Many “tax avoidance schemes” are in fact just tax fraud. We’ve been investigating “mini-umbrella company” (MUC) schemes, where a recruitment business is split between thousands of companies, with Filipino individuals hired as shareholders/directors to hinder HMRC counteraction. Each company then fraudulently claims to be an independent small company, and claims small company tax incentives.

Part 1 explained how the schemes work, Part 2 and Part 3 looked at how eminent tax KCs’ opinions facilitated the scheme

Donna

Meet Donna:1

Donna seems a nice person, but has a tendency to promote “get rich quick” internet promotions to her friends:

Or:

Those posts didn’t get much attention – I don’t know if anyone clicked, but nobody commented.

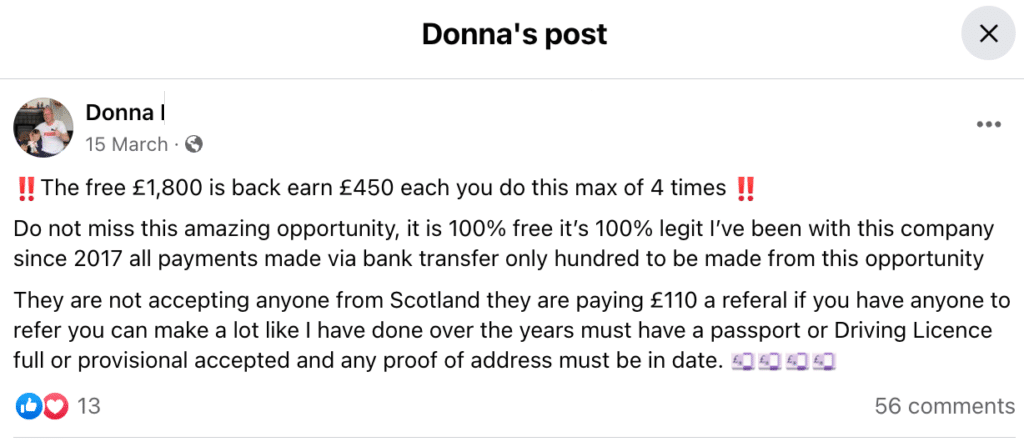

This one is different:

With comments like this:

What is this thing that you can do up to four times, but not if you’re Scottish, and if you’ve done one then you can’t do another?

It’s acting as the initial UK director/shareholder for a mini-umbrella company, before it is put into the name of someone from the Philippines, used as part of a MUC tax fraud, and then dissolved when HMRC catch up with it.

