New data suggests that one third of the farm estates affected by the Budget changes aren’t owned by farmers – they’re held by investors for tax planning purposes. This suggests the Budget proposal doesn’t go far enough to stop avoidance, but goes too far in how it applies to actual farms.

There’s a better approach which can achieve the Government’s aim to stopping avoidance whilst also protecting family farms.

We’ve calculated, on the basis of new data, that, if the Budget changes had been in place in 2021/22, fewer than 250 actual farm estates would have been charged inheritance tax in that year. That’s a surprisingly small number, and – given the planning that’s likely to be put in place – we wonder quite how much tax the Budget measure will raise.

At the same time, there’s a surprisingly large number of farm estates which are being held not by actual farmers, but for IHT planning purposes. In 2021/22 there were over 125 £1.5m+ estates in this category. Post-Budget, these would pay some IHT (but much less than a “normal” person). And there’s another 300+ smaller estates using farmland for IHT planning purposes – these would mostly escape the Budget changes, and remain IHT-free.

The Budget therefore risks missing the target:

- Overall, the revenue prospects don’t look very good, and the OBR’s forecast of 40% of revenues lost to tax planning looks optimistic.1

- Some individual farmers won’t be able to plan, and will pay too much.

- People who aren’t farmers will keep using farmland as an IHT planning vehicle, comparatively unaffected by the Budget.

We can fix all these problems at once. Protect real farmers with a complete exemption from inheritance tax (subject to a very large cap, say £20m). At the same time, counter avoidance by clawing-back the exemption if a farmer’s heirs sell the farm. This could achieve the Government’s aims in a way that’s both fairer and more effective – and plausibly raise about the same amount of revenue.

The figures and charts in this article can be found in this spreadsheet.

Inheritance tax – the background

As of today, if someone dies then their estate is subject to inheritance tax (IHT) at 40% on all their assets over the £325k “nil rate band” (NRB). A married couple automatically share their nil rate bands, so only marital assets over £650k are taxed.

The “estate” here has a different meaning from the way the word is often used, e.g. “landed estate”. The “estate” is the legal fiction that springs up when someone dies – the executors manage the estate, and inheritance tax is charged on (usually) the estate.

The Cameron government introduced an unnecessarily complicated additional “residence nil rate band” (RNRB) where the main residence is passed to children. This is £175k per person, and again automatically shared between married couples. So for most married couples, only marital assets over £1m are taxed. The RNRB starts to be withdrawn (“tapers”) for assets over £2m (with planning, a married couple can keep the RNRB with join assets of over £2m2).

It’s different if you’re a farmer. Agricultural property relief (APR) completely exempts the agricultural value of your farmland, farm buildings and (usually) farmhouse (which HMRC tends to accept about 70% is agricultural). Business relief (BPR3) completely exempts machinery and (often) any development value of the land above its agricultural value.

Another important rule: transfers to spouses are usually completely exempt from inheritance tax.

A brief detour for advice for anyone concerned about the impact of inheritance tax on their children if they unexpectedly die young (because marital assets are over £1m or they’re single and assets are over £500k). If you’re relatively young then the answer isn’t elaborate tax planning, it’s making sure you have enough life insurance to cover the tax. That’s very inexpensive if, for example, you’re a banker in your 40s. It gets more expensive if you’re older, less well, or have a relatively dangerous job (which sometimes includes farming).

What changed in the Budget?

BPR and APR were given a combined cap of £1m per person.

Under the cap, the reliefs continue to provide a complete exemption. Beyond that, the reliefs provide only a 50% reduction in the rate, rather than a complete exemption. In other words, any estate past the cap is subject to inheritance tax at 20% instead of the usual 40%.

The changes to BPR have a much wider impact on privately held businesses; but in this article I’ll be talking only about agriculture.

How many people will be affected by the change to APR and BPR?

Let’s park “affected” for now (but return to it later) and ask the easier question: at what level of assets will IHT apply to a farmer?

- For a single farmer who has no material assets other than his or her farm and farmhouse, and plans to leave everything to their kids, the new APR/BPR cap plus the nil rate band plus the residence nil rate band comes to £2m.4. Given that most small/medium farmers live in the farmhouse (usually/mostly covered by APR) and typically don’t have significant other assets, it is the £2m figure which should be used, not the £1m figure for the APR cap.

- For a couple, with some reasonably simple planning, the first £4m will be exempt. But that planning won’t always be possible. The couple may want to keep their finances separate, or there may be complications with third parties (like lenders) who don’t agree to the land and business becoming jointly owned.

So the answer is: usually somewhere between £2m and £4m, depending on circumstances.

The next question is: how many farm estates have this level of assets?

