A very strange High Court decision was just published – Webster v HMRC. It reveals that an unknown person or company is engaged in an international strategic litigation campaign to block international tax and transparency initiatives, and is going to great lengths to remain anonymous.

On the face of it, this case is about FATCA.

It used to be easy to evade tax on your income. Open an offshore bank account, put your money in that, and HMRC would likely never find out.

That changed in the mid-2010s. The US created FATCA, which forced governments all over the world to require their banks to report US citizens’ bank accounts to the IRS. The rest of the world first complained this was outrageous, Yankee imperialism, then decided it was a brilliant idea.

The outcome was the OECD common reporting standard (CRS), which does much the same thing for most countries in the world.1 On the face of it, Ms Webster is seeking a declaration that HMRC’s reporting of her UK bank accounts to the US was unlawful. But the implications are very wide. If she succeeded, it’s likely that reporting under CRS would also be unlawful. And if a UK court reached that view, we could easily see courts across the world, striking FATCA and CRS legislation down. This would be a disaster.

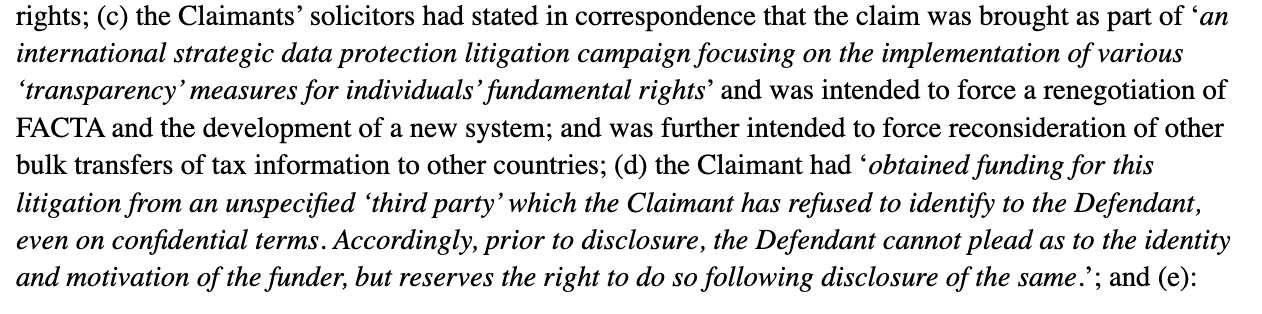

It became clear in the course of Ms Webster’s litigation that her claim was funded by an anonymous third party which was running “an international strategic data protection litigation campaign” seeking to block the implementation of tax and transparency measures:

This could be someone with a genuine ideological belief that an individual right to privacy is more important than countering tax evasion (a kind of libertarian equivalent of the Good Law Project). But it is also possibly something more sinister: a person with something to hide, using this litigation to block the rules that prevent its secrets from being uncovered – that would (of course) be entirely improper. So HMRC added abuse of process to its defence, and obtained a court order seeking disclosure of the identity of the funder.

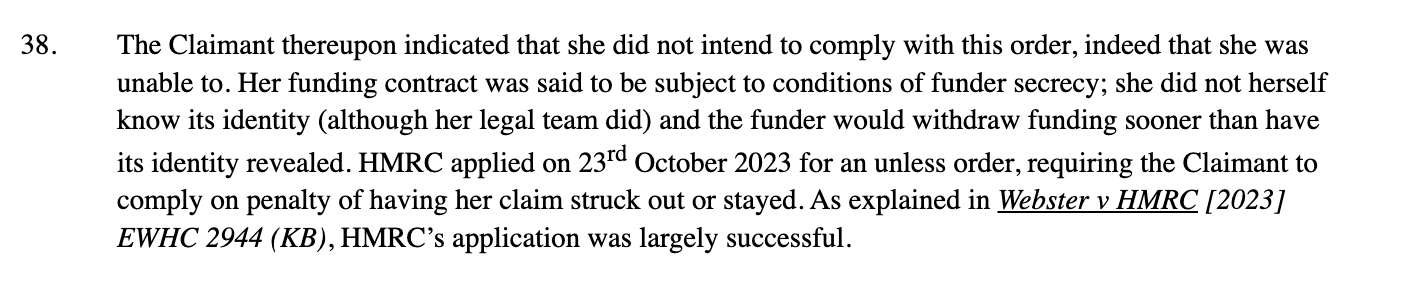

At which point Ms Webster said she didn’t know – only her lawyers, Mishcon de Reya, knew the identity of the funder.

