As inews has reported, Ian Lavery MP has refused to confirm whether he paid tax on £140,000 of irregular and uncommercial payments from his former union. He says all his tax affairs are up-to-date, but refuses to comment on the specific question of these payments. That is the same answer I received from Nadhim Zahawi back in July, and it’s not good enough.

I should say up-front: credit for this story goes to David Parsley from inews and the senior tax accountant who worked with him. I stand behind the story, and provided some assistance. Please read the inews story for full background.

Normally we wouldn’t think to ask if someone paid tax on their income, and it wouldn’t be remotely fair or sensible to ask this kind of question of every MP, or everyone in a public position. However this £140,000 is different.

The background

The Certification Office for Trade Unions & Employers’ Associations reported back in 2017 on financial irregularities in the Northumberland NUM, of which Mr Lavery was General Secretary. The BBC reported on it, as did the Guardian.

Here’s a short summary of what happened – but the Certification Officer report, and inews report, are well worth reading in full:

- Mr Lavery received a “redundancy payment” when as a legal matter he was not made redundant – he left the union because he became an MP.

- There was a peculiar arrangement whereby the union compensated Mr Lavery and his wife for the underperformance of an endowment policy that Mr Lavery and his wife (not the union) had invested in.

- Mr Lavery received loan write-offs of £91,5451 – this is highly unusual for an employee.

- The union (in the words of the Certification Officer’s report) “in effect purchased a share in its General Secretary’s home”, again contrary to usual commercial and trade union practice.

This was all in 2005-20132. No proper explanation or justification has ever been provided for these arrangements. The Certification Officer did not appoint an inspector to fully investigate (because he thought there would be insufficient financial records to facilitate an investigation). No prosecution was brought (or, as far as I am aware, contemplated). I will let others judge the propriety of the arrangements, and focus on the tax consequences.

The tax treatment of the payments

The experienced accountants working with inews say the loan write-offs and “redundancy payments” should have been fully taxable. I have reviewed the documentation and agree with this conclusion.

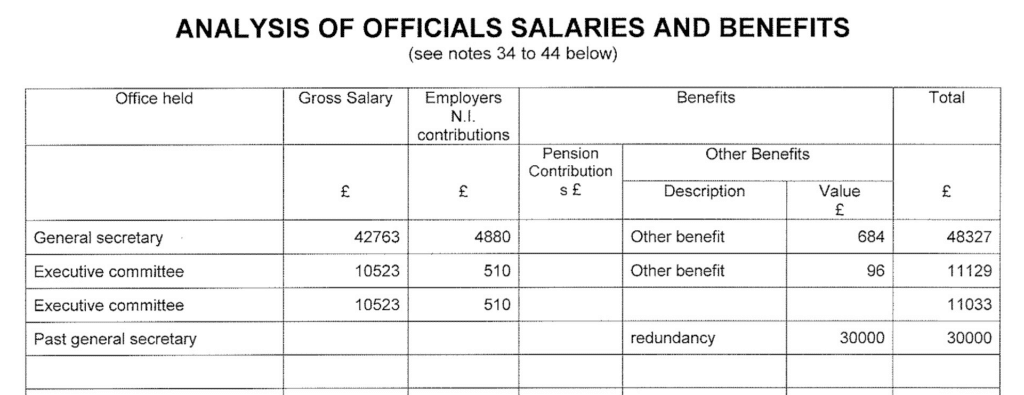

Note that there is usually an exemption for the first £30,000 of redundancy payments3, but the point is that these were not actually redundancy payments at all – Mr Lavery left his employment to become an MP, and was succeeded as general secretary by Denis Murphy (the former MP for Wansbeck – this was an unusual “job swap”). Note the description in the filed AR21 annual returns⚠️ for the union:4

A redundancy, by contrast, is when a job ceases to exist. Calling it a “redundancy” does not make it a redundancy, any more than calling my sister a grapefruit makes her a grapefruit. This was either a reward for his previous work as general secretary, or part of a quid-pro-quo for Mr Lavery’s job swap with Denis Murphy. In either case, the payments were general earnings, subject to income tax and national insurance in the usual way. The union, which Mr Lavery ran at the time, should have applied PAYE.

The loan write-off was more straightforward: fully taxable, no applicable exemptions, and with the income tax payable by Mr Lavery personally (not by PAYE).

