A new analysis by Tax Policy Associates shows that 900,000 UK companies have no UK directors – all their directors live abroad. This is permitted by current UK company law – but our analysis finds that these companies are seventeen times more likely to show signs of fraud than companies with at least one UK director.

This isn’t a coincidence. UK directors face fines and (at least in theory) prosecution if they file false information with Companies House. Foreign directors are in practice untouchable. Companies House has now been given a much wider enforcement role. But if this is to mean anything, then all UK companies should have someone in the UK who is accountable when false documents are filed.

It’s an easy problem to solve – we can require all UK companies to either have at least one UK director, or appoint a UK agent who is accountable for the accuracy of the information the company files.

Our findings

After several well-publicised cases of companies fraudulently using someone’s home or office address1Companies House was given new powers in 2024. Victims of “address theft” can now notify Companies House, which will then change the company/director’s address to Companies House’s “default address”.2 Here’s an example.

It is possible that a company or director could provide an incorrect address by accident, but we and other researchers believe that these are mostly instances of fraud. We can therefore use the number of companies using the “default address” to create a (lower-bound) estimate of the number of fraudulent companies. It’s very much a lower bound – there will be many frauds which don’t involve a false address.

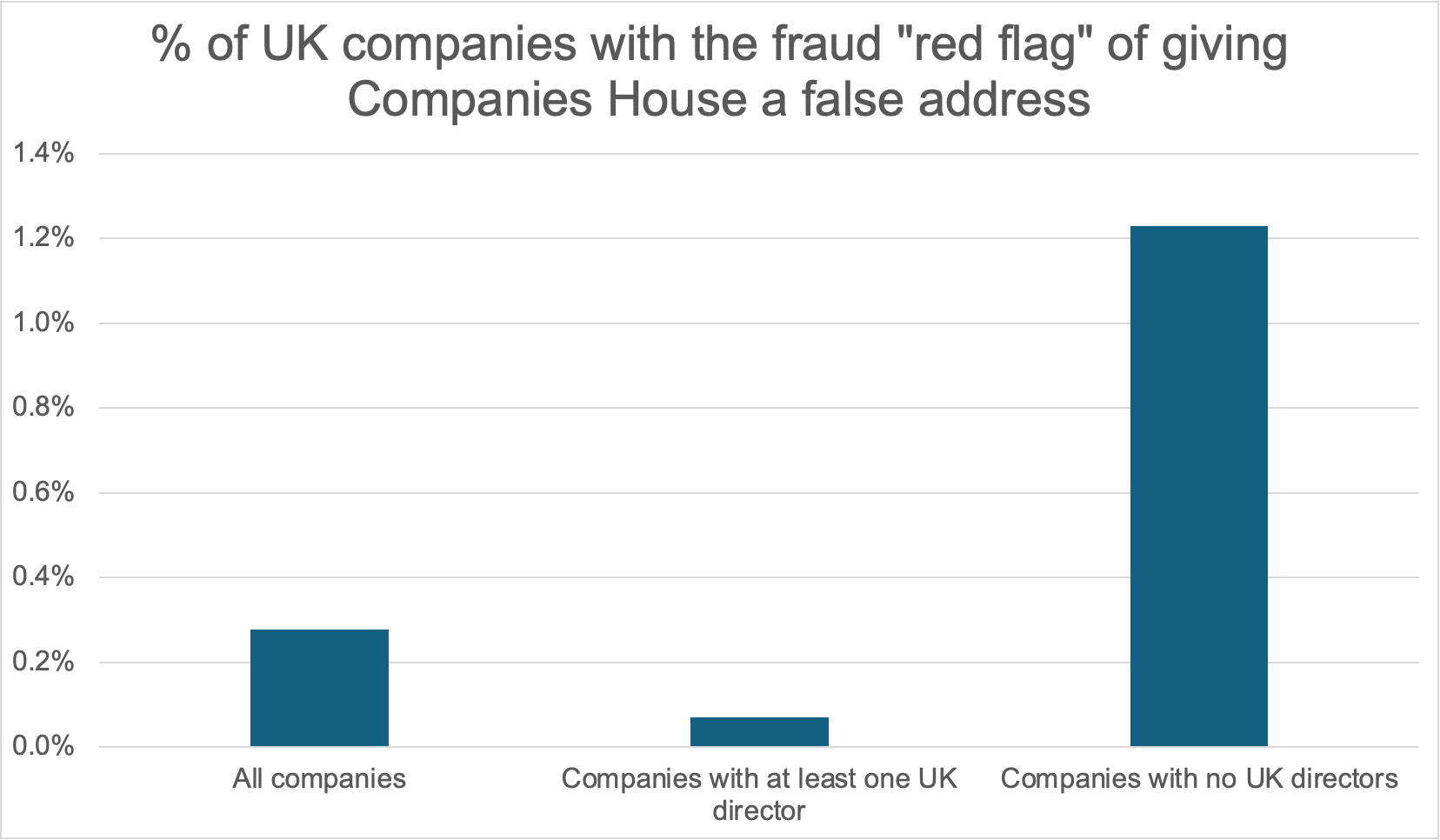

We analysed 209,431 active companies randomly selected from the 5.1 million currently on the Companies House register. We found that 17.8%3 had no UK directors, implying that 900,000 out of the total 5.1 million active companies have no UK director. We then looked at how many of these companies had the fraud “red flag” of a Companies House default address, compared with active UK companies that had at least one UK director.

