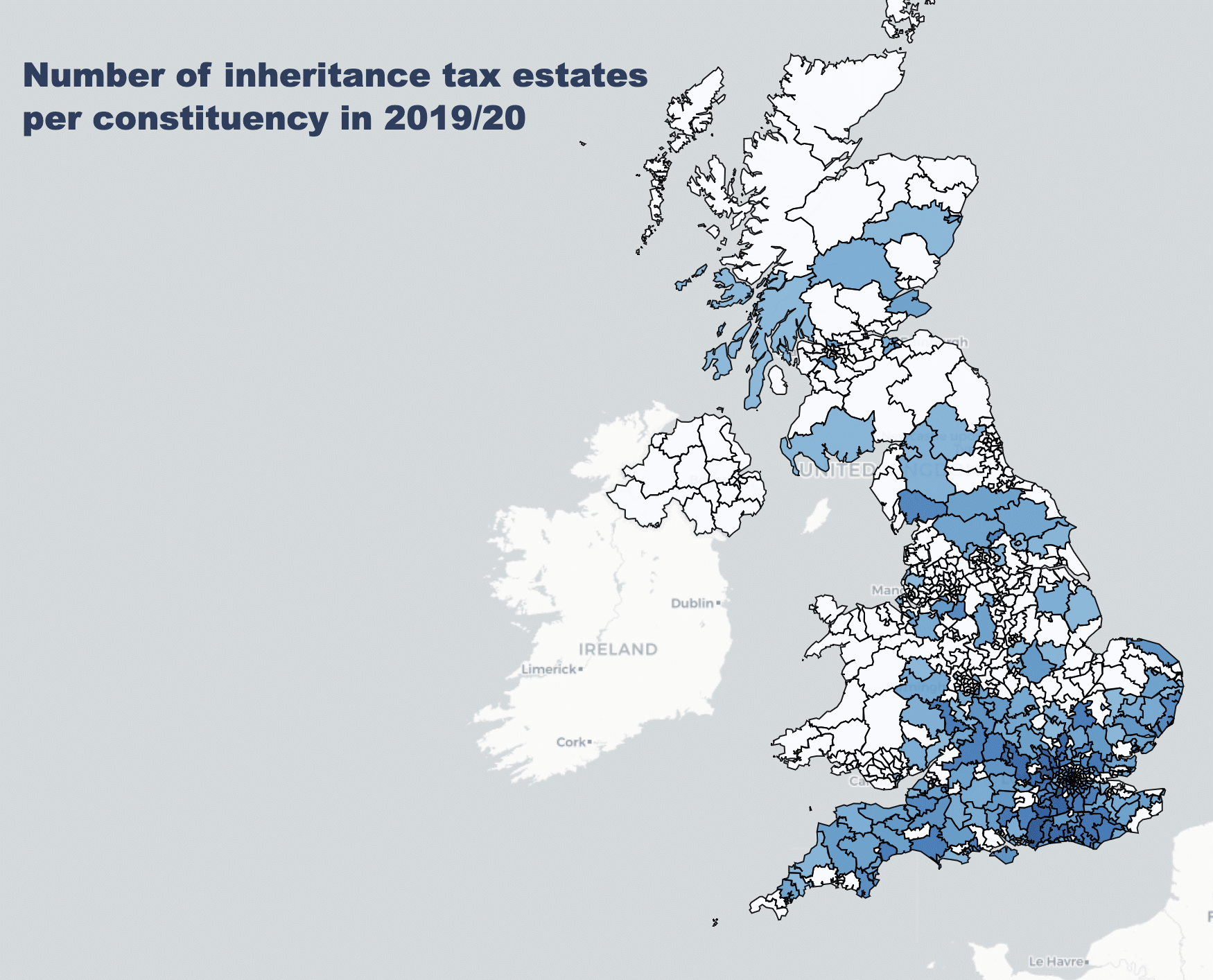

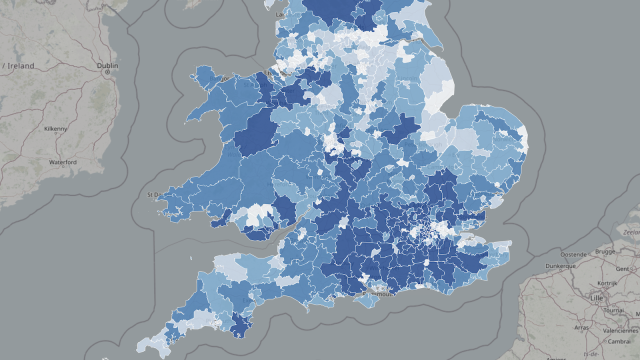

Here’s an interactive map showing inheritance tax paid in each parliamentary constituency in 2019/20, and shaded by the number of estates paying inheritance tax. You should be able to zoom around with your mouse/fingers, and if you hover/touch a constituency you’ll see the data:

You can see a full-screen version here, one with alternate shading by the amount of IHT paid here, and the source code is here. Note that, for data privacy reasons, we see no data for any constituency where the number of estates is less than 30.

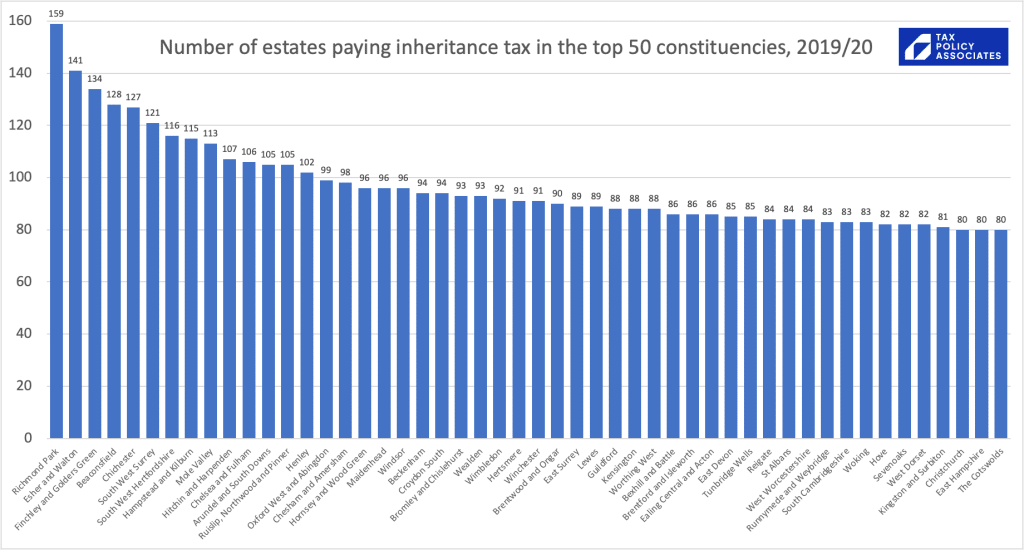

Another less pretty way to view this:

It’s easy to forget quite how few estates pay inheritance tax these days, given that most households will need £1m of net assets before they start paying the tax, and old age naturally depletes the assets we were saving in our life. Looking around to see how many households have £1m+ now is a poor guide to how many will end up paying inheritance tax (particularly given that many people will give assets to their children before they die).

So even in Richmond Park, only 159 estates paid inheritance tax.

And of course many of those that do pay inheritance tax will have a small bill. For example, if your estate has £1.5m of net assets, the inheritance tax is only on amount over the threshold/allowance – so an IHT bill of roughly £200,000.

(Note that the reason is absolutely not “the very rich don’t pay inheritance tax”. They do: they just pay a significantly lower effective rate than the merely comfortable off.)

So is there some political pattern in inheritance tax that makes it a big political draw? What if we look at the seats the Conservative Party has to hold to stay in power, say the 100 seats with the smallest Conservative majority? Many of those have less than 30 estates paying IHT, but of those with 30 or more:

No particular pattern, other than almost all of them have less than 100 estates paying inheritance tax (the Excel file is available here).