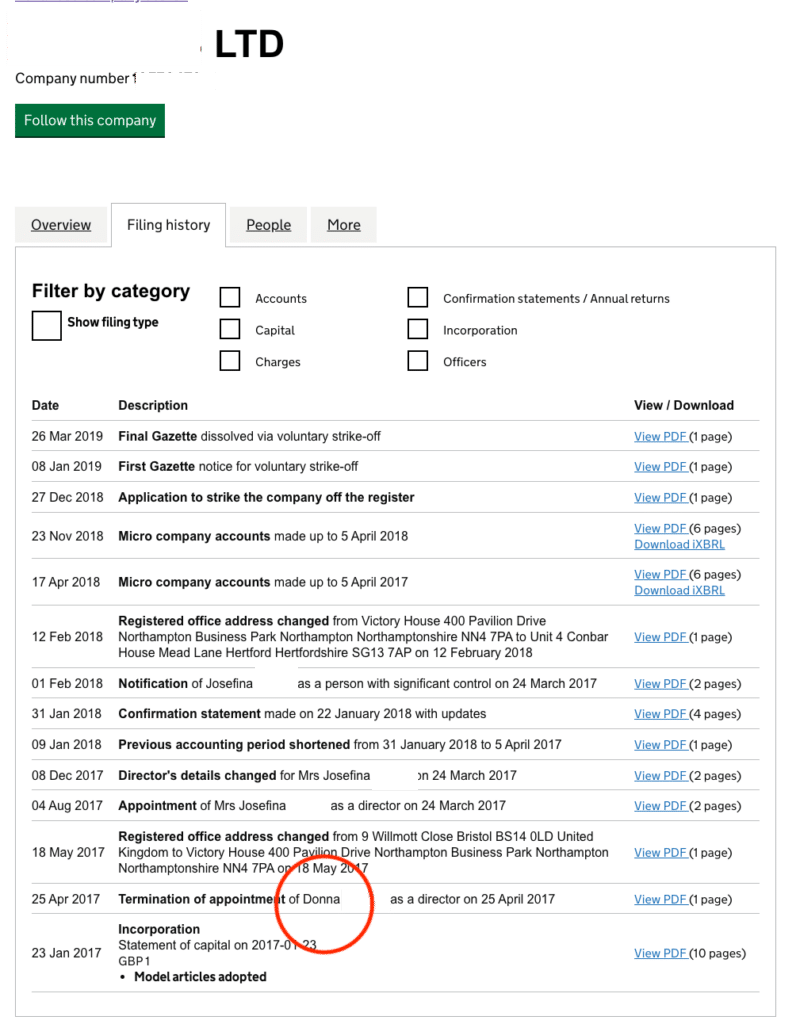

For example:

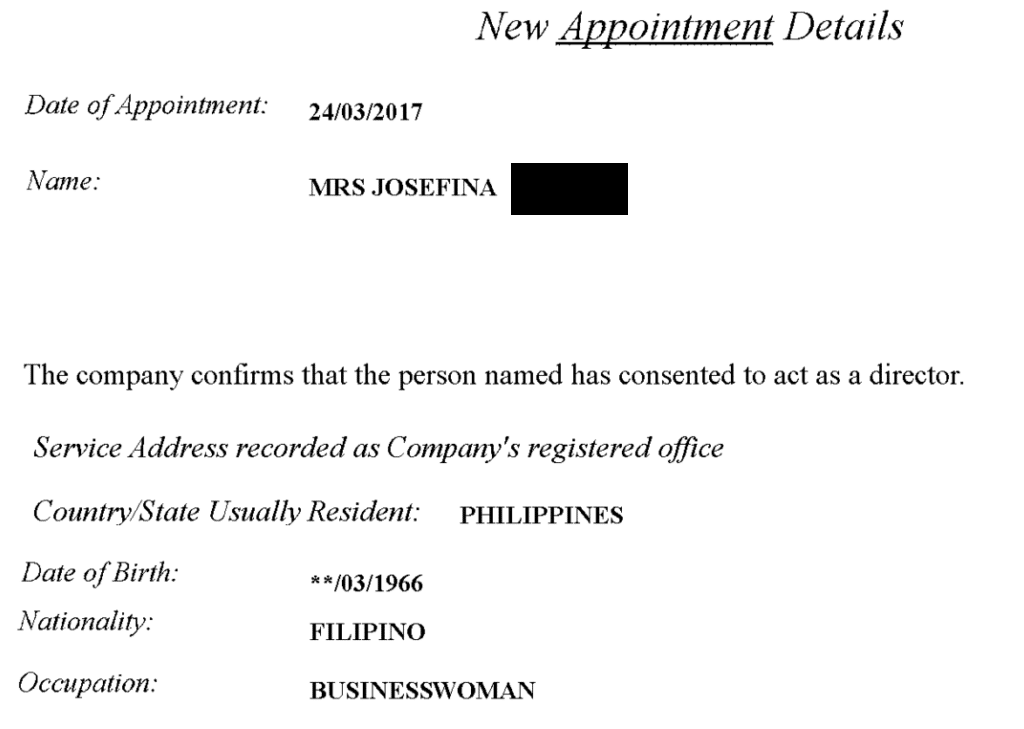

Josefina is a resident of the Philippines:

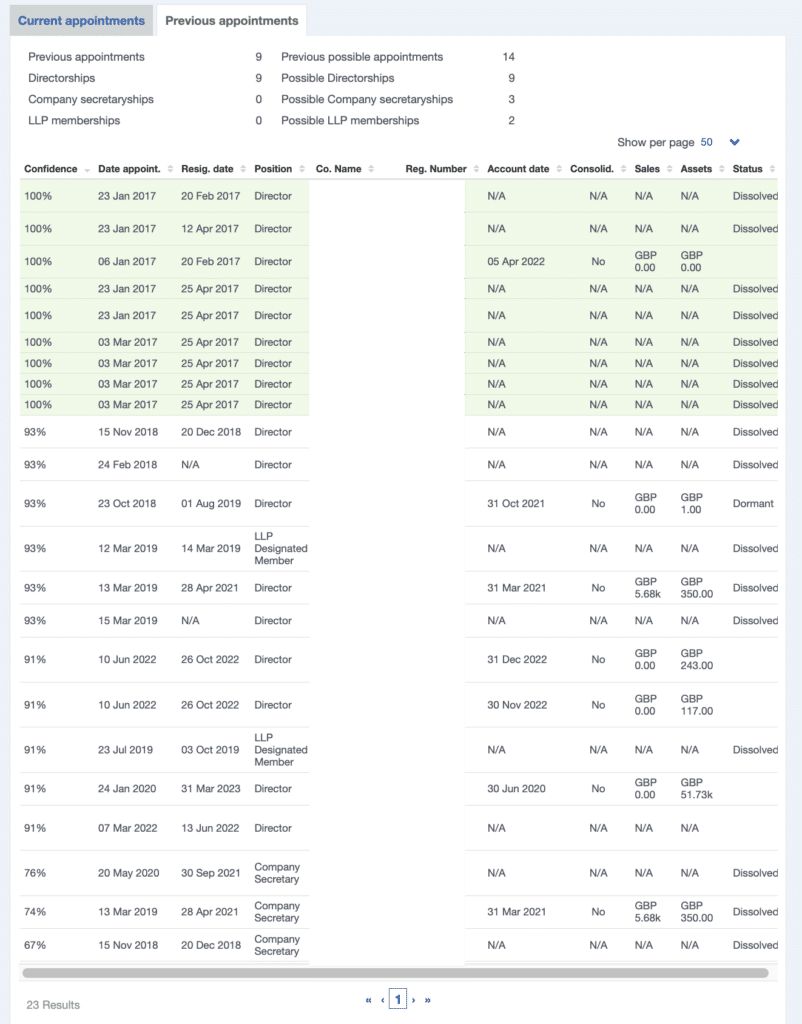

Donna’s done this at least 23 times – usually, she’s a director for a few months, then replaced by a Philippine resident individual, and then the company is dissolved:2

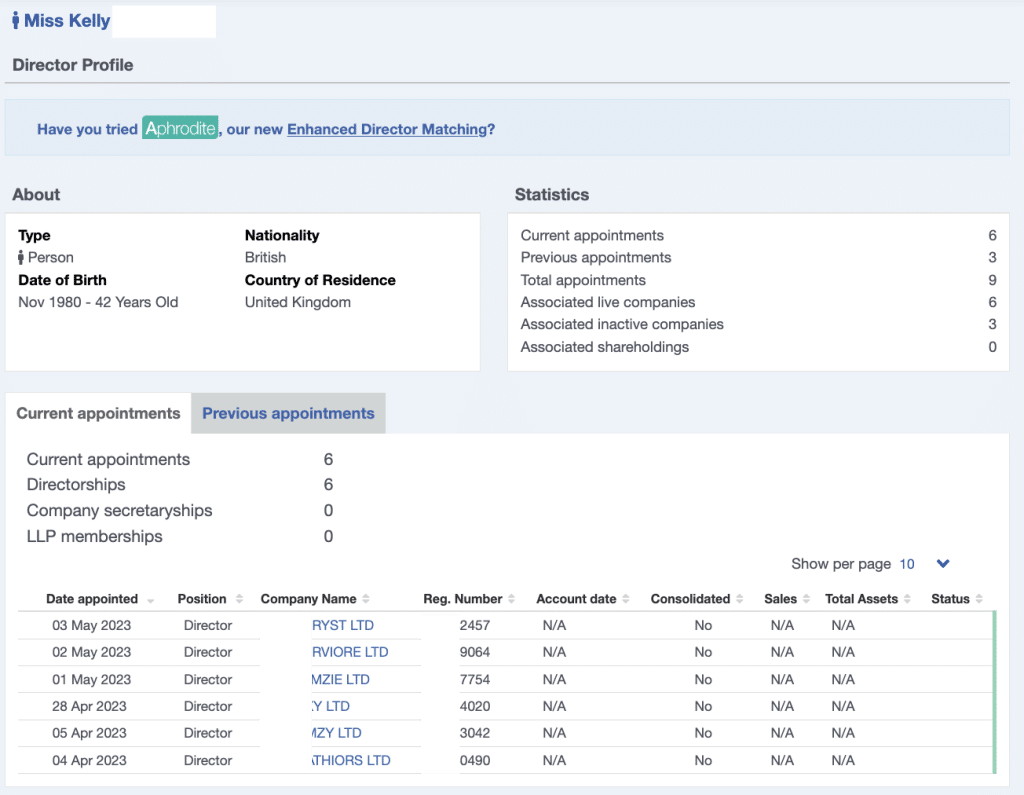

Kelly

Kelly seemed interested in the Facebook comment thread on 15 March:

And, sure enough:

Kelly hasn’t been replaced as Philippine director just yet.

What’s going on?

When I was a trainee, back in 1998, it took ages to set up a UK company. So my firm set up a few dozen companies ahead of time, with a couple of senior partners as shareholders and directors. Then, if a client needed a company sharpish, we would “pull it off the shelf” (literally, its documents would be on the shelf) and change the directors and shareholders to the new owner. This was perfectly proper and very sensible. They were “shelf companies”.

Donna and Kelly are unwittingly3 helping establish criminal shelf companies. Some unknown person sets up companies in advance. Not dozens, but many thousand. And then, when they find a criminal client, they pull the company off the shelf.

HMRC has been frantically trying to close down these mini-umbrella schemes. Our earlier pieces looked at two of the earlier schemes: the director behind one admits it was a fraud, and has been financially ruined and disqualified; the director behind the other has also been disqualified, in highly suspicious circumstances.

But the schemes continue. No longer the preserve of “legitimate” contractor businesses, armed with KC opinions, but now sometimes run by organised crime. We’ve seen estimates that total UK losses from the scheme are over £1bn.4

Is it Companies House’s fault?

If a bank didn’t spot someone opening thousands of bank accounts with Philippine directors then there would be an enormous scandal. Heads would roll. Enormous fines would be levied. So banks have sophisticated systems to identify suspicious transactions and report them. These systems are, as with all human systems, imperfect – but they are mostly very effective.

Companies House doesn’t have any power to check the companies it creates.5 It’s not much more than a robot, doing what the Companies Act requires of it.

So the MUC disaster is not the fault of Companies House.

Should the law change, so that Companies House is required to build bank-style systems to identify suspicious transactions and report them, or block or delay company formation? How much would it cost? How long would it take? How much impediment would it create for legitimate transactions? How much impediment would it create for fraudulent transactions? We don’t have answers to these questions, but we think they are questions policymakers should be asking.

And there are other, more modest, changes that could be made. These companies are usually dissolved within a year, before HMRC catches up and before any accounts have to be filed. There should be a requirement to file accounts before dissolution. And the current rules for small company accounts are too lax – small is actually pretty big (£10m) and there’s no requirement to even disclose revenue. Further simple financial disclosure could be required, still falling well short of requiring audited accounts.

So what’s the solution?

We think the answer is on the “demand” side, not the “supply side”. Close down the easy fraud opportunities which the MUCs are created to exploit.

