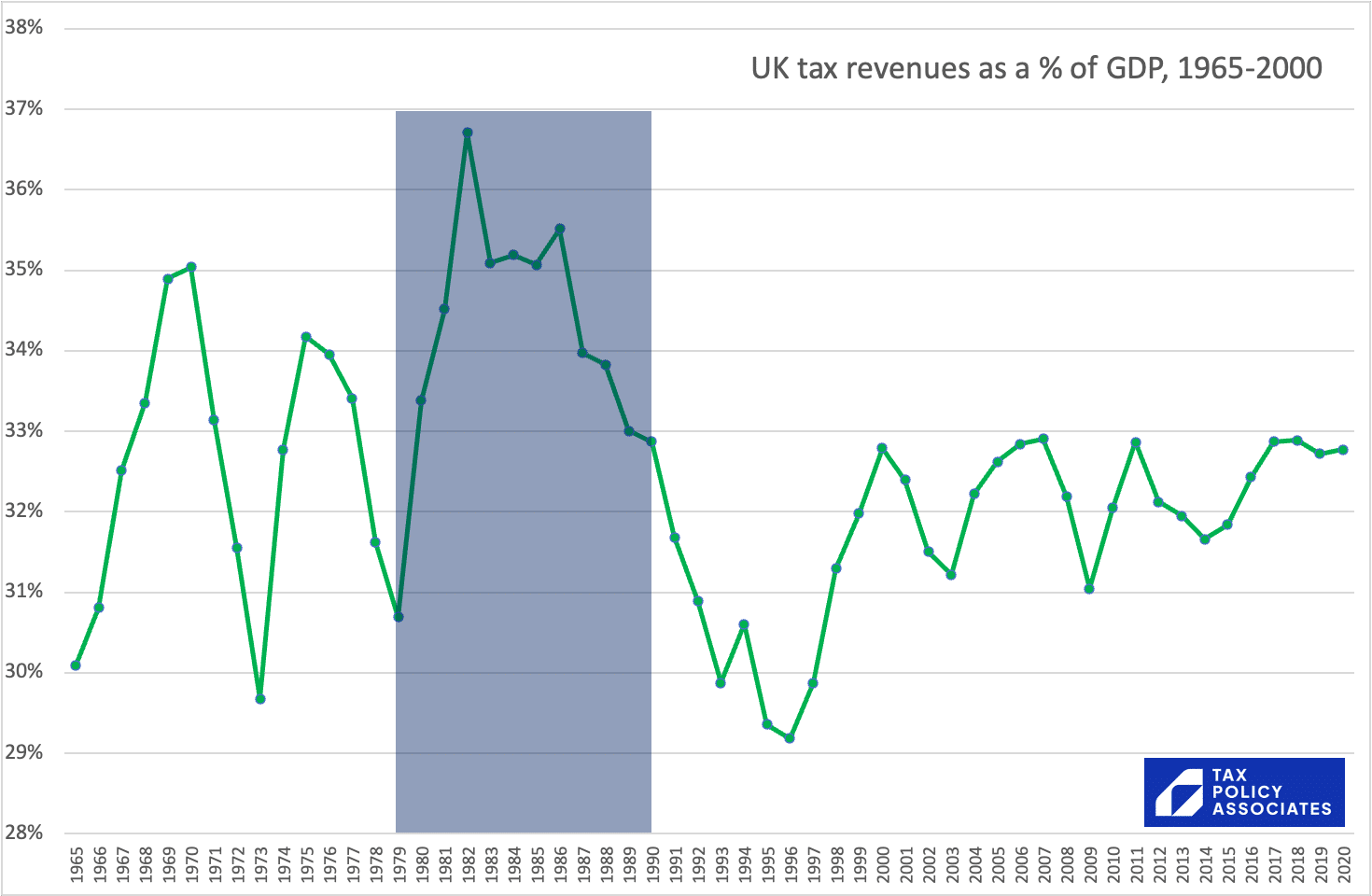

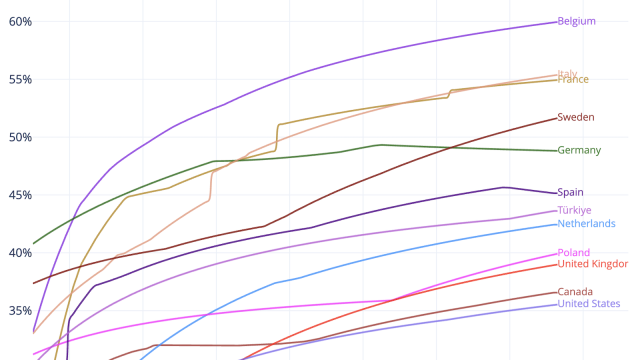

Mrs Thatcher is still heralded as a tax-cutter by many. But what actually happened to UK tax revenues, as a proportion of GDP, over her premiership?

They went up a lot, then down a fair bit, but not as much as they went up. Was this the result of specific policy decisions to raise tax? Or something else?

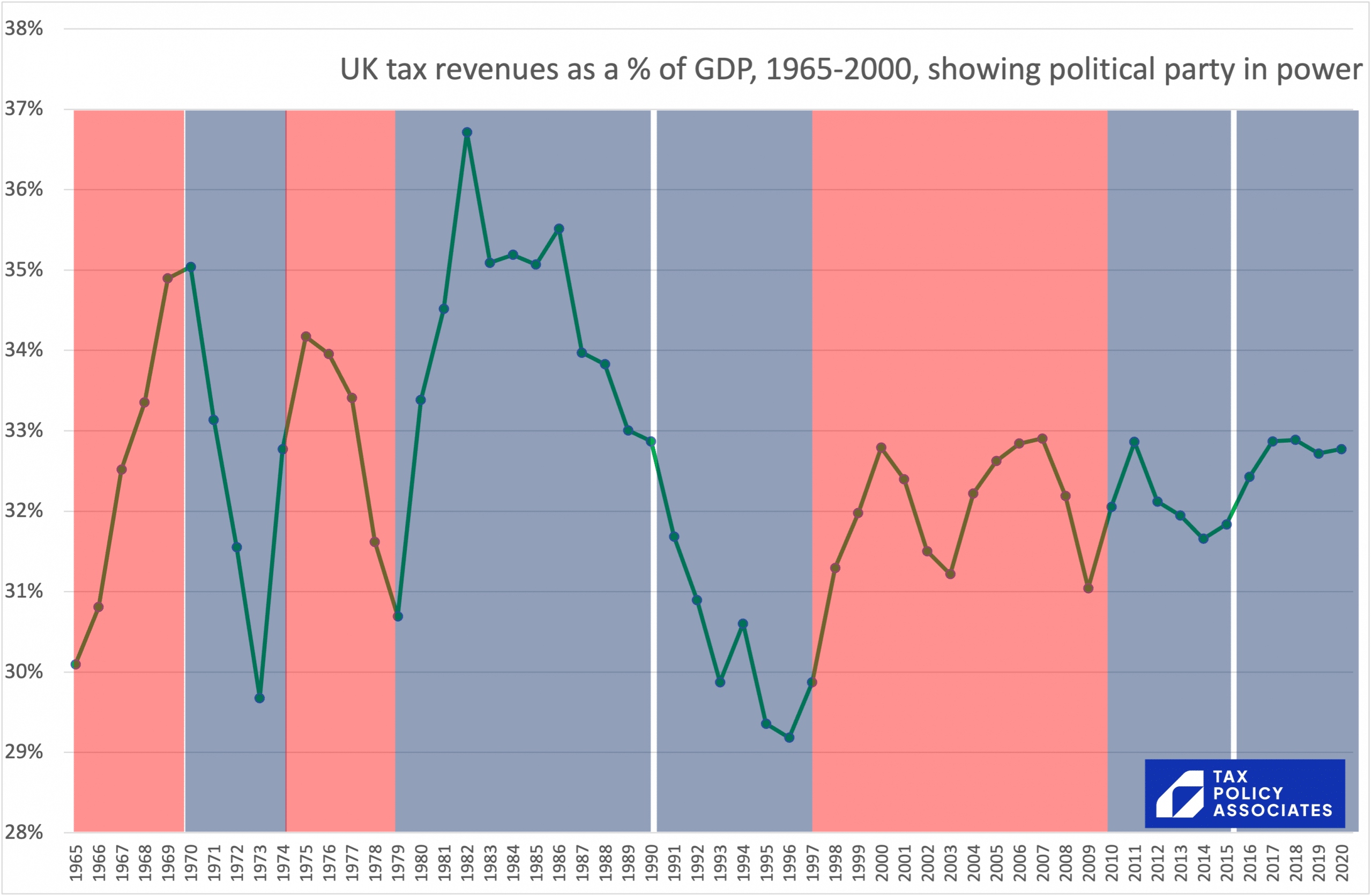

But first – can we make any general statement about the relationship between tax vs GDP and the political party in power? Not really:

One nice symmetry: the overall Thatcher increase in tax from 1979-1990 is almost exactly the same amount as the overall Blair/Brown increase in tax from 1997 to 2010.

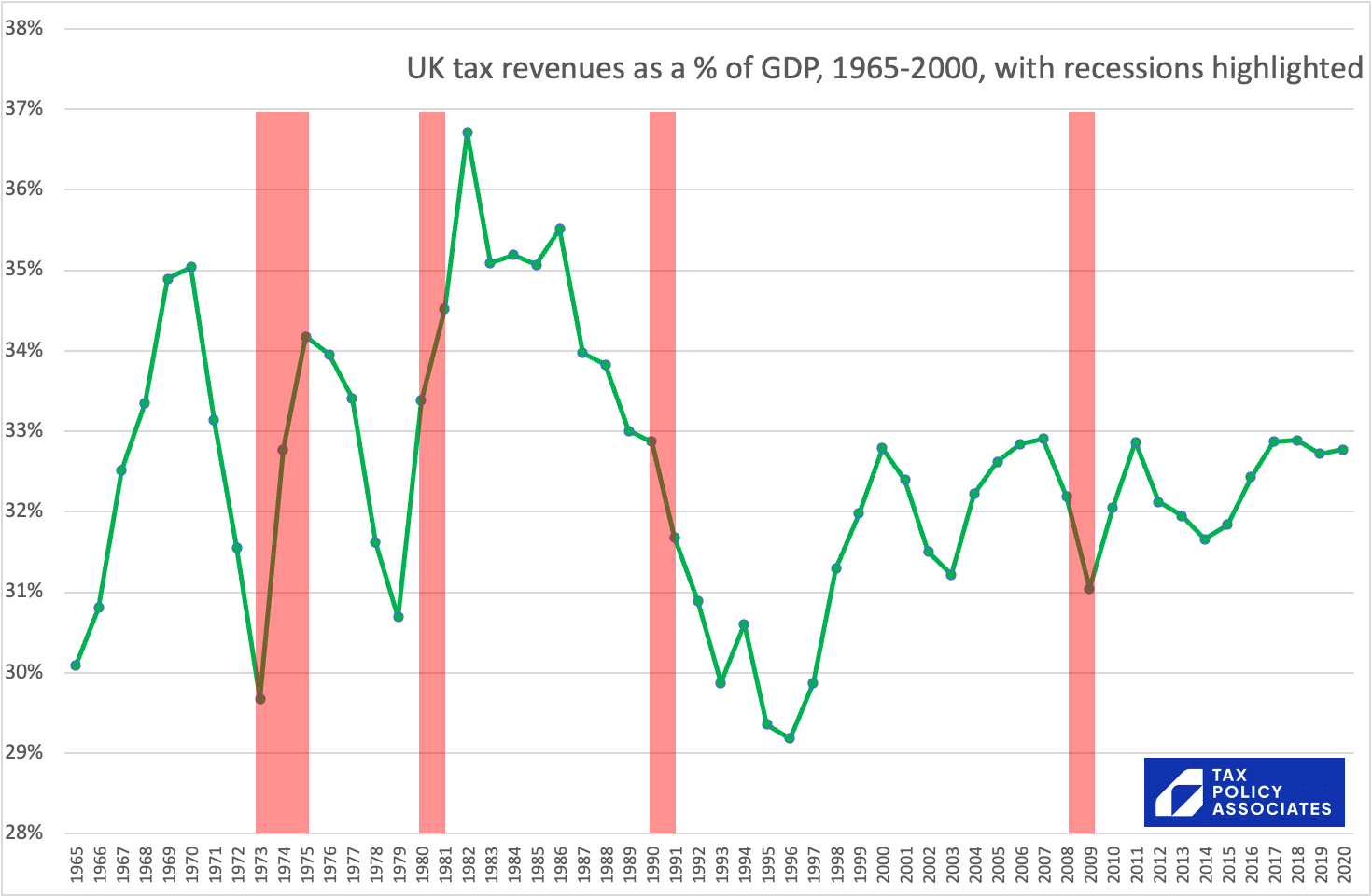

So is politics irrelevant? Are the wild swings in fact just driven by recessions, with GDP contracting and so tax/GDP increasing?

That looks like an inadequate explanation, only (arguably) fitting the data for the 1973-75 recession.

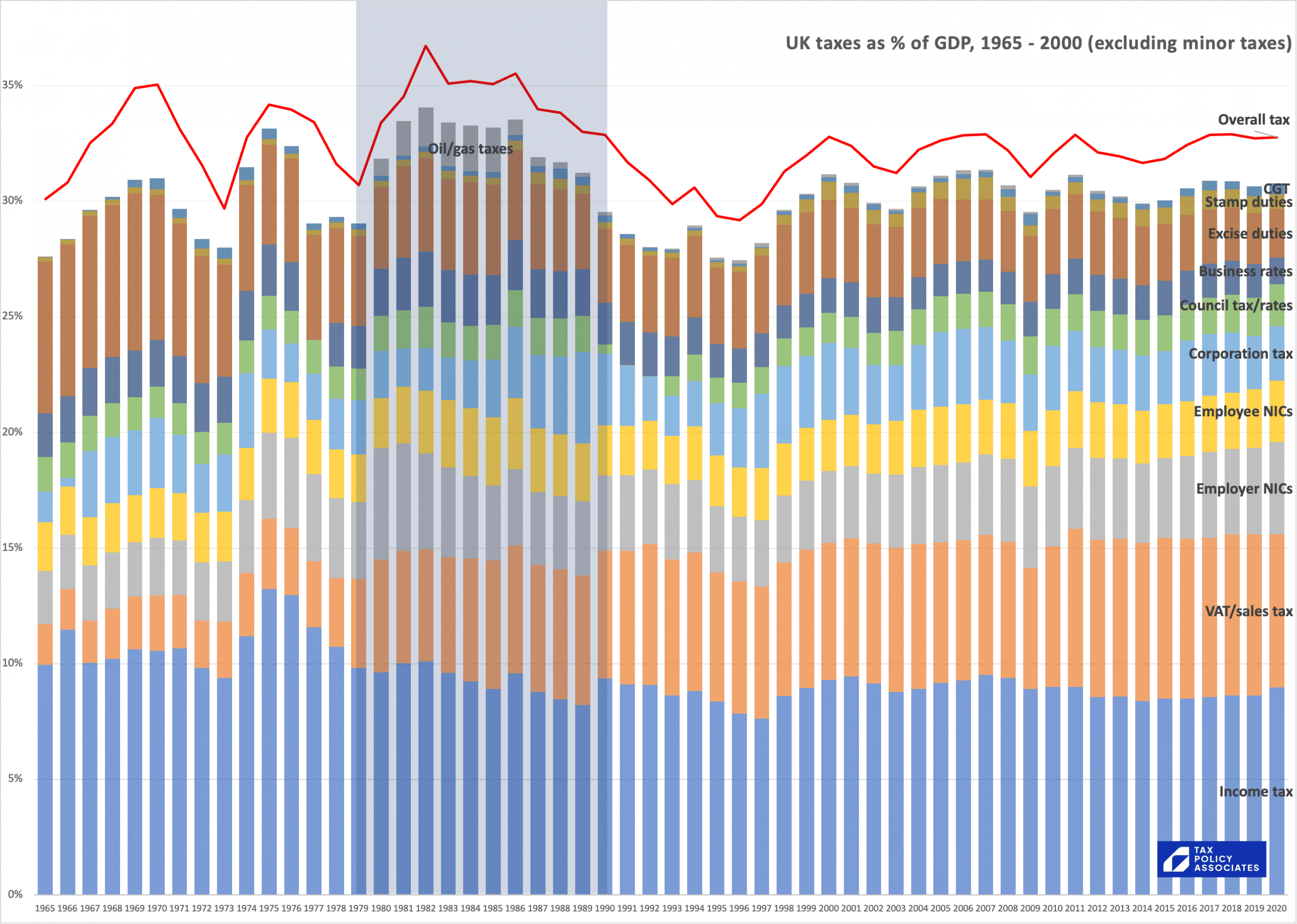

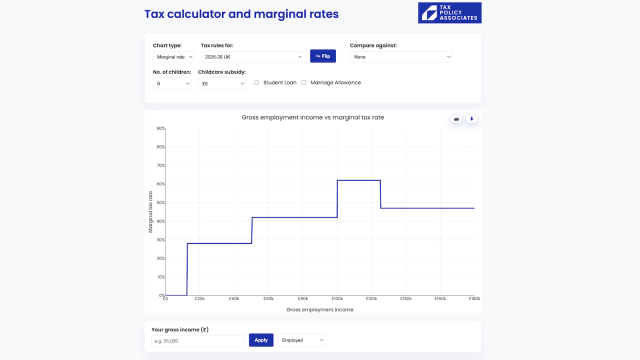

What if we look at the actual changes in individual taxes?

Now we have it: three drivers for the big tax increase over 1979-82: VAT rising from 10% to 15%, the North Sea oil boom, and the increase in employer NICs. Income tax was certainly cut, although not very dramatically, and that was more than overcome by the increase in VAT.

Seems fair to say that the Thatcher tax increase was an intentional policy-driven rise in tax, not a mere incident of GDP contraction.

All data from the wonderful OECD tax database, with similar taxes consolidated together to produce a reasonable like-for-like comparison across 1965-2020. Full spreadsheet here.

Leave a Reply