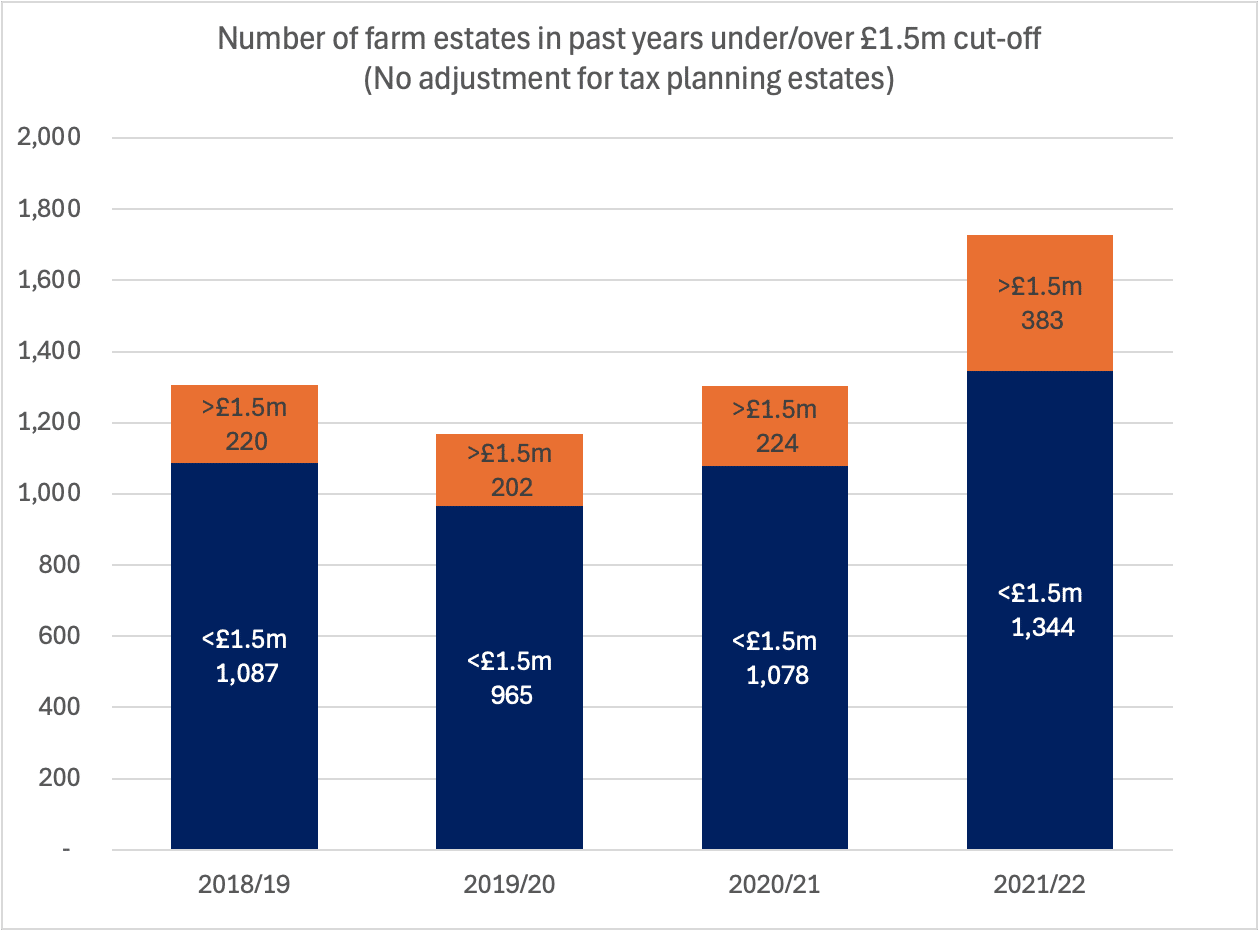

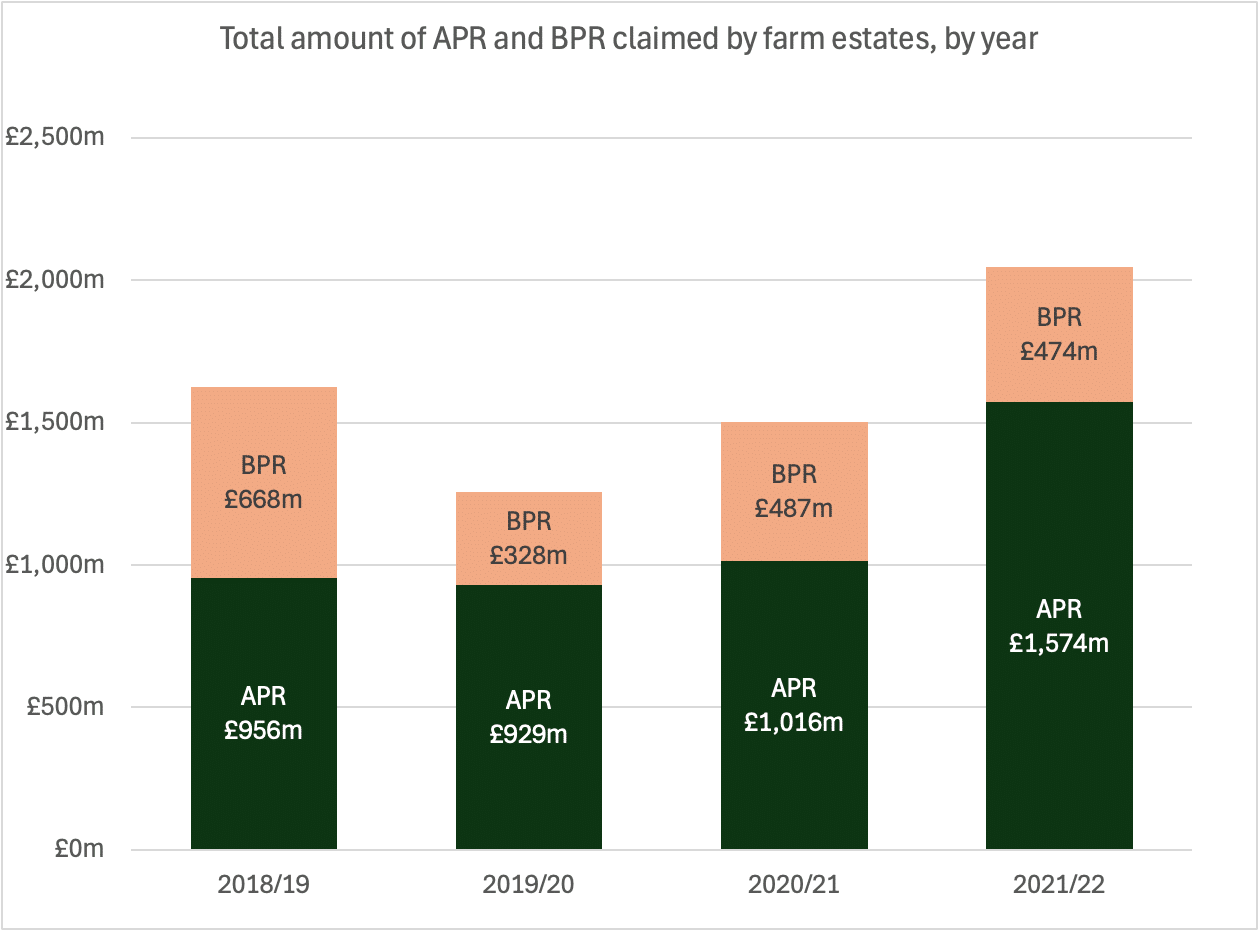

Previously we only had APR data for farms, but now we have both APR and BPR data for years from 2018/19 to 2021/22.5 That gives us a “static” estimate of what the impact would have been, had the Budget changes been in place in that year. The data breaks estate value at £1.5m rather than £2m but, by happy accident, that difference broadly equates to asset price inflation since 2021/22. So the number of estates at £1.5m in 2021/22 should be broadly equal to the number of estates hitting the taxable £2m point in 2025/26.

Some data was published with the original Government announcement. Further more detailed data was published in a letter sent by Rachel Reeves to the Chair of the Treasury Select Committee this week.6

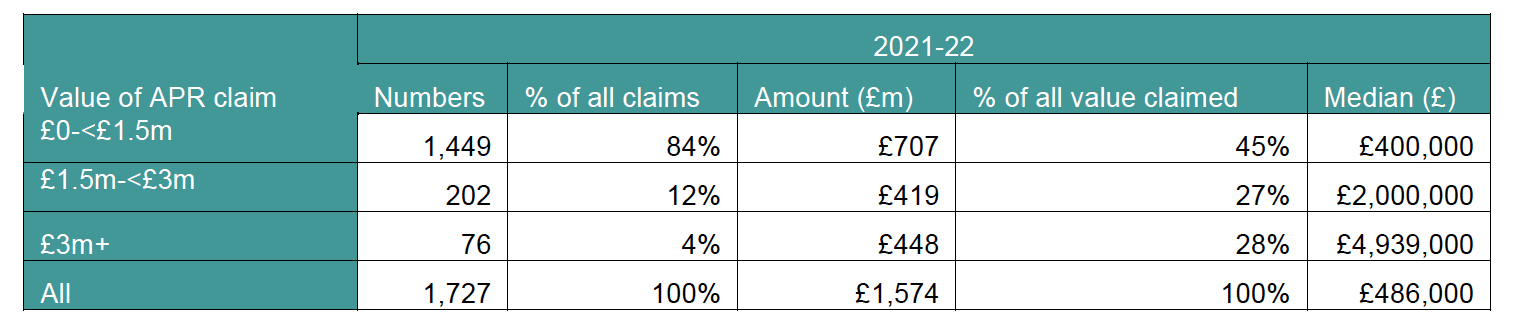

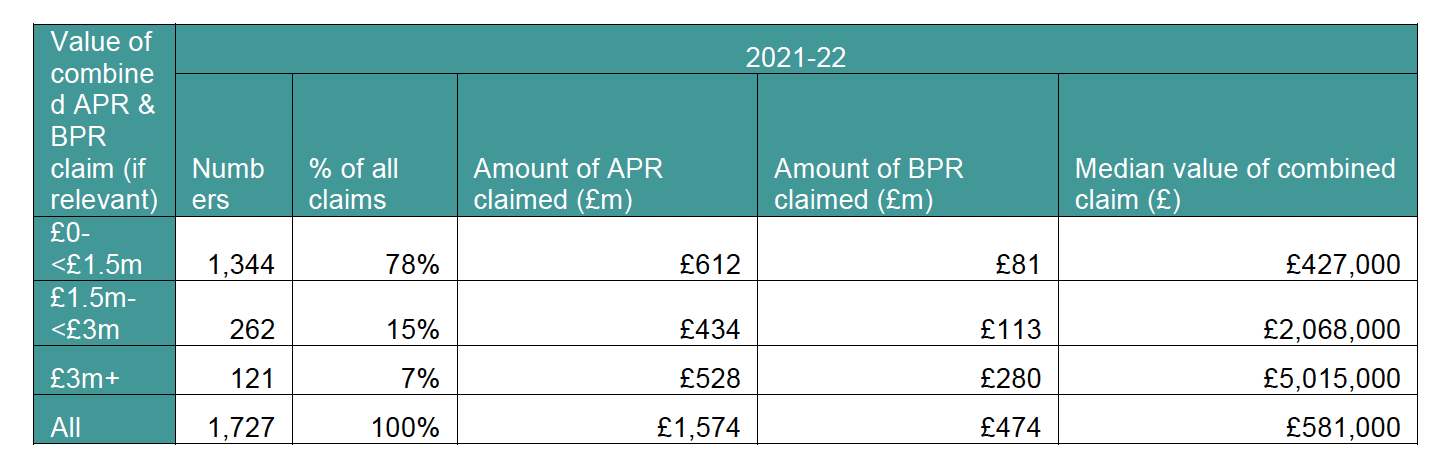

Here are the two key tables for 2021-22. I’ll focus on that year for now (but will return later to the question of whether other years are different).

