One man has set up a series of fake banks on Companies House – with real bank names, no checks, and zero consequences. When he’s caught, he does it again. And he’s been facilitated by a legitimate incorporation agent that, for reasons we don’t understand, incorporated an obviously fraudulent fake bank for him.

This report identifies a serial fraudster, the incorporation agent that enabled him, and how we can stop these frauds in the future.

Meet the fake banker

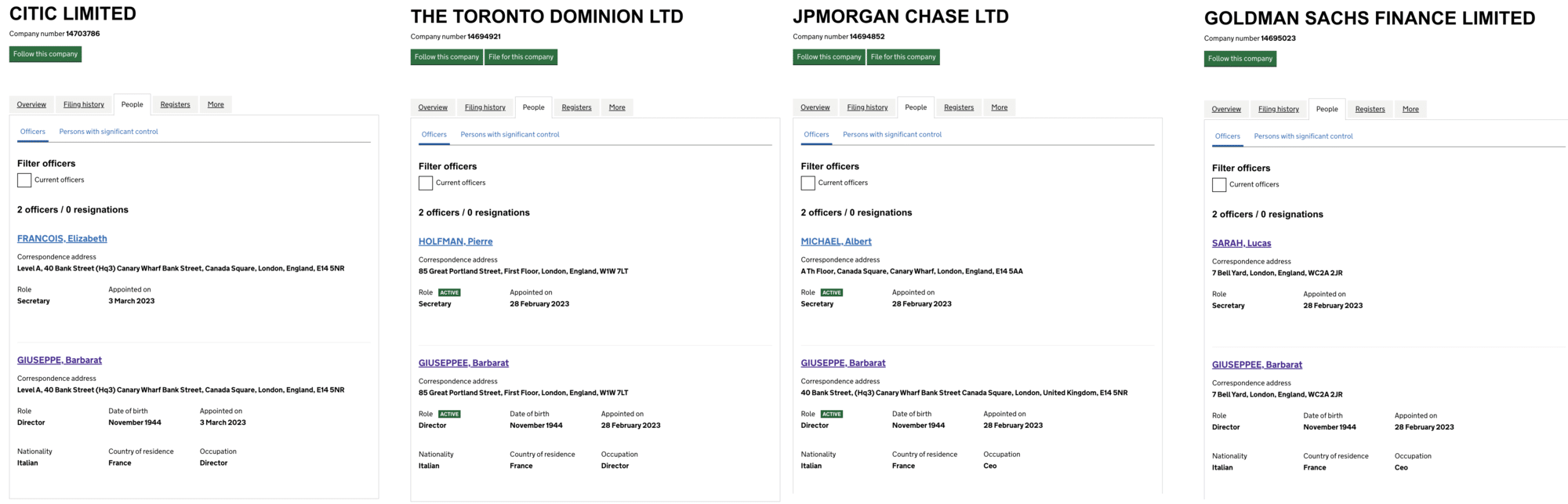

Meet Barbarat Giuseppe, the world’s most prolific banker. He’s run most of the world’s largest banks: JPMorgan, Soc Gen, SEB, Citi, Westpac, Natixis, Goldman Sachs, and many more:

Mr Giuseppe’s spectacular career is spoilt only by the small detail that it’s all fraudulent.

And it’s also spoilt by the other small detail that Giuseppe might not exist, or could be an innocent person whose name has been stolen (although why someone would invent or steal such an unusual name is unclear).1

“Giuseppe” sometimes gets caught. Perhaps an investigator like Graham Barrow spots one of the fake banks and informs the real bank. Then the real bank has to apply to the UK’s most obscure court, the Company Names Tribunal, for an order changing the company’s name. Here’s an example, brought by the real UBS against “UBS Group AG Ltd”. The fraudsters didn’t bother to defend their position, and the company was then renamed to “14695023 LTD” (after its company number).

The problem is that then nothing happens. No investigation by the police or any regulator.

In one case, the bank made a report to the police and was told that it was a civil matter. In another, a bank was told that the police couldn’t take any action unless a victim of fraud came forward.2

The fraudsters therefore act with total impunity.

So what happened after the fake “UBS Group AG Ltd” was forcibly renamed by the Tribunal and Companies House to “14695023 Ltd”? The fraudsters renamed it again – to “Goldman Sachs Finance Ltd“, and kept going. That wasn’t a one-off.

What is the scam? It’s hard to say. One knowledgable insider told me he suspects it’s money laundering – Giuseppe opens up a bank account in a country with slack KYC procedures and provides ID showing he’s the director of Goldman Sachs. But it could be almost anything – investor fraud, money laundering, sanctions-busting…

And Giuseppe is only one of many playing the same game. In 2024 there were nine defended Company Names Tribunal cases (which appear to have been bona fide disputes). There were 339 undefended orders – most of which look like plain fraud.

Who helped him do it?

The fraud is obvious on the face of the companies’ incorporation documents: a company called “UBS Group AG Ltd”, with the declared beneficial owner an individual living in France. It’s obviously nothing to do with the real UBS. The stated (paid) share capital of EUR1bn makes reasonably clear this isn’t someone’s weird game, but simple fraud.

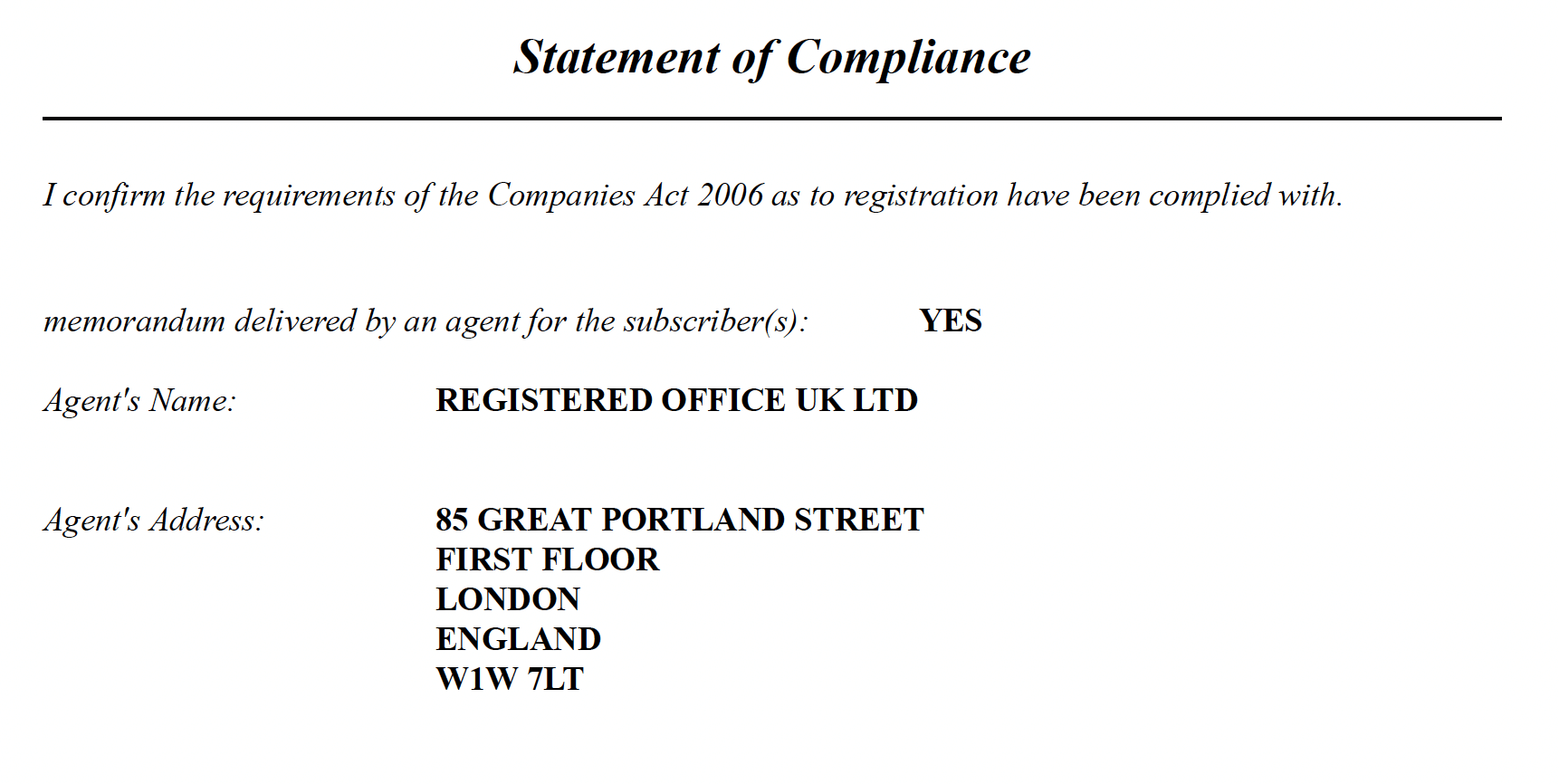

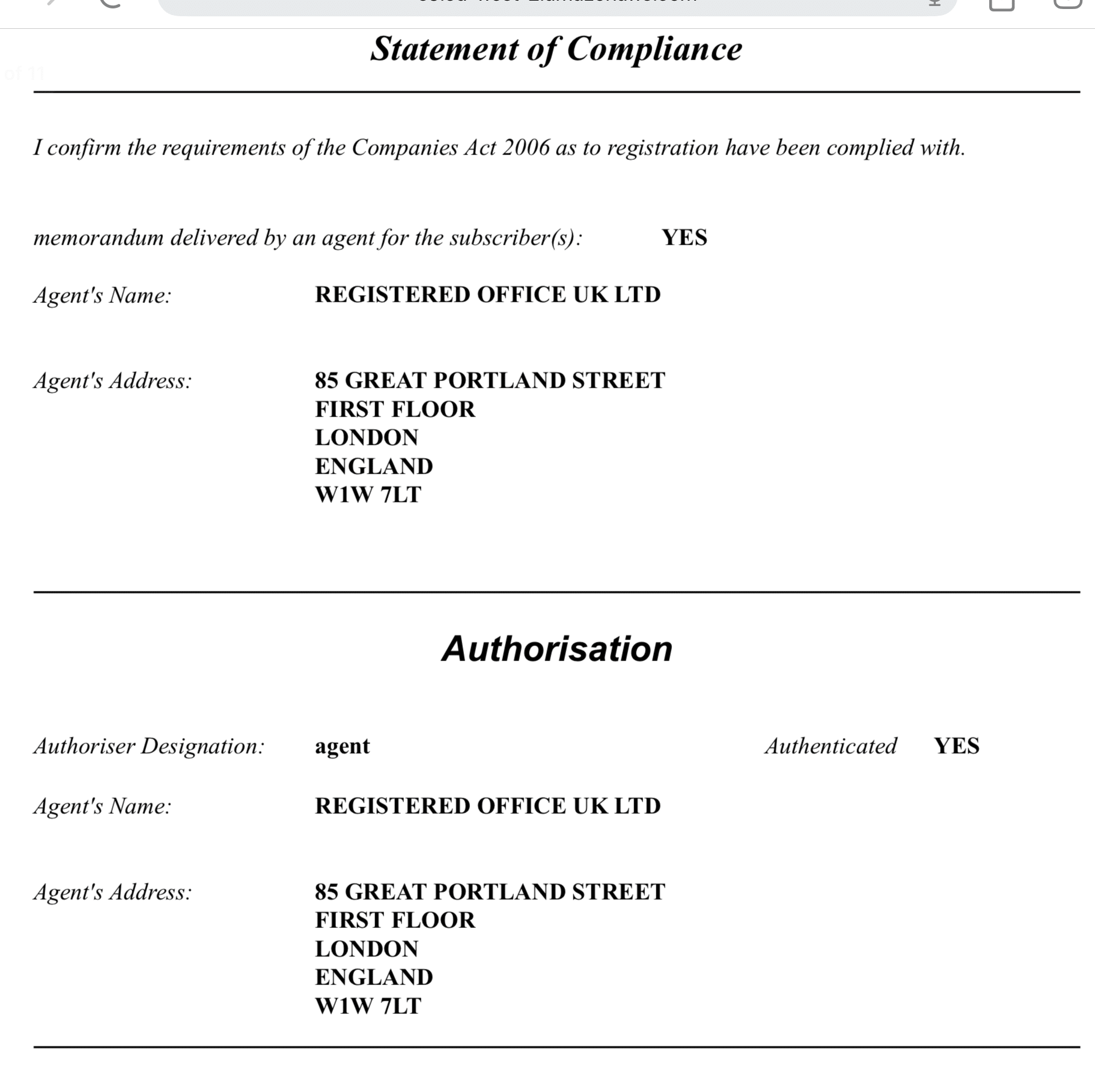

So who incorporated the company? The incorporation document contains a statement of compliance:

The declared agent is “Registered Office (UK) Ltd”, which3 trades as The London Office and MYCO Formations.

We see a statement of compliance from Registered Office (UK) Ltd on all the Barbarat fake bank companies.

The precise status of Registered Office (UK) Ltd isn’t clear to us. Generally speaking, companies providing incorporation or registered office services are treated as a TCSP (trust or company services provider) and have to be regulated for anti-money laundering (AML) purposes, usually by HMRC. However we can’t see Registered Office (UK) Ltd on the HMRC list.4 A previous story suggested that Registered Office (UK) Ltd believed all they had to do to comply with AML rules was to check clients’ passports. This is not correct.

The first response from Registered Office (UK) Ltd

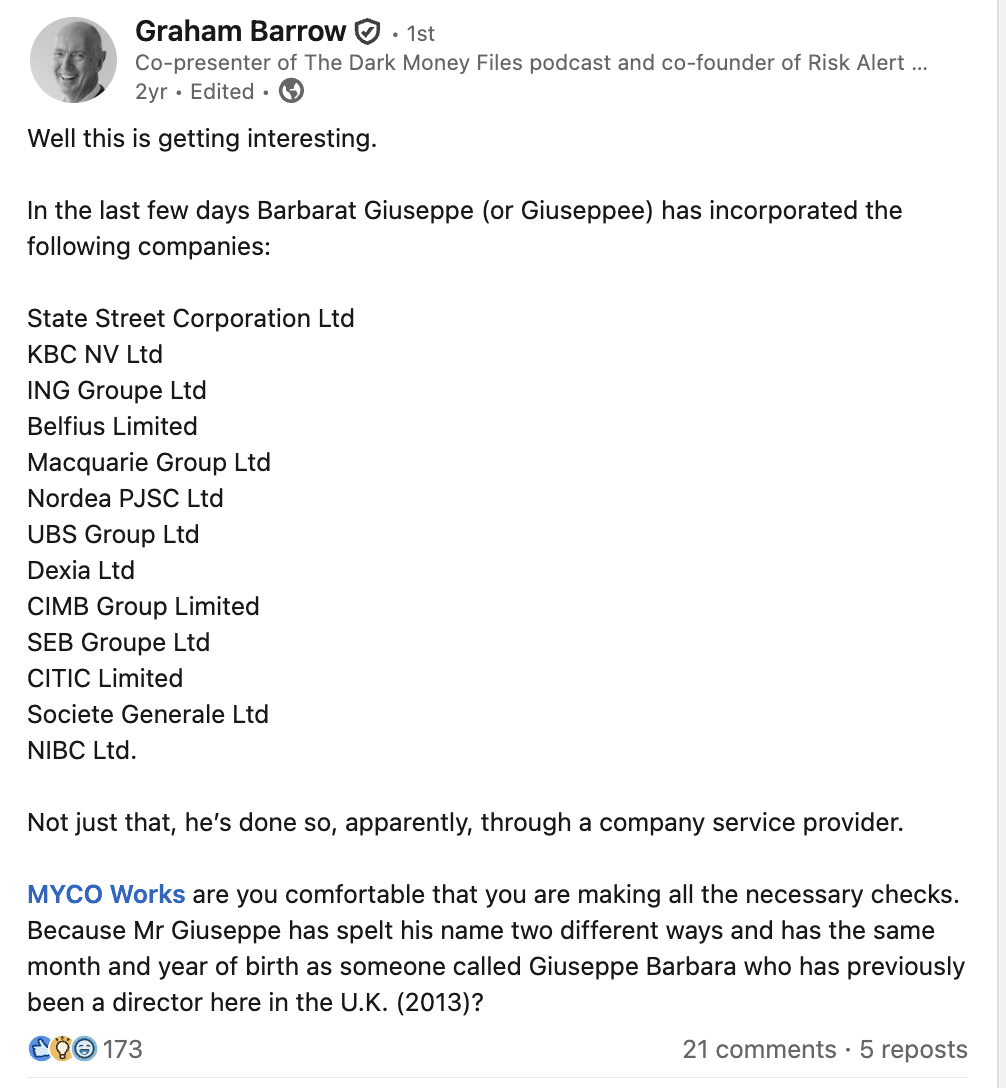

The Barbarat network was first spotted by Graham Barrow two years ago, and he asked MYCO about this.

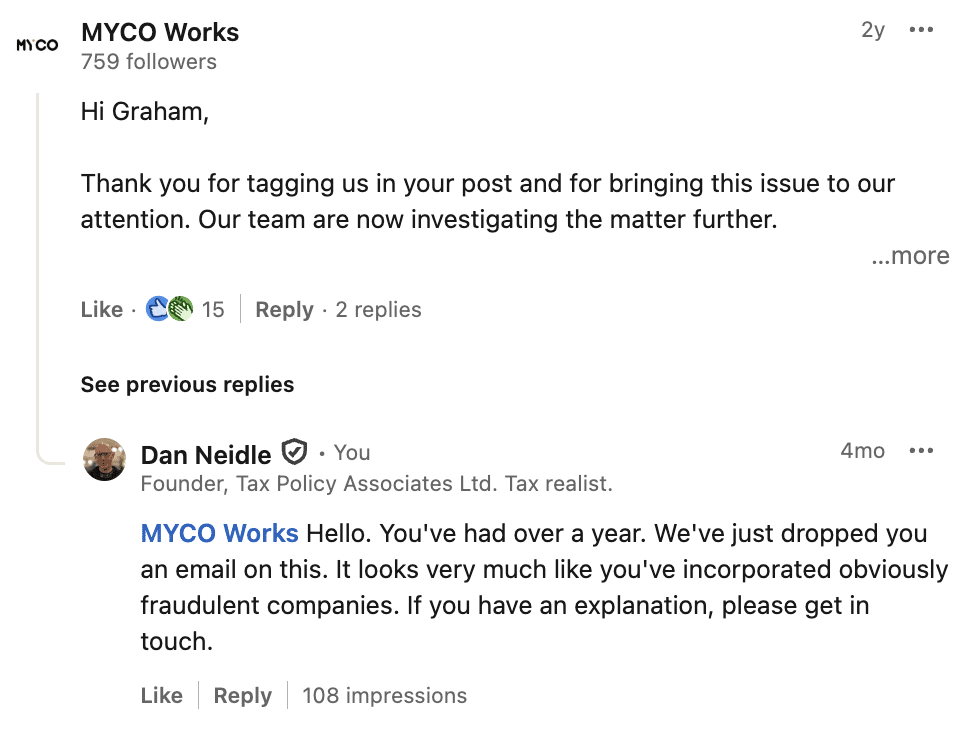

MYCO Works said they’d investigate:

There’s been no response since. Nor was there any response when we wrote to Registered Office (UK) Ltd back in February asking for comment.

Registered Office (UK)’s defence

We wrote to Registered Office (UK) Ltd again this week – and MYCO Works (their trading name) replied. They first claimed the fraudsters “just used our address”. After we pressed, the story changed – blaming their software and, finally, Companies House.

Here’s the complete chain.

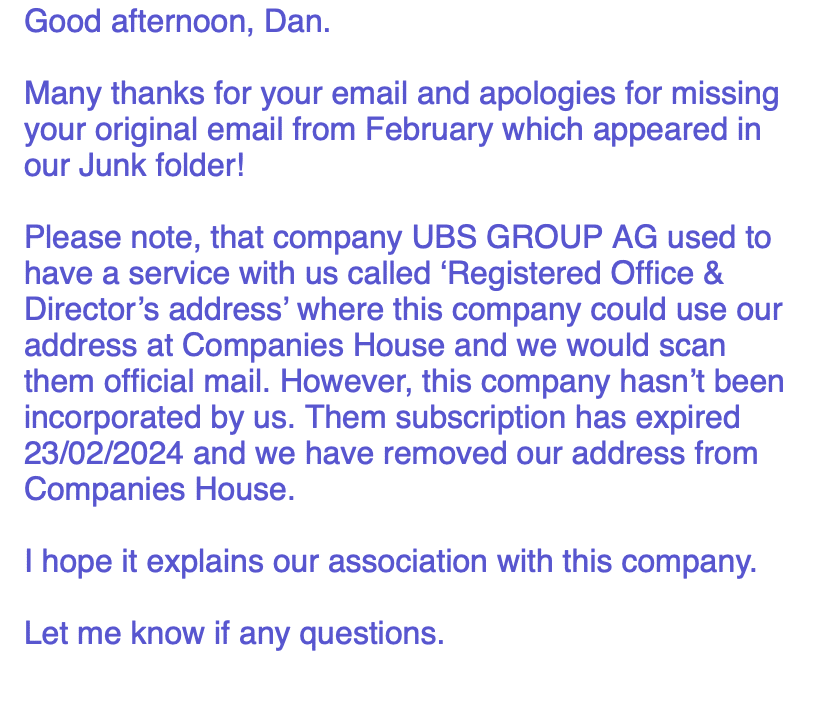

This is Registered Office (UK) Ltd telling us that they didn’t incorporate the UBS Group AG Ltd, but just provided a registered office:

We asked how that could be. The company was incorporated stating that Registered Office (UK) Ltd was the incorporation agent. Even if that could be forged (and I wasn’t sure it could be), surely they would have spotted the forgery, and the other obvious signs of fraud, and not accepted it as a client?

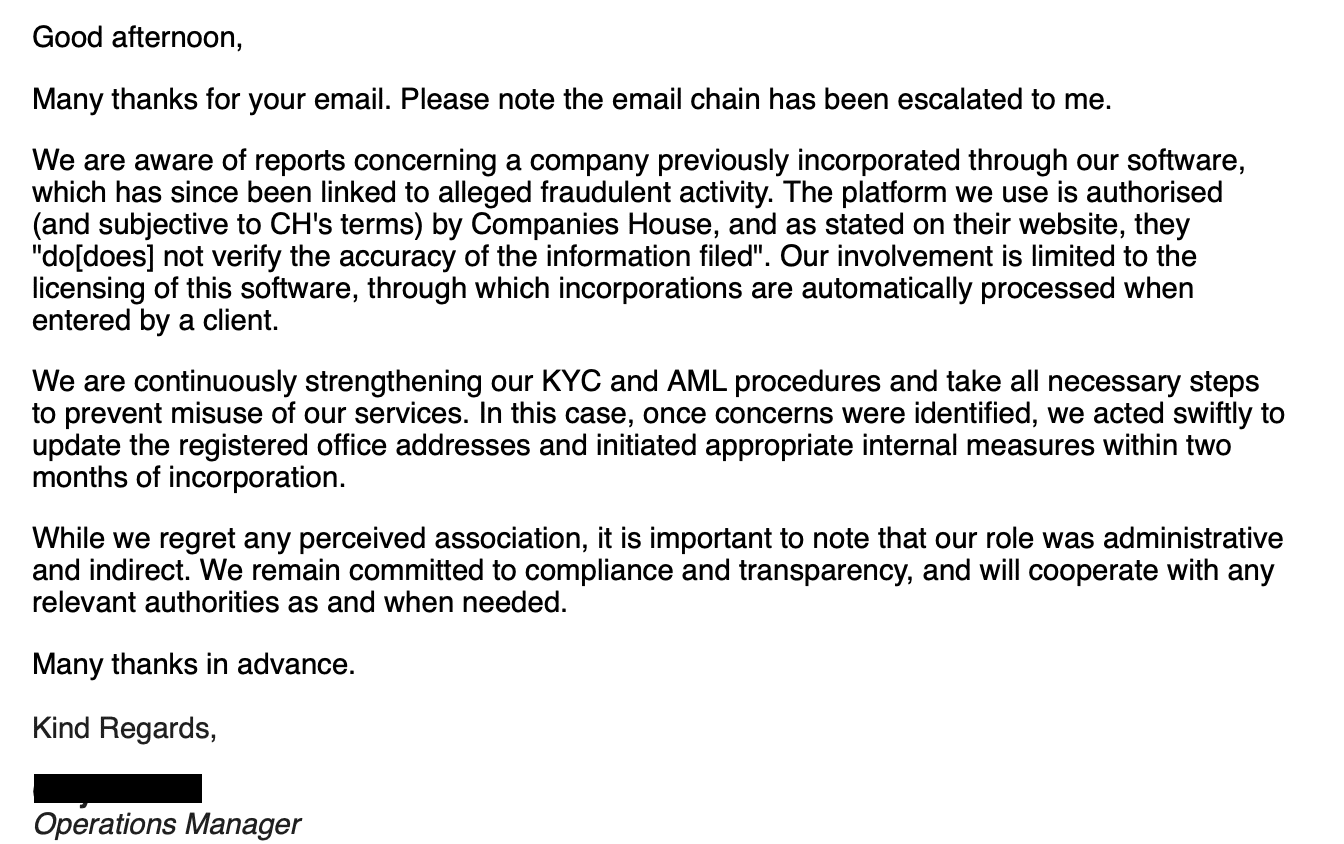

MYCO Works then escalated the matter internally, and we received a completely different response, which doesn’t make much sense:

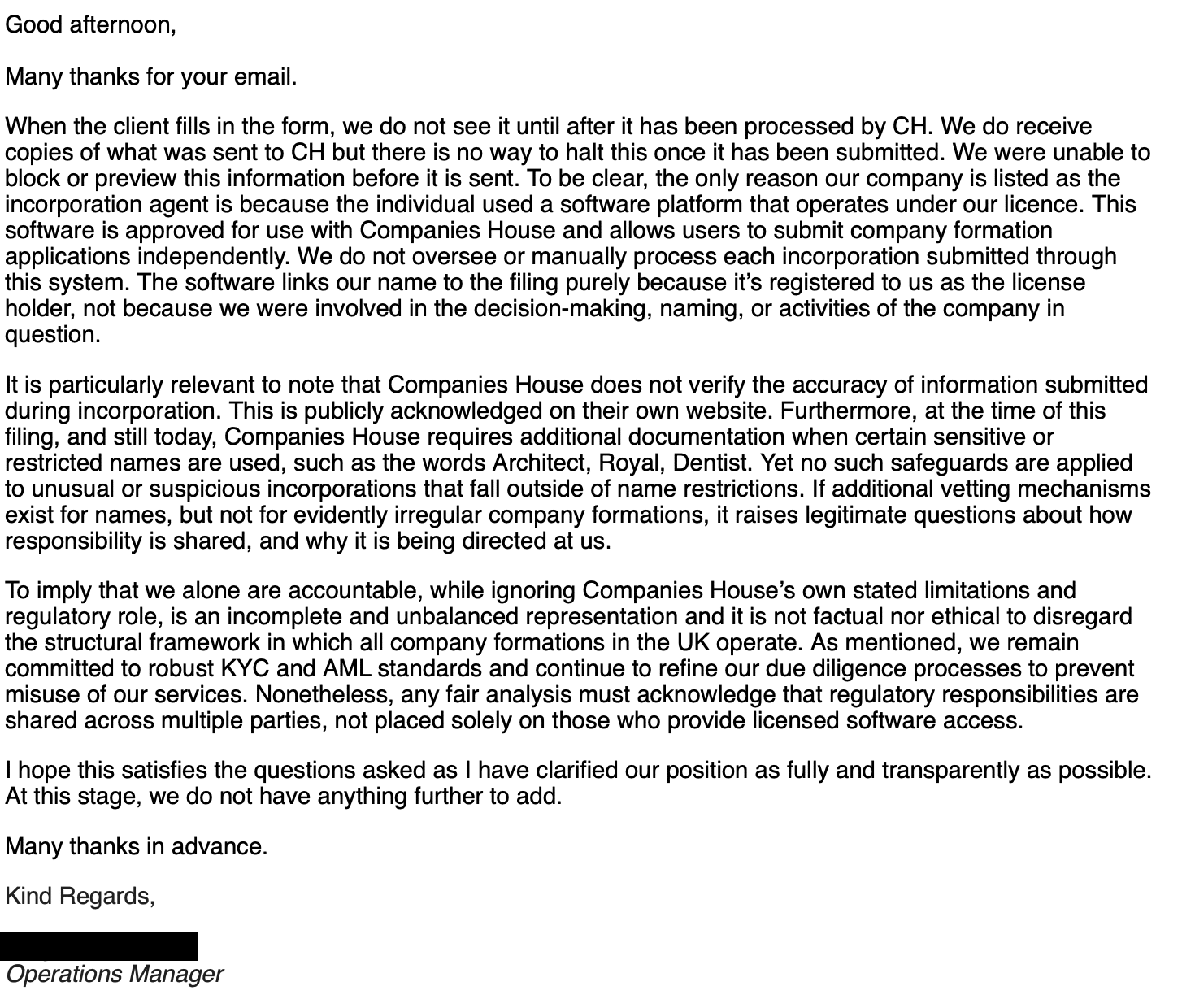

We replied saying that we didn’t understand how they could let unknown people use their software to incorporate companies, and received another response blaming software:

This again makes no sense. The reference to Companies House’s lack of verification looks like a distraction. Legally, an incorporation agent is responsible for companies they incorporate. That’s clear from the statement of compliance filed when UBS Group AG Ltd was incorporated

We don’t know what Registered Office (UK) Ltd is doing, or why it thinks it’s acceptable to let third parties incorporate companies in its name. We can’t imagine they knew that a fraud was being committed, but they seem to have taken the business decision to let absolutely anyone incorporate absolutely anything in their name.

The bottom line: Registered Office (UK) Ltd provided a certificate of compliance for a string of fake banks, each incorporated with obviously fake share capital of hundreds of millions or billions of pounds. Those certificates of compliance were false – and that should have consequences.

How to shut this down

There are three obvious steps that could be taken.

First, we need to see prosecutions. Skip the hard stuff of finding victims of fraud. Do an “Al Capone” and prosecute the easy offences instead. Anyone filing false information with Companies House has committed a criminal offence.

If (as in Giuseppe’s case) they do knowingly, it’s punishable by up to two years in jail. And Giuseppe has claimed to have paid £100m for shares in the fake UBS/Goldman Sachs (almost certainly false), and provided Companies House with a series of false addresses.

Second, Companies House should introduce address verification. Right now anyone can incorporate a company giving Buckingham Palace as their address – there are no checks whatsoever. But if someone falsely uses your address for their company, you have to provide full identification details to Companies House to get it fixed. That doesn’t feel right.

There are many ways to solve this: the simplest would be for Companies House to send automated letters with a security code to the registered office address, and only finalise incorporations once the security code has been entered.

Third: the authorities should go after the facilitators: legitimate businesses who share responsibility for the fraud. Not because they are criminals, but because (we believe) they’ve decided that conducting even small checks is inconvenient for their business. It appears in this case, providing fraudsters (unwittingly but, in our view, unethically) with the means to incorporate companies with zero oversight.

When that business decision facilitates fraud, it should have consequences. The lack of any due diligence suggests a breach of anti-money laundering rules. However the more serious consequence is the basic criminal offence (an unlimited fine but no jail time), which applies to any person who, without reasonable excuse, causes a false document to be delivered to Companies House.

It seems likely that this criminal offence was committed by the company formation agent, Registered Office (UK) Ltd.5 We will continue to see company formation agents facilitating fraud until there is a strong deterrent – meaning well-publicised prosecutions.

Many thanks to N for the original tip, and L, O and C for their input. And, most of all, to Graham Barrow for spotting this network years ago, and for freely providing us with his invaluable expertise.

Footnotes

We’d certainly assume that the other named directors of these companies are fictitious. ↩︎

Neither of these were the UBS Bank AG Ltd case. ↩︎

The missing brackets appear to be an error – there was a company called Registered Office UK Ltd, without the brackets, but it dissolved in 2015, eight years before the fake UBS company was incorporated. ↩︎

It’s also not on the FCA register. The HMRC list does list “MYCO Works” as a trading name of Alpha Commerce Ltd, and “London Office” as a trading name of Cooper Davis Associates Ltd, but we don’t know if these are the same businesses – the London Office and MYCO Works websites clearly state that the relevant legal entity is Registered Office (UK) Ltd. Either way, if Registered Office (UK) Ltd is undertaking incorporations then it ought to be registered. ↩︎

Unless they had a “reasonable excuse”. Our view is that letting third parties submit documents for you, without checking them is not a “reasonable excuse”. ↩︎

26 responses to “Who’s behind the fake banks on Companies House?”

Has anyone checked if these fake companies have applied for bounceback loans, furlow or other grants and loans? That could be the fraud. I know a few individuals that abused the system during the pandemic incorporating companies to get the bunceback loan then leaving the country. Would be great to get a list of how many companies never paid back the bounceback loan, or disolved when it was time to pay it back.

I believe there are other ways forward.

Government scrutiny and potential reforms: Failure to meet obligations could lead to investigations, reforms, and changes in how Companies House operates, as seen with the recent Economic Crime and Corporate Transparency Act 2023.

Legal challenges: Companies or individuals impacted by failures in Companies House’s processes could potentially initiate legal challenges, seeking rectification or compensation.

1. I will create a government petition please sign;

2. E-mailyour local MP;

3. Ask the banks and other financial institutions to seek Companies House to change the validation process as the FCA to support the Companies House change request and or petition to government.

https://petition.parliament.uk/

It is, of course, a curious matter that a company cannot be incorporated with “bank” in the name unless holder of a banking licence but there is any number of banks without “bank” in the name, UBS (formerly Union Bank of Switzerland), Goldman Sachs etc being but two. I suppose the problem will increase as more banks “dumb down” and shorten their names.

“Strukov” sounds like something of a joke in the context!

It’s worth noting it takes about six months to get a name changed via the Company Names Tribunal (even for undefended ones) and basic legal costs and application fees are £5k+. Even if you spot it immediately you have all that time where the fraud risk is heightened. Totally agree this is the kind of thing the UK needs to tighten up on to reduce risks and costs of fraud.