In my experience, when people fail to follow correct legal procedures for payments, and/or the payments do not make commercial sense, they often also fail to follow correct tax procedures. That’s true whether the failures are accidental (for example a result of administrative chaos), or intentional. I don’t know which was the case here, and the Certification Office report doesn’t reach any conclusions as to the parties’ motivation.

There are several possibilities:

- Mr Lavery paid tax on the payments in full at the time (or the tax was collected by PAYE) and nobody did anything wrong

- Mr Lavery did not pay the correct tax at the time, and/or the union did not correctly operate PAYE, but the tax was paid subsequently, e.g. as a result of an HMRC enquiry, potentially with “carelessness” or “deliberate” penalties applying.

- Mr Lavery/the union did not pay the correct tax at the time, and still has not.

- I and the senior tax accountant are both wrong, and the payments weren’t taxable. In that case I will happily issue an apology to Mr Lavery and make a donation to charity.

It is reasonable to ask Mr Lavery which of these scenarios we are in. The question is whether the true nature of the payments was disclosed to HMRC (for example the fact that the “redundancy” payment was not a redundancy payment).

Was Mr Lavery under HMRC investigation?

Mr Lavery used the word “enquiry” when speaking to inews, and said HMRC conducted a “desktop review”, but did not explain what that involved. On the other hand, he told the BBC that he has “never been under investigation” by HMRC.

These words all have slightly different meanings:

- An “enquiry” is the process that lets HMRC challenge someone’s tax return within twelve months of it being filed. HMRC does this by giving the taxpayer notice in writing, i.e. a taxpayer should always be aware of an enquiry.

- If HMRC realises it missed something in a tax return, but has passed the twelve month deadline, then HMRC is out of luck.

- But if HMRC discovers information which was not disclosed in a tax return, and suggests the tax was incorrect, they can raise a “discovery assessment”. The deadline for this is usually four years after the end of the tax year, extended to six years where a taxpayer or their advisers have been careless, and twenty years where the taxpayer’s non-disclosure was deliberate5

- HMRC will review someone’s affairs internally before deciding whether to commence an enquiry or discovery assessment, and that will usually involve correspondence with the taxpayer or their advisers

I think, in the usual English meaning of the word, all of the above would class as an HMRC “investigation”, and that’s how tax advisers would use the word too. So it’s not clear to me how Mr Lavery could have had dealings with HMRC well after the event (2005-2013) unless he was under investigation. Most likely because HMRC were considering whether to raise a discovery assessment – but even the six year time limit would have been challenging at that point.

Why it’s reasonable to expect an explanation

It was the unusual and uncommercial nature of the YouGov and Balshore structure which made me wonder if Mr Zahawi failed to pay all the tax that was due – and it turned out he had not. The unusual and uncommercial nature of the payments to Mr Lavery raises the same questions. The amounts are much less than Mr Zahawi’s but the principle is the same: we expect our representatives to pay the tax that’s due, in the same way millions of ordinary taxpayers do.

The other thing that’s the same is Mr Lavery’s response. inews asked him a very simple question. He should have an equally simple answer: tax was fully paid, and here are the tax returns to prove it. Giving us the same non-answers as Mr Zahawi provided is not good enough.

Mr Zahawi may agree that, in retrospect, it would have been better if he’d provided a proper explanation at the time.

I hope Mr Lavery takes the opportunity to provide us with a proper explanation now.

Thanks to the tax lawyers, tax accountants, employment lawyers and trade unionists who assisted with this report – but most of all, thanks to David Parsley for breaking the story.

Footnotes

corrected – first version said £90,454 ↩︎

corrected – first version said 2005-2012 ↩︎

Technically it’s more complicated than that, as Andrew ably explains in the comment below, but for practical purposes most people call it an “exemption” and I’ll do that here. ↩︎

It seems that at some point an argument was made that Murphy was not a “general secretary” but a “secretary” – that is not consistent with the annual returns ↩︎

For completeness, the deadline can also be: twelve years for certain offshore cases, and 20 years for a failure to notify of liability (i.e. you never completed a return at all), or where the matter relates to a tax avoidance scheme ↩︎

Comment policy

This website has benefited from some amazingly insightful comments, some of which have materially advanced our work. Comments are open, but we are really looking for comments which advance the debate – e.g. by specific criticisms, additions, or comments on the article (particularly technical tax comments, or comments from people with practical experience in the area). I love reading emails thanking us for our work, but I will delete those when they’re comments – just so people can clearly see the more technical comments. I will also delete comments which are political in nature.

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply