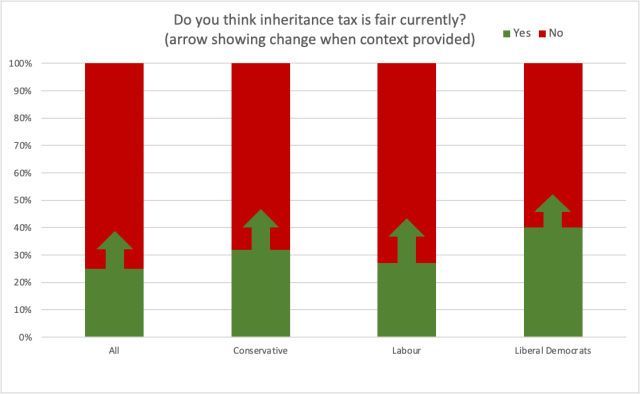

Thanks to pollsters WeThink, we polled public attitudes to paying more tax to provide the NHS with additional funding. We found a majority against raising tax, and few of those in favour of raising tax willing to pay more than £100 per year.

There may no longer be a majority in favour of increasing tax to pay for NHS spending

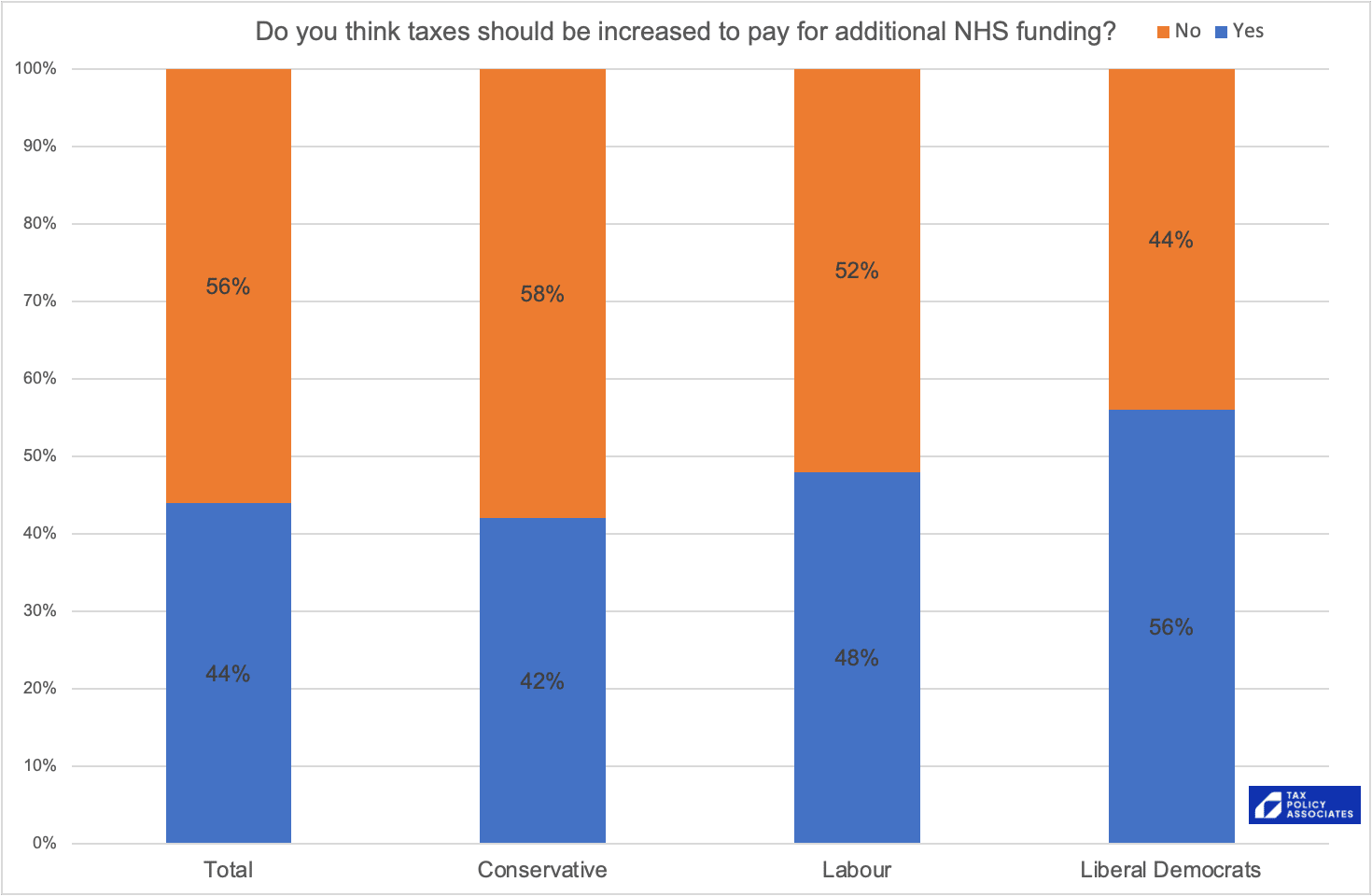

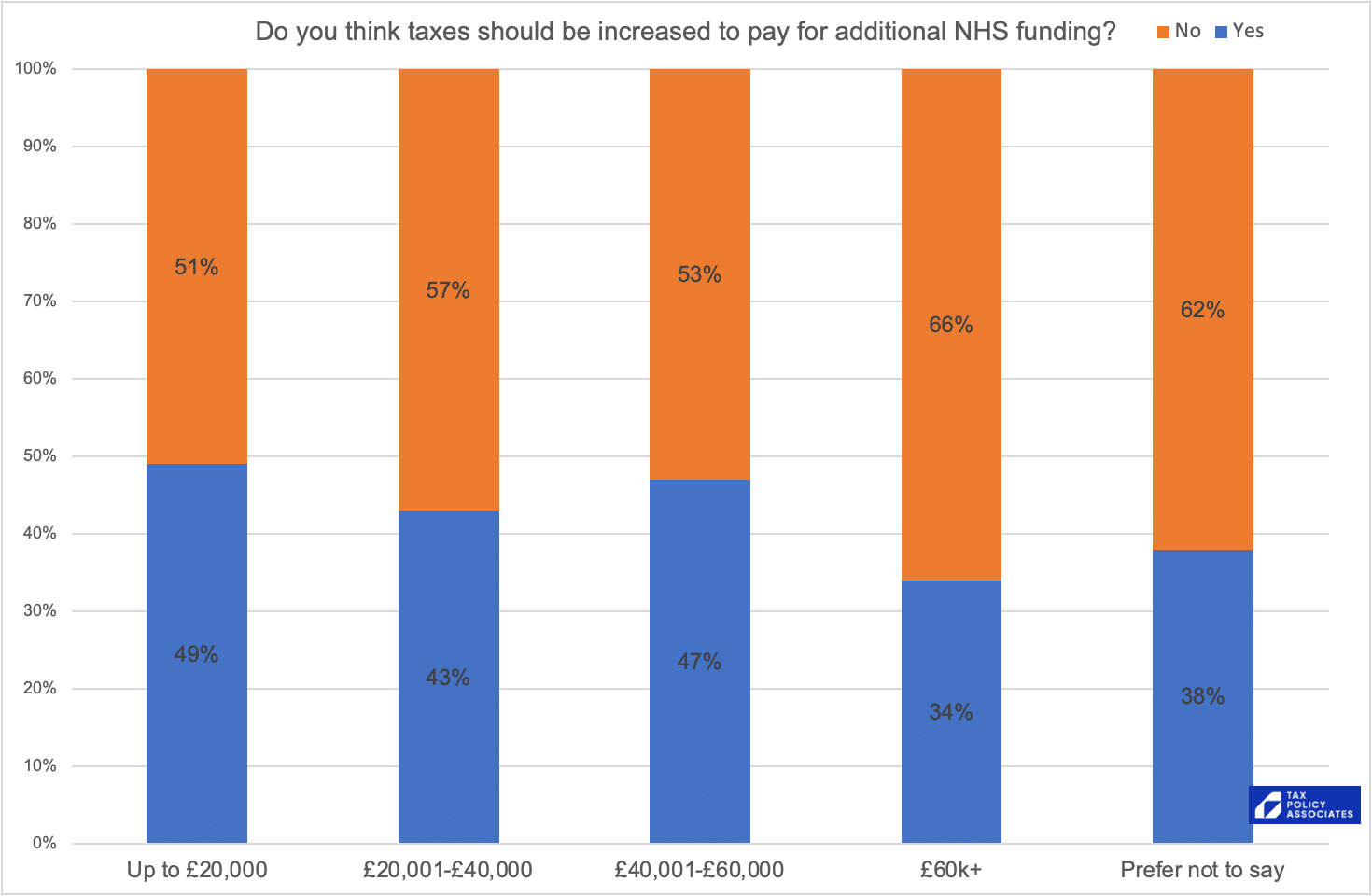

We first asked a simple question: “Do you think taxes should be increased to pay for additional NHS funding?”:

I was surprised to see a majority against increasing tax.1 Historic YouGov polling from 2017, 2018 and 2019 showed a majority in favour of raising income tax to fund the NHS. Recent YouGov polling has showed this majority reducing somewhat. Our result may be a further development of that, or it may result from polling differences.2

