We’ve created an automated search tool that crawls Companies House data to find companies with fraudulent accounts. It’s found hundreds of dubious companies, the worst of which claims £100 trillion of assets.

Our findings suggest that Companies House is asleep at the wheel. But they also show that it would be straightforward to clean things up, and stop the widespread abuse of UK companies by international fraudsters.

We published a report on Saturday on Avis Capital Limited. It claims to be a “bank” and to have £58bn of net assets and 150,000 employees. But none of that is true; it filed fake accounts as part of what we believe was an international fraud.

Our search tool draws up a shortlist of suspicious companies by looking for characteristics similar to Avis Capital: companies that claim to be carrying on a regulated activity, aren’t in fact regulated, and claim vast – and unbelievable – cash holdings, whilst also claiming to be dormant.

There are a large number of such companies.

We’ll be publishing more lists of these companies in the next few days; we’ll then publish the search tool and full instructions so that others can use it.1It’s quite rough at the moment and not very usable; we hope to take it to the stage where anyone familiar with the Mac/Linux command line will be able to use it – it may or may not work on Windows as well. Unfortunately the amount of storage and processing power required means it would be too expensive for us to turn it into a web app.

40 fake venture capital companies

Here’s how to find companies with false accounts:

- Chose a category of business that’s attractive to a fraudster. Today we’ll pick venture capital: the business of raising funds from investors and using it to fund early-stage startups.

- Search every company registered with Companies House that has a venture capital standard industrial classification (“SIC”) code. (Companies can pick whatever SIC they like.)

- Look for “venture capital” companies that aren’t regulated by the Financial Conduct Authority. Fraudsters usually steer clear of the FCA.

- Of those, find the companies with accounts claiming they’re holding a large amount of cash, over £10m.2By this we mean “cash at hand and in bank” rather than share capital which is issued and unpaid. “Cash” for this purpose can include liquid securities like bonds.

- Finally, see which of the cash-rich unregulated “venture capital” companies claim to be inactive (or “dormant“). A company that really had £10m would have entries in its accounts: income on the £10m, tax, and fees and other expenses. And that means it wouldn’t be dormant.

The result is a list of 40 “venture capital” companies with impossible accounts:

(Click here to view fullscreen; you can download a spreadsheet version here. You can click on the company numbers to jump straight to the Companies House entry and see the full accounts.)

