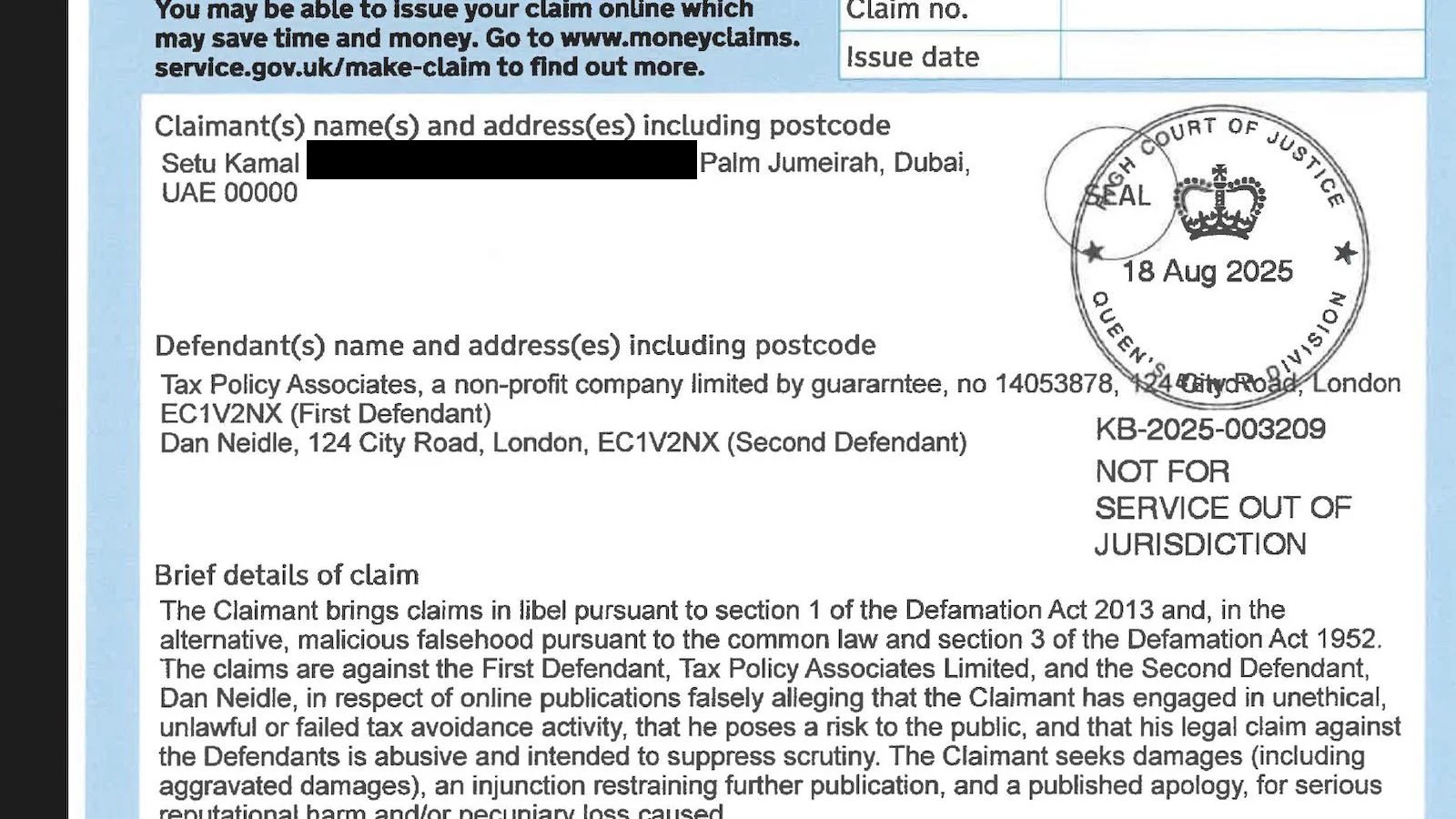

UPDATED 21 July 2024: Bhattacharya filed a DMCA takedown notice to try to remove this video from the internet. US fair use and UK fair dealing rules means it’s not going anywhere.

UPDATED 20 July 2024: in early 2024, HMRC notified Property118 that this was a tax avoidance scheme that should have been disclosed under DOTAS. Property118 continued to market the scheme, and as a consequence HMRC issued a stop notice on 18 July 2024.

UPDATED 1pm on 13 October 2023 with comment from HSBC UK

Here’s “property guru” and Youtuber Ranjan Bhattacharya promoting the Property118 tax avoidance scheme:1

Part of the Property118 scheme involves the landlord borrowing under a “bridge loan” for a few hours, with the money moving swiftly between three different bank accounts all controlled by the lender. The claim is that this magically avoids £100k+ of tax for the landlord.

But what kind of lender would facilitate such a scheme?