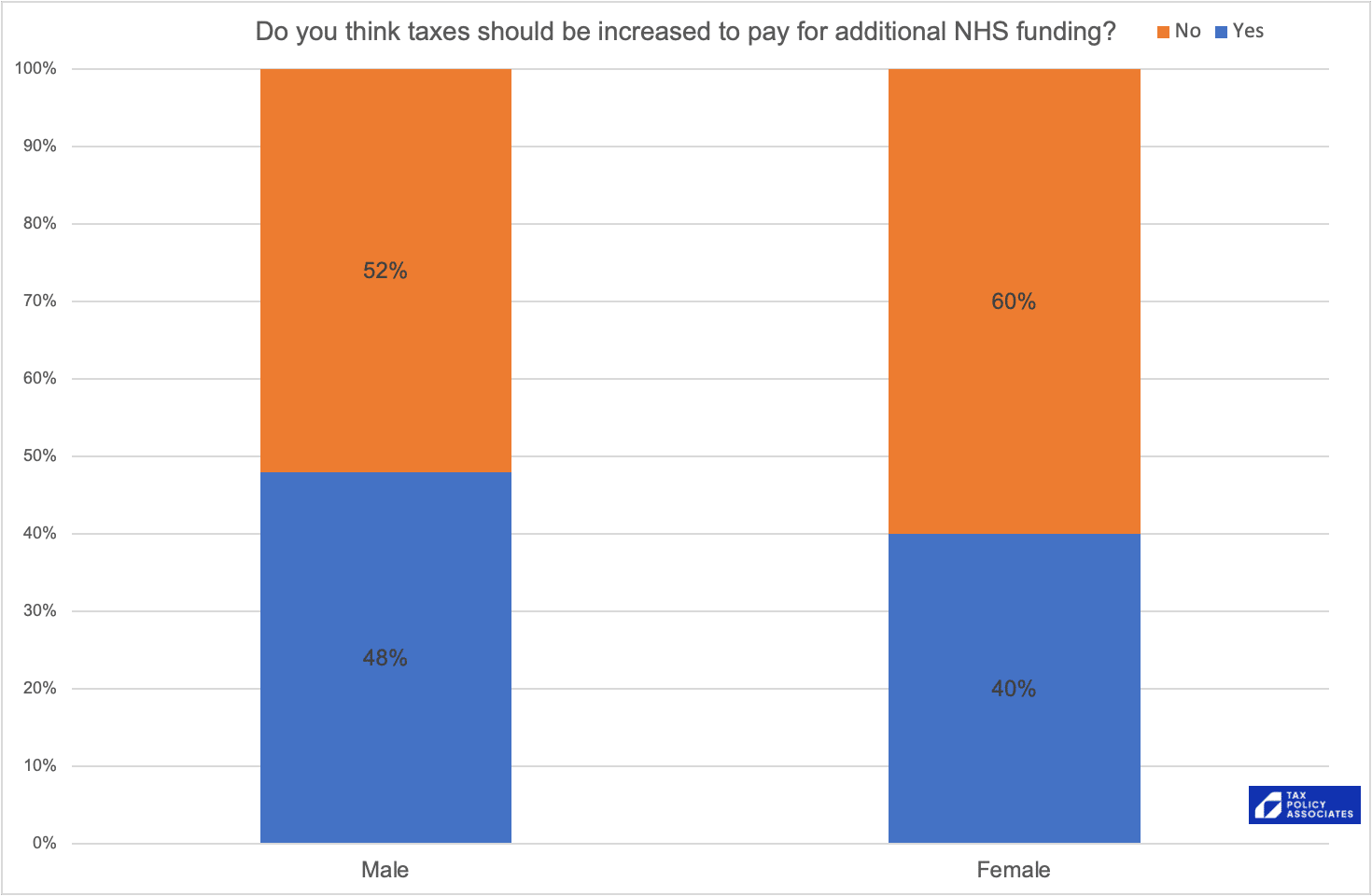

Women are more strongly against increasing tax to fund the NHS:

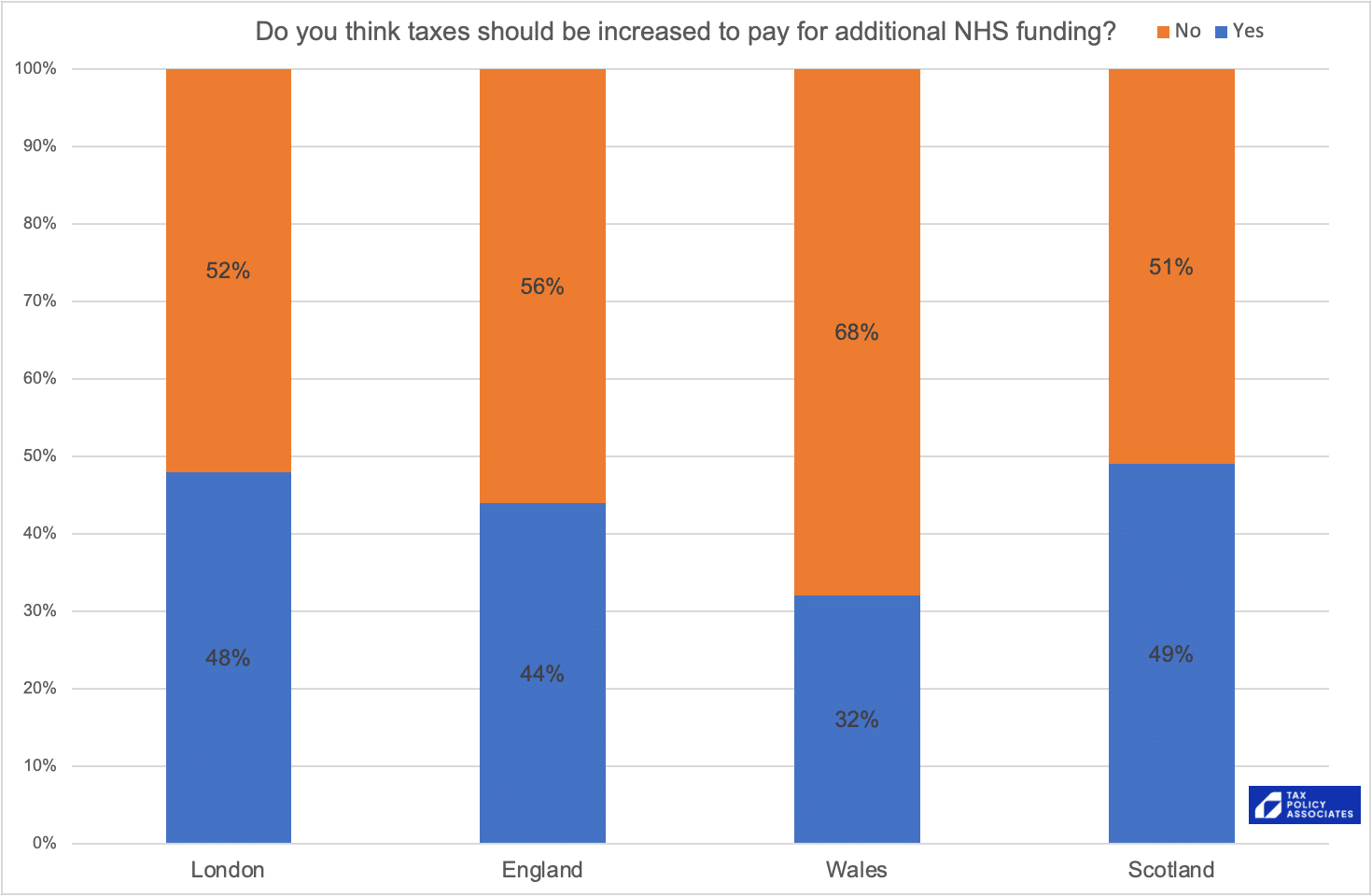

Regional variation is limited, with the striking exception of Wales:

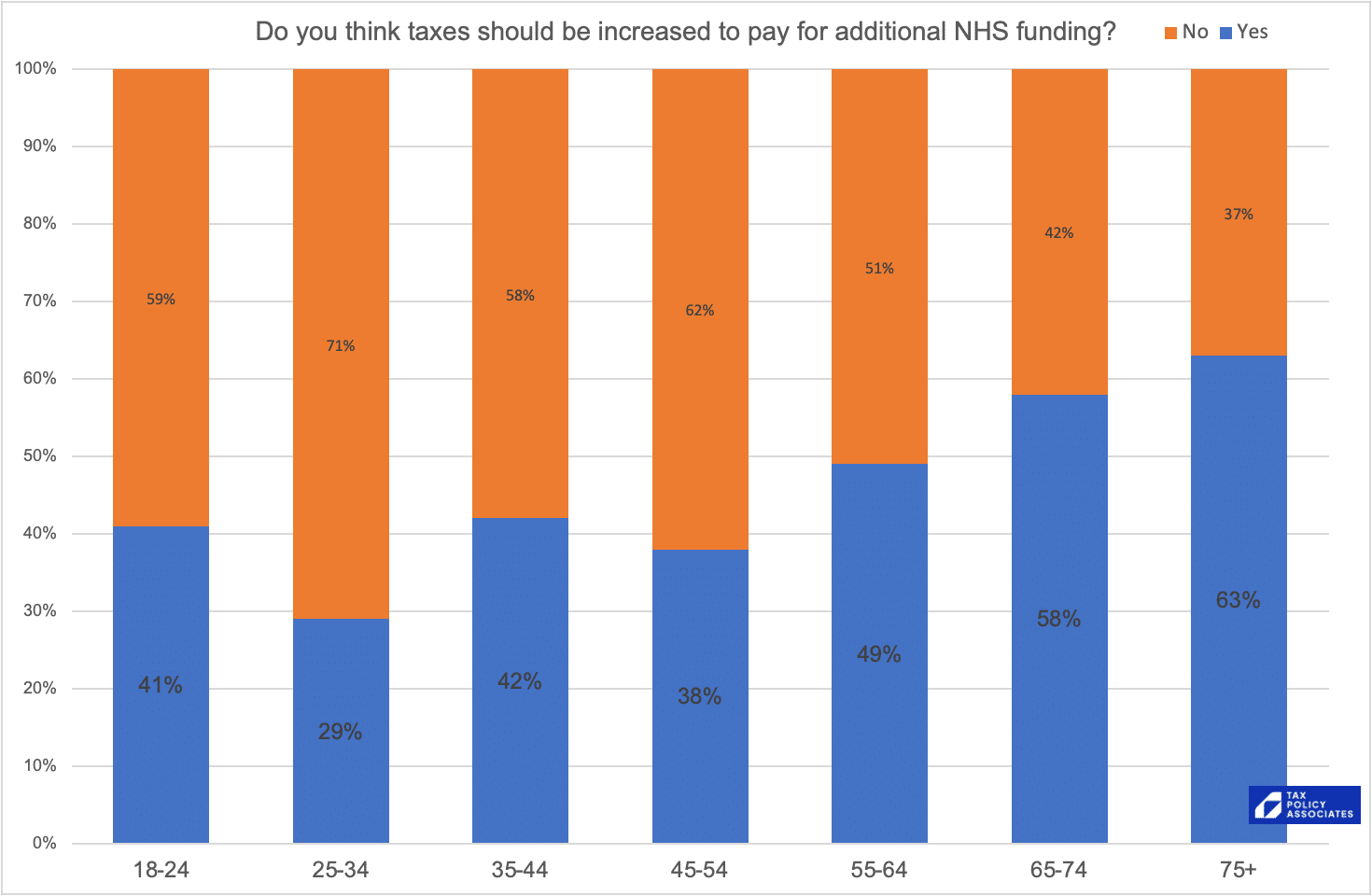

But we get more of a clue as to what’s going on if we break it down by age:

Perhaps it’s unsurprising that people who use the NHS more, and pay less tax, are more willing for tax to go up to pay for additional NHS funding.

And high earners are less in favour of raising tax:3

Supporters of higher tax are willing to pay more tax themselves, but not much

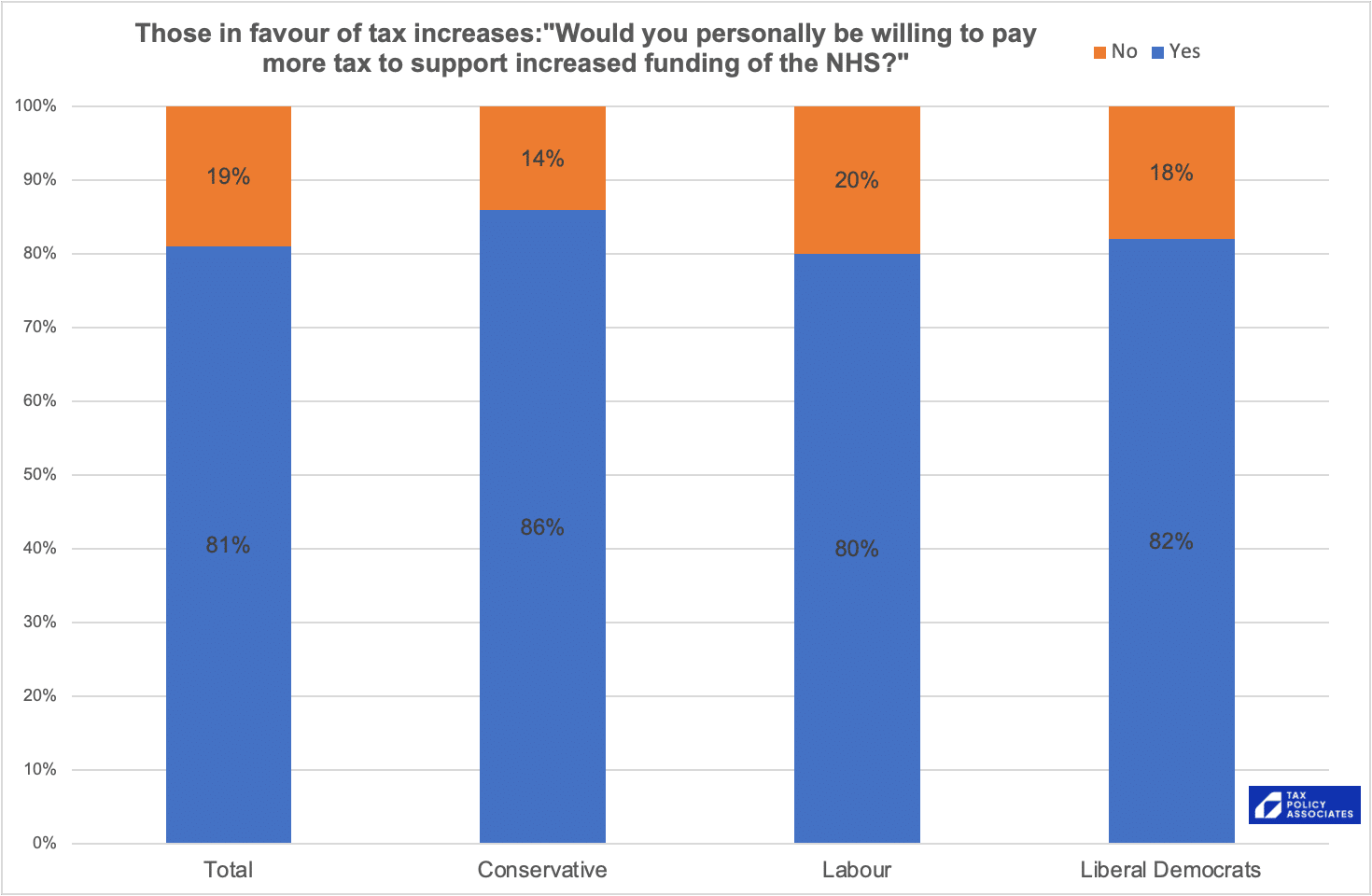

Contrary to what some cynics might believe, the vast majority of those in favour of increasing tax are willing to pay more tax themselves:

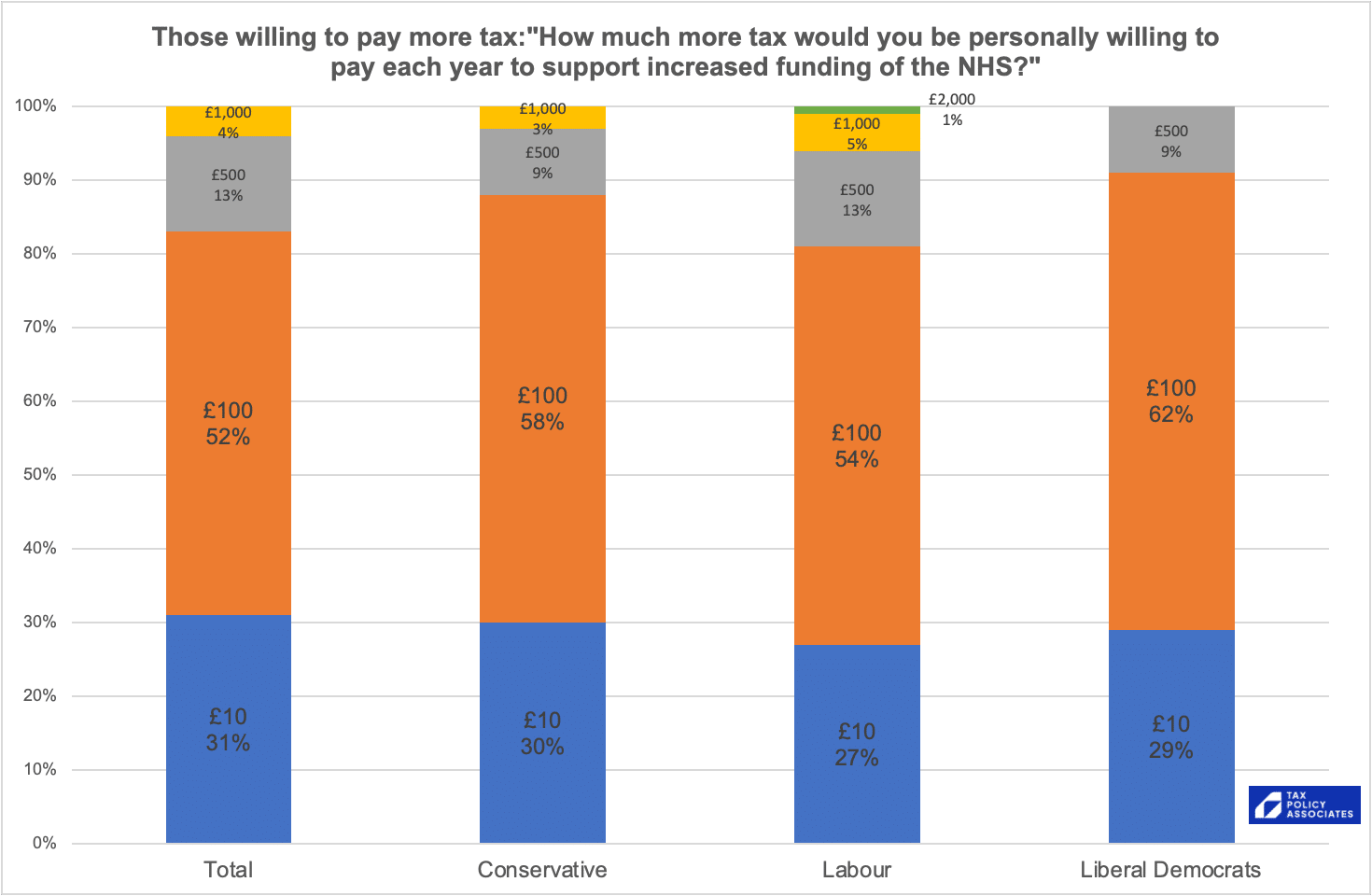

But only to a very small degree. Very few of those people are then willing to pay more than £100/year in additional tax:

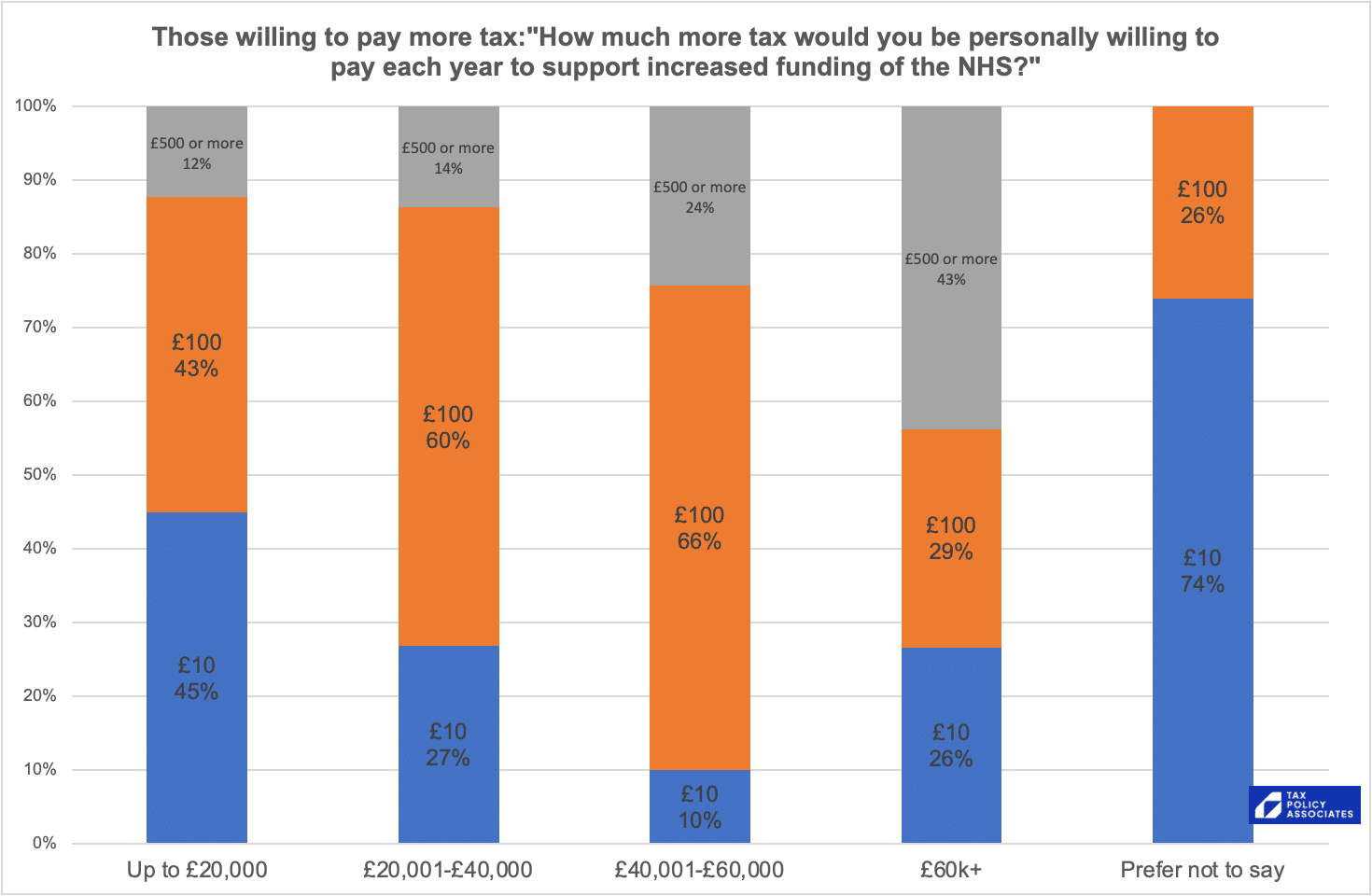

Willingness to pay goes up with income, but not enough to make much difference – the majority of people earning £60k or more aren’t willing to pay more than £100:4

The detailed tables don’t show much variation by age, region or education.