This table shows estates claiming agricultural property relief (APR):

And this one shows estates claiming APR plus business property relief (BPR).

First point: it’s sensible not to pay too much attention to the large number of small estates. Some will be small farms. Some will be hobby farms. Some will be small fields held as an investment and rented out to a local farmer. Some will be parts of large estates (for example most of a large farm owned by parents but with a significant but <£1.5m portion owned by adult children). I’m particularly interested in the number of large estates.

Second point: on the face of it, a lot of BPR is being claimed – 17% of the total.7

One of the reasons for this is stated in the letter:

“AIM shares” are shares listed on the “alternative investment market” – the junior sibling to the FTSE, for small and medium-sized companies. AIM shares are often used for tax planning because (until the Budget) if you acquired AIM shares8, your holding would qualify for BPR after two years and become entirely exempt from IHT. Most normal investors, even sophisticated ones, don’t hold AIM shares, as the historic returns have not been very good.9

Farmers are very unlikely to hold AIM shares. They’re high risk, historically offer poor returns, and most farmers would invest in their own farms instead. The IHT benefit of AIM shares isn’t a planning strategy that’s very sensible for farmers. None of the advisers I’ve spoken to who work in this area have ever seen a farmer who holds AIM shares.

So we can safely assume that this quarter of all farm APR/BPR claims isn’t from farmers who happen to hold AIM shares. It’s from investors – people looking to shelter their assets from inheritance tax who have bought AIM shares as part of their portfolio, and farmland as another part. The AIM shares are a “signal” that what’s going on here is IHT planning.10

How many of these tax-driven AIM/farming holdings are small, and how many are large? We can calculate this from the information in the Rachel Reeves letter – and the answer is surprising. About 30% of the AIM/farming holdings are over £1.5m.11 The other way to look at this is that, whilst the figures show 383 farming estates over £1.5m, we can be reasonably confident that about a third of these (32%) are just people engaging in tax planning, not actual farmers.

This will be an undercount of estates holding farmland as an IHT strategy, because the calculation only counts those IHT planning farm estates which revealed themselves by also containing AIM shares. There will be many that don’t.

So the true percentage of £1.5m+ agricultural estates which are held for IHT planning purposes will be more than one third.

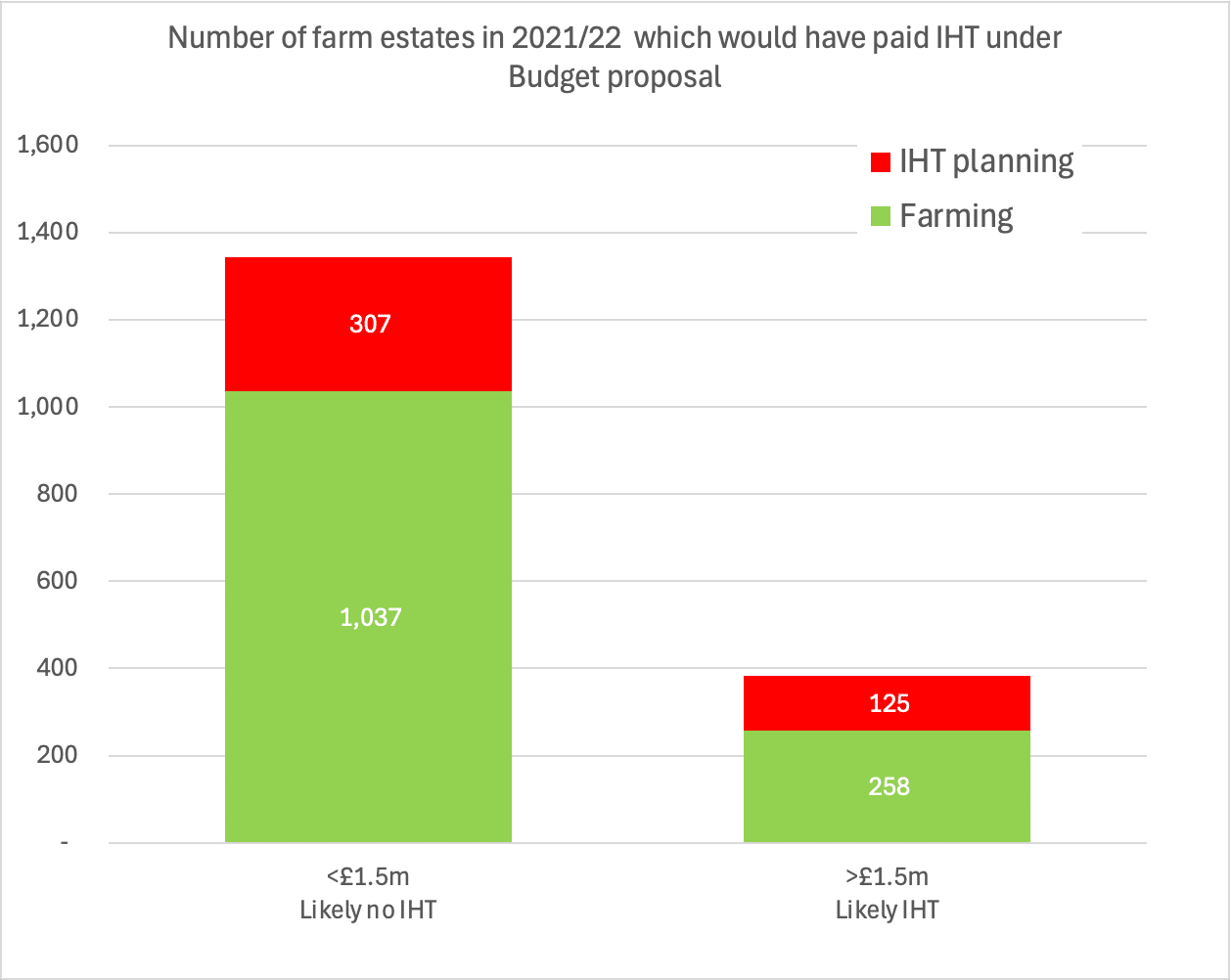

So here’s the answer to the question of how many farming estates would have been subject to IHT had the Budget rules been in place in 2021/22. Depending on how many are held by single farmers vs couples, how many couples employ tax planning, and myriad other factors: fewer than 250 “real” farming estates.

IHT would also be charged (at 20%) on 125 estates of over £1.5m owning farmland as part of an IHT strategy. And there would be another 300 estates of under £1.5m owning farmland for IHT purposes, most of whom would (post-Budget) still escape IHT altogether.

Or in chart form:

What about other years?

It’s often a bad idea to look at one year in isolation. 2021/22 could have been unusual. Perhaps for a good reason – e.g. fewer deaths post-Covid.12 Or perhaps just statistical fluke – when the numbers are this lowish, they can be dominated by one-off effects (e.g. the absence or presence of a small number of very wealthy estates can push the statistics meaningfully in one direction or another).

The data shows that 2021/22 didn’t have an unusually low level of farming IHT relief – it was a record high:

That was driven by a 50% increase in the number of APR claims. There was no such dramatic effect for BPR:13

This level of change is very surprising, and I don’t know what the explanation is.14

We don’t have AIM figures for other years, but it would be surprising to see a very different result.

Why do these figures show so few farm estates worth over £1.5m?

The NFU says that 75% of commercial family farms are above the £1m threshold. How can that be the case, if only a few hundred estates would be subject to IHT every year?

Because the number of estates is not the number of farms, and IHT applies to estates, not farms.

- Farmers, particularly those owning large farms, often give some or all of their property to their adult children when they retire. This can be for succession or tax planning reasons (because often APR/BPR does not provide a complete exemption). Tax rules make this relatively easy, and there normally isn’t a capital gains tax charge. So relatively few large farms end up in probate – the number of farm estates is always going to be less than the number of farms. (Those owning smaller/less profitable farms often financially aren’t able to do this.)

- Many farms are held by multiple people, e.g. a married couple and one or more of their children, owning the business together either in partnership or through a company. The NFU says, I’m sure correctly, that multiple ownership is unusual for small farms, but they concede that “multiple ownership might be more common in larger farms”. The farmers and advisers we spoke to believe it is indeed more common. So some (and perhaps many) of the <£1.5m estates will actually be interests in much larger farms.

There is no conflict in the data, and there conceptually shouldn’t be. If we want to know what the impact of the Budget changes would have been in 2021/22, the only data that’s relevant is the APR and BPR data for 2021/22.

The NFU are measuring the wrong thing.

Does this mean fewer than 300 farms will be affected?

That conclusion would be wrong.

The number of farms affected by the change will be larger than the number of estates subject to IHT each year. All farmers at, or approaching, the threshold will need to put planning in place. Those well over the threshold, or for whom planning isn’t appropriate, will worry about the consequences.

This can be for many reasons that are not a result of a failure to act on good advice, e.g. risk of divorce, restrictions on transfers due to banking requirements, financial or personal vulnerability of heirs, etc.

How many are in this category? That depends on how we define a generation, how long people will think the new IHT rules will remain in place, how worried we think people will be about events 25 years in the future, and what assumptions they’ll make about IHT rules in place at that time.15 It would be wrong to be more precise than “a few thousand” likely being affected. But that also means a larger number, probably low tens of thousands, are worrying about being affected. Farming tax advisers tell me they’re seeing an unprecedented level of demand.

What other adjustments do we need to make to the figures?

There are at least two factors which (of themselves) would make the number of farms affected in 2025/26 larger than the 2021/22 figures suggest:

- The value of farmland in 2025/26 will be higher than the value in 2021/22. There has been considerable asset-price inflation since 2021/22. Various sources say farmland has gone up somewhere between 4% and 8% each year. That suggests, by the time the new rules come in, valuations will be between 17% and 36% higher than those in the 2021/22 data. So the number of estates we found to be at the £1.5m point in 2021/22 will in fact be closer to £2m in 2025/26. By happy accident, £2m is the actual figure where IHT is likely to start applying… so asset inflation doesn’t end up changing our conclusions.

- The figures in the tables above include farms held by companies, but don’t include farms held on trust (or farms owned by companies owned by trusts). The rules for trusts are different: broadly speaking trusts aren’t subject to IHT when an individual dies; instead, there’s a 6% charge every ten years. APR and BPR used to provide a complete exemption from that charge. Trust assets over £1m will now be subject to a 3% charge every ten years. Some of the UK’s largest landowners hold property through trusts, as well as sophisticated individuals and some relatively small farms too (typically for current or historic succession planning reasons).

Set against this, there are three factors pushing in the other direction:

- The high number of farm purchases driven by IHT considerations means we can expect the IHT changes to reduce the value of farmland, particularly farmland over £1m. Exactly how much is hard to say, other than there will be an effect which is greater than zero, and less than 40%.16

- I took out estates including AIM shares from the figures above, because we can be reasonably confident they were engaged in tax planning rather than farming. But there will be additional estates in the figures where people acquired farmland for tax planning reasons but didn’t acquire AIM shares (e.g. because they viewed AIM shares as too risky). We don’t know how many such estates there are – perhaps dozens, perhaps over a hundred.

- Taxpayers will, as is always the case, change their behaviour to minimise the tax. The OBR estimates this will reduce revenue by about a third.17 There will be more use of the spouse exemption, and more gifting. Possibly also more use of trusts.

Why do the numbers matter?

Two reasons:

- The small number of actual farming estates affected tells us that the potential revenues are quite fragile. Any tax which collects relatively large amounts from a small number of people is likely to be subject to very significant planning. The advisers I speak to think that the OBR’s estimate of a one-third revenue loss from planning is optimistic.

- The surprisingly large number of IHT planning estates affected tells us that the proposal is failing to collect as much revenue as it should from the people it is actually aimed at. And, as noted above, the figures on this are an under-count because there will be IHT planning farm estates which don’t reveal themselves by also containing AIM shares.

Which raises the question as to whether the right approach is being taken here.

What would a fair policy look like?

Questions of “fairness” are very subjective, and we need to start with some principles.

First, if we accept the basic Budget approach, it should be made to work more fairly

Here there are some principles I think most people would agree with:

- Tax systems should treat people in a similar situation similarly. It’s unjust if two people in identical positions face radically different IHT results, depending on whether they obtained advice. All of inheritance tax used to work this way, with one spouse’s nil rate band “lost” unless simple planning was put in place. That changed in 2016, with the NRB now transferring automatically. It’s unclear why the APR/BPR cap doesn’t work the same way.

- It’s also unjust to make people spend time and money on tax planning to overcome shortcomings in legislation.

- If we are judging the fairness of the Budget based on a £1m cap as it applies today, then that cap should not be permitted to be eroded by asset price inflation. Recent experience has been that IHT thresholds don’t rise with inflation – the nil rate band hasn’t changed in fifteen years. So many farmers will rationally fear that asset inflation will bring their smaller farms within scope.

These are fairly easy to overcome:

- The £1m cap should automatically transfer between spouses, and (as was done for the residence nil rate band) retrospectively transfer for farmers whose spouse died in the last few years – becoming £2m in either case.

- The legislation should automatically raise the £1m cap in line with inflation (or some other fair measure of asset values).

- As the IFS suggests, the usual seven year gift rule should be relaxed for farmers. They (entirely reasonably) didn’t expect they’d ever have to plan for inheritance tax, and so some older farmers haven’t passed the farm to their children in the way they might have done if they’d thought about inheritance tax planning. Many will now be too late – and the rules could be relaxed to prevent what would otherwise be a significant unfairness.

Would these changes be sufficient?

Second, we should do a better job of targeting IHT planning/avoidance

Here some people will take the view that IHT itself is immoral, and all IHT planning is acceptable; even laudable. That’s not my view.

I would say:

- It’s wrong that one person can inherit a £3m house from their parents and sell it, with £800k inheritance tax, and another inherit £3m of farmland and sell it, with no inheritance tax.

- That’s a particularly unfair outcome if the situation was engineered (i.e. because their parents weren’t farmers, just wealthy people engaging in tax planning).

- And this tax planning has wider adverse consequences, creating artificial demand for farmland, boosting asset prices and hence reducing farmers’ return on capital.

The problem is that the Budget changes don’t stop tax planning very effectively. Acquiring farmland for IHT purposes remains a great strategy if you hold less than £1m (or £2m for a couple). And a pretty good strategy beyond that (20% IHT is better than 40%!).

I would instead refocus the changes to remove the IHT benefit for people who hold farmland for planning purposes. How to do this in practice?

- One approach: a “clawback” of all APR/BPR relief for a farm if those inheriting farmland sell it within a certain time. In other words, upon a sale, all the IHT that was previously exempt suddenly reappears and becomes charged. This isn’t a new concept. The UK already has similar clawback rules for other taxes. Ireland has a similar rule for its farming inheritance tax relief. The clawback period would have to be reasonably long (years not months) and should “taper” down gently to avoid a cliff-edge.18

- Or there’s a more radical solution which is being suggested by some – ending all IHT relief for owners of farmland who don’t occupy the land. That would certainly stop the use of farmland for tax planning. It would, however, have much wider effects. About half of all farmland is tenanted, and tenant farmers are concerned that their tenancies could be lost if the landowners sold part of their land to fund an IHT bill. I don’t know if that’s correct, but the point would need to be looked at very carefully. And then there is an additional complication – many farmers who own and operate their own farm will hold the land in a separate company. It would not always be easy for legislation to distinguish this case from a third party investor.

There may be other potential solutions. However the clawback route seems to me the most practicable.

Third, do we actually want to impose IHT on family farms?

Farmers owning farms which they believe are worth c£5m have told me their profit is currently so modest (under 1%)19 that the £400k inheritance tax bill they’d face under the proposed rules is unaffordable and couldn’t be paid up-front or financed – they would have to sell up.

How do we respond to this?

One approach is to say that a family farm yielding a 1% return20 isn’t economically viable when far better and easier returns on capital could be obtained elsewhere. Someone inheriting a £5m farm post-Budget could sell it, pay the £500k inheritance tax, buy a nice £1m house and stick the rest of the money in an index tracker fund – they and their descendants could then live happily off the c£150k income for essentially ever. Presumably that’s not a result farmers want, or they’d have done it already. Is it a result we as a society want? Are the economic effects positive (larger, more efficient, farms) or negative (lots of smaller <£1.5m less efficient farms)? What about the social consequences? How would food security be affected?

But if we’re happy with this outcome then we’re done, and all that’s necessary is to to make the new rules a bit fairer in terms of automatic transfer and indexing the cap, and being less facilitative of avoidance.

If we’re not, we need to find a better solution.

A better solution?

One response would be to adjust the way the current proposal works. For example: have a series of different caps and progressive rates.

I’d suggest something simpler: raise the cap dramatically (say to £20m21 In practice this will probably almost all be to trusts, so a 6% charge every ten years.[/mfn]) so that only the largest and most sophisticated farm businesses become subject to IHT (which they can fund through finance or selling part of the business). For everyone else, keep APR/BPR for farmland exactly as it is today, but – critically – with the “clawback” rule I suggest above. The clawback period would be set long enough to make farm IHT planning unviable for non-farmers:2223

- This would have no impact on a family farm succession planning, if the farmer’s heirs continue to own the farm.

- It would mean inheritance tax at 40% if some or all of the heirs cash out. But why shouldn’t it? If realistically they’re inheriting £5m cash then it’s only fair they’re taxed the same way as anyone else inheriting £5m of cash.

- And it would certainly mean inheritance tax at 40% for someone who buys farmland solely for IHT purposes (given that their children won’t be expecting to hold onto farmland forever, particularly at current yields).

We’d be taxing farmers a lot less, but IHT-exemption-chasing investors a lot more. My back-of-a-napkin calculations suggest that the revenue difference between this and the original Budget proposal is plausibly rather small, and could be positive.

Thanks to the farmers and farm tax/financial advisers who discussed the CenTax proposal with me. All opinions and any errors are my sole responsibility.

Footnotes

See page 58 here. ↩︎

In principle the RNRB could be retained in full with joint assets up to £4m, but in practice change in asset values between deaths make this very unlikely. ↩︎

The relief used to be called “business property relief” and many HMRC/HMT publications still refer to that, and “BPR” is more commonly used than “BR”. ↩︎

I and some others initially said the figure here was £1.5m – the £1m cap plus NRB plus RNRB. But that’s wrong, because the 50% APR/BPR relief applies first. So a £2m estate completely covered by APR/BPR has £1m completely exempt, then £1m relieved at 50% to £500k. That £500k is then covered by the NRB/RNRB. ↩︎

The BPR data makes little difference to the number of estates that would be taxed, because BPR for the smaller farms is very limited (BPR of course applies to all private businesses, of which farms are a relatively small proportion). ↩︎

There is additional historic data in the HMRC “non-structural” tax relief statistics here. But these figures are out of date, and therefore the 2021/22 figures are too low. The enticing 2022/23 and 2023/24 figures in this data are just forecasts, so I wouldn’t read too much into them. ↩︎

This is surprising given that agriculture is a small percentage of overall UK private business, even if we adjust for the fact that farming makes up a larger proportion of UK private business assets than it does of UK private business GDP. I’d welcome thoughts on why the figure here is so high. ↩︎

Or at least the right AIM shares ↩︎

Important point of detail: the BPR exemption applies to all shares listed on exchanges which aren’t “recognised stock exchanges“. So it applies to AIM (but not the FTSE). It also applies to some quite significant foreign exchanges, like the National Stock Exchange of India. ↩︎

The forecast on page 5 of the letter projects the number of APR/BPR estates including AIM shares falling dramatically by 2026/27, presumably because of the restriction being introduced on AIM BPR in the Budget. ↩︎

We can find this using simple maths because we have two pieces of information. First, we know that the number of AIM estates is about 432 (25% of 1727). Then we know that if we take the number of AIM estates out of the figures, the proportion of <£1.5m estates rises slightly to 80%. Let P be proportion of AIM estates under £1.5m. The number of <£1.5m estates if we take out the AIM estates is then: 1344 – 432P. As the proportion of <£1.5m estates is 80%, that tells us that (1344-432P) / (1727 – 432) = 0.80. So P = 71%. ↩︎

Some have suggested there could have been underreporting that year due to Covid-era backlogs. That shouldn’t be the case – the figures are for deaths in 2021/22 not filings in that year. The deadlines for probate, IHT returns and HMRC responses mean that the data for 2021/22 should now be reasonably complete. ↩︎

There was a significant jump in high-value BPR claims in 2018/19, but that was likely just a few very high value estates. ↩︎

It shouldn’t be Covid, because the data is for deaths in the relevant year, not filings in that year (and any increase in death rate would impact the BPR figures as well as the APR figures). ↩︎

This is a problem that bedevils IHT planning. If you’re planning for events 30 years ahead, you have to assume IHT rules will change numerous times. Indeed the concept of complete exemption for farms is only 32 years old. ↩︎

This is something it should be possible to analyse after the event, by comparing the change in market value of farmland above and below the £1m and £2m points. ↩︎

See page 55 here. ↩︎

This approach would certainly bring complications. How long would the “clawback period” be? Too short, and people would just wait before they sold. Too long, and it becomes hard to enforce. And applying to trusts brings a further level of complication. “It’s all very complicated” is the usual response to all tax changes, but complication can’t always be avoided. ↩︎

I say “believe” because I confess I don’t understand how economically it’s possible to have an asset worth so much but yielding so little. APR only applies to the pure agricultural value of property (not development value, hope value etc). BPR can apply to exempt non-agricultural value from IHT, but it’s not always straightforward, and won’t apply at all for the 50% of farms that are tenanted. But this is an aside – farmers clearly believe that there is a massive disparity between asset value and return. ↩︎

Important to note that these “return on capital” figures usually deduct an amount for the farmer’s labour. That’s economically the correct approach, but means in cash terms the farmer is receiving more than 1%. ↩︎

I’m not wedded to any particular figure. The idea is that very large landowners, who realistically can afford the IHT, pay it. It also restores the original purpose of the old estate duty – to prevent vast tracts of land becoming permanently locked into huge estates. Beyond the £20m, IHT should apply in full.21It may also be worth revisiting the current qualification period. Currently this is seven years for passively held farm interests, and two years for active farmers. The two year period may need extending. ↩︎

It’s six years in Ireland – but I’d tentatively suggest we need a longer period to make IHT planning non-viable. There would undoubtedly be calls to make the clawback more flexible, e.g. an exception for a forced sale of the farmhouse of one kind or other. I would take great care before creating such exceptions, as they’d inevitably be exploited for avoidance purposes. Limit exceptions to cases that are hard to exploit, like compulsory purchase (if the purchase monies are used to acquire new farmland). ↩︎

If this proposal was enacted then the obvious step for someone previously using APR to avoid IHT would be to move into an AIM (or other unlisted share) portfolio given that, even post Budget, AIM shares still receive 50% relief. I would give serious consideration to restricting AIM relief further, or abolishing it. If you close one IHT planning strategy, people will move to others – you have to shut them all. ↩︎

60 responses to “How to stop IHT avoidance but protect farmers”

Thank you for this exceptionally well-researched and thoughtful analysis. The data-driven approach highlights the real tension between curbing tax avoidance and protecting genuine farming families. The proposal for a clawback mechanism strikes a sensible balance—supporting long-term agricultural continuity while discouraging opportunistic use of farmland for IHT planning. A valuable contribution to a nuanced debate

Regard Unissula

Hi Dan, thanks for the article. SQE student here studying Wills, and just generally curious about the whole IHT system.

I understand one of the big concerns here is wealthier people trying to buy agricultural land just to turn some of their estate exempt (Clarkson etc). In that case, would one potential solution be to increase the amount of time the land needs to have been owned for? I understand that current rules are 2 years occupied/7 years owned + occupied by someone else – could those numbers not have been increased rather than the change they went for in the end?

Apologies if I’m missing anything or if you’ve already covered this, but just curious!

Cheers.

My guess would be because people planning for IHT do so years in advance, so by the time it is actually inherited, the 2/7 rule would have been fulfilled. The clawback rule would cover the other side of the inheritance, whereby you couldn’t sell it immediately. I’m no tax expert though, so was just a thought.

Its about time the definition of a farmer is clearly defined given the generous tax benefits that are brought. Some may argue that they are farmers of convivence only, jumping on the band wagon now the standing government have got wise to the super rich millionaire set(think Jeremy Clarkson, Oxfordshire & Steve Perez, Derbyshire and the rest, of which makes up a large % of UHNW).

My sympathy sits with actual farmers providing for the population not a farm shop or a local restaurant or two.

My immediate thoughts on this were that second generation and beyond land owners (farmers) should not have the tax levied. First generation land owners (those abusing the system, Clarkson, Dyson etc) should be charged the tax on exit/death. Going forwards new land owners exceeding the iht limit should be charged on entry in the same manner as a chargeable lifetime transfer would be taxed.

This whole discussion is based on the assumption that APR / BPR is egregiously exploited for tax planning. This assumption is nonsense.

Lets look at the numbers. If I want to give a large sum to my children I have two choices:

a) Buy farmland, an illiquid and low yielding asset with considerable management burdens, and hope that the IHT rules don’t change before I die (like they just have). In buying farmland I incur 5% stamp duty plus other costs (legal, agent’s fees) of 1-2%.

b) Make a potentially exempt gift to my children, allowing them to invest it in something sensible / liquid (like listed equities). Furthermore, I could buy a life policy to cover IHT liabilities should I fail to live out the seven years. Provided I am reasonably healthy this will cost a small fraction of the transactional fees for buying farmland noted above.

Now, which of those options seems like a more rational plan?

There are many reasons why non farmers might want to buy farm land (e.g. conservation, country sports, owning your own view, investment, enthusiasm for farming). IHT reliefs are (or were) at most a fringe benefit.

The idea that any non farmer who owns farm land is only (or even party) motivated by IHT benefits is nonsense given the option of making IHT free potentially exempt transfers.

Dan’s assumption that people only own AIM shares for the IHT benefit is equally ridiculous.

Part of the problem with this debate is that the number of people who understand both tax and farming appears to be vanishingly small which results in half baked government policy and its poor coverage in the broader media.

it’s not an assumption – it’s well evidenced. See the chart here showing how the effective rate paid by estates over £5m drops precipitously. That’s down to tax planning, principally APR and BPR.

Farmers and farm tax advisers most certainly understand that how common APR IHT planning is – they see the impact on the price of farmland. That’s one of the reasons so many farmers, and the NFU, have welcomed the proposal in this article.

As a 4th generation farmer with children who want to farm this makes a lot more sense, thank you.

My only thought would be, could a ‘roll over’ option be included, so a beneficiary could sell and buy land without the 40% being added? To downscale, increase acreage or just move. I would have thought the same objectives would still be met?

Inheritance tax raises, what £8bn a year? With hardly any of that being from the ultra-rich who can plan their way around it.

Just scrap the lot and replace with progressive taxation from other sources like LVT or your Inflation-adjusted CGT.

This would also have the effect of driving farm prices down dramatically, which will benefit new and productive farmers who want to expand.

Regarding the ‘Clawback’ clause you suggest is this not performed by Capital Gains Tax? although admittedly at 18%

it isn’t – CGT is wiped out at death (“rebased”) so someone inheriting property and immediately selling it has a CGT bill of £0

Dan,

Firstly, thanks for looking into this.

I’m a dairy farmer in West Wales. What I see happening very often around here are small holdings <£1m being purchased by people who’ve made their money outside farming and fancy a slice of the country life. These small holdings are not farms yet are still registered as agricultural holdings. Has this had any impact on the figures used by Rachel Reeves as to why the threshold was set at £1m apr and for her (and the whole Labour Party) to say that the number of farms affected will be very small? If these non farming holdings were taken out of the equation all together then wouldn’t this change things?

I agree with the possible solution you have suggested in your article by lifting the limit and having clawbacks in place however I had always thought that HMRC could apply a simple test:

1) Are you an active farmer?

2) Is your primary income from raising livestock and/or growing crops?

3) Is the area of land surrounding the homestead able to generate enough income to maintain the farm house?

Just a bit more about myself: I’m 46, farming 400 cattle on 450 acres. I’ve a mortgage big enough that it should have its own website. My father died of a farm accident at the age of 50. I was 21 at the time. I have 4 kids 14 -21 who are eager to farm at some point although I’m keen for them to get an education and persue a career of their own first. As things stand, I don’t see the point in paying off debt only for the kids to get a tax bill on my death. One also has to bare in mind that even a farm of this size won’t be viable between 4 siblings therefore, the 1 or 2 that want to take it on will/may have to pay the others out. I also hear of plenty of stories of 80+ year olds who’ve worked all their lives only to see their hard work now potentially being taxed. My way of thinking is that if those guys thought anything of their families, their businesses and their farms then they would have sorted out a succession plan some 20 odd years ago. Thank you. Gwyndaf.

thanks, Gwyndaf. The problem with that proposal is the impact on farmland that’s tenanted – i.e. about half of all farmland.

Question- why leave out the second condition for Irish Agricultural Property relief?

“Additionally, the person receiving the gift or inheritance, or the person leasing the property must either:

– have an agricultural qualification (as listed in Schedule 2, 2A or 2B of the Stamp Duties Consolidation Act 1999)

or

– farm the agricultural property for at least 50% of his or her normal working hours.”

A 6 year clawback (Irish rule) on its own is too short for families with substantial wealth – they will have other assets to live on. I very much doubt anyone but real farmers will satisfy the second test. With this you can eliminate the £1 million threshold and 50% IHT reduction beyond the threshold entirely to capture the large portion of agricultural land held solely for IHT planning. This may not cause an immediate sale of this property by wealthy individuals (concern if tenant farmers) – they could simply take advantage of the 7 year rule. But going forward there would be no incentive for the wealthy to buy and artificially drive up the price of farmland versus any other asset class.

I think the difference in the UK is the size/significance of the tenanted farm sector

One item I am not an expert in is roll over relief for CGT purposes. From talking to a few contacts, there are farmers who have sold their farmland for development and then have a CGT gain that they can only roll over into agricultural property which props up agricultural land prices.

I don’t know if this has come up in your discussions.

thanks – yes, it is a classic problem of a tax relief that benefits individual farmers but hurts farmers as a whole… not sure what the answer is…

“how to stop IHT avoidance”….. Estate Planning is, in itself a form of IHT avoidance is it not?

It’s not complicated. When someone I like does it, it’s planning. When anyone else does it, it’s avoidance.

Thank you Dan. I hope someone with enough clout will be studying your proposal.

Rather than argue to reverse the Chancellor of the Exchequer’s proposals, the discussion on farming and inheritance tax (IHT) needs to move on from protest alone to proposing alternatives that genuinely protect family farms but prevent tax avoidance (and inflation of land prices) by wealthy landowners with little or no interest in farming. The continuity of family farms is important for food production and an important glue for sustaining rural communities, making farming related inheritance tax (IHT) concessions justifiable. A simpler, fairer, better targeted approach than changing Agricultural Property Relief (APR) is required. Reversing the proposal maintains the status quo with all its associated abuse. Certainly the proposed thresholds could be raised, but that would remain overly complicated and will benefit even more tax avoiders than currently proposed if they fall beneath a raised threshold. It’s also ironic, and harsh, that a Labour government’s proposal disadvantages single parent farmers – e.g. divorced or widowed – who cannot share allowances with a spouse. Practical alternatives, such as a current farm residency requirement, or heirs’ commitments to continue farming for a number of years, or practicing nature-friendly farming practices, in exchange for IHT concessions have not been explored, but still could be (there is much to be learned from such approaches in Europe – especially France). A collaborative effort between the NFU and government on such ideas could break the current deadlock and reset relationships without either side losing face.

An inspiring article. Thank you

An interesting read, and you have come to some of the same conclusions as I have had for years. Unlike the Treasury, you have taken the time to research the subject and speak to people who understand the issues. Given that one of the main aims of APR and BPR is to prevent the sale or breakup of businesses to pay the tax, I have never understood why relief is given to people who sell these assets soon after inheritance. I would suggest a ten-year tapered clawback.

As someone involved in advising farmers on this subject it will be interesting to see what impact these changes have on land values, but think it will be modest. A wealthy individual will still be able to buy £2m of farmland and save £600k of IHT under the new rules.

You commented briefly on tenanted land in the article. The Tenant Farmers Association lobbied the previous government to restrict APR on let land to tenancies longer than 10 years. They at least had the sense to consult on this before proposing new legislation. Most of the people I spoke to were supportive of the intention, but thought it would be counter-productive, in that landlords would be as likely to enter into short-term joint vantures as long-term secure tenancies. Hence tenants would have less security than they have now.

I hope the Treasury have now realised that this is a complex area. They still have time to withdraw these proposals and consult on proposals which could raise more revenue with much less controversy.

Buried in Rachel Reeves letter, which is quoted in the article, is an fact about treasury figures:

The treasury figures for APR and BPR combined exclude all claims for BPR alone. Apparently it can be quite common for farmers to use only BPR.

It shows the median only. Do we have any idea how wide that distribution is? The BPR element, in theory , surely it could be £1m or more. How significant is this?.

Another option would be to allow anyone hit by the new tax to “pay” it by allowing a charge to be put against the land on the land registry. Then it would be worth less to anyone selling it, or borrowing against it. That’s only good for people prepared to accept lower yields for use as a farm.

Although this doesn’t have some of the advantages of your proposal, it does stop the problem of immediate sales. It has the political advantage of being a minor tweak to the existing policy, rather than a backtrack.

The APR legislation already has fairly strict tests to determine if someone is genuinely farming. If the farming is delegated to a tenant, then it has to be owned for seven full years before the death for any IHT relief. A simple gift would be a superior IHT strategy as the tax due would taper over the seven years. Also, the family would probably achieve a much better return on investment by investing in something other than farming.

The concept of farming being a good tax avoidance strategy for non-farmers is simply false.

A full u-turn on the budget measures for this would be the simplest and best solution.

APR and BPR have been useful supports for encouraging investment in and preservation of British family businesses and other SMEs for decades.

It is disingenuous for the Government to view it as ‘tax avoidance’. Investors have merely been responding to well-justified intentional tax policy.

SEIS supports British seed investment, EIS supports British early-stage investment and APR/BPR support British smaller companies more generally. Just leave APR/BPR as it was!

Without this support investors would prefer (mainly non-British) global equities.

Why make just ~1% per year for 7 years on a small private British business? If you can make ~10% a year on a passive global index tracker, that will be superior even after a 40% IHT hit.

We need to keep the support in there for farms and other smaller British businesses.

A significant part of why the return on asset value is so low is because the asset value is artificially high due to the attractiveness of the asset for avoiding IHT.

Abolish APR, introduce a targetted subsidiy to encourage owner-occupied farming, see asset values fall and so yields rise, and will famers say “thank you”?!

Hi Dan, Not sure how it will affect your analysis, but you should be aware a number of former mutual/ co-op farm businesses are/were listed on AIM – e.g. NWF PLC, Wynnstay Group PLC. As such it is maybe not surprising that some farm estates would also include these AIM shares.

I’m a farmer too- but this analysis omits what was discussed about in “Any Answers” – is it true the Swedish evidence pointed to inheritance taxes being a brake on economic efficiency- so they abolished them. Why are we double taxing effort ?There is also something about the smaller farmer looking after their land- I halved my sheep and cattle numbers , the grass grew longer , the mice came back , and then the barn owls . It’s made us so happy seeing the owls back. Consolidate the farms if they are sold it’s like selling London Bridge- to whom ?

It’s often said that IHT impacts economic efficiency but I’m not aware of any evidence to that effect. There were several reasons the Swedish tax was abolished, but this wasn’t one of them (or at least wasn’t apparent in the public debate at the time)

Hi Dan,

Fair play for going in to the detail here and revising your analysis. What are your thoughts on divorced farmers, farmers in their elder years (many are working full time now in their 80s) and those that are still working but have a terminal illness?

I can introduce you to all of the above for some live examples

The continuity of family farms is important for keeping farms within families and also for sustaining rural communities, making inheritance tax (IHT) concessions justifiable, although reforms are needed to exclude those treating land purely as an investment. A simpler, better targeted, approach than changing Agricultural Property Relief (APR) is needed to prevent tax avoidance by wealthy landowners (and inflation of land prices) with little or no interest in farming. Certainly the proposed thresholds could be raised, but that will still be complicated and create some unfairness. It’s also ironic, and harsh, that a Labour government’s proposal disadvantages single parent farmers – e.g. divorced or widowed – who cannot share allowances with a spouse. Practical suggestions, such as a current farm residency requirement, heirs’ commitments to continue farming for a number of years, or practicing nature-friendly farming practices, in exchange for inheritance tax (IHT) concessions have not been explored, but still could be (there is much to be learned from such approaches in Europe – especially France). Then, IHT revenue from estates that can’t meet those conditions and are sold could fund initiatives to support new entrants into farming, particularly if limiting tax avoidance leads to lower land prices. After all, there are schemes to help first-time home buyers. A collaborative effort between the NFU and government on such ideas could break the current deadlock and reset relationships without either side losing face.

I note that one of the alleged purposes of the IHT changes (I don’t believe it myself but I’ll go with what was stated) is to achieve fairness.

Raising the threshold from £2m to £20m increases the unfairness.