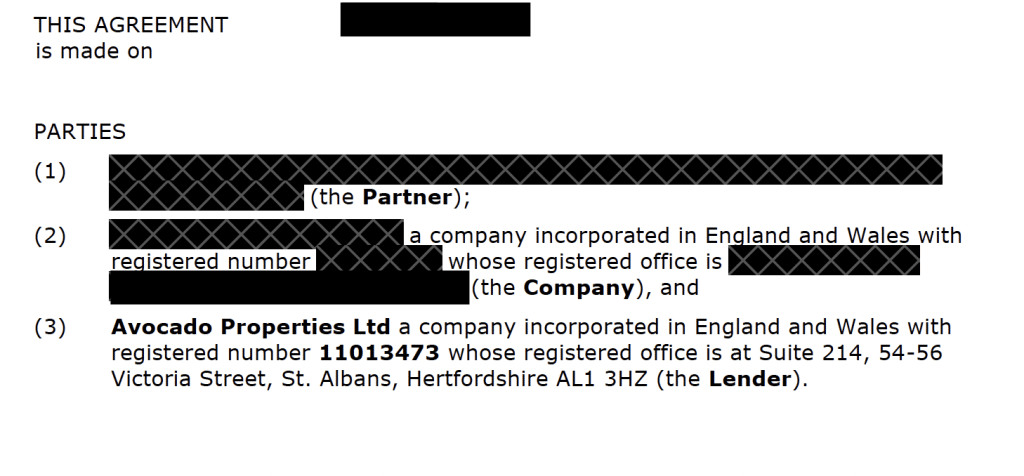

Who owns Avocado Properties Ltd?

Rajan Bhattacharya.

If what Property118 says is true, Avocado has made hundreds of such loans, charging a 1% fee each time. So Mr Bhattacharya has been paid more than £500k for facilitating the scheme.

His failure to disclose that in his promotional videos is startling – a breach of Advertising Standards Association guidance and YouTube’s own rules. But that’s the least of it.

When HMRC challenge the arrangement, which we expect they will, the landlords involved will potentially have to pay hundreds of thousands of pounds in tax, interest and penalties.

And Property118 and Mr Bhattacharya’s companies could be liable for fines of up to £1m for failing to disclose the scheme to HMRC.

The short summary above doesn’t do justice to how brazen the scheme is – full details are below.

Why hasn’t HMRC challenged the scheme yet?

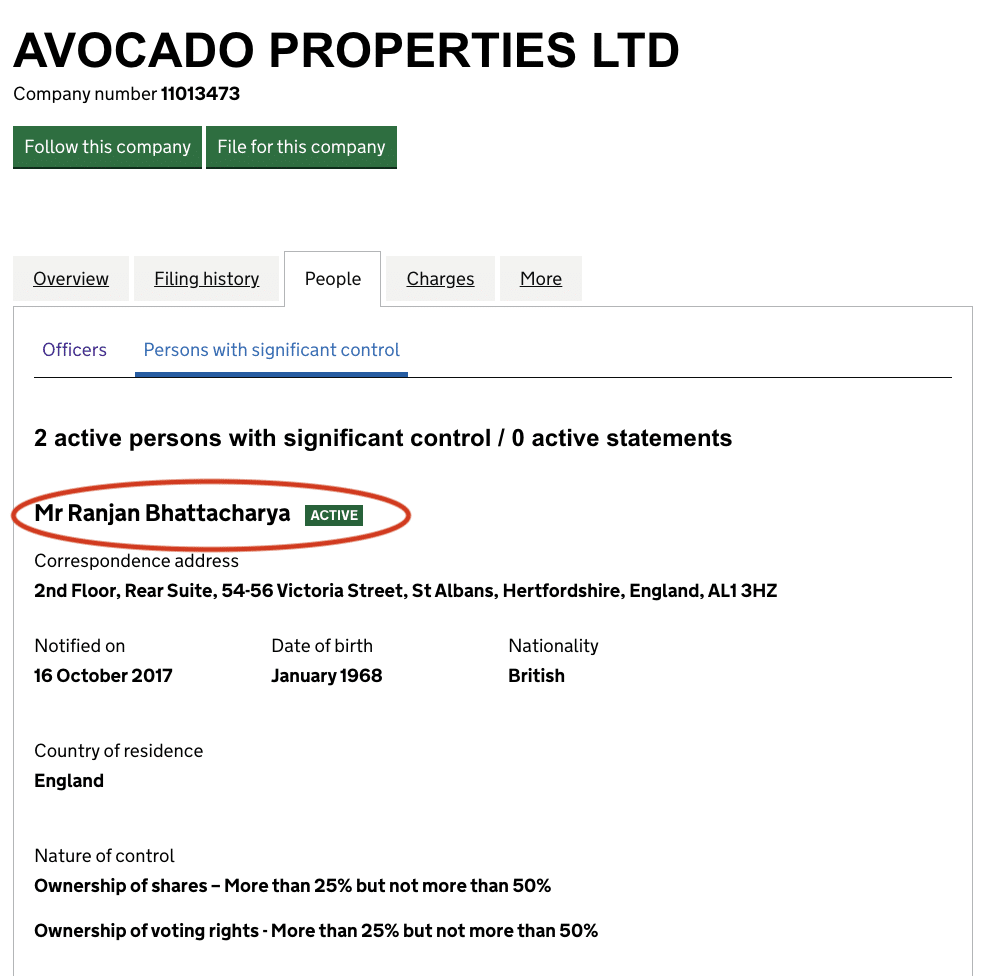

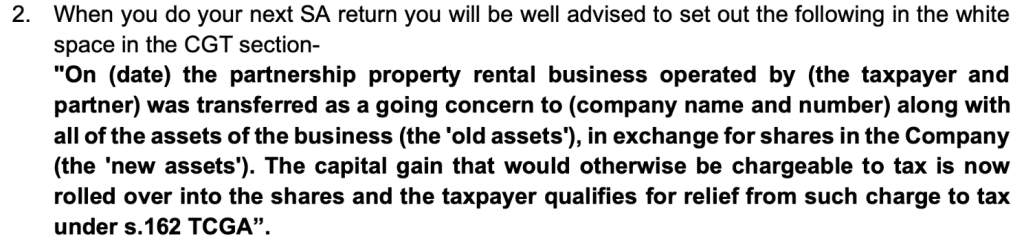

Because Property118 tell their clients not to mention the bridge loan when they file their self assessment return:2

Actually the business is sold for shares PLUS the assumption of the bridge loan (and other liabilities). Property118 surely know this, because their own documents say it. We expect they also know that the assumption of liabilities is highly relevant to incorporation relief, particularly when tax avoidance is involved. But they provide clients with disclosure that ensures HMRC don’t find out.3

The scheme

When a company makes a profit, it pays corporation tax. If it then pays the profit to its shareholders as a dividend, they pay tax on that. But if it can use the profit to repay a loan from the shareholders then they don’t pay tax on the loan repayment.

Standard (and legitimate) tax planning on incorporation takes advantage of that. In the standard approach, the landlord sells property to the newly incorporated company in return for (1) shares, (2) assumption of mortgage debt, and (3) a “loan note”4 (or similar) issued by the company to the landlord. Future profits can be used to repay the loan note.

That is uncontroversial, but has the disadvantage that the sale of the property to the company will be subject to capital gains tax.

Property118 think they’ve found a way to avoid the capital gains tax and extract profits by a tax-free loan repayment.5

An example: let’s take a landlord who owns properties worth £1m, has a mortgage of £500k, and wishes to transfer the properties to a newly incorporated company.6

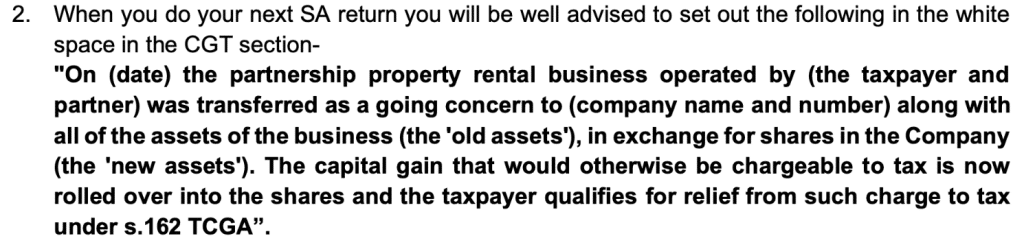

Step 1 – The loan

Avocado Properties Limited lends £450k to the landlord. So, on paper, the arrangement looks like this:

In reality, the money actually goes from Avocado Properties Limited to an HSBC bank account held by Fab Lets (London) LLP, a company owned by Mr Bhattacharya, held on escrow for the landlord. The landlord never gets the £450k.

Here’s what Property118 tell their clients about Avocado Properties Limited:

I am pleased to confirm I have now submitted your bridging finance application to our preferred lender and that:

-

-

- Your application matches their lending criteria perfectly

- Their processes and documentation have been compliance checked by Cotswold Barristers

- We have a 100% success record with this lender

- We have completed hundreds of loans with this lender

-

And here’s what they say about Fab Lets (London) LLP:

This is another of Ranjan’s companies and was originally purposed as a property management business, so it has the correct structures to securely create and manage clients’ accounts in a fully compliant, insured and ring-fenced manner.

The reality:

- Avocado Properties Limited is not a regulated lender, despite apparently making hundreds of loans to individuals.7

- Fab Lets (London) LLP is not regulated to act as an escrow agent, despite apparently having a significant escrow business.8

- As far as we are aware, Fab Lets (London) LLP has no insurance that would cover this arrangement.9 There is no evidence of any “ring-fencing”. Why did Property118 claim otherwise?