The difference was startling:

0.07%4 of active companies with at least one UK director had provided a false address. That compared with 1.2%5 of companies with no UK director.

This “red flag” for fraud is, therefore, over seventeen6 times more likely for companies with no UK director.

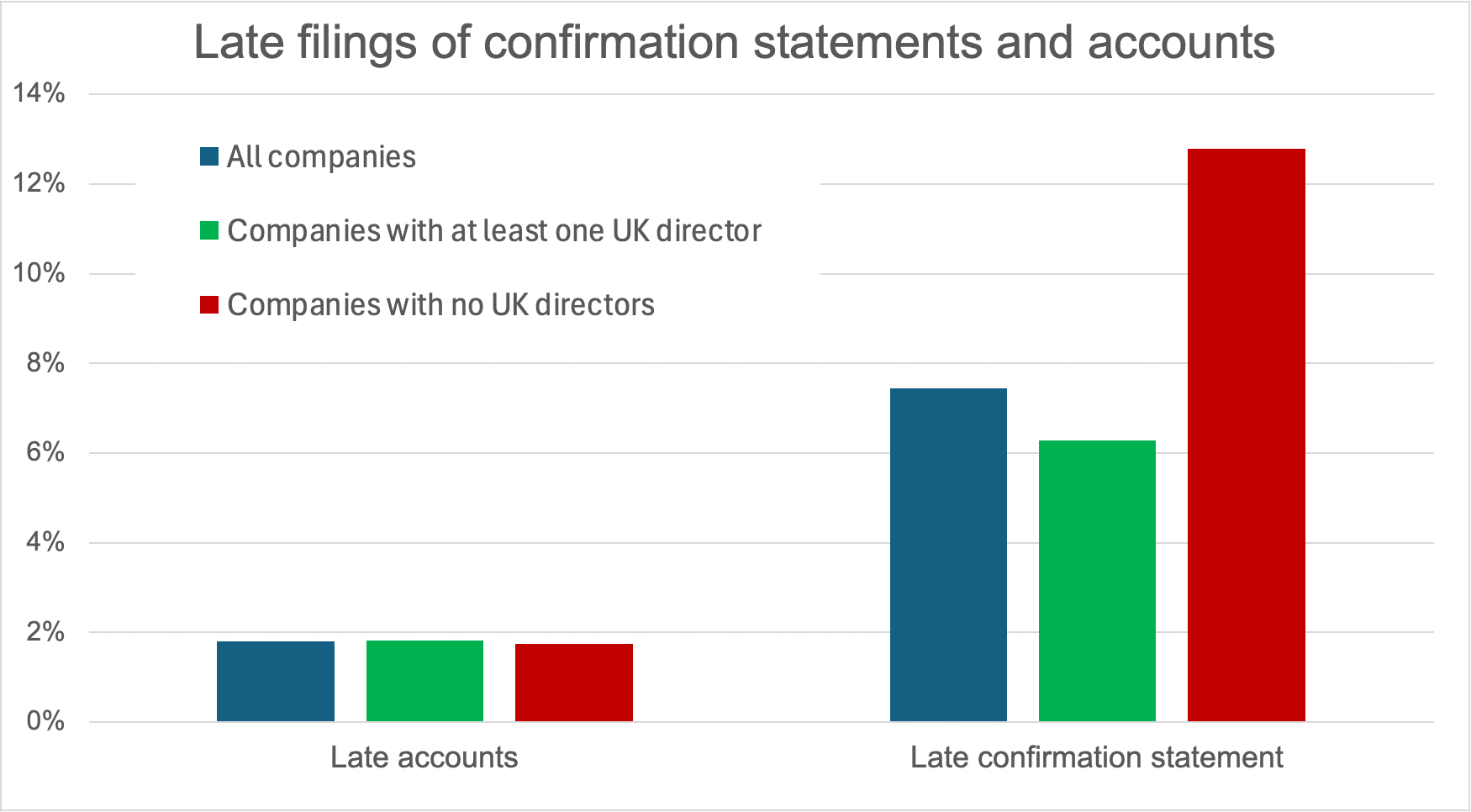

We also looked at late filings of accounts and annual confirmation statements (confirming that all information is correct and up-to-date):

Companies with no UK director were also twice as likely to be late filing their confirmation statement as companies with at least one UK director.7 However there was no statistically significant difference for late filings of accounts.8

Graham Barrow’s findings

Graham Barrow is an independent fraud investigator who advises investigative journalists and financial institutions on financial fraud, particularly frauds involving Companies House.

