Many fraudulent companies at Companies House are run by entirely fake directors – non-existent people with fabricated identities. But many others are fronted by “muppet” directors: real individuals, often recruited through Facebook, who lend their names to companies they don’t actually control. The true masterminds behind the fraud remain in the shadows.

From next month, we’re likely to see a surge in muppet directors. Companies House is introducing ID verification rules, making it much harder for fraudsters to register fake identities. The fraudsters’ likely response? Recruit more muppets.

Companies House needs to act to end muppet directors – and we have a simple proposal.

Donna

Meet Donna:1

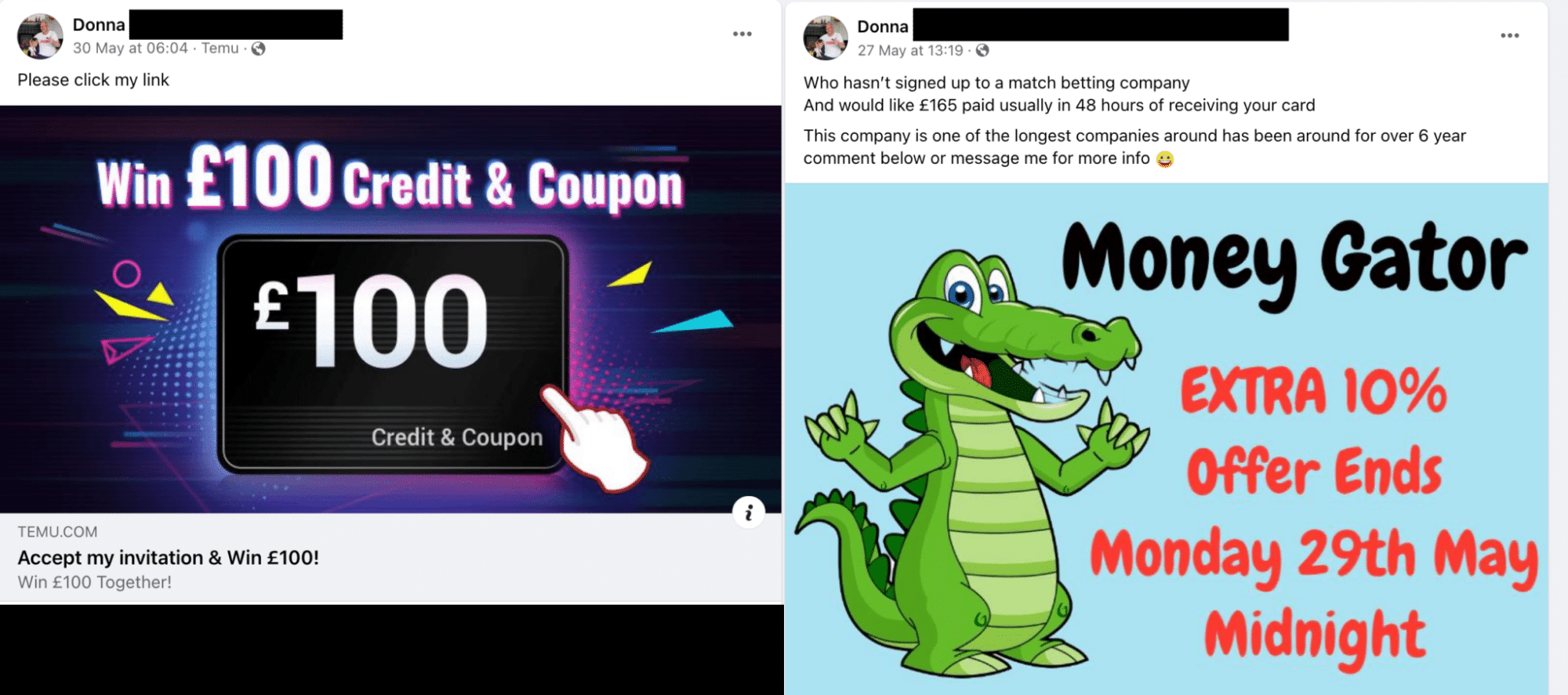

Donna seems a nice person, but has a tendency to promote “get rich quick” internet promotions to her friends:

Those posts didn’t get much attention, and nobody commented.