- There may also be a breach of HSBC’s account terms.

There are obvious questions as to the regulatory propriety of these arrangements, but that is not our expertise. We will leave such matters to regulatory lawyers and the FCA. The remainder of this report will focus on tax.10

HSBC has now seen this report. A spokesperson for HSBC UK told us:

“HSBC has zero tolerance for the facilitation of tax avoidance schemes using HSBC products and services.”

Our assumption is/was that HSBC had no knowledge or involvement in the scheme.

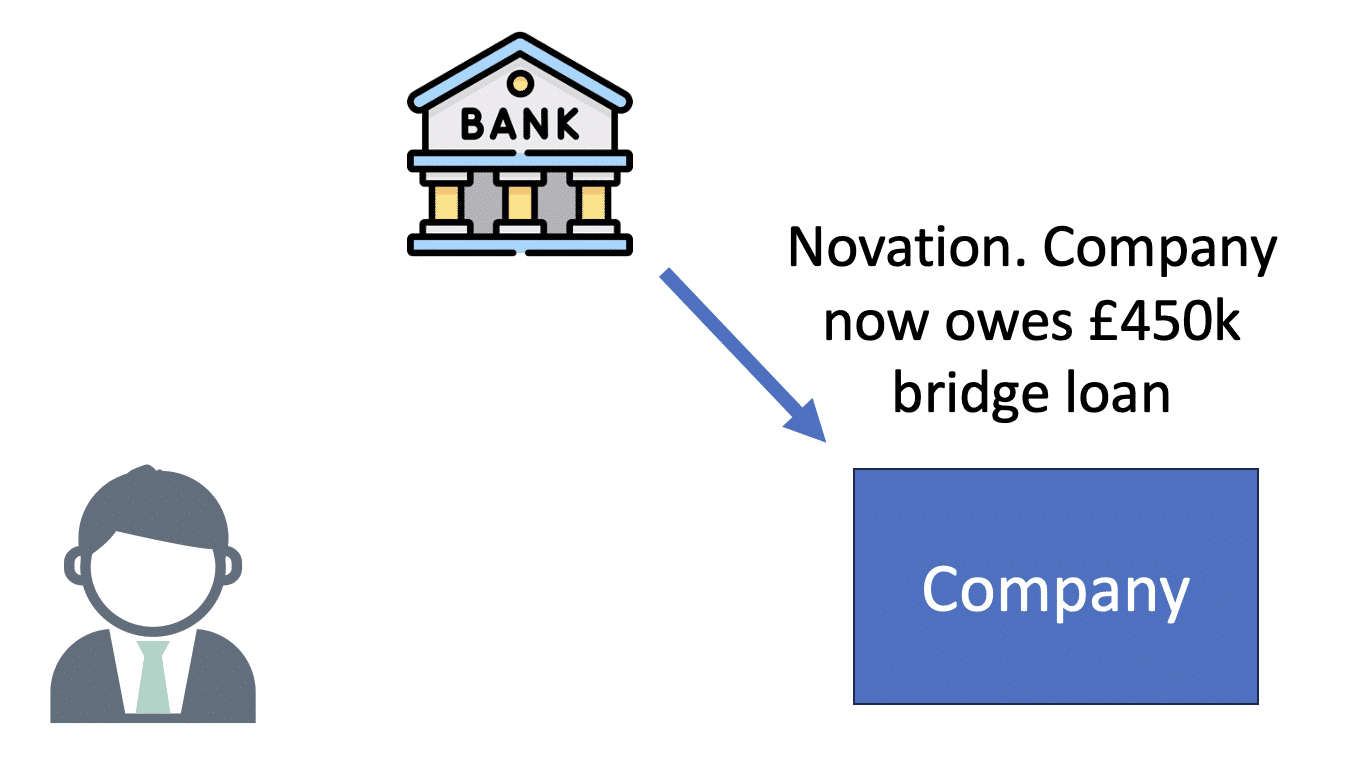

Step 2 – Novation

Immediately after the bridge loan, the landlord’s new company buys the rental properties. In return, the company issues £50k of shares to the landlord, and agrees to assume responsibility for the £500k mortgage and the £450k bridge loan (under a “novation”).

In theory, it’s this:

In practice, nothing happens, and no money moves.

