This is a slightly wordy explanation that I’ve written primarily for lawyers who are curious why an experienced lawyer would publish “without prejudice” correspondence. The main post is here.

The short answer is: because it wasn’t really “without prejudice” or “confidential”. If I write you a letter, and say the letter is an elephant, that doesn’t make it an elephant.

Without prejudice?

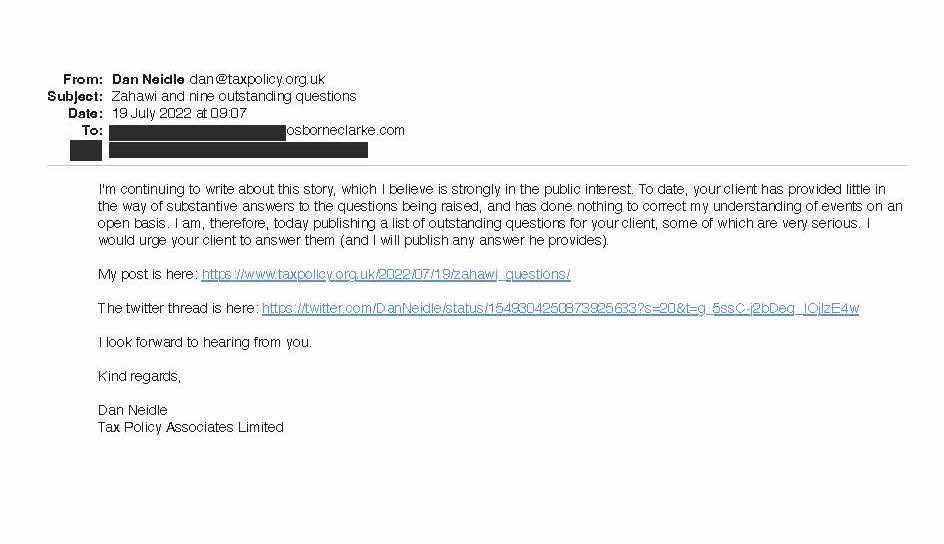

We generally want lawyers to negotiate to reach settlements, rather than taking everything to a time-consuming and expensive court hearing. “Without prejudice” is a longstanding rule designed to facilitate that. The Civil Procedure Rules summarise it as:

In other words, if I’m suing someone for £100m, and offer in a “without prejudice” letter to settle for £1 then, if we later get to court, the defendant can’t point to my £1 offer and say it suggests I don’t believe in my own case. The court will generally refuse to accept my letter as evidence. It is probably also improper for the defendant’s lawyer to publish my letter – it’s certainly bad manners.

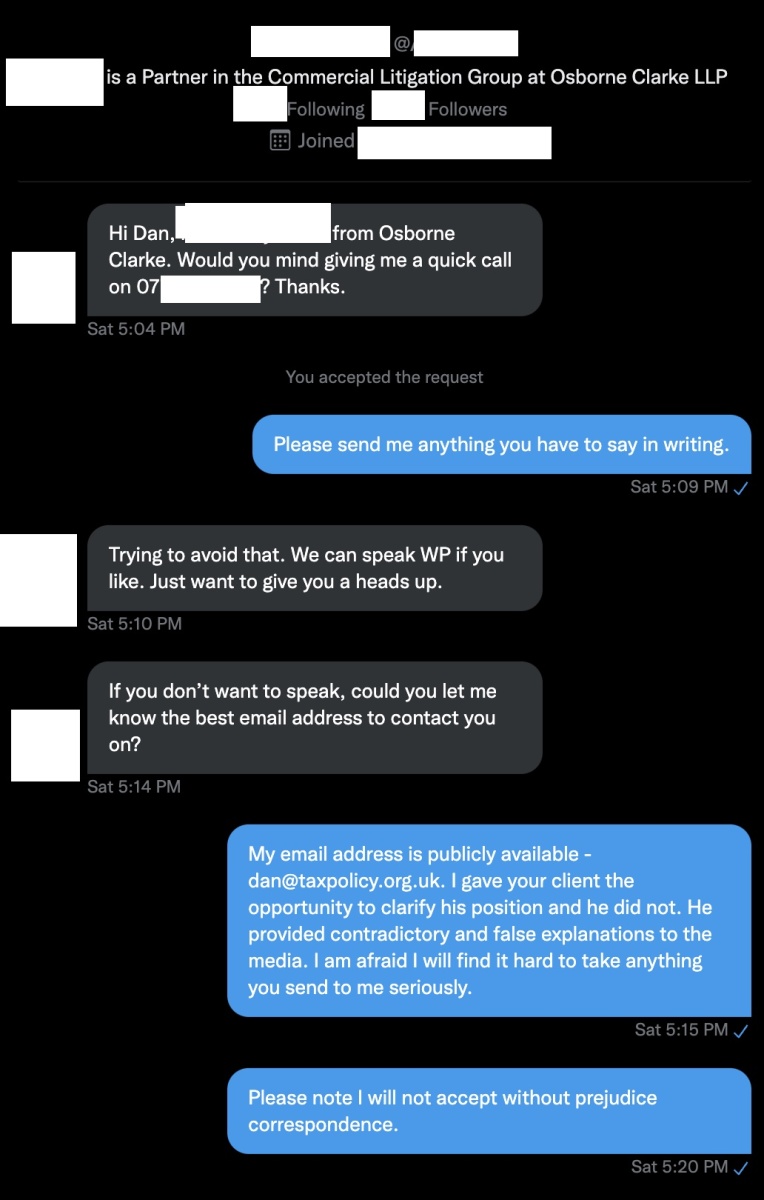

The Osborne Clarke email goes further than “bad manners”, and says:

“It is up to you whether you respond to this email but you are not entitled to publish it or refer to it other than for the purposes of seeking legal advice. That would be a serious matter as you know.”

This is poppycock – indeed it’s more than poppycock, it’s an improper attempt to intimidate someone without the rest of the world finding out about it.

But you can’t just slap “without prejudice” on any old letter – there has to be a genuine attempt to settle a dispute. As Lord Griffiths said in Rush & Tomkins v. GLC:

The “without prejudice” rule is a rule governing the admissibility of evidence and is founded upon the public policy of encouraging litigants to settle their differences rather than litigate them to a finish … The rule applies to exclude all negotiations genuinely aimed at settlement whether oral or in writing from being given in evidence.

That’s the key: there must be a dispute, and the correspondence must be – “genuinely aimed at settlement”. So actually my £1 offer above might not be “without prejudice”, because the recipient could well claim it wasn’t “genuine”1.

There are several reasons we can be confident the “without prejudice” doctrine doesn’t apply to this letter:

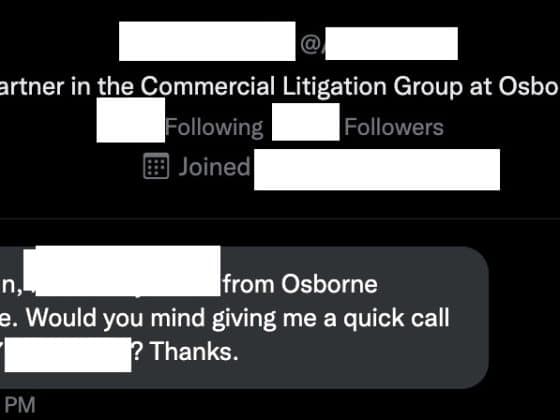

- This wasn’t a genuine attempt to settle a dispute. The way a normal settlement offer works is that, if the settlement isn’t accepted, you proceed to litigation. In fact here, when I rejected Zahawi’s “offer” (that I retract my claim about Zahawi), their next letter said they’re not suing me. So there was no dispute, and this wasn’t a genuine attempt to settle it. It was a bluff, aimed at getting me to retract.

- There wasn’t even a dispute. The “without prejudice” letter claims that I said Zahawi “was lying about the extent of involvement of [Zahawi’s] father in the very early days of YouGov when it was set up in 2000.”. That is not correct – I said no such thing. Osborne Clarke’s second letter correctly identifies what I actually said – that Zahawi’s first explanation – that his father contributed startup capital – was a lie. So the “without prejudice” letter relates to a matter that was never under dispute.

- I said explicitly I would not accept without prejudice correspondence.

I am therefore confident that the first letter was not in fact a “without prejudice” letter, it is not improper for me to publish it, and it could be adduced as evidence in court (in the laughably unlikely event this matter ever goes to trial).

Confidential?

Here’s the second Osborne Clarke letter.

They really, really, don’t want me to publish it:

“You have said that you will not accept without prejudice correspondence and therefore we are writing to you on an open, but confidential basis. If your request for open correspondence is motivated by a desire to publish whatever you receive then that would be improper. Please note that this letter is headed as both private and confidential and not for publication. We therefore request that you do not make the letter, the fact of the letter or its contents public.”

Slapping “confidential” on a letter doesn’t stop the recipient publishing it. You need two things: contents that are actually confidential, and then a duty of confidence must be agreed or implied.

We can dispose of the second point immediately. Obviously I hadn’t agreed to treat their correspondence as confidential, and there’s no reason to imply that I had; in fact they imply the opposite (that I may publish the letter). So no duty of confidence exists.

The first is more subtle, but here’s the problem: there is nothing confidential in the letter. Imagine they’d written “Look, Zahawi’s first explanation was wrong, and we admit that. But his press secretary had just been eaten by a rhinoceros, and the intern was so traumatised they put out any old nonsense. We still haven’t tracked down his family, so please treat this as confidential.”

Now that could have been confidential information. But nothing in the actual letter is confidential. They say nothing that the world doesn’t know already about Zahawi’s unconvincing explanations for his tax affairs.

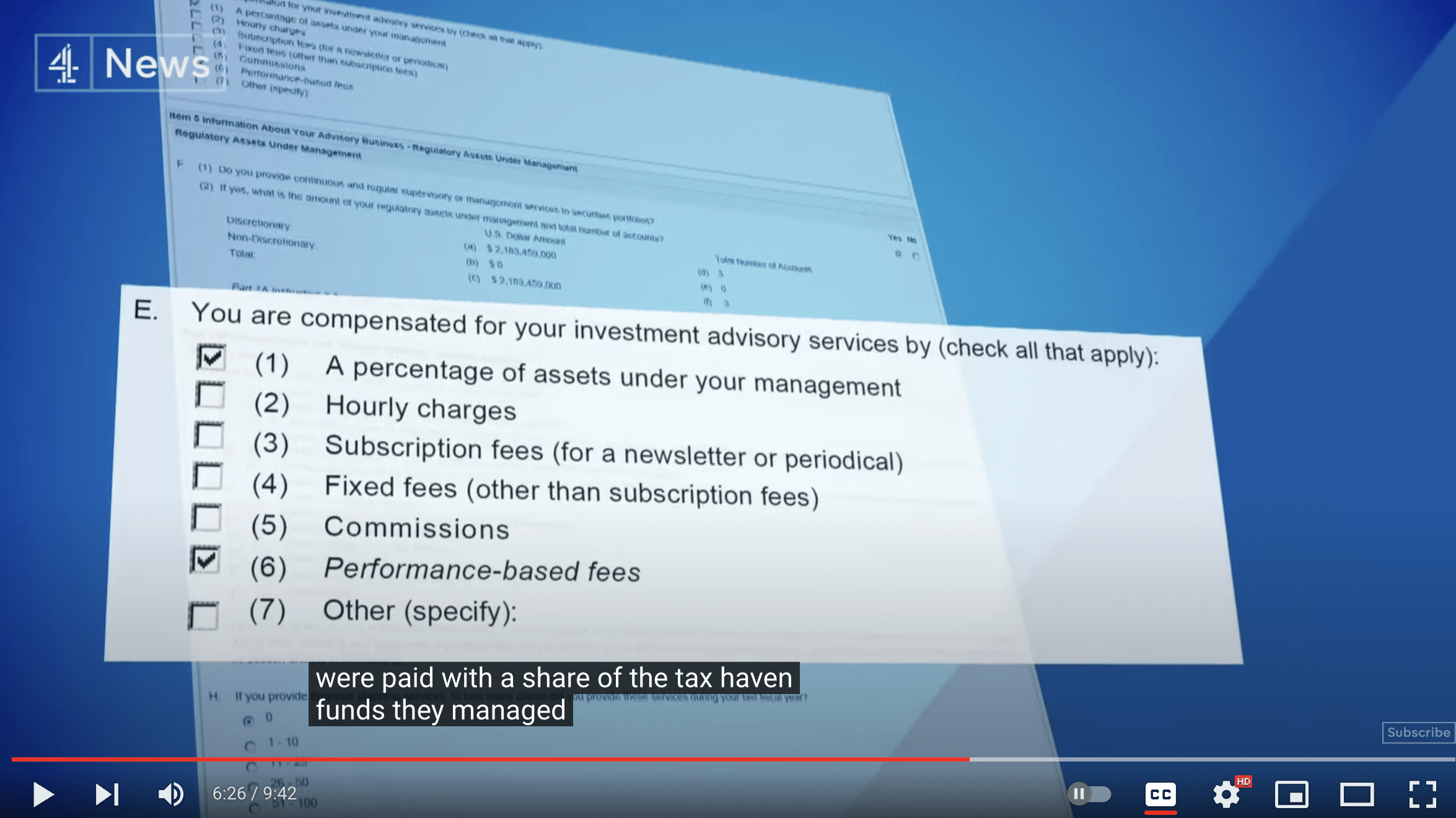

Oh, and there’s a further problem. Even if the letter was confidential, and a duty of confidence could be established, there is a defence if I can establish a public interest in publishing. Here I would say that publishing the fact the Chancellor is seeking to silence an allegation of dishonesty against him is absolutely in the public interest.

Wider implications

I believe the tactics Osborne Clarke used here are fairly common in the libel world – abusing “without prejudice” and confidentiality to ensure that libel threats are not reported. These aren’t real libel claims – they’re strategic lawsuits against public participation (SLAPP).

The Solicitors’ Regulatory Authority already warns lawyers about the potential for SLAPP misconduct. I will be writing them to ask that they expand their guidance to make clear that only in rare cases will a libel letter before claim be without prejudice and/or confidential. More generally, lawyers should not make assertions that their letters cannot be published unless they have a very clear and stated basis for doing so.

I should add that I am not making an SRA complaint against Osborne Clarke – my sole aim is for the SRA to ensure that SLAPP defendants are not misled into thinking that they cannot mention the purported claim against them to third parties.

I’m leaving comments on this post open for now, but will police them more than usual, for which my apologies.

Footnotes

This is a very smart point that I’d missed, but was picked up by a litigator – thank you Chris! ↩︎