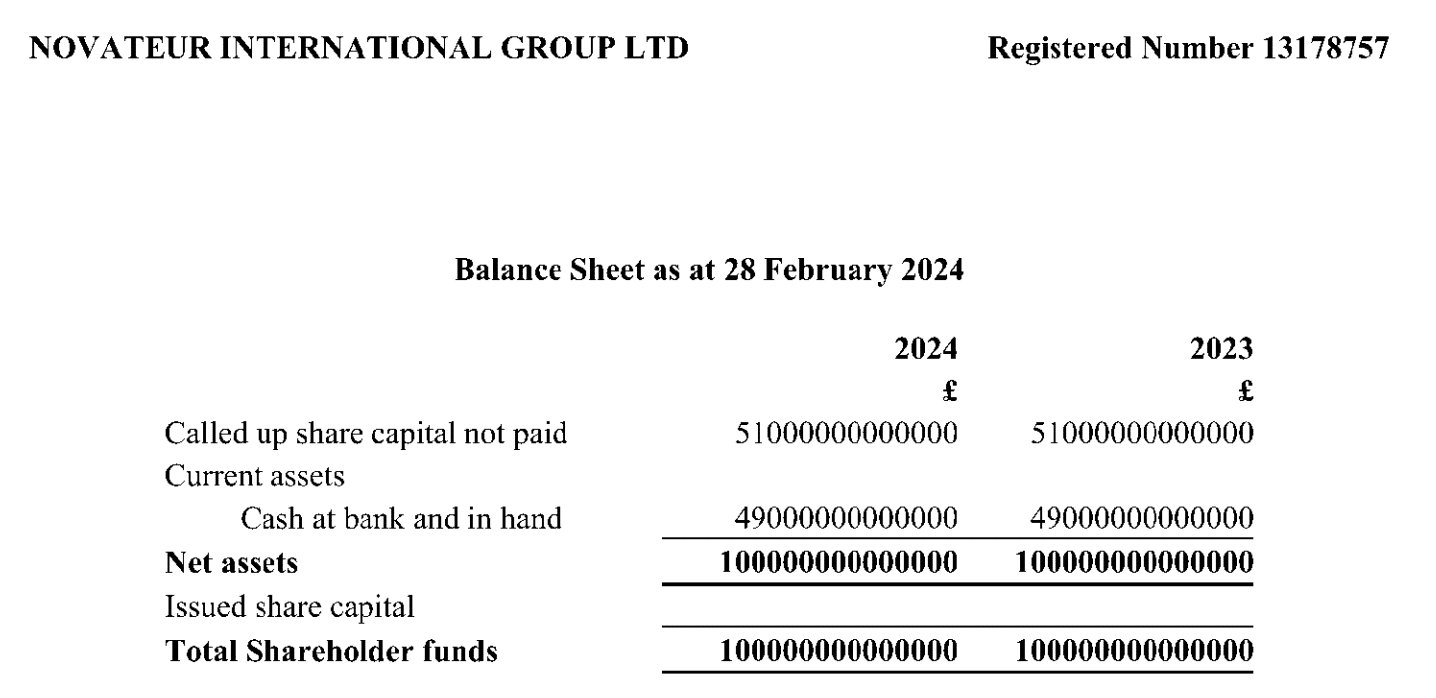

Top of the list: Novateur International Group Ltd. It claims to have £49 trillion cash, and net assets of £100 trillion. That makes it thirty times more valuable than Apple.

Novateur’s website says it’s “an emerging conglomerate providing innovative solutions to businesses and public sector organizations”. It’s owned by a Nigerian man called Kelvin Adejo.3There are signs someone is trying to tidy up the company’s filings, for good reasons or bad. A recent application reduces its share capital to £1,000. However there has been no attempt to correct the historic accounts showing £100 trillion.

Two commentators below pointed out that the various “Bandenia” companies on the list were part of an substantial Italian/Spanish money laundering operation which was mostly shut down in 2022/23.

We can’t know at this point how many of the others are frauds. They might be mistakes (although it’s hard to see how). They could be people playing games, or even just showing off to friends. But when we see companies with names like “US Fidelity and Guaranty Financial Group Ltd” and “BBP Banqueros Privados Ltd“, with obviously false balance sheets claiming hundreds of £m in cash, it’s hard to see any purpose other thank to defraud people.

We know fraudsters create accounts like this deliberately, to fool people into thinking their companies are valuable. We’ve spoken to someone who lost a large sum of money to Avis Capital after being shown its UK accounts. Many people, particularly people outside the UK, assume that if accounts are on Companies House then they must be correct. In fact, Companies House applies no standards at all.

What should Companies House do?

Nobody expects Companies House to undertake a detailed audit of the millions of registered companies. But they should be able to use an approach similar to ours to identify companies with obviously false accounts.

Swift action can then be taken:

- The Companies Act imposes civil penalties where the accounts rules are not followed. A company that’s filed false accounts for years will have incurred multiple £3,000 penalties. These should be immediately charged.

- The directors have committed a criminal offence unless they can show they “took all reasonable steps” to comply with the rules. That defence seems unlikely to be available for companies with false billion pound balance sheets. The consequence is an unlimited fine, and potentially imprisonment.

- Most importantly: Companies House has a duty to ensure the integrity of its records. It should use its powers to remove the false accounts from the register.

- It would be sensible for the false accounts to be still available for viewing, but with a prominent health warning that they have been withdrawn.

- And, for the future, Companies House should flag companies with anomalously high balance sheets for manual review.

One thing is for sure: the fraudulent use of UK companies will continue until there are clear adverse consequences for fraudsters.

Many thanks to the accountants and forensic accountants who assisted with this report, particularly P and J.

And thanks to Companies House and the Financial Conduct Authority for their commitment to public access and open data. Companies House has a woeful history of policing its own register. But its technology is excellent, one of the best in the world, and the access it gives researchers (for free) is laudable.

- 1It’s quite rough at the moment and not very usable; we hope to take it to the stage where anyone familiar with the Mac/Linux command line will be able to use it – it may or may not work on Windows as well. Unfortunately the amount of storage and processing power required means it would be too expensive for us to turn it into a web app.