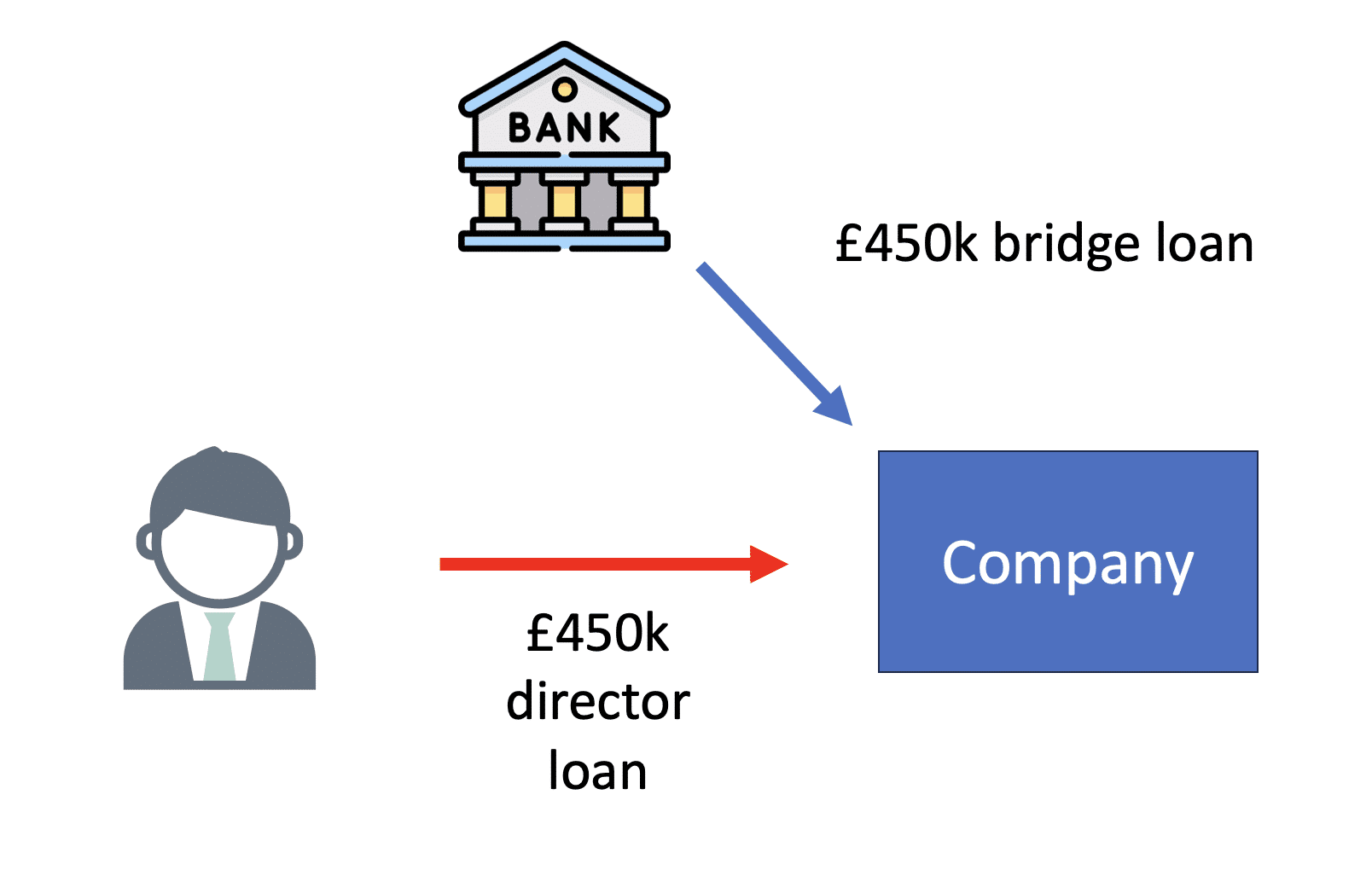

Step 3 – Director loan

The landlord now makes a £450k “director loan” to his company, using the £450k advanced under the bridge loan in step 1:

In practice, Fab Lets (London) LLP transfers the cash from the first HSBC bank account (supposedly held on escrow for the landlord), and moves it into a second HSBC bank account (but now supposedly held on escrow for the company).

Back in the real world, the landlord isn’t lending £450k, because the landlord never really had £450k.

