make clear that you can have the penalties withdrawn if you show HMRC you don’t need to file a return. See page 11 of the LITRG paper. ↩︎

The figures for the most recent year are always somewhat provisional; so the slight dip we see in all the 2022/23 figures will likely disappear when we get updated numbers later in the year. ↩︎

For an annual filer, penalties will apply after a taxpayer incurs two “points”. A year’s failure to file is one point. Points are wiped out after 24 months of compliance. ↩︎

One objection is that this removes the incentive to file. The opposite is the case. Someone who hasn’t filed will face penalties – but the penalties will disappear entirely once they file (or have the requirement to self-assess cancelled). ↩︎

The Freedom of Information Act response from HMRC shows that about 50% of the penalties charged on the first three income deciles are being collected. That’s around £28m over five years charged to people earning too little to pay tax. ↩︎

Leave a Reply to Dan Neidle Cancel reply