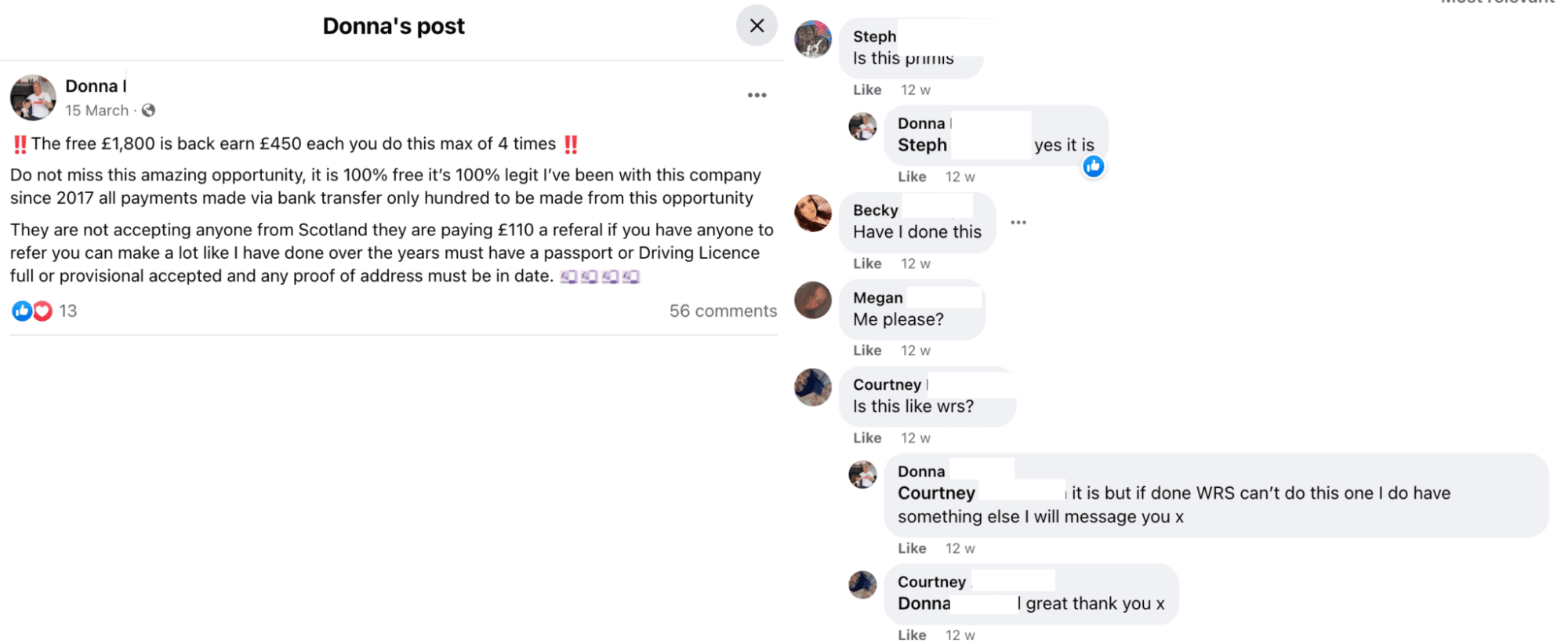

This one is different:

Dozens of people responded – not surprisingly, given the offer of £1,800 of free money.

But what is this thing that you can do up to four times, but not if you’re Scottish, and if you’ve done one then you can’t do another?