- 2By this we mean “cash at hand and in bank” rather than share capital which is issued and unpaid. “Cash” for this purpose can include liquid securities like bonds.

- 3There are signs someone is trying to tidy up the company’s filings, for good reasons or bad. A recent application reduces its share capital to £1,000. However there has been no attempt to correct the historic accounts showing £100 trillion.

29 responses to “Companies House failed to spot a £100 trillion fake company”

We have tried to report a company to companies house and fraud department who are trying to sell art to people to invest in but nobody is interested in our evidence

I assume the government are not interested in this at all?

Great work – again! Thank you.

Small typo in last sentence: But it’s technology is excellent.

This from Companies House more than a year ago when apologising to me:

Regarding your initial enquiry, we do have powers to investigate any discrepancies or inconsistencies with regards to information delivered to the register and, where appropriate take the necessary action. This is possible following the introduction of more robust querying powers provided by the Economic Crime and Corporate Transparency Act 2023 of which you are clearly aware of.

The information provided will be reviewed, however, I should advise that we do not provide updates on any investigations considered or ongoing but be assured we will act where appropriate.

The trouble is that the professionals have no interest in correcting anything – ICAEW states that there are more than 500 extra “owners” of KPMG llp than CoHse records show, and I quote them saying Companies Act has 2 different meanings of owner – which it doesn’t – depending upon whether it is for ICAEW use or CoHse.

Loads more at clcl.uk where I am still beavering away at holding the miscreants to account despite the best efforts of the AG and BEIS.

You are right that CH to be praised for having an easily accessible and free to use search facility, contrasting with most f Europe where you have to pay to get anything useful and the US where there is nothing useful on public registers for unlisted entities.

Are the staff at CH put off by big numbers being afraid of expensive lawyers challenging them given they are keen to bonce slightly failing financials for small often non trading entities like tenants management companies.

I’m a bit late to the party on this but when you released the first investigation report on Twitter a few people asked ‘how does this get reported now its been spotted’ and I recall you answered that officially its via ActionFraud but they have a poor track record.

I appreciate this is tangential to the main thrust of your report and reconemdnations here (i.e. that Companies House themselves make better use of their own technology to enforce their own rules via their own powers) but when it comes to the actual criminal action follow up, my understanding from a peice of work I did liaising with senior police officers at the City of London Police team who oversee Action Fraud is that the system is designed in such a way that there is almost no scope for any law enforcement officers (outside of the Serious Fraud Office and maybe the NCA within their own niche areas) to manually initiate a fraud investigation when a report/reports are given to Action Fraud regardless of how good the evidence is or the scale of the purported fraud.

Essentially – and the usual caveats apply, this is a rough overview of the impression I was left with as a result of the work I did a few years ago, I’m happy to be contradicted – the entire ‘output’ of what does/does not get investigated by the (pretty small) team of City of London Police officers who sit above Action Fraud gets decided be a computer algorithm. Because of the sheer volume of reports they get, although there are nominally intake teams who work for Action Fraud but who are not police officers, they are not really doing a proper intake screening role, that’s what the computer is doing.

The computer looks for patterns, the same names coming up more than once in different frauds etc. and only then when a very high bar is reached are they permitted by their operating proceedures to open an investigation because its been generated by the system from the bigger intelligence picture.

Because of the existence of Action Fraud, other forces are not allowed to accept or open fraud investigations without it being handed back to them via Action Fraud.

So when it comes to the criminal enforcement of the apparent frauds this accounting seemingly belies, short of personally drawing it to the attention of a DCI in the tiny CoL Police unit dedicated to this kind of thing, there is really no way in which its ever going to get looked at or investigated even if it does get flagged and reported by e.g. Companies House or the team from TPA whose research has uncovered this, despite the sums of money allegedly involved.

As I said I totally appreciate that the ‘Companies House’ as an enabler side of it all is a separate question and the true crux of this article, but I thought it was worth leaving a comment sharing a little bit about how the actual ‘fraud investigation post reporting’ side of things works and why that also contributes to a ‘free for all’ is these more overt potential fraud cases just as much as it does in lower ‘street level’ frauds.

thank you so much. That’s consistent with my experience – there is just nobody for us to report frauds to.