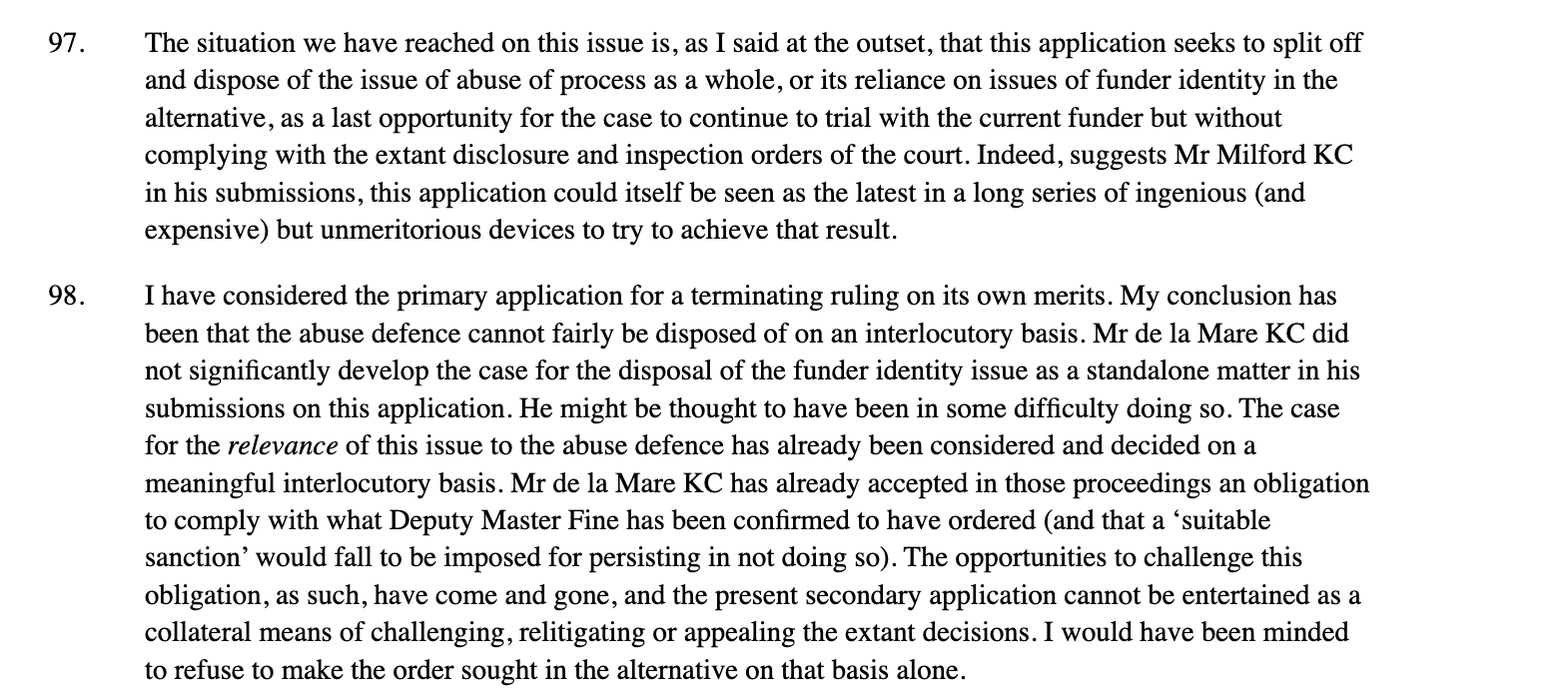

This judgment concerns an attempt by Ms Webster (or, more likely, her funder) to strike out the abuse of process defence, so the funder’s identity doesn’t have to be disclosed.

It did not go well:

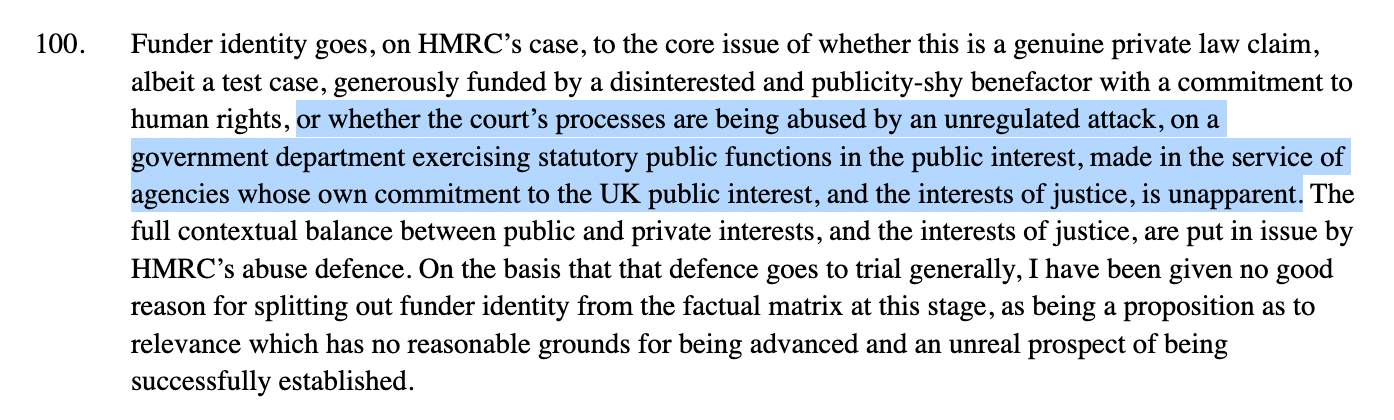

Indeed the judge, Mrs Justice Collins Rice, seemed rather concerned at what was going on:

So it seems either the mysterious funder will have to step out of the shadows, or the case will have to be dropped. A successful appeal against this judgment is unlikely.