Donna’s companies

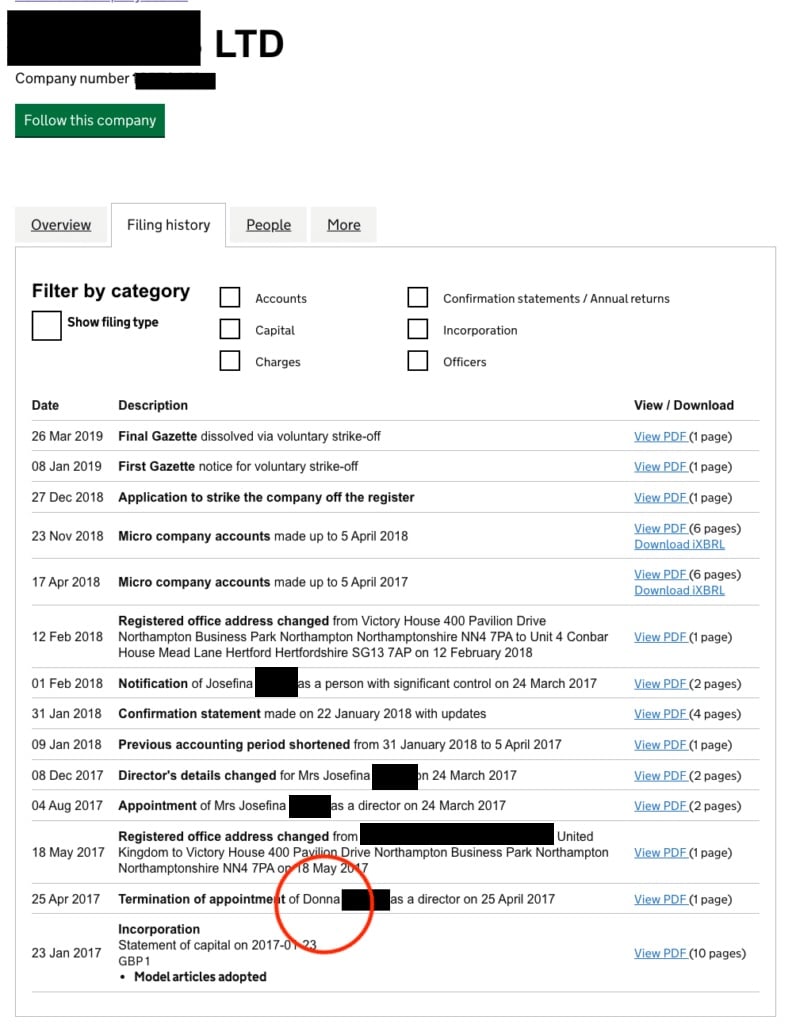

Here’s what happened to one of Donna’s companies:

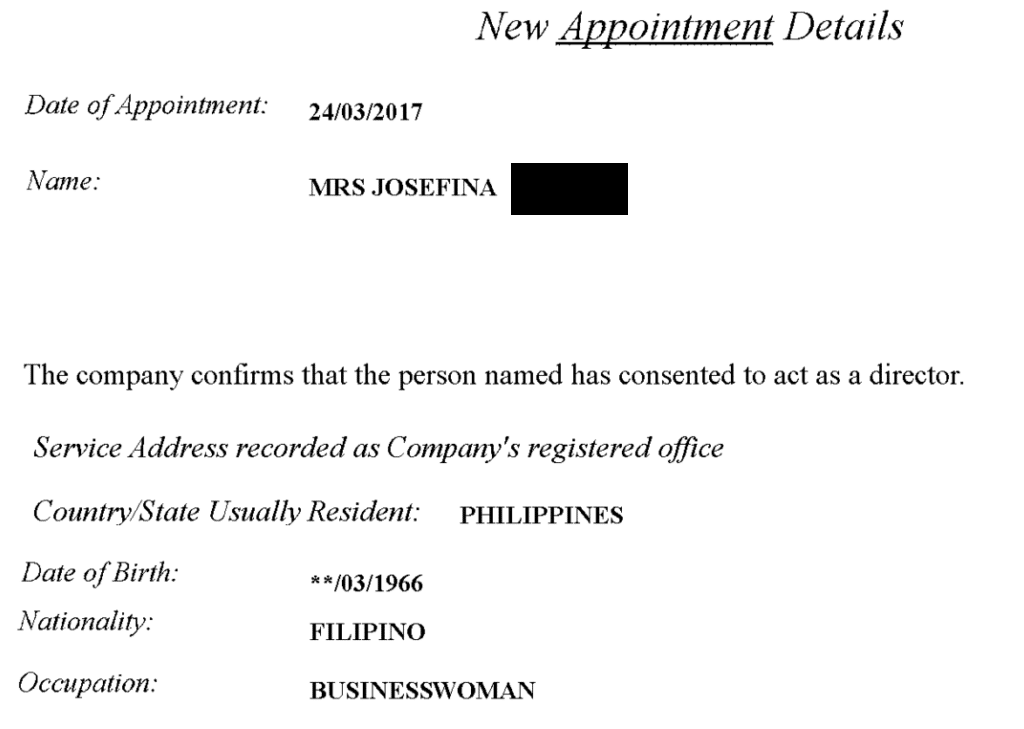

Four months after becoming a director, Donna resigned, and was replaced by Josefina – a resident of the Philippines:

Not long after, the company was struck off.

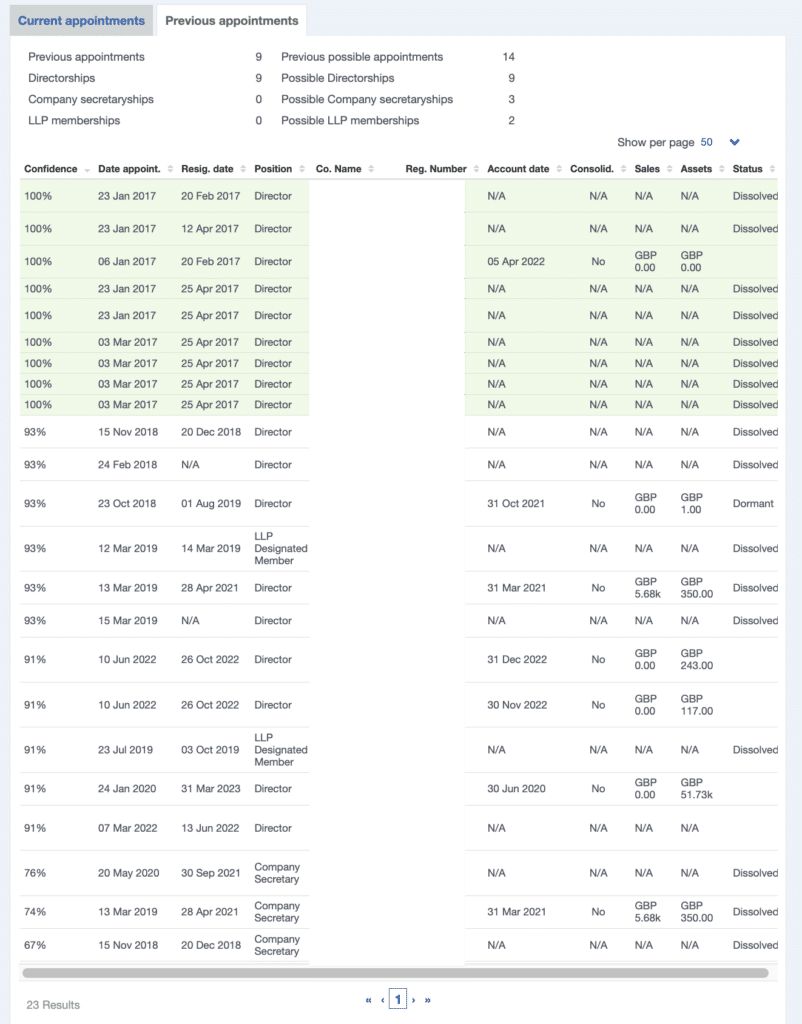

And this happened 23 times. Usually Donna is a director for a few months, then replaced by a Philippine resident individual, and then the company is dissolved:2

Kelly

Kelly responded to that Facebook comment thread on 15 March:

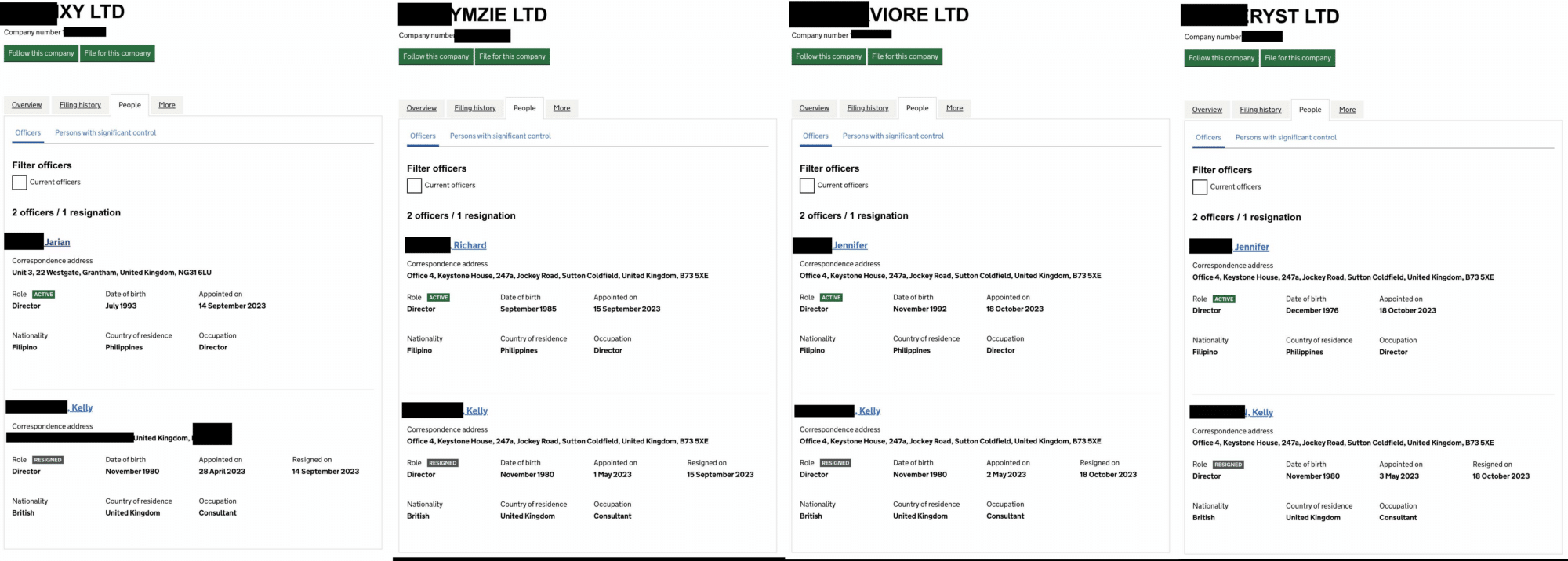

And, a few weeks later, she became the director of a series of companies, later resigning and being replaced by a Filipino individual:

These companies are still active.

What’s going on?

Donna and Kelly’s companies were used as part of what’s called “mini umbrella company” fraud – thousands of small companies created to claim tax incentives they’re not entitled to. We published a four part report into these frauds in 2023. HMRC’s view of these frauds is set out here.

HMRC initial response to the frauds was to ensure the tax incentives could only be claimed by companies with UK directors. That’s why Donna and Kelly were hired. But once the fraud has started, they’re not needed – better to use directors who can be paid less, and are much harder for HMRC to track down. The Philippines is an ideal location.

Is it a crime?

