We’ve been reporting on the shockingly brazen accounting frauds that slip through Companies House. Our new web-based fraud-finding tool takes just a few clicks to expose suspicious companies. We hope it’s useful to everyone interested in uncovering fraud, and helps illustrate how easy it would be for Companies House to do a better job of ensuring the integrity of its records.

The webapp was created in February 2025 and has not been updated since

Here’s the tool itself – just below that are step-by-step instructions and a quick tutorial video. For an app-like experience you can go here on mobile, and on iPhone if you “save to desktop” it should behave like an app.

Tutorial video

In this short video I demonstrate how to use the tool, and find a plausibly fraudulent company in two clicks:

Instructions

This website does one simple thing: it identifies companies filing accounts showing enormous asset values that are highly improbable and may be fraudulent. A quick guide:

Categories

- The main list displays business categories (SICs – “standard industrial classification” codes).

- The number on the right shows how many “high balance sheet” companies fall under each category.

Finding categories

- Type keywords into the search box (e.g., “bank”, “charities”, “real estate”) to find relevant categories quickly.

- Or scroll to see all categories, which you can also sort by the number of suspect companies, or alphabetically.

- There is one special category: “all SIC codes”, which includes all UK companies (subject to the limitations mentioned below).

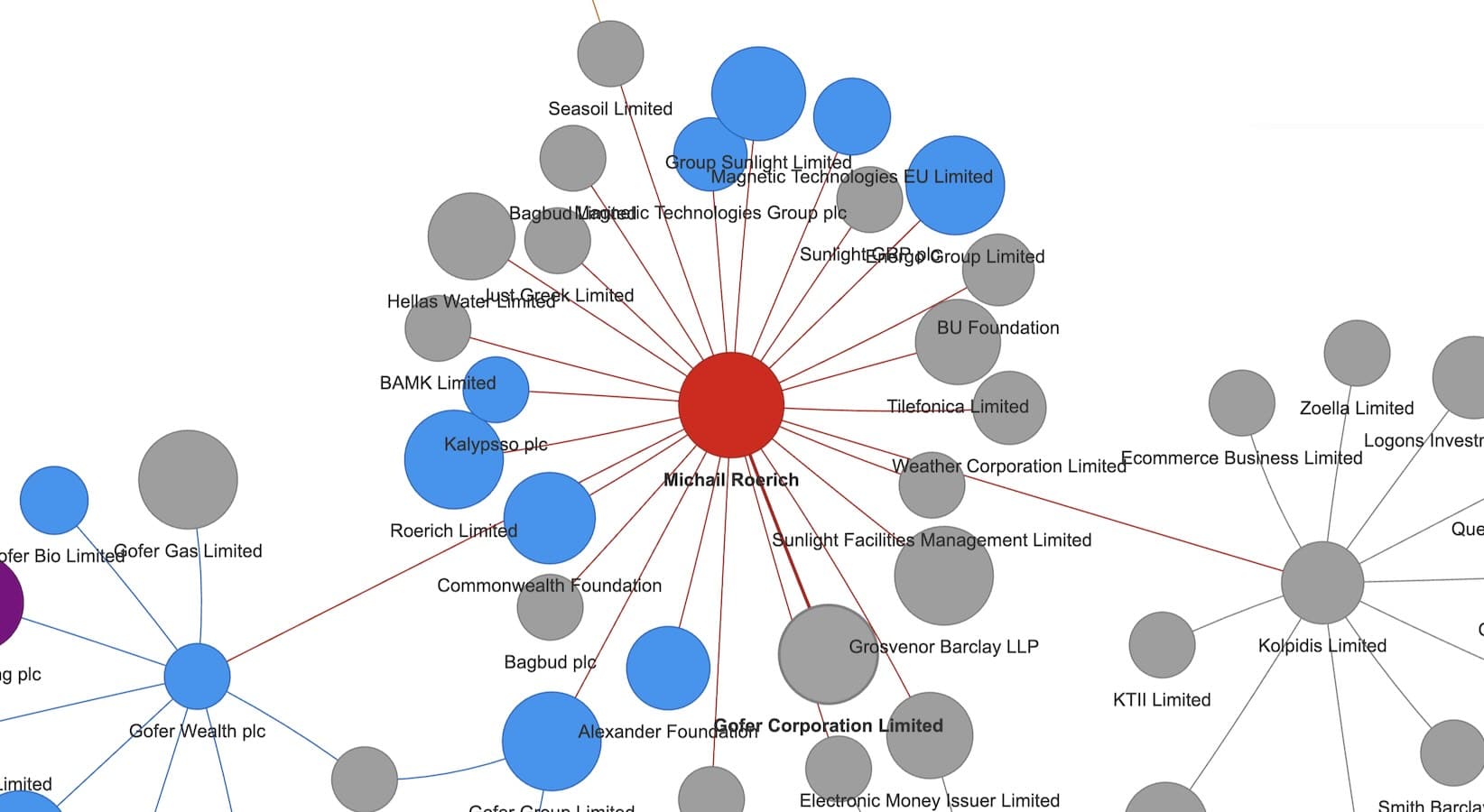

Investigate companies

- Click on a category to see a table of high-balance-sheet companies in that group.

- Narrow your results using these checkboxes:

- “Dormant only” – only lists companies that say they’re dormant (i.e. inactive) but also claim to have large asset holdings.

- “High cash only” – shows lists companies claiming large cash holdings (over £10m), excluding companies who just have other large balance sheet items in their accounts.

- Combining both can quickly reveal dormant companies claiming millions of idle cash. This is the easiest way to identify false accounts, as it’s most unlikely a real company will be dormant and sit on millions of pounds of cash.

- The lists automatically exclude companies that are regulated by the FCA.

Check the details

- The table shows a company’s reported cash balance, together with other sizeable balance-sheet items.

- Click the company number to open its Companies House entry and inspect the actual accounts.