Graham has tracked every single company (active or dissolved) which had its registered address, correspondence address and the PSC address all defaulted to Companies House on the same day. There are 51,910.

This is a different population to the one we were looking at: it is broader in scope (catching companies that no longer exist) but also more stringent (we mark as potentially fraudulent companies that have either their registered office address or a director’s address changed to the default address: Graham looks for three simultaneous defaults). It’s fair to say that it’s very unlikely this will be an accident; it’s a clear sign of fraud.

Given our findings about the prevalence of non-UK directors, we’d expect 9,240 of the 51,910 companies have entirely foreign directors. In fact, Graham finds 30,662.

That implies that (using Graham’s metric) companies with only foreign directors are over six times more likely to be fraudulent than companies with at least one UK director.9

As with our figure, this will be an under-estimate, because a significant proportion of the apparently UK directors will in reality be foreign individuals concealing their identity and/or location.

Why?

It is well-established, as well as common sense, that people are more likely to follow laws if there are consequences to non-compliance.

A foreign director whose company files false information or commits fraud will in practice face no adverse consequences.

We understand that Companies House is now sending out many more statutory fines to directors of non-compliant companies. But when the directors are based outside the UK, the fines are likely to be ignored. Criminal prosecution will in practice be out of the question.

Companies House is introducing identity verification later this year. That will make it harder to incorporate companies with fake directors, or using stolen identities. Anyone who wants to use a company to commit fraud will have a powerful incentive to use foreign directors who the UK authorities won’t be able to trace.10

So a new answer is required.

The answer

In many countries, you can only incorporate a company if it has at least one local director. That’s true for Australia, Canada, Singapore, for example.

Other countries, including many tax havens, permit companies to be incorporated with no local directors, but they must appoint a local agent who is responsible for anti-money laundering (AML) checks and/or verifying the information that’s filed. For example, the BVI, Guernsey, Jersey, the Cayman Islands, Delaware.

In the UK, normal UK companies have no such requirement.11 But there is a similar requirement for “overseas entities” owning UK property. They’ve had to register with Companies House since 2022 – and an overseas entity has to appoint a UK-regulated agent to verify the ownership information it files with Companies House.

The obvious answer is to treat a UK company with no UK directors in the same way we treat an overseas entity: require it to appoint a UK-regulated agent. UK companies file much more information with Companies House than overseas entities, so it’s reasonable to expand the scope of the agent’s duties. One approach would be to require the agent to conduct reasonable checks before filing information, with the agent liable if it fails to do so.

A UK-regulated agent would need to charge a commercial fee to reflect both the level of work this requires, and the risk it would be undertaking. That may make it unattractive for some foreign individuals to incorporate or maintain a UK company. We don’t see that as a problem for the UK.

It’s cheap and easy to incorporate a company in the UK. That creates an opportunity for fraudsters; but it also helps small and micro businesses in the UK. A policy decision has been taken, rightly or wrongly, that the balance lies in the direction of ease of incorporation.

But the position is very different for UK companies with no UK director. It’s hard to see any public interest in reducing the cost and administration associated with such incorporations. In few if any cases is there a benefit to the UK. But the UK does suffer the consequences of fraudulent incorporations, both directly and in the damage to its international reputation.

It’s reasonable for us to tell people outside the UK that they’re welcome to incorporate a UK company, but they’ll have to either appoint a UK director, or appoint an agent who will be responsible for the company’s filings.

We’ve discussed this proposal with many people in business and government, and we’re yet to hear a convincing argument against it. There’s general agreement that the UK’s standards should be at least as high as those of its tax havens.

Methodology

We created a random sample of 209,431 active companies from the Companies House “snapshot” and then queried data on those companies’ directors using the Companies House application programming interface (API) – a way that Companies House lets researchers and businesses query their database programmatically.

This took two days, because Companies House limits the speed at which people can access its servers – if we’d analysed all 5.1 million companies this would have taken six weeks.

An obvious consequence of not analysing the whole database is that there will be statistical error – the expected error can be calculated using well-established statistical sampling techniques. If we’d just wanted to estimate the percentage of companies with all foreign directors then we’d only have needed to sample a couple of thousand companies – but the relatively small percentage that are fraudulent meant that we needed a significantly larger sample size to reach a statistically significant result.