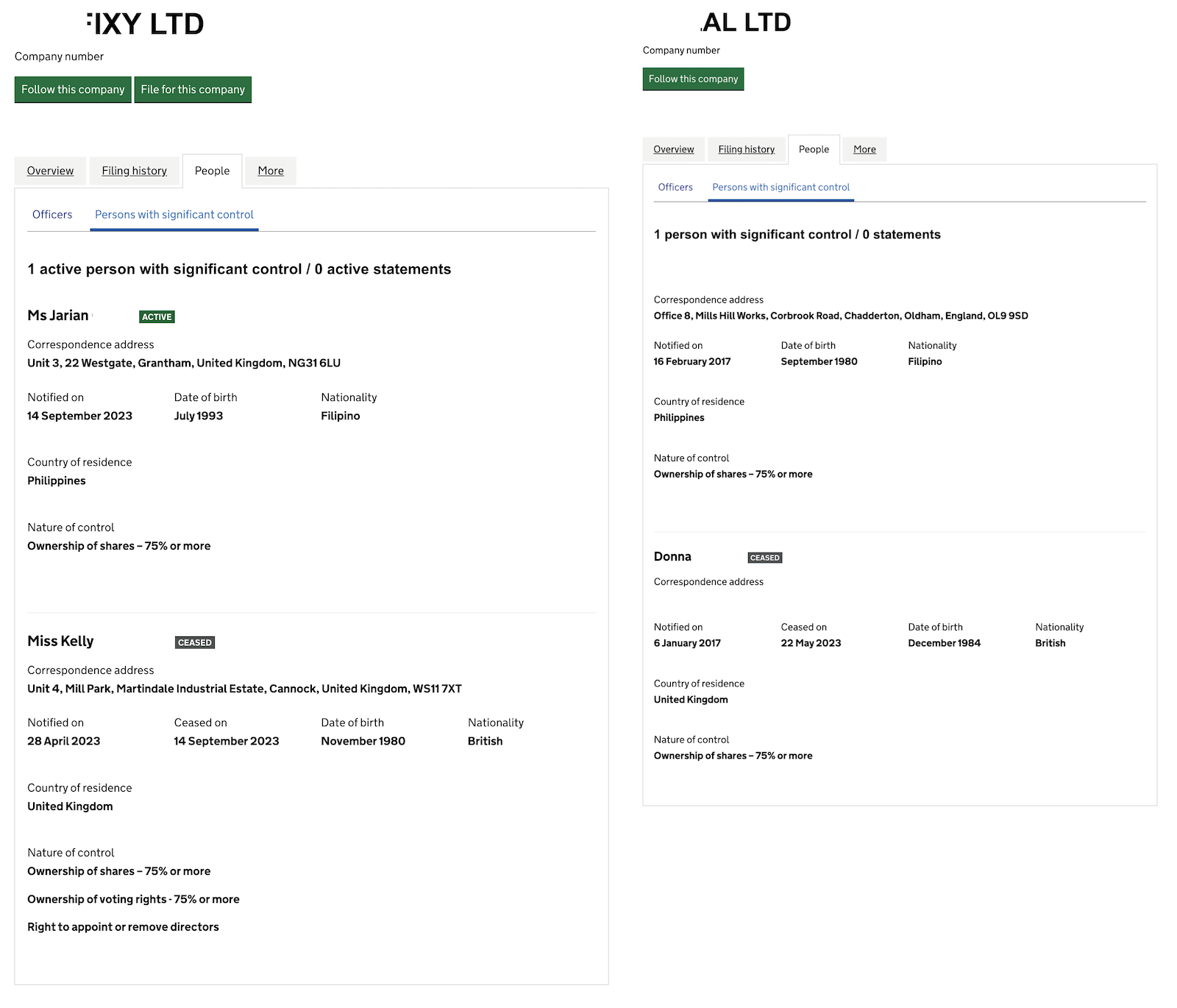

Donna and Kelly surely know nothing about the tax fraud that is these companies’ ultimate goal. But they both incorporated a company and clicked a box that says they control it – that they’re the “person with significant control”:

This isn’t true. Donna and Kelly aren’t in control of these companies – they’re doing what someone tells them. They provided false information to Companies House, and if they did so recklessly or intentionally then that’s a criminal offence.

The muppet explosion

As of today, muppets are a minority of the fraudulent companies at Companies House. Fraudsters are more likely to use completely non-existent people as directors – it’s easier and cheaper. The people hiring muppets probably did so because they wanted the veneer of legality.

But muppets are about to become much more common.

Companies House will have new identification procedures starting in March 2025 – this will make it much harder for criminals to establish companies using fake names. The obvious response from fraudsters? Hire more muppets. The muppets are real people – so would have no problem providing genuine identification documents.

We can therefore expect a large increase in muppet directors.

The Low Incomes Tax Reform Group issued a press release in 2023 warning people not to get involved in these “director” schemes. This was the right thing to do, but we fear it will not reach many of the people drawn to the schemes.

We have two suggestions:3

- Companies House’s incorporation website should add prominent warnings of penalties and criminal liability for people acting as “nominee” directors – i.e. agreeing to be a director on paper and follow someone else’s instructions. With the warning not merely a tick-box, but requiring new directors to type that they understand the warning.4

- Harsh as it may sound, we need widely publicised prosecutions of people like Donna. People will only stop being muppets if they know they face serious consequences.

An obvious response from the fraudsters would be to exclusively hire muppet directors from outside the UK, who are less likely to understand any warnings, and much less likely to have seen any prosecutions of previous muppets. That will, however, be less attractive to the fraudsters – if a company is trying to present itself as a real UK company (either to HMRC or other potential fraud victims) then foreign directors are a red flag. But if we’re wrong about this, and Companies House sees an explosion in foreign muppets, then we may need a radical solution, like requiring all foreign directors of UK companies to appoint a UK agent covered by money laundering rules.