So, why does inheritance tax matter politically?

I’m not sure we know, but it won’t stop me guessing: it’s because of a widespread perception that the rich don’t pay the tax, but the merely comfortably off can be landed with large bills. (I think that’s consistent with this fascinating research from Demos).

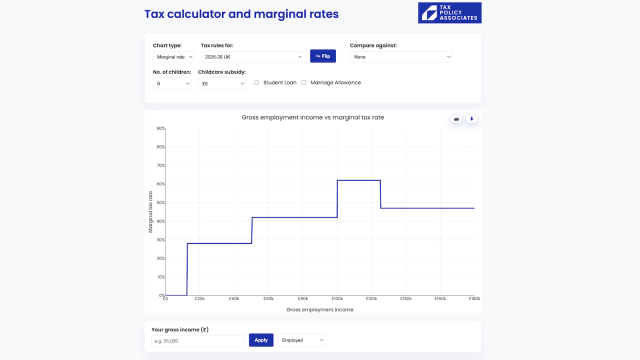

That perception is basically true. Check out this chart, from HMRC, looking at the 2016/17 figures on what estates are actually paying in inheritance tax. There’s a spectacular drop-off in the effective rate for large estates (£9m+):

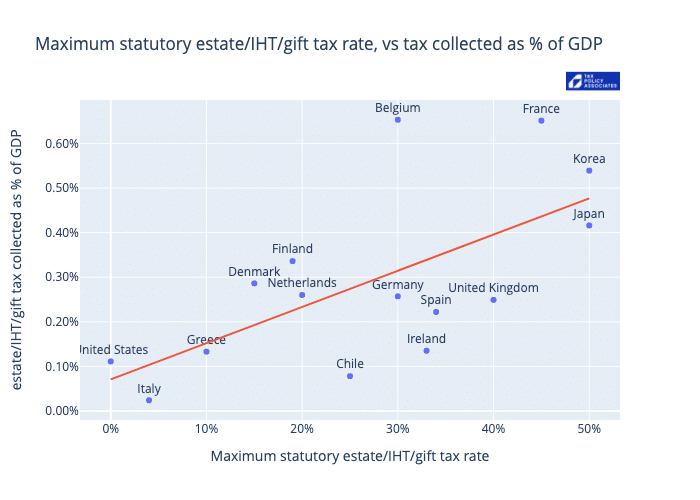

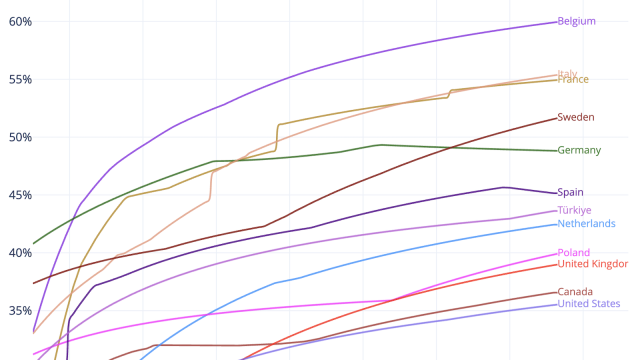

And look at what an outlier the UK is in international terms, with a relatively high rate but relatively low revenues:

There’s an obvious answer: we should fix inheritance tax so the green curve above is more flat, and the seriously wealthy pay the same effective rate as the merely reasonably wealthy. We should be able to do that by capping reliefs that are meant for small farms and small businesses, but end up providing a massive tax reduction for multi-millionaires. Then we can lower the rate to something more like 20% or 25%, without reducing revenues, and put the UK closer to The Netherlands, Denmark and Germany.

I think that would be the right thing to do, and treat both the seriously wealthy and the reasonably wealthy more fairly. I’ll leave others to judge how politically popular it would be.

Leave a Reply to Richard Sage Cancel reply