We identified directors as UK-based if they gave their residence as UK12 and their address identified them as being in the UK. 19.4%13 of directors give their residence as UK but provide a foreign address – that is unlikely to be correct and so we classified these directors as non-UK.14

We then counted the number of companies in the sample which hadn’t any UK directors, and looked at how many of these had been given the Companies House default address for either the company itself or one of the directors. We compared that with the figure for companies with at least one UK director.

The full code is available on our GitHub.

Thanks to Graham Barrow for his insight and generously sharing his data. The recent transformation of Companies House’s role is substantially thanks to him.

Thanks to K for help with the coding and to P for help with the statistical analysis. And, as ever, thanks to J for reviewing the draft.

Photo of Companies House © Glass Facades Ltd.

Footnotes

The report says 150,000 companies were identified with fraudulent addresses. Many of these companies will now have been struck off and won’t be included in our analysis. We’re looking at currently active companies only. ↩︎

This is the only way the “default address” will be listed for a company (although there is a similar process for PSCs which is outside the scope of our analysis. There’s a good summary of the 2024 changes here. ↩︎

The sampling error on this was ±0.16% at 95% significance ↩︎

Sampling error ±0.01% at 95% significance. ↩︎

Sampling error ±0.11% at 95% significance. ↩︎

17.03 ±3.37 at 95% significance. ↩︎

6.29% ±0.11% of companies with at least one UK director are late compared with 12.78% ±0.34% of companies with no UK director. ↩︎

1.82% ±0.06% for companies with at least one UK director, and 1.74% ±0.13% for companies with no UK director. That’s an interesting finding, and one we’ll investigate further. ↩︎

If we assume that our 17.8% is valid historically as well as for current active companies, we find the ratio with (30662 * 0.822) / (21248 * 0.178). Why is this a different number from our figure of seventeen? That could reflect the propensity for different types of companies to commit different types of fraud, or it could reflect the way Companies House uses its powers. ↩︎

Or indeed “muppets” – UK individuals hired off Facebook for a small fee, to act at the behest of the true owner. We talked about this problem in a previous report, and discussed possible solutions. ↩︎

There are businesses who act as a registered office, trust or company service provider (TCSP). They’re registered with HM Revenue & Customs (HMRC) for AML supervision (unless supervised by another body like the Financial Conduct Authority). A TCSP has a legal obligation to conduct due diligence on its clients, including verifying the identities of beneficial owners and directors. But it isn’t mandatory to engage a TCSP. ↩︎

The Companies House data is extremely poor. The residence provided by directors is full of correct variants (e.g. “Great Britain” vs “United Kingdom”), inconsistent variants (“Gt Britain”), regions (“Yorkshire”), spelling errors (“Ubnited Kingdom”) and misunderstandings (“Teacher”). We manually checked this and ensured that all variants were correctly classified. ↩︎

±0.11% at 95% significance ↩︎

This will be an under-estimate because we’re accepting people’s claim of their residence. A foreign director who wants to be deceptive could easily use a false or stolen name, claim to be UK resident, and then either use a UK forwarding address or a completely false address that was unlikely to be reported. ↩︎

5 responses to “UK companies with no UK director are 17× more likely to show signs of fraud”

One answer might be a better use of technology many on-line ID&V solutions are available on the market – financial services have been using digital ID identification and verification for years and also for Know your Customer(KYC) digital solutions for upload of address information. No solution will be perfect but my view isa better use of technology would also act as a deterrent.

One of the issues with the solution is that UK directors can be and are recruited through Facebook etc, and may similarly have no assets. This is a problem with the Mini Unbrella Company frauds that you have highlighted.

Uk directors or agents is good (though some of them are less than honest!) but ultimately there needs to be a lot more human checking before anyone gets to set up a company and I don’t think they should have limited liability in many cases, until there is some substance or other checking.

We are as a country like a one armed bandit that pays the player every time, often with a free play, with our loose checks. This includes a ‘pay now, ask questions later’ approach- which tells you all you need to know about the ‘real world’ awareness of HMRC. Thanks to this attitude we have about £50m of lost spending.

Unfortunately the numbers are just too large for human checking to work. We could follow the approach of Caymans etc, and require *all* companies to have a responsible UK agent – but that would greatly increase costs for small/micro businesses.

Dan, thank you for highlighting once again how poor the system is in the UK. That 17% of companies have no directors and have not been fined or struck off is a massive dereliction of duty by our government.

As a Caymanian, once again I highlight that instead of attacking Cayman (a UK overseas territory), the UK would be well served to reach out to Cayman to ask for their support an expertise in how to regulate and ensure compliance of registered entities.

Though I live in London, I remain very much connected with Cayman and with this area of business and expertise, I once again offer to connect anyone seeking to improve the UK systems with the right people in Cayman.

This is a massive scandal hiding in plain sight. The lack of regulation here is truly astounding. Let’s hope the government takes notice and heeds the call for urgent reform