We hope Companies House are ready to act.

Thanks to Simon Goodley at the Guardian for his original reporting on the MUC tax fraud, and Richard Smith and Gillian Schonrock for their amazing investigative work tracking down the scheme companies. If you haven’t read our original report, and how a tax KC blessed the fraudulent scheme, it’s available here.

Thanks to CompanyWatch for giving Tax Policy Associates access to their excellent software for free (there was no quid pro quo; they didn’t even ask to be credited).

Image by DALL-E 3: “a photorealistic image of a muppet committing fraud”

Footnotes

We are masking the name and identifying details of the individuals caught up in this scheme because it would be unfair for them to attract random abuse on social media. We expect researchers will be able to identify them without too much difficulty (and we’re happy to assist any researchers/government agencies who need more information). ↩︎

The software that extracts this data from Companies House is CompanyWatch – it’s much more sophisticated than the Companies House website, which often shows one person (even with a unique name) as multiple people, making it hard to see all the companies they’re involved with. CompanyWatch has kindly given us a free licence to use their software free. ↩︎

Another solution would be for Facebook to use its immense resources and knowhow to block people from promoting “get rich quick” scams. There is, however, little sign of this. ↩︎

For example typing something like: “I understand that if I act as a director on behalf of someone else without registering them as a PSC then I could be liable for large financial penalties and even imprisonment”. ↩︎

7 responses to “How criminals use “muppets” to commit corporate fraud – and how to stop them”

So… why does being Scottish prevent people from being a muppet director?

I might add, as a result of something I saw happening in front of my eyes on FB I did a lot of investigation into similar posts, in this case mostly ticket scams, a common trick is to get fake or hacked profiles of people who appear to be keen to get involved and give positive feedback, this encourages others. It may be that the real people, were hacked accounts and all their date stolen and used – this can happen just from a ‘like’ to a post from a scammer that looks to be genuine. My conclusion is as many as 30% of FB profiles could be fake or hacked accounts, using stolen data and photos. Anyone can create up multiple profiles fairly easily. Scammers and others use this to their advantage to repeat ‘offend’ and find more ‘muppets’. Reporting to FB rarely has any effect.

Why isn’t Meta taking responsibility? These ‘invites’ are all over FB profiles including fake profiles for Rishi Sunak, King Charles III, Paul Hollywood – hundreds of fake FB profiles in the names of celebrities, politicians, members of the Royal family exist and they are used to steal data and entice innocent people into such things, as well as selling fake tickets etc. etc. I find it increasingly worrying the lack of accountability that FB takes.

When I first became a Director (c.2010) I was given a letter by Companies House that made clear I could basically end up in jail for any wrongdoings by the company even if I didn’t do anything wrong personally. My company – the parent – indemnified me – but the letter itself was a wake up call and if CH have stopped sending these then I would find that a backwards step. Sure, they can be improved but they must still exist.

Some of those muppets may be baby solicitors. This happened to me many decades ago.

The senior partner asked me to sign something so I did. I was busy. I trusted him absolutely. He didn’t have time to explain but I had the impression it was about employers’ NI contributions. When I heard later from Companies House, I think that the annual return was late, and eventually realised what I had done, I was horrified and explained. Then I was horrified to realise I’d probably spoken out of turn about the senior partner. Nothing came if any of it as far as I know.

And as I now find to my surprise that he is still alive and even has his own name on some companies, I’ll leave it there.

Dan, what if the “mother country” could flip the script and, instead of telling Cayman what do to, in fact asked Cayman for their advice on how to handle this?

Cayman is VERY strict on KYC on these and other matters. No “muppet” directors there.

They have well established systems (including an online portal for reporting and for uploading relevant ID and other information) for Cayman companies.

I would LOVE to introduce you to the people in Cayman, perhaps starting with Dax Basdeo, Chief Officer of the Ministry of Financial Services, or Cindy Scotland, CEO of CIMA (Cayman Islands Monetary Authority).

I think interviewing them would help highlight to people in the UK how big the gaps are at Companies House here.

I mentioned that to Dan a while ago. I got the impression he didn’t believe me!