A Government consultation document last month proposed some sensible solutions. In particular:

- Making recruitment companies and/or end-users of MUCs (legitimate businesses like Tesco) responsible for MUCs’ unpaid tax. Thus effectively forcing people to carefully consider their supply chain, and (in their own interest) ensure it is free from fraud

- Restricting or ending the tax reliefs for small businesses which, ultimately are just too juicy a target for fraudsters.

We think the consultation document is very promising, and have responded supporting its proposals (and asking for some to go further):

MUCs are a disaster. They have no purpose other than tax. They often leave the workers stranded in a tax and employment law hell, caused by a completely unknown company with untraceable foreign owners. They’ve been exploited in schemes that could have cost the UK £1bn. Ending MUCs would be a good policy outcome of the consultation.

Thanks to Simon Goodley at the Guardian for the original reporting on this, and Richard Smith, Gillian Schonrock for their amazing investigative work (again noting that they draw no legal conclusions; the legal conclusions are the sole responsibility of Tax Policy Associates Ltd).

Thanks to CompanyWatch for giving Tax Policy Associates free access to their excellent software for free (there was no quid pro quo; they didn’t even ask to be name-checked).

Photo: Calculator with the text Tax Fraud on the display by Marco Verch under Creative Commons 2.0

Footnotes

I am masking the name and identifying details of the individuals caught up in this scheme because I very much doubt they know what they’ve fallen into, and the attention their Facebook pages might attract if I did identify them would be unfair. If any authorities, journalists or researchers are interested in following-up on the original links/names then please do get in touch ↩︎

The software that extracts this data from Companies House is CompanyWatch – it’s much more sophisticated than the Companies House website, which often shows one person (even with a unique name) as multiple several people, making it hard to see all the companies they’re involved with. CompanyWatch has kindly given us a free licence to use their software free. Richard and Gillian don’t use CompanyWatch – they’ve developed their own, much more specialised, software for tracking MUCs and other Companies House frauds ↩︎

The Low Incomes Tax Reform Group issued a press release warning people not to get involved in these “director” schemes. This was the right thing to do, but we fear it will not reach many of the people drawn to the schemes. ↩︎

This is not far-fetched. We conservatively estimated the Contrella scheme lost £50m in tax. That was one scheme, in one year. Schemes have been running since 2014, with tens of thousands of companies created each year. ↩︎

Companies House will soon be introducing identity requirements for directors and persons with significant control. That will certainly make some frauds more difficult, but these UK and Philippine individuals really exist (as far as we know). So that won’t make a difference. ↩︎

8 responses to “How Donna from Facebook became part of a £1bn tax fraud (part 4 of our series).”

Fascinating story.

Could you make a Mr Bates and the Post Office film, out of this?

Companies house a robot that takes fees for pretty much nothing. You can bet any change will result in increased fees.

https://www.gov.uk/government/publications/companies-house-fees/companies-house-fees

As a second thought, before we do damage to all small companies acting perfectly legitimately by restricting things like employment allowance, it may well be a good idea to require all UK companies to have a UK resident director at all times and to stop them hiding behind correspondence addresses

I find it odd that Companies House is the only formation agent that is exempt from the KYC regulations. If you form several companies through another formation agent they have a responsibility to do the usual KYC. As a result (and because it is cheaper) Companies House are the agent for approx 60% of formations

Do you think the approach for (English) LLPs is better?

Companies House do not provide Web incorporation for LLPs.

They do accept Software Incorporation, i.e. APIs to their system, used by agents.

So the choices are by paper, which costs £40, or by Agent using software, which I have used for £35, of which it seems that £30 goes to CH for same-day.

see https://www.gov.uk/government/publications/companies-house-fees/companies-house-fees#co-inc

I haven’t looked into that, but I believe LLPs have been widely used as part of MUC frauds…

The astonishing thing, when you search this on Companies House even, is that within 5 minutes you find 1,418 dissolved companies at the last registered address, almost all with a lifespan of 18 months or so – i.e before HMRC has much time to latch on to them. You can also see that Donna has had 9 directorships in total, all of which lasted two months at the most. Of those 8 companies are dissolved, the other is being dissolved . What did she think this was all about?

It was about £450!