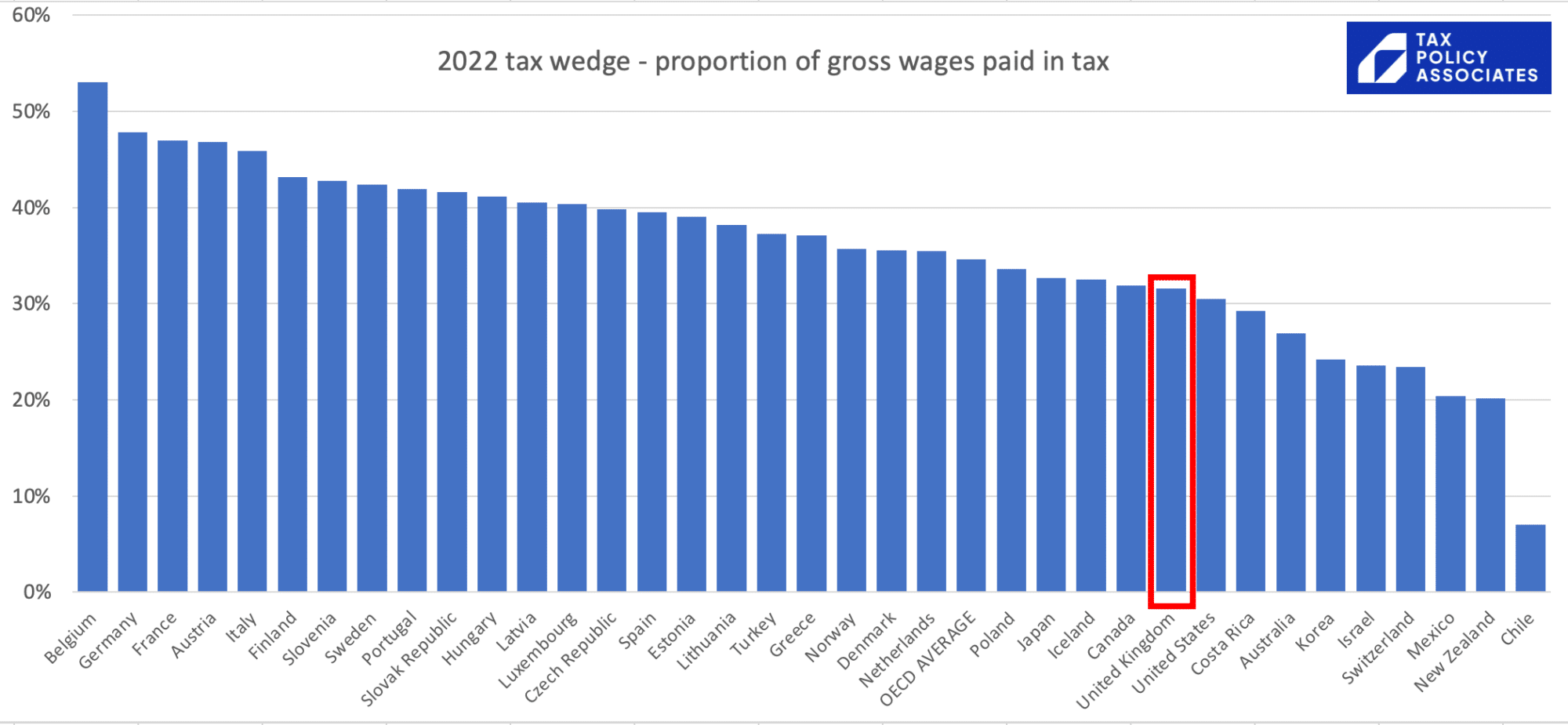

The reluctance by UK voters to pay additional tax either reflects, or causes, the UK to have one of the lowest overall rates of tax on average earners in the developed world. This statistic – the proportion of gross wages paid in tax – is often called the “tax wedge”, and the OECD provides data for 2022 which looks like this:

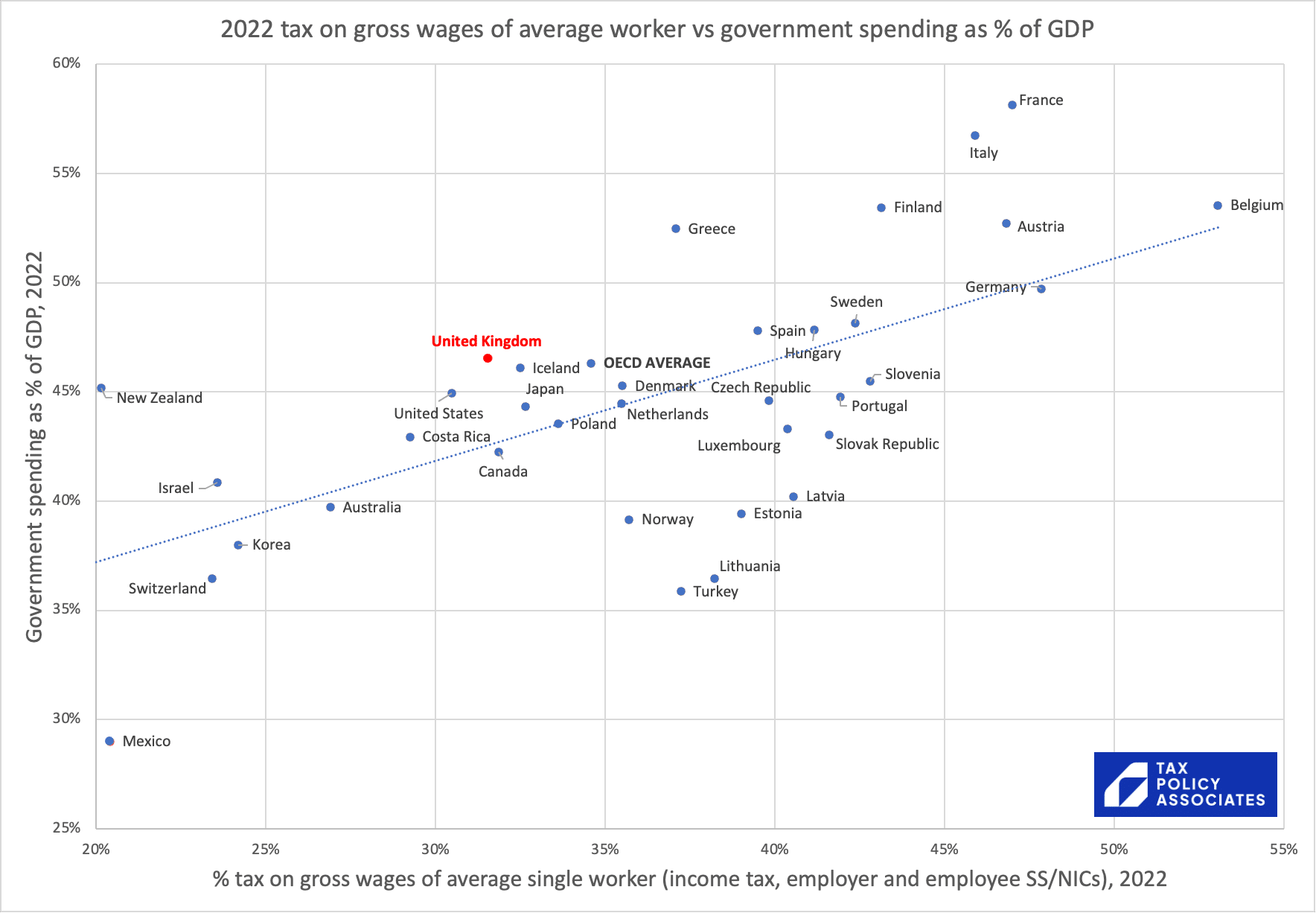

It’s even more dramatic than that, because those countries with a lower tax wedge than the UK, have a smaller state than the UK.

Another way to put that is: every country in the world which has higher public spending than the UK (as a % of GDP) also taxes the average worker more than the UK:

As the IFS points out, average earners in the UK have seen their tax burden fall over the last few years (with the overall tax increase borne by higher earners).

The relatively low income tax paid by an average earner in the UK, and the fact that this has fallen in recent times, is very rarely heard in public discourse. Indeed I’m not sure I can ever recall a politician making it.

This might explain why, despite widespread unhappiness with the state of the NHS, politicians are so unwilling to raise taxes significantly, and instead resort to gimmicks.

If you’re on the Left and you don’t talk about this, or your response is to question the statistics, then you’re in denial.

These polls are what happens when you want European-style public services, but think you can achieve it without European-style tax.

We can (and in my view should) raise additional tax from the wealthiest. But those who want to see significantly expanded public services need to either accept that means most ordinary people paying more tax (and advocate for that!), or believe that the UK can do something no country in the world can, and fund European levels of spending solely by taxing above-average taxpayers. I don’t think that’s possible. You’re free to disagree with me – but you need to understand you’re arguing for something that literally nobody has achieved.

I’m keen to explore more about public attitudes to tax using questions with actual numbers, rather than asking people generalities. Please do drop me a line if you have any suggestions for topics and approaches. When we commission a poll we will always publish its findings in full.

Many thanks to WeThink for conducting this polling for us pro bono – they didn’t even ask to be credited. The polling was conducted by WeThink on 14-15 March 2024, questioned 1,270 people and is weighted to a national representative population. The full tables are available here.

Footnotes

Other parties are included in the data, but I don’t show them here because the numbers are too small for statistical significance. ↩︎

Note that YouGov specifies income tax; we didn’t specify which tax we’d raise. YouGov also gives a “not sure” option and we did not. The question of whether “forced choice” is the best approach has a long history… I have no expertise in this, and was happy to be guided by the experts at WeThink. ↩︎

I’ve combined the £60-80k, £80k-100k and £100k+ brackets in the data because otherwise the numbers are too small to be statistically valid. ↩︎

I’ve combined earning brackets and additional tax amounts to achieve statistically validity. We would need a much larger sample than that obtained by normal opinion polls to obtain statistically valid results for those on £100k+ incomes. So, tempting as it is to look at the raw numbers, and snigger at the 26% of people earning £100k are only willing to pay £10 more tax, these numbers are subject to massive uncertainty and shouldn’t be used. ↩︎

Leave a Reply to Dougie Undersub Cancel reply