And is there any wonder that fraud crime stats are the only reason crime rates are growing? No one is taking it seriously as a law enforcement issue. I don’t get it (though I have my own suspicions).

First rate analysis Dan – thanks; and thanks for the clever work on your search tool.

Sad though that it would take so little time for someone in the bowels of Companies House to do the same

More Bandenia brazenness, in the House of Commons no less! https://www.theguardian.com/politics/2023/may/09/unlicensed-bank-ceo-mohammed-imran-qureshi-commons-invite-stokes-lobbying-access-concern-bandenia-challenger-bank

Wow.

Full story (so far), inc Spanish cocaine smuggling and a little FCA fumble, in yet another OCCRP report https://www.occrp.org/en/investigation/a-fake-bank-was-shut-down-in-spain-now-a-new-one-has-popped-up-in-the-uk

thank you!

DN spot on about the quality of Companies House technology and the free access it offers.

But that easy, free access is inherently dangerous to users who assume that because it is a government agency the data it holds & publishes on behalf of the exec, is checked for accuracy – even after past 14 years people don’t want to view the UK as a banana republic.

This year need to see what Ms Smyth has achieved with the ECCTA 2023 – been in effect since March 2024

There is a resolution to reduce Novateur International’s capital on 15 May 2024 on Companies House so the ridiculous numbers must have been (belatedly) spotted. Their share capital is now £1000.

I saw that (see footnote!) but that resolution doesn’t fix anything – you end up with shares with a nominal amount of £1,000 and ridiculously high premium. If honest people were trying to fix things, they’d file corrected accounts.

Have you approached CH asking what they will be doing in response to your findings?

Should/could there not be a process to ensure that only audited accounts, and perhaps other records, are submitted by known entities, say by regulated auditors, rather than the companies themselves?

we’ll soon be posting something which will make your comment seem very prescient!

It would be interesting to see a response from Companies House. They do not appear to be taking their responsibilities seriously.

Great job Dan! Exceptional analysis and insight. Please do take care for your own safety though. You may well have listed some serious criminal operations, who may not take kindly to this.

It may not be as effective, but would you be consider instead distribute this via the media or directly to the fraud office?

I expect you’ve already thought about that and concluded they could trace it to you anyway, but please do take care. In any case, a huge thank you for seeking to find a way to undermine the fraudsters.

Dan, the Bandenia companies were all part of a massive multinational money laundering operation. See here https://www.occrp.org/en/news/bandenia-charges-brought-against-fake-banks-associate-in-italy

Blimey.

On November 2, 2023, BBP BANDENIA PLC, a company regulated by the FCA, was dissolved without any legal problem as you indicate, the events that occurred in Spain do not concern this legal entity. Your work consisted of being paid a few cents, publishing with copy and paste existing news on the web in a superficial and unprofessional way without having awareness of the reality.