The table shows the cash balance for each company and then lists other high balance sheet items. At this point it’s easiest to click on the company number in the table – you’ll then go straight to the Companies House entry where you can look at the accounts.

Advanced options

For more advanced options, including searching by registered office address, the full version of the tool, is available on our GitHub here. But this route requires some command line experience, and it takes some time to download the very large Companies House snapshot files.

Caveats

See our previous report for details on the methodology and limitations.

As a rough guide:

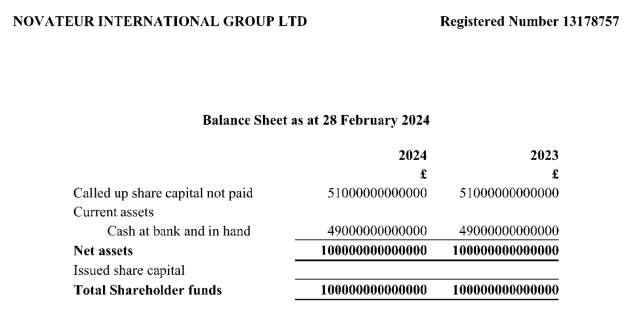

- Dormant companies with high cash balances have likely filed false accounts. If those balances remain the same year-after-year then they are almost certainly have filed false accounts.

- Dormant companies with other high (non-cash) balance sheet entries may have filed false accounts.

- Non-dormant companies may of course be perfectly normal companies. It’s expected for a successful large company to have large balance sheet items; in some sectors they will also have large cash holdings. Spotting the frauds in such cases will usually require accounting expertise. But you should be suspicious if there are large numbers on the balance sheets that don’t change from year to year.

Of course there may be exceptions. And accounts being false doesn’t necessarily mean fraud: someone may have made a mistake, or just be playing a silly game of some kind.

Users of this website and the tool should be very careful about making any allegations of fraud. It’s prudent to always review the accounts and to seek input from someone with appropriate qualifications.

Conversely, there are many, many ways in which accounts can be wrong or fraudulent that this tool will not detect. This is a simple tool that does one thing.

And there are the limitations we mentioned in the original article: the tool can only search through accounts filed electronically last year. Companies that didn’t file last year won’t be visible. Nor will companies that filed accounts by post – most real, large, complex companies have to file by post because of Companies House limitations.

Image by DALL-E 3⚠️: prompt was “A high-tech digital investigation scene with a magnifying glass hovering over a financial document on a computer screen, revealing a red ‘FRAUD’ stamp. The background shows financial data, charts, and a blurred Companies House logo. The image has a modern, investigative tone with dark blue and red highlights, suggesting urgency and exposure of fraud. Perfect for an article about uncovering fraudulent companies.”

Leave a Reply