Hi Dan, Myco Works says ‘We are continuously strengthening our KYC and AML procedures and take all necessary steps to prevent misuse of our services’. Did you ask what steps they take?

From the information you and especially they supply in their email replies it seems they state they do absolutely zero checks while knowingly providing a certificate of compliance and thus being the incorporation agent. They also imply they will continue to do zero checks as they just license the software.

Did you ask for or get any additional information on the checks or decided there was little point?

I’ve asked who their AML regulator is. Will update if/when I hear back.

I hope Registered Office (UK) Ltd’s compliance with tax matters has improved since the last set of accounts were lodged at CH. I see many companies with “other debtors” as a significant element of the balance sheet, the figure in the accounts grows year on year.

In fairness Tom, we do not know what disclosure is made to HMRC in the tax computations and potentially tax paid thereon under the likes of Section 455 (loans to participators).

Asking for a detailed analysis of large Other Debtors’ figures is built into HMRC’s risk assessment procedures and will often lead to a full enquiry in an owner-managed business.

Companies House is a complete shambles!

You should try and incorporate a company through the agent to see what the process is.

I have thought about trying to incorporate “Amalgamated Fraud Inc”, with paid share capital of £100 trillion – but concluded that the SRA might not think it’s a great joke. I’m also conscious one of the very few prosecutions for making a false application was this guy: https://www.independent.co.uk/news/uk/home-news/companies-house-fraud-whistleblower-prosecuting-kevin-brewer-vince-cable-a8307246.html

Thanks Dan

I come across companies all the time with matching 2022/2023 figures…etc

In Companies House Balance Sheets

As a Caymanian who see how rigorous the Cayman Island Monetary Authority and General Registry are with all the areas of compliance, once again I shake my head at how the UK constantly tells Cayman how to handle such areas as beneficial ownership registers when CH is so poor that you really couldn’t make this stuff up.

I also note that the other day, they backtracked on having micro and small companies a) file electronically, and b) file financial statements.

Only part of this was problematic to me, that of filing full financial statements (rather than abbreviated ones) that would then be open to the public, as this is sensitive commercial information.

Other than that, yes, electronic filing, yes, filing of financial statements, as well as full filings annually of any changes in directors, officers, shareholders.

CH could easily have made the small adjustment I note here, of still having full financial statements filed, but only having (at most) abbreviated ones as public record (as is the case with companies above the small companies threshold right now).

They COULD have done this, but no, they just cancelled the whole thing, so here we stay, with the (woefully insufficient for purpose) old systems and rules.

In closing, once again I offer to connect anybody in authority from the “mother country” to their highly skilled and experienced counterparts in Cayman, they would be happy to support when the UK is ready to commit to a world class system.

Tom, this is high satire worthy of the late great Peter Cook, or the Pythons at their peak. Or are you doing this with a straight face? Either way, hilarious!

My thoughts on electronic filing is that it doesn’t stop false accounting. You just put junk data into your software and file it. What benefit does it bring to make a micro entity pay for software that can cost hundreds of pounds a year?

If it is in a controlled format, you can let AI loose on it…

Are you are doing amazing work, Dan. Huge respect, and congratulations.

According to HMRC’s Supervised Business Regsiter, Myco Works is a trading name of Alpha Commerce Limited. If that is this company (04983758), the director is called Aleksej Strukov. Aleksej Strukov (I dpon;t know if it is the same one) is mentioned in this article about company formations: https://www.occrp.org/en/investigation/ownership-of-chemicals-that-exploded-at-beirut-port-traces-back-to-ukraine

I’m not sure this is the same MYCO Works.

Various lack of verifications at Companies House would seem to reflect a conscious choice. The balance to be struck is between speed, simplicity and cost vs rigour. I would expect that more good than harm has come from the current balance in the form of greater economic activity vs fraud.

You may disagree but I would assume that you acknowledge the balance exists. We shouldn’t allow a very small minority of fraudsters to harass and hamper the vast majority of genuine users (waiting for a verification code in the post is not a minor process change).

Rather than changing the front end the preferred solution would be greater enforcement in my view.

Great work on the investigations.

I agree. It’s unfashionable to say so, but we always choose to accept a level of fraud. Sometimes a very low level (say: a large law firm conducting AML on its clients). Sometimes a high level (Covid loans; I think a deliberate and sensible policy choice). Companies House’s automation in the 2000s *accidentally* created a high level of fraud. There was never a cost/benefit analysis. The pendulum swung *way* too far.

‘waiting for a verification code in the post is not a minor process change’ Really? I think it is. Identity fraud is a growing problem beyond this particular challenge. Anyone incorporating a company that can’t wait a few days has a serious problem with planning.

Are Registered Office UK Limited on HMRC’s register of TCSPs?

Yes, they are. That only covers AML compliance & regulation – although they’re probably lax there as well.

From next year, TCSPs will need to be registered separately with Companies House as an ACSP in order to be able to file information on behalf of other entities. I do hope CH make good use of their new powers to withdraw ACSP registrations from agents filing plainly wrong information.

are they? I couldn’t see them. https://www.gov.uk/guidance/money-laundering-regulations-supervised-business-register