https://s3.eu-west-2.amazonaws.com/document-api-images-live.ch.gov.uk/docs/fWg0iOxse3QydQOWZATA9PMti0SgMeATEXxfiO_MNYY/application-pdf?X-Amz-Algorithm=AWS4-HMAC-SHA256&X-Amz-Credential=ASIAWRGBDBV3KKX53MZI%2F20250415%2Feu-west-2%2Fs3%2Faws4_request&X-Amz-Date=20250415T074129Z&X-Amz-Expires=60&X-Amz-Security-Token=IQoJb3JpZ2luX2VjEJ7%2F%2F%2F%2F%2F%2F%2F%2F%2F%2FwEaCWV1LXdlc3QtMiJIMEYCIQCDgJnUN84OJ1ABB%2FI%2B4JEGEMQZXVjRy8PIg72HDqfWPQIhAK6ssnSSVv%2Flk6JpVoYtvrzSOK8XQeZ1fq65V1H9kcIxKrsFCCcQBRoMNDQ5MjI5MDMyODIyIgzzglIgw7CRMFBbb78qmAU33Mgeh7lhlPG%2FBAqK%2BailPTVoeimsvY%2Buj%2FvHBERU%2FUd54OcujEtAF%2F0XiNAUrJTMv9WzbaHsqHv7FnfgJFENHoD3jNujWbZFiIyFVEbxkcsIm4yslnaf1Ck2lCkUS5E1T5vZpKm5VsqYLoKnN12J0I90OsToQNy13Lj2NTwmwl1tX1vP2XB6X8nXYtjkkCRhEohU6liOHOGepLYxdfnbzeGcV7UYQWdbd0q5qulR1py%2B1ShQSh7M%2F7eh%2BvHdrReydgX04MvnxoNOWFNrGVrz3zxgDKjIszL9nHzhwh6ggyMFkn%2FyQhuE2BW9b4nGNJof6Ydmci8zU34fNK00T1gq9ejRHgH3uLKiyEuWK4Ahq8dOCng4npqUOW548jLcwO0igTw8QLbDOgQSTOnJ%2ByMeWFoOU%2BpkWH0i4XKnWsQwm3yNAXV037qo5Ff0rZzoxUClB%2BUFHm24eqaAouOIRCU%2BTi6vFxm384VZz%2FFllNg3mhJTQyx4Nk7H0Vn6Eln%2FkaU3t192phHPh6MEdDgeplAJ7ZiXT%2BmbtoJELyMXRX%2Fz4lJW9%2BL5%2FwA0CETTQiFBCNvBoBrwG0UoBbZ8bZM6BmZhiKs5w%2F2Bl0P7X7tfhBc%2FYPpF%2FpBcjSAlZcjqUBTBnmXsDdRKTJ4gKW6PN9jUpYFHwBfaIP83%2B9LX1pB5PMj6jy21TpiBu51U%2BpFuNUI2wJAjecQJb%2BPch7MmrVcWl2mWnaK%2FhsGSpW8mjNt%2B2dA0%2FGqRCY%2BPnUstdiBpuVFBBIbeSS9WG8MODQ76DqiIgiDFDGjSDgaus2U1ymHNA%2FVH%2FKCZjwibr554c7DuWU2VuvdwTsznC3WMk2HvGAIeAgOVw0ZfKZIiBJA8k9R%2F6iavUmj5arUTyTWAMOvd978GOrABiNYZVVvZSR1zwluPawpy3beoVxJmJPqtP%2BEVbIjalvjxowD8xzAnlE6ZPFpIPOjCkAP3NTm2Tgpjc6G%2BijuXGStuAcOFWe4%2Bk0ja6nLzRvqKsuA2r7zu6Jflny%2BMS8siekV8rkLzYQkcW2ovmRrMYSksauO2AO7uvhLnsJ2pYiRdyjQpTEuOpBVc2AhUa9i%2BEMCbVzHNDePLZB67FZw0%2BkjEc0ghL01jkyr6yxg6dIA%3D&X-Amz-SignedHeaders=host&response-content-disposition=inline%3Bfilename%3D%22companies_house_document.pdf%22&X-Amz-Signature=4ef06f144b9bf6b6c549ec6b30fb2fc81a0a1834ca56faa667ba7669c88cda24

Perhaps you are misunderstanding. We’re not paid “a few cents” or indeed anything. This article isn’t republishing anything, but sets out an original approach to find fraudulent companies through the use of open source data.

Great work by all the team at TPA to highlight practices that many of us have been concerned about for years.

Companies House do conduct checks but what checklists do they use?

What role does the auditor have in all of this? Avis was obviously a sham before Derek Williamson got involved so did he do any DD / did he report it once he resigned?

Hopefully this sparks a new wave of sensible controls on who can incorporate in the UK and the standards they must meet before automatic dissolution.

Bandenia is a fraudulent financial operation initially exposed in Spain in 2017 and linked to money laundering activities. Key details include:

Origins and Criminal Activities

• Spanish authorities uncovered around 27 shell companies operating as a fake bank in Madrid

• Accused of moving money for 253 criminal clients, including drug traffickers and fraudsters

• Used fake banking licenses from Mwali (Comoros Islands) to create an illusion of legitimacy

Key Figures

• Notable individuals involved include:

• Massimiliano Arena

• Fabio Pastore (CEO wanted by British authorities)

• José Miguel Artiles Ceballos (sentenced to 4 years in prison for money laundering)

thank you!

And yet…. No action by Companies House. Are they a shell regulator, providing the appearance of regulation?