Which begs the question: who is the mysterious funder, and what else are they up to in their “international strategic litigation” to block tax and transparency initiatives?

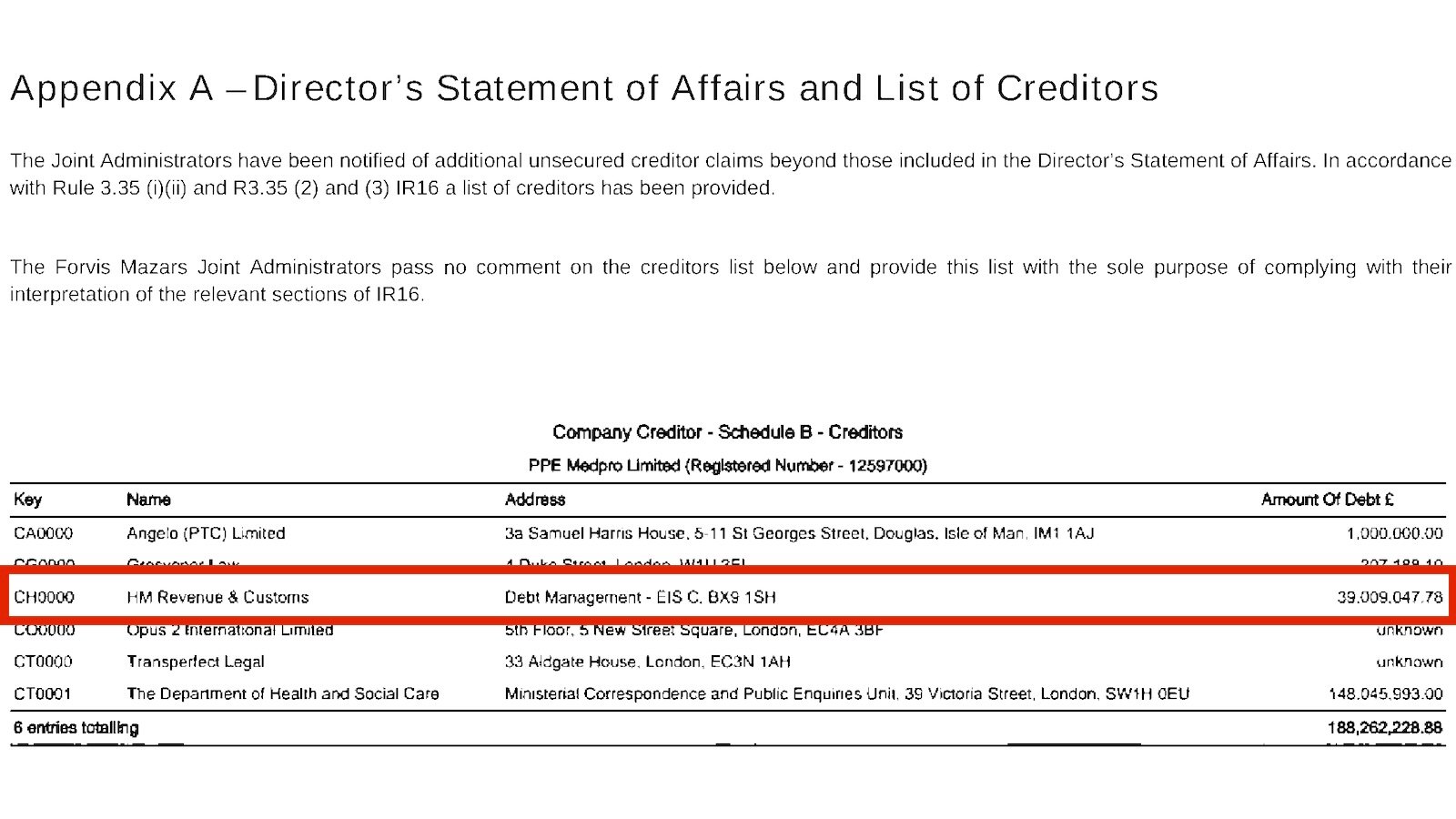

We don’t have to look very far. The biggest reversal to recent transparency initiatives was the 2022 decision of the CJEU⚠️ to block public disclosure of beneficial ownership of companies across the EU.2 And the law firm involved in that?

So we don’t know who is behind this campaign, and we don’t know what else they’re up to, but it’s a reasonable inference that they’ve had one huge success already.

Photo by Tarik Haiga on Unsplash

Leave a Reply to Dougie Cancel reply