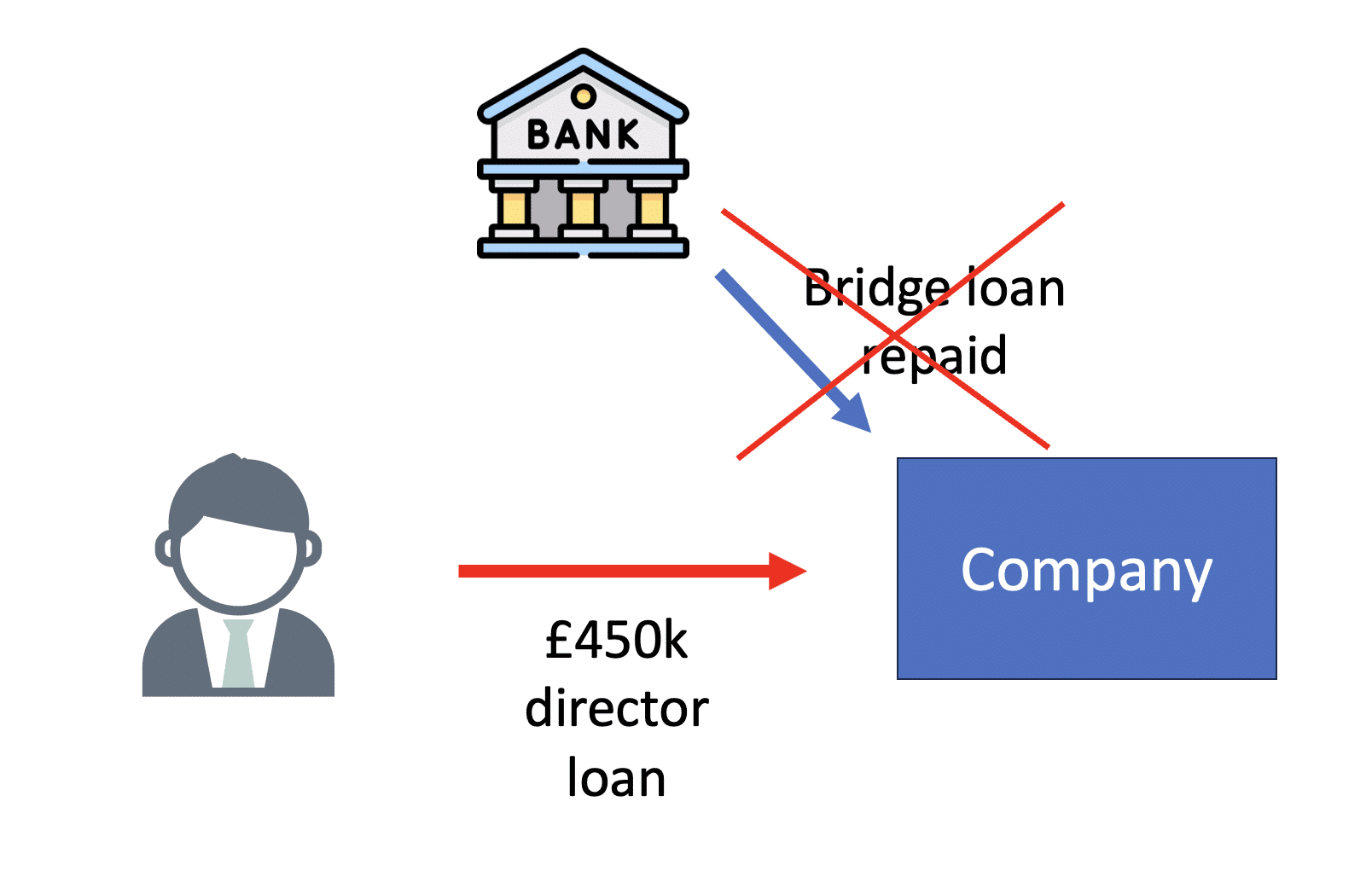

Step 4 – Repayment

Immediately afterwards – this is all happening on the same day – the company uses the £450k to “repay” the bridge loan. In theory:

In practice, Fab Lets (London) LLP returns the £450k to Avocado Properties Ltd. The money never left Mr Bhattacharya’s control.

The intended consequences

There are four intended consequences:

- The company now magically owes £450k to the landlord under the “director loan”, despite the landlord never having £450k and the company never receiving £450k. The next £450k of profit made by the company can be paid to the landlord as a repayment of the “loan” – and the landlord won’t be taxed on it. That’s saved/avoided up to £177k of tax.11

- Incorporation relief applies so there is no capital gains tax, thanks to the HMRC concession that allows a company to assume liabilities of the business.

- Rajan Bhattacharya has made £5,25012 for moving £450k between three bank accounts in the course of one day. If Property118 have really “completed hundreds of loans with this lender” then Mr Bhattacharya has made well over £500k in total.13

- Property118 has made a £4,500 “arrangement fee”.

The actual consequence – a large CGT hit

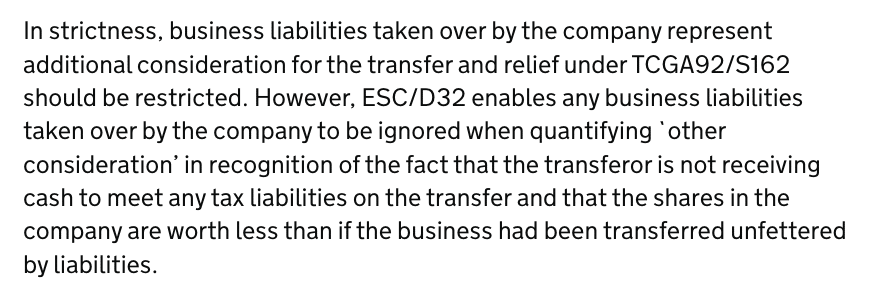

When a landlord incorporates their property rental business, an important and legitimate part of the tax planning is ensuring “incorporation relief” applies to prevent an immediate capital gains tax hit on moving the properties into the company.