But suppose the purpose of the changes isn’t fairness, then what is it? If it’s to raise revenue and narrow the deficit by taking from an industry that doesn’t contribute enough, then get rid of all of the subsidies and go full New Zealand. And/or stop subsidising foreign farmland owners.

my proposal isn’t to raise the threshold to £20m – it’s to raise the threshold but create a clawback so the exemption only applies if the farm continues to be owned and operated by the heirs

“long enough to make farm IHT planning unviable for non-farmers”

That may be forever. It’s a very low risk asset, doesn’t move, perceived to be scarce and is collateral for other investments. Keep farm (or landed estate), buy Nvidia? At current land price inflation there is unlikely to be a margin call. We may have found an actual use for Ricardian Equivalence. They do think that long term.

Thank you for doing this work. There are some great suggestions. My parents are in their 80’s. Dad severe dementia. Farm 295 acres farmed responsibly and ethically by 55 year old brother since the age of 16. He works the farm alone. He loves his animals he is innovative to new environmental practices and crops. This tax will ruin him. He earns about £30-£40k he will have to pay £30k a year for 10 years.

Aacrage not carafe not in previous

Land value has not gone down in East Yorkshire since 2021- it has gone up. We’re arable farmers- glad you’re properly looking at this I only hope the government do as well- please think about input costings in farming- they are absolutely colossal. I’m a family farmer with a large a carafe and we Can Not cover the proposed IHT – we are larger as more efficient for inputs.BPS needs reversing also in food production. The central documents need through scrutiny . I hope the government does something and admits they are totally wrong on this. Be the best thing they can do right now.as utterly wrong too.

Hi – yes, please see above where I discuss farmland asset-price inflation since 2021/22.

We are dealing here with something that gets lost in the roundings in government finance, but it is all about perceptions. Even if only one estate a year were currently caught farmers would be concerned about the principle given failures on indexation of reliefs (and making it statutory has failed historically as a new government just changes the rules).

Your suggestion is way better than that proposed, although something needs to be done about the pure IHT avoiders buying farmland, and thus inflating prices.

The TNRB was introduced in 2007 not 2016.

Interesting to read how the estate of a single farmer with a farm valued at 2m will not be subject to IHT. 4m for a couple.

that’s not correct – it was 2016, after the Ed Miliband coverage, but made retrospective to 2007.

Lot of food for thought.But picking up on Note 18. I think many non farmers apply a classic market rationale here. But farmers I know don’t take that approach. Farming is not a rational “business”.

Ironically you can see that from Clarksons Farms

I would hope that there is a lot more substantive data underpinning this policy, rather than the broad-brush numbers and assumptions that you have used in this opinion.

The NFU have drawn attention to the discrepency between the HMRC APR and DEFRA farm values, pointing to what would amount to incompetent, sloppy assumptions and analysis, when framing this policy.

To add insult to injury, it would seem that the government and HMRC haven’t bothered to consult, or request feed-back, before framing this policy, given the reaction of farmers.

I would suggest that this speaks to a level of incompetence at the Treasury, HMRC and DEFRA that should cause acute embarrassment.

On a specific issue, I note that you suggest that family farming businesses worth up to GBP4m can escape IHT, while the government have widely publicised the figure to be a maximum of GBP3m, if married (as I understand it, the GBP1m exemption on agricultural property and assets, and the combined GBP500k NRB and RNRB, per individual)?

The “discrepancy” point is rather silly. If you want to know the impact of abolishing a relief, you look at the stats for that relief. IHT isn’t applied to farms, it’s applied to “estates”. So NFU data on farms tells us little about the IHT consequences. I discuss this above.

Sorry, I don’t agree with you.

The Government tabled these changes parroting that only a small number of [commercial] farmers would be affected by the legislation (was it 22%). You have attempted to address this in tabling your suggestions, but, in doing so, you have simply underscored why the government’s claim is disingenuous, at best.

And, while I agree that looking at the HMRC data is the starting point for assessing the impact on the Treasury of withdrawing the IHT relief, what is quite clear is that the Government are pretty clueless as to how the policy impacts [commercial] farmers. They simply do not appear to have the “granular” data, as they like to call it, nor any data beyond 2022, to work on, because Estate Returns are filed manually. So they, and you, are forced to make sweeping assumptions about land values, what proportion of the Estates reported represent commercial farms &&. Information that should be readily available, at the very least, by consultation with DEFRA or the commercial farming unions.

For the Government and the Treasury, in particular, this looks to be utterly incompetent. And this before, the point you now make, that the Treasury does not seem to have been able to interpret its own legislation correctly, widely publicising that only commercial farm estates in excess of GBP3m will be affected by the Budget, when, it seems, the figure should be GBP4m?

So, I stand by my point that the Government, and, in particular, the Chancellor, the Treasury, DEFRA and HMRC should be acutely embarrassed by their incompetence….and, at the very least, they should invite a period of consultation and feedback before they shoot themselves in the foot, again?

sorry but I don’t agree with this. The definitive answer to the question “how many farm estates will pay IHT if APR and BPR is removed” is the APR and BPR data. The data certainly isn’t very granular, but it gives us a very good idea of the numbers.

I have recently been through the five year process of sorting out my brothers farming estate. The HMRC data can give you no idea of the numbers as they are never recorded in the first place, we never had to value farm machinery or stock there was no point it was not taxable. Most of the exchanges were around the Balfour relief my brothers farming was probably not even recorded as he farmed through a company and HMRC have openly said that they do not have that data. I asked my Farming Buying Group what percentage of their 1400 members farm through a Company and it is 32%. The reality is HMRC have zero real information on which to base there budget proposals.

Minor correction:-

“The value of farmland in 2021/22 will be higher than the value in 2025/26.”

Isn’t that wrong way round?

[First sentence of first bullet point in “What other adjustments do we need to make to the figures?”]

my apologies – bad typo, now fixed

Can ignore my comment. I’ve belatedly seen you addressed this in a footnote. Suggest instead that this point is made in the body of the article as it is nuance that is constantly being missed in the discourse.

Has anybody ever clarified what “profit” means in the context of farms? Many seem to be implying that these c1% returns are all the farmer has to live off, but that seems hard to believe. Is it actually 1% net profit after the farmers pay themselves a wage / have expensed a large part of their own lifestyle costs (fuel, energy costs, vehicles etc.; putting aside whether this is appropriate) through the farm?

No, it’s before drawings!

Assuming a business is run as sole trader or partnership (as most are) the farm ‘profit’ has to cover drawings, tax, the capital element of any loan/hp borrowings, and capital investment. So yes, farmers generally are not well renumerated. Combined withthe long hours most work, their take home £/hour is way often below the minimum wage

If the business is run as a company then the directors renumeration is taken before profit is shown.

As most farm offices are in the farmhouse then an element of the house energy costs, phone etc can be claimed as a business expense. Any qualifying vehicle (pick up trucks, commercial vehicles) that is used exclusively for business use can have all its purchase and running costs claimed against the business, similar to any tradespersons (builders van etc) vehicle. A car does not qualify as a business expense

In practice, if the Owner is the Worker, some expenses which HMRC would like to classify as personal, go through the business.

I don’t think HMRC should allocate resources to policing that overly hard; just that farmers (and other business owner-workers) should not moan too hard based on the reported figures.

Very interesting read.

(Small drafting point that needs correcting I think – “The value of farmland in 2021/22 will be higher than the value in 2025/26.” – should be the other way round)

I have no farming clients, but watching this debate with interest to understand the real impact vs the media hype. Thanks for the article.

In the section titled ‘What other adjustments do we need to make to the figures?’ the tax years in the first bullet point need to be switched.

all of this complication is confusing. Could be avoided with an annual tax on a percentage of the value of the land, without property etc. Tax it based on the planning permission it is has

So true.

And if there is a government desire to encourage famers with smallish holdings to live on their land, provide a subsidy explicitly for that, not a wrinkle in IHT, which is inevitably abused by others.