The UK’s high marginal tax rates on people earning £50k are a disincentive to work. They’re made worse by the way a large chunk of the tax is collected – the “high income child benefit charge” (HICBC).

The HICBC creates a “tax trap” for employees who usually wouldn’t file a tax return. If they earn £50k, and they or their partner claims child benefit, they have an immediate requirement to file and pay the HICBC. It’s easy to get that wrong. In the last four years 19,000 did, and were hit with a penalty of up to 30%.

Tax systems shouldn’t have marginal rates of over 70%, and shouldn’t have “traps” that can catch the unwary. The HICBC should be abolished.

UPDATE: note that the income point where child benefit starts to be clawed back was moved from £50k to £60k in the Spring 2024 Budget. That’s an improvement – but all the problems of HICBC we discuss in this article stil remain.

The Financial Times covered this story over the weekend, and there was more on marginal rates in Saturday’s Times.

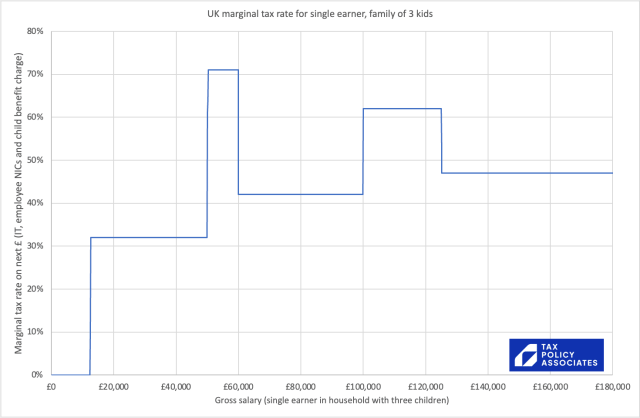

The chart above shows the marginal rate of income tax paid by a UK taxpayer with three children under 18. That’s a 71% marginal tax rate between £50k and £60k.1

The high marginal rate results from George Osborne’s 2013 decision to withdraw child benefit from people earning a “high income” – £50,000. If the £50k threshold had been upgraded with inflation it would be £67,000 now – but it wasn’t. Around one in three households now include someone earning £50,000 – it’s not a “high income”.

How the HICBC works

Whatever we think of the politics of withdrawing child benefit from “high earners”, the way that it was done was a mess.

UK tax generally applies to individuals.2 I’m taxed on my income; my wife is taxed on hers. The benefits system on the other hand, looks at overall household income and capital. The decision was taken to withdraw child benefit based on a mixture of both – if the highest earner in a household hit £50,000 then child benefit would start to be clawed back, and if it hit £60,000 then all child benefit would be withdrawn.3

The challenge was that, whilst HMRC knows how much I earn, it doesn’t have a way to see how much the highest earning person in my household earns. So child benefit couldn’t “automatically” be clawed back.

The highly bureaucratic answer to this challenge was to outsource all the work to taxpayers. Osborne created a new tax – the HICBC – and required people to self-assess it in their tax return. It’s a bad answer because most people earning £50,000 are employees, and don’t file a tax return. So people would have to realise they had to start filing a tax return just because they claimed “too much” child benefit, and notify HMRC.

It was very foreseeable this would cause problems, and many said so at the time. There’s an excellent briefing on the HICBC from the wonderful House of Commons Library.

The HICBC choices

If your household has children under 18 and someone earning £50k, then you have three choices:

- Don’t claim child benefit.

- Register for child benefit but opt not to receive it.

- Register for child benefit, receive it, and then pay some/all of it back through a special tax, the High Income Child Benefit Charge.

These are difficult choices with not-at-all-obvious outcomes:

- The first choice – not claiming child benefit – seems the easiest thing to do, but is actually a mistake, because it means a non-working parent can lose their national insurance entitlement.4 It’s a mistake I made – and as a result my wife lost some pension entitlement. The Government pledged to fix this🔒 back in April, but nothing’s happened since.5

- The second is the “correct” answer if the highest earner in a household makes £60k+ but not so great an answer if they earn £50-60k, because they’re then giving up all their child benefit unnecessarily.

- The third is a pretty bad answer, but if the highest earner makes between £50k and £60k then it’s the only way to receive some child benefit. If you’re already on self assessment and filing online, then paying the HICBC is fairly easy – you just tick a box and type in the amount of child benefit claimed. But if, like most employed people, you’re not on self assessment, then you’ll have to register for self assessment. If you don’t, you’re breaking the law.

These choices all get more complicated if income unexpectedly changes during a year, or a couple separate, or a couple move in together.

And lots of people get it wrong. Sometimes in the Dan’s-wife-loses-some-of-her-pension way. And sometimes in failing to realise you now have to register for self assessment and file/pay the HICBC.

How many people get it wrong?

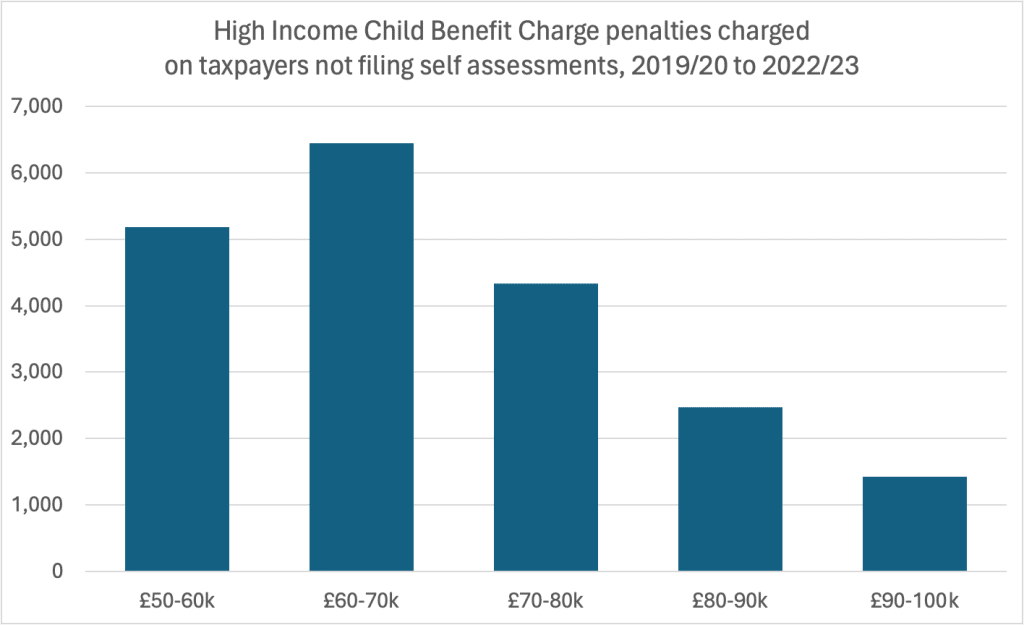

Almost 20,000 people who weren’t on self assessment were hit with penalties from 2019/2020 to 2022/23 for not realising6 they should be paying the HICBC:7

We don’t have data on the amount of the penalties, but likely it was several hundred pounds.8

This is after an HMRC review of HICBC penalties in 2018 – before then, there were about twice as many penalties issued.9

HMRC has sent millions of letters to people warning them about the HICBC, but not everyone affected has received one. HMRC has pursued people for penalties even when they weren’t adequately informed; tax tribunals have been reasonably sympathetic to taxpayers.10

What should happen?

Marginal rates of over 60% should be regarded as unacceptable. I’d abolish the HICBC on this ground alone.

But the way the HICBC was implemented is an illustration of how a tax system shouldn’t work. A wholly disproportionate level of complication for people on not-very-high incomes doing something as ordinary as having children, where the total amount of tax at stake is so small (likely around £1bn).

The Government has promised to improve things by enabling HICBC to be collected through PAYE, removing the need to file a self assessment form. But taxpayers would still have to notify HMRC this, and still have to make surprisingly difficult choice as to how to proceed.

I’d hope abolishing the HICBC would appeal to both a Conservative Party that regards high marginal rates as an anathema, and a Labour Party that’s always supported the principle of universal child benefit. The amount of money at stake is small, and if the government wished to recoup the cost from people earning £50k, that could be easily done in a less damaging way (for example by upgrading the higher rate income tax threshold slightly more slowly than it otherwise would).

Footnotes

It’s not even the most extreme example – student loan repayments can take the rate to 77%. ↩︎

That didn’t used to be the case – until 1988, the income of a married woman was taxed as if it belonged to her husband, on his tax return. Married women had no financial privacy. ↩︎

There are a number of cases where it’s more complicated than this. For example: where the high earning parent doesn’t know if the other parent claims child benefit, or where child benefit is claimed by someone outside the household but who provides the household with financial support. I’m going to ignore these issues for now, but they’re important for the people affected. ↩︎

It also means the child won’t automatically receive a national insurance number when they turn 16 ↩︎

Thanks to Miro in the comments for reminding me of this. ↩︎

My assumption is that it was almost always an accident, because I think it would be obvious to most people who understood the system that they would be caught ↩︎

The source for this is an FOIA request we filed with HMRC – the full FOIA response is here. ↩︎

That’s on the basis that a penalty will usually be 10-30% of the tax due, and child benefit is £1,250 each year (for a first child). ↩︎

There is some data on this here, but it is all older than the data above, and doesn’t show the penalties charged to people not on self assessment ↩︎

We can add “wasting the time of tax tribunals” to the charge sheet against the HICBC. One recent appeal was over a £182.40 penalty. ↩︎

Leave a Reply to Elizabeth Goshtai Cancel reply