Here’s Oxfam’s press release from earlier this month:

To Oxfam’s credit, they now link to the methodology from the press release:

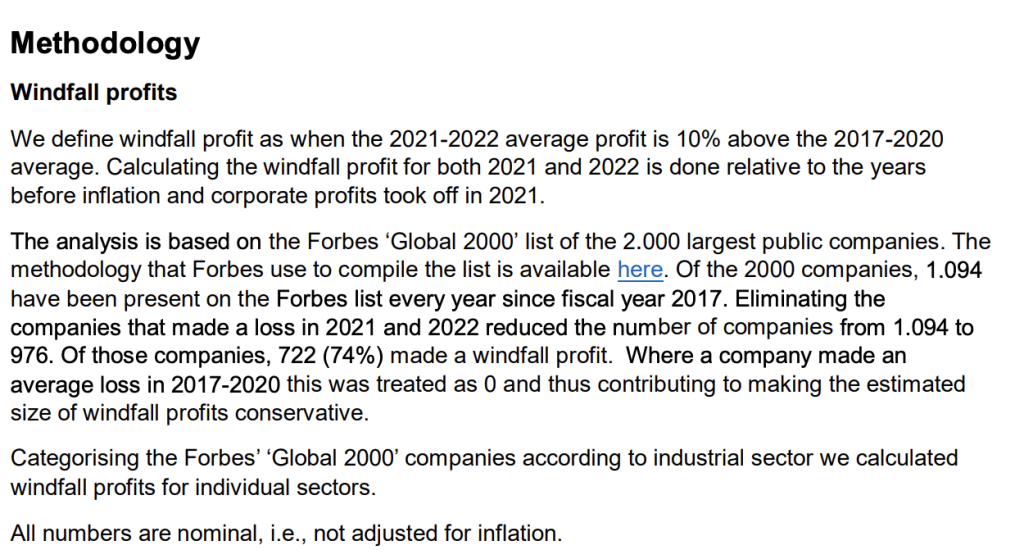

So a company has made a “windfall profit” – and gets taxed at 90% – if its 2021-2022 average profit is 10% above the 2017-2020 average profit.

Here’s a simple math question: how fast would a company’s profitability have to grow over those six years before it has a 10% profit increase, and therefore a “windfall”?

Let’s start by assuming no real terms profitability growth at all, and see what happens. Starting with $100 profit in 2017, and using a very simple model that just uprates each year’s profit by global average inflation in the previous year:

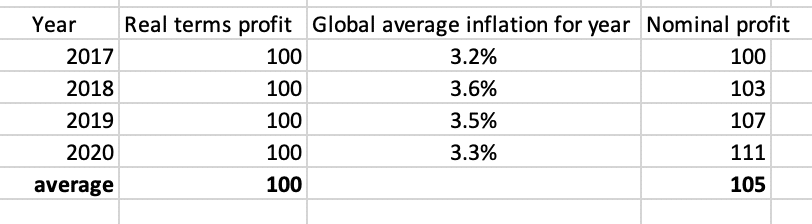

Now let’s keep going, and see where zero real terms profitability growth takes us in 2021-22:

That 11.2% increase is, in Oxfam’s terms, a windfall – and the 90% tax applies (because they only use nominal figures). But in real terms, there’s been no profit increase at all.

So the answer to the simple math question is: Oxfam forgot about inflation, and compounding. so its methodology will always consider a company to have a windfall unless its profit has shrunk in real terms. They didn’t actually find 722 multinationals that had made a windfall; they found 722 multinationals whose profits hadn’t fallen in real terms (or at least hadn’t fallen much).

I wrote to Oxfam pointing this out and received a disappointing response (full copy here) which justifies reporting profits in nominal figures (which is fine, indeed commonplace), but doesn’t justify using nominal figures/ignoring inflation to calculate “windfalls”. I don’t think it can reasonably be defended.

I don’t think this was intentional. Oxfam used to write thoughtful pieces about the role of taxation in development. Now they just throw out endless identikit windfall tax and wealth tax proposals; how and whether such proposals could actually be implemented doesn’t seem terribly important to them anymore.

It’s a shame. Oxfam have considerable resources and a large research team. If they turned back to serious tax policy they could do a lot of good.

Leave a Reply to John Teal Cancel reply