That requires (amongst other conditions) that the property is sold in consideration for shares in the company, and only for shares.

By concession, HMRC also permit the company to take over business liabilities of the landlord:

In the Property118 scheme, the bridge loan is taken over by the company; but the problem is that it’s not a “business liability” of the landlord. It barely exists at all, and certainly isn’t used for the landlord’s business.

Oh, and HMRC expressly say that this concession can’t be used for tax avoidance:

So incorporation relief is DOA. Not “it’s doubtful the relief applies” or “some would question whether the relief applies”. We see no reasonable basis for believing incorporation relief applies to the assumption of debt in such circumstances. That means a large up-front capital gains tax hit for the landlord, probably around £130k on the numbers in the example above.14

If the bridge loan had been properly disclosed to HMRC we expect that HMRC would have raised this point. However, Property118 tell their clients not to mention it:

We asked Property118 why they do this. They didn’t respond, so we have to speculate. Our view is that no reasonable adviser would advise a client to mis-describe a transaction to HMRC. Best case, it’s carelessness, for which penalties apply. Worst case, it’s deliberate and concealed, and we are into serious penalties. We still believe Property118 are incompetent rather than dishonest… but if we are wrong, and this is dishonesty, then we get into criminal tax fraud territory.

Another consequence – the “director loan” isn’t a loan

This is an artificial tax avoidance structure. The bridge loan is taken immediately prior to incorporation for no purpose other than tax avoidance. Money is then moved in a predetermined circle for no purpose other than tax avoidance, and achieves no result other than tax avoidance. The bridge loan doesn’t even exist for a whole day. Structures of this kind have been repeatedly struck down by the courts over the last 25 years.15

So the question is: despite that artificiality, can the director loan be used to facilitate tax-free profit-extraction in the same way as the “loan note” in the standard version of the structure?

There are several ways this could be viewed:16

- Realistically, the bridge loan did nothing and can be disregarded – but the director loan can still be viewed as part of the consideration for the sale of the property. In other words, if we step back and ignore the silly intermediate steps, the landlord sold the property to the company for consideration comprising: shares, the assumption of the mortgage debt, and another £450k which remains outstanding as a director loan. In this scenario it’s clear CGT incorporation relief fails. But future profits can be paid out on the director loan without suffering income tax. The structure failed to achieve its CGT aim, but did achieve the basic planning aim of the standard structure… in a much more complicated way and at much greater expense for the landlord.

- The bridge loan didn’t exist and neither did the director loan. So future profits can’t be paid out on it, and the structure fails completely. This seems a harsh result. Can HMRC really say the director loan exists enough to kill CGT incorporation relief, but not enough to shield future profits from income tax on dividends? HMRC has a history of running such harsh “double tax” arguments when attacking tax avoidance schemes, but not always successfully.

The consequence of failing to disclose to HMRC

Most tax avoidance schemes are required to be disclosed to HMRC under the “DOTAS” rules. The idea is that a promoter who comes up with a scheme has to disclose it to HMRC. HMRC will then give them a “scheme reference number”, which they have to give to clients, and those clients have to put on their tax return. The expected HMRC response is to challenge the scheme and pursue the taxpayers for the tax.

For this reason, promoters of tax avoidance schemes typically don’t disclose, even though they should. This is often on the basis of tenuous legal and factual arguments, to which the courts have given short shrift17. One recent example was Less Tax for Landlords, who were adamant their structure was “not a scheme” and so not disclosable. HMRC disagreed.

It is, therefore, unsurprising that the Property118 structure has not been disclosed under DOTAS. In our view, it clearly should have been. The structure has the main purpose of avoiding tax – indeed that’s its sole purpose. The high fees charged by Property118 and Mr Bhattacharya are the kind of “premium fee” that triggers disclosure18

The failure to disclose means Property118 may be liable for penalties of up to £1m. It also means that HMRC could have up to 20 years to challenge the landlord’s tax position.

Mr Bhattacharya’s companies may also be liable as “promoters”, as their role administering the transaction may make them a “relevant business”. HMRC say:

How do Property118 defend the structure?

We asked Mr Bhattacharya and Property118 for comment; neither responded.

In the advice note Property118 sends to clients, they refer to HMRC guidance in the “Business Income Manual”. Advisers questioning the structure have received the same explanation. But that guidance is irrelevant – it relates to when a company can claim an interest deduction for a loan taken by the company to fund a withdrawal of capital by its shareholders. It has nothing to do with creating a “director loan” out of nothing, and nothing to do with circular tax avoidance transactions.

Property118 have also assured advisers that HMRC have accepted the structure in numerous cases. We are highly doubtful that the true nature of the structure was ever explained to HMRC (and, as noted above, Property118 appear to advise against providing an explanation). Any clearance, or enquiry closure, obtained on the basis of incomplete disclosure is worthless.

These two responses are typical of Property118 and other avoidance scheme promoters. Little or no reference is ever made to the law, and certainly never to tax avoidance caselaw. Instead, HMRC guidance is quoted out of context, and clients are assured that nothing has ever gone wrong in the past, whilst success is (apparently) assured by never revealing the full details to HMRC.

When and if Property118 and Mr Bhattacharya do respond, we will gladly correct any factual or legal errors they identify.

What if you’ve implemented this structure?

We would strongly suggest you seek advice from an independent tax professional, in particular a tax lawyer or an accountant who is a member of a regulated tax body (e.g. ACCA, ATT, CIOT, ICAEW, ICAS or STEP).

If it appears you will suffer a financial loss from the scheme, you may wish to also approach a lawyer with a record of bringing claims against tax avoidance scheme promoters.19

We would advise against approaching Property118 given the obvious conflict of interest.

Thanks to accountants and tax advisers across the country for telling us about their experiences with Property118, as well as the clients who contacted us directly. Thanks again to all the many advisers who’ve worked with us on these issues.

Landlord image by rawpixel.com on Freepik. Bank image by Freepik – Flaticon

Video © Ranjan Bhattacharya and Property118 Limited, and reproduced here in the public interest and for purposes of criticism and review.

Footnotes

The original video is now taken down; this is a copy we downloaded. ↩︎

We have seen the exact same wording for multiple clients. The fact they don’t even complete the company name illustrates quite how standardised Property118’s advice is. ↩︎

That wording also means HMRC doesn’t find out about the trust, or the assumption of the mortgage liabilities. ↩︎

Why a loan note and not a loan? Because, conceptually, the company is then giving something (the loan note) as part of the purchase price for the properties. In part because the tax treatment for the company is more certain, as a loan note is clearly a “loan relationship” for tax purposes, and simply leaving money on account may not be ↩︎

This is an update of our earlier piece here – we have since learned more about the scheme mechanics, thanks to a detailed review of the scheme documentation and bank account statements. We have also been able to confirm the identity of the parties. ↩︎

The actual figures we’ve seen are typically twice as large as this, but we’ll use the same figures as in our original explanation, in the interests of clarity. ↩︎

It can be a criminal offence for an unregulated company to carry out “unauthorised business” such as making a loan to an individual. Not all lending is required to be regulated; however in this case, the exemption for loans made “wholly or predominantly for the purposes of a business” may not apply, because the loan is not for the business, it’s for the personal tax benefit of the landlord. The exemption for loans to high net worth individuals might have applied if the loan included an appropriate declaration, but it does not. The absence of a declaration suggests that Property118 may not have taken appropriate legal advice. However, we take no position on the substantive question of whether the lending was unlawful . ↩︎

Escrow agents are generally required to be regulated under the Payment Services Regulation 2017, breach of which may be a criminal offence. We take no position on whether Fab Lets (London) LLP is in breach. ↩︎

Fab Lets is a member of the Property Ombudsman⚠️. That doesn’t make it insured to operate escrow accounts. ↩︎

There are additional VAT questions for Mr Bhattacharya’s companies: does the exempt lending activity impact VAT recovery by Avocado? Should VAT be charged on the escrow services? We have insufficient facts to comment. ↩︎

The highest marginal rate of tax on dividends is 39.35% ↩︎

A 1% fee plus £750 “contribution towards administrative costs” ↩︎

That seems a very conservative estimate. The loan in this example is small by Property118’s standards. “Hundreds” would usually mean at least 200. So we could easily be talking over £1m ↩︎

95% (the proportion of non-share consideration) x 28% (the CGT rate) x £500k (assuming the property has doubled in value). The landlord could argue that incorporation relief should still apply for the assumed mortgage, but not for the bridge loan, roughly halving the CGT cost – however HMRC are entitled to disapply all of ESC D32. ↩︎

We are only aware of one such scheme that wasn’t defeated – SHIPS 2, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction. The consequence of that decision was the creation of the GAAR, which doubtless would have kiboshed SHIPS 2 had it existed at the time ↩︎

Our original draft suggested the second scenario was more likely; on reflection we think that would be a harsh result. The CGT element of the structure still fails, but the taxpayer may avoid a double tax disaster ↩︎

See e.g. the Hyrax case, where the tribunal described as “incredible” the evidence of one witness that she wasn’t aware the transaction was involved tax avoidance ↩︎

The terminology is that the premium fee is a “hallmark”. Other plausible hallmarks are the “standardised tax product” hallmark (given how standardised the documents and advice appear to be), the “financial products” hallmark (given the off-market nature of the arrangements), and the “confidentiality hallmark” (given the fact the arrangement appears to be hidden from HMRC). ↩︎

It feels inappropriate for us to recommend anybody, but a simple Google search will find examples fairly quickly ↩︎

Leave a Reply to Richard Sage Cancel reply